Studying the minimum investment

|

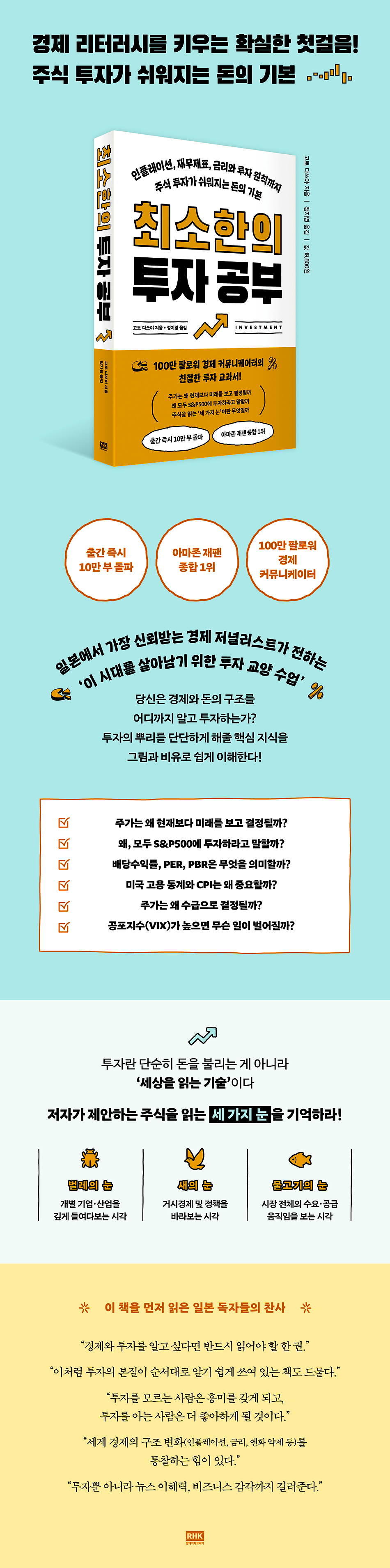

Description

Book Introduction

An economic communicator with 1 million followers

Investment Literacy Classes for Surviving This Era

The KOSPI index broke through 4,000, reaching an all-time high.

Interest in stocks is also hot.

In order not to miss out on the new wave of wealth, the number of novice investors who are breaking into their savings and jumping into the stock market is increasing.

But the world economy is now at a huge turning point.

Inflation, interest rates, exchange rates, and geopolitical risks remain unresolved, and it is impossible to know when or what changes will occur.

In times like these, when expectations and anxieties coexist, proper study is essential when investing.

"Minimum Investment Study" is a book that clearly and easily conveys the economic and financial structure that investors must know.

Instead of complex economic jargon, it uses familiar analogies and real-world news examples to explain things like "why growth stocks weaken when interest rates rise," "how exchange rates affect consumer prices," and "how central bank decisions influence investor sentiment."

Even among Japanese readers who first encountered this book, it received positive reviews, saying, “This is the best book to start studying investment.”

The author is a former reporter for the Nihon Keizai Shimbun, covering economics and finance for over 20 years.

Since his days as a journalist, he has been recognized as "the person who most clearly explains the complex economy." After becoming independent, he has worked as an online economic communicator and journalist, amassing a million followers.

The author says, “Investing is not simply about making money, but rather the art of reading the world.”

This book is packed with essential investment and economic knowledge to help novice investors develop the ability to interpret policy and structural trends without being swayed by short-term market fluctuations.

Investment Literacy Classes for Surviving This Era

The KOSPI index broke through 4,000, reaching an all-time high.

Interest in stocks is also hot.

In order not to miss out on the new wave of wealth, the number of novice investors who are breaking into their savings and jumping into the stock market is increasing.

But the world economy is now at a huge turning point.

Inflation, interest rates, exchange rates, and geopolitical risks remain unresolved, and it is impossible to know when or what changes will occur.

In times like these, when expectations and anxieties coexist, proper study is essential when investing.

"Minimum Investment Study" is a book that clearly and easily conveys the economic and financial structure that investors must know.

Instead of complex economic jargon, it uses familiar analogies and real-world news examples to explain things like "why growth stocks weaken when interest rates rise," "how exchange rates affect consumer prices," and "how central bank decisions influence investor sentiment."

Even among Japanese readers who first encountered this book, it received positive reviews, saying, “This is the best book to start studying investment.”

The author is a former reporter for the Nihon Keizai Shimbun, covering economics and finance for over 20 years.

Since his days as a journalist, he has been recognized as "the person who most clearly explains the complex economy." After becoming independent, he has worked as an online economic communicator and journalist, amassing a million followers.

The author says, “Investing is not simply about making money, but rather the art of reading the world.”

This book is packed with essential investment and economic knowledge to help novice investors develop the ability to interpret policy and structural trends without being swayed by short-term market fluctuations.

- You can preview some of the book's contents.

Preview

index

preface

Chapter 1: Entering an Era of Investment Crucial

The image of Japanese stocks is changing.

The iPhone shook up national consciousness

Disneyland suffers from inflation due to weak yen

The 20 Million Yen Problem of the Centennial Era

Investing experience in your youth becomes a weapon for building wealth.

The point of investing isn't just about increasing your money.

Why I Started Investing in Stocks

Considering where to invest is a similar experience to management.

[Column] Stock Market Stories from 9/11

Investing is a world of gamble, with nothing certain.

Investing is reskilling, sharpening your business mindset.

[Column] What is Risk?

How do investments connect and contribute to society?

The Difference Between Bank Deposits and Stock Investments

Investing to Survive in an Age of Change

Chapter 2: Let's Rethink the Basics

What is a stock?

Shareholders have two main rights.

Establish a stock company in 2022

Raise capital with a growth story, even if sales don't increase.

Receiving investment also creates a sense of burden.

Listing stocks is similar to listing them on an auction site.

Going public will expand the avenues for raising additional capital.

[Column] What Does an IPO Mean to a Startup?

Let's think of the company's value as a restaurant.

Stock prices are determined by looking to the future rather than the present.

Financial statements are an essential weapon for business.

Among various benefits, operating profit is the most important.

The characteristics of the industry and company are reflected in the operating profit ratio.

Net income directly attributable to shareholders

How much of the profits will be distributed as dividends?

Balance Sheets: Learning from Restaurant Management

If you expand your store

Let's briefly summarize the financial statements.

A high capital ratio is not necessarily a good thing.

Comparing the financial statements of Toyota and Nintendo

[Column] Human Capital Not on the Balance Sheet

[Column] Followers Are Capital, Too

The income statement is flow, the balance sheet is stock

The importance of ROE is increasing.

Chapter 3: What Drives Stock Prices?

Three Eyes for Stock Prices

(Bug's Eye) Let's consider the value of Studio Ghibli.

(Bug's Eye) Three indicators for finding a reasonable stock price

(Bug's Eye) Dividend Yields Preferred by Japanese People

(Bug's Eye) There's a reason for the high dividends.

(Bug's Eye) What are the characteristics of high-dividend stocks and low-dividend stocks?

[Column] Dividend Yields Still Have Power

(Bug's Eye) The most used criterion PER

[Column] Even if there's a deficit, if expectations are high, the stock price soars.

(Bug's Eye) PBR, Book Value and Market Value

(Bug's Eye) Companies with low PBRs are wasteful.

[Column] PBR is less than 1 = Disband?

[Column] Tokyo Stock Exchange Calls for Improvement of PBR Below 1x

(Bug's Eye) A Global Corporate Landscape by Market Capitalization

(Bug's Eye) Stock prices are the result of a fierce tug-of-war.

(Bug's Eye) The standard is important, but there are other things that are important too.

Let's see from a bird's eye view

(Bird's Eye) Big money moves macroscopically.

(Bird's Eye) The indicators to keep an eye on are constantly changing.

(Bird's Eye) Key U.S. Economic Indicators ① U.S. Employment Statistics

(Bird's Eye) Key US Economic Indicators ② CPI

(Bird's Eye) Key US Economic Indicators ③ ISM

[Column] What is Market Forecasting?

(Bird's Eye) Alternative data can improve the accuracy of economic forecasts.

See seemingly trivial news with a bird's eye view

(Fish Eye) Stock prices are determined by supply and demand.

(Fish Eye) Does it mean that there are many people who want to buy it?

(Fish Eye) As the total amount of funds increases, they head to the investment market.

(Fish Eye) Sentiment drives the market.

(Fish Eye) Bull markets arise from pessimism.

(Fish Eye) VIX, the Barometer of Fear

(Fish Eye) There are different types of investors.

(Fish Eye) Foreign investors are the main players in Japanese stocks.

(Fish Eye) The Power of the New NISA: Pay Attention to Personal Finance

Overlapping three types of eyes: (insect eyes), (bird eyes), and (fish eyes)

Chapter 4: The Central Bank is the Heart of the Financial Market

Central banks become a concern for ordinary citizens.

The central bank's job isn't just to issue banknotes.

Measures to stabilize prices, monetary policy

The central bank controls the economy and prices through interest rates.

Raising interest rates puts the brakes on the economy.

Interest rates are the body temperature of the economy.

Central banks around the world target 2% inflation.

The Bank of Japan introduced a 2% inflation target in 2013.

2% inflation, a decade that feels distant

Yield curve control policy that adjusts long-term interest rates on government bonds

Two Reasons for the Yen's Weakness

[Column] The Trade Deficit That Stimulates Structural Yen Weakness

What will happen to prices in Japan?

The dynamics of price increases are beginning to change.

Structural changes in the dynamics of salary increases

The era of employees choosing their companies has arrived.

The US Federal Reserve is the center of global finance.

Key US Financial Policies Post-COVID

Which comes first: economy or prices?

The financial system surrounds society like blood vessels.

Chapter 5: Let's Start Investing

The most important thing when investing

The basic flow when you want to start investing in stocks

Investments made by the author himself

Short-term is disadvantageous for individual investors.

Long-term investment is advantageous for individual investors.

Diversification is the king, concentration is high risk

Let's decentralize countries and currencies too.

Investment Trusts: What You Need to Know

If you're hesitant, go with the S&P 500

High-fee investment trusts are not necessarily good.

Spread out your time

If you invest overseas, be mindful of exchange rates.

Don't just believe information on social media; make your own judgments.

[Column] Long-term trust is more important than immediate attention.

The learning and fun of investing in individual stocks

Conclusion

Chapter 1: Entering an Era of Investment Crucial

The image of Japanese stocks is changing.

The iPhone shook up national consciousness

Disneyland suffers from inflation due to weak yen

The 20 Million Yen Problem of the Centennial Era

Investing experience in your youth becomes a weapon for building wealth.

The point of investing isn't just about increasing your money.

Why I Started Investing in Stocks

Considering where to invest is a similar experience to management.

[Column] Stock Market Stories from 9/11

Investing is a world of gamble, with nothing certain.

Investing is reskilling, sharpening your business mindset.

[Column] What is Risk?

How do investments connect and contribute to society?

The Difference Between Bank Deposits and Stock Investments

Investing to Survive in an Age of Change

Chapter 2: Let's Rethink the Basics

What is a stock?

Shareholders have two main rights.

Establish a stock company in 2022

Raise capital with a growth story, even if sales don't increase.

Receiving investment also creates a sense of burden.

Listing stocks is similar to listing them on an auction site.

Going public will expand the avenues for raising additional capital.

[Column] What Does an IPO Mean to a Startup?

Let's think of the company's value as a restaurant.

Stock prices are determined by looking to the future rather than the present.

Financial statements are an essential weapon for business.

Among various benefits, operating profit is the most important.

The characteristics of the industry and company are reflected in the operating profit ratio.

Net income directly attributable to shareholders

How much of the profits will be distributed as dividends?

Balance Sheets: Learning from Restaurant Management

If you expand your store

Let's briefly summarize the financial statements.

A high capital ratio is not necessarily a good thing.

Comparing the financial statements of Toyota and Nintendo

[Column] Human Capital Not on the Balance Sheet

[Column] Followers Are Capital, Too

The income statement is flow, the balance sheet is stock

The importance of ROE is increasing.

Chapter 3: What Drives Stock Prices?

Three Eyes for Stock Prices

(Bug's Eye) Let's consider the value of Studio Ghibli.

(Bug's Eye) Three indicators for finding a reasonable stock price

(Bug's Eye) Dividend Yields Preferred by Japanese People

(Bug's Eye) There's a reason for the high dividends.

(Bug's Eye) What are the characteristics of high-dividend stocks and low-dividend stocks?

[Column] Dividend Yields Still Have Power

(Bug's Eye) The most used criterion PER

[Column] Even if there's a deficit, if expectations are high, the stock price soars.

(Bug's Eye) PBR, Book Value and Market Value

(Bug's Eye) Companies with low PBRs are wasteful.

[Column] PBR is less than 1 = Disband?

[Column] Tokyo Stock Exchange Calls for Improvement of PBR Below 1x

(Bug's Eye) A Global Corporate Landscape by Market Capitalization

(Bug's Eye) Stock prices are the result of a fierce tug-of-war.

(Bug's Eye) The standard is important, but there are other things that are important too.

Let's see from a bird's eye view

(Bird's Eye) Big money moves macroscopically.

(Bird's Eye) The indicators to keep an eye on are constantly changing.

(Bird's Eye) Key U.S. Economic Indicators ① U.S. Employment Statistics

(Bird's Eye) Key US Economic Indicators ② CPI

(Bird's Eye) Key US Economic Indicators ③ ISM

[Column] What is Market Forecasting?

(Bird's Eye) Alternative data can improve the accuracy of economic forecasts.

See seemingly trivial news with a bird's eye view

(Fish Eye) Stock prices are determined by supply and demand.

(Fish Eye) Does it mean that there are many people who want to buy it?

(Fish Eye) As the total amount of funds increases, they head to the investment market.

(Fish Eye) Sentiment drives the market.

(Fish Eye) Bull markets arise from pessimism.

(Fish Eye) VIX, the Barometer of Fear

(Fish Eye) There are different types of investors.

(Fish Eye) Foreign investors are the main players in Japanese stocks.

(Fish Eye) The Power of the New NISA: Pay Attention to Personal Finance

Overlapping three types of eyes: (insect eyes), (bird eyes), and (fish eyes)

Chapter 4: The Central Bank is the Heart of the Financial Market

Central banks become a concern for ordinary citizens.

The central bank's job isn't just to issue banknotes.

Measures to stabilize prices, monetary policy

The central bank controls the economy and prices through interest rates.

Raising interest rates puts the brakes on the economy.

Interest rates are the body temperature of the economy.

Central banks around the world target 2% inflation.

The Bank of Japan introduced a 2% inflation target in 2013.

2% inflation, a decade that feels distant

Yield curve control policy that adjusts long-term interest rates on government bonds

Two Reasons for the Yen's Weakness

[Column] The Trade Deficit That Stimulates Structural Yen Weakness

What will happen to prices in Japan?

The dynamics of price increases are beginning to change.

Structural changes in the dynamics of salary increases

The era of employees choosing their companies has arrived.

The US Federal Reserve is the center of global finance.

Key US Financial Policies Post-COVID

Which comes first: economy or prices?

The financial system surrounds society like blood vessels.

Chapter 5: Let's Start Investing

The most important thing when investing

The basic flow when you want to start investing in stocks

Investments made by the author himself

Short-term is disadvantageous for individual investors.

Long-term investment is advantageous for individual investors.

Diversification is the king, concentration is high risk

Let's decentralize countries and currencies too.

Investment Trusts: What You Need to Know

If you're hesitant, go with the S&P 500

High-fee investment trusts are not necessarily good.

Spread out your time

If you invest overseas, be mindful of exchange rates.

Don't just believe information on social media; make your own judgments.

[Column] Long-term trust is more important than immediate attention.

The learning and fun of investing in individual stocks

Conclusion

Detailed image

Into the book

The world of investing is an economic drama that unfolds in a completely different direction than expected.

Unlike the economic theories learned at a desk, this is a field where investors from around the world compete fiercely to interpret the vivid events of each day and determine how to move money.

This can also be a very useful experience for business people.

Because the world of business you are in and will be in is such a place.

Companies desperately try to increase their profit margins under various uncertain conditions.

There aren't many business models that offer comfortable and reliable ways to make money.

Customer trends or rules can change suddenly.

--- p.49, from “Investment is a world of fierce competition with no certainty”

It's been said that flow and stock are closely related, and the indicator that measures whether the two are effectively aligned is return on equity (ROE). ROE is calculated by dividing one year's net income by equity (net assets).

It shows how the shareholders' equity, which is capital, is utilized to generate profits.

Let's say there are two restaurants with capital (net assets) of 100 million yen (1 billion won).

If Restaurant A's net profit is 20 million yen (ROE 20%) and Restaurant B's net profit is 4 million yen (ROE 4%), then Restaurant A is obviously using its capital efficiently and generating profits.

--- p.131, from “The importance of ROE is increasing”

The most notable inflation indicator in the United States is the Consumer Price Index (CPI).

Until around 2020, it was not a particularly popular economic indicator, but now it is one of the most watched economic indicators in the world.

Why has it garnered so much attention? A glance at the picture in 〈3-12〉 will make it clear.

As will be explained in detail in Chapter 4, the Federal Reserve, the central bank of the United States, operates monetary policy with the goal of maintaining an inflation rate of around 2%.

We can see that until the spring of 2020, before the coronavirus outbreak, it was around 2%, although there was some fluctuation.

The central bank's inflation target was nearly achieved, and both monetary policy and markets were stable.

--- p.200, from “Bird’s Eye, Important US Economic Indicators ② CPI”

The top companies in the S&P 500 are giant tech companies such as Apple, Microsoft, and Amazon.

Traditional American companies such as Visa, Johnson & Johnson, and Coca-Cola are also included.

If you are diversifying your investments overseas, it is more secure to invest in companies you are familiar with.

This will be even more true if it is a long-term investment.

The second point is the benefit of global economic growth.

Big American corporations don't just make money in the United States.

As you can tell from the fact that you know our company name, we do business all over the world.

In other words, as the global economy grows, it is easy for major American companies to make money and their stock prices to rise.

Even if the Japanese economy lags behind, if you invest in US stocks, you can benefit from global economic growth.

Unlike the economic theories learned at a desk, this is a field where investors from around the world compete fiercely to interpret the vivid events of each day and determine how to move money.

This can also be a very useful experience for business people.

Because the world of business you are in and will be in is such a place.

Companies desperately try to increase their profit margins under various uncertain conditions.

There aren't many business models that offer comfortable and reliable ways to make money.

Customer trends or rules can change suddenly.

--- p.49, from “Investment is a world of fierce competition with no certainty”

It's been said that flow and stock are closely related, and the indicator that measures whether the two are effectively aligned is return on equity (ROE). ROE is calculated by dividing one year's net income by equity (net assets).

It shows how the shareholders' equity, which is capital, is utilized to generate profits.

Let's say there are two restaurants with capital (net assets) of 100 million yen (1 billion won).

If Restaurant A's net profit is 20 million yen (ROE 20%) and Restaurant B's net profit is 4 million yen (ROE 4%), then Restaurant A is obviously using its capital efficiently and generating profits.

--- p.131, from “The importance of ROE is increasing”

The most notable inflation indicator in the United States is the Consumer Price Index (CPI).

Until around 2020, it was not a particularly popular economic indicator, but now it is one of the most watched economic indicators in the world.

Why has it garnered so much attention? A glance at the picture in 〈3-12〉 will make it clear.

As will be explained in detail in Chapter 4, the Federal Reserve, the central bank of the United States, operates monetary policy with the goal of maintaining an inflation rate of around 2%.

We can see that until the spring of 2020, before the coronavirus outbreak, it was around 2%, although there was some fluctuation.

The central bank's inflation target was nearly achieved, and both monetary policy and markets were stable.

--- p.200, from “Bird’s Eye, Important US Economic Indicators ② CPI”

The top companies in the S&P 500 are giant tech companies such as Apple, Microsoft, and Amazon.

Traditional American companies such as Visa, Johnson & Johnson, and Coca-Cola are also included.

If you are diversifying your investments overseas, it is more secure to invest in companies you are familiar with.

This will be even more true if it is a long-term investment.

The second point is the benefit of global economic growth.

Big American corporations don't just make money in the United States.

As you can tell from the fact that you know our company name, we do business all over the world.

In other words, as the global economy grows, it is easy for major American companies to make money and their stock prices to rise.

Even if the Japanese economy lags behind, if you invest in US stocks, you can benefit from global economic growth.

--- p.321, from "If you hesitate, S&P 500"

Publisher's Review

Inflation, financial statements, interest rates, and investment principles

Key knowledge that will solidify the foundation of your investment

“Why, when I buy stocks, they fall, and when I sell them, they rise?”

“I bought it because others said it was good, so why am I anxious?”

“I want to invest properly and with my own judgment.”

The first difficulty that people who are just starting to invest face is surprisingly not 'losing money'.

Rather, it is the confusion that comes from not knowing what I need to know and what I don't know.

The news is full of information like interest rate hikes, currency fluctuations, and corporate earnings announcements, but we don't really understand how this connects to stock prices.

Chart analysis is complex, and experts often disagree.

Beginner investors often hesitate to invest, uncertain about whether to buy or sell.

Tatsuya Goto, an economic journalist known as the "economics teacher" for Japanese young adults, points out this point in his book "Minimum Investment Study," saying, "If you know the basics, your perspective on news will change, and if your perspective changes, your actions will change."

Ultimately, the power to understand the economy, or 'economic literacy', must be the foundation.

The core of this book lies in the perspective that 'investment is ultimately the power to read the world.'

How are corporate performance and stock prices linked? Why do central bank interest rate decisions shake the market? How do inflation and exchange rate changes impact household purchasing power? The book connects these questions to real-life contexts, helping readers understand the chain reactions of the economy for themselves.

It provides a comprehensive overview of the concepts necessary to interpret markets in transition, including stock and interest rate movements, changes in financial policy, and the reorganized global supply chain following the pandemic.

In particular, the author focuses on establishing a solid foundation in investment fundamentals.

Rather than "tricks" like short-term trading techniques or strategies for targeting soaring stocks, the emphasis is on principles that remain unwavering even in the face of changing times: diversification, a long-term perspective, risk management, and a fundamental framework for viewing the economy.

The "fundamentals" he speaks of are not simply asset accumulation techniques, but rather a mindset and decision-making ability to navigate uncertainty.

Core concepts of investment and economics

Explained in an easy-to-understand manner with pictures and analogies

Three Eyes for Reading Stocks

Combine bug eyes, bird eyes, and fish eyes!

This book condenses and summarizes the economics and monetary structures that beginner investors must understand, while also conveying "easy and fun economics" by incorporating complex concepts into everyday metaphors and examples.

Through the management of a virtual restaurant, we explain why stock prices are determined by looking to the future rather than the present, and we compare the financial statements of familiar companies such as Toyota and Nintendo to teach the basics of corporate analysis.

Also, in Chapter 3, What Drives Stock Prices, the book presents investors' thinking through three metaphors: "bug's eye (a perspective that closely observes individual companies and industries)," "bird's eye (a macroeconomic and policy perspective)," and "fish's eye (a sense that detects market supply and demand).

If you combine these three perspectives to read the world, you will understand why stock prices move and your investment acumen will be greatly enhanced.

If you've been passing over phrases like "The Fed bought Treasury bonds" or "The central bank adjusted interest rate policy," this book will help you develop the ability to decipher the hidden meaning in economic news.

You will be able to grasp the 'flow of money' hidden among such information at a glance, and realize once again that the economy is not a story of a distant world, but a structure that determines your wallet, labor, consumption, and future.

《Minimum Investment Study》 became a bestseller immediately after its publication, selling over 100,000 copies. It received favorable reviews in Japan, such as “the most beginner-friendly introduction to economics and investment” and “after reading this book, I started seeing the news differently.”

The book comprehensively covers the overall economic structure, factors that determine stock price movements, and the basic framework for investment decisions.

Ultimately, the "investment literacy" discussed in this book isn't about specific techniques or stock recommendations, but rather intellectual guidance on how to think in an era of change and how to maintain balance amidst uncertainty.

For the author, “Investing is not a matter of prediction, but a skill of response.”

It's about training your judgment by reading the world and the movements of money without deciding on a direction.

That is the attitude of a true investor who can survive in uncertain times.

Key knowledge that will solidify the foundation of your investment

“Why, when I buy stocks, they fall, and when I sell them, they rise?”

“I bought it because others said it was good, so why am I anxious?”

“I want to invest properly and with my own judgment.”

The first difficulty that people who are just starting to invest face is surprisingly not 'losing money'.

Rather, it is the confusion that comes from not knowing what I need to know and what I don't know.

The news is full of information like interest rate hikes, currency fluctuations, and corporate earnings announcements, but we don't really understand how this connects to stock prices.

Chart analysis is complex, and experts often disagree.

Beginner investors often hesitate to invest, uncertain about whether to buy or sell.

Tatsuya Goto, an economic journalist known as the "economics teacher" for Japanese young adults, points out this point in his book "Minimum Investment Study," saying, "If you know the basics, your perspective on news will change, and if your perspective changes, your actions will change."

Ultimately, the power to understand the economy, or 'economic literacy', must be the foundation.

The core of this book lies in the perspective that 'investment is ultimately the power to read the world.'

How are corporate performance and stock prices linked? Why do central bank interest rate decisions shake the market? How do inflation and exchange rate changes impact household purchasing power? The book connects these questions to real-life contexts, helping readers understand the chain reactions of the economy for themselves.

It provides a comprehensive overview of the concepts necessary to interpret markets in transition, including stock and interest rate movements, changes in financial policy, and the reorganized global supply chain following the pandemic.

In particular, the author focuses on establishing a solid foundation in investment fundamentals.

Rather than "tricks" like short-term trading techniques or strategies for targeting soaring stocks, the emphasis is on principles that remain unwavering even in the face of changing times: diversification, a long-term perspective, risk management, and a fundamental framework for viewing the economy.

The "fundamentals" he speaks of are not simply asset accumulation techniques, but rather a mindset and decision-making ability to navigate uncertainty.

Core concepts of investment and economics

Explained in an easy-to-understand manner with pictures and analogies

Three Eyes for Reading Stocks

Combine bug eyes, bird eyes, and fish eyes!

This book condenses and summarizes the economics and monetary structures that beginner investors must understand, while also conveying "easy and fun economics" by incorporating complex concepts into everyday metaphors and examples.

Through the management of a virtual restaurant, we explain why stock prices are determined by looking to the future rather than the present, and we compare the financial statements of familiar companies such as Toyota and Nintendo to teach the basics of corporate analysis.

Also, in Chapter 3, What Drives Stock Prices, the book presents investors' thinking through three metaphors: "bug's eye (a perspective that closely observes individual companies and industries)," "bird's eye (a macroeconomic and policy perspective)," and "fish's eye (a sense that detects market supply and demand).

If you combine these three perspectives to read the world, you will understand why stock prices move and your investment acumen will be greatly enhanced.

If you've been passing over phrases like "The Fed bought Treasury bonds" or "The central bank adjusted interest rate policy," this book will help you develop the ability to decipher the hidden meaning in economic news.

You will be able to grasp the 'flow of money' hidden among such information at a glance, and realize once again that the economy is not a story of a distant world, but a structure that determines your wallet, labor, consumption, and future.

《Minimum Investment Study》 became a bestseller immediately after its publication, selling over 100,000 copies. It received favorable reviews in Japan, such as “the most beginner-friendly introduction to economics and investment” and “after reading this book, I started seeing the news differently.”

The book comprehensively covers the overall economic structure, factors that determine stock price movements, and the basic framework for investment decisions.

Ultimately, the "investment literacy" discussed in this book isn't about specific techniques or stock recommendations, but rather intellectual guidance on how to think in an era of change and how to maintain balance amidst uncertainty.

For the author, “Investing is not a matter of prediction, but a skill of response.”

It's about training your judgment by reading the world and the movements of money without deciding on a direction.

That is the attitude of a true investor who can survive in uncertain times.

GOODS SPECIFICS

- Date of issue: November 25, 2025

- Page count, weight, size: 344 pages | 538g | 145*210*21mm

- ISBN13: 9788925572925

- ISBN10: 8925572923

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)