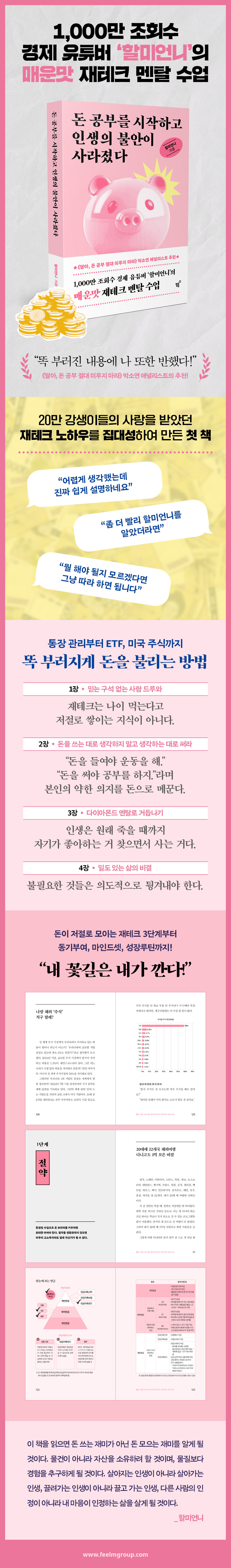

I started studying money and my anxiety in life disappeared.

|

Description

Book Introduction

Spicy financial management mental training from economic YouTuber "Grandma's Sister," who has 10 million views. “If you don’t know what to do, just follow along,” “I really like this girl!”, “I thought it would be difficult, but she explains it really easily,” said economic YouTuber Halmi Unnie, who has surpassed 10 million cumulative views and inspired many people to want to live as clearly as her. The first book I wrote, which is a compilation of the financial know-how that has been loved by subscribers, is "I started studying money and my anxiety in life disappeared." This book is divided into four parts: motivation, financial management, mindset, and growth routine. It is packed with financial management know-how, from the three steps of financial management that will make money accumulate naturally to ETFs and US stocks. It also shares the power of consistently saving money and maintaining the habit of saving money, as well as self-management techniques. I hope that through this book, you will take a step closer to financial management and gain experience that will help you eliminate the anxiety in life. |

- You can preview some of the book's contents.

Preview

index

Recommendation

Prologue | The only person responsible for my own happiness is myself.

Chapter 1: Drew, the man without a corner of faith

What are you serious about?

Why You Should Start Investing ASAP

There's a difference between living for today and living in the present.

I won't die tomorrow, and I won't die the day after tomorrow either.

We all end up being grandparents.

[Grandma's Bitter Words 1] Ji In Ji Jo: Ji's life is Ji Jin Da

Chapter 2: Don't think about how you spend money, spend it the way you think.

Before you start investing

Step 1 Savings

The secret to saving 100 million won while traveling to 22 countries in your 20s

Why you need to have a lot of money

Let's keep dating expenses to a minimum

Step 2 Savings

Saving comes before investing

Don't let your salary sit idle in your bank account.

3-step investment

I shop for ETFs in my retirement account.

Do you want to buy overseas stocks with me?

My own principles for successful investing

[Grandma's Bitter Words 2] You forgot to buy a house in this life? Come to your senses!

Chapter 3: Reborn with a Diamond Mentality

Consumer addiction is a disease with a cause.

Absolutely protect your broken self-esteem!

People you must filter out in life

When you save money and get a headache

In your 20s, age is a gangster

The secret to making work life enjoyable

Self-management tips to escape the hell of lethargy

[Grandma's Bitter Words 3] Shaking hands at the end of a long game

Chapter 4: The Secret to a Dense Life

I want to live 'a lot', not just for a long time.

Hobbies are another universe

If the Earth were a book

How to live your life in order

You have to know that time is precious

Life is a balance game

You're a practical young man, aren't you?

[Grandma's Bitter Words 4] What to Fill the Cart of Life

Epilogue | Life isn't about waiting for the storm to pass, it's about learning to dance in the rain.

Prologue | The only person responsible for my own happiness is myself.

Chapter 1: Drew, the man without a corner of faith

What are you serious about?

Why You Should Start Investing ASAP

There's a difference between living for today and living in the present.

I won't die tomorrow, and I won't die the day after tomorrow either.

We all end up being grandparents.

[Grandma's Bitter Words 1] Ji In Ji Jo: Ji's life is Ji Jin Da

Chapter 2: Don't think about how you spend money, spend it the way you think.

Before you start investing

Step 1 Savings

The secret to saving 100 million won while traveling to 22 countries in your 20s

Why you need to have a lot of money

Let's keep dating expenses to a minimum

Step 2 Savings

Saving comes before investing

Don't let your salary sit idle in your bank account.

3-step investment

I shop for ETFs in my retirement account.

Do you want to buy overseas stocks with me?

My own principles for successful investing

[Grandma's Bitter Words 2] You forgot to buy a house in this life? Come to your senses!

Chapter 3: Reborn with a Diamond Mentality

Consumer addiction is a disease with a cause.

Absolutely protect your broken self-esteem!

People you must filter out in life

When you save money and get a headache

In your 20s, age is a gangster

The secret to making work life enjoyable

Self-management tips to escape the hell of lethargy

[Grandma's Bitter Words 3] Shaking hands at the end of a long game

Chapter 4: The Secret to a Dense Life

I want to live 'a lot', not just for a long time.

Hobbies are another universe

If the Earth were a book

How to live your life in order

You have to know that time is precious

Life is a balance game

You're a practical young man, aren't you?

[Grandma's Bitter Words 4] What to Fill the Cart of Life

Epilogue | Life isn't about waiting for the storm to pass, it's about learning to dance in the rain.

Detailed image

Into the book

The reason I prepare for retirement is because I enjoy a life where I receive gifts every day.

Preparing for retirement is a gift to your future self.

In some ways, you might think that you are giving up your present happiness and sending it to the future, but the ‘future me’ is also ‘me’ (not someone else).

And the present me who gives gifts to my future self is happy.

Because gifts are meant to make the giver happier than the receiver.

Since there is both a giver and a receiver, how can one not be happy?

Our lives are sometimes boring.

It's fun when there's something to look forward to.

If you've decided to travel, why not dream of a happy retirement while waiting for that day to arrive with excitement and joy? Isn't life a journey far longer and more important than any travel?

--- From "Chapter 1: The Man Without a Corner of Belief"

“You have to spend money to exercise.” “You have to spend money to study.” They compensate for their weak will with money.

It's a shame to spend so much money on something that could be done for free if you just had the will.

People with a rotten mindset won't exercise no matter how much money they spend or what they do.

--- From "Chapter 2: Don't think about how you spend money, spend it as you think"

“I don’t really know what I like.”

This also happens occasionally among teenagers and people in their 20s.

It's okay.

There are far more people who don't know what they like than those who know what they like.

Life is about finding what you love until you die.

--- From "Chapter 3: Rebirth with a Diamond Mentality"

If you look at the diary I wrote when I was a freshman in society, there are more records about my feelings at work than about my daily life.

This is a 2-3 line journal entry for the company, including my concerns about the work I was assigned to or the details of the work I did.

When new employees keep a work log, an interesting phenomenon occurs later.

Even though only 3 or 6 months have passed, it is written that things that are easy now like eating were daunting back then.

You'll find that doing unfamiliar things is difficult and overwhelming at first, but you'll soon get used to it.

There are things to be learned from going through this process in a short period of time, not even a few years.

The attitude towards accepting new tasks changes.

I feel confident about my work because I think, 'It might be a little annoying and difficult at first, but eventually I'll get good at it.'

Preparing for retirement is a gift to your future self.

In some ways, you might think that you are giving up your present happiness and sending it to the future, but the ‘future me’ is also ‘me’ (not someone else).

And the present me who gives gifts to my future self is happy.

Because gifts are meant to make the giver happier than the receiver.

Since there is both a giver and a receiver, how can one not be happy?

Our lives are sometimes boring.

It's fun when there's something to look forward to.

If you've decided to travel, why not dream of a happy retirement while waiting for that day to arrive with excitement and joy? Isn't life a journey far longer and more important than any travel?

--- From "Chapter 1: The Man Without a Corner of Belief"

“You have to spend money to exercise.” “You have to spend money to study.” They compensate for their weak will with money.

It's a shame to spend so much money on something that could be done for free if you just had the will.

People with a rotten mindset won't exercise no matter how much money they spend or what they do.

--- From "Chapter 2: Don't think about how you spend money, spend it as you think"

“I don’t really know what I like.”

This also happens occasionally among teenagers and people in their 20s.

It's okay.

There are far more people who don't know what they like than those who know what they like.

Life is about finding what you love until you die.

--- From "Chapter 3: Rebirth with a Diamond Mentality"

If you look at the diary I wrote when I was a freshman in society, there are more records about my feelings at work than about my daily life.

This is a 2-3 line journal entry for the company, including my concerns about the work I was assigned to or the details of the work I did.

When new employees keep a work log, an interesting phenomenon occurs later.

Even though only 3 or 6 months have passed, it is written that things that are easy now like eating were daunting back then.

You'll find that doing unfamiliar things is difficult and overwhelming at first, but you'll soon get used to it.

There are things to be learned from going through this process in a short period of time, not even a few years.

The attitude towards accepting new tasks changes.

I feel confident about my work because I think, 'It might be a little annoying and difficult at first, but eventually I'll get good at it.'

--- From "Chapter 4: The Secret to a Dense Life"

Publisher's Review

Money study for me who has no corner to trust

“I will pave my own flower path!”

It is a common misconception that saving money means not being able to enjoy life properly and giving up present happiness.

However, the author reveals that by accurately distinguishing between necessary and unnecessary spending, he was able to save 100 million won while traveling to 22 countries in his 20s.

Saving doesn't necessarily mean enduring time in pain.

Rather, he explains that investing is a process of getting to know yourself by focusing your spending only on what you truly want.

It explains in detail how to live a fulfilling life while saving the money you have set as your goal.

In particular, the author warns against compensating for one's weak will with money.

It is emphasized that we must prevent money from being wasted on things like tuition fees for private academies and gyms that are not used after paying expensive tuition fees to enroll in them.

This book will guide you in understanding your spending and developing healthy spending habits.

"Daughter, Never Put Off Studying Money," recommended by analyst Park So-yeon.

“I also fell in love with the content that was so clear!”

It is said that one of the biggest regrets of people in their 50s is not having studied investing when they were younger.

The author emphasizes that everything has its stages, while saying that you should start investing as soon as possible.

He points out that financial management is made up of three stages: saving, saving, and investing, and that investments made without the stages of saving and investing will not last long.

In particular, he cited skipping savings and going straight to investing as a common mistake beginners make.

I strongly recommend that you prepare seed money before investing.

So, I'll tell you three essential mindsets to keep in mind when creating seed money, as well as a savings account management method that will help you save even small amounts of money.

The book covers everything from pension savings, which is essential for grandmothers, to ETFs and US stocks.

We've created a chart called "Pension at a Glance" that neatly organizes the types of pensions, pension investment order, and even the characteristics of pension accounts.

The reason why the author's financial know-how is particularly noteworthy is because it focuses on building lifelong assets rather than one-time profits.

In an age where all sorts of financial strategies are out there, and people are divided into those who become rich overnight or those who become poor overnight, the author's voice, which talks about how to save money steadily, sounds even clearer and more welcome.

With this book, you no longer have to be afraid or impatient about investing.

Grandma's method of explaining things simply and easily by pointing out only the necessary points is clearly reflected in the book, so anyone can follow along.

If you want to manage your finances without wavering even in uncertain times, be sure to read this book.

If you want to change your life, start by studying money.

“Don’t just worry and regret, believe in yourself!”

Anyone who has ever tried investing will know.

An experience where I knew good information but didn't try it because it was unfamiliar, and I regretfully missed it.

This time, I tried it thinking it was real, but I had a bad experience and gave up because it didn't suit me.

The experience of putting off investing while repeating, “I have to do this…” only to end up with increasing anxiety about the future.

This is why attitude is more important than knowledge in investing.

This book is not simply intended to convey financial investment methods.

We share the secrets of self-management, which form the foundation of financial management, from motivation and mindset to growth routines.

The grandmother-like answer that captured the hearts of subscribers with her sharp personality was detailed in the book.

The author shares his approach to life, including what to do to boost your self-esteem, what kind of people to exclude from your life, and how to overcome feelings of helplessness.

The author's sharp wit, which makes you snap out of your thoughts, was captured in this corner of bitter words that become flesh and blood, adding to the fun.

If you've avoided investing because it's difficult, if you're unsure about investing and just stare at the charts every day, or if you don't want to lose both money and life, take Grandma's spicy investment mentality class.

This book will give you the courage to forge your own path without being swayed by money.

“I will pave my own flower path!”

It is a common misconception that saving money means not being able to enjoy life properly and giving up present happiness.

However, the author reveals that by accurately distinguishing between necessary and unnecessary spending, he was able to save 100 million won while traveling to 22 countries in his 20s.

Saving doesn't necessarily mean enduring time in pain.

Rather, he explains that investing is a process of getting to know yourself by focusing your spending only on what you truly want.

It explains in detail how to live a fulfilling life while saving the money you have set as your goal.

In particular, the author warns against compensating for one's weak will with money.

It is emphasized that we must prevent money from being wasted on things like tuition fees for private academies and gyms that are not used after paying expensive tuition fees to enroll in them.

This book will guide you in understanding your spending and developing healthy spending habits.

"Daughter, Never Put Off Studying Money," recommended by analyst Park So-yeon.

“I also fell in love with the content that was so clear!”

It is said that one of the biggest regrets of people in their 50s is not having studied investing when they were younger.

The author emphasizes that everything has its stages, while saying that you should start investing as soon as possible.

He points out that financial management is made up of three stages: saving, saving, and investing, and that investments made without the stages of saving and investing will not last long.

In particular, he cited skipping savings and going straight to investing as a common mistake beginners make.

I strongly recommend that you prepare seed money before investing.

So, I'll tell you three essential mindsets to keep in mind when creating seed money, as well as a savings account management method that will help you save even small amounts of money.

The book covers everything from pension savings, which is essential for grandmothers, to ETFs and US stocks.

We've created a chart called "Pension at a Glance" that neatly organizes the types of pensions, pension investment order, and even the characteristics of pension accounts.

The reason why the author's financial know-how is particularly noteworthy is because it focuses on building lifelong assets rather than one-time profits.

In an age where all sorts of financial strategies are out there, and people are divided into those who become rich overnight or those who become poor overnight, the author's voice, which talks about how to save money steadily, sounds even clearer and more welcome.

With this book, you no longer have to be afraid or impatient about investing.

Grandma's method of explaining things simply and easily by pointing out only the necessary points is clearly reflected in the book, so anyone can follow along.

If you want to manage your finances without wavering even in uncertain times, be sure to read this book.

If you want to change your life, start by studying money.

“Don’t just worry and regret, believe in yourself!”

Anyone who has ever tried investing will know.

An experience where I knew good information but didn't try it because it was unfamiliar, and I regretfully missed it.

This time, I tried it thinking it was real, but I had a bad experience and gave up because it didn't suit me.

The experience of putting off investing while repeating, “I have to do this…” only to end up with increasing anxiety about the future.

This is why attitude is more important than knowledge in investing.

This book is not simply intended to convey financial investment methods.

We share the secrets of self-management, which form the foundation of financial management, from motivation and mindset to growth routines.

The grandmother-like answer that captured the hearts of subscribers with her sharp personality was detailed in the book.

The author shares his approach to life, including what to do to boost your self-esteem, what kind of people to exclude from your life, and how to overcome feelings of helplessness.

The author's sharp wit, which makes you snap out of your thoughts, was captured in this corner of bitter words that become flesh and blood, adding to the fun.

If you've avoided investing because it's difficult, if you're unsure about investing and just stare at the charts every day, or if you don't want to lose both money and life, take Grandma's spicy investment mentality class.

This book will give you the courage to forge your own path without being swayed by money.

GOODS SPECIFICS

- Date of issue: September 4, 2024

- Page count, weight, size: 280 pages | 304g | 128*188*18mm

- ISBN13: 9791193262238

- ISBN10: 1193262232

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)