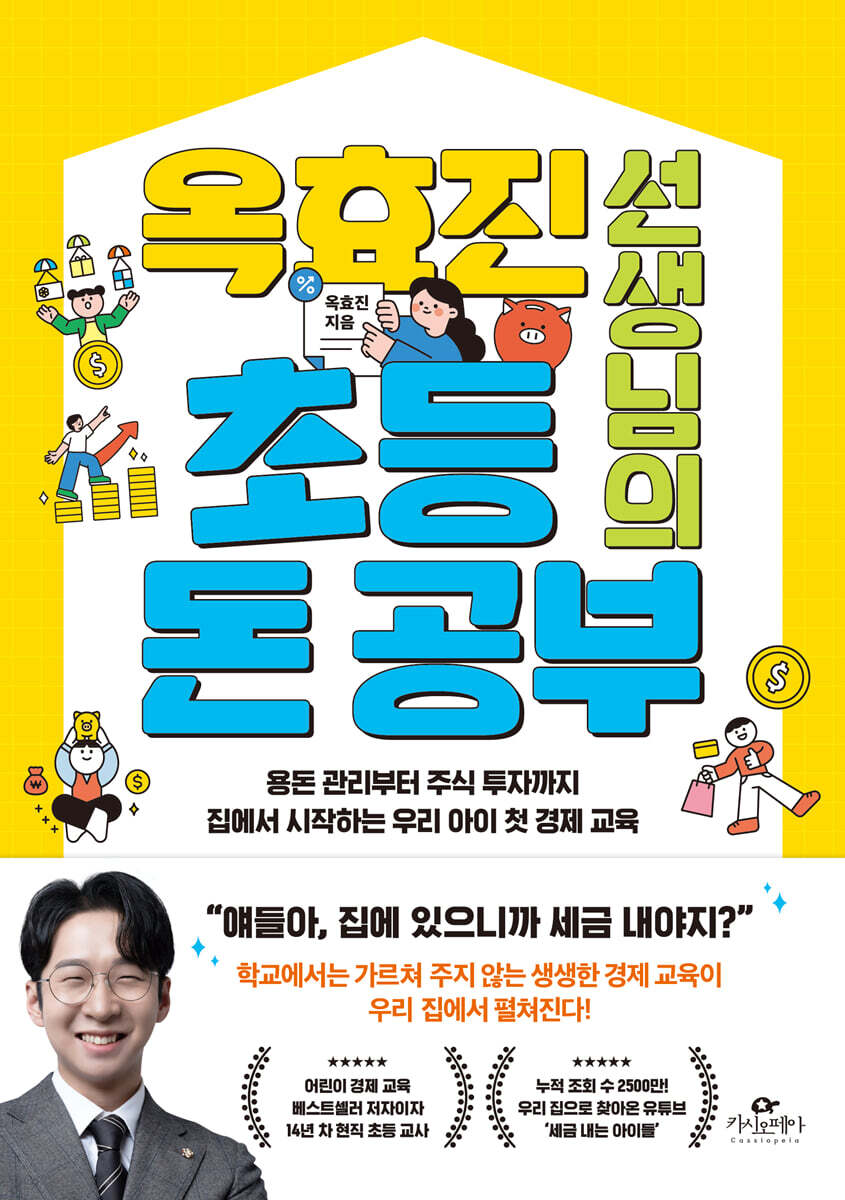

Teacher Ok Hyo-jin's elementary school money study

|

Description

Book Introduction

* tvN's 'You Quiz on the Block's Hot Elementary School Teacher * 2019, 2020 Republic of Korea Economic Education Award Winner 2022 7th Financial Day Presidential Citation Award 2022 Kyobo Education Awards Future Education Content Category Grand Prize 2021 Deputy Prime Minister and Minister of Strategy and Finance Award “I get paid from home, save money at my mom’s bank, and even sign a lease!” Ok Hyo-jin, a bestselling author of children's economic education and an elementary school teacher with 14 years of experience 'Real elementary school money studies that are closely related to daily life' that are not taught in school are being taught at our home! From eating delicious food, buying necessities, to using public transportation to get where we want to go, money is involved in every aspect of our daily lives. However, school education has limitations in teaching about money, which is essential for real life, due to the short one-year class cycle and economics studies focused on entrance exams. Since parents have never properly studied money, they are equally at a loss as to how to teach their children about money. How can we teach children about money in a fun and easy way while also allowing them to apply it directly in their daily lives? Ok Hyo-jin, a bestselling author in the field of children's economics education and a current elementary school teacher with 14 years of experience who has garnered much attention through her YouTube channel "Children Who Pay Taxes," has published a fun and practical economics education book that anyone can use at home to help parents and elementary school children facing this reality. "Teacher Ok Hyo-jin's Elementary Money Study" is a book that helps parents and children practice economic activities together by transforming "Class Money Management," which the author developed and has been continuing for over six years, into "Money Management at Home." Children can experience firsthand the "real money studies" that are not taught in school, such as writing employment contracts and receiving salaries, managing holiday allowances, creating "Mom's Bank" and "Dad's Bank," managing credit scores, writing loan agreements, creating investment products, and signing monthly rent and deposit contracts. The first six years of elementary school are the golden time to establish lifelong economic concepts. During this period, the parents' attitude toward money is completely inherited by the child. If parents and children study money together at home by following this book, children will learn about money in an easy and fun way, and parents will gain confidence in financial education and be able to instill sound financial values in their children. |

- You can preview some of the book's contents.

Preview

index

Prologue: Living Money Study, Brought Home from Classroom

Chapter 1: Why do elementary school children need to learn about money?

Money that parents didn't know about and couldn't teach us about

How our parents learned about money / How our children are learning about money / The future of money studies / The pitfalls of economic education in school

Is it really necessary to study money?

What is the most important goal in elementary economics education? / What makes the economic education of the wealthy different? / Parents who are being bullied / Children need to learn about money through their own experiences / Children learn through mistakes

Beware of the 'Cobra Effect' in Money Studies

The Backlash of Cobra Catching / Why Money Shouldn't Be a Weapon

Can I make a card for my child?

A cashless society / Children develop a sense of money by handling bills and coins / How to use a check card?

Chapter 2 Income: How do you make money?

I need money to study money.

3 Ways Kids Get Money / "I Don't Get Allowance" / The Difference Between Money Received and Money Earned!

Why You Shouldn't Say "500 Won for One Wash!"

Practice Earning Your Own Money / Things to Consider When Giving Your Child Allowance

Creating a job for our family

I am a salaried child / What job should I choose? / Important criteria for choosing a job

When is a good time to give allowance?

“Monday is allowance day!” / Increase the period little by little / What if your child throws a tantrum?

How much allowance should I give?

“How much should I give my 6th grader?” / Sit down at the negotiating table with your child

Writing our child's first employment contract

What you must include in an employment contract / Signing with your own stamp and signature / What happens if you don't look at the contract / Things to consider when writing a contract

The tragedy of holiday allowance

Holiday allowances that interfere with planned money management / "What will you do with your holiday allowance?" / What if you received a lot of allowance? / Three ways to keep holiday allowances under parental control

Chapter 3: Spending: How to Spend Money Well is More Important Than Earning It

How can I spend my hard-earned money wisely?

Is spending bad? / 'Money spent now' and 'money spent later' / Stop bad spending now / What are our children's spending tendencies?

Understanding the "consumption area" that is more important than the amount of money spent

"Mom pays for everything?" / 'Money you have to spend' and 'Money you want to spend' / Nothing in life is taken for granted / "From now on, you have to take responsibility" / Three ways for children and parents to share spending responsibilities / What if children can't manage money properly? / Children learning the value and gratitude of money

How can I develop the habit of spending according to plan?

First, let's make a spending plan / Step 1: Write a spending plan / How to get your child to stick to the plan / Step 2: Review the money you've spent

Do I really need to write down my allowance?

A classic study of money: "Allowance Recording Book" / Four ways to properly use an allowance recording book

There are various types of consumption in the world.

Consumption for myself, consumption for others / The joy of sharing, donation

Chapter 4: Saving: Even small amounts of money can become a lot of money if you save them little by little.

Why should we save?

How do I explain to my child why they should save? / "Can parents save for me?" / Why elementary school children struggle with saving in the bank

Creating a home bank

Mom's Bank, Dad's Bank, Grandma's Bank / How to Record Your Savings / Interest is Easy, but Interest Rates Are Hard

What should I save for?

Savings goals should be tangible / Creating savings goals for our children

Our home bank also has interest rates.

Interest rates change / Which bank's products offer the highest interest? / My compound interest product

Chapter 5: Investing: Putting Your Money to Work for a Better Future

Do elementary school children need investment education?

Investing is not a priority / “Should I open a stock account for my child?”

What kind of investment activities should I try at home with my children?

Real-world investing is risky / Explaining investing through savings / Creating investment products tailored to children's needs

Creating an investment product for our home

Mom, Dad, Weight Investment Products / How to Calculate Profits? / How to Record Investment Details / Providing Investment Information / What Investment Products Are Good for Our Home? / Investing in Just 1 Minute a Day

Chapter 6: Credit and Loans: Managing Your Credit Score

How trustworthy am I?

Children entering society without knowing their credit / Building a family credit score / Trust is about keeping promises / How to help children manage their own credit scores / What you can do with your child's credit score

Can parents lend money to their children?

Who is eligible to borrow money? / “If you borrow money, you have to pay interest” / What happens if you don’t know how to calculate interest? / How to determine the loan limit?

“You must repay the money you borrow.”

How to repay borrowed money? / What if your child doesn't repay on time? / Writing a loan agreement with your child / Risky loans to watch out for / "Can parents borrow money from their children?"

Chapter 7: Taxes and Real Estate: The Beginning of Financial Independence for Our Children

Where there is income, there is always tax.

Children surprised to receive their first paycheck / Are taxes 'stolen money'?

Children paying taxes at home

How to Pay Taxes / How to Use Taxes in Your Household

“Do you want to live in a rented house or a jeonse house?”

There's No Such Thing as a Free Home / Signing a Lease with a Child / Opening a Subscription Account in My Name

Chapter 8: Knowing Money Makes the World Look Different

Children exposed to financial crime

Social Media Has Become a Hotbed of Financial Crime / Just Lend Me Your Name

Will having a lot of money make you happy?

More money doesn't make you happier / The more money you have, the happier you become / Money prevents life's unhappiness

Things to Teach with Money

The Power of Non-Comparison / Gratitude

Epilogue: Children inherit their parents' attitudes toward money.

Chapter 1: Why do elementary school children need to learn about money?

Money that parents didn't know about and couldn't teach us about

How our parents learned about money / How our children are learning about money / The future of money studies / The pitfalls of economic education in school

Is it really necessary to study money?

What is the most important goal in elementary economics education? / What makes the economic education of the wealthy different? / Parents who are being bullied / Children need to learn about money through their own experiences / Children learn through mistakes

Beware of the 'Cobra Effect' in Money Studies

The Backlash of Cobra Catching / Why Money Shouldn't Be a Weapon

Can I make a card for my child?

A cashless society / Children develop a sense of money by handling bills and coins / How to use a check card?

Chapter 2 Income: How do you make money?

I need money to study money.

3 Ways Kids Get Money / "I Don't Get Allowance" / The Difference Between Money Received and Money Earned!

Why You Shouldn't Say "500 Won for One Wash!"

Practice Earning Your Own Money / Things to Consider When Giving Your Child Allowance

Creating a job for our family

I am a salaried child / What job should I choose? / Important criteria for choosing a job

When is a good time to give allowance?

“Monday is allowance day!” / Increase the period little by little / What if your child throws a tantrum?

How much allowance should I give?

“How much should I give my 6th grader?” / Sit down at the negotiating table with your child

Writing our child's first employment contract

What you must include in an employment contract / Signing with your own stamp and signature / What happens if you don't look at the contract / Things to consider when writing a contract

The tragedy of holiday allowance

Holiday allowances that interfere with planned money management / "What will you do with your holiday allowance?" / What if you received a lot of allowance? / Three ways to keep holiday allowances under parental control

Chapter 3: Spending: How to Spend Money Well is More Important Than Earning It

How can I spend my hard-earned money wisely?

Is spending bad? / 'Money spent now' and 'money spent later' / Stop bad spending now / What are our children's spending tendencies?

Understanding the "consumption area" that is more important than the amount of money spent

"Mom pays for everything?" / 'Money you have to spend' and 'Money you want to spend' / Nothing in life is taken for granted / "From now on, you have to take responsibility" / Three ways for children and parents to share spending responsibilities / What if children can't manage money properly? / Children learning the value and gratitude of money

How can I develop the habit of spending according to plan?

First, let's make a spending plan / Step 1: Write a spending plan / How to get your child to stick to the plan / Step 2: Review the money you've spent

Do I really need to write down my allowance?

A classic study of money: "Allowance Recording Book" / Four ways to properly use an allowance recording book

There are various types of consumption in the world.

Consumption for myself, consumption for others / The joy of sharing, donation

Chapter 4: Saving: Even small amounts of money can become a lot of money if you save them little by little.

Why should we save?

How do I explain to my child why they should save? / "Can parents save for me?" / Why elementary school children struggle with saving in the bank

Creating a home bank

Mom's Bank, Dad's Bank, Grandma's Bank / How to Record Your Savings / Interest is Easy, but Interest Rates Are Hard

What should I save for?

Savings goals should be tangible / Creating savings goals for our children

Our home bank also has interest rates.

Interest rates change / Which bank's products offer the highest interest? / My compound interest product

Chapter 5: Investing: Putting Your Money to Work for a Better Future

Do elementary school children need investment education?

Investing is not a priority / “Should I open a stock account for my child?”

What kind of investment activities should I try at home with my children?

Real-world investing is risky / Explaining investing through savings / Creating investment products tailored to children's needs

Creating an investment product for our home

Mom, Dad, Weight Investment Products / How to Calculate Profits? / How to Record Investment Details / Providing Investment Information / What Investment Products Are Good for Our Home? / Investing in Just 1 Minute a Day

Chapter 6: Credit and Loans: Managing Your Credit Score

How trustworthy am I?

Children entering society without knowing their credit / Building a family credit score / Trust is about keeping promises / How to help children manage their own credit scores / What you can do with your child's credit score

Can parents lend money to their children?

Who is eligible to borrow money? / “If you borrow money, you have to pay interest” / What happens if you don’t know how to calculate interest? / How to determine the loan limit?

“You must repay the money you borrow.”

How to repay borrowed money? / What if your child doesn't repay on time? / Writing a loan agreement with your child / Risky loans to watch out for / "Can parents borrow money from their children?"

Chapter 7: Taxes and Real Estate: The Beginning of Financial Independence for Our Children

Where there is income, there is always tax.

Children surprised to receive their first paycheck / Are taxes 'stolen money'?

Children paying taxes at home

How to Pay Taxes / How to Use Taxes in Your Household

“Do you want to live in a rented house or a jeonse house?”

There's No Such Thing as a Free Home / Signing a Lease with a Child / Opening a Subscription Account in My Name

Chapter 8: Knowing Money Makes the World Look Different

Children exposed to financial crime

Social Media Has Become a Hotbed of Financial Crime / Just Lend Me Your Name

Will having a lot of money make you happy?

More money doesn't make you happier / The more money you have, the happier you become / Money prevents life's unhappiness

Things to Teach with Money

The Power of Non-Comparison / Gratitude

Epilogue: Children inherit their parents' attitudes toward money.

Detailed image

.jpg)

Into the book

While it's encouraging to hear that interest in economic education is growing and that there are movements for change in schools, unfortunately, economic education in schools has its limitations.

The limitation is that it lacks continuity in daily life.

Money is an area that is closely connected to real life, so it should not be a one- or two-hour lesson or a one-unit lesson, but should be a constant part of children's lives.

However, economic education in schools lasts only one or two classes, or at most one unit.

Even if you meet a teacher who is interested in economic education and study economics through experience for a year, the activity will end after a year.

What can make up for these limitations is economic education at home.

For a child's education about money to be sustainable, financial education at home is essential.

---「Chapter 1.

From "Why do elementary school children need to learn about money?"

For a child, having a job and getting paid feels like a game.

Because it is a game, people participate with interest.

But, strangely enough, children also show a tendency to want to resemble adults.

So when I write a contract, I write it with a very serious expression.

Just writing a contract gives your child a special experience that his or her peers don't have.

And if you have your own signature or stamp, your mindset will change.

---「Chapter 2.

Income: How do you make money?

Handing over the realm of consumption can be seen as the beginning of education on money and consumption.

It's about making people consume on their own.

Next, you need to develop good spending habits.

Developing good spending habits requires two steps: planning your spending and reflecting on your spending.

If you don't follow these two steps, no matter how much you move beyond the realm of spending, you won't be learning how to manage your money properly to form spending habits.

If you get paid (or have an allowance) once a week, do these two steps once a week. If you get paid (or have an allowance) once a month, do these two steps once a month.

---「Chapter 3.

From "Consumption: How to Spend Money Well is More Important Than Earning It"

In a time when savings interest rates are 3-4%, and the principal amount saved by an elementary school student is not large, the interest received by the child after waiting for one-tenth of his or her life is at most a few thousand won (based on a principal of 100,000 won).

In this situation, it is difficult for children to feel the appeal of 'interest', which is one of the reasons why they should save.

Also, since there is a one-year waiting period, the number of times a child can experience full term before becoming an adult is limited.

There are not enough maturity experiences to form a saving habit.

---「Chapter 4.

Savings: Even small amounts of money can become a lot of money if you save them little by little.

If you decide to lend money to your child at home, set some criteria.

The question is, 'Is the child eligible to borrow money?'

Because we only lend money to people who are expected to keep their promises.

If you run your credit score from home, you can use your credit score as a benchmark.

If you start with a credit score of 500, you can set it so that you can get a loan when your score is 600 or higher.

If you don't run a credit score, the loan eligibility is determined based on the amount of money your child has saved, such as "savings of 500,000 won or more."

---「Chapter 6.

From "Credit and Loans: Managing My Trust Score"

At home, children have their own space.

Of course, depending on family circumstances, some children have their own room, while others share a space with siblings or parents.

But the important thing is that the house is the parents' asset.

It's not the child's.

If so, you can create additional areas for consumption by having your child pay for the space you provide.

---「Chapter 7.

From "Taxes and Real Estate: The Beginning of Our Children's Financial Independence"

There is one thing to keep in mind when teaching your child about money.

That is, the way parents treat money is directly passed on to their children.

Money education at home will likely incorporate your parents' philosophy and perspective on money.

So, I hope you will first establish your parents' philosophy on money.

The most important thing you can get from this activity is not just learning how to handle and manage money, but also sharing and discussing your values about money with your parents.

Through this, children can learn not only money management skills, but also responsibility for money and various values in our lives, including money.

Learning about money isn't just about learning how to manage it.

The limitation is that it lacks continuity in daily life.

Money is an area that is closely connected to real life, so it should not be a one- or two-hour lesson or a one-unit lesson, but should be a constant part of children's lives.

However, economic education in schools lasts only one or two classes, or at most one unit.

Even if you meet a teacher who is interested in economic education and study economics through experience for a year, the activity will end after a year.

What can make up for these limitations is economic education at home.

For a child's education about money to be sustainable, financial education at home is essential.

---「Chapter 1.

From "Why do elementary school children need to learn about money?"

For a child, having a job and getting paid feels like a game.

Because it is a game, people participate with interest.

But, strangely enough, children also show a tendency to want to resemble adults.

So when I write a contract, I write it with a very serious expression.

Just writing a contract gives your child a special experience that his or her peers don't have.

And if you have your own signature or stamp, your mindset will change.

---「Chapter 2.

Income: How do you make money?

Handing over the realm of consumption can be seen as the beginning of education on money and consumption.

It's about making people consume on their own.

Next, you need to develop good spending habits.

Developing good spending habits requires two steps: planning your spending and reflecting on your spending.

If you don't follow these two steps, no matter how much you move beyond the realm of spending, you won't be learning how to manage your money properly to form spending habits.

If you get paid (or have an allowance) once a week, do these two steps once a week. If you get paid (or have an allowance) once a month, do these two steps once a month.

---「Chapter 3.

From "Consumption: How to Spend Money Well is More Important Than Earning It"

In a time when savings interest rates are 3-4%, and the principal amount saved by an elementary school student is not large, the interest received by the child after waiting for one-tenth of his or her life is at most a few thousand won (based on a principal of 100,000 won).

In this situation, it is difficult for children to feel the appeal of 'interest', which is one of the reasons why they should save.

Also, since there is a one-year waiting period, the number of times a child can experience full term before becoming an adult is limited.

There are not enough maturity experiences to form a saving habit.

---「Chapter 4.

Savings: Even small amounts of money can become a lot of money if you save them little by little.

If you decide to lend money to your child at home, set some criteria.

The question is, 'Is the child eligible to borrow money?'

Because we only lend money to people who are expected to keep their promises.

If you run your credit score from home, you can use your credit score as a benchmark.

If you start with a credit score of 500, you can set it so that you can get a loan when your score is 600 or higher.

If you don't run a credit score, the loan eligibility is determined based on the amount of money your child has saved, such as "savings of 500,000 won or more."

---「Chapter 6.

From "Credit and Loans: Managing My Trust Score"

At home, children have their own space.

Of course, depending on family circumstances, some children have their own room, while others share a space with siblings or parents.

But the important thing is that the house is the parents' asset.

It's not the child's.

If so, you can create additional areas for consumption by having your child pay for the space you provide.

---「Chapter 7.

From "Taxes and Real Estate: The Beginning of Our Children's Financial Independence"

There is one thing to keep in mind when teaching your child about money.

That is, the way parents treat money is directly passed on to their children.

Money education at home will likely incorporate your parents' philosophy and perspective on money.

So, I hope you will first establish your parents' philosophy on money.

The most important thing you can get from this activity is not just learning how to handle and manage money, but also sharing and discussing your values about money with your parents.

Through this, children can learn not only money management skills, but also responsibility for money and various values in our lives, including money.

Learning about money isn't just about learning how to manage it.

---From the "Epilogue"

Publisher's Review

“Knock knock knock.

Save your money in Mom's bank.

“We will refund you with a 12-week maturity and 10% interest rate.”

From writing employment contracts to managing your credit score,

Living economic education at home with teacher Ok Hyo-jin!

“I’ve never received any specific education about money.” “I don’t know where or how to start teaching my child.” “Educating about finances is too difficult.” There’s probably no one who doesn’t know that money is important in life.

However, most parents with elementary school children are at a loss as to how to teach their children about money.

That's understandable, because the education about money that our parents' generation received as children consisted almost entirely of writing down their allowance, saving, and saving. They were literally thrown into society as adults, and had no choice but to belatedly encounter unavoidable economic activities like taxes, insurance, and loans.

"Teacher Ok Hyo-jin's Elementary Money Study" is an economics education book that helps parents and children learn about money, which is essential for real-life situations.

Ok Hyo-jin, a bestselling author of children's economics education and an elementary school teacher with 14 years of experience, has been working on "Class Money" for over six years to teach children the economic knowledge they need to know in life.

He introduced the process of children creating their own jobs, earning their own salaries, saving and investing on his YouTube channel, “Children Who Pay Taxes.” His economic education became a hot topic, to the point that there was talk of “One Ok Hyo-jin per family.”

However, he explains that unfortunately, there are limitations to teaching children practical money through school education due to the short one-year class cycle and economics studies focused on entrance exams, and therefore, economics education at home is absolutely necessary.

“Money is an area that is closely connected to real life, so it should not be something that can be covered in a one- or two-hour class or a single unit, but rather something that should be continuously taught in children’s lives.

However, economic education in schools lasts only one or two classes, or at most one unit.

Even if you meet a teacher who is interested in economic education and study economics through experience for a year, the activity will end after a year.

What can make up for these limitations is economic education at home.

“For a child’s financial education to be sustainable, financial education at home is essential.”

- Chapter 1.

Why do elementary school children need to learn about money?', pp.

19~20

The golden time to establish lifelong economic principles: the 6th year of elementary school!

“A child who studied money with his or her parents during elementary school

“Grow into an adult who can build his own life.”

This book provides an easy-to-understand overview of six fundamental economic concepts: income, consumption, savings, investment, credit and loans, taxes, and real estate.

Before teaching children about money, we separately explain economic concepts that parents must know, such as the Depositors Protection Act, statutory interest rates, and signatures and stamps. We also bring in interesting examples from 'Children Who Pay Taxes' to help children become interested in studying money.

This book is also full of economic activities that parents and children can practice themselves.

It explains various practical activities, from how to make money, such as writing an employment contract and receiving a salary, managing holiday allowance, creating a mom bank and dad bank, creating investment products, building our household credit score, writing a loan agreement, and signing a monthly rent lease, to how to save and manage money and become wealthy.

For example, rather than giving their children an allowance, parents are encouraged to let their children choose a career they want to pursue, such as being a barista or DJ, and then pay them a salary.

Children who choose a career as a barista can earn money by doing things like making coffee at a coffee machine or filling thermoses for outings.

Children learn about salary payment methods and their take-home pay by checking the taxes deducted from their monthly paychecks. They also save part of their paychecks in their mother's bank account to use the money they save to go to an amusement park. They also study stocks by investing in their father's weight.

They use their credit scores to get loans from their grandmother's bank, or they study real estate and the concept of monthly rent while paying rent for the room they are staying in.

Just as you need to kick the ball to get good at soccer and press the keys to get good at playing the piano, in the same way, to properly study money, it is important for children to have hands-on experiences like this rather than sitting at a desk and learning from text.

Children who experience the living study of money by earning, spending, saving, and investing money on their own will naturally understand the flow of money and grow into adults who can build their own lives.

Some might say that we are teaching economics too early to children who are already overwhelmed with their schoolwork.

However, the first six years of elementary school are the golden time to establish lifelong financial awareness, and the optimal time to receive proper financial education before entering middle and high school, when the workload increases and students must rush toward college entrance exams.

If parents and children read this book, which combines theory and practice, and practice economic activities together at home, children will not only develop the right attitude toward money, but also learn responsibility for money and various values in life.

Save your money in Mom's bank.

“We will refund you with a 12-week maturity and 10% interest rate.”

From writing employment contracts to managing your credit score,

Living economic education at home with teacher Ok Hyo-jin!

“I’ve never received any specific education about money.” “I don’t know where or how to start teaching my child.” “Educating about finances is too difficult.” There’s probably no one who doesn’t know that money is important in life.

However, most parents with elementary school children are at a loss as to how to teach their children about money.

That's understandable, because the education about money that our parents' generation received as children consisted almost entirely of writing down their allowance, saving, and saving. They were literally thrown into society as adults, and had no choice but to belatedly encounter unavoidable economic activities like taxes, insurance, and loans.

"Teacher Ok Hyo-jin's Elementary Money Study" is an economics education book that helps parents and children learn about money, which is essential for real-life situations.

Ok Hyo-jin, a bestselling author of children's economics education and an elementary school teacher with 14 years of experience, has been working on "Class Money" for over six years to teach children the economic knowledge they need to know in life.

He introduced the process of children creating their own jobs, earning their own salaries, saving and investing on his YouTube channel, “Children Who Pay Taxes.” His economic education became a hot topic, to the point that there was talk of “One Ok Hyo-jin per family.”

However, he explains that unfortunately, there are limitations to teaching children practical money through school education due to the short one-year class cycle and economics studies focused on entrance exams, and therefore, economics education at home is absolutely necessary.

“Money is an area that is closely connected to real life, so it should not be something that can be covered in a one- or two-hour class or a single unit, but rather something that should be continuously taught in children’s lives.

However, economic education in schools lasts only one or two classes, or at most one unit.

Even if you meet a teacher who is interested in economic education and study economics through experience for a year, the activity will end after a year.

What can make up for these limitations is economic education at home.

“For a child’s financial education to be sustainable, financial education at home is essential.”

- Chapter 1.

Why do elementary school children need to learn about money?', pp.

19~20

The golden time to establish lifelong economic principles: the 6th year of elementary school!

“A child who studied money with his or her parents during elementary school

“Grow into an adult who can build his own life.”

This book provides an easy-to-understand overview of six fundamental economic concepts: income, consumption, savings, investment, credit and loans, taxes, and real estate.

Before teaching children about money, we separately explain economic concepts that parents must know, such as the Depositors Protection Act, statutory interest rates, and signatures and stamps. We also bring in interesting examples from 'Children Who Pay Taxes' to help children become interested in studying money.

This book is also full of economic activities that parents and children can practice themselves.

It explains various practical activities, from how to make money, such as writing an employment contract and receiving a salary, managing holiday allowance, creating a mom bank and dad bank, creating investment products, building our household credit score, writing a loan agreement, and signing a monthly rent lease, to how to save and manage money and become wealthy.

For example, rather than giving their children an allowance, parents are encouraged to let their children choose a career they want to pursue, such as being a barista or DJ, and then pay them a salary.

Children who choose a career as a barista can earn money by doing things like making coffee at a coffee machine or filling thermoses for outings.

Children learn about salary payment methods and their take-home pay by checking the taxes deducted from their monthly paychecks. They also save part of their paychecks in their mother's bank account to use the money they save to go to an amusement park. They also study stocks by investing in their father's weight.

They use their credit scores to get loans from their grandmother's bank, or they study real estate and the concept of monthly rent while paying rent for the room they are staying in.

Just as you need to kick the ball to get good at soccer and press the keys to get good at playing the piano, in the same way, to properly study money, it is important for children to have hands-on experiences like this rather than sitting at a desk and learning from text.

Children who experience the living study of money by earning, spending, saving, and investing money on their own will naturally understand the flow of money and grow into adults who can build their own lives.

Some might say that we are teaching economics too early to children who are already overwhelmed with their schoolwork.

However, the first six years of elementary school are the golden time to establish lifelong financial awareness, and the optimal time to receive proper financial education before entering middle and high school, when the workload increases and students must rush toward college entrance exams.

If parents and children read this book, which combines theory and practice, and practice economic activities together at home, children will not only develop the right attitude toward money, but also learn responsibility for money and various values in life.

GOODS SPECIFICS

- Date of issue: April 22, 2024

- Page count, weight, size: 256 pages | 412g | 148*210*20mm

- ISBN13: 9791168271845

- ISBN10: 1168271843

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)