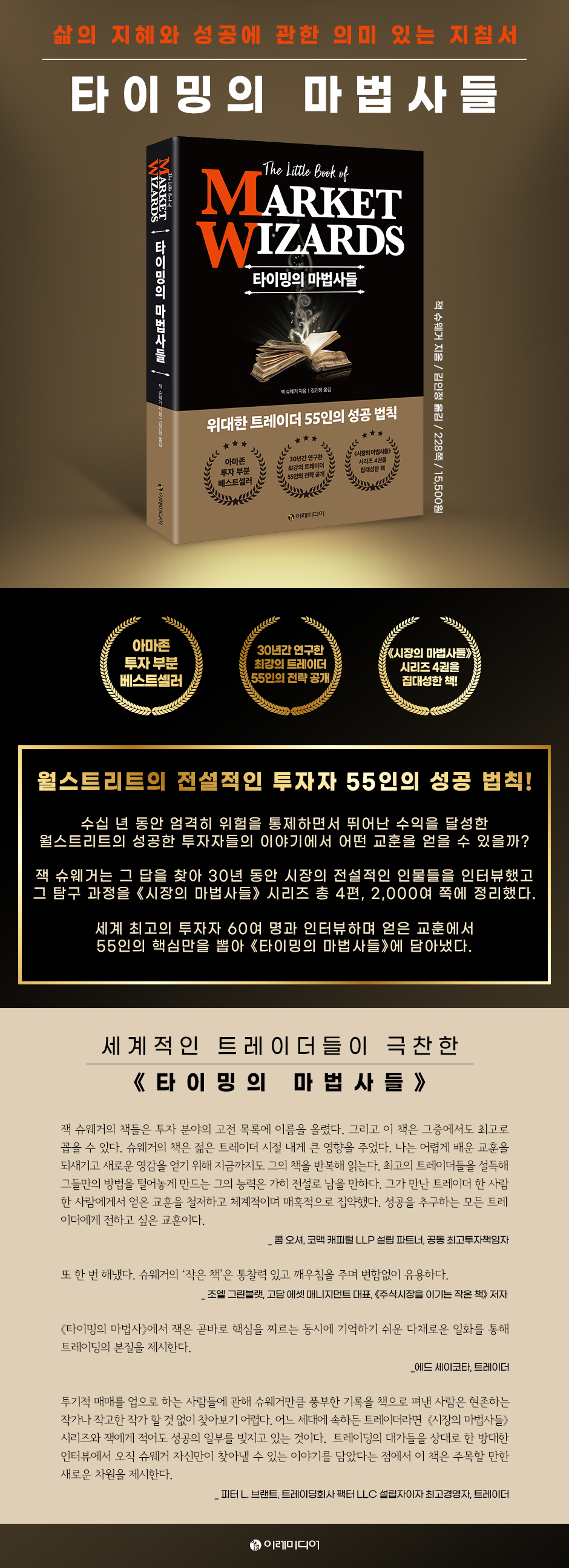

Wizards of Timing

|

Description

Book Introduction

Amazon Investment Bestseller

The Success Secrets of 55 Legendary Investors

Jack Schwager, who has interviewed legendary Wall Street investors for the past 30 years and compiled his research into a four-part, 2,000-page book series titled "Market Wizards," has published a new book.

From interviews with over 60 of the world's best traders, I've distilled the key insights from 55 of them into "The Wizards of Timing."

Each chapter contains quotes from legendary investors.

By comparing the secrets to market success with the quotes of 55 famous people, readers can develop their own principles and strategies.

If you've already read the first four volumes of the "Market Wizards" series, reading this book will feel like revisiting the entire series.

Even readers who haven't read the series yet can benefit from this book as it provides a quick overview of all four volumes.

The current stock market situation, where it is impossible to see even an inch ahead, is the perfect time to return to the basics and principles of stock investment.

The answer to returning to the basics and principles is in this book.

The Success Secrets of 55 Legendary Investors

Jack Schwager, who has interviewed legendary Wall Street investors for the past 30 years and compiled his research into a four-part, 2,000-page book series titled "Market Wizards," has published a new book.

From interviews with over 60 of the world's best traders, I've distilled the key insights from 55 of them into "The Wizards of Timing."

Each chapter contains quotes from legendary investors.

By comparing the secrets to market success with the quotes of 55 famous people, readers can develop their own principles and strategies.

If you've already read the first four volumes of the "Market Wizards" series, reading this book will feel like revisiting the entire series.

Even readers who haven't read the series yet can benefit from this book as it provides a quick overview of all four volumes.

The current stock market situation, where it is impossible to see even an inch ahead, is the perfect time to return to the basics and principles of stock investment.

The answer to returning to the basics and principles is in this book.

- You can preview some of the book's contents.

Preview

index

Recommendation_The first step to developing your own strategy

Introduction_ The key elements for success are the same!

Part 1.

There is no success without failure.

Chapter 1.

Failure is unpredictable

Chapter 2.

There is no single right answer

Chapter 3.

Find a method that suits your personality.

Chapter 4.

Gain a competitive edge

Chapter 5.

Effort and hard work are important

Chapter 6.

I need to relax

Chapter 7.

Worst of times, best of times

Part 2.

What makes successful traders different?

Chapter 8.

Risk Management Principles

Chapter 9.

You can't let your guard down for even a moment.

Chapter 10.

Judge independently

Chapter 11.

Qualities of a Successful Trader

Chapter 12.

Losing is part of the game.

Chapter 13.

When you have to wait patiently

Chapter 14.

Loyalty is not a virtue in trading.

Chapter 15.

Size matters

Chapter 16.

Seek discomfort

Chapter 17.

When you are swayed by emotions

Chapter 18.

Dynamic Trading vs.

static trading

Chapter 19.

Adjust your strategy based on market reaction.

Part 3.

How to survive in the market

Chapter 20.

Worthwhile mistakes

Chapter 21.

How to execute

Chapter 22.

If the market lets it go easily

Chapter 23.

The joy of selling out

Appendix_ Understanding the Basics of Options

Author's Note

Translator's Note: A meaningful guide to life wisdom and success.

Introduction_ The key elements for success are the same!

Part 1.

There is no success without failure.

Chapter 1.

Failure is unpredictable

Chapter 2.

There is no single right answer

Chapter 3.

Find a method that suits your personality.

Chapter 4.

Gain a competitive edge

Chapter 5.

Effort and hard work are important

Chapter 6.

I need to relax

Chapter 7.

Worst of times, best of times

Part 2.

What makes successful traders different?

Chapter 8.

Risk Management Principles

Chapter 9.

You can't let your guard down for even a moment.

Chapter 10.

Judge independently

Chapter 11.

Qualities of a Successful Trader

Chapter 12.

Losing is part of the game.

Chapter 13.

When you have to wait patiently

Chapter 14.

Loyalty is not a virtue in trading.

Chapter 15.

Size matters

Chapter 16.

Seek discomfort

Chapter 17.

When you are swayed by emotions

Chapter 18.

Dynamic Trading vs.

static trading

Chapter 19.

Adjust your strategy based on market reaction.

Part 3.

How to survive in the market

Chapter 20.

Worthwhile mistakes

Chapter 21.

How to execute

Chapter 22.

If the market lets it go easily

Chapter 23.

The joy of selling out

Appendix_ Understanding the Basics of Options

Author's Note

Translator's Note: A meaningful guide to life wisdom and success.

Detailed image

Into the book

It would be difficult to find a topic where opinions are so clearly divided and each person staunchly holds their own opinion, as if there were a certain trading method that worked.

For Rogers, whose judgments are based entirely on fundamental analysis, technical analysis is nothing more than a dummy drug.

On the other hand, Schwartz, who always suffered losses through fundamental analysis, achieved remarkable results through technical analysis.

Both men have achieved remarkable success, and both view each other's methods with utter contempt and cynicism.

--- p.32

The same principle applies to trading.

If things are going well, there is no need to exert effort.

When things don't go well, you can't force things to be right just by working harder.

When trading is not going well and your judgment is always wrong, there is no use in trying harder.

Rather, it only makes the problem worse.

It's okay to work harder and do more research.

It's also good to try harder to figure out what's going wrong.

--- p.58

The conclusion I came to from the interview is that you will know when you get to that level.

If you're not sure, it means you're not there yet.

In such a situation, it is necessary to be more cautious and fully aware of the lack of confidence when investing in risky opportunities.

Asking others for advice is also a sure sign of lack of confidence.

--- p.103

I asked Greenblatt why he thought investors performed so much worse when they made their own decisions.

Greenblatt responded:

“People reduced their exposure as the market fell.

There was a tendency to sell when individual stocks or the overall portfolio performance was low.

We asked people to choose stocks to invest in from a pre-selected list, and the results were worse than if they had chosen randomly.

“Because I overlooked some of the most profitable stocks, I overlooked some that were particularly painful to hold.” In short, isn’t this saying that the problem was the decision to take comfort in the moment?

For Rogers, whose judgments are based entirely on fundamental analysis, technical analysis is nothing more than a dummy drug.

On the other hand, Schwartz, who always suffered losses through fundamental analysis, achieved remarkable results through technical analysis.

Both men have achieved remarkable success, and both view each other's methods with utter contempt and cynicism.

--- p.32

The same principle applies to trading.

If things are going well, there is no need to exert effort.

When things don't go well, you can't force things to be right just by working harder.

When trading is not going well and your judgment is always wrong, there is no use in trying harder.

Rather, it only makes the problem worse.

It's okay to work harder and do more research.

It's also good to try harder to figure out what's going wrong.

--- p.58

The conclusion I came to from the interview is that you will know when you get to that level.

If you're not sure, it means you're not there yet.

In such a situation, it is necessary to be more cautious and fully aware of the lack of confidence when investing in risky opportunities.

Asking others for advice is also a sure sign of lack of confidence.

--- p.103

I asked Greenblatt why he thought investors performed so much worse when they made their own decisions.

Greenblatt responded:

“People reduced their exposure as the market fell.

There was a tendency to sell when individual stocks or the overall portfolio performance was low.

We asked people to choose stocks to invest in from a pre-selected list, and the results were worse than if they had chosen randomly.

“Because I overlooked some of the most profitable stocks, I overlooked some that were particularly painful to hold.” In short, isn’t this saying that the problem was the decision to take comfort in the moment?

--- p.150

Publisher's Review

55 Legendary Wall Street Investors: The Secrets of Investing!

A compilation of the four volumes of the "Market Wizards" series!

What lessons can we learn from the stories of successful Wall Street investors who achieved outstanding returns over decades while rigorously managing risk? Jack Schwager spent 30 years interviewing legendary market figures to find the answer, and he compiled his explorations into four volumes and over 2,000 pages in the "Market Wizards" series.

Jack Schwager interviewed over 60 of the world's best investors and compiled the key insights from 55 of them into The Timing Wizards.

Are great investors born with talent, or are they made through learning and mastering trading techniques?

The secret to success for investors who have weathered and overcome crises in unpredictable markets and made a fortune is, in a way, simple.

It is about gaining insight into what investing is, establishing clear investment principles, and sticking to them thoroughly.

"The Wizards of Timing" offers the answers to the question, "How can I become a true investor?" through the stories of 55 people, rather than "How can I succeed in investing?"

In particular, it is fun to compare the successful strategies of Jim Rogers, who was faithful to fundamental analysis, and Marty Schwartz, who enjoyed the highest returns through technical analysis.

We also compare Paul Tutor Jones with Gil Blake, who has a completely opposite style, to show what it means to invest according to your personality.

This book compares the styles, personalities, and other secrets to success of the world's best investors, allowing readers to explore these differences and determine the investment approach that best suits their needs.

“A true fool does something stupid anytime, anywhere.

“The fool on Wall Street is always looking to make a trade.”

_ Edwin Lefebvre

“The things that make you feel good are usually the things you shouldn’t do.”

_ William Eckhart

“Traders who apply the rules are successful in the long run.”

_Come on

This book contains quotes from great investors in each chapter.

Reading their stories along with their famous quotes can be very moving.

If you've already read the first four volumes of the "Market Wizards" series, reading this book will feel like revisiting the entire series.

For readers who haven't read the series yet, this book has the advantage of providing a quick overview of all four volumes.

As an ordinary investor, if you read this book with a mindset of "timing"—how to deal with losses, when to adjust your principles, when to start and stop trading, and when to step back and reevaluate your strategy—it will help you develop principles and strategies that suit you.

A meaningful guide to life wisdom and success

It is said that many highly successful investors experienced failure in their early years.

A representative example is Michael Marcus.

Michael got into commodity trading during his third year of college, following an acquaintance he met through a friend.

Enticed by the promise of doubling his money in two weeks, he agreed to pay his friend $30 a week as a consulting fee and scraped together a savings account to open one.

It seemed like there was absolutely no way I would lose money, but my account was already at rock bottom, and I managed to raise another $500, but I lost that too.

When he felt miserable because he seemed to be continuing to lose money, he looked up at the sky and lamented, “Can it really be this pathetic?”

It is said that after that, a clear answer seemed to come.

“No, you’re not pathetic.

“Just endure until the end.” So he is said to have endured until the end.

Unable to accept failure, Marcus refused to give up and cashed out $3,000 from the life insurance policy his deceased father had left him.

After studying grains, the $3,000 I invested grew to $30,000.

Like "Market Wizards," this book begins with a story about failure, not success.

Part 1 looks back at the painful failures of great investors.

Their ability to achieve success despite harsh setbacks is a testament to their perseverance, self-discipline, hard work, training, and intense preparation.

In Part 2, we look at the characteristics of successful investors.

You'll explore the commonalities of great investors, from the qualities necessary for success and the psychological states they should be wary of, to their trading attitudes and how to overcome weaknesses.

Part 3 covers basic yet practical guidelines for surviving fully in the market.

It's especially helpful to analyze your mistakes so you don't repeat them, and to know that if the market is letting you off easy when you're in trouble, it's not time to get out yet.

If you want to build a foundation for success in the marketplace, the 55 successful strategies in "The Timing Wizards" may not be necessary right now, but they will come in handy someday.

Although this book is about investing, in a broader sense it is about general success.

It will be an essential guide for our lives, as it applies to all areas that require considerable effort and hard work.

A compilation of the four volumes of the "Market Wizards" series!

What lessons can we learn from the stories of successful Wall Street investors who achieved outstanding returns over decades while rigorously managing risk? Jack Schwager spent 30 years interviewing legendary market figures to find the answer, and he compiled his explorations into four volumes and over 2,000 pages in the "Market Wizards" series.

Jack Schwager interviewed over 60 of the world's best investors and compiled the key insights from 55 of them into The Timing Wizards.

Are great investors born with talent, or are they made through learning and mastering trading techniques?

The secret to success for investors who have weathered and overcome crises in unpredictable markets and made a fortune is, in a way, simple.

It is about gaining insight into what investing is, establishing clear investment principles, and sticking to them thoroughly.

"The Wizards of Timing" offers the answers to the question, "How can I become a true investor?" through the stories of 55 people, rather than "How can I succeed in investing?"

In particular, it is fun to compare the successful strategies of Jim Rogers, who was faithful to fundamental analysis, and Marty Schwartz, who enjoyed the highest returns through technical analysis.

We also compare Paul Tutor Jones with Gil Blake, who has a completely opposite style, to show what it means to invest according to your personality.

This book compares the styles, personalities, and other secrets to success of the world's best investors, allowing readers to explore these differences and determine the investment approach that best suits their needs.

“A true fool does something stupid anytime, anywhere.

“The fool on Wall Street is always looking to make a trade.”

_ Edwin Lefebvre

“The things that make you feel good are usually the things you shouldn’t do.”

_ William Eckhart

“Traders who apply the rules are successful in the long run.”

_Come on

This book contains quotes from great investors in each chapter.

Reading their stories along with their famous quotes can be very moving.

If you've already read the first four volumes of the "Market Wizards" series, reading this book will feel like revisiting the entire series.

For readers who haven't read the series yet, this book has the advantage of providing a quick overview of all four volumes.

As an ordinary investor, if you read this book with a mindset of "timing"—how to deal with losses, when to adjust your principles, when to start and stop trading, and when to step back and reevaluate your strategy—it will help you develop principles and strategies that suit you.

A meaningful guide to life wisdom and success

It is said that many highly successful investors experienced failure in their early years.

A representative example is Michael Marcus.

Michael got into commodity trading during his third year of college, following an acquaintance he met through a friend.

Enticed by the promise of doubling his money in two weeks, he agreed to pay his friend $30 a week as a consulting fee and scraped together a savings account to open one.

It seemed like there was absolutely no way I would lose money, but my account was already at rock bottom, and I managed to raise another $500, but I lost that too.

When he felt miserable because he seemed to be continuing to lose money, he looked up at the sky and lamented, “Can it really be this pathetic?”

It is said that after that, a clear answer seemed to come.

“No, you’re not pathetic.

“Just endure until the end.” So he is said to have endured until the end.

Unable to accept failure, Marcus refused to give up and cashed out $3,000 from the life insurance policy his deceased father had left him.

After studying grains, the $3,000 I invested grew to $30,000.

Like "Market Wizards," this book begins with a story about failure, not success.

Part 1 looks back at the painful failures of great investors.

Their ability to achieve success despite harsh setbacks is a testament to their perseverance, self-discipline, hard work, training, and intense preparation.

In Part 2, we look at the characteristics of successful investors.

You'll explore the commonalities of great investors, from the qualities necessary for success and the psychological states they should be wary of, to their trading attitudes and how to overcome weaknesses.

Part 3 covers basic yet practical guidelines for surviving fully in the market.

It's especially helpful to analyze your mistakes so you don't repeat them, and to know that if the market is letting you off easy when you're in trouble, it's not time to get out yet.

If you want to build a foundation for success in the marketplace, the 55 successful strategies in "The Timing Wizards" may not be necessary right now, but they will come in handy someday.

Although this book is about investing, in a broader sense it is about general success.

It will be an essential guide for our lives, as it applies to all areas that require considerable effort and hard work.

GOODS SPECIFICS

- Date of issue: December 30, 2020

- Format: Hardcover book binding method guide

- Page count, weight, size: 228 pages | 478g | 144*205*20mm

- ISBN13: 9791188279982

- ISBN10: 118827998X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)