Mom's 1 billion

|

Description

Book Introduction

“Financial planning for busy moms needs to be different.”

The investment navigation that turned an ordinary working mom into a billionaire.

***Recommended books by Ja-cheong, Kim Mi-kyung, John Lee, and Joo Eon-gyu***

***KBS [Morning Plaza] EBS [Homo Economicus] Economic Mentor***

***[Special Feature] 14-Day Rich Habit Project***

After a hectic work life and a tough parenting routine, the fried chicken and beer I used to enjoy as a reward for the day, has now cost over 40,000 won, making it difficult to call it a small consolation.

Not only the rising cost of living but also the rising interest rates on housing loans every month are putting pressure on couples raising children to choose dual-income families.

As a result, mothers today live as supermoms, juggling childcare, housework, and work.

Busy mothers who drop their children off at daycare in the morning and go to work, or take care of household chores after work.

I work hard all day to raise my child happily, but the only time I can really see my child is after he or she falls asleep.

In an age where people ridicule each other and say, "A little goes a long way," mothers' money mentor, author Lee Ji-young, has returned to us.

She grew from an ordinary working mom living in a one-room villa to a billionaire with assets worth 10 billion won. She also had a wish to 'spend a lot of time with her child without worrying about money', so in 'Mom's 10 Billion Won', she talks about how to build a pipeline that automatically brings in money and unshakable rich habits for mothers who have the same concerns.

It's time to experience the rich muscle training that will make the wish of mothers who wish they had just 500,000 won more per month come true.

The investment navigation that turned an ordinary working mom into a billionaire.

***Recommended books by Ja-cheong, Kim Mi-kyung, John Lee, and Joo Eon-gyu***

***KBS [Morning Plaza] EBS [Homo Economicus] Economic Mentor***

***[Special Feature] 14-Day Rich Habit Project***

After a hectic work life and a tough parenting routine, the fried chicken and beer I used to enjoy as a reward for the day, has now cost over 40,000 won, making it difficult to call it a small consolation.

Not only the rising cost of living but also the rising interest rates on housing loans every month are putting pressure on couples raising children to choose dual-income families.

As a result, mothers today live as supermoms, juggling childcare, housework, and work.

Busy mothers who drop their children off at daycare in the morning and go to work, or take care of household chores after work.

I work hard all day to raise my child happily, but the only time I can really see my child is after he or she falls asleep.

In an age where people ridicule each other and say, "A little goes a long way," mothers' money mentor, author Lee Ji-young, has returned to us.

She grew from an ordinary working mom living in a one-room villa to a billionaire with assets worth 10 billion won. She also had a wish to 'spend a lot of time with her child without worrying about money', so in 'Mom's 10 Billion Won', she talks about how to build a pipeline that automatically brings in money and unshakable rich habits for mothers who have the same concerns.

It's time to experience the rich muscle training that will make the wish of mothers who wish they had just 500,000 won more per month come true.

- You can preview some of the book's contents.

Preview

index

Prologue The moment your real life begins

Chapter 1: Mom's Rich Mindset

01 Rich Habits Project

02 5 Ways Moms Can Generate Side Income

03 The 3-Step Rule for Creating Seed Money

04 Rich Mom Habits That Changed My Life

Mom's Billion Dollar Roadmap: Recommended Investment Community & YouTube Channel

Chapter 2: Mom's 10-Step Roadmap to Becoming Rich

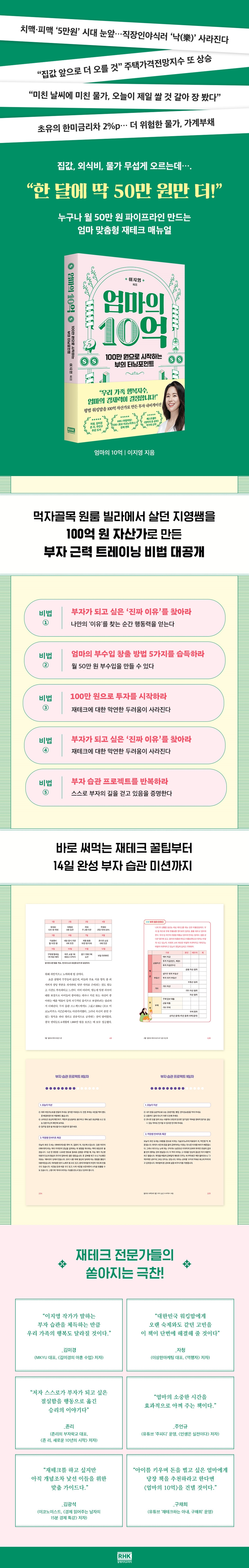

01 Find the 'real reason' why you want to become rich.

02 Follow the money habits of the rich.

03 Start investing with 1 million won

04 Control the environment

05 Build a network that brings you wealth.

06 Create a money-making specialty

07 Create Cash Flow

08 Prepare for Risk

09 Let your money work for you

10 Believe in the power of habit and repeat it.

Mom's Billion Dollar Roadmap: 100 Recommended Books

Chapter 3: Mom's 10 Commandments of Rich Habits

01 Build diverse pipelines

02 Distinguish between good debt and bad debt.

03 Crisis Brings New Wealth

04 Solve other people's problems and money will follow.

05 30% When you're ready, try it

06 Invest 20% of your income in yourself.

07 Create Avatar Income

08 Plan to become rich

09 Learn the easiest way to overcome fear

Repeat the 10 Rich Habits Project

Acknowledgements

Mom's Billion Dollar Roadmap: The 14-Day Rich Habits Project

Chapter 1: Mom's Rich Mindset

01 Rich Habits Project

02 5 Ways Moms Can Generate Side Income

03 The 3-Step Rule for Creating Seed Money

04 Rich Mom Habits That Changed My Life

Mom's Billion Dollar Roadmap: Recommended Investment Community & YouTube Channel

Chapter 2: Mom's 10-Step Roadmap to Becoming Rich

01 Find the 'real reason' why you want to become rich.

02 Follow the money habits of the rich.

03 Start investing with 1 million won

04 Control the environment

05 Build a network that brings you wealth.

06 Create a money-making specialty

07 Create Cash Flow

08 Prepare for Risk

09 Let your money work for you

10 Believe in the power of habit and repeat it.

Mom's Billion Dollar Roadmap: 100 Recommended Books

Chapter 3: Mom's 10 Commandments of Rich Habits

01 Build diverse pipelines

02 Distinguish between good debt and bad debt.

03 Crisis Brings New Wealth

04 Solve other people's problems and money will follow.

05 30% When you're ready, try it

06 Invest 20% of your income in yourself.

07 Create Avatar Income

08 Plan to become rich

09 Learn the easiest way to overcome fear

Repeat the 10 Rich Habits Project

Acknowledgements

Mom's Billion Dollar Roadmap: The 14-Day Rich Habits Project

Detailed image

Into the book

As I listened to the mothers' inner thoughts, I learned that their aspirations started from the simple wish, "If only I had 500,000 won more per month."

Raising a child is, of course, a very precious and valuable thing.

These days, it's no exaggeration to say that mothers worry every day about how to balance parenting and work, as their careers are just as important as raising children.

I try to suppress my fear of a career break, but the worry that 'my life might end just by looking after my child like this' always lingers in the back of my mind.

Sometimes, impulsive spending occurs as we try to relieve the stress, big or small, that these fears bring.

As the saying goes, "financial therapy," spending money to control emotions is the first step, but since this is not a fundamental solution, it ultimately leads to greater guilt.

--- p.28, from “5 Ways for Moms to Generate Side Income”

Although we didn't spend a lot of money to create an online fruit shopping mall, we are generating steady profits.

Rather than expanding the scale to cover the entire country, targeting only small regions was effective.

We limited our delivery to areas where we could deliver the freshest fruit, and we made sure to spread the word there.

Although it is a local fruit shop, it is delivered online and its quality is top-notch, so word of mouth gradually spread to Mom's Cafe, and now it is earning an automatic income of over 5 million won per month.

Above all, it is said that the fact that they did not start with a large sum of money but rather used a sales strategy through blog group purchases and Naver Band to reduce the initial investment and increase profits was very effective.

To make money through a blog, consistency and authenticity are the foundation.

--- p.36, from “5 Ways for Moms to Generate Side Income”

During the saving phase, it is important to set realistic goals rather than being overly ambitious.

For example, something like 'Tackle only one item per month'.

For those of you who are not sure what I mean by tackling one item a month, here's an example.

In January, target your dining out expenses, in February, clothing expenses, and in March, coffee expenses. Find out what you spend the most on and focus on that for a month.

--- p.44, from “The 3-Step Rule for Creating Seed Money”

The Rich Mom Mindset is a must-have if you want to become rich.

It's hard enough to spend time worrying about how to make money without losing money, so you can't waste time blaming and resenting others.

Since everyone has a certain amount of energy, I must use my precious energy on good thoughts.

--- p.53, from “The Rich Mom’s Habits That Changed My Life”

The moment we find the 'real reason', we achieve things we thought we would never be able to do.

To take a step out of a frustrating situation, you need a 'real reason'.

Until we are faced with extreme situations, we never easily move from our familiar reality.

To find the 'real reason', you need to take the time to be honest with yourself about what you truly want.

--- p.68, from “Find the ‘Real Reason’”

When we have worries, we usually confide in our close friends and ask for advice.

Of course, advice from acquaintances can be beneficial at times, but on the other hand, it can also be a huge obstacle in life.

That's why it's so important to have people around me.

If you want to take a new path, you have to make new connections.

I'm talking about connections that bring wealth.

--- p.96, from “Build a network that brings you wealth”

When it comes to real estate investing, risk is like two sides of a coin.

Managing risk well can lead to greater returns.

However, if risks are not managed well, it can lead to huge losses.

When investing, you must carefully examine the risks caused by external factors (e.g., economic fluctuations, policy changes, interest rate hikes) and internal factors related to the transaction itself (e.g., location analysis, rental management, taxes).

You should make an investment when you feel you can handle the worst case scenario.

--- p.114, from “Prepare for Risk”

Making money work for you is a lifelong endeavor, so avoid betting on short-term gains.

If you look around, there are many people who have been deceived by tempting phrases like "You can make hundreds of millions of won in a few months" and have mistakenly joined stock reading rooms, resulting in huge losses.

On the other hand, there are people who are in debt of hundreds of millions of won through coins.

Instead of trying to make a quick buck, you need to approach it with the mindset of making your money work for you for the rest of your life.

When it comes to making money work for you, there are also some principles you need to follow.

For me, there are three principles I stick to when it comes to making money work for me.

--- p.120, from “Make Money Work for You”

Apptech is a combination of the words app and investment, and refers to generating revenue in various ways using mobile devices such as tablets and smartphones.

People who use apps to manage their finances are sometimes called app tech people.

There are many different types of app tech, each with its own pros and cons. However, if you use it to your advantage, it can be beneficial for your financial management and help you develop consistent wealth-building habits.

--- p.154, from “Build a Diverse Pipeline”

There are two types of debt.

Good debt brings me income and increases in value over time.

Bad debt only takes away my money and loses its value over time.

Unfortunately, many people don't know the difference between good debt and bad debt.

That's why people insist on 'jeonse' or 'monthly rent' because they think debt is not good, and they tend to pay for new cars in installments.

On the other hand, some people buy a house without any prior research, with the complacent thought that everything will be solved once they buy a house.

And then you spend more than 30 years paying off the mortgage.

--- p.160, from “Distinguish between good debt and bad debt”

People know that when they drive, they need navigation, and even when they travel on foot, they need a map.

When building a house, you know you need to plan it with an architect.

However, when it comes to financial management, the importance of ‘planning’ is often overlooked.

When driving, first decide on your 'destination', where you want to go.

When building, first think about what kind of house you want to build.

Likewise, if you want to become rich, you must clearly set your goals.

You must first clearly plan the size of your assets or level of wealth you want in 3, 5, or 10 years.

Are you thinking, "If I just work hard, it'll just happen"? Like all things, the path to wealth requires a plan.

--- p.194, from “Plan to Become Rich”

I, too, created the 14-day Rich Habits Project to help me develop small habits first in order to become rich.

As I carried out the mission for each day for two weeks from day 1 to day 14, I gained confidence without even realizing it.

After two weeks, I rewarded myself by opening a Diamond Savings Account and Windmill Savings Account No. 1, which boosted my self-esteem.

Not only me, but now hundreds of people have completed the Rich Habits Project and reached a turning point in their lives.

Raising a child is, of course, a very precious and valuable thing.

These days, it's no exaggeration to say that mothers worry every day about how to balance parenting and work, as their careers are just as important as raising children.

I try to suppress my fear of a career break, but the worry that 'my life might end just by looking after my child like this' always lingers in the back of my mind.

Sometimes, impulsive spending occurs as we try to relieve the stress, big or small, that these fears bring.

As the saying goes, "financial therapy," spending money to control emotions is the first step, but since this is not a fundamental solution, it ultimately leads to greater guilt.

--- p.28, from “5 Ways for Moms to Generate Side Income”

Although we didn't spend a lot of money to create an online fruit shopping mall, we are generating steady profits.

Rather than expanding the scale to cover the entire country, targeting only small regions was effective.

We limited our delivery to areas where we could deliver the freshest fruit, and we made sure to spread the word there.

Although it is a local fruit shop, it is delivered online and its quality is top-notch, so word of mouth gradually spread to Mom's Cafe, and now it is earning an automatic income of over 5 million won per month.

Above all, it is said that the fact that they did not start with a large sum of money but rather used a sales strategy through blog group purchases and Naver Band to reduce the initial investment and increase profits was very effective.

To make money through a blog, consistency and authenticity are the foundation.

--- p.36, from “5 Ways for Moms to Generate Side Income”

During the saving phase, it is important to set realistic goals rather than being overly ambitious.

For example, something like 'Tackle only one item per month'.

For those of you who are not sure what I mean by tackling one item a month, here's an example.

In January, target your dining out expenses, in February, clothing expenses, and in March, coffee expenses. Find out what you spend the most on and focus on that for a month.

--- p.44, from “The 3-Step Rule for Creating Seed Money”

The Rich Mom Mindset is a must-have if you want to become rich.

It's hard enough to spend time worrying about how to make money without losing money, so you can't waste time blaming and resenting others.

Since everyone has a certain amount of energy, I must use my precious energy on good thoughts.

--- p.53, from “The Rich Mom’s Habits That Changed My Life”

The moment we find the 'real reason', we achieve things we thought we would never be able to do.

To take a step out of a frustrating situation, you need a 'real reason'.

Until we are faced with extreme situations, we never easily move from our familiar reality.

To find the 'real reason', you need to take the time to be honest with yourself about what you truly want.

--- p.68, from “Find the ‘Real Reason’”

When we have worries, we usually confide in our close friends and ask for advice.

Of course, advice from acquaintances can be beneficial at times, but on the other hand, it can also be a huge obstacle in life.

That's why it's so important to have people around me.

If you want to take a new path, you have to make new connections.

I'm talking about connections that bring wealth.

--- p.96, from “Build a network that brings you wealth”

When it comes to real estate investing, risk is like two sides of a coin.

Managing risk well can lead to greater returns.

However, if risks are not managed well, it can lead to huge losses.

When investing, you must carefully examine the risks caused by external factors (e.g., economic fluctuations, policy changes, interest rate hikes) and internal factors related to the transaction itself (e.g., location analysis, rental management, taxes).

You should make an investment when you feel you can handle the worst case scenario.

--- p.114, from “Prepare for Risk”

Making money work for you is a lifelong endeavor, so avoid betting on short-term gains.

If you look around, there are many people who have been deceived by tempting phrases like "You can make hundreds of millions of won in a few months" and have mistakenly joined stock reading rooms, resulting in huge losses.

On the other hand, there are people who are in debt of hundreds of millions of won through coins.

Instead of trying to make a quick buck, you need to approach it with the mindset of making your money work for you for the rest of your life.

When it comes to making money work for you, there are also some principles you need to follow.

For me, there are three principles I stick to when it comes to making money work for me.

--- p.120, from “Make Money Work for You”

Apptech is a combination of the words app and investment, and refers to generating revenue in various ways using mobile devices such as tablets and smartphones.

People who use apps to manage their finances are sometimes called app tech people.

There are many different types of app tech, each with its own pros and cons. However, if you use it to your advantage, it can be beneficial for your financial management and help you develop consistent wealth-building habits.

--- p.154, from “Build a Diverse Pipeline”

There are two types of debt.

Good debt brings me income and increases in value over time.

Bad debt only takes away my money and loses its value over time.

Unfortunately, many people don't know the difference between good debt and bad debt.

That's why people insist on 'jeonse' or 'monthly rent' because they think debt is not good, and they tend to pay for new cars in installments.

On the other hand, some people buy a house without any prior research, with the complacent thought that everything will be solved once they buy a house.

And then you spend more than 30 years paying off the mortgage.

--- p.160, from “Distinguish between good debt and bad debt”

People know that when they drive, they need navigation, and even when they travel on foot, they need a map.

When building a house, you know you need to plan it with an architect.

However, when it comes to financial management, the importance of ‘planning’ is often overlooked.

When driving, first decide on your 'destination', where you want to go.

When building, first think about what kind of house you want to build.

Likewise, if you want to become rich, you must clearly set your goals.

You must first clearly plan the size of your assets or level of wealth you want in 3, 5, or 10 years.

Are you thinking, "If I just work hard, it'll just happen"? Like all things, the path to wealth requires a plan.

--- p.194, from “Plan to Become Rich”

I, too, created the 14-day Rich Habits Project to help me develop small habits first in order to become rich.

As I carried out the mission for each day for two weeks from day 1 to day 14, I gained confidence without even realizing it.

After two weeks, I rewarded myself by opening a Diamond Savings Account and Windmill Savings Account No. 1, which boosted my self-esteem.

Not only me, but now hundreds of people have completed the Rich Habits Project and reached a turning point in their lives.

--- p.208-209, from “Repeat the Rich Habit Project”

Publisher's Review

Aren't you too busy making money to spend time with your children?

The truly rich create systems that automatically bring in money!

"Wealthy Muscle Training" by Lee Ji-young, author of "Mom's Money Study"

Children's tuition, utility bills, insurance premiums, loan interest, and principal... At the end of the page filled with withdrawal records, you can see the empty balance.

I just got my paycheck, but what will I do about living expenses until next month? Every month, mothers worry about the same thing.

The chicken and pizza that children insist on eating are not the 'regular menu items of the common people.'

With public utility and transportation fees rising every day, mothers' wallets are already thinning, and they are full of worries.

How great would it be if we had “just 500,000 won more” in times like these?

Author Lee Ji-young has returned with a solution that will turn mothers' wishes into reality.

Having guided 100,000 readers on the path to financial freedom with “Mom’s Money Study,” she now shares her financial management secrets for overcoming the high inflation crisis in her new book, “Mom’s 1 Billion Won.”

Starting with 1 million won and creating 1 billion won through a step-by-step roadmap, and even how to build a pipeline of over 500,000 won per month through app tech, smart stores, and blogs, just reading this realistically organized book will help mothers breathe easier.

For mothers who have given up on their careers because their children are young and it is difficult to balance work and childcare, the satisfaction and sense of efficacy gained from earning money themselves is limitless.

What if you could see your bank balance gradually accumulating? Wouldn't you be able to create new opportunities to achieve both work and happiness in a life that's been like a spinning top?

The book includes a two-week plan to help you quickly embed the insights and habits of the wealthy, ensuring these secrets stick.

Now, you can move beyond the past, desperately trying to escape a negative balance, and build a more solid financial structure, not to mention purchasing a home.

How to build a pipeline that can be used while raising children

How to invest a small amount of 1 million won, including risk management!

We offer a full course of customized financial planning for moms.

For mothers unfamiliar with financial planning, author Lee Ji-young offers a step-by-step guide.

As you implement them one by one, you will gain the satisfaction of earning money yourself and the confidence that you can become rich.

As a very first step, let's find your own 'real reason' for wanting to become rich and gain the driving force for change.

Find your own desperate reasons for becoming rich, such as 'I want to spend more time with my child without worrying about money' or 'I want to build a piano room for my child', and plant the seeds of change.

After that, let's create a side income of 500,000 won per month based on various methods of generating side income that can be done while raising children, such as blogging, talent sharing platforms, Instagram, smart stores, YouTube, and rental businesses.

If you're somewhat familiar with investing, start with a small investment of 1 million won.

For mothers who believe that the only investment method they can use is through savings account specials, we've included various investment methods, including app tech, REITs, challenge tech, art tech, and food tech.

Finding small-scale investment methods that work for you will not only help you overcome your vague fears about investing, but also help you develop your own clear investment perspective.

In addition, you can acquire unwavering wealth stamina through customized, all-weather financial consulting, including how to build a pipeline that generates steady monthly cash flow and how to manage risks that may arise as your investment amount increases.

Asset & Liability Statement, Morning Plan, Recommended Investment Community & YouTube, etc.

Full of practical financial tips and savings information

《Mom's Billion》 doesn't just tell a theoretical story.

As economist Kim Gwang-seok recommends, “This is a tailored guide for those who want to invest but are still unfamiliar with the concept,” various practical investment tips that can be put to use right away are included throughout the book to help mothers make immediate changes.

For those who are far from financial management and don't even know how much assets they have, there is the 'Asset and Debt Status Checklist', the '100 Recommended Financial Management Books' that you must read if you have decided to study financial management, the 'Recommended Financial Management Community & YouTube Channel' where you can acquire financial management information in real time, and the '14-Day Rich Habit Project' that equips you with the most basic habits to become rich by completing missions for two weeks. These are all like secret tutoring classes that save time for busy mothers.

In addition, the realistic tips such as 'Types of acquaintances to avoid when giving financial advice', 'How to distinguish between bad debt and good debt', and '10 promises to yourself to become rich' are advice that have become the lifeblood and flesh of a financial expert, perfected through the author's own trial and error.

The truly rich create systems that automatically bring in money!

"Wealthy Muscle Training" by Lee Ji-young, author of "Mom's Money Study"

Children's tuition, utility bills, insurance premiums, loan interest, and principal... At the end of the page filled with withdrawal records, you can see the empty balance.

I just got my paycheck, but what will I do about living expenses until next month? Every month, mothers worry about the same thing.

The chicken and pizza that children insist on eating are not the 'regular menu items of the common people.'

With public utility and transportation fees rising every day, mothers' wallets are already thinning, and they are full of worries.

How great would it be if we had “just 500,000 won more” in times like these?

Author Lee Ji-young has returned with a solution that will turn mothers' wishes into reality.

Having guided 100,000 readers on the path to financial freedom with “Mom’s Money Study,” she now shares her financial management secrets for overcoming the high inflation crisis in her new book, “Mom’s 1 Billion Won.”

Starting with 1 million won and creating 1 billion won through a step-by-step roadmap, and even how to build a pipeline of over 500,000 won per month through app tech, smart stores, and blogs, just reading this realistically organized book will help mothers breathe easier.

For mothers who have given up on their careers because their children are young and it is difficult to balance work and childcare, the satisfaction and sense of efficacy gained from earning money themselves is limitless.

What if you could see your bank balance gradually accumulating? Wouldn't you be able to create new opportunities to achieve both work and happiness in a life that's been like a spinning top?

The book includes a two-week plan to help you quickly embed the insights and habits of the wealthy, ensuring these secrets stick.

Now, you can move beyond the past, desperately trying to escape a negative balance, and build a more solid financial structure, not to mention purchasing a home.

How to build a pipeline that can be used while raising children

How to invest a small amount of 1 million won, including risk management!

We offer a full course of customized financial planning for moms.

For mothers unfamiliar with financial planning, author Lee Ji-young offers a step-by-step guide.

As you implement them one by one, you will gain the satisfaction of earning money yourself and the confidence that you can become rich.

As a very first step, let's find your own 'real reason' for wanting to become rich and gain the driving force for change.

Find your own desperate reasons for becoming rich, such as 'I want to spend more time with my child without worrying about money' or 'I want to build a piano room for my child', and plant the seeds of change.

After that, let's create a side income of 500,000 won per month based on various methods of generating side income that can be done while raising children, such as blogging, talent sharing platforms, Instagram, smart stores, YouTube, and rental businesses.

If you're somewhat familiar with investing, start with a small investment of 1 million won.

For mothers who believe that the only investment method they can use is through savings account specials, we've included various investment methods, including app tech, REITs, challenge tech, art tech, and food tech.

Finding small-scale investment methods that work for you will not only help you overcome your vague fears about investing, but also help you develop your own clear investment perspective.

In addition, you can acquire unwavering wealth stamina through customized, all-weather financial consulting, including how to build a pipeline that generates steady monthly cash flow and how to manage risks that may arise as your investment amount increases.

Asset & Liability Statement, Morning Plan, Recommended Investment Community & YouTube, etc.

Full of practical financial tips and savings information

《Mom's Billion》 doesn't just tell a theoretical story.

As economist Kim Gwang-seok recommends, “This is a tailored guide for those who want to invest but are still unfamiliar with the concept,” various practical investment tips that can be put to use right away are included throughout the book to help mothers make immediate changes.

For those who are far from financial management and don't even know how much assets they have, there is the 'Asset and Debt Status Checklist', the '100 Recommended Financial Management Books' that you must read if you have decided to study financial management, the 'Recommended Financial Management Community & YouTube Channel' where you can acquire financial management information in real time, and the '14-Day Rich Habit Project' that equips you with the most basic habits to become rich by completing missions for two weeks. These are all like secret tutoring classes that save time for busy mothers.

In addition, the realistic tips such as 'Types of acquaintances to avoid when giving financial advice', 'How to distinguish between bad debt and good debt', and '10 promises to yourself to become rich' are advice that have become the lifeblood and flesh of a financial expert, perfected through the author's own trial and error.

GOODS SPECIFICS

- Date of issue: August 11, 2023

- Page count, weight, size: 232 pages | 480g | 145*215*12mm

- ISBN13: 9788925576206

- ISBN10: 8925576201

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)