Kim Beom-gon's 3 million won monthly lifetime pension

|

Description

Book Introduction

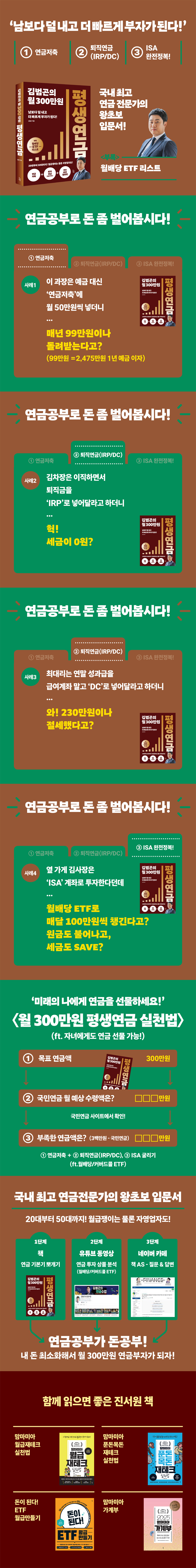

Why do you earn money when you study pension? A project to minimize my expenses and receive a monthly pension of 3 million won! There's a lot of talk about pensions these days. Manager Lee received 990,000 won in tax refunds every year through 'pension savings', and Deputy Manager Kim received his retirement pay as 'IRP', so he said he paid no taxes. Even CEO Choi received his performance bonus as a 'DC' instead of a salary account, saving 2.3 million won in taxes. President Kim of the store next door reportedly receives 1 million won per month from a dividend ETF he runs in an 'ISA'. Even the principal increases and taxes are reduced... How on earth do they know this information? Why am I the only one who doesn't know and is suffering losses? Target pension of 3 million won per month - National pension = Insufficient pension? ① Pension savings + ② Retirement pension (IRP/DC), ③ Solve it by rolling it into ISA! The author of this book, Beomgon Kim, is renowned as Korea's top pension expert. He is a first-class financial qualification instructor who has trained stockbrokers and bankers for 10 years, and runs Naver's No. 1 pension cafe. I've met countless people and shared the most frequently asked questions, answers, and tips for building a retirement account. This book begins by looking at the expected national pension amount. And we encourage you to achieve the remaining amount after deducting the national pension from the target pension of 3 million won per month. So why a monthly pension of 3 million won? According to a 2023 survey by Statistics Korea, the appropriate retirement living expenses for a couple is 3.24 million won. This means that a monthly pension of approximately 3 million won is the amount needed to live worry-free after retirement. This book assumes that anyone can achieve a monthly pension of 3 million won by consistently generating income and combining savings and investments. From 20s to 50s! Salaried workers and even the self-employed! Increase your principal and dividends! - Includes monthly dividend/covered call ETF investment tips! This book recommends ① pension savings + ② retirement pension (IRP/DC) ③ ISA account to achieve the monthly pension goal of 3 million won, and explains how to safely increase the principal and dividends. It divides the [Deposit]->[Operation]->[Withdrawal] sections for each account and informs you that you can receive a monthly pension of 3 million won when you retire by receiving the maximum tax return instead of paying the minimum amount of your money. Depending on account usage, the annual pension limit may exceed 100 million won. There is information like Altolan included here and there, so you should read it carefully. Ultimately, if you want to make money by studying pensions, you need to pay attention to two things. One is ‘tax benefits’ and the other is ‘pension management’. The final amount received will vary depending on how you pay, manage, and withdraw pension funds for each account. The most important thing is ‘pension management.’ The size of the bundle of money changes during this process. This book focuses on both salaried workers and self-employed people in their 20s to 50s. Above all, I recommend investing in monthly dividend/covered call ETFs to ensure that your principal grows without being damaged and that you can receive your pension solely from dividends. It contains a variety of simulation cases based on age/payment period/amount/assets, so it will be very helpful. |

- You can preview some of the book's contents.

Preview

index

〈Preparatory Exercise〉 Anyone can become a pensioner with 3 million won per month!

01 The best gift you can give yourself - a lifetime pension of 3 million won per month

02 National Pension Just Isn't Enough! - The Pension Big Three and ISAs Are Here!

〈Tip〉 DB vs. DC Retirement Pension: Which is Better?

03 How much will my national pension be? (ft.

(How to calculate insufficient pension)

〈Tip〉 4 Ways to Get More National Pension

03 If you are not a civil servant, pay an additional 9% of your salary into your pension savings account!

04 Never cut your retirement pension prematurely! (ft. DC/DB/IRP are pensions, not lump sums!)

05 Pension Savings Simulation ① Tax Deduction (Pay 6 million won per year and receive 990,000 won in return)

06 Pension Savings Simulation ② Tax Deferral (When managing 100 million ft, gain 7.4 million won over deposit)

〈Tip〉Carefully Decide on Pension Withdrawals

07 Create your own pension scenario

〈Tip〉If I use my house as a housing pension

〈First Yard〉 How to Practicalize a Monthly Pension of 3 Million Won ① Pension Savings

Q&A you need to know about the pension savings [payment] stage

01 [Payment] For pension savings, we recommend using a securities company's pension savings fund!

〈Tip〉 Allowing transfers between pension accounts - Pension Savings Transfer System

02 [Payment] Reason for paying with a pension savings goal of 100 million won (ft.

(Goal of creating a pension of 1 million won per month)

03 [Payment] Principal 100 million won VS Appraised value 100 million won - What is my goal?

04 [Payment] Pension savings payment plan for Mr. A, a 40-year-old single-income earner

Q&A on what you need to know about pension savings [management]

05 [Operation] Long-term investment × tax deferral = compound interest

06 [Operation] TDF recommended for beginner investors considering retirement age!

07 [Operation] Fees affect returns! (ft.

Fund & ETF Fee Comparison)

08 [Operation] Accumulated installment purchases and rebalancing are the fundamental principles of investment!

09 [Operation] Risky Assets vs. Safe Assets Allocation Based on Investment Tendency

〈Tip〉 An app that helps you rebalance your assets - The Rich

10 [Operation] For the Lazy Investor - 60.80% Return in 5 Years!

〈Tip〉What if I didn't rebalance? What would my final return be?

11 [Operation] For those nearing retirement! - Highly recommended monthly dividend ETF!

12 [Operation] Monthly Dividend ETF Pension Savings Withdrawal Simulation (ft.

Price difference? VS monthly rental income?

Q&A on pension savings [withdrawal]

13 [Withdrawal] 3 ways to withdraw 100 million won pension (ft.

Fixed-term, fixed-amount, and non-regular pensions)

14 [Withdrawal] Worry-free retirement = Operating income 〉 Withdrawal ratio

〈Tip〉How to Create Pension Savings for Minors

15 [Withdrawal] A and B, who have pensions of 100 million won, why are their withdrawal balances different? (ft.

Risk of yield generation sequence)

16 [Withdrawal] This is pension savings I paid while unemployed, but why is there a tax deduction? (ft.

Hongtax double taxation correction application)

17 [Withdrawal] Minimize taxes with low-rate pension income tax!

18 [Withdrawal] The higher the pension receipt year, the higher the pension receipt limit!

〈Tip〉A Complete Guide to Pension Withdrawals

19 [Withdrawal] What if the subscriber dies while receiving the pension?

〈Second Yard〉 How to Implement a 3 Million Won Monthly Pension ② Retirement Pension (DC/IRP)

Q&A you need to know about the retirement pension [payment] stage

01 [Payment] Retirement pension 9DC/DB type) If you want to manage it properly?

〈Tip〉To increase DC-type profits, choose securities products!

02 [Payment] How to maximize your tax deduction by meeting your payment limit (ft. IRP + Pension Savings Collaboration)

03 [Payment] Lump sum retirement allowance -〉Receive it into an IRP account for greater tax savings!

04 [Payment] Incentive-〉If you receive it in the DC form, you will get a huge tax saving effect!

Q&A on what you need to know about retirement pension [management]

05 [Operation] Split Purchase Strategy When a Large Amount of Retirement Benefit Comes In

06 [Operation] Accumulation investment method that varies depending on investment tendency

07 [Operation] 100 Million Won in Retirement Savings for Lazy Investors

08 [Operation] 100 Million Won in Retirement Savings for Diligent Investors

08 [Operation] Financial products available for selection in retirement pension (DC/IRP) accounts

Q&A on the retirement pension withdrawal stage

09 [Withdrawal] In which account should I receive my statutory retirement pay, honorary retirement pay, and severance pay?

〈Tip〉If you receive retirement benefits through an IRP, is it cumbersome to withdraw them early?

10 [Withdrawal] Special case for retirement pension (DB/DC/IRP) subscribers before 2013 (ft.

(Applies to the 6th year of pension receipt)

11 [Withdrawal] New IRP VS Existing IRP - 100 million won difference in pension amount?

〈Tip〉Conditions for transferring the subscription period when transferring a pension account (pension savings/DC type/IRP)

12 [Withdrawal] If you meet the IRP pension conditions, withdraw at least 10,000 won per year! (ft.

Accumulating pension years)

13 [Withdrawal] Is there a specific order in which money is withdrawn from IRP?

〈Tip〉Everything About Early Withdrawals from Retirement Pensions (DB/DC/IRP)

〈Third Yard〉 How to Save 3 Million Won a Month in Pension ③ ISA

Q&A you need to know about the ISA [payment] stage

01 [Payment] Choosing a Financial Product

02 [Payment] Creating a Portfolio

03 [Payment] Accumulated investment and portfolio purchase

04. [Payment] Cash management and portfolio purchase

05 [Payment] Portfolio Review

06 [Payment] Portfolio Rebalancing

Q&A you need to know at the ISA [Operation] stage

01 [Operation] Re-enrollment after cancellation/Precautions/Tax savings

02 [Operation] Long-term management of lump sum funds

〈Tip〉Withdrawing only dividends while managing monthly dividend ETFs

〈Tip〉 Strategy to maximize long-term investment returns

03 [Operation] Transfer/Re-enrollment/Tax Benefits of Pension Accounts After Cancellation

〈Tip〉: Top 10 ETFs for Investing in ISA Accounts

Q&A on ISA withdrawals

04 [Withdrawal] Create a monthly pension of 3 million won by life cycle

05 [Withdrawal] How long will you work?

06 [Withdrawal] What is the appropriate monthly savings amount by age?

07 [Withdrawal] Portfolio provided by investment purpose

〈Tip〉 5%/7%/9%/12% Dividend Portfolio

04 [Withdrawal] How to create a monthly pension of 3 million won.

〈Tip〉Setting Pension Creation Goals

Creating a monthly pension of 1 million won with public pension

Create a monthly pension of 1 million won with retirement pension

Create a monthly pension of 1 million won through pension savings

01 The best gift you can give yourself - a lifetime pension of 3 million won per month

02 National Pension Just Isn't Enough! - The Pension Big Three and ISAs Are Here!

〈Tip〉 DB vs. DC Retirement Pension: Which is Better?

03 How much will my national pension be? (ft.

(How to calculate insufficient pension)

〈Tip〉 4 Ways to Get More National Pension

03 If you are not a civil servant, pay an additional 9% of your salary into your pension savings account!

04 Never cut your retirement pension prematurely! (ft. DC/DB/IRP are pensions, not lump sums!)

05 Pension Savings Simulation ① Tax Deduction (Pay 6 million won per year and receive 990,000 won in return)

06 Pension Savings Simulation ② Tax Deferral (When managing 100 million ft, gain 7.4 million won over deposit)

〈Tip〉Carefully Decide on Pension Withdrawals

07 Create your own pension scenario

〈Tip〉If I use my house as a housing pension

〈First Yard〉 How to Practicalize a Monthly Pension of 3 Million Won ① Pension Savings

Q&A you need to know about the pension savings [payment] stage

01 [Payment] For pension savings, we recommend using a securities company's pension savings fund!

〈Tip〉 Allowing transfers between pension accounts - Pension Savings Transfer System

02 [Payment] Reason for paying with a pension savings goal of 100 million won (ft.

(Goal of creating a pension of 1 million won per month)

03 [Payment] Principal 100 million won VS Appraised value 100 million won - What is my goal?

04 [Payment] Pension savings payment plan for Mr. A, a 40-year-old single-income earner

Q&A on what you need to know about pension savings [management]

05 [Operation] Long-term investment × tax deferral = compound interest

06 [Operation] TDF recommended for beginner investors considering retirement age!

07 [Operation] Fees affect returns! (ft.

Fund & ETF Fee Comparison)

08 [Operation] Accumulated installment purchases and rebalancing are the fundamental principles of investment!

09 [Operation] Risky Assets vs. Safe Assets Allocation Based on Investment Tendency

〈Tip〉 An app that helps you rebalance your assets - The Rich

10 [Operation] For the Lazy Investor - 60.80% Return in 5 Years!

〈Tip〉What if I didn't rebalance? What would my final return be?

11 [Operation] For those nearing retirement! - Highly recommended monthly dividend ETF!

12 [Operation] Monthly Dividend ETF Pension Savings Withdrawal Simulation (ft.

Price difference? VS monthly rental income?

Q&A on pension savings [withdrawal]

13 [Withdrawal] 3 ways to withdraw 100 million won pension (ft.

Fixed-term, fixed-amount, and non-regular pensions)

14 [Withdrawal] Worry-free retirement = Operating income 〉 Withdrawal ratio

〈Tip〉How to Create Pension Savings for Minors

15 [Withdrawal] A and B, who have pensions of 100 million won, why are their withdrawal balances different? (ft.

Risk of yield generation sequence)

16 [Withdrawal] This is pension savings I paid while unemployed, but why is there a tax deduction? (ft.

Hongtax double taxation correction application)

17 [Withdrawal] Minimize taxes with low-rate pension income tax!

18 [Withdrawal] The higher the pension receipt year, the higher the pension receipt limit!

〈Tip〉A Complete Guide to Pension Withdrawals

19 [Withdrawal] What if the subscriber dies while receiving the pension?

〈Second Yard〉 How to Implement a 3 Million Won Monthly Pension ② Retirement Pension (DC/IRP)

Q&A you need to know about the retirement pension [payment] stage

01 [Payment] Retirement pension 9DC/DB type) If you want to manage it properly?

〈Tip〉To increase DC-type profits, choose securities products!

02 [Payment] How to maximize your tax deduction by meeting your payment limit (ft. IRP + Pension Savings Collaboration)

03 [Payment] Lump sum retirement allowance -〉Receive it into an IRP account for greater tax savings!

04 [Payment] Incentive-〉If you receive it in the DC form, you will get a huge tax saving effect!

Q&A on what you need to know about retirement pension [management]

05 [Operation] Split Purchase Strategy When a Large Amount of Retirement Benefit Comes In

06 [Operation] Accumulation investment method that varies depending on investment tendency

07 [Operation] 100 Million Won in Retirement Savings for Lazy Investors

08 [Operation] 100 Million Won in Retirement Savings for Diligent Investors

08 [Operation] Financial products available for selection in retirement pension (DC/IRP) accounts

Q&A on the retirement pension withdrawal stage

09 [Withdrawal] In which account should I receive my statutory retirement pay, honorary retirement pay, and severance pay?

〈Tip〉If you receive retirement benefits through an IRP, is it cumbersome to withdraw them early?

10 [Withdrawal] Special case for retirement pension (DB/DC/IRP) subscribers before 2013 (ft.

(Applies to the 6th year of pension receipt)

11 [Withdrawal] New IRP VS Existing IRP - 100 million won difference in pension amount?

〈Tip〉Conditions for transferring the subscription period when transferring a pension account (pension savings/DC type/IRP)

12 [Withdrawal] If you meet the IRP pension conditions, withdraw at least 10,000 won per year! (ft.

Accumulating pension years)

13 [Withdrawal] Is there a specific order in which money is withdrawn from IRP?

〈Tip〉Everything About Early Withdrawals from Retirement Pensions (DB/DC/IRP)

〈Third Yard〉 How to Save 3 Million Won a Month in Pension ③ ISA

Q&A you need to know about the ISA [payment] stage

01 [Payment] Choosing a Financial Product

02 [Payment] Creating a Portfolio

03 [Payment] Accumulated investment and portfolio purchase

04. [Payment] Cash management and portfolio purchase

05 [Payment] Portfolio Review

06 [Payment] Portfolio Rebalancing

Q&A you need to know at the ISA [Operation] stage

01 [Operation] Re-enrollment after cancellation/Precautions/Tax savings

02 [Operation] Long-term management of lump sum funds

〈Tip〉Withdrawing only dividends while managing monthly dividend ETFs

〈Tip〉 Strategy to maximize long-term investment returns

03 [Operation] Transfer/Re-enrollment/Tax Benefits of Pension Accounts After Cancellation

〈Tip〉: Top 10 ETFs for Investing in ISA Accounts

Q&A on ISA withdrawals

04 [Withdrawal] Create a monthly pension of 3 million won by life cycle

05 [Withdrawal] How long will you work?

06 [Withdrawal] What is the appropriate monthly savings amount by age?

07 [Withdrawal] Portfolio provided by investment purpose

〈Tip〉 5%/7%/9%/12% Dividend Portfolio

04 [Withdrawal] How to create a monthly pension of 3 million won.

〈Tip〉Setting Pension Creation Goals

Creating a monthly pension of 1 million won with public pension

Create a monthly pension of 1 million won with retirement pension

Create a monthly pension of 1 million won through pension savings

Detailed image

GOODS SPECIFICS

- Date of issue: January 2, 2025

- Page count, weight, size: 384 pages | 466g | 152*215*20mm

- ISBN13: 9791193732151

- ISBN10: 1193732158

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)