Shoulders of Giants 1

|

Description

Book Introduction

- A word from MD

-

Learning how to invest from a masterThis is a new book by CEO Hong Jin-chae, who taught us how to become a wise investor through his previous work, “The Mind of Stock Investing.”

In answer to the question, "Can you make money investing in stocks?", the author of this book analyzes and organizes the investment methods of masters to achieve sustainable performance and establishes his own investment principles.

December 16, 2022. Economics and Management PD Kim Sang-geun

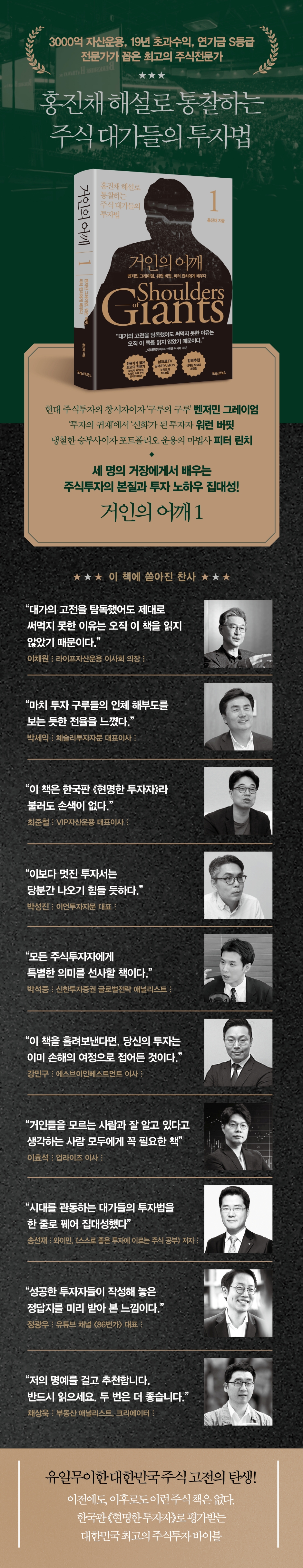

300 billion won in assets under management, 19 years of over-the-top returns, pension fund S rating, and experts selected by experts

Insights through Hong Jin-chae's commentary

The investment methods of stock experts

Benjamin Graham, the founder of modern stock investing; Warren Buffett, the legendary investor; and Peter Lynch, the cool-headed gambler.

A compilation of the essence of stock investing and investment know-how learned from three masters!

An exploration of the investment philosophies and methods of stock market gurus of the era, as explained by author Hong Jin-chae.

"Shoulders of Giants" is planned to consist of three volumes, with volumes 1 and 2 being published simultaneously, and volume 3 scheduled for release in 2023.

In Volume 1, we examine the investment methods of Benjamin Graham, Warren Buffett, and Peter Lynch from the beginning and explore ways to put their methods into practice.

By dismantling and reassembling the thought processes of three masters, we examine what stocks are, what value they have, the relationship between value and price, and which elements of a company each investor should focus on and which elements should be ignored to make money through this relationship, helping them establish their own investment thought process.

Insights through Hong Jin-chae's commentary

The investment methods of stock experts

Benjamin Graham, the founder of modern stock investing; Warren Buffett, the legendary investor; and Peter Lynch, the cool-headed gambler.

A compilation of the essence of stock investing and investment know-how learned from three masters!

An exploration of the investment philosophies and methods of stock market gurus of the era, as explained by author Hong Jin-chae.

"Shoulders of Giants" is planned to consist of three volumes, with volumes 1 and 2 being published simultaneously, and volume 3 scheduled for release in 2023.

In Volume 1, we examine the investment methods of Benjamin Graham, Warren Buffett, and Peter Lynch from the beginning and explore ways to put their methods into practice.

By dismantling and reassembling the thought processes of three masters, we examine what stocks are, what value they have, the relationship between value and price, and which elements of a company each investor should focus on and which elements should be ignored to make money through this relationship, helping them establish their own investment thought process.

- You can preview some of the book's contents.

Preview

index

Recommendation

Introduction: In Search of Foundation

Part 1.

Do I really have to work hard?

1.

Stocks, this peculiar asset

2.

Creativity and honesty

3.

Always a troubled investor

4.

You can stop here

*Investor's Study

Part 2.

shoulders of giants

5.

Welcome, human

6.

Graham, still so underrated

Let's see the results

Can you learn?

Lesson 1.

Stocks are ownership rights in a business.

Lesson 2.

Mr. Market

Lesson 3.

safety margin

Misconception 1.

value stocks

Misconception 2.

Price converges to value

Misconception 3.

Graham 'Style'

7.

Buffett, the untouchable genius

Let's see the results

Don't try this at home

Lesson 1.

Let's raise dairy cows

Lesson 2.

economic moat

Lesson 3.

Range of abilities

Buffett's words, words, words

8.

Lynch, the one and only hero

Let's see the results

Easy, right?

Lesson 1.

Bottom up

Lesson 2.

10-base hit

Lesson 3.

Diversification

Peter Lynch's 'techniques'

*Investor's Study

supplement.

Finding Benjamin Graham's Return

The rest of the story

annotation

Introduction: In Search of Foundation

Part 1.

Do I really have to work hard?

1.

Stocks, this peculiar asset

2.

Creativity and honesty

3.

Always a troubled investor

4.

You can stop here

*Investor's Study

Part 2.

shoulders of giants

5.

Welcome, human

6.

Graham, still so underrated

Let's see the results

Can you learn?

Lesson 1.

Stocks are ownership rights in a business.

Lesson 2.

Mr. Market

Lesson 3.

safety margin

Misconception 1.

value stocks

Misconception 2.

Price converges to value

Misconception 3.

Graham 'Style'

7.

Buffett, the untouchable genius

Let's see the results

Don't try this at home

Lesson 1.

Let's raise dairy cows

Lesson 2.

economic moat

Lesson 3.

Range of abilities

Buffett's words, words, words

8.

Lynch, the one and only hero

Let's see the results

Easy, right?

Lesson 1.

Bottom up

Lesson 2.

10-base hit

Lesson 3.

Diversification

Peter Lynch's 'techniques'

*Investor's Study

supplement.

Finding Benjamin Graham's Return

The rest of the story

annotation

Detailed image

Into the book

"Can you make money investing in stocks?" The early years of my investing career were a multi-year journey to answer this question.

Rather than analyzing companies and reading macroeconomic trends right away, it was far more important to answer the questions, "Does this make sense?" and "If it does make sense, can I make it happen?"

To answer this question, I devoured not only the classics of investment, but also books on management, economics, and psychology, and, above all, I pondered deeply the "efficient market hypothesis."

The current tentative conclusion is as follows from Benjamin Graham:

“Achieving satisfactory investment performance isn't as difficult as you might think, but achieving excellent performance is harder than you might think.”

---"introduction.

From "In Search of Foundation"

The stock market is a game that, if you sit down and play patiently, you will not lose easily.

Nevertheless, we cannot sit still and try to do something.

Perhaps because they are not satisfied with the average.

Or maybe you don't know how to achieve average performance, or even what that average is. What do you think when you hear, "If you just sit still, you'll earn 6-10% annually in the long run?" Many people would say, "Hey, that's what you invest in stocks for?"

One of the most frustrating times when talking about investing is when things go wrong.

A common error in statistics, and one that also has a significant impact on psychology, is "survivorship bias." As the saying goes, "dead men tell no tales."

The facts we observe today are facts that have not died and disappeared.

If we just collect the surviving facts and look for commonalities, we will fall into some error.

---「3.

From "Always a Troubled Investor"

The contrast between value and growth is completely logical.

In Chapter 3, we said that the value of a stock is the 'present discount of future cash flows.'

Future growth is a key element in creating value.

If you expect a lot of growth, you can give it a lot of value.

The important thing is to be able to quantify that expectation and compare it to the price to determine whether it is cheap or expensive.

The opposite of a 'valuable stock' would be a 'worthless stock'.

The opposite of 'high-growth stocks' would be 'low-growth stocks'.

The opposite of 'cheap stock' is simply 'expensive stock'.

Value and growth are not mutually exclusive concepts.

---「6.

Graham, still so underrated

Buffett inherited the margin of safety risk management system from Graham, but he implemented it differently.

For Graham, margin of safety meant, for example, how much he could get back if the company he invested in went bankrupt, or how much he could sell his investment for if he lost a fight with the company.

And because we can't predict the future with certainty, we diversify our investments by finding as many investments with a margin of safety as possible.

Buffett thought that hedging in this way was meaningless.

Buffett selected a few stocks that he understood better, studied them in depth, and invested heavily in them.

While the two shared the idea that knowing a lot about a company is a way to reduce risk, they differed on what type of knowledge should be accumulated.

Graham figured out his margin of safety by filling his head with a quantifiable checklist, while Buffett filled his head with knowledge of how businesses actually work.

---「7.

From "Buffett, the Unapproachable Genius"

There is a saying that goes, 'Time, not timing, is what matters.'

What's important is not timing, but time itself, that is, creating a structure where time is on your side and money grows naturally over time.

If you lean on great companies and strive to develop the discernment to identify them, you'll ultimately win. It's truly a blessing to understand Peter Lynch's words: "Don't be obsessed with market trends."

Rather than analyzing companies and reading macroeconomic trends right away, it was far more important to answer the questions, "Does this make sense?" and "If it does make sense, can I make it happen?"

To answer this question, I devoured not only the classics of investment, but also books on management, economics, and psychology, and, above all, I pondered deeply the "efficient market hypothesis."

The current tentative conclusion is as follows from Benjamin Graham:

“Achieving satisfactory investment performance isn't as difficult as you might think, but achieving excellent performance is harder than you might think.”

---"introduction.

From "In Search of Foundation"

The stock market is a game that, if you sit down and play patiently, you will not lose easily.

Nevertheless, we cannot sit still and try to do something.

Perhaps because they are not satisfied with the average.

Or maybe you don't know how to achieve average performance, or even what that average is. What do you think when you hear, "If you just sit still, you'll earn 6-10% annually in the long run?" Many people would say, "Hey, that's what you invest in stocks for?"

One of the most frustrating times when talking about investing is when things go wrong.

A common error in statistics, and one that also has a significant impact on psychology, is "survivorship bias." As the saying goes, "dead men tell no tales."

The facts we observe today are facts that have not died and disappeared.

If we just collect the surviving facts and look for commonalities, we will fall into some error.

---「3.

From "Always a Troubled Investor"

The contrast between value and growth is completely logical.

In Chapter 3, we said that the value of a stock is the 'present discount of future cash flows.'

Future growth is a key element in creating value.

If you expect a lot of growth, you can give it a lot of value.

The important thing is to be able to quantify that expectation and compare it to the price to determine whether it is cheap or expensive.

The opposite of a 'valuable stock' would be a 'worthless stock'.

The opposite of 'high-growth stocks' would be 'low-growth stocks'.

The opposite of 'cheap stock' is simply 'expensive stock'.

Value and growth are not mutually exclusive concepts.

---「6.

Graham, still so underrated

Buffett inherited the margin of safety risk management system from Graham, but he implemented it differently.

For Graham, margin of safety meant, for example, how much he could get back if the company he invested in went bankrupt, or how much he could sell his investment for if he lost a fight with the company.

And because we can't predict the future with certainty, we diversify our investments by finding as many investments with a margin of safety as possible.

Buffett thought that hedging in this way was meaningless.

Buffett selected a few stocks that he understood better, studied them in depth, and invested heavily in them.

While the two shared the idea that knowing a lot about a company is a way to reduce risk, they differed on what type of knowledge should be accumulated.

Graham figured out his margin of safety by filling his head with a quantifiable checklist, while Buffett filled his head with knowledge of how businesses actually work.

---「7.

From "Buffett, the Unapproachable Genius"

There is a saying that goes, 'Time, not timing, is what matters.'

What's important is not timing, but time itself, that is, creating a structure where time is on your side and money grows naturally over time.

If you lean on great companies and strive to develop the discernment to identify them, you'll ultimately win. It's truly a blessing to understand Peter Lynch's words: "Don't be obsessed with market trends."

---「8.

From "Lynch, the One and Only Hero"

From "Lynch, the One and Only Hero"

Publisher's Review

“I didn’t know much, but I thought I knew much

“Insight into the investment philosophies of stock market experts!”

The Meaning of Stock Investing Through the Eyes of Benjamin Graham, Warren Buffett, and Peter Lynch

The author says that the most important thing in stock investment is not 'how to make money', but establishing a system of thinking about investment.

The author emphasizes that developing and continuously refining such a mindset is a key task for sustainable performance, and that the reason we study the masters is not to imitate their trading, but to learn from their mindset and create our own.

Volume 1 closely explores the process and fruits of the investment philosophies and methods established by three giants: Benjamin Graham, Warren Buffett, and Peter Lynch.

Benjamin Graham is known as the 'founder of value investing,' but he is said to be much more than that.

He is the one who elevated stock investment from a "war of tactical forces" to a "rational process of inquiry" and a "means of income generation accessible to the public."

This book devotes a significant portion of its time to reestablishing Graham's core thought system and clearing up many misconceptions surrounding it.

The author says that Warren Buffett, who is called the 'Oracle of Omaha' and the 'investment genius', is not just an outstanding investor, but also a businessman, philosopher, and man of action.

This book focuses on how Buffett inherited and developed Graham's core thinking system.

Peter Lynch is the author's favorite investor, and he inspires hope in ordinary investors that "I can do it too."

However, Peter Lynch's thought process is often misunderstood because it is explained too easily.

This book explains not only his perspective on stocks, but also his overall portfolio management method.

“Investment methods of masters who have transcended the times

“Let’s string it all together and compile it!”

Insights into the origins and growth of modern stock investing, and the process by which the investment methods of the masters were established.

Volume 1 of "Shoulders of Giants" explains the investment methods of stock market experts through two parts: Part 1, "Do I really have to work hard?" and Part 2, "Shoulders of Giants," and eight chapters.

Part 1, "Do I really need to work hard?" explains the unique characteristics of stocks that make them different from any other asset class.

Chapter 1: Stocks, This Unusual Asset and Chapter 2: Creativity and Honesty take a closer look at what stocks are and why they have been able to deliver outstanding performance over the long term.

Chapter 3, "The Always-Hard-Hard Investor," examines in detail why investors lose money in stocks, despite their guaranteed returns.

In Chapter 4, "You Can Stop Here," we statistically verify whether "skill" actually exists in stock investment, thereby breaking down stereotypes about stock investment.

Part 2, "Shoulders of Giants," dissects the investment thinking of three investment giants: Benjamin Graham, Warren Buffett, and Peter Lynch.

In Chapter 5, "Welcome, Human," which opens Part 2, we examine why three masters are considered experts in stock investment and what they can teach those investing in stocks.

Chapter 6: Graham, Still So Underrated, discusses the investment thinking of Benjamin Graham, the founder of value investing.

Considered a pioneer in the technique of identifying undervalued stocks, this book redefines the core thinking of Benjamin Graham, one of the most underrated investment managers in the world, and dispels many of the misconceptions surrounding him.

In 'Chapter 7 Buffett, the Unapproachable Genius,' we closely examine the thoughts and investment methods of Warren Buffett, known as the 'Sage of Omaha' and the 'Investment Genius.'

Chapter 8, Lynch: The One and Only Hero, delves into Peter Lynch's investment thinking process.

This book explains that Peter Lynch's investment environment, where he bought and sold stocks with his clients' money as a "working-class" fund manager, is not fundamentally different from that of today's general investors, and details Peter Lynch's perspective on individual stocks as well as his overall portfolio management methods.

“The reason I couldn’t use it even though I read the classics of the great masters is

“Only because I haven’t read this book.”

The best investment strategy for preparing for the future is understanding the investment methods of giants.

“Can you make money investing in stocks?” The author says he wrote this book to answer this question.

To answer this question, he devoured classic investment books, as well as books on management, economics, and psychology, and pondered deeply about the 'efficient market hypothesis'. However, after reading Benjamin Graham's famous quote, he thought, 'This must be the conclusion.'

“Achieving satisfactory investment performance isn't as difficult as you might think, but achieving excellent performance is harder than you might think.”

"Shoulders of Giants" is a book filled with the author's intense struggle to properly answer the above question.

This is the fruit and culmination of research into the essence of stock investment and all the elements necessary to establish investment principles, while tracing the origins of stocks and studying the investment methods of masters.

As CEO Choi Jun-cheol mentioned in his recommendation, there is no doubt that this book could have been written by author Hong Jin-chae, who possesses the aspects of both a scientist and a philosopher.

And I think it's a book worth writing because he's achieved excess returns for 19 years.

Anyone entering the world of investing starts out learning from others, but eventually finds their own path.

We must all develop our own principles so that we can continue to invest without wavering, based on our own principles, even in real-world investment situations.

If deep reflection on what investing is and building our own experiences and decision-making systems are the path we should take, the footsteps of the masters will undoubtedly serve as a very bright beacon.

I hope and pray that this book will become the wick of that light.

“Insight into the investment philosophies of stock market experts!”

The Meaning of Stock Investing Through the Eyes of Benjamin Graham, Warren Buffett, and Peter Lynch

The author says that the most important thing in stock investment is not 'how to make money', but establishing a system of thinking about investment.

The author emphasizes that developing and continuously refining such a mindset is a key task for sustainable performance, and that the reason we study the masters is not to imitate their trading, but to learn from their mindset and create our own.

Volume 1 closely explores the process and fruits of the investment philosophies and methods established by three giants: Benjamin Graham, Warren Buffett, and Peter Lynch.

Benjamin Graham is known as the 'founder of value investing,' but he is said to be much more than that.

He is the one who elevated stock investment from a "war of tactical forces" to a "rational process of inquiry" and a "means of income generation accessible to the public."

This book devotes a significant portion of its time to reestablishing Graham's core thought system and clearing up many misconceptions surrounding it.

The author says that Warren Buffett, who is called the 'Oracle of Omaha' and the 'investment genius', is not just an outstanding investor, but also a businessman, philosopher, and man of action.

This book focuses on how Buffett inherited and developed Graham's core thinking system.

Peter Lynch is the author's favorite investor, and he inspires hope in ordinary investors that "I can do it too."

However, Peter Lynch's thought process is often misunderstood because it is explained too easily.

This book explains not only his perspective on stocks, but also his overall portfolio management method.

“Investment methods of masters who have transcended the times

“Let’s string it all together and compile it!”

Insights into the origins and growth of modern stock investing, and the process by which the investment methods of the masters were established.

Volume 1 of "Shoulders of Giants" explains the investment methods of stock market experts through two parts: Part 1, "Do I really have to work hard?" and Part 2, "Shoulders of Giants," and eight chapters.

Part 1, "Do I really need to work hard?" explains the unique characteristics of stocks that make them different from any other asset class.

Chapter 1: Stocks, This Unusual Asset and Chapter 2: Creativity and Honesty take a closer look at what stocks are and why they have been able to deliver outstanding performance over the long term.

Chapter 3, "The Always-Hard-Hard Investor," examines in detail why investors lose money in stocks, despite their guaranteed returns.

In Chapter 4, "You Can Stop Here," we statistically verify whether "skill" actually exists in stock investment, thereby breaking down stereotypes about stock investment.

Part 2, "Shoulders of Giants," dissects the investment thinking of three investment giants: Benjamin Graham, Warren Buffett, and Peter Lynch.

In Chapter 5, "Welcome, Human," which opens Part 2, we examine why three masters are considered experts in stock investment and what they can teach those investing in stocks.

Chapter 6: Graham, Still So Underrated, discusses the investment thinking of Benjamin Graham, the founder of value investing.

Considered a pioneer in the technique of identifying undervalued stocks, this book redefines the core thinking of Benjamin Graham, one of the most underrated investment managers in the world, and dispels many of the misconceptions surrounding him.

In 'Chapter 7 Buffett, the Unapproachable Genius,' we closely examine the thoughts and investment methods of Warren Buffett, known as the 'Sage of Omaha' and the 'Investment Genius.'

Chapter 8, Lynch: The One and Only Hero, delves into Peter Lynch's investment thinking process.

This book explains that Peter Lynch's investment environment, where he bought and sold stocks with his clients' money as a "working-class" fund manager, is not fundamentally different from that of today's general investors, and details Peter Lynch's perspective on individual stocks as well as his overall portfolio management methods.

“The reason I couldn’t use it even though I read the classics of the great masters is

“Only because I haven’t read this book.”

The best investment strategy for preparing for the future is understanding the investment methods of giants.

“Can you make money investing in stocks?” The author says he wrote this book to answer this question.

To answer this question, he devoured classic investment books, as well as books on management, economics, and psychology, and pondered deeply about the 'efficient market hypothesis'. However, after reading Benjamin Graham's famous quote, he thought, 'This must be the conclusion.'

“Achieving satisfactory investment performance isn't as difficult as you might think, but achieving excellent performance is harder than you might think.”

"Shoulders of Giants" is a book filled with the author's intense struggle to properly answer the above question.

This is the fruit and culmination of research into the essence of stock investment and all the elements necessary to establish investment principles, while tracing the origins of stocks and studying the investment methods of masters.

As CEO Choi Jun-cheol mentioned in his recommendation, there is no doubt that this book could have been written by author Hong Jin-chae, who possesses the aspects of both a scientist and a philosopher.

And I think it's a book worth writing because he's achieved excess returns for 19 years.

Anyone entering the world of investing starts out learning from others, but eventually finds their own path.

We must all develop our own principles so that we can continue to invest without wavering, based on our own principles, even in real-world investment situations.

If deep reflection on what investing is and building our own experiences and decision-making systems are the path we should take, the footsteps of the masters will undoubtedly serve as a very bright beacon.

I hope and pray that this book will become the wick of that light.

GOODS SPECIFICS

- Publication date: December 12, 2022

- Page count, weight, size: 416 pages | 732g | 152*225*24mm

- ISBN13: 9791192625133

- ISBN10: 1192625137

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)