All About Money

|

Description

Book Introduction

Is Bitcoin the new currency? Can you get rich from stocks?

Where did all that money come from? Why doesn't America, with all its debt, go bankrupt?

Why can't I get rich even if I work hard? Why do prices just keep rising?

Answering countless questions about money

Watching Bitcoin's price rise daily, doesn't the emergence of new virtual assets feel unsettling or even alarming? Seeing the stock market and large capital dominate economic news, don't you wonder how money influences the world? What exactly is money? If you find yourself wondering these things, you need to first understand the functions and properties of currency.

You need to understand not only when Bitcoin emerged, what it is, and how it came to function as a currency in society, but also the true nature of "money," which holds the world economy in its hands.

If you want to make money and become rich, you must first understand how money moves the world.

If you are a young person who vaguely thinks that having a lot of money would be nice, I hope this book will help you understand and face money in a more concrete and realistic way.

This book is a real money story that explains the physiology of money in a friendly and fun way.

Where did all that money come from? Why doesn't America, with all its debt, go bankrupt?

Why can't I get rich even if I work hard? Why do prices just keep rising?

Answering countless questions about money

Watching Bitcoin's price rise daily, doesn't the emergence of new virtual assets feel unsettling or even alarming? Seeing the stock market and large capital dominate economic news, don't you wonder how money influences the world? What exactly is money? If you find yourself wondering these things, you need to first understand the functions and properties of currency.

You need to understand not only when Bitcoin emerged, what it is, and how it came to function as a currency in society, but also the true nature of "money," which holds the world economy in its hands.

If you want to make money and become rich, you must first understand how money moves the world.

If you are a young person who vaguely thinks that having a lot of money would be nice, I hope this book will help you understand and face money in a more concrete and realistic way.

This book is a real money story that explains the physiology of money in a friendly and fun way.

- You can preview some of the book's contents.

Preview

index

-Chapter 1: Can Bitcoin Become a Currency?

Global Financial Crisis / What is Decentralization? / The Annals of the Joseon Dynasty and Blockchain / Bitcoin and Starbucks Coffee / The Conditions of Money / [TokTok Plus] Cigarettes Used as Money

-Chapter 2 How is money created?

The Double Coincidence of Desire / Money Must Be Hard! / China, the First to Use Paper Money / Gold Certificates and Banknotes / The Gold Standard / Only I Issue Banknotes / The Gold Standard Is Too Hard / How is Money Made? / The Emergence of Credit Cards / Is There a Huge Jewish Power Behind the Federal Reserve? / [Toktok Plus] A Coin Floating in Water

-Chapter 3 Why do prices keep rising?

Jjajangmyeon and Inflation / Why Inflation Occurs / The Culprit is Money / The Modern Miracle of the Five Loaves and Two Fish: Credit Creation / The Government Loves Inflation / [TokTok Plus] The Fall of Venezuela, Which Became Rich Through Oil

-Chapter 4 Is it okay for the United States to have a lot of debt?

Money doesn't breed / Hypocritical discretionary deposits / What's the difference between bonds and stocks? / High risk, high return / The essence of bonds, government bonds / Government bonds are just debt / Is it okay for the United States to have a lot of debt? / Debt ceiling / [TokTok Plus] Pogroms and the Russo-Japanese War

-Chapter 5 Should I use the money I earn to help others?

Kuznets hypothesis/ Gini coefficient measuring income inequality/ Wealth inequality, inheritance of wealth/ Can we solve the problem of wealth inequality?/ Basic income controversy/ Sharing is justice/ [Toktok Plus] Don't force me to make sacrifices!

Global Financial Crisis / What is Decentralization? / The Annals of the Joseon Dynasty and Blockchain / Bitcoin and Starbucks Coffee / The Conditions of Money / [TokTok Plus] Cigarettes Used as Money

-Chapter 2 How is money created?

The Double Coincidence of Desire / Money Must Be Hard! / China, the First to Use Paper Money / Gold Certificates and Banknotes / The Gold Standard / Only I Issue Banknotes / The Gold Standard Is Too Hard / How is Money Made? / The Emergence of Credit Cards / Is There a Huge Jewish Power Behind the Federal Reserve? / [Toktok Plus] A Coin Floating in Water

-Chapter 3 Why do prices keep rising?

Jjajangmyeon and Inflation / Why Inflation Occurs / The Culprit is Money / The Modern Miracle of the Five Loaves and Two Fish: Credit Creation / The Government Loves Inflation / [TokTok Plus] The Fall of Venezuela, Which Became Rich Through Oil

-Chapter 4 Is it okay for the United States to have a lot of debt?

Money doesn't breed / Hypocritical discretionary deposits / What's the difference between bonds and stocks? / High risk, high return / The essence of bonds, government bonds / Government bonds are just debt / Is it okay for the United States to have a lot of debt? / Debt ceiling / [TokTok Plus] Pogroms and the Russo-Japanese War

-Chapter 5 Should I use the money I earn to help others?

Kuznets hypothesis/ Gini coefficient measuring income inequality/ Wealth inequality, inheritance of wealth/ Can we solve the problem of wealth inequality?/ Basic income controversy/ Sharing is justice/ [Toktok Plus] Don't force me to make sacrifices!

Detailed image

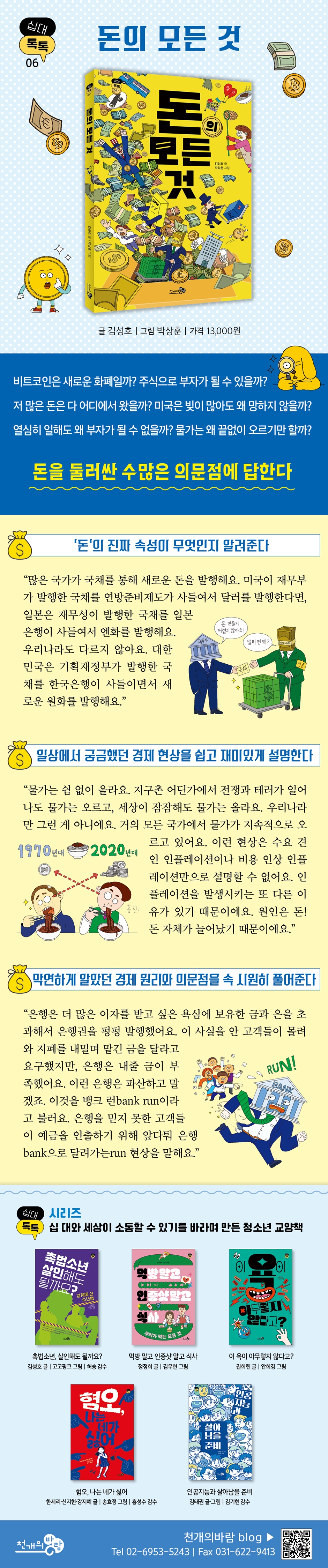

Publisher's Review

▶ By understanding the true nature of 'money' rather than rigid economic concepts, you can flexibly adapt to changes driven by 'money'.

Following the U.S. presidential election, the stock market has fluctuated, with some stock prices fluctuating significantly, while experts are busy analyzing the changing global economic landscape.

Since the US dollar already dominates the global economy, it is natural to worry about the impact of the US situation on the global economy.

So when did the dollar become the reserve currency?

Bitcoin achieved a market capitalization of $1 trillion in just 12 years, putting numerous global companies at its feet.

Bitcoin is still a virtual asset and not a currency in Korea, but there may come a day when Bitcoin becomes our legal tender.

So who created Bitcoin and why? How did Bitcoin come to dominate the global economy?

It is no exaggeration to say that money is the main character in today's economy, society, politics, and culture.

But how money rules the world, the true nature of money is not taught in school economics classes.

This book will help young people understand the true nature of money and flexibly adapt to the changes driven by money.

The bankruptcy of banks that were once believed to be absolutely safe, the government that printed money like crazy to save those failing banks, and those who looked at this with disapproval came to deeply distrust the 'money' we use and the system that creates and supplies that 'money' - the central government and banks.

Programmer Satoshi Nakamoto was one of those people.

On October 31, 2008, during the height of Halloween celebrations, Satoshi Nakamoto uploaded a strange white paper to the Internet.

The title of this short, nine-page, 2,736-word white paper was "Bitcoin: A Peer-to-Peer Electronic Cash System."

- From "All About Money"

▶ It covers economic phenomena that we are curious about in our daily lives, such as stocks, debt, credit cards, foreign exchange crises, and exchange rates, making it easy and fun to read.

Many people say that the market economy has changed dramatically since the 2008 foreign exchange crisis. Some even say that foreign investors have increased since the IMF crisis, and the labor market has changed.

The foreign exchange crisis occurred when major US financial institutions, driven to the brink by mismanagement, withdrew their investments globally. The IMF declared a moratorium on loans to South Korea due to its inability to repay loans it had borrowed from foreign countries.

Domestic shopping cart prices fluctuate in response to international oil price fluctuations, and the South Korean currency supply also increases in line with the US currency supply.

The government is fiercely fighting inflation every day, setting inflation targets.

Whether you're interested in economics or not, the monetary phenomenon caused by 'money' shakes up our daily lives.

This book is interesting because it deals with economic phenomena related to money that we encounter in our daily lives.

It provides friendly explanations of economic phenomena that we usually wonder about, such as why prices keep rising, why the government prefers inflation to deflation, and why the United States doesn't go bankrupt despite its large debt.

There is a saying, 'There is no business without debt.'

Even in the United States, the mounting debt is bound to be a concern.

The United States has long been known as a country known for its large spending habits.

The U.S. Congress, unable to stand by and watch, went so far as to legislate a maximum amount of debt the U.S. government could borrow.

This is called the 'debt ceiling'.

Incidentally, the only two countries on Earth with debt ceilings are the United States and Denmark.

- From "All About Money"

▶ Through characteristic events and examples, you can clearly understand economic principles that you had vaguely known and questions that you had.

On May 22, 2010, an American man named Laszlo Haniec posted a message on the Internet.

The post said that anyone who bought two pizzas would receive 10,000 Bitcoins.

A few days later, a British man accepted the offer and sent two pizzas to Hanietz's house.

This is the first recorded purchase of an item with Bitcoin.

One day in 1949, American businessman Frank McNamara was paying the bill after a meal at a fancy restaurant in New York when he realized he had left his wallet behind.

McNamara, who was so embarrassed in front of people, created a credit card that could pay for meals even if he didn't have cash.

This was the first credit card in the modern sense, the paper Diners Club.

This book introduces economic changes and principles through major events and anecdotes.

You can clearly understand questions you've always wondered about or economic principles you weren't sure about.

Following the U.S. presidential election, the stock market has fluctuated, with some stock prices fluctuating significantly, while experts are busy analyzing the changing global economic landscape.

Since the US dollar already dominates the global economy, it is natural to worry about the impact of the US situation on the global economy.

So when did the dollar become the reserve currency?

Bitcoin achieved a market capitalization of $1 trillion in just 12 years, putting numerous global companies at its feet.

Bitcoin is still a virtual asset and not a currency in Korea, but there may come a day when Bitcoin becomes our legal tender.

So who created Bitcoin and why? How did Bitcoin come to dominate the global economy?

It is no exaggeration to say that money is the main character in today's economy, society, politics, and culture.

But how money rules the world, the true nature of money is not taught in school economics classes.

This book will help young people understand the true nature of money and flexibly adapt to the changes driven by money.

The bankruptcy of banks that were once believed to be absolutely safe, the government that printed money like crazy to save those failing banks, and those who looked at this with disapproval came to deeply distrust the 'money' we use and the system that creates and supplies that 'money' - the central government and banks.

Programmer Satoshi Nakamoto was one of those people.

On October 31, 2008, during the height of Halloween celebrations, Satoshi Nakamoto uploaded a strange white paper to the Internet.

The title of this short, nine-page, 2,736-word white paper was "Bitcoin: A Peer-to-Peer Electronic Cash System."

- From "All About Money"

▶ It covers economic phenomena that we are curious about in our daily lives, such as stocks, debt, credit cards, foreign exchange crises, and exchange rates, making it easy and fun to read.

Many people say that the market economy has changed dramatically since the 2008 foreign exchange crisis. Some even say that foreign investors have increased since the IMF crisis, and the labor market has changed.

The foreign exchange crisis occurred when major US financial institutions, driven to the brink by mismanagement, withdrew their investments globally. The IMF declared a moratorium on loans to South Korea due to its inability to repay loans it had borrowed from foreign countries.

Domestic shopping cart prices fluctuate in response to international oil price fluctuations, and the South Korean currency supply also increases in line with the US currency supply.

The government is fiercely fighting inflation every day, setting inflation targets.

Whether you're interested in economics or not, the monetary phenomenon caused by 'money' shakes up our daily lives.

This book is interesting because it deals with economic phenomena related to money that we encounter in our daily lives.

It provides friendly explanations of economic phenomena that we usually wonder about, such as why prices keep rising, why the government prefers inflation to deflation, and why the United States doesn't go bankrupt despite its large debt.

There is a saying, 'There is no business without debt.'

Even in the United States, the mounting debt is bound to be a concern.

The United States has long been known as a country known for its large spending habits.

The U.S. Congress, unable to stand by and watch, went so far as to legislate a maximum amount of debt the U.S. government could borrow.

This is called the 'debt ceiling'.

Incidentally, the only two countries on Earth with debt ceilings are the United States and Denmark.

- From "All About Money"

▶ Through characteristic events and examples, you can clearly understand economic principles that you had vaguely known and questions that you had.

On May 22, 2010, an American man named Laszlo Haniec posted a message on the Internet.

The post said that anyone who bought two pizzas would receive 10,000 Bitcoins.

A few days later, a British man accepted the offer and sent two pizzas to Hanietz's house.

This is the first recorded purchase of an item with Bitcoin.

One day in 1949, American businessman Frank McNamara was paying the bill after a meal at a fancy restaurant in New York when he realized he had left his wallet behind.

McNamara, who was so embarrassed in front of people, created a credit card that could pay for meals even if he didn't have cash.

This was the first credit card in the modern sense, the paper Diners Club.

This book introduces economic changes and principles through major events and anecdotes.

You can clearly understand questions you've always wondered about or economic principles you weren't sure about.

GOODS SPECIFICS

- Date of issue: November 22, 2024

- Page count, weight, size: 160 pages | 258g | 135*205*11mm

- ISBN13: 9791165735821

- ISBN10: 1165735822

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)