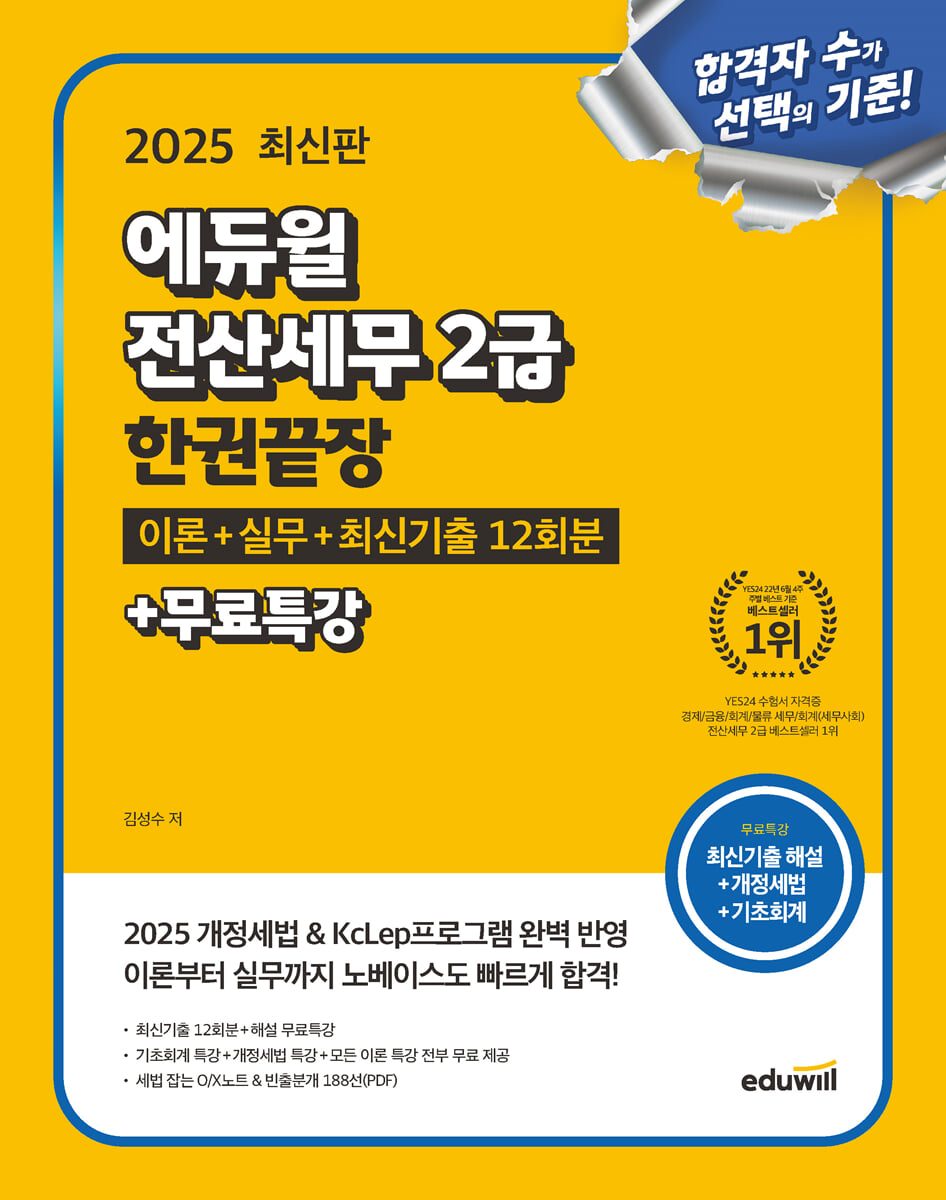

2025 Eduwill Computerized Tax Accounting Level 2: Complete in One Book (Theory + Practice + Latest 12 Past Exam Questions + Free Special Lecture)

|

Description

Book Introduction

[Theory + Practice + Latest 12 Past Exam Questions] All in one book! Pass the exam quickly, even with no prior accounting or tax background!

2025 Eduwill Computerized Tax Accounting Level 2: Complete Theory + Practice + Latest 12 Past Exam Questions + Free Special Lectures

[Theory Edition]: A practical review of the key theories and modified questions from the most recent 30 exams, with the number of times they appeared.

Understand the exam trends and maximize your practical experience with the latest exam questions [Practical Edition].

[Latest Past Exam Questions] contains the latest 6 sets of past exam questions and detailed explanations (an additional 6 sets are provided in PDF format, allowing you to study past exam questions from a total of 4 years).

Final review with 188 core theories and frequently used phrases (PDF).

2025 Eduwill Computerized Tax Accounting Level 2: Complete Theory + Practice + Latest 12 Past Exam Questions + Free Special Lectures

[Theory Edition]: A practical review of the key theories and modified questions from the most recent 30 exams, with the number of times they appeared.

Understand the exam trends and maximize your practical experience with the latest exam questions [Practical Edition].

[Latest Past Exam Questions] contains the latest 6 sets of past exam questions and detailed explanations (an additional 6 sets are provided in PDF format, allowing you to study past exam questions from a total of 4 years).

Final review with 188 core theories and frequently used phrases (PDF).

- You can preview some of the book's contents.

Preview

index

[Theory]

PART 01 Financial Accounting

CHAPTER 01 Accounting Theory

CHAPTER 02 Current Assets

CHAPTER 03 Inventory Assets

CHAPTER 04 Tangible Assets

CHAPTER 05 Intangible Assets

CHAPTER 06 Securities

CHAPTER 07 Debt

CHAPTER 08 CAPITAL

CHAPTER 09 Revenues and Expenses

CHAPTER 10 Accounting Changes and Error Corrections

PART 02 Cost Accounting

CHAPTER 01 Classification and Flow of Costs

CHAPTER 02 Cost Behavior

CHAPTER 03 Individual Cost Calculation

CHAPTER 04 Comprehensive Cost Calculation

PART 03 VAT

CHAPTER 01 General Introduction to Value Added Tax

CHAPTER 02 Taxable Transactions

CHAPTER 03 Tax Rates and Exemptions

CHAPTER 04 Tax Base

CHAPTER 05 Purchase Tax

CHAPTER 06 Tax Invoice

CHAPTER 07 Supply Timing

CHAPTER 08 Tax withheld and reporting/payment

CHAPTER 09 Simplified Taxpayers

PART 04 Income Tax

CHAPTER 01 General Income Tax

CHAPTER 02 Financial Income

CHAPTER 03 BUSINESS INCOME

CHAPTER 04 Earned Income

CHAPTER 05 Pension Income and Other Income

CHAPTER 06 Calculating Comprehensive Income

CHAPTER 07 Comprehensive Income Deduction

CHAPTER 08 Tax withheld and reporting/payment

[Practical & Latest Past Questions]

PART 05 Practical Exam

CHAPTER 01 Basic Information Management

CHAPTER 02 General Voucher Entry

CHAPTER 03 Entering Purchase and Sales Vouchers

CHAPTER 04 VAT Return and Attached Documents

CHAPTER 05 Entering Financial Statement Data

CHAPTER 06 Withholding Tax and Year-End Settlement

PART 06 Latest Past Exam Questions

118th exam questions

117th exam questions

116th exam questions

115th exam questions

114th exam questions

113th exam questions

PART 01 Financial Accounting

CHAPTER 01 Accounting Theory

CHAPTER 02 Current Assets

CHAPTER 03 Inventory Assets

CHAPTER 04 Tangible Assets

CHAPTER 05 Intangible Assets

CHAPTER 06 Securities

CHAPTER 07 Debt

CHAPTER 08 CAPITAL

CHAPTER 09 Revenues and Expenses

CHAPTER 10 Accounting Changes and Error Corrections

PART 02 Cost Accounting

CHAPTER 01 Classification and Flow of Costs

CHAPTER 02 Cost Behavior

CHAPTER 03 Individual Cost Calculation

CHAPTER 04 Comprehensive Cost Calculation

PART 03 VAT

CHAPTER 01 General Introduction to Value Added Tax

CHAPTER 02 Taxable Transactions

CHAPTER 03 Tax Rates and Exemptions

CHAPTER 04 Tax Base

CHAPTER 05 Purchase Tax

CHAPTER 06 Tax Invoice

CHAPTER 07 Supply Timing

CHAPTER 08 Tax withheld and reporting/payment

CHAPTER 09 Simplified Taxpayers

PART 04 Income Tax

CHAPTER 01 General Income Tax

CHAPTER 02 Financial Income

CHAPTER 03 BUSINESS INCOME

CHAPTER 04 Earned Income

CHAPTER 05 Pension Income and Other Income

CHAPTER 06 Calculating Comprehensive Income

CHAPTER 07 Comprehensive Income Deduction

CHAPTER 08 Tax withheld and reporting/payment

[Practical & Latest Past Questions]

PART 05 Practical Exam

CHAPTER 01 Basic Information Management

CHAPTER 02 General Voucher Entry

CHAPTER 03 Entering Purchase and Sales Vouchers

CHAPTER 04 VAT Return and Attached Documents

CHAPTER 05 Entering Financial Statement Data

CHAPTER 06 Withholding Tax and Year-End Settlement

PART 06 Latest Past Exam Questions

118th exam questions

117th exam questions

116th exam questions

115th exam questions

114th exam questions

113th exam questions

Detailed image

Publisher's Review

[Theory] Optimize your exam preparation with frequently asked theories and detailed concept explanations!

- Summary of key content essential for passing the exam based on analysis of the latest 30 exam questions

- Practice test questions organized by type for each chapter

- For frequently appearing types, similar problems are grouped together to provide multiple problems so that you can go over them clearly.

[Practical & Latest Exam Questions] Includes practical practice questions reflecting the latest exam trends, along with KcLep program screens!

12 sets of the latest exam questions (6 sets of textbooks + 6 sets of PDFs) provided + special lectures on past exam questions provided

- Practical problems designed to allow sufficient practice for each program menu based on previous exam questions

- Theories related to practice are also concisely compressed and inserted into the auxiliary section.

- Perfect preparation for the exam with the latest 12 sets of past exam questions and special lectures on past exam questions.

[Special Appendix] Tax Law Fact Sheet + 188 Frequently Asked Questions (PDF)

Don't miss out on the annual tax law revisions! [Tax Law Fact Sheet] contains only the most confusing tax laws.

- [188 Frequently Occurring Resentments], where you can learn practical resentment cases organized by account.

[4-week study plan] that allows even those with no accounting background to systematically learn

Special benefits

- 12 sets of the latest exam questions (6 sets of textbooks + 6 sets of PDFs) & free special lectures on past exam questions

- Free special lectures on the revised tax law, which can be applied directly to real-world problems.

- Free basic accounting special lecture (7 days) and all theory special lectures (5 days)

- [Special Appendix] Tax Law OX Notes + 188 Frequently Asked Questions (PDF)

- We provide a [4-week pass plan] that even those with no accounting background can easily follow.

- Summary of key content essential for passing the exam based on analysis of the latest 30 exam questions

- Practice test questions organized by type for each chapter

- For frequently appearing types, similar problems are grouped together to provide multiple problems so that you can go over them clearly.

[Practical & Latest Exam Questions] Includes practical practice questions reflecting the latest exam trends, along with KcLep program screens!

12 sets of the latest exam questions (6 sets of textbooks + 6 sets of PDFs) provided + special lectures on past exam questions provided

- Practical problems designed to allow sufficient practice for each program menu based on previous exam questions

- Theories related to practice are also concisely compressed and inserted into the auxiliary section.

- Perfect preparation for the exam with the latest 12 sets of past exam questions and special lectures on past exam questions.

[Special Appendix] Tax Law Fact Sheet + 188 Frequently Asked Questions (PDF)

Don't miss out on the annual tax law revisions! [Tax Law Fact Sheet] contains only the most confusing tax laws.

- [188 Frequently Occurring Resentments], where you can learn practical resentment cases organized by account.

[4-week study plan] that allows even those with no accounting background to systematically learn

Special benefits

- 12 sets of the latest exam questions (6 sets of textbooks + 6 sets of PDFs) & free special lectures on past exam questions

- Free special lectures on the revised tax law, which can be applied directly to real-world problems.

- Free basic accounting special lecture (7 days) and all theory special lectures (5 days)

- [Special Appendix] Tax Law OX Notes + 188 Frequently Asked Questions (PDF)

- We provide a [4-week pass plan] that even those with no accounting background can easily follow.

GOODS SPECIFICS

- Date of issue: April 30, 2025

- Page count, weight, size: 912 pages | 1,800g | 205*260*40mm

- ISBN13: 9791136037398

- ISBN10: 113603739X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)