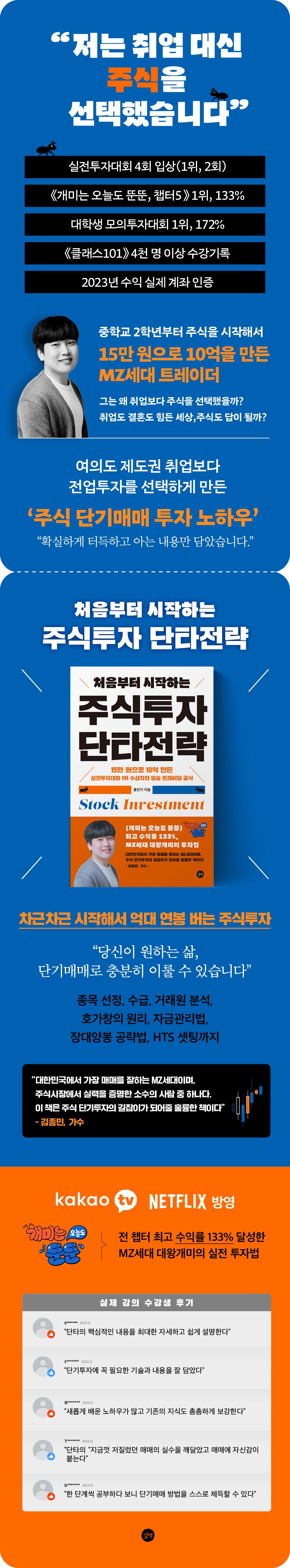

Short-term stock investment strategy starting from scratch

|

Description

Book Introduction

The know-how of a 20-something MZ trader who won first place in a real-life investment competition and a mock investment competition for college students. The safe trading formula that made people choose professional investors over institutional employment in Yeouido. -A surefire short-term stock trading strategy that starts slowly and earns you hundreds of millions of won a year. A practical investment strategy book that contains only the knowledge and insights gained from the market. - From stock selection, supply and demand, traders, the secrets of the order book, and even long-term candlestick trading methods, the A to Z of short-term trading -The best guide for those who want to start short-term investing. How do MZ generation traders, fresh out of college, earn millions? The Giant Ant's Sure-Winning Strategy: Making Short-Term Investments Safely "You can achieve the life you want with short-term trading." People tend to think that short-term investing is always risky. Half right and half wrong. If you can learn short-term trading properly, you have a high probability of making money. However, even if you learn someone else's trading method, the level is usually very high and difficult to follow. In the former case, it is difficult to find someone who can properly teach you short-term trading. In the latter case, it is easy to lose money quickly because trading is difficult and it is difficult to create your own trading method. Both assume that the probability of making a profit is higher if you actually invest a small amount of money in the market and learn and experience it firsthand. However, if you're drawn to short-term trading and want to get started, "Stock Investment Short-Term Trading Strategy from Scratch" will solve the complex and tangled real-world problems. The author of this book emphasizes that he only included things that he 'certainly understood and knew'. That means the author has excluded trading methods that he either doesn't make money with, doesn't actually trade with, or doesn't understand. This means that only thoroughly verified and well-known information is included in relation to short-term trading, also known as short-term trading. Although the author focuses on short-term trading, he is a meticulous risk manager and prefers relatively safe investments compared to other short-term investors. He is in his mid-20s, and he did not win first place in a real investment game by chance, but rather he proved his skills in several competitions. He verified that he had made hundreds of millions of won in profit at a relatively young age by including his actual account in 2023, a year of steep declines and repeated ups and downs in the stock market. Anyone interested in short-term stock trading must read "Stock Investment Short-Term Strategy from Scratch." Without any preparation, you blindly follow the trading method advocated by a certain YouTuber and end up losing your precious investment money to the market in an instant. If you don't want to throw away money so easily, you need to learn short-term trading step by step and use it properly to increase your chances of making a profit. This book was written at the level of those who really want to learn short-term trading. If there is someone who is looking for a quick fortune that they cannot afford, it is better to give up quickly. This book was created for those who want to learn short-term trading strategies that safely and gradually build profits. Without any fiction or exaggeration, the author has included only know-how based on his actual experience in the market. I hope that those who want to learn this will at least not feel unbearable pain even if they go through trial and error. Hong In-gi, the author of "The Great Ant," who became a multi-millionaire trader in his 20s, said, "I hope that the know-how in this book will become a turning point that will change someone's life." "Stock Investment Short-Term Strategy from Scratch" offers genuine hope to short-term investors of this era. |

- You can preview some of the book's contents.

Preview

index

Part 1.

What investments should I make?

01.

Short-term investments chosen to avoid losing money

- My stock investment story

- What investment is right for me?

02.

Why short-term investing is good

- Low risk

- You can start right away with a small amount

- You can make money even in a bear market.

- Performance can be measured in a short period of time.

- You can steadily accumulate profits through continuous withdrawals.

03.

False illusions about long-term investing

- The illusion that if you wait, it will go up

- The stock market is a tilted playing field

- Differences in opinion between major and minority shareholders

- When you know it, it's the most difficult long-term investment.

- If an individual wants to make a profit through long-term investment

Part 2.

Only selected stocks rise

04.

Let's choose a popular theme

- Market-leading themes

- Find popular themes by trading price

- Identifying the issue

- Analyzing the news

05.

Only the best survive

- Let's follow the trend

- Let's focus on the stocks that are rising the most.

- Second place is not allowed

- Change at the moment of reversal

- There's a reason my stock isn't rising.

06.

stocks with a lot of potential

- The answer lies in past charts.

- The one who has been to the upper limit goes there.

07.

Conditions for good stocks to trade

- Market capitalization suitable for short-term trading

- Stocks that cannot be short-sold or have a low short-selling balance ratio

Part 3.

Technical Analysis for Successful Short-Term Trading

08.

chart

- Basic chart description

- Support and resistance

- Prices that can become support and resistance

- The most powerful chart

- Rising and falling stocks

09.

Supply and demand

- There must be a supply and demand entity for it to rise.

- Trader

- Program trading

- Institutional investor aggregate

- Check market trends

- The principle of hogachang

Part 4.

The Art of the Deal

10.

Weight management

- Understanding your own bowl

- Weight management (burning and watering)

11.

Trading timing

- First Long Yang Bong (D) Strategy

- Strategy for the day after long-term farming (D+1)

- Strategy for 2 days after long-term farming (D+2)

- Stock trading strategy by trading hour

12.

Loss-cutting method

13. HTS Settings

Part 5.

How to protect your money

14.

How to avoid rain showers

15.

Money Management Law

16.

Heart method

[Appendix] 2023 Account Disclosure

What investments should I make?

01.

Short-term investments chosen to avoid losing money

- My stock investment story

- What investment is right for me?

02.

Why short-term investing is good

- Low risk

- You can start right away with a small amount

- You can make money even in a bear market.

- Performance can be measured in a short period of time.

- You can steadily accumulate profits through continuous withdrawals.

03.

False illusions about long-term investing

- The illusion that if you wait, it will go up

- The stock market is a tilted playing field

- Differences in opinion between major and minority shareholders

- When you know it, it's the most difficult long-term investment.

- If an individual wants to make a profit through long-term investment

Part 2.

Only selected stocks rise

04.

Let's choose a popular theme

- Market-leading themes

- Find popular themes by trading price

- Identifying the issue

- Analyzing the news

05.

Only the best survive

- Let's follow the trend

- Let's focus on the stocks that are rising the most.

- Second place is not allowed

- Change at the moment of reversal

- There's a reason my stock isn't rising.

06.

stocks with a lot of potential

- The answer lies in past charts.

- The one who has been to the upper limit goes there.

07.

Conditions for good stocks to trade

- Market capitalization suitable for short-term trading

- Stocks that cannot be short-sold or have a low short-selling balance ratio

Part 3.

Technical Analysis for Successful Short-Term Trading

08.

chart

- Basic chart description

- Support and resistance

- Prices that can become support and resistance

- The most powerful chart

- Rising and falling stocks

09.

Supply and demand

- There must be a supply and demand entity for it to rise.

- Trader

- Program trading

- Institutional investor aggregate

- Check market trends

- The principle of hogachang

Part 4.

The Art of the Deal

10.

Weight management

- Understanding your own bowl

- Weight management (burning and watering)

11.

Trading timing

- First Long Yang Bong (D) Strategy

- Strategy for the day after long-term farming (D+1)

- Strategy for 2 days after long-term farming (D+2)

- Stock trading strategy by trading hour

12.

Loss-cutting method

13. HTS Settings

Part 5.

How to protect your money

14.

How to avoid rain showers

15.

Money Management Law

16.

Heart method

[Appendix] 2023 Account Disclosure

Detailed image

Into the book

Stock investing has influenced many aspects of my life.

It helped me not have to force myself to do things I didn't like, and I was able to focus more on things I liked.

However, that doesn't mean that things will always go smoothly.

Even now, there are still many failures in the market and we are constantly learning.

Life is full of uncertainties, but I can tell you one thing for sure:

My life has always been about stocks and will always be like that.

--- p.7

When I first heard that Samsung Bio's stock price, which was around 500,000 won before enlistment, had fallen to 280,000 won, I thought that maybe I had written the first digit wrong.

Even while he was in training, the Financial Services Commission determined that Samsung BioLogics had intentionally committed fraudulent accounting and suspended stock trading.

I thought the stock price would go up if I waited any longer, but I just couldn't hold out any longer.

If I had invested only with my own money, I could have waited for the stock price to rise even if it fell significantly, but since I had already invested using a stock-secured loan, there was nothing I could do.

--- p.22

When people think of 'short-term trading', they often think of it as being volatile and risky.

There are many adages about stock investing, but most of them are negative about short-term investing.

That's why many people consider short-term trading to be a shortcut to ruin and say to avoid it if possible.

However, if done properly, short-term investing in the Korean stock market is one of the safest investment methods.

--- p.33

In the case of long-term investments, it is common to continuously increase the investment amount without withdrawing the profits to obtain compound interest.

If you increase your investment capital, even a single failure can reduce or eliminate the profits you have accumulated over a long period of time, so thorough risk management is essential above all else.

Long-term investment in individual stocks offers the greatest expected returns because it allows for the utilization of compound interest, but it is also the most difficult method of investing in stocks.

--- p.52

Sometimes, people look for stocks by looking at the stocks with the highest trading volume.

Stocks with the highest trading volume often have low prices per week, as shown in the figure above, so they have high trading volume but low trading value.

When we buy and sell stocks, we only decide how much money to invest, and we don't buy and sell the same number of shares for a 1,000 won stock and a 100,000 won stock.

Therefore, you should always check the top trading volume stocks, as the top trading volume stocks are meaningless in determining which stocks people are interested in.

--- p.81

Stocks that break through the reported price are likely to experience a major trend, but you should never trade them just by looking at the chart.

The most likely case for success is when a bullish candlestick breaks through the high and becomes the leading stock in the market's leading theme.

If a stock has not broken through its peak while receiving the most attention in the market, but rather has risen because the market is in an upward trend or other stocks have followed suit, it can easily fall even if it has broken through its past peak.

--- p.181

Just because a stock is eligible for short selling doesn't mean you should never trade it.

If you are a leading stock in a leading theme that is receiving the most attention from the market, you may have the power to overcome short selling and rise.

This means that, when all other conditions are equal, stocks that cannot be short-sold or stocks with a low short-selling balance ratio are better to target, but it does not mean that stocks that cannot be short-sold are always advantageous for short-term trading.

--- p.151

Accurate trading trends can only be confirmed after the market closes.

However, to increase your chances of profit, it is important to understand the intraday supply and demand.

Intraday supply and demand can be estimated through aggregated data from traders, program traders, and institutional investors.

By understanding intraday supply and demand, identifying foreign and institutional buying and selling trends, and utilizing these trends appropriately for short-term trading, you can slightly increase your chances of success.

--- p.222

When a large quantity of purchases come in at a price where a large quantity is accumulated, if the following buying force is strong and the quantity is quickly absorbed, it can be seen that the resistance has been broken through.

Because if the quantity is being consumed at a fast pace, it can be judged that there were many buyers waiting to buy.

--- p.251

The money in your stock account can disappear at any time if your psychology breaks down or you make one or two bad trades.

Therefore, it is very important to secure your profits by withdrawing them continuously.

Rather than increasing your trading amount without withdrawing, it is better to set an amount appropriate for your account and manage your profits separately by continuously withdrawing money.

It helped me not have to force myself to do things I didn't like, and I was able to focus more on things I liked.

However, that doesn't mean that things will always go smoothly.

Even now, there are still many failures in the market and we are constantly learning.

Life is full of uncertainties, but I can tell you one thing for sure:

My life has always been about stocks and will always be like that.

--- p.7

When I first heard that Samsung Bio's stock price, which was around 500,000 won before enlistment, had fallen to 280,000 won, I thought that maybe I had written the first digit wrong.

Even while he was in training, the Financial Services Commission determined that Samsung BioLogics had intentionally committed fraudulent accounting and suspended stock trading.

I thought the stock price would go up if I waited any longer, but I just couldn't hold out any longer.

If I had invested only with my own money, I could have waited for the stock price to rise even if it fell significantly, but since I had already invested using a stock-secured loan, there was nothing I could do.

--- p.22

When people think of 'short-term trading', they often think of it as being volatile and risky.

There are many adages about stock investing, but most of them are negative about short-term investing.

That's why many people consider short-term trading to be a shortcut to ruin and say to avoid it if possible.

However, if done properly, short-term investing in the Korean stock market is one of the safest investment methods.

--- p.33

In the case of long-term investments, it is common to continuously increase the investment amount without withdrawing the profits to obtain compound interest.

If you increase your investment capital, even a single failure can reduce or eliminate the profits you have accumulated over a long period of time, so thorough risk management is essential above all else.

Long-term investment in individual stocks offers the greatest expected returns because it allows for the utilization of compound interest, but it is also the most difficult method of investing in stocks.

--- p.52

Sometimes, people look for stocks by looking at the stocks with the highest trading volume.

Stocks with the highest trading volume often have low prices per week, as shown in the figure above, so they have high trading volume but low trading value.

When we buy and sell stocks, we only decide how much money to invest, and we don't buy and sell the same number of shares for a 1,000 won stock and a 100,000 won stock.

Therefore, you should always check the top trading volume stocks, as the top trading volume stocks are meaningless in determining which stocks people are interested in.

--- p.81

Stocks that break through the reported price are likely to experience a major trend, but you should never trade them just by looking at the chart.

The most likely case for success is when a bullish candlestick breaks through the high and becomes the leading stock in the market's leading theme.

If a stock has not broken through its peak while receiving the most attention in the market, but rather has risen because the market is in an upward trend or other stocks have followed suit, it can easily fall even if it has broken through its past peak.

--- p.181

Just because a stock is eligible for short selling doesn't mean you should never trade it.

If you are a leading stock in a leading theme that is receiving the most attention from the market, you may have the power to overcome short selling and rise.

This means that, when all other conditions are equal, stocks that cannot be short-sold or stocks with a low short-selling balance ratio are better to target, but it does not mean that stocks that cannot be short-sold are always advantageous for short-term trading.

--- p.151

Accurate trading trends can only be confirmed after the market closes.

However, to increase your chances of profit, it is important to understand the intraday supply and demand.

Intraday supply and demand can be estimated through aggregated data from traders, program traders, and institutional investors.

By understanding intraday supply and demand, identifying foreign and institutional buying and selling trends, and utilizing these trends appropriately for short-term trading, you can slightly increase your chances of success.

--- p.222

When a large quantity of purchases come in at a price where a large quantity is accumulated, if the following buying force is strong and the quantity is quickly absorbed, it can be seen that the resistance has been broken through.

Because if the quantity is being consumed at a fast pace, it can be judged that there were many buyers waiting to buy.

--- p.251

The money in your stock account can disappear at any time if your psychology breaks down or you make one or two bad trades.

Therefore, it is very important to secure your profits by withdrawing them continuously.

Rather than increasing your trading amount without withdrawing, it is better to set an amount appropriate for your account and manage your profits separately by continuously withdrawing money.

--- p.326

Publisher's Review

A short-term strategy that minimizes losses and maximizes profits even in market conditions where it is difficult to predict even an inch ahead.

Learn the know-how of the MZ generation giant ants who make millions of won even in a bear market!

After reaching its highest point in 2021, the stock market continued to decline, and the difficult market continued into 2023.

With the stock market situation in 2024 difficult to predict, many investors are unsure of where and how to invest.

But did you know that in these volatile markets, short-term trading strategies can actually reduce risk and generate profits? Winning markets come when you can reduce your seed size and quickly shift your investment positions according to market trends.

However, many investors struggle to control their greed and panic mentality, and often end up wasting money on the market because they don't even know how to conduct short-term trading.

Although YouTube is full of various short-term trading techniques, it is difficult to find content that properly teaches beginners how to trade short-term.

This book doesn't just talk about how to invest by looking at charts.

From stock selection to the reasons for targeting top stocks, trading conditions, understanding the main drivers of supply and demand, the principles of the order book, and weight management, this book covers short-term trading methods in a detailed and easy-to-understand manner from A to Z.

In addition, it will teach you how to trade on D-Day and D+1 and D+2.

Therefore, anyone looking to make a quick profit must thoroughly understand the fundamentals of trading with this book to avoid losing valuable investment and secure it.

The author is a top trader of the MZ generation, having actually proven his earnings of hundreds of millions of won in his mid-20s.

It is particularly noteworthy that his profits continued to grow by following the solid short-term trading principles he established even in such a difficult market.

This book contains only the truthful information that he has truly grasped and knows.

This is a must-read for anyone who wants to make a profit through short-term trading, including beginners in stock investing.

Short-term trading looks easy, but it's actually incredibly difficult. Who can you learn from?

If you're going to try short-term trading, learn 'properly' from someone who has proven their skills in the market!

In 2022, the KOSPI index fell by at least 400 points and up to 1,000 points compared to the previous year's high.

2023 will see volatility with sharp declines and surges, maintaining a box range around the 2,500 level.

Hong In-gi, a trader in his mid-20s who goes by the nickname "School Cafeteria King Ant," is a true expert who won first place twice and second place twice in the KB Securities Real Investment Competition, even amidst the market's outcry.

Not only that, he is the person who took first place in the 2020 Korea Investment & Securities College Student Mock Investment Competition with an astonishing return of 172%.

With a background in university investment clubs, he appeared in Chapter 5 of [Ants Are Tuntun Today], which aired on Kakao TV and Netflix in 2021, and showed remarkable performance.

In particular, he set a record with a 133% return rate among the five chapters of the season, and showed the public how he acts as an investment mentor for the celebrities who appear on the show.

In 2023, he delivered insightful investment tips on his YouTube channel while simultaneously generating hundreds of millions of dollars in short-term trading profits.

He has actually proven his skills with his resume and earnings.

Author Hong In-gi's approach is a little different from that of successful senior traders or professional investors.

Even though the size of the seed and profit is relatively small compared to them, the risk of losing money is significantly eliminated by pursuing short-term trading that is 'sure to make a profit'.

In other words, from the perspective of someone learning short-term trading, it's crucial to distinguish between "trades I can do" and "trades I can't do," and to learn the author's short-term trading strategies, which are statistically safe and have a high success rate. Hong In-gi, a MZ generation super ant, is only in his mid-twenties, but he began investing in stocks in his second year of middle school and will be a 15-year investor by 2024.

After recently completing my internship at S Securities, I boldly decided to pursue a career as a full-time investor ahead of joining K Securities as an intern.

By choosing stocks over employment, you are on the fast track to wealth.

For anyone interested in learning short-term trading, the wisest choice would be to learn from a certified tutor who has proven his or her skills and has trained over 4,000 students through [Class 101].

Started with 150,000 won in stocks, earned 100 million won, then kicked the can down the drain and made another billion won.

Full verification of actual accounts in 2023

In "Stock Investment Short-Term Strategy from Scratch," the author's actual account is included to verify his profits.

The book explains investment methodology, but also captures actual transaction records to prove his techniques and logic.

Account verification in 2023 in particular has special significance.

In a highly volatile market where the index fluctuates greatly and is said to be causing a 'whistle', positive returns were confirmed.

The fact that he can generate profits in the hundreds of millions of won in any market is a good signal that it is worth learning his trading methods.

His short-term trading investment style is a strategy that aims to generate 'sure' profits by eliminating 'risk' as much as possible.

The two words 'short-term trading' and 'safety' have somewhat conflicting meanings, but they are important keywords that beginners in short-term stock trading must keep in mind.

There are short-term traders who have proven that they have made billions of won in profits, but if it is a trading method that does not generate profits based on my skills and carries the risk of significant losses, it is better to abandon it.

A relatively safer short-term trading strategy is a surefire way to generate profits while minimizing losses.

Especially in a market with extreme fluctuations, if you follow the so-called 'heavenly' short-term trading method, your account can be completely ruined and become a failure.

If you learn a short-term strategy that pursues safety as much as possible while still generating a sure profit, it will undoubtedly become a powerful weapon that will help you survive in any market.

Learn the know-how of the MZ generation giant ants who make millions of won even in a bear market!

After reaching its highest point in 2021, the stock market continued to decline, and the difficult market continued into 2023.

With the stock market situation in 2024 difficult to predict, many investors are unsure of where and how to invest.

But did you know that in these volatile markets, short-term trading strategies can actually reduce risk and generate profits? Winning markets come when you can reduce your seed size and quickly shift your investment positions according to market trends.

However, many investors struggle to control their greed and panic mentality, and often end up wasting money on the market because they don't even know how to conduct short-term trading.

Although YouTube is full of various short-term trading techniques, it is difficult to find content that properly teaches beginners how to trade short-term.

This book doesn't just talk about how to invest by looking at charts.

From stock selection to the reasons for targeting top stocks, trading conditions, understanding the main drivers of supply and demand, the principles of the order book, and weight management, this book covers short-term trading methods in a detailed and easy-to-understand manner from A to Z.

In addition, it will teach you how to trade on D-Day and D+1 and D+2.

Therefore, anyone looking to make a quick profit must thoroughly understand the fundamentals of trading with this book to avoid losing valuable investment and secure it.

The author is a top trader of the MZ generation, having actually proven his earnings of hundreds of millions of won in his mid-20s.

It is particularly noteworthy that his profits continued to grow by following the solid short-term trading principles he established even in such a difficult market.

This book contains only the truthful information that he has truly grasped and knows.

This is a must-read for anyone who wants to make a profit through short-term trading, including beginners in stock investing.

Short-term trading looks easy, but it's actually incredibly difficult. Who can you learn from?

If you're going to try short-term trading, learn 'properly' from someone who has proven their skills in the market!

In 2022, the KOSPI index fell by at least 400 points and up to 1,000 points compared to the previous year's high.

2023 will see volatility with sharp declines and surges, maintaining a box range around the 2,500 level.

Hong In-gi, a trader in his mid-20s who goes by the nickname "School Cafeteria King Ant," is a true expert who won first place twice and second place twice in the KB Securities Real Investment Competition, even amidst the market's outcry.

Not only that, he is the person who took first place in the 2020 Korea Investment & Securities College Student Mock Investment Competition with an astonishing return of 172%.

With a background in university investment clubs, he appeared in Chapter 5 of [Ants Are Tuntun Today], which aired on Kakao TV and Netflix in 2021, and showed remarkable performance.

In particular, he set a record with a 133% return rate among the five chapters of the season, and showed the public how he acts as an investment mentor for the celebrities who appear on the show.

In 2023, he delivered insightful investment tips on his YouTube channel while simultaneously generating hundreds of millions of dollars in short-term trading profits.

He has actually proven his skills with his resume and earnings.

Author Hong In-gi's approach is a little different from that of successful senior traders or professional investors.

Even though the size of the seed and profit is relatively small compared to them, the risk of losing money is significantly eliminated by pursuing short-term trading that is 'sure to make a profit'.

In other words, from the perspective of someone learning short-term trading, it's crucial to distinguish between "trades I can do" and "trades I can't do," and to learn the author's short-term trading strategies, which are statistically safe and have a high success rate. Hong In-gi, a MZ generation super ant, is only in his mid-twenties, but he began investing in stocks in his second year of middle school and will be a 15-year investor by 2024.

After recently completing my internship at S Securities, I boldly decided to pursue a career as a full-time investor ahead of joining K Securities as an intern.

By choosing stocks over employment, you are on the fast track to wealth.

For anyone interested in learning short-term trading, the wisest choice would be to learn from a certified tutor who has proven his or her skills and has trained over 4,000 students through [Class 101].

Started with 150,000 won in stocks, earned 100 million won, then kicked the can down the drain and made another billion won.

Full verification of actual accounts in 2023

In "Stock Investment Short-Term Strategy from Scratch," the author's actual account is included to verify his profits.

The book explains investment methodology, but also captures actual transaction records to prove his techniques and logic.

Account verification in 2023 in particular has special significance.

In a highly volatile market where the index fluctuates greatly and is said to be causing a 'whistle', positive returns were confirmed.

The fact that he can generate profits in the hundreds of millions of won in any market is a good signal that it is worth learning his trading methods.

His short-term trading investment style is a strategy that aims to generate 'sure' profits by eliminating 'risk' as much as possible.

The two words 'short-term trading' and 'safety' have somewhat conflicting meanings, but they are important keywords that beginners in short-term stock trading must keep in mind.

There are short-term traders who have proven that they have made billions of won in profits, but if it is a trading method that does not generate profits based on my skills and carries the risk of significant losses, it is better to abandon it.

A relatively safer short-term trading strategy is a surefire way to generate profits while minimizing losses.

Especially in a market with extreme fluctuations, if you follow the so-called 'heavenly' short-term trading method, your account can be completely ruined and become a failure.

If you learn a short-term strategy that pursues safety as much as possible while still generating a sure profit, it will undoubtedly become a powerful weapon that will help you survive in any market.

GOODS SPECIFICS

- Date of issue: December 22, 2023

- Page count, weight, size: 344 pages | 508g | 152*225*21mm

- ISBN13: 9791140707492

- ISBN10: 1140707493

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)