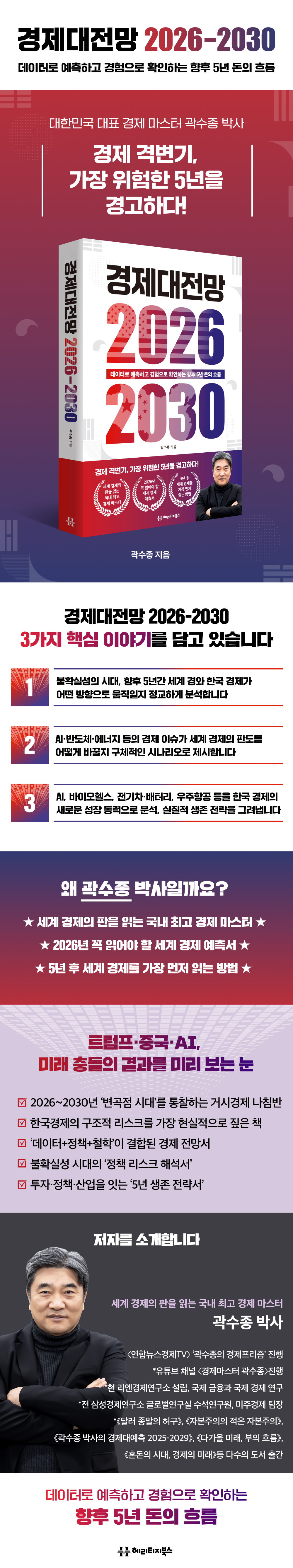

Economic Outlook 2026-2030

|

Description

Book Introduction

A period of economic upheaval,

Warning of the most dangerous five years!

★ Korea's top economic master who reads the global economic landscape ★

★ Must-Read World Economic Forecasts for 2026 ★

★ How to be the first to read the world economy 5 years from now ★

In an age of uncertainty, prediction becomes survival.

In an age where uncertainty is the norm, the ability to read the direction of the economy is becoming a condition for survival.

《Economic Outlook 2026-2030》 is a book by Dr. Kwak Su-jong, an economist who has been active in major broadcasting, that provides a three-dimensional outlook on the global economic trends for the next five years based on 30 years of research and data analysis.

In this era of turbulent change, where all economic variables, including interest rates, exchange rates, prices, stocks, and real estate, fluctuate simultaneously, the author presents the true direction of the Korean economy, focusing on the major axes of the macroeconomy.

This book comprehensively analyzes the changes in the global economic structure from 2026 to 2030.

It points out the restructuring of the industrial landscape that will be brought about by the reorganization of the US-centric supply chain, China's structural slowdown, and Europe's decarbonization transition, and warns that the full-blown new industrial revolution, represented by AI, semiconductors, and the energy war, will further widen the gap between countries.

Furthermore, it presents the trends of the new global economic order, including the rise of BRICS+ emerging countries and the cracks in the digital dollar system, with specific data.

This book is a comprehensive outlook that examines the trends of policy, industry, investment, and finance from a single, macroscopic perspective, and a practical strategy book that transforms future risks into opportunities.

Dr. Kwak Soo-jong says, “Prediction is not the answer, but the direction.”

Only those who can read the direction of the economy can seize opportunities even in times of crisis.

In a world easily swayed by short-term news and volatility, "Economic Outlook 2026-2030" provides readers with a long-term perspective and structural insights, providing them with the basis for sound judgment.

This book will serve as a compass for everyone who must prepare for the new economic order in the five years of change.

Warning of the most dangerous five years!

★ Korea's top economic master who reads the global economic landscape ★

★ Must-Read World Economic Forecasts for 2026 ★

★ How to be the first to read the world economy 5 years from now ★

In an age of uncertainty, prediction becomes survival.

In an age where uncertainty is the norm, the ability to read the direction of the economy is becoming a condition for survival.

《Economic Outlook 2026-2030》 is a book by Dr. Kwak Su-jong, an economist who has been active in major broadcasting, that provides a three-dimensional outlook on the global economic trends for the next five years based on 30 years of research and data analysis.

In this era of turbulent change, where all economic variables, including interest rates, exchange rates, prices, stocks, and real estate, fluctuate simultaneously, the author presents the true direction of the Korean economy, focusing on the major axes of the macroeconomy.

This book comprehensively analyzes the changes in the global economic structure from 2026 to 2030.

It points out the restructuring of the industrial landscape that will be brought about by the reorganization of the US-centric supply chain, China's structural slowdown, and Europe's decarbonization transition, and warns that the full-blown new industrial revolution, represented by AI, semiconductors, and the energy war, will further widen the gap between countries.

Furthermore, it presents the trends of the new global economic order, including the rise of BRICS+ emerging countries and the cracks in the digital dollar system, with specific data.

This book is a comprehensive outlook that examines the trends of policy, industry, investment, and finance from a single, macroscopic perspective, and a practical strategy book that transforms future risks into opportunities.

Dr. Kwak Soo-jong says, “Prediction is not the answer, but the direction.”

Only those who can read the direction of the economy can seize opportunities even in times of crisis.

In a world easily swayed by short-term news and volatility, "Economic Outlook 2026-2030" provides readers with a long-term perspective and structural insights, providing them with the basis for sound judgment.

This book will serve as a compass for everyone who must prepare for the new economic order in the five years of change.

index

Prologue: The United States was responsible for 80% of China's growth.

PART 1.

Outlook for the World Economy

Chapter 1.

Trapped in the Uncertainty of the 21st Century

- 21st Century Post-Industrial Society: Standing on the Brink of Change

A trending trend: the new normal created by AI.

Trump's tariff bomb shakes the world order.

- The global economy through the eyes of business

- The topic is AI

- Global economic outlook from major institutions beyond 2026

Chapter 2.

Trump shakes up the world order

- History is described as the 'movement of cities'.

- Autumn in New York, the birth of Trump

Bretton Woods, the blueprint and paradox of dollar hegemony

- From manufacturing to finance

- Where is the next center?

Chapter 3.

American exceptionalism

- Clash of Civilizations Reboot

Negotiation is my weapon, Trump's tripolar system plan

- The nation follows trade, the Trump doctrine?

Dictator Trump? A mountain of domestic political issues.

Chapter 4.

Where does real power lie?

Will Trump End the American Century?

- Asymmetry of deficit and surplus and trade relations

- Hard power vs. soft power

- The specter of globalization

- Betting on weaknesses

PART 2.

Outlook for the U.S. Economy

Chapter 1.

What will become of the debt-ridden empire of the United States?

fiscal deficit

-Wall Street's warning

- Expenditures are increasing and income is insufficient.

- The shadow of the government bond market

- Government bond yields, the benchmark for everything

The attractiveness of government bonds is diminishing, and US financial hegemony is shaking.

consumer prices

- Fed independence, number of rate cuts, and a weak dollar

- Tariffs and consumer prices

Credit rating downgrade

- US debt on an unsustainable path

tariff war

Success is my fault, failure is someone else's: Trump-style leadership.

Chapter 2.

Will the Dollar Last? The Shadow of Bretton Woods

- The international monetary order and Trump's tariff policy

- Deleted Article 899

PART 3.

Outlook for the Chinese Economy

Chapter 1.

China Prepares for a Counterattack Scenario

Trump's Second Term: A Change in China's Negotiating Attitude

- From the century of humiliation to the century of glory

- Xi Jinping's new order: Don't conform to the US!

- Attack is the best defense

Chapter 2.

Technological growth: a fortress built on AI and robots

- Protect national economic security through technological independence.

Made in China 2025: Investment is the Answer

Declaring nuclear energy independence, "Hwarong 1" breaks dependence on the United States.

Chapter 3.

The End of the Bubble: Real Estate, Deflation, and Youth Unemployment

- Bright China vs. Dark China

China's gloomy economy plunges into recession

Chapter 4.

The Rare Earth Wars: The Final Card That Will Halt the Industry

What are rare earth elements?

- Why did rare earth elements become a strategic resource?

Why China Controls Rare Earth Supply So Much

- This is how rare earth elements are mined.

Why the Seven Rare Earth Elements Controlled by China Are Important

- Has China ever stopped exporting rare earth elements before?

Why China Halted Rare Earth Exports

- Rare earth hegemony: what is the future direction?

What China Should Be Wary of

- Excessive display of power, rather than a strategic loss

The Rare Earth Wars: Who Will Win?

- Who will give in first?

- Miscalculation and obsession

- China's trials and tribulations

PART 4.

War Games

Chapter 1. AI Hegemony Map

- From data centers to data sovereignty

China's AI

- A slowing economy and a rapidly approaching future

- Economic ripple effects

AI in Europe

- Traces of old names and the path of new names

- Winter in the digital industry

- Regulation, regulation, regulation!

conclusion

- Jensen Huang is right.

- Thinking about AI, its future, and beyond

Chapter 2.

Topographic map of gold

- The question raised again

- Free from government debt

The ultimate safe haven? Compared to competing assets.

The second-largest reserve asset, central banks' demand for it is declining.

- Will the rise in gold prices continue?

Chapter 3.

Cryptocurrency 'Stablecoin'

Stablecoins and the Genius Act

- Implemented during Trump's term

- The power of lobbying

- July 18, 2025

The biggest victim is Tether

- Headquarters relocation

- Beneficiary is a circle

Chapter 4.

Geopolitical Uncertainty: The 2027-2028 Crisis

- China's military expands its influence in the Pacific.

- Cooperation with allies

- A whirlwind of tension

- Ominous sign

- Course correction

PART 5.

Economic Outlook Scenarios for the U.S., China, and South Korea

Chapter 1.

U.S. Economic Outlook and Assumptions

Ten Key Assumptions That Will Open the Future

- The future of the U.S. economy as seen by 69 scholars

- Labor market and consumption

- Household delinquency rate

Chapter 2.

China's Economic Outlook and Assumptions

- A new perspective on the Chinese economy

- When will the real estate market's 'Two Sessions' take place?

- Unemployment rate

Chapter 3.

Korean Economic Outlook and Assumptions

- Methodology

- Short-term outlook for the US, China, and South Korea economies by scenario

Chapter 4.

Conclusion and Implications

The inevitable dilemma of the dollar and the world economy

Four Strategies for Individual Investors in an Age of Uncertainty

PART 1.

Outlook for the World Economy

Chapter 1.

Trapped in the Uncertainty of the 21st Century

- 21st Century Post-Industrial Society: Standing on the Brink of Change

A trending trend: the new normal created by AI.

Trump's tariff bomb shakes the world order.

- The global economy through the eyes of business

- The topic is AI

- Global economic outlook from major institutions beyond 2026

Chapter 2.

Trump shakes up the world order

- History is described as the 'movement of cities'.

- Autumn in New York, the birth of Trump

Bretton Woods, the blueprint and paradox of dollar hegemony

- From manufacturing to finance

- Where is the next center?

Chapter 3.

American exceptionalism

- Clash of Civilizations Reboot

Negotiation is my weapon, Trump's tripolar system plan

- The nation follows trade, the Trump doctrine?

Dictator Trump? A mountain of domestic political issues.

Chapter 4.

Where does real power lie?

Will Trump End the American Century?

- Asymmetry of deficit and surplus and trade relations

- Hard power vs. soft power

- The specter of globalization

- Betting on weaknesses

PART 2.

Outlook for the U.S. Economy

Chapter 1.

What will become of the debt-ridden empire of the United States?

fiscal deficit

-Wall Street's warning

- Expenditures are increasing and income is insufficient.

- The shadow of the government bond market

- Government bond yields, the benchmark for everything

The attractiveness of government bonds is diminishing, and US financial hegemony is shaking.

consumer prices

- Fed independence, number of rate cuts, and a weak dollar

- Tariffs and consumer prices

Credit rating downgrade

- US debt on an unsustainable path

tariff war

Success is my fault, failure is someone else's: Trump-style leadership.

Chapter 2.

Will the Dollar Last? The Shadow of Bretton Woods

- The international monetary order and Trump's tariff policy

- Deleted Article 899

PART 3.

Outlook for the Chinese Economy

Chapter 1.

China Prepares for a Counterattack Scenario

Trump's Second Term: A Change in China's Negotiating Attitude

- From the century of humiliation to the century of glory

- Xi Jinping's new order: Don't conform to the US!

- Attack is the best defense

Chapter 2.

Technological growth: a fortress built on AI and robots

- Protect national economic security through technological independence.

Made in China 2025: Investment is the Answer

Declaring nuclear energy independence, "Hwarong 1" breaks dependence on the United States.

Chapter 3.

The End of the Bubble: Real Estate, Deflation, and Youth Unemployment

- Bright China vs. Dark China

China's gloomy economy plunges into recession

Chapter 4.

The Rare Earth Wars: The Final Card That Will Halt the Industry

What are rare earth elements?

- Why did rare earth elements become a strategic resource?

Why China Controls Rare Earth Supply So Much

- This is how rare earth elements are mined.

Why the Seven Rare Earth Elements Controlled by China Are Important

- Has China ever stopped exporting rare earth elements before?

Why China Halted Rare Earth Exports

- Rare earth hegemony: what is the future direction?

What China Should Be Wary of

- Excessive display of power, rather than a strategic loss

The Rare Earth Wars: Who Will Win?

- Who will give in first?

- Miscalculation and obsession

- China's trials and tribulations

PART 4.

War Games

Chapter 1. AI Hegemony Map

- From data centers to data sovereignty

China's AI

- A slowing economy and a rapidly approaching future

- Economic ripple effects

AI in Europe

- Traces of old names and the path of new names

- Winter in the digital industry

- Regulation, regulation, regulation!

conclusion

- Jensen Huang is right.

- Thinking about AI, its future, and beyond

Chapter 2.

Topographic map of gold

- The question raised again

- Free from government debt

The ultimate safe haven? Compared to competing assets.

The second-largest reserve asset, central banks' demand for it is declining.

- Will the rise in gold prices continue?

Chapter 3.

Cryptocurrency 'Stablecoin'

Stablecoins and the Genius Act

- Implemented during Trump's term

- The power of lobbying

- July 18, 2025

The biggest victim is Tether

- Headquarters relocation

- Beneficiary is a circle

Chapter 4.

Geopolitical Uncertainty: The 2027-2028 Crisis

- China's military expands its influence in the Pacific.

- Cooperation with allies

- A whirlwind of tension

- Ominous sign

- Course correction

PART 5.

Economic Outlook Scenarios for the U.S., China, and South Korea

Chapter 1.

U.S. Economic Outlook and Assumptions

Ten Key Assumptions That Will Open the Future

- The future of the U.S. economy as seen by 69 scholars

- Labor market and consumption

- Household delinquency rate

Chapter 2.

China's Economic Outlook and Assumptions

- A new perspective on the Chinese economy

- When will the real estate market's 'Two Sessions' take place?

- Unemployment rate

Chapter 3.

Korean Economic Outlook and Assumptions

- Methodology

- Short-term outlook for the US, China, and South Korea economies by scenario

Chapter 4.

Conclusion and Implications

The inevitable dilemma of the dollar and the world economy

Four Strategies for Individual Investors in an Age of Uncertainty

Detailed image

Into the book

Globalization is an irreversible technological evolution of interdependence, and smart countries, companies, and investors must manage short-term shocks while redesigning value chains by integrating AI infrastructure (power, data centers, semiconductors), standards, talent, and capital.

Korea, too, must strengthen its alignment as an AI and advanced manufacturing hub connecting the Indo-Pacific and the EU as the 'game' changes. Companies must prioritize supply chain friend-shoring and cash flow, while investors must prioritize AI beneficiaries (infrastructure, semiconductors, power, cloud, and applications) along with long-term fundamentals, sector diversification, and risk sensitivity.

In short, the essence beyond the noise of tariffs is an AI-driven restructuring of order, and the winner will be the one who first secures smart power by first linking standards, talent, infrastructure, and capital.

--- From "Outlook on the World Economy"

America's interests in the 21st century and beyond are to further strengthen its global political, economic, social, cultural, and environmental dominance.

Although China is mentioned as the most powerful competitor, a closer look at the facts reveals that this is not necessarily the case.

A kind of "taming the world" is likely a tactic of "strategic flexibility" aimed at clarifying America's interests among nations and ensuring that America's position is never shaken.

--- From "The 21st Century, Trapped in Uncertainty"

A serious question for American policymakers may be how best to preserve American interests in the coming Chinese century.

But the past is not a perfect guide.

One reason Braudel's account still feels fresh 40 years after its publication is that the French historian was wise enough to avoid predictions.

He judged that New York and America were in decline, but he did not say what would happen next.

His story seems to have been carried on by Ray Dalio.

--- From "Trump Shakes Up the World Order"

Unfortunately, if the Trump administration remains fixated on trade imbalances and sanctions, and narrowly focuses on coercive hard power, its second-term policies are likely to weaken, rather than strengthen, the US-led international order.

Trump should not be so focused on the costs of "free riding" by his allies that he loses sight of the fact that the United States is in the driver's seat—that it has the power to choose the destination and the route.

We must not forget that the true 'free rider' is the United States itself, which holds the world's reserve currency.

President Trump seems to fail to grasp that America's strength lies in interdependence.

Far from making America great again, he is betting on its tragic weakness.

We must never forget what Dr. Albert Schweitzer emphasized to the United States immediately after World War II.

“A truly strong person is one who, with the virtue of humility, extends a helping hand to his neighbors.”

--- From "Where Does True Power Lie?"

The Trump administration has a different view of the dollar.

This too could be a 'fake'.

In other words, the global role of the US dollar is seen as a burden that is disadvantageous to the United States.

The meaning that a tariff war is a silent war applies here as well.

They argue that the benefits to Wall Street and global asset managers outweigh the losses to American workers and farmers.

In his recent article, “A User’s Guide to Restructuring the Global Trading System,”36 Stephen Miran, chairman of the Council of Economic Advisers, argues that the U.S. defense umbrella and the dollar’s role as the world’s reserve currency are “public goods” and should be compensated for.

One way is to raise public funds by imposing tariffs on U.S. imports, and another is to impose taxes or fees on central banks that hold U.S. Treasury securities.

Tariffs could also be used as leverage in an international negotiation, the Mar-a-Lago Agreement, named after Trump's Florida retreat, which aims to weaken the dollar.

This is a passage reminiscent of the 1985 Plaza Accord.

The reason is that the constant inflow of capital from the United States' trading partners, that is, the demand for foreign exchange reserves, causes the dollar to be chronically overvalued, resulting in a current account deficit.

--- From "Will the Dollar Last? The Shadow of Bretton Woods"

Xi Jinping's hard-line stance may at first seem irrational and dangerous, given that the domestic economic situation is far worse than during the previous trade war.

The Chinese economy, burdened by stagnant real estate, rising debt, and falling prices, is struggling to cope with the sharp decline in exports to the United States, which account for about 3% of GDP.

The tariff bomb Trump unleashed in April 2025 has caused a sharp decline in orders, halting production across China and threatening the job security of millions of people.

Therefore, one might question whether it is in China's interests to take such a hard-line stance toward the United States.

While managing relations with the United States is key, being too forceful may not be beneficial.

But it's a complex situation, as President Xi Jinping must also avoid appearing weak vis-à-vis his geopolitical rival, the United States.

_ From “Prepared China, Counterattack Scenario”

In May 2018, at a conference of scientists held at the Great Hall of the People in Beijing, President Xi Jinping emphasized that China cannot safeguard its economic security without technological independence, saying, “China cannot beg for technology.”

Since then, China has made rapid progress in strategic fields such as electric vehicles, AI, biopharmaceuticals, advanced robotics, and satellites, and in some areas, it is assessed that it has caught up with or reached a level where it can compete with the United States.

Chinese cargo ships dominate global maritime logistics, and they have launched more than 800 satellites to monitor the entire planet.

They are also pursuing food and energy independence and strengthening their military capabilities.44 These achievements serve as a foundation for strengthening China's economy and security amid the protracted conflict and trade war between the United States and China.

--- From "Technological Growth? A Fortress Built with AI and Robots"

The major consumer of these seven metals is the automotive industry.

This industry uses a lot of heat-resistant rare earth magnets.

However, these metals are also essential for manufacturing semiconductors, medical imaging chemicals, robots, offshore wind turbines, and various military equipment.

Rare earth magnets are up to 15 times stronger than iron magnets of the same weight.

Dozens of small electric motors in today's cars all require rare earth magnets.

Motors for brakes, steering, and many other systems all rely on rare earth magnets.

A single seat in a luxury car can contain as many as twelve rare earth magnets, which are used in the steering motors.

Electric vehicles use additional rare earth magnets for the motors that drive the wheels.

China produces about 90% of the world's rare earth magnets.

--- From "The Rare Earth Wars: The Last Card to Halt the Industry"

Therefore, neither the US nor China wants a conflict that would ultimately lead to a worse outcome. AI can be used to improve weapons and military strategy.

Both the US and China will probably do so for the time being.

However, AI can also be used as a tool to penetrate the decision-making logic of figures like Vladimir Putin, Ayatollah Khamenei, and President Xi Jinping. It will meticulously record their closed and wishful thinking, their self-justifications, their errors in mistaking randomness for pattern, their belief in control, and their tendency to reduce people to a fixed group. Should anyone later question them, AI will unearth all their memories from their old chips and reveal them to the world.

The unification of the Korean Peninsula could be achieved more easily than expected, perhaps by the time AI makes its judgment call or quantum computing advances.

Wouldn't the scenario for Korean unification, envisioned by a computer, be the most accurate and, in terms of probability, the most superior option? In the future, when leaders make decisions, they will do so in an environment where all their arguments and assumptions are instantly analyzed by powerful tools. AI may have arrived on this planet just in time to save us from the human errors that will be responsible for the lives of billions, if not millions.

--- From "AI Hegemony Map"

Ultimately, it must meet U.S. law enforcement and regulatory requirements.

Stablecoin issuers must comply with law enforcement requests to seize cryptocurrency, as described above, and comply with bank-level know-your-customer (KYC) and suspicious transaction reporting obligations.

During the Biden administration, the Justice and Treasury departments were investigating Tether for potential violations of anti-money laundering and sanctions evasion regulations, and Tether claims to have complied with requests to freeze stablecoins used in illicit activity.

The allegations were that stablecoins issued by Tether were used by individuals and entities on sanctions lists, including Russian arms dealers and Hamas.

While it is unclear whether this investigation is ongoing, it will need to meet all US requirements to avoid public scrutiny and operate transparently as a trading asset.

--- From "Cryptocurrency 'Stablecoin'"

One factor that has allowed consumers to spend freely so far is the savings they accumulated through government stimulus measures and a booming stock market during the pandemic.

But these savings have now largely been depleted.

The amount of money the government sprayed from helicopters at the time was 11.2 trillion dollars, calculated from the subprime crisis in 2008.

During the pandemic, households were holding onto about $3 trillion of the government-funded money supply.

This means that these funds are now almost depleted.

So, the savings that helped households weather high prices during the pandemic may no longer exist.

In tough economic times, the top 10% of households, who drive most of the consumer spending, can still maintain a healthy financial position, but the problem lies with the roughly 90% of households below them.

These households are increasingly under financial pressure.

--- From "U.S. Economic Outlook and Assumptions"

In conclusion, China's youth unemployment problem should not be viewed as a temporary economic downturn, but rather as a complex structural problem intertwined with changes in industrial structure and policy failures.

This should not be resolved or glossed over with short-term economic stimulus or numerical management.

It appears to be time to establish a mid- to long-term comprehensive strategy encompassing education, industry, labor, and welfare to lay the foundation for practical job creation.

This is an issue that requires a national consensus, as it goes beyond simply a youth issue and is a key task that will determine the future economic and social stability of China as a whole.

--- From "China's Economic Outlook and Assumptions"

The outlook period for each scenario is five years, from 2026 to 2030.

Each economic indicator is an annual average over a five-year period.

The basic assumptions for the economic outlook through 2026 and the five years thereafter are as follows:

First, the global economy is gradually entering a recovery phase, based on the robust performance of the U.S. economy, although there is friction in export competitiveness due to tariff measures.

Second, as the US and global economies recover, the biggest Achilles' heel for the Chinese economy is the shadow banking problem, such as LGFVs, which are linked to the real estate downturn.

The catch is that even the Chinese central government doesn't know the exact numbers.

If this situation spreads into a real estate and financial market crisis or leads to a foreign exchange crisis, both the global and Korean economies could suffer significant shocks.

This could provide an internal justification for launching a Taiwan invasion scenario after 2027.

Third, while the competitive system resulting from trade deals and technological development between the US and China could, on the one hand, pose the risk of a "new Cold War" in the global economy, it is assumed that in the medium to long term, it will foster cooperative relationships in mutual value and supply chains through industrial structural transformation and technological advancement.

We assume that the US will maintain an absolute advantage over China in technological standardization and rule-setting power over the next five years. While China's economic leap forward is possible in some digital information and communication industries, such as AI, and in the development of computing algorithm programs and platforms, platform-based standardization and rules, such as AI agents, are likely to be dominated by the US, largely through its dominant market share in "data centers."

Korea, too, must strengthen its alignment as an AI and advanced manufacturing hub connecting the Indo-Pacific and the EU as the 'game' changes. Companies must prioritize supply chain friend-shoring and cash flow, while investors must prioritize AI beneficiaries (infrastructure, semiconductors, power, cloud, and applications) along with long-term fundamentals, sector diversification, and risk sensitivity.

In short, the essence beyond the noise of tariffs is an AI-driven restructuring of order, and the winner will be the one who first secures smart power by first linking standards, talent, infrastructure, and capital.

--- From "Outlook on the World Economy"

America's interests in the 21st century and beyond are to further strengthen its global political, economic, social, cultural, and environmental dominance.

Although China is mentioned as the most powerful competitor, a closer look at the facts reveals that this is not necessarily the case.

A kind of "taming the world" is likely a tactic of "strategic flexibility" aimed at clarifying America's interests among nations and ensuring that America's position is never shaken.

--- From "The 21st Century, Trapped in Uncertainty"

A serious question for American policymakers may be how best to preserve American interests in the coming Chinese century.

But the past is not a perfect guide.

One reason Braudel's account still feels fresh 40 years after its publication is that the French historian was wise enough to avoid predictions.

He judged that New York and America were in decline, but he did not say what would happen next.

His story seems to have been carried on by Ray Dalio.

--- From "Trump Shakes Up the World Order"

Unfortunately, if the Trump administration remains fixated on trade imbalances and sanctions, and narrowly focuses on coercive hard power, its second-term policies are likely to weaken, rather than strengthen, the US-led international order.

Trump should not be so focused on the costs of "free riding" by his allies that he loses sight of the fact that the United States is in the driver's seat—that it has the power to choose the destination and the route.

We must not forget that the true 'free rider' is the United States itself, which holds the world's reserve currency.

President Trump seems to fail to grasp that America's strength lies in interdependence.

Far from making America great again, he is betting on its tragic weakness.

We must never forget what Dr. Albert Schweitzer emphasized to the United States immediately after World War II.

“A truly strong person is one who, with the virtue of humility, extends a helping hand to his neighbors.”

--- From "Where Does True Power Lie?"

The Trump administration has a different view of the dollar.

This too could be a 'fake'.

In other words, the global role of the US dollar is seen as a burden that is disadvantageous to the United States.

The meaning that a tariff war is a silent war applies here as well.

They argue that the benefits to Wall Street and global asset managers outweigh the losses to American workers and farmers.

In his recent article, “A User’s Guide to Restructuring the Global Trading System,”36 Stephen Miran, chairman of the Council of Economic Advisers, argues that the U.S. defense umbrella and the dollar’s role as the world’s reserve currency are “public goods” and should be compensated for.

One way is to raise public funds by imposing tariffs on U.S. imports, and another is to impose taxes or fees on central banks that hold U.S. Treasury securities.

Tariffs could also be used as leverage in an international negotiation, the Mar-a-Lago Agreement, named after Trump's Florida retreat, which aims to weaken the dollar.

This is a passage reminiscent of the 1985 Plaza Accord.

The reason is that the constant inflow of capital from the United States' trading partners, that is, the demand for foreign exchange reserves, causes the dollar to be chronically overvalued, resulting in a current account deficit.

--- From "Will the Dollar Last? The Shadow of Bretton Woods"

Xi Jinping's hard-line stance may at first seem irrational and dangerous, given that the domestic economic situation is far worse than during the previous trade war.

The Chinese economy, burdened by stagnant real estate, rising debt, and falling prices, is struggling to cope with the sharp decline in exports to the United States, which account for about 3% of GDP.

The tariff bomb Trump unleashed in April 2025 has caused a sharp decline in orders, halting production across China and threatening the job security of millions of people.

Therefore, one might question whether it is in China's interests to take such a hard-line stance toward the United States.

While managing relations with the United States is key, being too forceful may not be beneficial.

But it's a complex situation, as President Xi Jinping must also avoid appearing weak vis-à-vis his geopolitical rival, the United States.

_ From “Prepared China, Counterattack Scenario”

In May 2018, at a conference of scientists held at the Great Hall of the People in Beijing, President Xi Jinping emphasized that China cannot safeguard its economic security without technological independence, saying, “China cannot beg for technology.”

Since then, China has made rapid progress in strategic fields such as electric vehicles, AI, biopharmaceuticals, advanced robotics, and satellites, and in some areas, it is assessed that it has caught up with or reached a level where it can compete with the United States.

Chinese cargo ships dominate global maritime logistics, and they have launched more than 800 satellites to monitor the entire planet.

They are also pursuing food and energy independence and strengthening their military capabilities.44 These achievements serve as a foundation for strengthening China's economy and security amid the protracted conflict and trade war between the United States and China.

--- From "Technological Growth? A Fortress Built with AI and Robots"

The major consumer of these seven metals is the automotive industry.

This industry uses a lot of heat-resistant rare earth magnets.

However, these metals are also essential for manufacturing semiconductors, medical imaging chemicals, robots, offshore wind turbines, and various military equipment.

Rare earth magnets are up to 15 times stronger than iron magnets of the same weight.

Dozens of small electric motors in today's cars all require rare earth magnets.

Motors for brakes, steering, and many other systems all rely on rare earth magnets.

A single seat in a luxury car can contain as many as twelve rare earth magnets, which are used in the steering motors.

Electric vehicles use additional rare earth magnets for the motors that drive the wheels.

China produces about 90% of the world's rare earth magnets.

--- From "The Rare Earth Wars: The Last Card to Halt the Industry"

Therefore, neither the US nor China wants a conflict that would ultimately lead to a worse outcome. AI can be used to improve weapons and military strategy.

Both the US and China will probably do so for the time being.

However, AI can also be used as a tool to penetrate the decision-making logic of figures like Vladimir Putin, Ayatollah Khamenei, and President Xi Jinping. It will meticulously record their closed and wishful thinking, their self-justifications, their errors in mistaking randomness for pattern, their belief in control, and their tendency to reduce people to a fixed group. Should anyone later question them, AI will unearth all their memories from their old chips and reveal them to the world.

The unification of the Korean Peninsula could be achieved more easily than expected, perhaps by the time AI makes its judgment call or quantum computing advances.

Wouldn't the scenario for Korean unification, envisioned by a computer, be the most accurate and, in terms of probability, the most superior option? In the future, when leaders make decisions, they will do so in an environment where all their arguments and assumptions are instantly analyzed by powerful tools. AI may have arrived on this planet just in time to save us from the human errors that will be responsible for the lives of billions, if not millions.

--- From "AI Hegemony Map"

Ultimately, it must meet U.S. law enforcement and regulatory requirements.

Stablecoin issuers must comply with law enforcement requests to seize cryptocurrency, as described above, and comply with bank-level know-your-customer (KYC) and suspicious transaction reporting obligations.

During the Biden administration, the Justice and Treasury departments were investigating Tether for potential violations of anti-money laundering and sanctions evasion regulations, and Tether claims to have complied with requests to freeze stablecoins used in illicit activity.

The allegations were that stablecoins issued by Tether were used by individuals and entities on sanctions lists, including Russian arms dealers and Hamas.

While it is unclear whether this investigation is ongoing, it will need to meet all US requirements to avoid public scrutiny and operate transparently as a trading asset.

--- From "Cryptocurrency 'Stablecoin'"

One factor that has allowed consumers to spend freely so far is the savings they accumulated through government stimulus measures and a booming stock market during the pandemic.

But these savings have now largely been depleted.

The amount of money the government sprayed from helicopters at the time was 11.2 trillion dollars, calculated from the subprime crisis in 2008.

During the pandemic, households were holding onto about $3 trillion of the government-funded money supply.

This means that these funds are now almost depleted.

So, the savings that helped households weather high prices during the pandemic may no longer exist.

In tough economic times, the top 10% of households, who drive most of the consumer spending, can still maintain a healthy financial position, but the problem lies with the roughly 90% of households below them.

These households are increasingly under financial pressure.

--- From "U.S. Economic Outlook and Assumptions"

In conclusion, China's youth unemployment problem should not be viewed as a temporary economic downturn, but rather as a complex structural problem intertwined with changes in industrial structure and policy failures.

This should not be resolved or glossed over with short-term economic stimulus or numerical management.

It appears to be time to establish a mid- to long-term comprehensive strategy encompassing education, industry, labor, and welfare to lay the foundation for practical job creation.

This is an issue that requires a national consensus, as it goes beyond simply a youth issue and is a key task that will determine the future economic and social stability of China as a whole.

--- From "China's Economic Outlook and Assumptions"

The outlook period for each scenario is five years, from 2026 to 2030.

Each economic indicator is an annual average over a five-year period.

The basic assumptions for the economic outlook through 2026 and the five years thereafter are as follows:

First, the global economy is gradually entering a recovery phase, based on the robust performance of the U.S. economy, although there is friction in export competitiveness due to tariff measures.

Second, as the US and global economies recover, the biggest Achilles' heel for the Chinese economy is the shadow banking problem, such as LGFVs, which are linked to the real estate downturn.

The catch is that even the Chinese central government doesn't know the exact numbers.

If this situation spreads into a real estate and financial market crisis or leads to a foreign exchange crisis, both the global and Korean economies could suffer significant shocks.

This could provide an internal justification for launching a Taiwan invasion scenario after 2027.

Third, while the competitive system resulting from trade deals and technological development between the US and China could, on the one hand, pose the risk of a "new Cold War" in the global economy, it is assumed that in the medium to long term, it will foster cooperative relationships in mutual value and supply chains through industrial structural transformation and technological advancement.

We assume that the US will maintain an absolute advantage over China in technological standardization and rule-setting power over the next five years. While China's economic leap forward is possible in some digital information and communication industries, such as AI, and in the development of computing algorithm programs and platforms, platform-based standardization and rules, such as AI agents, are likely to be dominated by the US, largely through its dominant market share in "data centers."

--- From "Korean Economic Outlook and Assumptions"

Publisher's Review

He who reads the direction seizes the future.

In an era where the COVID-19 pandemic, war, inflation, and the race for technological supremacy overlap.

We are currently experiencing economic volatility more rapid and unstable than ever before. "Economic Outlook 2026-2030" precisely depicts the direction the global and Korean economies will take over the next five years amidst this uncertainty.

Dr. Kwak Soo-jong, who has studied macroeconomics for decades, offers the insight that "the essence of forecasting is not the right answer, but the direction," based on vast data and a sense of reality.

A map of the world five years from now, drawn with data

This book is not simply a forecast; it is an "economic map" that provides a three-dimensional analysis of the interplay between the structural forces and policies that drive the economy.

It presents specific scenarios for how the restructuring of the US supply chain, China's slowdown, Europe's decarbonization transition, and the spread of the new industrial revolution symbolized by AI, semiconductors, and energy will reshape the global economic landscape.

It also provides a sober assessment of the new global order, including the rise of BRICS+ emerging countries and the cracks in the digital dollar system.

The turning point for the Korean economy, the time for a reboot is now.

Dr. Kwak Soo-jong says that the Korean economy still has room to grow despite structural constraints such as an aging population, debt, and a demographic cliff.

He emphasizes that the most important task facing Korea over the next five years is to structurally transform its "export-dependent economy," which is highly vulnerable to external factors such as slowing global demand, the US-China technological hegemony conflict, and increasing protectionism.

In particular, it analyzes AI, biohealth, electric vehicles and batteries, aerospace, and cultural content as new growth engines and presents practical survival strategies through the harmony of policy, industry, and finance.

The Eyes that Read the Future, the Power that Moves the Economy

Dr. Kwak Soo-jong views the economy not as a simple movement of numbers, but as the 'interaction between people and systems.'

He emphasizes that rather than fearing the waves of change, we must read their direction, offering a perspective that identifies the essence of opportunity within the flow of data. "Economic Outlook 2026-2030" will serve as a premonition for the next five years for policymakers, businesspeople, investors, and all readers preparing for the future.

In an era where the COVID-19 pandemic, war, inflation, and the race for technological supremacy overlap.

We are currently experiencing economic volatility more rapid and unstable than ever before. "Economic Outlook 2026-2030" precisely depicts the direction the global and Korean economies will take over the next five years amidst this uncertainty.

Dr. Kwak Soo-jong, who has studied macroeconomics for decades, offers the insight that "the essence of forecasting is not the right answer, but the direction," based on vast data and a sense of reality.

A map of the world five years from now, drawn with data

This book is not simply a forecast; it is an "economic map" that provides a three-dimensional analysis of the interplay between the structural forces and policies that drive the economy.

It presents specific scenarios for how the restructuring of the US supply chain, China's slowdown, Europe's decarbonization transition, and the spread of the new industrial revolution symbolized by AI, semiconductors, and energy will reshape the global economic landscape.

It also provides a sober assessment of the new global order, including the rise of BRICS+ emerging countries and the cracks in the digital dollar system.

The turning point for the Korean economy, the time for a reboot is now.

Dr. Kwak Soo-jong says that the Korean economy still has room to grow despite structural constraints such as an aging population, debt, and a demographic cliff.

He emphasizes that the most important task facing Korea over the next five years is to structurally transform its "export-dependent economy," which is highly vulnerable to external factors such as slowing global demand, the US-China technological hegemony conflict, and increasing protectionism.

In particular, it analyzes AI, biohealth, electric vehicles and batteries, aerospace, and cultural content as new growth engines and presents practical survival strategies through the harmony of policy, industry, and finance.

The Eyes that Read the Future, the Power that Moves the Economy

Dr. Kwak Soo-jong views the economy not as a simple movement of numbers, but as the 'interaction between people and systems.'

He emphasizes that rather than fearing the waves of change, we must read their direction, offering a perspective that identifies the essence of opportunity within the flow of data. "Economic Outlook 2026-2030" will serve as a premonition for the next five years for policymakers, businesspeople, investors, and all readers preparing for the future.

GOODS SPECIFICS

- Date of issue: November 21, 2025

- Page count, weight, size: 392 pages | 152*225*30mm

- ISBN13: 9791198404220

- ISBN10: 1198404221

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)