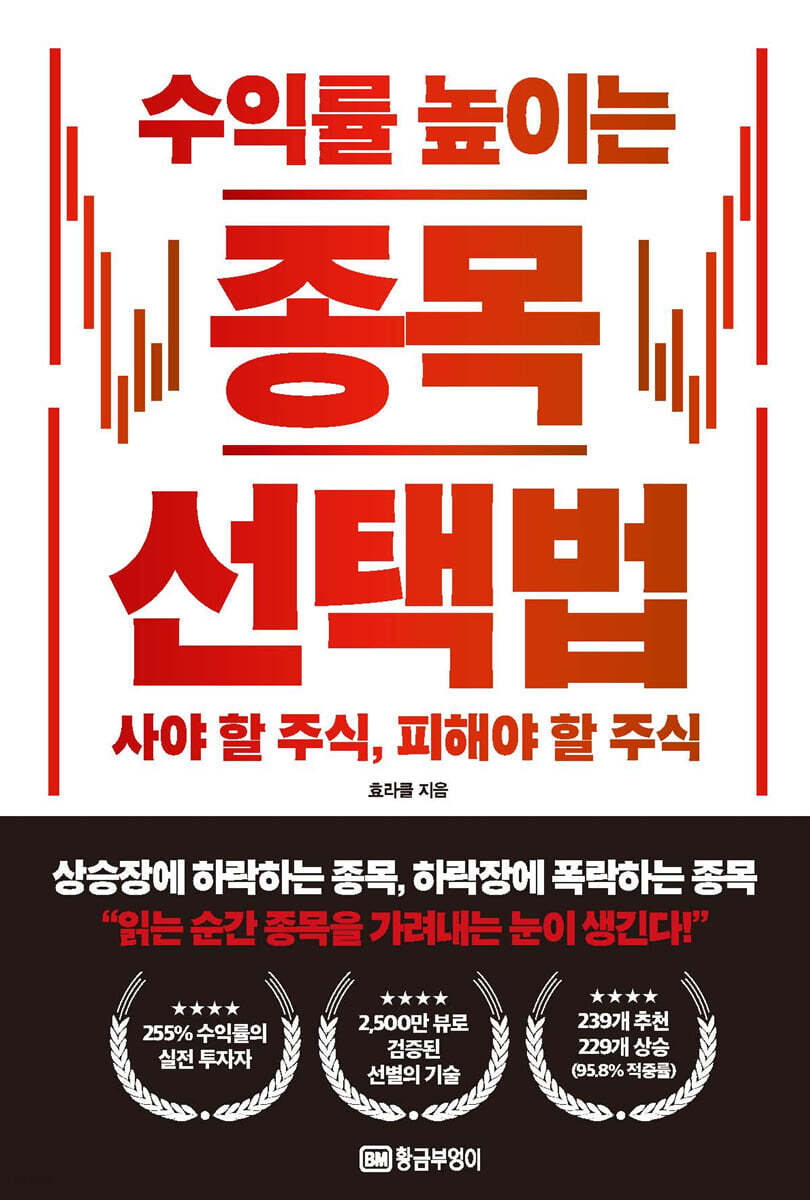

How to Select Stocks with High Returns

|

Description

Book Introduction

“The KOSPI is skyrocketing, but why aren’t my stocks rising?”

Hyoracle, a practical investor who sees through the illusion of a bull market, offers a method for selecting stocks that maximize returns.

The KOSPI index reached an all-time high in 2025.

The market is in a festive mood, with articles like "KOSPI breaks 3,800 for the first time ever" and "Is the KOSPI 4,000 era dawning?" pouring out every day.

The media makes it sound like all stocks are rising, but in reality, only a few large-cap stocks are driving the KOSPI upward.

If you don't own the rising stocks, your returns will remain stagnant or even negative, no matter how much the KOSPI rises.

Although the Korean stock market may appear no different from other countries on the surface, the structure of stock price movements is completely different.

'Stories' and 'issues' move stock prices more than a company's performance or financial statements.

A market where stock prices fluctuate based on new business announcements, political themes, or even a single comment from a celebrity—this is the reality of the Korean stock market.

But this market is actually an opportunity.

Even if you filter out only risky stocks, your returns will increase.

It is much simpler and more certain to filter out stocks that will fall than to predict which stocks will rise.

In other words, knowing 'what not to buy' rather than 'what to buy' is the most realistic way to increase your returns.

《How to Select Stocks with High Profitability》 is a book that establishes criteria for stock selection.

Author Hyoracle is a real investor with 25 million cumulative YouTube views and 229 of the 239 stocks he recommended over the past year have seen gains.

He is a data-proven investor, recording a 255% return even during the COVID-19 bear market.

He reads the market with data, not intuition.

Analyze the events and structures that drive stock prices, and find common signals among plummeting stocks.

It provides concrete examples of market structural pitfalls, such as total risk, political themes, and labor union issues, and provides precise methods for identifying stocks to buy and those to avoid.

Hyoracle, a practical investor who sees through the illusion of a bull market, offers a method for selecting stocks that maximize returns.

The KOSPI index reached an all-time high in 2025.

The market is in a festive mood, with articles like "KOSPI breaks 3,800 for the first time ever" and "Is the KOSPI 4,000 era dawning?" pouring out every day.

The media makes it sound like all stocks are rising, but in reality, only a few large-cap stocks are driving the KOSPI upward.

If you don't own the rising stocks, your returns will remain stagnant or even negative, no matter how much the KOSPI rises.

Although the Korean stock market may appear no different from other countries on the surface, the structure of stock price movements is completely different.

'Stories' and 'issues' move stock prices more than a company's performance or financial statements.

A market where stock prices fluctuate based on new business announcements, political themes, or even a single comment from a celebrity—this is the reality of the Korean stock market.

But this market is actually an opportunity.

Even if you filter out only risky stocks, your returns will increase.

It is much simpler and more certain to filter out stocks that will fall than to predict which stocks will rise.

In other words, knowing 'what not to buy' rather than 'what to buy' is the most realistic way to increase your returns.

《How to Select Stocks with High Profitability》 is a book that establishes criteria for stock selection.

Author Hyoracle is a real investor with 25 million cumulative YouTube views and 229 of the 239 stocks he recommended over the past year have seen gains.

He is a data-proven investor, recording a 255% return even during the COVID-19 bear market.

He reads the market with data, not intuition.

Analyze the events and structures that drive stock prices, and find common signals among plummeting stocks.

It provides concrete examples of market structural pitfalls, such as total risk, political themes, and labor union issues, and provides precise methods for identifying stocks to buy and those to avoid.

- You can preview some of the book's contents.

Preview

index

Prologue: Why "What Not to Buy" Matters More

The first commandment.

Don't buy companies that compete with China.

1.

"Cheap is expensive" is no longer a Chinese thing.

2.

Solar energy, batteries, petrochemicals, and displays: Industries losing to China

3.

When Korean talent goes to medical school, Chinese talent goes to engineering school.

Second Commandment.

Don't buy a company whose CEO has been in jail.

1.

A country that hates ex-convicts but forgives conglomerate leaders

2.

Fluctuations in stock prices before and after the imprisonment and release of conglomerate leaders

The Third Commandment.

If you're a long-term investor, don't even look at KOSDAQ.

1.

Nasdaq is innovation, KOSDAQ is illusion

2. Companies with high PERs but no net profit

3.

KOSDAQ loss-making companies are suitable for short-term trading.

The Fourth Commandment.

Don't buy before earnings announcement

1.

Why Stock Prices Fall Despite Good Performance

2.

Korean-style "material extinction" and the structure of buying and selling with a sense of humor

3.

Representative examples of material depletion

The Fifth Commandment.

Don't buy stocks that rose a lot last year.

1.

The splendid EcoPro: What happened the following year?

2.

Why can't stock prices rise further when only good news is pouring in?

3.

A new star is born every year.

The 6th Commandment.

Don't buy all or nothing stocks

1.

Bio, gaming, new products… Investing in the results.

2.

Shining Moment: When Moga Comes Out

3.

The Moment of the Chopsticks: When the Tao Comes

The 7th Commandment.

Don't buy companies with political ties.

1.

Governments change and scandals repeat themselves.

2.

Park Geun-hye and Kim Kun-hee: The impeached regime is fierce.

3.

Stock prices are shaken by the investigation. Are you confident in handling it?

The 8th Commandment.

Don't buy a company with a strong union.

1.

An aristocratic union that has strayed from its original purpose

2.

Uncertainty created by strike risks and breakdown in negotiations

3.

The Yellow Envelope Law and the Full-scale Introduction of Robots

The 9th Commandment.

Don't buy companies that run counter to government policy.

1.

Dancing policies, dancing stock prices, dancing to the regime

2.

Companies that the government hates are also hated by the people.

3.

Atmosphere is more important than performance - The Economics of Perception

The 10th Commandment.

Don't buy a company with a diversified business structure.

1.

A spin-off is the easiest way to abandon shareholders.

2.

Even if one sector does well, other sectors hold it back.

3.

Diversification is a shield for management, but a shackle for investors.

Epilogue_So what do you want me to buy?

The first commandment.

Don't buy companies that compete with China.

1.

"Cheap is expensive" is no longer a Chinese thing.

2.

Solar energy, batteries, petrochemicals, and displays: Industries losing to China

3.

When Korean talent goes to medical school, Chinese talent goes to engineering school.

Second Commandment.

Don't buy a company whose CEO has been in jail.

1.

A country that hates ex-convicts but forgives conglomerate leaders

2.

Fluctuations in stock prices before and after the imprisonment and release of conglomerate leaders

The Third Commandment.

If you're a long-term investor, don't even look at KOSDAQ.

1.

Nasdaq is innovation, KOSDAQ is illusion

2. Companies with high PERs but no net profit

3.

KOSDAQ loss-making companies are suitable for short-term trading.

The Fourth Commandment.

Don't buy before earnings announcement

1.

Why Stock Prices Fall Despite Good Performance

2.

Korean-style "material extinction" and the structure of buying and selling with a sense of humor

3.

Representative examples of material depletion

The Fifth Commandment.

Don't buy stocks that rose a lot last year.

1.

The splendid EcoPro: What happened the following year?

2.

Why can't stock prices rise further when only good news is pouring in?

3.

A new star is born every year.

The 6th Commandment.

Don't buy all or nothing stocks

1.

Bio, gaming, new products… Investing in the results.

2.

Shining Moment: When Moga Comes Out

3.

The Moment of the Chopsticks: When the Tao Comes

The 7th Commandment.

Don't buy companies with political ties.

1.

Governments change and scandals repeat themselves.

2.

Park Geun-hye and Kim Kun-hee: The impeached regime is fierce.

3.

Stock prices are shaken by the investigation. Are you confident in handling it?

The 8th Commandment.

Don't buy a company with a strong union.

1.

An aristocratic union that has strayed from its original purpose

2.

Uncertainty created by strike risks and breakdown in negotiations

3.

The Yellow Envelope Law and the Full-scale Introduction of Robots

The 9th Commandment.

Don't buy companies that run counter to government policy.

1.

Dancing policies, dancing stock prices, dancing to the regime

2.

Companies that the government hates are also hated by the people.

3.

Atmosphere is more important than performance - The Economics of Perception

The 10th Commandment.

Don't buy a company with a diversified business structure.

1.

A spin-off is the easiest way to abandon shareholders.

2.

Even if one sector does well, other sectors hold it back.

3.

Diversification is a shield for management, but a shackle for investors.

Epilogue_So what do you want me to buy?

Detailed image

Into the book

In the past, it was said that 'cheap things are expensive', but now 'cheap things are expensive' has become a powerful means to destroy competitors.

Being cheap is never a weakness.

It's a strategy, a structure, and a weapon.

China is killing its competitors with its low prices.

Even if the quality is a little poor, it cannot withstand the onslaught of quantity.

No matter how good your technology is, you cannot survive in a battlefield where there is no profit.

Is the stock you're currently holding competing in the same industry as China? If so, it's like riding a bicycle against a truck speeding at 300 km/h.

--- 「'The first commandment.

From "Don't buy companies that compete with China"

The KOSDAQ market survives on ‘optical illusions.’

How are illusions created? First, it's about theme, not performance.

If your name appears in the news, it will definitely rise.

For example, if the government announces a policy related to artificial intelligence, even AI-related stocks with no track record will rise by tens of percent.

Even if the name contains only 'AI', it will rise.

And after a while it falls out again.

This pattern repeats itself in bio.

The stock price hits the upper limit on the news of 'success in phase 1 clinical trial'.

However, the success may be at a meaningless preclinical level, and in many cases, it ends up being meaningless as it fails to pass phase 2 or 3 trials or fails to obtain approval.

Nevertheless, investors are seduced by a single line of hopeful news, and that anticipation creates another illusion.

--- “The Third Commandment.

If you are a long-term investor, don't even look at KOSDAQ.'

Many people firmly believed that Celltrion's true value would be revealed if it went to KOSPI, where there were more excellent companies than KOSDAQ.

The market was dominated by the logic that Celltrion's stock price would naturally rise because numerous ETFs tracking the KOSPI would buy it.

But the stock price had already reflected such things long ago.

The material regarding the brisk sales of Ramsima in Europe, the expanded approval of Trusima, and the listing before KOSPI were already sufficiently spread in the market, and the stock price broke through 300,000 won on the back of these expectations.

No matter how good the material is, if there is no more news to come, expectations are bound to fade.

--- “The Fourth Commandment.

From "Don't buy before earnings announcement"

New keywords such as artificial intelligence and robots are born every day.

Beneficiaries of Nvidia, ChatGPT-related stocks, beneficiaries of the Ukraine War, beneficiaries of the Yellow Envelope Act, and beneficiaries of Korea-US cooperation, etc.

In the endless stream of trends, yesterday's ace becomes tomorrow's overvalued stock.

A stock that looked so good yesterday is not doing so well today.

This is the Korean stock market.

A country where people change trends too quickly, always wanting new things and buying what's changed first.

So, it is a country that global companies use as a test bed to identify trends.

Just as the fashion industry produces new products every season, the stock market also creates new keywords every year.

Stocks often rise not because they are ‘good’ but because they are ‘new’.

And no matter how good a company is, if there is nothing new to offer, its stock price will be ignored.

So remember.

'What was good last year was last year's story.

Being cheap is never a weakness.

It's a strategy, a structure, and a weapon.

China is killing its competitors with its low prices.

Even if the quality is a little poor, it cannot withstand the onslaught of quantity.

No matter how good your technology is, you cannot survive in a battlefield where there is no profit.

Is the stock you're currently holding competing in the same industry as China? If so, it's like riding a bicycle against a truck speeding at 300 km/h.

--- 「'The first commandment.

From "Don't buy companies that compete with China"

The KOSDAQ market survives on ‘optical illusions.’

How are illusions created? First, it's about theme, not performance.

If your name appears in the news, it will definitely rise.

For example, if the government announces a policy related to artificial intelligence, even AI-related stocks with no track record will rise by tens of percent.

Even if the name contains only 'AI', it will rise.

And after a while it falls out again.

This pattern repeats itself in bio.

The stock price hits the upper limit on the news of 'success in phase 1 clinical trial'.

However, the success may be at a meaningless preclinical level, and in many cases, it ends up being meaningless as it fails to pass phase 2 or 3 trials or fails to obtain approval.

Nevertheless, investors are seduced by a single line of hopeful news, and that anticipation creates another illusion.

--- “The Third Commandment.

If you are a long-term investor, don't even look at KOSDAQ.'

Many people firmly believed that Celltrion's true value would be revealed if it went to KOSPI, where there were more excellent companies than KOSDAQ.

The market was dominated by the logic that Celltrion's stock price would naturally rise because numerous ETFs tracking the KOSPI would buy it.

But the stock price had already reflected such things long ago.

The material regarding the brisk sales of Ramsima in Europe, the expanded approval of Trusima, and the listing before KOSPI were already sufficiently spread in the market, and the stock price broke through 300,000 won on the back of these expectations.

No matter how good the material is, if there is no more news to come, expectations are bound to fade.

--- “The Fourth Commandment.

From "Don't buy before earnings announcement"

New keywords such as artificial intelligence and robots are born every day.

Beneficiaries of Nvidia, ChatGPT-related stocks, beneficiaries of the Ukraine War, beneficiaries of the Yellow Envelope Act, and beneficiaries of Korea-US cooperation, etc.

In the endless stream of trends, yesterday's ace becomes tomorrow's overvalued stock.

A stock that looked so good yesterday is not doing so well today.

This is the Korean stock market.

A country where people change trends too quickly, always wanting new things and buying what's changed first.

So, it is a country that global companies use as a test bed to identify trends.

Just as the fashion industry produces new products every season, the stock market also creates new keywords every year.

Stocks often rise not because they are ‘good’ but because they are ‘new’.

And no matter how good a company is, if there is nothing new to offer, its stock price will be ignored.

So remember.

'What was good last year was last year's story.

--- “The Fifth Commandment.

From "Don't buy stocks that rose a lot last year"

From "Don't buy stocks that rose a lot last year"

Publisher's Review

“Give up your greed to buy ankle boots!”

What matters is not when, but what to buy.

The real losses in stock investing come from buying stocks you shouldn't have.

If you are an investor, you have probably experienced this at least once.

A moment when the loss from buying stocks you shouldn't have bought was greater than the profit you made from buying good stocks.

Many investors struggle to find good stocks, but the power to increase profits actually comes from having the ability to discern which stocks to avoid.

In a market that's too exciting, only those who can read the warning signs first can protect and grow their profits.

Hyoracle says:

"While picking stocks that will rise is a divine skill, avoiding stocks that will collapse is a skill." "How to Pick Stocks That Increase Profitability" presents a set of criteria for investors to make unwavering decisions, even when market noise and expectations intersect.

After analyzing the Korean market for several years, Hyoracle summarized recurring risk patterns into the "10 Commandments."

'Avoid companies competing with China', 'Check the CEO's risk', 'Don't be swayed by political themes', 'Read the signals of union conflict'…

Each commandment provides specific evidence of how a particular issue or event has affected stock prices and what patterns have been repeatedly observed.

Readers will understand the market structure through figures and examples, not through vague feelings.

The moment you read this book, the criteria for distinguishing between 'stocks to buy' and 'stocks not to buy' will become clear.

“There are always the same signals for a stock that is falling.”

Just knowing that signal can change your returns.

The biggest strength of this book lies in its ‘data.’

Oracle shows you step-by-step how to interpret the news, read charts, and compare and analyze market data.

Shows the causal relationship between events and stock prices in charts and numbers.

We've compiled visualized data to help you grasp complex market dynamics at a glance, including stock price fluctuations before and after the CEO's arrest or release, industry-specific stock price trends in response to government policy changes, and even the long-term impact of labor union issues on stock prices.

Through this, readers can determine for themselves 'what news affects stock prices' and 'what structure shakes a company's stock price.'

In other words, you gain the power to judge logically and respond based on evidence, rather than investing based on feelings.

《How to Select Stocks with High Profitability》 goes beyond simple explanations.

Each chapter includes QR codes for key topics, allowing you to instantly check out a list of stocks to avoid in the current market based on the topic covered in the book.

Ultimately, this book is the most realistic strategy book that makes 'investment without loss' possible.

The power to make investment decisions based on your own principles, regardless of whether the market is rising or falling—that power is the true ability to increase profits.

This book is a must-read for investors who want to penetrate the structural pitfalls of Korean stocks and secure reliable returns in an uncertain market.

By the time you finish this book, you'll have a solid sense of risk and the ability to avoid losses before anyone else.

What matters is not when, but what to buy.

The real losses in stock investing come from buying stocks you shouldn't have.

If you are an investor, you have probably experienced this at least once.

A moment when the loss from buying stocks you shouldn't have bought was greater than the profit you made from buying good stocks.

Many investors struggle to find good stocks, but the power to increase profits actually comes from having the ability to discern which stocks to avoid.

In a market that's too exciting, only those who can read the warning signs first can protect and grow their profits.

Hyoracle says:

"While picking stocks that will rise is a divine skill, avoiding stocks that will collapse is a skill." "How to Pick Stocks That Increase Profitability" presents a set of criteria for investors to make unwavering decisions, even when market noise and expectations intersect.

After analyzing the Korean market for several years, Hyoracle summarized recurring risk patterns into the "10 Commandments."

'Avoid companies competing with China', 'Check the CEO's risk', 'Don't be swayed by political themes', 'Read the signals of union conflict'…

Each commandment provides specific evidence of how a particular issue or event has affected stock prices and what patterns have been repeatedly observed.

Readers will understand the market structure through figures and examples, not through vague feelings.

The moment you read this book, the criteria for distinguishing between 'stocks to buy' and 'stocks not to buy' will become clear.

“There are always the same signals for a stock that is falling.”

Just knowing that signal can change your returns.

The biggest strength of this book lies in its ‘data.’

Oracle shows you step-by-step how to interpret the news, read charts, and compare and analyze market data.

Shows the causal relationship between events and stock prices in charts and numbers.

We've compiled visualized data to help you grasp complex market dynamics at a glance, including stock price fluctuations before and after the CEO's arrest or release, industry-specific stock price trends in response to government policy changes, and even the long-term impact of labor union issues on stock prices.

Through this, readers can determine for themselves 'what news affects stock prices' and 'what structure shakes a company's stock price.'

In other words, you gain the power to judge logically and respond based on evidence, rather than investing based on feelings.

《How to Select Stocks with High Profitability》 goes beyond simple explanations.

Each chapter includes QR codes for key topics, allowing you to instantly check out a list of stocks to avoid in the current market based on the topic covered in the book.

Ultimately, this book is the most realistic strategy book that makes 'investment without loss' possible.

The power to make investment decisions based on your own principles, regardless of whether the market is rising or falling—that power is the true ability to increase profits.

This book is a must-read for investors who want to penetrate the structural pitfalls of Korean stocks and secure reliable returns in an uncertain market.

By the time you finish this book, you'll have a solid sense of risk and the ability to avoid losses before anyone else.

GOODS SPECIFICS

- Date of issue: November 26, 2025

- Page count, weight, size: 240 pages | 152*225*20mm

- ISBN13: 9788960306530

- ISBN10: 8960306533

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)