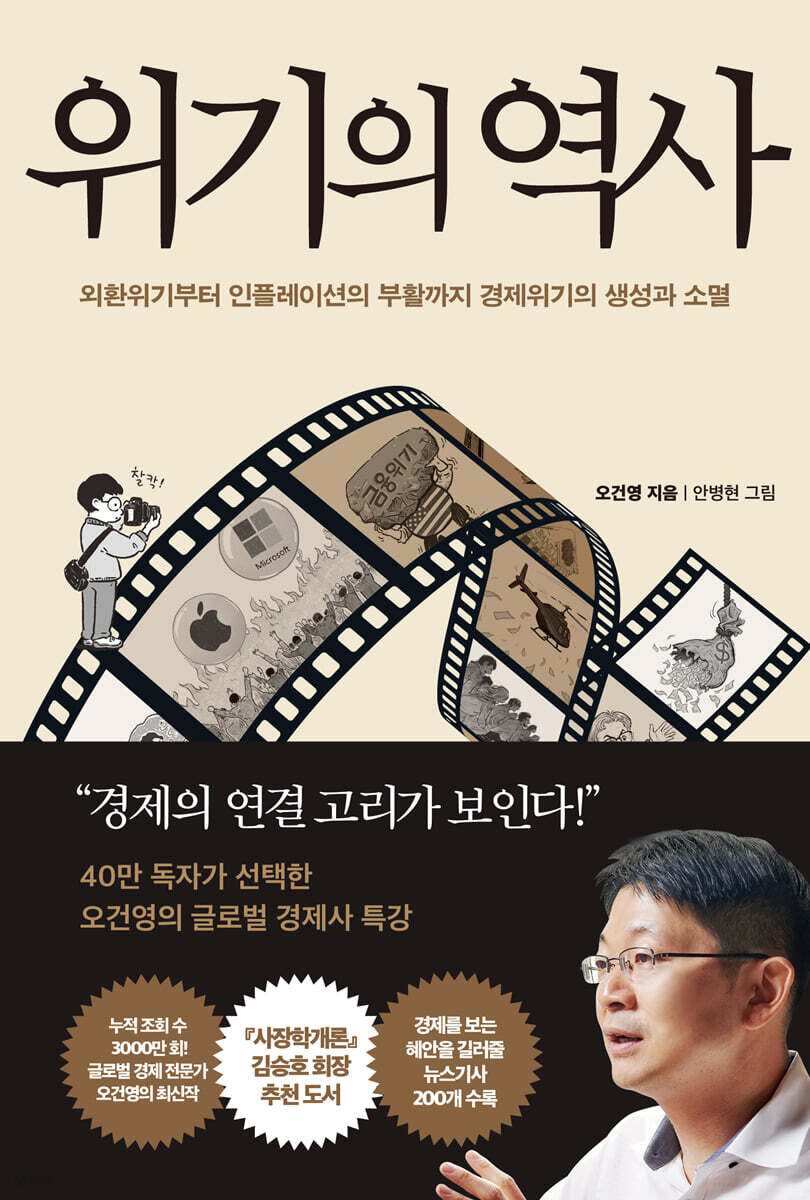

History of Crisis

|

Description

Book Introduction

- A word from MD

-

When you recognize a crisis, you see opportunity.A new book by macroeconomics expert Oh Geon-young.

From the IMF foreign exchange crisis in 1997 to the first inflation shock in 40 years.

It provides an easy-to-understand explanation of four historical events that have influenced our lives, from the causes of the crisis to the impact of the events.

Let's let go of vague anxiety and turn the crisis into an opportunity.

July 25, 2023. Economics and Management PD Kim Sang-geun

Oh Geon-young's Special Lecture on Global Economic History, Selected by 400,000 Readers

With over 5.5 million cumulative views, the popular lecture is now available in book form!

From the foreign exchange crisis, the dot-com bubble, the financial crisis, to the resurgence of inflation.

The creation and elimination of economic crises

“I see the economic links!”

With a gaze of insight instead of vague fear and extreme optimism,

The moment we truly understand the past, the true nature of the crisis is revealed!

Since the start of US interest rate hikes in 2022 and the strongest inflation in 40 years, a new financial environment has unfolded unlike anything we have ever experienced before.

The dollar-won exchange rate soared to its highest level since the financial crisis, deposit interest rates, which had been close to 0%, rose to 5-6%, forcing people to turn to banks instead of the stock market, and the real estate market, which had maintained its invincible reputation, collapsed, bringing many "young-kul-jok" (young people) to tears.

These rapid changes have made today's financial markets unstable, naturally leading investors to be wary of extreme risks.

It is a vague anxiety that an unprecedented crisis is coming.

People tend to think inertially.

People mistakenly believe that the current situation will continue for simple reasons such as the low interest rate trend, the stable inflation rate, and the fact that real estate always rises.

But that inertia was shattered by an unexpected crisis, creating the current inflationary situation that has been the first in 40 years.

But the situation we are experiencing now is something that happened in the past, and the same things happened back then for similar reasons and with similar misconceptions.

The reason it keeps happening is because we have simply gone through a crisis and do not really know it.

We are completely unaware of the crisis.

With over 5.5 million cumulative views, the popular lecture is now available in book form!

From the foreign exchange crisis, the dot-com bubble, the financial crisis, to the resurgence of inflation.

The creation and elimination of economic crises

“I see the economic links!”

With a gaze of insight instead of vague fear and extreme optimism,

The moment we truly understand the past, the true nature of the crisis is revealed!

Since the start of US interest rate hikes in 2022 and the strongest inflation in 40 years, a new financial environment has unfolded unlike anything we have ever experienced before.

The dollar-won exchange rate soared to its highest level since the financial crisis, deposit interest rates, which had been close to 0%, rose to 5-6%, forcing people to turn to banks instead of the stock market, and the real estate market, which had maintained its invincible reputation, collapsed, bringing many "young-kul-jok" (young people) to tears.

These rapid changes have made today's financial markets unstable, naturally leading investors to be wary of extreme risks.

It is a vague anxiety that an unprecedented crisis is coming.

People tend to think inertially.

People mistakenly believe that the current situation will continue for simple reasons such as the low interest rate trend, the stable inflation rate, and the fact that real estate always rises.

But that inertia was shattered by an unexpected crisis, creating the current inflationary situation that has been the first in 40 years.

But the situation we are experiencing now is something that happened in the past, and the same things happened back then for similar reasons and with similar misconceptions.

The reason it keeps happening is because we have simply gone through a crisis and do not really know it.

We are completely unaware of the crisis.

- You can preview some of the book's contents.

Preview

index

Introduction: A New Current Discovered in a Great Disconnection

Chapter 1 Foreign Exchange Crisis

01.

The IMF foreign exchange crisis, a major turning point for the Korean economy.

02.

The Butterfly Effect of the Kobe Earthquake That Caused a Slump in Korean Exports

03.

The semiconductor shock that caused our country's export slump

04.

Why Dollar Debt Has Grow: The Impossible Trinity

05.

The fear of short-term foreign debt that destroyed South Korea's finances

06.

Possibility of a second foreign exchange crisis

Chapter 2: The Dot-Com Bubble

07.

The prelude to the dot-com bubble

08.

The burst of the dot-com bubble

09.

Things that can't be solved even by lowering interest rates

Chapter 3 Financial Crisis

10.

Two climaxes

11.

The subprime mortgage crisis: the start of a domino collapse

12.

The Diverging Dreams of Emerging Countries and the United States That Caused Global Imbalances

13.

The Emerging Market Dilemma That Caused Global Imbalances

14.

All-out war against the financial crisis: what will be the result?

Chapter 4: The COVID-19 Crisis and the First Inflation in 40 Years

15.

Inflation: A Monster Awakened After 40 Years Due to COVID-19

16.

Why did the Fed fail?

17.

The message the crisis of the 1970s sends us

18.

The Bankruptcy of Silicon Valley Bank (SVB) and What the Future Holds for Us

Chapter 1 Foreign Exchange Crisis

01.

The IMF foreign exchange crisis, a major turning point for the Korean economy.

02.

The Butterfly Effect of the Kobe Earthquake That Caused a Slump in Korean Exports

03.

The semiconductor shock that caused our country's export slump

04.

Why Dollar Debt Has Grow: The Impossible Trinity

05.

The fear of short-term foreign debt that destroyed South Korea's finances

06.

Possibility of a second foreign exchange crisis

Chapter 2: The Dot-Com Bubble

07.

The prelude to the dot-com bubble

08.

The burst of the dot-com bubble

09.

Things that can't be solved even by lowering interest rates

Chapter 3 Financial Crisis

10.

Two climaxes

11.

The subprime mortgage crisis: the start of a domino collapse

12.

The Diverging Dreams of Emerging Countries and the United States That Caused Global Imbalances

13.

The Emerging Market Dilemma That Caused Global Imbalances

14.

All-out war against the financial crisis: what will be the result?

Chapter 4: The COVID-19 Crisis and the First Inflation in 40 Years

15.

Inflation: A Monster Awakened After 40 Years Due to COVID-19

16.

Why did the Fed fail?

17.

The message the crisis of the 1970s sends us

18.

The Bankruptcy of Silicon Valley Bank (SVB) and What the Future Holds for Us

Detailed image

.jpg)

Into the book

Everyone has a tendency to think in a passive way.

I expect that the trend that has continued until now will continue.

But low interest rates have continued for 20 years.

Who could possibly expect interest rates to jump significantly tomorrow? Most would expect the current downward trend or low interest rate environment to continue.

After the foreign exchange crisis in our country, not only did low interest rates appear, but a rational expectation that low interest rates would continue for a long time also began to build in the minds of economic entities.

After that situation, interest rates began to rise sharply in the second half of 2021.

So, this interest rate change felt like an even greater burden to people.

--- p.36

Of course, the Kobe earthquake is not the only factor explaining the yen's strength and subsequent weakening following the Plaza Accord.

However, I think it has become a catalyst that further strengthens the yen's already strong trend.

For reference, the record of a super strong yen in April 1995, when the yen was below 80 per dollar, remained unbroken for a while until it was finally broken in 2011.

In March of that year, there was the Great East Japan Earthquake, which is still vivid in everyone's memory.

Abenomics was launched to overcome the super strong yen that appeared after the Great East Japan Earthquake, and this led to a sharp weakening of the yen.

--- p.59

What if a country's export companies are experiencing growth? The best option would be a stable exchange rate.

If exchange rate movements continue at predictable levels, it will provide companies with the confidence to increase facility investment and expand their businesses.

If you make a significant investment in facilities and then the exchange rate suddenly changes, the favorable environment becomes unfavorable, which can be disastrous.

If companies begin to be cautious rather than bold in their investments, economic growth itself could be hampered.

--- p.86

Having experienced a foreign exchange crisis once, I learned that a foreign exchange crisis can strike very quickly when there is a dollar shortage.

Learning from that experience, our country is steadily accumulating more foreign exchange reserves than in the past.

And because we know the dangers of short-term foreign debt, we are also careful about managing maturity when raising funds from abroad.

If during the foreign exchange crisis our country's breakwater was around 300 meters high, you can see that it is now around 4,200 meters high.

Of course, the 4,200-meter breakwater may spoil the beauty of the beach, but it has the power to block even bigger waves.

This means that stability has been secured compared to the past.

--- p.144

It's difficult to answer the question, "Does the stock market rise when interest rates fall?"

Because there are many factors other than interest rates that determine stock prices.

This question can be reversed to ask, "Does raising interest rates cause stock prices to fall?"

Likewise, it is very difficult to answer because there are many factors other than interest rates that determine stock prices.

--- p.218

As loans were made available to people with poor credit ratings, the number of loans with lower ratings, or subprime ratings, increased significantly.

An increase in home purchases leads to an increase in housing demand, and an increase in housing demand leads to further increases in housing prices.

Yes, the expansion of subprime mortgage lending further fueled the steady rise in house prices.

Even if it is a subprime mortgage loan given to people with low credit ratings, the possibility of the loan being repaid is very low if the price of the house that serves as collateral continues to rise.

AAA-rated bonds are created based on the bullish housing market and subprime mortgage bonds that are considered to have a very low probability of default.

--- p.281

Products made in China and imported are called 'Made in China'.

Made in China feels very cheap rather than luxurious.

In the early 2000s, the influx of cheap Chinese products around the world significantly curbed inflation.

Globally, prices have stabilized, and emerging economies, led by China, have secured a bridgehead for growth.

--- p.306

Many people believe that the cause of the financial crisis was the bankruptcy of Lehman Brothers.

Or, more specifically, you might think that the financial crisis was caused by a credit crunch that arose as the US housing price decline made the derivatives market insolvent and the financial institutions faced increasing bankruptcy concerns.

While this may explain the insolvency of U.S. financial institutions, it does not explain the environment of "global imbalances" surrounding emerging economies, which served as the engines of global economic growth at the time.

In fact, the growth of emerging markets, which can compensate for the reduced consumption in the United States, will be key to overcoming the financial crisis by resolving the problem of global imbalances to a certain extent.

--- p.352

Sometimes, when I cross the crosswalk, this happens.

There is still some distance to the crosswalk, but the traffic light has turned green.

I keep thinking about whether I should run or not.

You walk carelessly, thinking, 'I'll cross next time,' but then suddenly you think you can cross, so you run at full speed and cross the road only when the traffic lights have almost stopped flashing.

Because I ran so fast, I was exhausted and ended up panting and struggling for breath.

The Fed appears to have made a similar mistake.

If they had raised rates a little earlier, if they had started running slowly when the light turned green, they might not have had to sprint to raise rates at such a rapid pace at the end.

--- p.402

If corporate investment does not increase easily, even if the economy improves somewhat, it will not lead to increased corporate investment.

Stagnant corporate capital investment can be interpreted to mean that companies are not building factories or expanding their offices.

No new jobs will be created, and as employment does not increase, people's incomes will not increase.

Since income does not increase, demand naturally does not become stronger.

Weak demand can be greatly weakened by even a small shock, which can act as a factor in reinforcing the decline in prices, i.e. deflation.

--- p.421

Every military unit has a guard post.

If we knew when, at what time, and how a crisis would strike, there would be no need to set up outposts and maintain constant vigilance.

Crises always come at unexpected times and in unexpected ways.

There is a Chinese idiom called ‘Geoansawi (居安思危)’.

It's a saying that tells us to think of danger when we stay in comfort.

I think this is the attitude we should have now.

I expect that the trend that has continued until now will continue.

But low interest rates have continued for 20 years.

Who could possibly expect interest rates to jump significantly tomorrow? Most would expect the current downward trend or low interest rate environment to continue.

After the foreign exchange crisis in our country, not only did low interest rates appear, but a rational expectation that low interest rates would continue for a long time also began to build in the minds of economic entities.

After that situation, interest rates began to rise sharply in the second half of 2021.

So, this interest rate change felt like an even greater burden to people.

--- p.36

Of course, the Kobe earthquake is not the only factor explaining the yen's strength and subsequent weakening following the Plaza Accord.

However, I think it has become a catalyst that further strengthens the yen's already strong trend.

For reference, the record of a super strong yen in April 1995, when the yen was below 80 per dollar, remained unbroken for a while until it was finally broken in 2011.

In March of that year, there was the Great East Japan Earthquake, which is still vivid in everyone's memory.

Abenomics was launched to overcome the super strong yen that appeared after the Great East Japan Earthquake, and this led to a sharp weakening of the yen.

--- p.59

What if a country's export companies are experiencing growth? The best option would be a stable exchange rate.

If exchange rate movements continue at predictable levels, it will provide companies with the confidence to increase facility investment and expand their businesses.

If you make a significant investment in facilities and then the exchange rate suddenly changes, the favorable environment becomes unfavorable, which can be disastrous.

If companies begin to be cautious rather than bold in their investments, economic growth itself could be hampered.

--- p.86

Having experienced a foreign exchange crisis once, I learned that a foreign exchange crisis can strike very quickly when there is a dollar shortage.

Learning from that experience, our country is steadily accumulating more foreign exchange reserves than in the past.

And because we know the dangers of short-term foreign debt, we are also careful about managing maturity when raising funds from abroad.

If during the foreign exchange crisis our country's breakwater was around 300 meters high, you can see that it is now around 4,200 meters high.

Of course, the 4,200-meter breakwater may spoil the beauty of the beach, but it has the power to block even bigger waves.

This means that stability has been secured compared to the past.

--- p.144

It's difficult to answer the question, "Does the stock market rise when interest rates fall?"

Because there are many factors other than interest rates that determine stock prices.

This question can be reversed to ask, "Does raising interest rates cause stock prices to fall?"

Likewise, it is very difficult to answer because there are many factors other than interest rates that determine stock prices.

--- p.218

As loans were made available to people with poor credit ratings, the number of loans with lower ratings, or subprime ratings, increased significantly.

An increase in home purchases leads to an increase in housing demand, and an increase in housing demand leads to further increases in housing prices.

Yes, the expansion of subprime mortgage lending further fueled the steady rise in house prices.

Even if it is a subprime mortgage loan given to people with low credit ratings, the possibility of the loan being repaid is very low if the price of the house that serves as collateral continues to rise.

AAA-rated bonds are created based on the bullish housing market and subprime mortgage bonds that are considered to have a very low probability of default.

--- p.281

Products made in China and imported are called 'Made in China'.

Made in China feels very cheap rather than luxurious.

In the early 2000s, the influx of cheap Chinese products around the world significantly curbed inflation.

Globally, prices have stabilized, and emerging economies, led by China, have secured a bridgehead for growth.

--- p.306

Many people believe that the cause of the financial crisis was the bankruptcy of Lehman Brothers.

Or, more specifically, you might think that the financial crisis was caused by a credit crunch that arose as the US housing price decline made the derivatives market insolvent and the financial institutions faced increasing bankruptcy concerns.

While this may explain the insolvency of U.S. financial institutions, it does not explain the environment of "global imbalances" surrounding emerging economies, which served as the engines of global economic growth at the time.

In fact, the growth of emerging markets, which can compensate for the reduced consumption in the United States, will be key to overcoming the financial crisis by resolving the problem of global imbalances to a certain extent.

--- p.352

Sometimes, when I cross the crosswalk, this happens.

There is still some distance to the crosswalk, but the traffic light has turned green.

I keep thinking about whether I should run or not.

You walk carelessly, thinking, 'I'll cross next time,' but then suddenly you think you can cross, so you run at full speed and cross the road only when the traffic lights have almost stopped flashing.

Because I ran so fast, I was exhausted and ended up panting and struggling for breath.

The Fed appears to have made a similar mistake.

If they had raised rates a little earlier, if they had started running slowly when the light turned green, they might not have had to sprint to raise rates at such a rapid pace at the end.

--- p.402

If corporate investment does not increase easily, even if the economy improves somewhat, it will not lead to increased corporate investment.

Stagnant corporate capital investment can be interpreted to mean that companies are not building factories or expanding their offices.

No new jobs will be created, and as employment does not increase, people's incomes will not increase.

Since income does not increase, demand naturally does not become stronger.

Weak demand can be greatly weakened by even a small shock, which can act as a factor in reinforcing the decline in prices, i.e. deflation.

--- p.421

Every military unit has a guard post.

If we knew when, at what time, and how a crisis would strike, there would be no need to set up outposts and maintain constant vigilance.

Crises always come at unexpected times and in unexpected ways.

There is a Chinese idiom called ‘Geoansawi (居安思危)’.

It's a saying that tells us to think of danger when we stay in comfort.

I think this is the attitude we should have now.

--- p.477

Publisher's Review

Foreign exchange crisis, dot-com bubble, financial crisis, and even inflation

Find out the causes of the crisis that created our country and the process of overcoming it!

In this regard, author Oh Geon-young, Korea's leading macroeconomic expert, provides insightful perspectives on past crises through his book, "A History of Crisis."

He analyzes the messages the past sends us in this book, saying that if we have a little more in-depth knowledge of the anxious times of the past, we can avoid being swept up in fear in the anxious times that may come in the future.

Chapters 1 to 6 cover the 'IMF foreign exchange crisis,' which remains the most tragic event in the history of the Korean people.

This shocking incident, which shook the national economy and plunged the lives of ordinary people into tragedy, was vividly captured using news articles from the time.

Chapters 7-9 cover the creation and collapse of the dot-com bubble brought about by the Internet revolution.

Although the dot-com bubble is not called an economic crisis, it did have a significant impact on asset markets at the time, and the stimulus measures aimed at mitigating that impact contributed to the subsequent global financial crisis.

The 'global financial crisis' in Chapters 10-14 was a severe crisis recorded as the worst since the Great Depression of 1929, and was a negative factor that brought about low growth around the world.

Chapters 15-17 are about the COVID-19 crisis and the subsequent inflation shock that occurred 40 years ago, and the final epilogue, Chapter 18, examines the commonalities among the crises covered in this book, comparing them to the recent bank failure of a Silicon Valley bank.

This book will help you assess the current economic situation with a more objective perspective, moving away from vague fears about the current crisis or extreme optimism that nothing will go wrong, through stories from the past.

A Global Economics Class Explained in Eighteen Essays

Gain insight into the economy through 200 articles.

This book consists of 18 essays, each of which is like a movie.

The major themes covered in each essay are presented at a glance through illustrations, arousing readers' curiosity.

And instead of a chronological approach that lists things in chronological order, it throws curiosity into events, expands on them, and concludes with a conclusion.

Although it may seem like a difficult topic to discuss, the author Oh Geon-yeong's explanations make it an easy and fun read.

His greatest strength, storytelling that creates apt examples and easy-to-read sentences that turn even beginners into financial experts, is clearly evident in this book.

Economic articles received through the press at the time add vividness to the book.

Reading articles that actually appeared in the context of the great historical crisis will broaden your understanding.

With a total of 200 articles cited, this book is also an excellent textbook for effective reading study.

Find out the causes of the crisis that created our country and the process of overcoming it!

In this regard, author Oh Geon-young, Korea's leading macroeconomic expert, provides insightful perspectives on past crises through his book, "A History of Crisis."

He analyzes the messages the past sends us in this book, saying that if we have a little more in-depth knowledge of the anxious times of the past, we can avoid being swept up in fear in the anxious times that may come in the future.

Chapters 1 to 6 cover the 'IMF foreign exchange crisis,' which remains the most tragic event in the history of the Korean people.

This shocking incident, which shook the national economy and plunged the lives of ordinary people into tragedy, was vividly captured using news articles from the time.

Chapters 7-9 cover the creation and collapse of the dot-com bubble brought about by the Internet revolution.

Although the dot-com bubble is not called an economic crisis, it did have a significant impact on asset markets at the time, and the stimulus measures aimed at mitigating that impact contributed to the subsequent global financial crisis.

The 'global financial crisis' in Chapters 10-14 was a severe crisis recorded as the worst since the Great Depression of 1929, and was a negative factor that brought about low growth around the world.

Chapters 15-17 are about the COVID-19 crisis and the subsequent inflation shock that occurred 40 years ago, and the final epilogue, Chapter 18, examines the commonalities among the crises covered in this book, comparing them to the recent bank failure of a Silicon Valley bank.

This book will help you assess the current economic situation with a more objective perspective, moving away from vague fears about the current crisis or extreme optimism that nothing will go wrong, through stories from the past.

A Global Economics Class Explained in Eighteen Essays

Gain insight into the economy through 200 articles.

This book consists of 18 essays, each of which is like a movie.

The major themes covered in each essay are presented at a glance through illustrations, arousing readers' curiosity.

And instead of a chronological approach that lists things in chronological order, it throws curiosity into events, expands on them, and concludes with a conclusion.

Although it may seem like a difficult topic to discuss, the author Oh Geon-yeong's explanations make it an easy and fun read.

His greatest strength, storytelling that creates apt examples and easy-to-read sentences that turn even beginners into financial experts, is clearly evident in this book.

Economic articles received through the press at the time add vividness to the book.

Reading articles that actually appeared in the context of the great historical crisis will broaden your understanding.

With a total of 200 articles cited, this book is also an excellent textbook for effective reading study.

GOODS SPECIFICS

- Date of issue: July 19, 2023

- Page count, weight, size: 480 pages | 152*225*30mm

- ISBN13: 9791169850360

- ISBN10: 1169850367

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)