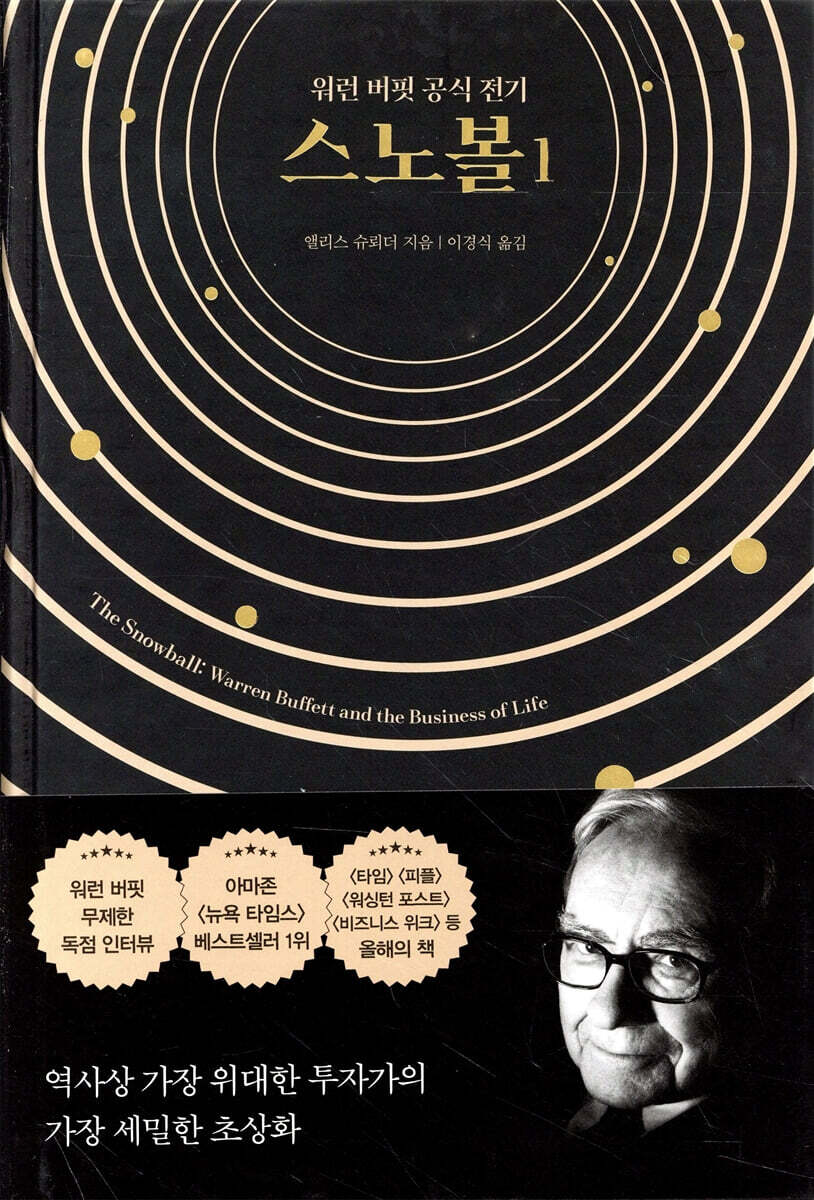

Snowball 1

|

Description

Book Introduction

Warren Buffett Unlimited Exclusive Interview

#1 Amazon/New York Times Bestseller

Book of the Year by [Time], [People], [Washington Post], [Business Week], etc.

The most detailed portrait of Warren Buffett, the greatest investor in history.

“Can you write my story?”

One day, Alice Schroeder, who was working as an executive at Morgan Stanley, receives an unbelievable offer.

The person who made this suggestion was none other than the great investor Warren Buffett, known as the 'Sage of Omaha.'

He has held the top spot on Wall Street, the center of global finance, for over 50 years, but has never written a single book, and is only remembered as a legend. He has finally decided to take off his veil and share his story with the world.

Alice Schroeder then devoted herself entirely to writing his story, researching and analyzing Buffett for five years.

For this project, Warren Buffett promises her unlimited interview opportunities, extensive information about himself, and active support from those around him.

As a result, the unique biography "Snowball" was born, which records Buffett's life without omission.

As soon as this book was published in 2009, it not only won the title of 'Book of the Year' selected by major media outlets, but also became a bestseller simultaneously around the world.

This is partly due to the fervent interest in the great investor Warren Buffett, but also thanks to Alice Schroeder's persistent efforts to convey Buffett's investment performance, as well as his unusual private life and foolish mistakes, as objectively and meticulously as possible.

This revised edition, which is being republished in response to popular demand, corrects errors from the previous edition and features a new cover that faithfully captures the meaning of the title.

Volume 1, which mainly contains stories in chronological order from Buffett's birth to his 40s, provides a glimpse into how Buffett's extraordinary 'economic sense' and 'clear perception of the flow of wealth', which were evident from his childhood, were developed.

You can also learn about his unusual family story and the secret love triangle between his lifelong lover Susie and his second companion Astrid.

Rare old photographs of Buffett and those around him add further detail to the biography of this remarkable man.

Warren Buffett, who still holds a reputation as the world's number one investor even after more than 10 years since the book was published.

For those wondering where his insight, which has allowed him to continue making "winning investments" in a turbulent stock market for over half a century, comes from, this book will provide the most definitive answer.

#1 Amazon/New York Times Bestseller

Book of the Year by [Time], [People], [Washington Post], [Business Week], etc.

The most detailed portrait of Warren Buffett, the greatest investor in history.

“Can you write my story?”

One day, Alice Schroeder, who was working as an executive at Morgan Stanley, receives an unbelievable offer.

The person who made this suggestion was none other than the great investor Warren Buffett, known as the 'Sage of Omaha.'

He has held the top spot on Wall Street, the center of global finance, for over 50 years, but has never written a single book, and is only remembered as a legend. He has finally decided to take off his veil and share his story with the world.

Alice Schroeder then devoted herself entirely to writing his story, researching and analyzing Buffett for five years.

For this project, Warren Buffett promises her unlimited interview opportunities, extensive information about himself, and active support from those around him.

As a result, the unique biography "Snowball" was born, which records Buffett's life without omission.

As soon as this book was published in 2009, it not only won the title of 'Book of the Year' selected by major media outlets, but also became a bestseller simultaneously around the world.

This is partly due to the fervent interest in the great investor Warren Buffett, but also thanks to Alice Schroeder's persistent efforts to convey Buffett's investment performance, as well as his unusual private life and foolish mistakes, as objectively and meticulously as possible.

This revised edition, which is being republished in response to popular demand, corrects errors from the previous edition and features a new cover that faithfully captures the meaning of the title.

Volume 1, which mainly contains stories in chronological order from Buffett's birth to his 40s, provides a glimpse into how Buffett's extraordinary 'economic sense' and 'clear perception of the flow of wealth', which were evident from his childhood, were developed.

You can also learn about his unusual family story and the secret love triangle between his lifelong lover Susie and his second companion Astrid.

Rare old photographs of Buffett and those around him add further detail to the biography of this remarkable man.

Warren Buffett, who still holds a reputation as the world's number one investor even after more than 10 years since the book was published.

For those wondering where his insight, which has allowed him to continue making "winning investments" in a turbulent stock market for over half a century, comes from, this book will provide the most definitive answer.

- You can preview some of the book's contents.

Preview

index

PART 1 BUBBLES

1.

Less flattering | 2.

Sun Valley | 3.

Animals of Habit | 4.

“Warren, what’s the problem?”

PART 2 The Inner Scoreboard

5.

The Impulse of Preaching | 6.

Bathtub Stone Race | 7.

World War I Armistice Day | 8.

A Thousand Ways | 9.

Newspaper Delivery Master | 10.

Criminal Acts | 11.

Hot Idol | 12.

Silent Sales | 13.

The Laws of the Racecourse | 14.

Elephant | 15.

Interview Test | 16.

Strike Out! | 17.

Mount Everest | 18.

Miss Nebraska | 19.

stage fright

PART 3 Racecourse

20.

Graham-Newman | 21.

Knife handle | 22.

Hidden Splendor | 23.

Omaha Club | 24.

Locomotive | 25.

Windmill Wars | 26.

Golden Haystack | 27.

Foolishness | 28.

Dry kindling | 29.

Worst | 30.

Jet Jack | 31.

The future teeters precariously on the scaffold | 32.

Easy, safe, profitable, and fun | 33.

Loosening

PART 4 Suzy sings a song

34.

Candy Harry | 35.

The Omaha Line | 36.

Two drowning mice | 37.

Newspaperman | 38.

Spaghetti Western | 39.

Giant | 40.

It's not about running a public library | 41.

So? | 42.

1st place

main

1.

Less flattering | 2.

Sun Valley | 3.

Animals of Habit | 4.

“Warren, what’s the problem?”

PART 2 The Inner Scoreboard

5.

The Impulse of Preaching | 6.

Bathtub Stone Race | 7.

World War I Armistice Day | 8.

A Thousand Ways | 9.

Newspaper Delivery Master | 10.

Criminal Acts | 11.

Hot Idol | 12.

Silent Sales | 13.

The Laws of the Racecourse | 14.

Elephant | 15.

Interview Test | 16.

Strike Out! | 17.

Mount Everest | 18.

Miss Nebraska | 19.

stage fright

PART 3 Racecourse

20.

Graham-Newman | 21.

Knife handle | 22.

Hidden Splendor | 23.

Omaha Club | 24.

Locomotive | 25.

Windmill Wars | 26.

Golden Haystack | 27.

Foolishness | 28.

Dry kindling | 29.

Worst | 30.

Jet Jack | 31.

The future teeters precariously on the scaffold | 32.

Easy, safe, profitable, and fun | 33.

Loosening

PART 4 Suzy sings a song

34.

Candy Harry | 35.

The Omaha Line | 36.

Two drowning mice | 37.

Newspaperman | 38.

Spaghetti Western | 39.

Giant | 40.

It's not about running a public library | 41.

So? | 42.

1st place

main

Into the book

It's winter, the year Warren was nine years old. It's snowing outside and Warren is playing in the yard with his younger sister, Bertie.

Warren catches the snowflake in his hand.

Then he gathers a handful of snow with his hand.

More and more eyes are closing.

It becomes a fairly large snowball.

The boy now puts it on the ground and starts rolling it.

A snowball becomes a snowball, and this snowball gets bigger and bigger.

The excited boy rolls the snowball across the yard, and the snowball grows bigger and bigger.

Eventually, the snowball reaches the end of the boy's yard.

After hesitating for a moment, the boy finally makes up his mind and pushes the snowball into the neighbor's yard.

Warren continued to push the snowball, his gaze now turned to the entire snow-covered world.

--- From "Before You Begin"

Seeing this reminds me of the story of an oil prospector who died and went to heaven.

Saint Peter said:

'I have looked into your records and I see that you have all the qualifications to go to heaven.'

And he continued to say:

'But there is one problem.

Here in heaven, zoning laws are strict, so all oil prospectors are forced to stay in those cages.

But as you can see, the place is packed to the brim, so there's no room for you to enter.'

Then the oil prospector asked, 'Would you mind if I shouted just one word?'

Saint Peter said that it was not a difficult request, so he did so.

Then the oil prospector made a horn with both hands and shouted loudly.

'Oil has been discovered in hell!'

Then the lock on the iron cage fell off and the oil prospectors inside the cage burst out like lightning and ran straight into hell.

Saint Peter said:

'You're quite good at using your head.

Then go in now and get some rest.

There must be plenty of space.'

Then the oil prospector hesitated for a moment, said nothing, and then said:

'Wait a minute, I guess I'll have to follow those guys to hell too.

'If the rumors are spreading like that and everyone is going, then I think there must really be something going on.'

People feel and act this way about stocks too.

It's too easy to believe that there's something real in the rumors floating around.

--- 「2.

From "Sun Valley"

Warren began to think about time differently.

Welfare connects the present with the future.

If one dollar today becomes ten dollars a few years from now, then one dollar today and ten dollars a few years from now are the same.

Warren thought this way.

Warren sat on the front steps of his friend Stu Erickson's house and declared that he would be a millionaire by the age of thirty-five.

It was an absurd thing for a child living in the depression of 1941 to say.

But if Warren calculated it (and the book said it would), it was definitely possible.

He still had 25 years left.

Although he needed a little more money, he was confident he could do it.

The earlier you start saving money, the longer it will last, and the more likely you are to achieve your goals.

And a year later, Warren revealed the essence of his identity to the people.

By the spring of 1942, his fortune had grown to $120 million.

Needless to say, his family was surprised and proud of him.

--- 「8.

Among “A Thousand Ways”

Before that, no one had ever thought of installing a pinball machine in a barbershop, but the two kids went to Eriko and made that suggestion.

Eriko accepted the offer.

The two children removed the pinball machine's legs and loaded it into Danley's father's car and drove it to the barbershop.

And the prediction came true.

When Warren and Don went to see how business was going on the first evening, there were coins totaling nearly four dollars waiting to be fed into the machine.

Eriko loved it, and the pinball machine has been there ever since.

(…)

All of them were $25.

It was enough money to buy another pinball machine.

Soon, Mr. Wilson's pinball machines grew to eighteen, occupying a corner in every barbershop in Omaha.

Here Warren witnessed the miracle of capital.

Money was like a person who worked for a job, earning money for his master.

--- 「12.

From "Silent Sales"

“So, I bought a cigarette butt.

I tried to light this cigarette butt and smoke it.

If you walk down the street, you will see cigarette butts.

It's so damp and disgusting that I feel reluctant to pick up the cigarette butts.

But it's free.

(…) Maybe I could take a puff of smoke.

But Berkshire didn't have a single sip left to suck.

It was just a wet cigarette butt.

I put the cigarette butt in my mouth.

That was Berkshire Hathaway in 1965.

“They tied a huge amount of money to that cigarette butt.”

--- 「27.

From "Foolishness"

Suzy, who was always reaching out to others in search of emotional connection, later said that her husband was by no means an emotionally deficient person.

It's just that I didn't express my feelings outwardly.

But it seemed clear that Warren felt a strong emotional connection to his friends and investors.

Warren felt a strong sense of duty toward them and practically considered them family.

Warren's family could not help but be particularly aware of this aspect of Warren.

Warren behaved in a ceremonial manner when attending family functions, preoccupied with something else, which was a marked difference from his behavior when dealing with friends or investors.

--- 「33.

From "Unraveling"

Warren tried to convince Kay that acquiring a media company was difficult because the accounting issues were a significant burden to anyone trying to acquire one.

“Then Kay started to snicker, saying things like, ‘The depreciation of intangible assets is causing us problems.’

Howard looked straight into Kay's face and said,

"K, what does depreciation of intangible assets mean?" At that very moment, oh, it was truly amazing.

Kay was frozen in place.

It was as good as being completely paralyzed.

Howard seemed to enjoy that.

I intervened and explained to Howard what that meant.

After I finished explaining everything, Kay said this.

“That’s it.”

Warren enjoyed outwitting Simons, cutting the game short and cleverly defending Kay.

Kay's stiff smile began to loosen.

“From that moment on, we became each other’s best friends.

I became Lancelot, a Knight of the Round Table.

I would say it was one of the most shining moments of my life.

“It was the moment that turned her defeat into victory.”

Warren catches the snowflake in his hand.

Then he gathers a handful of snow with his hand.

More and more eyes are closing.

It becomes a fairly large snowball.

The boy now puts it on the ground and starts rolling it.

A snowball becomes a snowball, and this snowball gets bigger and bigger.

The excited boy rolls the snowball across the yard, and the snowball grows bigger and bigger.

Eventually, the snowball reaches the end of the boy's yard.

After hesitating for a moment, the boy finally makes up his mind and pushes the snowball into the neighbor's yard.

Warren continued to push the snowball, his gaze now turned to the entire snow-covered world.

--- From "Before You Begin"

Seeing this reminds me of the story of an oil prospector who died and went to heaven.

Saint Peter said:

'I have looked into your records and I see that you have all the qualifications to go to heaven.'

And he continued to say:

'But there is one problem.

Here in heaven, zoning laws are strict, so all oil prospectors are forced to stay in those cages.

But as you can see, the place is packed to the brim, so there's no room for you to enter.'

Then the oil prospector asked, 'Would you mind if I shouted just one word?'

Saint Peter said that it was not a difficult request, so he did so.

Then the oil prospector made a horn with both hands and shouted loudly.

'Oil has been discovered in hell!'

Then the lock on the iron cage fell off and the oil prospectors inside the cage burst out like lightning and ran straight into hell.

Saint Peter said:

'You're quite good at using your head.

Then go in now and get some rest.

There must be plenty of space.'

Then the oil prospector hesitated for a moment, said nothing, and then said:

'Wait a minute, I guess I'll have to follow those guys to hell too.

'If the rumors are spreading like that and everyone is going, then I think there must really be something going on.'

People feel and act this way about stocks too.

It's too easy to believe that there's something real in the rumors floating around.

--- 「2.

From "Sun Valley"

Warren began to think about time differently.

Welfare connects the present with the future.

If one dollar today becomes ten dollars a few years from now, then one dollar today and ten dollars a few years from now are the same.

Warren thought this way.

Warren sat on the front steps of his friend Stu Erickson's house and declared that he would be a millionaire by the age of thirty-five.

It was an absurd thing for a child living in the depression of 1941 to say.

But if Warren calculated it (and the book said it would), it was definitely possible.

He still had 25 years left.

Although he needed a little more money, he was confident he could do it.

The earlier you start saving money, the longer it will last, and the more likely you are to achieve your goals.

And a year later, Warren revealed the essence of his identity to the people.

By the spring of 1942, his fortune had grown to $120 million.

Needless to say, his family was surprised and proud of him.

--- 「8.

Among “A Thousand Ways”

Before that, no one had ever thought of installing a pinball machine in a barbershop, but the two kids went to Eriko and made that suggestion.

Eriko accepted the offer.

The two children removed the pinball machine's legs and loaded it into Danley's father's car and drove it to the barbershop.

And the prediction came true.

When Warren and Don went to see how business was going on the first evening, there were coins totaling nearly four dollars waiting to be fed into the machine.

Eriko loved it, and the pinball machine has been there ever since.

(…)

All of them were $25.

It was enough money to buy another pinball machine.

Soon, Mr. Wilson's pinball machines grew to eighteen, occupying a corner in every barbershop in Omaha.

Here Warren witnessed the miracle of capital.

Money was like a person who worked for a job, earning money for his master.

--- 「12.

From "Silent Sales"

“So, I bought a cigarette butt.

I tried to light this cigarette butt and smoke it.

If you walk down the street, you will see cigarette butts.

It's so damp and disgusting that I feel reluctant to pick up the cigarette butts.

But it's free.

(…) Maybe I could take a puff of smoke.

But Berkshire didn't have a single sip left to suck.

It was just a wet cigarette butt.

I put the cigarette butt in my mouth.

That was Berkshire Hathaway in 1965.

“They tied a huge amount of money to that cigarette butt.”

--- 「27.

From "Foolishness"

Suzy, who was always reaching out to others in search of emotional connection, later said that her husband was by no means an emotionally deficient person.

It's just that I didn't express my feelings outwardly.

But it seemed clear that Warren felt a strong emotional connection to his friends and investors.

Warren felt a strong sense of duty toward them and practically considered them family.

Warren's family could not help but be particularly aware of this aspect of Warren.

Warren behaved in a ceremonial manner when attending family functions, preoccupied with something else, which was a marked difference from his behavior when dealing with friends or investors.

--- 「33.

From "Unraveling"

Warren tried to convince Kay that acquiring a media company was difficult because the accounting issues were a significant burden to anyone trying to acquire one.

“Then Kay started to snicker, saying things like, ‘The depreciation of intangible assets is causing us problems.’

Howard looked straight into Kay's face and said,

"K, what does depreciation of intangible assets mean?" At that very moment, oh, it was truly amazing.

Kay was frozen in place.

It was as good as being completely paralyzed.

Howard seemed to enjoy that.

I intervened and explained to Howard what that meant.

After I finished explaining everything, Kay said this.

“That’s it.”

Warren enjoyed outwitting Simons, cutting the game short and cleverly defending Kay.

Kay's stiff smile began to loosen.

“From that moment on, we became each other’s best friends.

I became Lancelot, a Knight of the Round Table.

I would say it was one of the most shining moments of my life.

“It was the moment that turned her defeat into victory.”

--- 「37.

From "Newspaper Man"

From "Newspaper Man"

Publisher's Review

20% average annual return for over 50 years!

Where did his extraordinary insight come from?

In an era where even five years of consistent investment performance is considered impressive, Warren Buffett has maintained his position at the top for over half a century, achieving returns of over 20%.

His wealth is unparalleled in that he did not inherit it but earned it entirely through his own efforts.

But these investment performances are just one adjective that sets him apart.

What made him not only "the world's richest man" but also "a respected sage"? What is it about him that earns him such acclaim as an investor and as a human being?

Born the son of a banker who lost his job during the Great Depression, Buffett began selling gum at the age of six to earn money, driven by a desire to become rich.

Then, at the age of eleven, he started investing in stocks and experienced all kinds of part-time jobs, including delivering newspapers, and learned the 'snowball' principle of modern capitalism, or the principle of 'compound interest', which states that 'if you start with a small amount of money and gradually increase it, eventually money will make more money.'

Welfare is like rolling a snowball down a hill.

If you start with a small lump and keep rolling the snowball, it will eventually become a really big snowball.

He says he first made a small snowball when he was 14 years old while delivering newspapers, and that he has been rolling it very carefully down a long hill ever since.

The incredible story of how he realized this principle early on and effectively utilized it to create enormous wealth is not only admirable in itself, but also provides a profound lesson.

Surprisingly, the lesson isn't about money.

Buffett's incredible focus and learning curve, which allows him to tirelessly absorb all available information at a terrifying pace; the complete trust of shareholders he earned by thoroughly pursuing 'honesty' in a stock market rife with fraud and trickery; his independent thinking that strictly follows his 'internal scoreboard' in a market swayed by cutting-edge financial engineering and rumors; and his incredible judgment that allows him to instantly find the best method when faced with complex problems.

Warren Buffett's life is a life filled with opportunities, yet fraught with pitfalls and pitfalls, and a source of inspiration for everyone in the world of investing and business, as well as countless others who aspire to succeed in life.

Katharine Graham and her two wives,

The never-before-seen true face of Warren Buffett

When the book was first published, the part that aroused the most curiosity was Warren's personal life.

Born into a family with a history of mental illness, his mother abused him and his older sister, and an aunt and a nephew committed suicide.

While he was working as a director of the Washington Post and was obsessed with Katharine Graham, who had the same complex, his wife Susie, whom he loved and cared for dearly, left him. After that, he lived with Astrid, whom Susie sent to him, and 'Susie became his official wife, and Astrid became his de facto wife who lives with him.'

Having unintentionally had two wives, he did not hide this fact from his family and friends, as befitting his personality of thoroughly pursuing 'honesty'.

He never gave up on something precious, whether it was money or a person, and he never let go of the love of his life, Suzy, even after breaking away from monogamy.

Likewise, he built a strong network of trustworthy, wise people and maintained lifelong friendships with them.

In terms of investment, we have shared a true sense of partnership with like-minded shareholders through a 'web of trust built seamlessly.'

This has created an organic structure where Berkshire Hathaway can freely move capital with its subsidiaries, which hold enormous amounts of cash, and has enabled it to function as a continuous system that creates wealth for shareholders as a compounding engine.

To him, shareholders were not just customers, but students who learned his 'investment philosophy' and 'life philosophy', and life companions.

He felt a sense of responsibility for their lives, even advising them on the best way to manage their investments when they were withdrawing their money.

This sense of responsibility led him to live a life of 'noblesse oblige'.

He participated in the campaign to repeal the estate tax, opposing policies "by the rich, for the rich" during the Bush administration.

He also criticized the reality that the world's richest people have lower income tax rates than their secretaries.

He recognized his exceptional ability to make money as an innate calling to accumulate vast wealth without squandering it and to distribute it efficiently to all sectors of society.

For him, his astronomical wealth was a depository, indicating that he had temporarily set aside resources that should have been used for society.

And in 2006, he opened the doors of his warehouse and gave back his wealth to society.

Through this book, readers will once again be able to experience his outstanding insight into reading economic trends.

Moreover, you will be able to glimpse the humble attitude and resonant values of someone who has risen to the top of the world through his own intuition and vision.

It can be said to be a great biography.

Where did his extraordinary insight come from?

In an era where even five years of consistent investment performance is considered impressive, Warren Buffett has maintained his position at the top for over half a century, achieving returns of over 20%.

His wealth is unparalleled in that he did not inherit it but earned it entirely through his own efforts.

But these investment performances are just one adjective that sets him apart.

What made him not only "the world's richest man" but also "a respected sage"? What is it about him that earns him such acclaim as an investor and as a human being?

Born the son of a banker who lost his job during the Great Depression, Buffett began selling gum at the age of six to earn money, driven by a desire to become rich.

Then, at the age of eleven, he started investing in stocks and experienced all kinds of part-time jobs, including delivering newspapers, and learned the 'snowball' principle of modern capitalism, or the principle of 'compound interest', which states that 'if you start with a small amount of money and gradually increase it, eventually money will make more money.'

Welfare is like rolling a snowball down a hill.

If you start with a small lump and keep rolling the snowball, it will eventually become a really big snowball.

He says he first made a small snowball when he was 14 years old while delivering newspapers, and that he has been rolling it very carefully down a long hill ever since.

The incredible story of how he realized this principle early on and effectively utilized it to create enormous wealth is not only admirable in itself, but also provides a profound lesson.

Surprisingly, the lesson isn't about money.

Buffett's incredible focus and learning curve, which allows him to tirelessly absorb all available information at a terrifying pace; the complete trust of shareholders he earned by thoroughly pursuing 'honesty' in a stock market rife with fraud and trickery; his independent thinking that strictly follows his 'internal scoreboard' in a market swayed by cutting-edge financial engineering and rumors; and his incredible judgment that allows him to instantly find the best method when faced with complex problems.

Warren Buffett's life is a life filled with opportunities, yet fraught with pitfalls and pitfalls, and a source of inspiration for everyone in the world of investing and business, as well as countless others who aspire to succeed in life.

Katharine Graham and her two wives,

The never-before-seen true face of Warren Buffett

When the book was first published, the part that aroused the most curiosity was Warren's personal life.

Born into a family with a history of mental illness, his mother abused him and his older sister, and an aunt and a nephew committed suicide.

While he was working as a director of the Washington Post and was obsessed with Katharine Graham, who had the same complex, his wife Susie, whom he loved and cared for dearly, left him. After that, he lived with Astrid, whom Susie sent to him, and 'Susie became his official wife, and Astrid became his de facto wife who lives with him.'

Having unintentionally had two wives, he did not hide this fact from his family and friends, as befitting his personality of thoroughly pursuing 'honesty'.

He never gave up on something precious, whether it was money or a person, and he never let go of the love of his life, Suzy, even after breaking away from monogamy.

Likewise, he built a strong network of trustworthy, wise people and maintained lifelong friendships with them.

In terms of investment, we have shared a true sense of partnership with like-minded shareholders through a 'web of trust built seamlessly.'

This has created an organic structure where Berkshire Hathaway can freely move capital with its subsidiaries, which hold enormous amounts of cash, and has enabled it to function as a continuous system that creates wealth for shareholders as a compounding engine.

To him, shareholders were not just customers, but students who learned his 'investment philosophy' and 'life philosophy', and life companions.

He felt a sense of responsibility for their lives, even advising them on the best way to manage their investments when they were withdrawing their money.

This sense of responsibility led him to live a life of 'noblesse oblige'.

He participated in the campaign to repeal the estate tax, opposing policies "by the rich, for the rich" during the Bush administration.

He also criticized the reality that the world's richest people have lower income tax rates than their secretaries.

He recognized his exceptional ability to make money as an innate calling to accumulate vast wealth without squandering it and to distribute it efficiently to all sectors of society.

For him, his astronomical wealth was a depository, indicating that he had temporarily set aside resources that should have been used for society.

And in 2006, he opened the doors of his warehouse and gave back his wealth to society.

Through this book, readers will once again be able to experience his outstanding insight into reading economic trends.

Moreover, you will be able to glimpse the humble attitude and resonant values of someone who has risen to the top of the world through his own intuition and vision.

It can be said to be a great biography.

GOODS SPECIFICS

- Publication date: December 22, 2021

- Format: Hardcover book binding method guide

- Page count, weight, size: 1,016 pages | 1,486g | 149*219*60mm

- ISBN13: 9788925579108

- ISBN10: 8925579103

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)