The world's kindest exchange rate class

|

Description

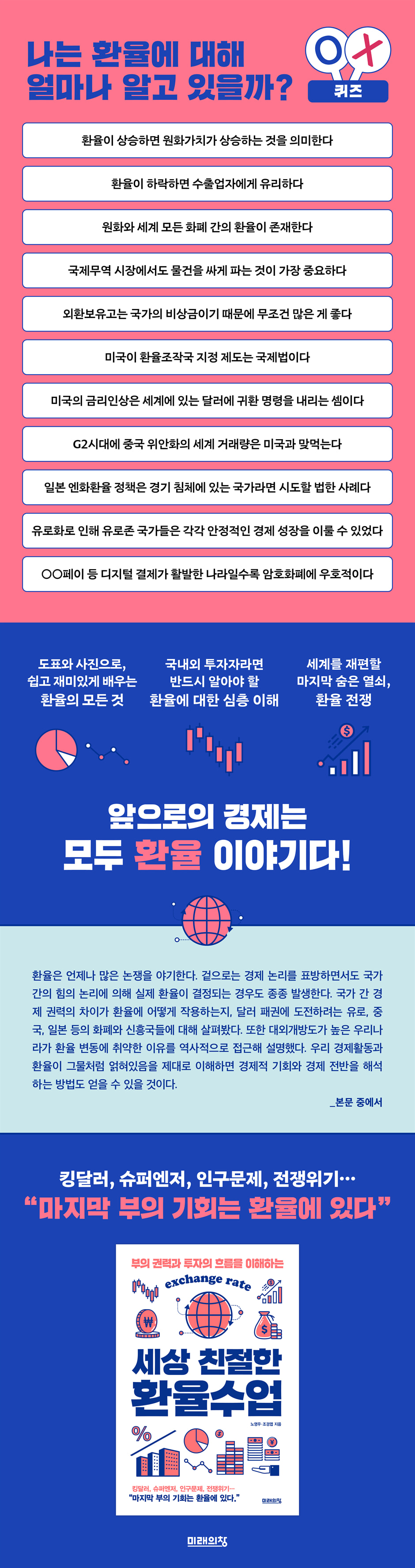

Book Introduction

Everything You Need to Know About Exchange Rates in One Book

The exchange rate has been unusual recently.

The soaring won-dollar exchange rate, the yen, which seemed destined for a long period of decline, is gradually rising due to the Japanese government's interest rate hike, and the dollar's movements and the global economy are rippled by the decisions of the U.S. central bank and the political situation in the United States.

Sales at export companies are good, but wages remain the same and prices are rising, making life difficult. On the other hand, foreign stocks are rising a lot, making people feel good.

If our fate in this global economic era is to cry and laugh at a single number called the exchange rate, it would be better to understand its principles and observe its trends.

Is it better for the exchange rate to rise or fall? In the volatile foreign exchange market, is it better to exchange money in advance? Is the government's high exchange rate policy simply passing the burden on to consumers? Will Bitcoin replace traditional currencies? From personal daily life and national policy to the political and economic dynamics of nations around the world and the future economy increasingly intertwined with the digital world, this book will explore everything about exchange rates, which will shape our lives.

The exchange rate has been unusual recently.

The soaring won-dollar exchange rate, the yen, which seemed destined for a long period of decline, is gradually rising due to the Japanese government's interest rate hike, and the dollar's movements and the global economy are rippled by the decisions of the U.S. central bank and the political situation in the United States.

Sales at export companies are good, but wages remain the same and prices are rising, making life difficult. On the other hand, foreign stocks are rising a lot, making people feel good.

If our fate in this global economic era is to cry and laugh at a single number called the exchange rate, it would be better to understand its principles and observe its trends.

Is it better for the exchange rate to rise or fall? In the volatile foreign exchange market, is it better to exchange money in advance? Is the government's high exchange rate policy simply passing the burden on to consumers? Will Bitcoin replace traditional currencies? From personal daily life and national policy to the political and economic dynamics of nations around the world and the future economy increasingly intertwined with the digital world, this book will explore everything about exchange rates, which will shape our lives.

- You can preview some of the book's contents.

Preview

index

Entering.

Knowing exchange rates reveals the world economy.

Chapter 1.

The birth of exchange rates

Jeon Woo-chi and the Law of One Thing and One Family

Understanding Exchange Rates: Countries, Currencies, and Trade

The absolute power of trade in determining exchange rates, relative technology

Gold standard → dollar standard → market standard?!

There is no foreign exchange market without government intervention.

Exchange rates in everyday life, everyday life in exchange rates

The illusion that exchange rates can be controlled

Chapter 2.

The foreign exchange market, where exchange rates are determined

Three Characteristics of the Forex Market: Collectivity, Relativity, and Ambiguity

Dual Relationships: Prices and Exchange Rates

The paradoxical relationship between economic trends and exchange rates

Psychological Relationships, Financial Markets, and Exchange Rates

Intuitive Relationships: Interest Rates and Exchange Rates

Forex market, where time and conditions are traded

National emergency fund, foreign exchange reserves

Chapter 3.

Dollar hegemony and exchange rates

The force that made America strong: dollar hegemony

The US dollar has no exchange rate, but it does have a dollar index.

A stronger dollar after the Nixon Shock

Dollar Watcher Designates the US as a Currency Manipulator

America's Hidden Weapon: Central Bank Currency Swaps

Weaponizing the Dollar and the De-dollarization Movement

If the dollar disappears

Chapter 4.

Exchange rates and the Korean economy

The Korean foreign exchange market, where the exchange rate continues to rise

Risk factors in the Korean foreign exchange market

Is exporting the only way to survive? The exchange rate made it possible.

What Happens to the Korean Economy When Foreign Exchange Management Fails

The global currency war is a "squid game."

Chapter 5.

Challenges and Limits to Dollar Hegemony

The Chinese Yuan Challenges the Dollar's Hegemony

BRICS' Common Currency Plan

Multiplayer India: A Rising Nation

Countries Trying to Move Away from the Dollar in a Digital World

Countries that entrust their exchange rates and interest rates to the United States

Chapter 6.

Japan and the eurozone are keeping an eye on the US dollar.

The super-yen policy that led to Japan's revival

Conflicting interests over the engine

The Eurozone, a symbol of European integration

The Eurozone Paradox: Widening the Wealth Gap

The future of the euro faces many challenges.

Chapter 7.

Exchange rate stories around us

Is it better if the exchange rate rises or falls?

Overseas travel, fund investment… Is it better to exchange money in advance?

Foreign investors, the invisible hand that moves domestic stocks

Overseas Securities Investment: Killing Two Birds with One Stone or Adding insult to injury?

They say it's Enger, should I get a foreign currency loan at a low interest rate?

Is there any way to avoid currency risk?

High exchange rate policy that shifts the burden onto consumers

Will Bitcoin Replace Traditional Currency?

Going out.

Travel in the US Dollar

Knowing exchange rates reveals the world economy.

Chapter 1.

The birth of exchange rates

Jeon Woo-chi and the Law of One Thing and One Family

Understanding Exchange Rates: Countries, Currencies, and Trade

The absolute power of trade in determining exchange rates, relative technology

Gold standard → dollar standard → market standard?!

There is no foreign exchange market without government intervention.

Exchange rates in everyday life, everyday life in exchange rates

The illusion that exchange rates can be controlled

Chapter 2.

The foreign exchange market, where exchange rates are determined

Three Characteristics of the Forex Market: Collectivity, Relativity, and Ambiguity

Dual Relationships: Prices and Exchange Rates

The paradoxical relationship between economic trends and exchange rates

Psychological Relationships, Financial Markets, and Exchange Rates

Intuitive Relationships: Interest Rates and Exchange Rates

Forex market, where time and conditions are traded

National emergency fund, foreign exchange reserves

Chapter 3.

Dollar hegemony and exchange rates

The force that made America strong: dollar hegemony

The US dollar has no exchange rate, but it does have a dollar index.

A stronger dollar after the Nixon Shock

Dollar Watcher Designates the US as a Currency Manipulator

America's Hidden Weapon: Central Bank Currency Swaps

Weaponizing the Dollar and the De-dollarization Movement

If the dollar disappears

Chapter 4.

Exchange rates and the Korean economy

The Korean foreign exchange market, where the exchange rate continues to rise

Risk factors in the Korean foreign exchange market

Is exporting the only way to survive? The exchange rate made it possible.

What Happens to the Korean Economy When Foreign Exchange Management Fails

The global currency war is a "squid game."

Chapter 5.

Challenges and Limits to Dollar Hegemony

The Chinese Yuan Challenges the Dollar's Hegemony

BRICS' Common Currency Plan

Multiplayer India: A Rising Nation

Countries Trying to Move Away from the Dollar in a Digital World

Countries that entrust their exchange rates and interest rates to the United States

Chapter 6.

Japan and the eurozone are keeping an eye on the US dollar.

The super-yen policy that led to Japan's revival

Conflicting interests over the engine

The Eurozone, a symbol of European integration

The Eurozone Paradox: Widening the Wealth Gap

The future of the euro faces many challenges.

Chapter 7.

Exchange rate stories around us

Is it better if the exchange rate rises or falls?

Overseas travel, fund investment… Is it better to exchange money in advance?

Foreign investors, the invisible hand that moves domestic stocks

Overseas Securities Investment: Killing Two Birds with One Stone or Adding insult to injury?

They say it's Enger, should I get a foreign currency loan at a low interest rate?

Is there any way to avoid currency risk?

High exchange rate policy that shifts the burden onto consumers

Will Bitcoin Replace Traditional Currency?

Going out.

Travel in the US Dollar

Detailed image

Into the book

In the world of international trade, selling something cheap often causes more problems than selling it expensive.

In international trade, the act of selling more goods by lowering the price of goods overseas while keeping the domestic price the same is called 'dumping'.

In international trade, dumping is an act condemned as unfair trade.

It's ironic that 'selling things cheaply is the problem,' but it's a key way to understand international trade.

Interestingly, changes in exchange rates can justify such unfair trade practices.

For example, let's assume that when Samsung Electronics sells smartphones, the exchange rate changes from 1,000 won per dollar to 1,100 won per dollar.

In this case, the price of Samsung Electronics' smartphone, which costs 1 million won in Korea, would be about $909 in the US.

That's because it's a similar value to 1 million won in Korea.

At this point, it wouldn't be a problem if Samsung Electronics lowered the price of its smartphones for sale in the US to around $900.

Such price changes cannot be called dumping.

This is because when the new exchange rate (1 dollar = 1,100 won) is applied, prices in Korea and the US are almost the same.

--- From "There is no foreign exchange market without government intervention"

Although nominal exchange rate, real exchange rate, price index, and trade share may seem complicated, there is an important point that runs through all of these concepts.

The fact is that exchange rates are closely related not only to national policy but also to our daily lives.

The real effective exchange rate reflects prices in each country around the world and trade relations with our country.

If this exchange rate is low, my company's exports will be smooth, but if I personally need foreign currency for study abroad or travel, it could be a significant burden.

Even if you change your position just a little, the same exchange rate will feel different.

This is also why we need to understand exchange rates from a broad perspective.

--- From "Exchange Rates in Daily Life, Daily Life in Exchange Rates"

When the economy improves and exports increase, you earn more money.

Since there is a lot of money, domestic consumption increases, and since there is the ability to import what is lacking from abroad, imports also increase.

During an economic upturn, exports generally increase at a greater rate than domestic consumption.

Because of this, the amount of money coming in from abroad increases, which causes the value of the won to rise (the exchange rate to fall).

When the market goes down, it has the opposite effect than when it goes up.

The amount of goods produced in our country decreases, and as a result, the amount of foreign exchange coming into our country also decreases.

As demand for foreign exchange increases and the won weakens, the exchange rate rises.

Given this, national currencies in booming economies tend to perform well in global foreign exchange markets.

The value of a country's currency is proportional to the flow of the economy.

The market peaks, then goes through a downward phase, forms a low point, and then goes through an upward phase to reach a peak.

In a capitalist economy, the economy goes through ups and downs, and it can also be understood that the currency of a country with a growing economy gradually becomes stronger.

--- From "Paradoxical Relationships: Economic Trends and Exchange Rates"

The United States cooperates with the International Monetary Fund (IMF) and applies pressure through a cooperative system when negotiating with countries it designates as currency manipulators.

Sanctions such as imposing tariffs and other disadvantages, restricting investment by American companies, and blocking participation in the US procurement market are also implemented. The power of the dollar's hegemony is also evident in the fact that the IMF is under US influence and plays a crucial role in maintaining the dollar standard.

There have been various opinions regarding the designation of the United States as a currency manipulator.

First, there is the question of whether it is appropriate to regulate the global trading system based on U.S. domestic law.

Although there are inevitable aspects to this in the realities of the global economy and diplomacy, where the logic of power operates, it is difficult to avoid the criticism that it is an arbitrary decision.

There is also a point that, although it has the effect of overturning the 'name and shame' of being a currency manipulator, it does not actually help improve the trade balance.

This is because determining the trade balance or current account balance depends on the competitiveness of industries and companies producing goods and services as much as on the exchange rate.

--- From "Dollar Watchers: Designating the U.S. as a Currency Manipulator"

When the global economy, including the United States, is shocked, the flow of dollars in international financial markets changes.

From the US perspective, the problem is solved by printing or recalling dollars.

In short, there is not much of a shock from the foreign exchange market.

Meanwhile, countries other than the United States are busy clamping down on the dollars they have in their countries.

They raise interest rates and intervene in the foreign exchange market to stabilize the exchange rate to prevent dollar outflow.

At this time, a gap arises between the fundamentals of the national economy and the exchange rate in the foreign exchange market, and speculative forces active around the world take advantage of this gap.

For example, if you think that a certain currency is overvalued compared to the real economy, you continuously buy that currency to create a bubble in its value, and then sell it all at once just before the bubble bursts.

Also, if they attack one country and it doesn't seem to be working, they move on to another country.

They poke at various countries and bite at the weak links they find.

The way to deal with them in the foreign exchange market is to persevere and not give up even when faced with a crisis.

You just have to survive until they decide you're not having fun.

--- From "The Global Currency War is a 'Squid Game'"

Since joining the WTO and becoming an economic powerhouse with a socialist market economy as its motto, China's leaders view its rapid economic growth over the past 50 years not as "new development," but as a process of "returning" to the position of world leader it has held for thousands of years throughout history.

The emphasis on Sinocentrism and the promotion of a Chinese economic sphere in recent years is partly a response to the United States, but also reflects China's determination to complete its rise as a major power.

China's goal is to become the world's leading economy by the end of two centuries: 2021, the 100th anniversary of the founding of the Communist Party of China, and 2049, the 100th anniversary of the founding of the People's Republic of China.

As China moves forward, securing financial hegemony commensurate with its economic scale, centered around the yuan, is a crucial task.

China has made no secret of its ambition to create a day when the world will value its currency in terms of the yuan.

To this end, China has established various systems to ensure that the yuan maintains a stable value without fluctuations, and is implementing financial liberalization measures according to its own timetable.

--- From "The Chinese Yuan Challenges the Dollar's Hegemony"

India's position in international relations is so complex and nuanced that it is called a 'multi-player'.

In 2004, it joined the Quad, a regional security cooperation system involving the United States, Japan, Australia, and India, and is also participating in BRICS and the Shanghai Cooperation Organization with China, with which it has long had a border dispute.

Moreover, despite financial sanctions against Russia imposed by the United States and other Western developed countries, India has significantly increased its imports of Russian oil.

Western sanctions allowed Russia to import Russian oil at lower prices, easing its fiscal burden and helping to manage inflation as import prices fell.

These diplomatic moves are a strategy to gain maximum benefit.

As a major power in Asia, it appears that it is trying to lead neighboring countries and secure its status and protect its own interests through cooperation, competition, and restraint with countries vying for hegemony, such as the United States and China.

--- From "Multiplayer India: Is it a new rising country?"

Exchange rates fluctuate depending on a variety of variables, but the base interest rate plays a major role.

Accordingly, the key factor in Japan's continued ultra-low yen was its long-term negative interest rate policy.

Before 2020, Japan was mired in a long period of deflation, so it was an unusual measure to lower the base interest rate to negative levels, not to mention the zero interest rate policy.

Moreover, since the U.S. took big steps and giant steps in March 2022 to rapidly raise interest rates following the COVID-19 pandemic crisis, the interest rate differential between the U.S. and Japan reached 5.60%.

This suggests that Japan's negative interest rate and yield curve control (YCC) policies were possible only with the tacit approval of the United States.

Maintaining ultra-low or negative interest rates is virtually no different from exchange rate intervention or manipulation.

Maintaining negative interest rates for a long period of time without being labeled a currency manipulator would be unsustainable without the US's recognition and support.

Former Prime Minister Abe, who led Abenomics, demonstrated a close relationship with U.S. President Bush during his first term, and displayed strong alliances with Presidents Obama and Trump during his second term.

In international trade, the act of selling more goods by lowering the price of goods overseas while keeping the domestic price the same is called 'dumping'.

In international trade, dumping is an act condemned as unfair trade.

It's ironic that 'selling things cheaply is the problem,' but it's a key way to understand international trade.

Interestingly, changes in exchange rates can justify such unfair trade practices.

For example, let's assume that when Samsung Electronics sells smartphones, the exchange rate changes from 1,000 won per dollar to 1,100 won per dollar.

In this case, the price of Samsung Electronics' smartphone, which costs 1 million won in Korea, would be about $909 in the US.

That's because it's a similar value to 1 million won in Korea.

At this point, it wouldn't be a problem if Samsung Electronics lowered the price of its smartphones for sale in the US to around $900.

Such price changes cannot be called dumping.

This is because when the new exchange rate (1 dollar = 1,100 won) is applied, prices in Korea and the US are almost the same.

--- From "There is no foreign exchange market without government intervention"

Although nominal exchange rate, real exchange rate, price index, and trade share may seem complicated, there is an important point that runs through all of these concepts.

The fact is that exchange rates are closely related not only to national policy but also to our daily lives.

The real effective exchange rate reflects prices in each country around the world and trade relations with our country.

If this exchange rate is low, my company's exports will be smooth, but if I personally need foreign currency for study abroad or travel, it could be a significant burden.

Even if you change your position just a little, the same exchange rate will feel different.

This is also why we need to understand exchange rates from a broad perspective.

--- From "Exchange Rates in Daily Life, Daily Life in Exchange Rates"

When the economy improves and exports increase, you earn more money.

Since there is a lot of money, domestic consumption increases, and since there is the ability to import what is lacking from abroad, imports also increase.

During an economic upturn, exports generally increase at a greater rate than domestic consumption.

Because of this, the amount of money coming in from abroad increases, which causes the value of the won to rise (the exchange rate to fall).

When the market goes down, it has the opposite effect than when it goes up.

The amount of goods produced in our country decreases, and as a result, the amount of foreign exchange coming into our country also decreases.

As demand for foreign exchange increases and the won weakens, the exchange rate rises.

Given this, national currencies in booming economies tend to perform well in global foreign exchange markets.

The value of a country's currency is proportional to the flow of the economy.

The market peaks, then goes through a downward phase, forms a low point, and then goes through an upward phase to reach a peak.

In a capitalist economy, the economy goes through ups and downs, and it can also be understood that the currency of a country with a growing economy gradually becomes stronger.

--- From "Paradoxical Relationships: Economic Trends and Exchange Rates"

The United States cooperates with the International Monetary Fund (IMF) and applies pressure through a cooperative system when negotiating with countries it designates as currency manipulators.

Sanctions such as imposing tariffs and other disadvantages, restricting investment by American companies, and blocking participation in the US procurement market are also implemented. The power of the dollar's hegemony is also evident in the fact that the IMF is under US influence and plays a crucial role in maintaining the dollar standard.

There have been various opinions regarding the designation of the United States as a currency manipulator.

First, there is the question of whether it is appropriate to regulate the global trading system based on U.S. domestic law.

Although there are inevitable aspects to this in the realities of the global economy and diplomacy, where the logic of power operates, it is difficult to avoid the criticism that it is an arbitrary decision.

There is also a point that, although it has the effect of overturning the 'name and shame' of being a currency manipulator, it does not actually help improve the trade balance.

This is because determining the trade balance or current account balance depends on the competitiveness of industries and companies producing goods and services as much as on the exchange rate.

--- From "Dollar Watchers: Designating the U.S. as a Currency Manipulator"

When the global economy, including the United States, is shocked, the flow of dollars in international financial markets changes.

From the US perspective, the problem is solved by printing or recalling dollars.

In short, there is not much of a shock from the foreign exchange market.

Meanwhile, countries other than the United States are busy clamping down on the dollars they have in their countries.

They raise interest rates and intervene in the foreign exchange market to stabilize the exchange rate to prevent dollar outflow.

At this time, a gap arises between the fundamentals of the national economy and the exchange rate in the foreign exchange market, and speculative forces active around the world take advantage of this gap.

For example, if you think that a certain currency is overvalued compared to the real economy, you continuously buy that currency to create a bubble in its value, and then sell it all at once just before the bubble bursts.

Also, if they attack one country and it doesn't seem to be working, they move on to another country.

They poke at various countries and bite at the weak links they find.

The way to deal with them in the foreign exchange market is to persevere and not give up even when faced with a crisis.

You just have to survive until they decide you're not having fun.

--- From "The Global Currency War is a 'Squid Game'"

Since joining the WTO and becoming an economic powerhouse with a socialist market economy as its motto, China's leaders view its rapid economic growth over the past 50 years not as "new development," but as a process of "returning" to the position of world leader it has held for thousands of years throughout history.

The emphasis on Sinocentrism and the promotion of a Chinese economic sphere in recent years is partly a response to the United States, but also reflects China's determination to complete its rise as a major power.

China's goal is to become the world's leading economy by the end of two centuries: 2021, the 100th anniversary of the founding of the Communist Party of China, and 2049, the 100th anniversary of the founding of the People's Republic of China.

As China moves forward, securing financial hegemony commensurate with its economic scale, centered around the yuan, is a crucial task.

China has made no secret of its ambition to create a day when the world will value its currency in terms of the yuan.

To this end, China has established various systems to ensure that the yuan maintains a stable value without fluctuations, and is implementing financial liberalization measures according to its own timetable.

--- From "The Chinese Yuan Challenges the Dollar's Hegemony"

India's position in international relations is so complex and nuanced that it is called a 'multi-player'.

In 2004, it joined the Quad, a regional security cooperation system involving the United States, Japan, Australia, and India, and is also participating in BRICS and the Shanghai Cooperation Organization with China, with which it has long had a border dispute.

Moreover, despite financial sanctions against Russia imposed by the United States and other Western developed countries, India has significantly increased its imports of Russian oil.

Western sanctions allowed Russia to import Russian oil at lower prices, easing its fiscal burden and helping to manage inflation as import prices fell.

These diplomatic moves are a strategy to gain maximum benefit.

As a major power in Asia, it appears that it is trying to lead neighboring countries and secure its status and protect its own interests through cooperation, competition, and restraint with countries vying for hegemony, such as the United States and China.

--- From "Multiplayer India: Is it a new rising country?"

Exchange rates fluctuate depending on a variety of variables, but the base interest rate plays a major role.

Accordingly, the key factor in Japan's continued ultra-low yen was its long-term negative interest rate policy.

Before 2020, Japan was mired in a long period of deflation, so it was an unusual measure to lower the base interest rate to negative levels, not to mention the zero interest rate policy.

Moreover, since the U.S. took big steps and giant steps in March 2022 to rapidly raise interest rates following the COVID-19 pandemic crisis, the interest rate differential between the U.S. and Japan reached 5.60%.

This suggests that Japan's negative interest rate and yield curve control (YCC) policies were possible only with the tacit approval of the United States.

Maintaining ultra-low or negative interest rates is virtually no different from exchange rate intervention or manipulation.

Maintaining negative interest rates for a long period of time without being labeled a currency manipulator would be unsustainable without the US's recognition and support.

Former Prime Minister Abe, who led Abenomics, demonstrated a close relationship with U.S. President Bush during his first term, and displayed strong alliances with Presidents Obama and Trump during his second term.

--- From "The Super Yen Policy That Led to Japan's Revival"

Publisher's Review

If the won-dollar exchange rate exceeds 1,400 won, will another foreign exchange crisis occur?

When is it best to exchange money when traveling abroad?

Does the success or failure of exchange rate policy depend on the relationship with the United States?

The beginning of studying economics

A map showing the wealth that will survive to the end

The world's kindest and greatest exchange rate lesson!

Thanks to the super yen, I've been enjoying frequent travel and shopping, but suddenly the yen is rising?! Experts are warning of a crisis on the scale of the 2008 foreign exchange crisis due to the constantly rising won-dollar exchange rate, and I'm starting to worry.

Even though I can't fully comprehend the news that the U.S. presidential election results will affect interest rates and the global economy, seeing it reported every day gives me a sense of unease.

Although the countries and topics are different, there is one keyword that runs through all these stories.

It's the exchange rate.

Exchange rates have become an increasingly important part of our daily lives.

However, we only see it as a single fixed number, and it feels difficult to understand its meaning beyond that and predict changes.

I feel a bit intimidated by the topics and scope that need to be addressed, such as why prices fluctuate, what impact they have on our economy, and how they relate to political issues overseas.

For such readers, this book highlights the following key words and characteristics for understanding exchange rates: collectivity, relativity, and ambiguity.

Even sudden changes in exchange rates, whose causal relationships seem unclear, can be viewed through these three lenses to gain a certain level of understanding of their flow.

Currency war? The ongoing course of financial history!

From the basic concepts of exchange rates to the deepening global situation,

Seizing Opportunities in Rapid Change: Everything You Need to Know About Exchange Rates

Its origins date back to the birth of exchange rates.

From the gold standard, where gold was used as currency, to the Bretton Woods system, which introduced the dollar to the global economy, to the modern floating exchange rate system, reading about its history and background reveals the complex world of exchange rates at a glance.

Because it is a story about history and the ongoing world power struggles.

We can gauge Korea's position within the context of the US dollar becoming the center of global finance, China and other emerging countries challenging it, and Japan and Europe aligning with the US (relativity of exchange rates).

This helps us understand and apply exchange rates in our daily lives.

This is because the exchange rate is an indicator that reflects the flow of how the exchange rate is determined through the economic activities of individuals and countries, and how the exchange rate thus determined in turn affects the economic lives of individuals and countries (collectivity).

Even within a country, the exchange rate divides interests, regulates domestic and international investment sentiment, and influences the sales and living expenses of the company I work for. This demonstrates the exchange rate's presence in our daily lives.

We can also imagine our lives in the future digital world, with things like Bitcoin and cryptocurrency.

The authors of this book have been working in both the field and theory for over 20 years as journalists and researchers.

Thanks to this, we were able to include a vivid story about the global economy, which is based on economic logic but also sometimes driven by the logic of power between countries, and the exchange rate according to the political situations of each country.

From those just beginning to study investing and economics to those seeking to understand the increasingly complex global landscape, this book is all you need to understand the global economy and find opportunities amidst exchange rate fluctuations.

When is it best to exchange money when traveling abroad?

Does the success or failure of exchange rate policy depend on the relationship with the United States?

The beginning of studying economics

A map showing the wealth that will survive to the end

The world's kindest and greatest exchange rate lesson!

Thanks to the super yen, I've been enjoying frequent travel and shopping, but suddenly the yen is rising?! Experts are warning of a crisis on the scale of the 2008 foreign exchange crisis due to the constantly rising won-dollar exchange rate, and I'm starting to worry.

Even though I can't fully comprehend the news that the U.S. presidential election results will affect interest rates and the global economy, seeing it reported every day gives me a sense of unease.

Although the countries and topics are different, there is one keyword that runs through all these stories.

It's the exchange rate.

Exchange rates have become an increasingly important part of our daily lives.

However, we only see it as a single fixed number, and it feels difficult to understand its meaning beyond that and predict changes.

I feel a bit intimidated by the topics and scope that need to be addressed, such as why prices fluctuate, what impact they have on our economy, and how they relate to political issues overseas.

For such readers, this book highlights the following key words and characteristics for understanding exchange rates: collectivity, relativity, and ambiguity.

Even sudden changes in exchange rates, whose causal relationships seem unclear, can be viewed through these three lenses to gain a certain level of understanding of their flow.

Currency war? The ongoing course of financial history!

From the basic concepts of exchange rates to the deepening global situation,

Seizing Opportunities in Rapid Change: Everything You Need to Know About Exchange Rates

Its origins date back to the birth of exchange rates.

From the gold standard, where gold was used as currency, to the Bretton Woods system, which introduced the dollar to the global economy, to the modern floating exchange rate system, reading about its history and background reveals the complex world of exchange rates at a glance.

Because it is a story about history and the ongoing world power struggles.

We can gauge Korea's position within the context of the US dollar becoming the center of global finance, China and other emerging countries challenging it, and Japan and Europe aligning with the US (relativity of exchange rates).

This helps us understand and apply exchange rates in our daily lives.

This is because the exchange rate is an indicator that reflects the flow of how the exchange rate is determined through the economic activities of individuals and countries, and how the exchange rate thus determined in turn affects the economic lives of individuals and countries (collectivity).

Even within a country, the exchange rate divides interests, regulates domestic and international investment sentiment, and influences the sales and living expenses of the company I work for. This demonstrates the exchange rate's presence in our daily lives.

We can also imagine our lives in the future digital world, with things like Bitcoin and cryptocurrency.

The authors of this book have been working in both the field and theory for over 20 years as journalists and researchers.

Thanks to this, we were able to include a vivid story about the global economy, which is based on economic logic but also sometimes driven by the logic of power between countries, and the exchange rate according to the political situations of each country.

From those just beginning to study investing and economics to those seeking to understand the increasingly complex global landscape, this book is all you need to understand the global economy and find opportunities amidst exchange rate fluctuations.

GOODS SPECIFICS

- Date of issue: August 16, 2024

- Page count, weight, size: 288 pages | 444g | 152*225*18mm

- ISBN13: 9791193638385

- ISBN10: 1193638380

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)