A book that contains 30 volumes of great economic classics in one volume.

|

Description

Book Introduction

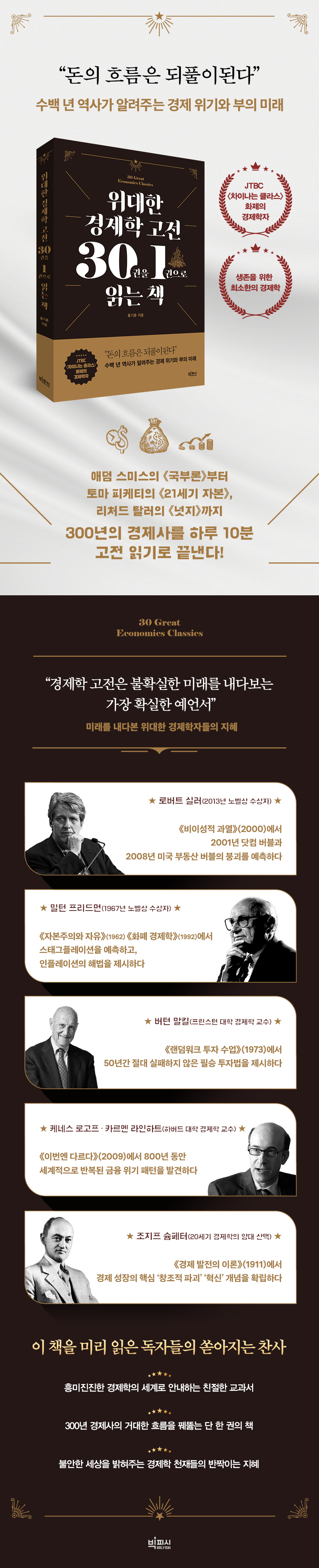

"The history of money repeats itself." Economic crises and the future of wealth as revealed by centuries of history Adam Smith, known as the 'father of economics', was born in England 300 years ago. Since Adam Smith, countless economists have developed economics, and as a result, economics in the 21st century we live in has become an essential discipline that cannot be left out when discussing national policy or even individual life. But economics still feels difficult. For these people, Professor Hong Ki-hoon, the author of this book, recommends reading the classic works of various economists to learn economics most easily. This is because in the process, you can naturally build basic knowledge, understand the causes of phenomena, and learn about the impact their theories have had on society. What's amazing is that great economists predicted economic crises and proposed solutions hundreds of years ago. This book introduces 30 classic economics books in an easy-to-understand yet in-depth manner, from Adam Smith's "The Wealth of Nations" to Richard Thaler and Cass Sunstein's "Nudge." This will be an excellent textbook for working professionals who want to understand at least a basic understanding of economic concepts, students looking for a book to refer to in their economics classes, and anyone interested in the framework of economic thinking. |

- You can preview some of the book's contents.

Preview

index

introduction.

The history of money repeats itself

Chapter 1.

The most influential economic classic on humanity

1.

Adam Smith, The Wealth of Nations, 1776

: The birth of the greatest book since the Bible

2.

Thomas Malthus, An Essay on the Principle of Population, 1798

: What if the population grows faster than food?

3.

John Stuart Mill, Principles of Political Economy, 1848

: The first economics textbook

4.

Karl Marx, Capital, 1867

: The book that has had the greatest influence on humanity

5.

Alfred Marshall, Principles of Economics, 1890

: Independent from economics, philosophy and politics

6.

John Maynard Keynes, The General Theory of Employment, Interest and Money, 1936

: The government finally intervenes in the market.

Chapter 2.

Classic economics books I wish I had learned in school

7.

John Kenneth Galbraith, The Affluent Society, 1958

A new world needs a new economics.

8.

Gary Becker, Human Capital, 1964

: Putting humans at the center of economics

9.

Hirofumi Uzawa, The Social Cost of Automobiles, 1974

: Presenting economic solutions to the problems of capitalism

10.

Joseph Stiglitz, Globalization and Its Discontents, 2002

: What is behind globalization?

11.

Freakonomics, by Steven Levitt and Stephen Dubner, 2005

: The homework thrown at economics that is becoming distant from the public

12.

Darren Acemoglu and James A.

Robinson, Why Nations Fail, 2012

: A realistic solution to overcome national poverty

Chapter 3.

Classic economics books by Nobel Prize winners

13.

John Hicks, Value and Capital, 1939

: Systematizing the theoretical framework of microeconomics

14.

Friedrich Hayek, The Road to Serfdom, 1944

: Questioning the Role of Government, the Market, and the Meaning of Freedom

15.

Elinor Ostrom, Beyond the Tragedy of the Commons, 1990

: Is the destruction of humanity due to climate change inevitable?

16.

Robert Schiller, Irrational Exuberance, 2000

The collapse of the economic bubble that followed unprecedented prosperity

17.

Paul Krugman, "End This Depression Now!" (2012)

: Focus on overcoming the economic crisis rather than its causes.

Chapter 4.

A classic economics book showing the flow of wealth

18.

Milton Friedman, Capitalism and Freedom, 1962

: Accurately predicting stagflation

19.

Burton Malkiel, "Random Walk: A Guide to Investment" (1973)

: A winning investment strategy for ordinary investors

20.

George Soros, The Alchemy of Finance, 1987

: The financial markets as seen by the world's most successful investors

21.

Milton Friedman, Monetary Economics, 1992

: A solution to inflation presented by a Nobel Prize winner in economics

22.

Kenneth Rogoff and Carmen Reinhart, This Time Is Different, 2009

: The phrase "This time is different" is always followed by a financial crisis.

Chapter 5.

An economics classic that reveals the truth about capitalism.

23.

Joseph Schumpeter, The Theory of Economic Development, 1911

: What is entrepreneurship, the key to economic growth?

24.

Hyman Minsky, Stabilizing Unstable Economies, 1986

: Predicting the 2008 financial crisis

25.

Jeffrey Sachs, The End of Poverty, 2005

: What role should policy play in poverty eradication?

26.

Thomas Piketty, Capital in the Twenty-First Century, 2013

: The eternal debate: the study of wealth distribution

Chapter 6.

A New Economics Classic for Us Now

27.

Adolph Berley and Gardiner Means, The Modern Corporation and Private Property, 1932

: A book that served as a pioneer in ESG

28.

Nassim Taleb's Black Swan, 2007

: Humans do not know that they do not know

29.

Richard Thaler and Cass Sunstein, Nudge, 2008

: Studying human rationality through a fusion of psychology and science.

30.

Daniel Kahneman, Thinking, Fast and Slow, 2011

: The Bible of Behavioral Economics that Overturns the Framework of Traditional Economics

The history of money repeats itself

Chapter 1.

The most influential economic classic on humanity

1.

Adam Smith, The Wealth of Nations, 1776

: The birth of the greatest book since the Bible

2.

Thomas Malthus, An Essay on the Principle of Population, 1798

: What if the population grows faster than food?

3.

John Stuart Mill, Principles of Political Economy, 1848

: The first economics textbook

4.

Karl Marx, Capital, 1867

: The book that has had the greatest influence on humanity

5.

Alfred Marshall, Principles of Economics, 1890

: Independent from economics, philosophy and politics

6.

John Maynard Keynes, The General Theory of Employment, Interest and Money, 1936

: The government finally intervenes in the market.

Chapter 2.

Classic economics books I wish I had learned in school

7.

John Kenneth Galbraith, The Affluent Society, 1958

A new world needs a new economics.

8.

Gary Becker, Human Capital, 1964

: Putting humans at the center of economics

9.

Hirofumi Uzawa, The Social Cost of Automobiles, 1974

: Presenting economic solutions to the problems of capitalism

10.

Joseph Stiglitz, Globalization and Its Discontents, 2002

: What is behind globalization?

11.

Freakonomics, by Steven Levitt and Stephen Dubner, 2005

: The homework thrown at economics that is becoming distant from the public

12.

Darren Acemoglu and James A.

Robinson, Why Nations Fail, 2012

: A realistic solution to overcome national poverty

Chapter 3.

Classic economics books by Nobel Prize winners

13.

John Hicks, Value and Capital, 1939

: Systematizing the theoretical framework of microeconomics

14.

Friedrich Hayek, The Road to Serfdom, 1944

: Questioning the Role of Government, the Market, and the Meaning of Freedom

15.

Elinor Ostrom, Beyond the Tragedy of the Commons, 1990

: Is the destruction of humanity due to climate change inevitable?

16.

Robert Schiller, Irrational Exuberance, 2000

The collapse of the economic bubble that followed unprecedented prosperity

17.

Paul Krugman, "End This Depression Now!" (2012)

: Focus on overcoming the economic crisis rather than its causes.

Chapter 4.

A classic economics book showing the flow of wealth

18.

Milton Friedman, Capitalism and Freedom, 1962

: Accurately predicting stagflation

19.

Burton Malkiel, "Random Walk: A Guide to Investment" (1973)

: A winning investment strategy for ordinary investors

20.

George Soros, The Alchemy of Finance, 1987

: The financial markets as seen by the world's most successful investors

21.

Milton Friedman, Monetary Economics, 1992

: A solution to inflation presented by a Nobel Prize winner in economics

22.

Kenneth Rogoff and Carmen Reinhart, This Time Is Different, 2009

: The phrase "This time is different" is always followed by a financial crisis.

Chapter 5.

An economics classic that reveals the truth about capitalism.

23.

Joseph Schumpeter, The Theory of Economic Development, 1911

: What is entrepreneurship, the key to economic growth?

24.

Hyman Minsky, Stabilizing Unstable Economies, 1986

: Predicting the 2008 financial crisis

25.

Jeffrey Sachs, The End of Poverty, 2005

: What role should policy play in poverty eradication?

26.

Thomas Piketty, Capital in the Twenty-First Century, 2013

: The eternal debate: the study of wealth distribution

Chapter 6.

A New Economics Classic for Us Now

27.

Adolph Berley and Gardiner Means, The Modern Corporation and Private Property, 1932

: A book that served as a pioneer in ESG

28.

Nassim Taleb's Black Swan, 2007

: Humans do not know that they do not know

29.

Richard Thaler and Cass Sunstein, Nudge, 2008

: Studying human rationality through a fusion of psychology and science.

30.

Daniel Kahneman, Thinking, Fast and Slow, 2011

: The Bible of Behavioral Economics that Overturns the Framework of Traditional Economics

Detailed image

Into the book

I believe that the most effective way to understand economics is to learn and follow the opinions of various economists in a fun way.

In this process, we naturally build a foundational understanding of economics, understand why these phenomena and claims emerge, and understand the ultimate impact economists' theories have had on our society.

What is remarkable is that great economists predicted inflation in their books before the term "inflation" even existed, and stagflation before we experienced it.

Not only were the 2001 dot-com bubble and the 2008 financial crisis predicted, but the global spotlight today on ESG and the human crisis caused by climate change were also introduced by economists over 100 years ago, and their own solutions were even proposed.

Isn't it amazing? This is how we can know the future through the past.

And the easiest way to predict the future is to stand on the shoulders of giants and read the great economic classics they wrote.

---"introduction.

From “The history of money repeats itself (page 6)”

Since Keynes, economics has become more difficult and mathematical.

The economy has a profound impact on the lives of ordinary people, and given that then-presidential candidate Bill Clinton famously remarked in 1992, “It’s the economy, stupid!”, it’s a shame that economics has become an increasingly inaccessible discipline for non-economists.

Despite its lack of academic expertise and logical soundness, Freakonomics's immense success as a storytelling tool for ordinary people demonstrates the public's hunger for easy and clear economic explanations of the real world.

This is a golden opportunity and a heavy responsibility for economists who want to change the world for a better place.

---From "Steven Levitt and Stephen Dubner, Freakonomics: The Challenges of Economics Disengaging from the Public (pp. 108-109)"

Is investing a gamble where the outcome is unpredictable? According to Malkiel, yes.

But we can look far ahead with enough confidence, not just an inch ahead.

Short-term stock price movements are difficult to predict, but a comprehensive look at the data shows that the overall market shows a steady, gradual upward trend.

And this is the surefire way to success that Malkiel talks about.

It is difficult to predict the short term and the direction of a single company, but the long-term trend of the entire market is upward, so the idea is to ride this wave.

---From "Burton Malkiel, 'Random Walk Investment Class': A Winning Investment Strategy for Ordinary Investors (pp. 176-177)"

In the 1970s, when the U.S. stock market rose only 47% over a 10-year period, Soros' Quantum Fund recorded a return of 4,200%.

His fund, which started with $4 million in 1970, generated over $32 billion in profits by 2010.

(…) Soros emphasizes that the market is neither efficient nor stable, citing the formation and collapse of various bubbles throughout history as evidence.

Market fluctuations and crashes are not abnormal phenomena, but rather natural and expected.

He does not analyze the intrinsic characteristics of a company, commonly referred to as "fundamentals."

In his view, there is no inherent value, everything is relative.

This is because when the intrinsic characteristics are analyzed and the stock price moves according to that judgment, the company's circumstances are also affected by the stock price and change.

Therefore, he thoroughly understands the investment targets and market players, predicts their behavioral inducements and psychology, and then bets on either an upward or downward trend.

---From "George Soros, 'The Alchemy of Finance': The Financial Market as Seen by the World's Most Successful Investor (p. 185)"

Minsky and his book first gained attention in 1998, during the height of the Russian financial crisis.

Paul McCauley, a fund manager at Pimco, one of the world's largest bond management firms, took notice of Minsky's theory.

During the economic crisis at the time, asset prices across the market plummeted, leading to a more severe recession.

Macaulay felt that this situation was very similar to Minsky's theory and called it the 'Minsky Moment'.

Minsky and his book briefly gained attention in the late 1990s, but then returned to prominence during the economic golden age of the early 21st century, only to be forgotten.

And humanity had to pay the price for that forgetfulness again.

(…) In 2007, as concerns about the onset of an economic crisis and the realization that real estate mortgages were becoming toxic, business publications such as the Wall Street Journal and the Financial Times began to talk about Minsky.

And in March 2008, when Bear Stearns, the fifth-largest investment bank on Wall Street, was acquired by JPMorgan due to distressed assets, Minsky finally received a reevaluation.

---From Hyman Minsky, Stabilizing the Unstable Economy: Predicting the 2008 Financial Crisis (pp. 216-217)

After analyzing data from the 18th century to the present, Piketty discovers shocking results.

Except for the Great Depression and wartime periods, the rate of return on capital has consistently outpaced economic growth.

The fact that capital is growing faster than the overall national income means that the rich are getting richer and the poor are getting poorer, meaning that the wealth of those who already have capital is growing much faster.

(…) Piketty says that a ‘global capital tax’ is absolutely necessary and will definitely be introduced.

The reason he believes this is simple.

Marx predicted that when the gap between rich and poor exceeds its limit, a revolution will occur and the system will be overthrown.

And if wealth inequality continues to worsen as it is now, it is clear that it will ultimately lead to great social unrest.

In this situation, the world will have no choice but to adopt a global capital tax because it is a better alternative than revolution and the loss of democracy.

In this process, we naturally build a foundational understanding of economics, understand why these phenomena and claims emerge, and understand the ultimate impact economists' theories have had on our society.

What is remarkable is that great economists predicted inflation in their books before the term "inflation" even existed, and stagflation before we experienced it.

Not only were the 2001 dot-com bubble and the 2008 financial crisis predicted, but the global spotlight today on ESG and the human crisis caused by climate change were also introduced by economists over 100 years ago, and their own solutions were even proposed.

Isn't it amazing? This is how we can know the future through the past.

And the easiest way to predict the future is to stand on the shoulders of giants and read the great economic classics they wrote.

---"introduction.

From “The history of money repeats itself (page 6)”

Since Keynes, economics has become more difficult and mathematical.

The economy has a profound impact on the lives of ordinary people, and given that then-presidential candidate Bill Clinton famously remarked in 1992, “It’s the economy, stupid!”, it’s a shame that economics has become an increasingly inaccessible discipline for non-economists.

Despite its lack of academic expertise and logical soundness, Freakonomics's immense success as a storytelling tool for ordinary people demonstrates the public's hunger for easy and clear economic explanations of the real world.

This is a golden opportunity and a heavy responsibility for economists who want to change the world for a better place.

---From "Steven Levitt and Stephen Dubner, Freakonomics: The Challenges of Economics Disengaging from the Public (pp. 108-109)"

Is investing a gamble where the outcome is unpredictable? According to Malkiel, yes.

But we can look far ahead with enough confidence, not just an inch ahead.

Short-term stock price movements are difficult to predict, but a comprehensive look at the data shows that the overall market shows a steady, gradual upward trend.

And this is the surefire way to success that Malkiel talks about.

It is difficult to predict the short term and the direction of a single company, but the long-term trend of the entire market is upward, so the idea is to ride this wave.

---From "Burton Malkiel, 'Random Walk Investment Class': A Winning Investment Strategy for Ordinary Investors (pp. 176-177)"

In the 1970s, when the U.S. stock market rose only 47% over a 10-year period, Soros' Quantum Fund recorded a return of 4,200%.

His fund, which started with $4 million in 1970, generated over $32 billion in profits by 2010.

(…) Soros emphasizes that the market is neither efficient nor stable, citing the formation and collapse of various bubbles throughout history as evidence.

Market fluctuations and crashes are not abnormal phenomena, but rather natural and expected.

He does not analyze the intrinsic characteristics of a company, commonly referred to as "fundamentals."

In his view, there is no inherent value, everything is relative.

This is because when the intrinsic characteristics are analyzed and the stock price moves according to that judgment, the company's circumstances are also affected by the stock price and change.

Therefore, he thoroughly understands the investment targets and market players, predicts their behavioral inducements and psychology, and then bets on either an upward or downward trend.

---From "George Soros, 'The Alchemy of Finance': The Financial Market as Seen by the World's Most Successful Investor (p. 185)"

Minsky and his book first gained attention in 1998, during the height of the Russian financial crisis.

Paul McCauley, a fund manager at Pimco, one of the world's largest bond management firms, took notice of Minsky's theory.

During the economic crisis at the time, asset prices across the market plummeted, leading to a more severe recession.

Macaulay felt that this situation was very similar to Minsky's theory and called it the 'Minsky Moment'.

Minsky and his book briefly gained attention in the late 1990s, but then returned to prominence during the economic golden age of the early 21st century, only to be forgotten.

And humanity had to pay the price for that forgetfulness again.

(…) In 2007, as concerns about the onset of an economic crisis and the realization that real estate mortgages were becoming toxic, business publications such as the Wall Street Journal and the Financial Times began to talk about Minsky.

And in March 2008, when Bear Stearns, the fifth-largest investment bank on Wall Street, was acquired by JPMorgan due to distressed assets, Minsky finally received a reevaluation.

---From Hyman Minsky, Stabilizing the Unstable Economy: Predicting the 2008 Financial Crisis (pp. 216-217)

After analyzing data from the 18th century to the present, Piketty discovers shocking results.

Except for the Great Depression and wartime periods, the rate of return on capital has consistently outpaced economic growth.

The fact that capital is growing faster than the overall national income means that the rich are getting richer and the poor are getting poorer, meaning that the wealth of those who already have capital is growing much faster.

(…) Piketty says that a ‘global capital tax’ is absolutely necessary and will definitely be introduced.

The reason he believes this is simple.

Marx predicted that when the gap between rich and poor exceeds its limit, a revolution will occur and the system will be overthrown.

And if wealth inequality continues to worsen as it is now, it is clear that it will ultimately lead to great social unrest.

In this situation, the world will have no choice but to adopt a global capital tax because it is a better alternative than revolution and the loss of democracy.

---From Thomas Piketty, Capital in the Twenty-First Century: A Study of Wealth Distribution, a Perennial Debate (pp. 234-236)

Publisher's Review

How does economics become a weapon for life?

The world is trembling with anxiety over an economic recession due to recent concerns about high interest rates and inflation.

I learned that interest rate hikes, which seemed like they had nothing to do with me, had a huge impact on my salary, my spending, my mortgage, and my daily life.

The economy is closer to my life than I think.

So more and more people want to know more about economics.

But when you actually go to a bookstore and open a book, a feast of graphs and numbers unfolds.

I don't even know where or how to start.

Then, I searched for a YouTube video that explains it more easily.

The title may seem easy, but since it focuses on the present story, it is still difficult for those who do not know the basics.

Because I only explain the phenomenon without talking about the context, everything is superficial.

Is there any way to help us understand the economy and economics a little more fundamentally?

The dot-com bubble, the financial crisis, ESG, the climate crisis…

It was already predicted, and the solution is even in the classic economics books?

The most important thing when learning economics is to understand the overall context, not just fragmented knowledge like interest rates or stock prices.

For example, if you want to understand the Roman Empire, you need to know how the Roman Republic was born, what process it developed through, what problems it faced, and why the republican system collapsed.

In other words, if you want to understand how inflation can lead to a recession and threaten your investments, you need to learn step by step how inflation occurs, how to deal with it, and why you should deal with it that way.

From this perspective, the best way to understand economics is to read the classics of various economists.

In this process, you can naturally build a basic understanding of economics, understand why certain phenomena and claims arise, and what impact economists' theories ultimately have on society.

What is surprising is that great economists predicted inflation in their books before the term "inflation" even existed, and stagflation before we experienced it.

Not only were the 2001 dot-com bubble and the 2008 financial crisis predicted, but the global spotlight today on ESG and the human crisis caused by climate change were also introduced by economists over 100 years ago, and their own solutions were even proposed.

Isn't it amazing? This is how we can know the future through the past.

And the easiest way to predict the future is to stand on the shoulders of giants and read the great economic classics they wrote.

From Adam Smith's "The Wealth of Nations" to Richard Thaler and Cass Sunstein's "Nudge"

From classical economics to behavioral economics

300 years of economic history in 30 volumes

This book selects 30 classic books that will help you understand the core of economics.

First, we will understand the background of the book based on the era in which the classic was written, and then we will kindly explain the core content of the book and its influence on later generations.

Moreover, it introduces many classics that are difficult to find in translation in Korea today.

Reading this book will help you realize how closely economics, which has been considered distant and difficult, is actually related to our lives and how it can be of great help in understanding the real world.

This will be an excellent textbook for working professionals who want to understand at least a basic understanding of economic concepts, students looking for a book to refer to in their economics classes, and anyone interested in the framework of economic thinking.

The world is trembling with anxiety over an economic recession due to recent concerns about high interest rates and inflation.

I learned that interest rate hikes, which seemed like they had nothing to do with me, had a huge impact on my salary, my spending, my mortgage, and my daily life.

The economy is closer to my life than I think.

So more and more people want to know more about economics.

But when you actually go to a bookstore and open a book, a feast of graphs and numbers unfolds.

I don't even know where or how to start.

Then, I searched for a YouTube video that explains it more easily.

The title may seem easy, but since it focuses on the present story, it is still difficult for those who do not know the basics.

Because I only explain the phenomenon without talking about the context, everything is superficial.

Is there any way to help us understand the economy and economics a little more fundamentally?

The dot-com bubble, the financial crisis, ESG, the climate crisis…

It was already predicted, and the solution is even in the classic economics books?

The most important thing when learning economics is to understand the overall context, not just fragmented knowledge like interest rates or stock prices.

For example, if you want to understand the Roman Empire, you need to know how the Roman Republic was born, what process it developed through, what problems it faced, and why the republican system collapsed.

In other words, if you want to understand how inflation can lead to a recession and threaten your investments, you need to learn step by step how inflation occurs, how to deal with it, and why you should deal with it that way.

From this perspective, the best way to understand economics is to read the classics of various economists.

In this process, you can naturally build a basic understanding of economics, understand why certain phenomena and claims arise, and what impact economists' theories ultimately have on society.

What is surprising is that great economists predicted inflation in their books before the term "inflation" even existed, and stagflation before we experienced it.

Not only were the 2001 dot-com bubble and the 2008 financial crisis predicted, but the global spotlight today on ESG and the human crisis caused by climate change were also introduced by economists over 100 years ago, and their own solutions were even proposed.

Isn't it amazing? This is how we can know the future through the past.

And the easiest way to predict the future is to stand on the shoulders of giants and read the great economic classics they wrote.

From Adam Smith's "The Wealth of Nations" to Richard Thaler and Cass Sunstein's "Nudge"

From classical economics to behavioral economics

300 years of economic history in 30 volumes

This book selects 30 classic books that will help you understand the core of economics.

First, we will understand the background of the book based on the era in which the classic was written, and then we will kindly explain the core content of the book and its influence on later generations.

Moreover, it introduces many classics that are difficult to find in translation in Korea today.

Reading this book will help you realize how closely economics, which has been considered distant and difficult, is actually related to our lives and how it can be of great help in understanding the real world.

This will be an excellent textbook for working professionals who want to understand at least a basic understanding of economic concepts, students looking for a book to refer to in their economics classes, and anyone interested in the framework of economic thinking.

GOODS SPECIFICS

- Date of issue: March 2, 2023

- Page count, weight, size: 272 pages | 466g | 148*210*16mm

- ISBN13: 9791191825763

- ISBN10: 1191825760

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)