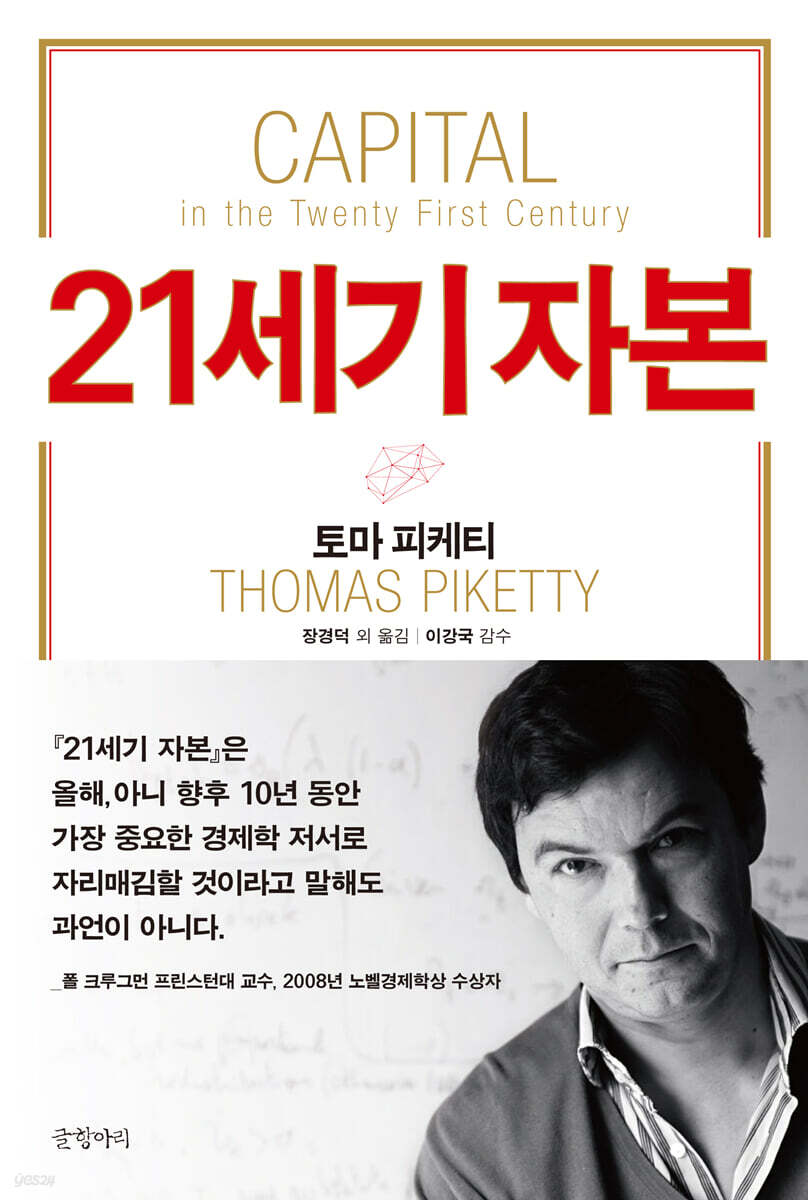

21st Century Capital

|

Description

Book Introduction

Professor Thomas Piketty of the Paris School of Economics' "21st Century Capital Syndrome" Lands in Korea

A data-driven, empirical theory of capitalism!

Professor Thomas Piketty of the Paris School of Economics, France, who sparked the 'Piketty Syndrome' around the world, has finally landed in Korea with his book 'Capital in the 21st Century'.

Since its publication in French in August of last year and in the United States in April of this year, Capital in the Twenty-First Century has garnered the attention of not only the business community but also intellectuals around the world. It is also at the center of controversy in Korea for its novel and empirical analysis of the dynamics of inequality inherent in capitalism and its bold and groundbreaking proposal of alternatives.

This book examines the historical development of inequality, drawing on historical data from more than 20 countries over three centuries.

Because it is a rigorous empirical study based on a vast amount of data, it breaks free from the limitations of mathematical and theoretical considerations that prevail in mainstream economics books.

The materials used by the author are broadly divided into two categories.

The first is material dealing with income distribution and its inequality, and the second is material dealing with wealth distribution and the relationship between wealth and income.

These two are key assets of this book, enabling us to study the historical dynamics of wealth distribution and the hierarchical structure of society.

It was this pragmatic and historical approach that allowed him to propose a new dynamic of capitalism, after having refuted Marx's 19th-century prophecy in Capital that the structural contradictions of capitalism, in which the rate of return on capital constantly declines, would lead to a proletarian revolution, and Kuznets' theory that economic inequality that arose in the early stages of economic growth would be alleviated and stabilized in the advanced stages of capitalist development.

A data-driven, empirical theory of capitalism!

Professor Thomas Piketty of the Paris School of Economics, France, who sparked the 'Piketty Syndrome' around the world, has finally landed in Korea with his book 'Capital in the 21st Century'.

Since its publication in French in August of last year and in the United States in April of this year, Capital in the Twenty-First Century has garnered the attention of not only the business community but also intellectuals around the world. It is also at the center of controversy in Korea for its novel and empirical analysis of the dynamics of inequality inherent in capitalism and its bold and groundbreaking proposal of alternatives.

This book examines the historical development of inequality, drawing on historical data from more than 20 countries over three centuries.

Because it is a rigorous empirical study based on a vast amount of data, it breaks free from the limitations of mathematical and theoretical considerations that prevail in mainstream economics books.

The materials used by the author are broadly divided into two categories.

The first is material dealing with income distribution and its inequality, and the second is material dealing with wealth distribution and the relationship between wealth and income.

These two are key assets of this book, enabling us to study the historical dynamics of wealth distribution and the hierarchical structure of society.

It was this pragmatic and historical approach that allowed him to propose a new dynamic of capitalism, after having refuted Marx's 19th-century prophecy in Capital that the structural contradictions of capitalism, in which the rate of return on capital constantly declines, would lead to a proletarian revolution, and Kuznets' theory that economic inequality that arose in the early stages of economic growth would be alleviated and stabilized in the advanced stages of capitalist development.

- You can preview some of the book's contents.

Preview

index

21st Century Capital

introduction

Part 1: Income and Capital

Chapter 1 Income and Production

Chapter 2: Growing Up: Fantasy and Reality

Part 2: Dynamics of the Capital/Income Ratio

Chapter 3: The Transformation of Capital

Chapter 4: From Old Europe to the New World

Chapter 5 Long-Term Trends in the Capital/Income Ratio

Chapter 6: The Income Distribution of Capital and Labor in the 21st Century

Part 3: The Structure of Inequality

Chapter 7: Inequality and Concentration: Preliminary Considerations

Chapter 8 Two Worlds

Chapter 9 Inequality of Labor Income

Chapter 10: Inequality of Capital Ownership

Chapter 11: Meritocracy and Inheritance from a Long-Term Perspective

Chapter 12: Global Wealth Inequality in the 21st Century

Part 4: Capital Regulation in the 21st Century

Chapter 13: The Social State of the 21st Century

Chapter 14: Rethinking the Progressive Income Tax

Chapter 15: Global Capital Tax

Chapter 16: The Problem of Public Debt

conclusion

main

clear

Translator's Note

Reviewer's Note

Search

introduction

Part 1: Income and Capital

Chapter 1 Income and Production

Chapter 2: Growing Up: Fantasy and Reality

Part 2: Dynamics of the Capital/Income Ratio

Chapter 3: The Transformation of Capital

Chapter 4: From Old Europe to the New World

Chapter 5 Long-Term Trends in the Capital/Income Ratio

Chapter 6: The Income Distribution of Capital and Labor in the 21st Century

Part 3: The Structure of Inequality

Chapter 7: Inequality and Concentration: Preliminary Considerations

Chapter 8 Two Worlds

Chapter 9 Inequality of Labor Income

Chapter 10: Inequality of Capital Ownership

Chapter 11: Meritocracy and Inheritance from a Long-Term Perspective

Chapter 12: Global Wealth Inequality in the 21st Century

Part 4: Capital Regulation in the 21st Century

Chapter 13: The Social State of the 21st Century

Chapter 14: Rethinking the Progressive Income Tax

Chapter 15: Global Capital Tax

Chapter 16: The Problem of Public Debt

conclusion

main

clear

Translator's Note

Reviewer's Note

Search

Publisher's Review

21st Century Capital

Capital income always outweighs labor income!

This book first clearly explains the operating principles of capitalism, which breeds economic inequality.

The author proposes a theory that the fundamental cause of income inequality is that the rate of return on capital is always higher than the rate of economic growth.

That is, the income gap is widening because the income that capital earns through its own growth (rent, dividends, interest, profits, income from real estate or financial products, etc.) exceeds the income earned through labor (wages, bonuses, etc.).

Indeed, a closer look at the statistics presented by the author reveals that the share of capital in income fell sharply between 1914 and 1945, then began to rise again, recently reaching levels just below those of the 19th century.

The author argues that the brief period of relatively high equality between 1914 and 1945 was simply a result of governments intentionally imposing significant taxes on the inherited wealth of the wealthy to facilitate post-war recovery.

Will we enter an era of "hereditary capitalism," where wealth distribution becomes polarized and capital is concentrated in inherited assets?

A Bold Alternative: A Global Capital Tax

The author proposes a bold alternative.

Two options are available: taxing a tiny minority of top earners at much higher rates from current levels, and a progressive global capital tax.

The seeds of the numerous debates this book has sparked worldwide are not so much its economic and historical analysis of wealth inequality as its radical and idealistic proposal for an alternative.

The mechanism by which wealth is concentrated in capital income rather than labor income will lead to lives and society being determined by birth rather than talent or effort, fundamentally undermining the meritocracy that forms the foundation of a democratic society.

Piketty states in his book that he is not interested in criticizing capitalism itself, but rather in creating appropriate institutions and policies to achieve a fair and democratic social order.

As Harvard professor Dani Rodrik comments, whether you agree with the solutions he proposes or not, the book poses a challenge to those who want to preserve capitalism.

A data-driven empirical theory of capitalism

This book examines the historical development of inequality, drawing on historical data from more than 20 countries over three centuries.

Because it is a rigorous empirical study based on a vast amount of data, it breaks free from the limitations of mathematical and theoretical considerations that prevail in mainstream economics books.

The materials used by the author are broadly divided into two categories.

The first is material dealing with income distribution and its inequality, and the second is material dealing with wealth distribution and the relationship between wealth and income.

These two are key assets of this book, enabling us to study the historical dynamics of wealth distribution and the hierarchical structure of society.

It was this pragmatic and historical approach that allowed him to propose a new dynamic of capitalism, after having refuted Marx's 19th-century prophecy in Capital that the structural contradictions of capitalism, in which the rate of return on capital constantly declines, would lead to a proletarian revolution, and Kuznets' theory that economic inequality that arose in the early stages of economic growth would be alleviated and stabilized in the advanced stages of capitalist development.

Book structure

This book consists of 4 parts and 16 chapters.

Part 1, “Income and Capital” (Chapters 1-2), introduces the basic concepts of this book.

We present the concepts of national income, capital, and the capital/income ratio, and examine how the distribution of income and production has changed globally from a macro perspective.

It also analyzes in detail the changes in population and production growth rates since the Industrial Revolution.

Part II, "The Dynamics of the Capital/Income Ratio" (Chapters 3-6), examines the prospects for long-term changes in the capital/income ratio and serves as a preliminary step toward examining how national income will be distributed globally between labor and capital in the 21st century.

Beginning with the cases of the UK and France, which have the most data available over a long period of time, and moving on to the cases of Germany and the US, we summarize historical data from around the world to conduct preliminary work to predict the dynamics of capitalism.

Part 3, "The Structure of Inequality" (chapters 7-12), provides an overview of the levels of inequality based on labor income and capital income, and then analyzes the historical dynamics of inequality in all countries for which historical data are available.

It also examines how the importance of inherited wealth has changed over time and forecasts global wealth distribution in the early 21st century.

Part 4, “Capital Regulation in the 21st Century” (chapters 13-16), is a conclusion aimed at deriving normative and policy alternatives.

After diagnosing the form of a 'social state' suitable for the current situation, we propose a progressive global capital tax.

And he compares this bold alternative to a range of regulations, from Europe's wealth tax to China's capital controls to the resurgence of protectionism in various countries.

Finally, we address the pressing issue of public debt and consider the optimal level of public capital accumulation.

Capital income always outweighs labor income!

This book first clearly explains the operating principles of capitalism, which breeds economic inequality.

The author proposes a theory that the fundamental cause of income inequality is that the rate of return on capital is always higher than the rate of economic growth.

That is, the income gap is widening because the income that capital earns through its own growth (rent, dividends, interest, profits, income from real estate or financial products, etc.) exceeds the income earned through labor (wages, bonuses, etc.).

Indeed, a closer look at the statistics presented by the author reveals that the share of capital in income fell sharply between 1914 and 1945, then began to rise again, recently reaching levels just below those of the 19th century.

The author argues that the brief period of relatively high equality between 1914 and 1945 was simply a result of governments intentionally imposing significant taxes on the inherited wealth of the wealthy to facilitate post-war recovery.

Will we enter an era of "hereditary capitalism," where wealth distribution becomes polarized and capital is concentrated in inherited assets?

A Bold Alternative: A Global Capital Tax

The author proposes a bold alternative.

Two options are available: taxing a tiny minority of top earners at much higher rates from current levels, and a progressive global capital tax.

The seeds of the numerous debates this book has sparked worldwide are not so much its economic and historical analysis of wealth inequality as its radical and idealistic proposal for an alternative.

The mechanism by which wealth is concentrated in capital income rather than labor income will lead to lives and society being determined by birth rather than talent or effort, fundamentally undermining the meritocracy that forms the foundation of a democratic society.

Piketty states in his book that he is not interested in criticizing capitalism itself, but rather in creating appropriate institutions and policies to achieve a fair and democratic social order.

As Harvard professor Dani Rodrik comments, whether you agree with the solutions he proposes or not, the book poses a challenge to those who want to preserve capitalism.

A data-driven empirical theory of capitalism

This book examines the historical development of inequality, drawing on historical data from more than 20 countries over three centuries.

Because it is a rigorous empirical study based on a vast amount of data, it breaks free from the limitations of mathematical and theoretical considerations that prevail in mainstream economics books.

The materials used by the author are broadly divided into two categories.

The first is material dealing with income distribution and its inequality, and the second is material dealing with wealth distribution and the relationship between wealth and income.

These two are key assets of this book, enabling us to study the historical dynamics of wealth distribution and the hierarchical structure of society.

It was this pragmatic and historical approach that allowed him to propose a new dynamic of capitalism, after having refuted Marx's 19th-century prophecy in Capital that the structural contradictions of capitalism, in which the rate of return on capital constantly declines, would lead to a proletarian revolution, and Kuznets' theory that economic inequality that arose in the early stages of economic growth would be alleviated and stabilized in the advanced stages of capitalist development.

Book structure

This book consists of 4 parts and 16 chapters.

Part 1, “Income and Capital” (Chapters 1-2), introduces the basic concepts of this book.

We present the concepts of national income, capital, and the capital/income ratio, and examine how the distribution of income and production has changed globally from a macro perspective.

It also analyzes in detail the changes in population and production growth rates since the Industrial Revolution.

Part II, "The Dynamics of the Capital/Income Ratio" (Chapters 3-6), examines the prospects for long-term changes in the capital/income ratio and serves as a preliminary step toward examining how national income will be distributed globally between labor and capital in the 21st century.

Beginning with the cases of the UK and France, which have the most data available over a long period of time, and moving on to the cases of Germany and the US, we summarize historical data from around the world to conduct preliminary work to predict the dynamics of capitalism.

Part 3, "The Structure of Inequality" (chapters 7-12), provides an overview of the levels of inequality based on labor income and capital income, and then analyzes the historical dynamics of inequality in all countries for which historical data are available.

It also examines how the importance of inherited wealth has changed over time and forecasts global wealth distribution in the early 21st century.

Part 4, “Capital Regulation in the 21st Century” (chapters 13-16), is a conclusion aimed at deriving normative and policy alternatives.

After diagnosing the form of a 'social state' suitable for the current situation, we propose a progressive global capital tax.

And he compares this bold alternative to a range of regulations, from Europe's wealth tax to China's capital controls to the resurgence of protectionism in various countries.

Finally, we address the pressing issue of public debt and consider the optimal level of public capital accumulation.

GOODS SPECIFICS

- Date of issue: September 12, 2014

- Format: Hardcover book binding method guide

- Page count, weight, size: 820 pages | 1,274g | 160*230*44mm

- ISBN13: 9788967351274

- ISBN10: 8967351275

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)