There is an order to investing.

|

Description

Book Introduction

The first investment book by Hong Chun-wook, Korea's top economist.

Investment strategies for each age group, from dollars, stocks, auctions, REITs, and real estate! “The rate of return depends on the order of investments.” The first investment book by Hong Chun-wook, Korea's most trusted analyst, has been published. "Economist Hong Chun-wook's Investing Has Order" delves into the numerous investment questions the author has received from people of all ages on various channels, including YouTube. From saving for your 20s to saving for retirement in your 50s, we'll show you the best investment strategies for every age group. In particular, for retail investors who rely solely on their intuition without sufficient risk analysis or countermeasures, the author imparts the investment methods he has practiced based on his 29 years of studying money. Furthermore, living up to its title of "Korea's Top Economist's Investment Book," it covers the dollar, stocks, bonds, auctions, REITs, and real estate, and even details investment items that have shown good performance over the long term but are overlooked by most. It includes tips on how to minimize capital loss, including which stocks should be invested aggressively based on age and which stocks require careful consideration of risk, as well as how to find the investment opportunities that maximize investment returns based on individual circumstances and conditions. If money is your biggest worry, try creating an investment portfolio as Hong Chun-wook suggests in this book. No matter your age or circumstances, you can manage your money effectively and plan for a worry-free future. |

- You can preview some of the book's contents.

Preview

index

Prologue: You must save until you have accumulated seed money.

Part 1: Investment for 20-Somethings: Half-and-Half Accumulation Investment

Chapter 1: How should I start investing?

Chapter 2: How can I further improve the performance of my half-and-half investment strategy?

Chapter 3: Is there any way to save money quickly?

Chapter 4: What is Hong Chun-wook's investment philosophy?

Part 2: Investing for 30-Somethings: The Three-Part Investment Rule

Chapter 5: Can't you predict the ceiling and floor of stock prices?

Chapter 6: What if I invest in US stocks?

Chapter 7: What if I switch between US and Korean stocks at the right time?

Chapter 8: Are there any good markets to invest in besides Korean and US stocks?

Chapter 9: How does a change in government affect the economy?

Part 3: Investing for 40-Somethings: Talmud Investments

Chapter 10: Isn't Korean real estate too expensive?

Chapter 11: How do you decide when to buy or sell an apartment?

Chapter 12: Is there any way to prepare for when your expectations about the real estate market turn out to be wrong?

Chapter 13: What are your thoughts on borrowing money to invest?

Chapter 14: I'm curious about how to save money.

Part 4: Investing for People in Their 50s: The Four Dichotomies of Investing

Chapter 15: How should you invest when prices are rising sharply?

Chapter 16: How should I withdraw my retirement funds?

Chapter 17: What are some ways to study investing?

References

Part 1: Investment for 20-Somethings: Half-and-Half Accumulation Investment

Chapter 1: How should I start investing?

Chapter 2: How can I further improve the performance of my half-and-half investment strategy?

Chapter 3: Is there any way to save money quickly?

Chapter 4: What is Hong Chun-wook's investment philosophy?

Part 2: Investing for 30-Somethings: The Three-Part Investment Rule

Chapter 5: Can't you predict the ceiling and floor of stock prices?

Chapter 6: What if I invest in US stocks?

Chapter 7: What if I switch between US and Korean stocks at the right time?

Chapter 8: Are there any good markets to invest in besides Korean and US stocks?

Chapter 9: How does a change in government affect the economy?

Part 3: Investing for 40-Somethings: Talmud Investments

Chapter 10: Isn't Korean real estate too expensive?

Chapter 11: How do you decide when to buy or sell an apartment?

Chapter 12: Is there any way to prepare for when your expectations about the real estate market turn out to be wrong?

Chapter 13: What are your thoughts on borrowing money to invest?

Chapter 14: I'm curious about how to save money.

Part 4: Investing for People in Their 50s: The Four Dichotomies of Investing

Chapter 15: How should you invest when prices are rising sharply?

Chapter 16: How should I withdraw my retirement funds?

Chapter 17: What are some ways to study investing?

References

Detailed image

Into the book

When you become an adult, the amount of allowance you receive during holidays changes.

Because your maternal uncle, aunt, or paternal aunt gave you a large sum of money, something you rarely see before, to congratulate you on getting into college.

If you add up the money you save from part-time jobs and other things, it can add up to quite a lot of money.

How should I manage this money? Picking a stock you like and going all-in is one option, but there are two problems with this approach.

The first is external shock.

If a major shareholder suddenly chooses to merge the company or spin off a business unit to increase control, existing shareholders will inevitably face great risks.

The most representative example would be the merger of Dongwon Industries, famous for its canned tuna.

---From "Chapter 1: How should I start investing?"

In Chapter 1, we learned how important rate of return and investment period are in saving money.

However, the principal amount of investment is just as important as the rate of return and investment period.

Those who inherited a lot from their parents can increase their assets with sufficient investment capital, but this will be impossible for those who came from poor backgrounds.

So what should we do?

---From "Chapter 3: Is there no way to save money quickly?"

Ultimately, the argument is that rather than going all-in on the current US Nasdaq market, it may be better to diversify your investments.

The strategy created by taking the above into consideration is the 'Investment Triad'.

As the name suggests, the idea is to invest 1/3 each in Korean stocks, US stocks, and US Treasury bonds.

This way, the return is quite high because the investment proportion of stocks reaches 2/3, and since the investment proportion of US Treasury bonds is about 1/3, it provides a certain level of defense even in a crash like 2020 or 2008.

---From "Chapter 6: What if I Invest in US Stocks?"

Buying a home often feels like a 'symbol of success'.

You can tell just by looking at the friends who bought a house in a nice place and having a nice housewarming party with everyone.

However, when I was working in the financial district of Yeouido, there were many colleagues who did not own a home.

Because the argument that “stocks have a much higher return on investment than real estate, so is there really a need to buy a house?” sounded plausible.

---From "Chapter 10: Isn't Korean Real Estate Too Expensive?"

Now that we know that US REITs are a good investment, let's look at how to invest in them.

There are several ways to invest in US REITs, but the easiest and most effective is the "Three-Part Investment Rule."

To avoid confusion with the investment trichotomy introduced in Chapter 3 (US stocks + US Treasury bonds + Korean stocks), I will call it the 'Talmudic investment method.'

A simple diversification strategy introduced in the Jewish scripture, the Talmud, states that Jews divide their assets into thirds and invest them in real estate, cash, and businesses.

The "Talmudic Investment Method" is to invest in American REITs, U.S. Treasury bonds, and Korean stocks by adapting the teachings of the Talmud to today's reality.

---From "Chapter 12: Is there any way to prepare for when your expectations about the real estate market turn out to be wrong?"

While it would be great to achieve success with value investing and top-down investment strategies, it's not that easy.

Because, it's not just us who are studying, but others who are also studying hard and worrying about it.

In this respect, the stock market is like a 'speculative arena with no weight class restrictions.'

I bought Samsung Electronics today, but the person who sold it might have been Warren Buffett.

Therefore, to invest well, you need to not only study stocks, but also read books that help you develop an investment attitude.

Because your maternal uncle, aunt, or paternal aunt gave you a large sum of money, something you rarely see before, to congratulate you on getting into college.

If you add up the money you save from part-time jobs and other things, it can add up to quite a lot of money.

How should I manage this money? Picking a stock you like and going all-in is one option, but there are two problems with this approach.

The first is external shock.

If a major shareholder suddenly chooses to merge the company or spin off a business unit to increase control, existing shareholders will inevitably face great risks.

The most representative example would be the merger of Dongwon Industries, famous for its canned tuna.

---From "Chapter 1: How should I start investing?"

In Chapter 1, we learned how important rate of return and investment period are in saving money.

However, the principal amount of investment is just as important as the rate of return and investment period.

Those who inherited a lot from their parents can increase their assets with sufficient investment capital, but this will be impossible for those who came from poor backgrounds.

So what should we do?

---From "Chapter 3: Is there no way to save money quickly?"

Ultimately, the argument is that rather than going all-in on the current US Nasdaq market, it may be better to diversify your investments.

The strategy created by taking the above into consideration is the 'Investment Triad'.

As the name suggests, the idea is to invest 1/3 each in Korean stocks, US stocks, and US Treasury bonds.

This way, the return is quite high because the investment proportion of stocks reaches 2/3, and since the investment proportion of US Treasury bonds is about 1/3, it provides a certain level of defense even in a crash like 2020 or 2008.

---From "Chapter 6: What if I Invest in US Stocks?"

Buying a home often feels like a 'symbol of success'.

You can tell just by looking at the friends who bought a house in a nice place and having a nice housewarming party with everyone.

However, when I was working in the financial district of Yeouido, there were many colleagues who did not own a home.

Because the argument that “stocks have a much higher return on investment than real estate, so is there really a need to buy a house?” sounded plausible.

---From "Chapter 10: Isn't Korean Real Estate Too Expensive?"

Now that we know that US REITs are a good investment, let's look at how to invest in them.

There are several ways to invest in US REITs, but the easiest and most effective is the "Three-Part Investment Rule."

To avoid confusion with the investment trichotomy introduced in Chapter 3 (US stocks + US Treasury bonds + Korean stocks), I will call it the 'Talmudic investment method.'

A simple diversification strategy introduced in the Jewish scripture, the Talmud, states that Jews divide their assets into thirds and invest them in real estate, cash, and businesses.

The "Talmudic Investment Method" is to invest in American REITs, U.S. Treasury bonds, and Korean stocks by adapting the teachings of the Talmud to today's reality.

---From "Chapter 12: Is there any way to prepare for when your expectations about the real estate market turn out to be wrong?"

While it would be great to achieve success with value investing and top-down investment strategies, it's not that easy.

Because, it's not just us who are studying, but others who are also studying hard and worrying about it.

In this respect, the stock market is like a 'speculative arena with no weight class restrictions.'

I bought Samsung Electronics today, but the person who sold it might have been Warren Buffett.

Therefore, to invest well, you need to not only study stocks, but also read books that help you develop an investment attitude.

---From "Chapter 17: What are some ways to study investment?"

Publisher's Review

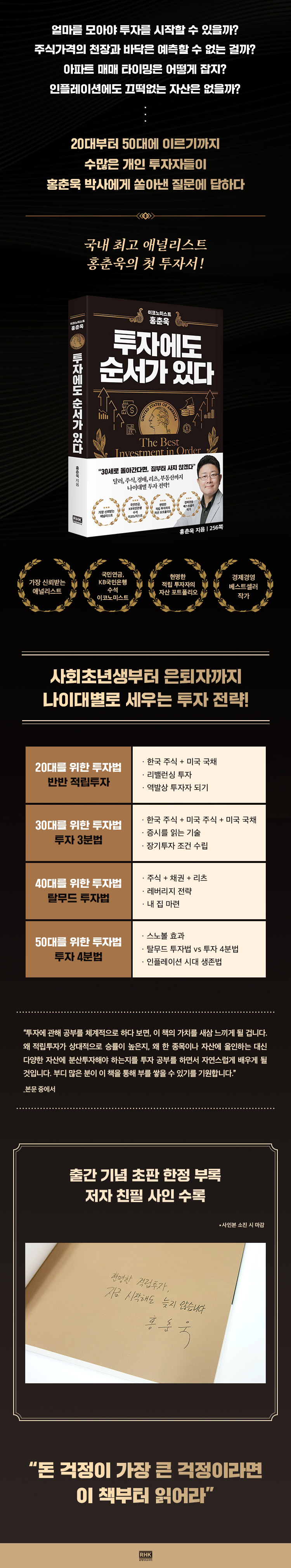

Investment portfolios by age group, from young professionals to retirees

"The rate of return varies depending on the order of investment."

The global economic journal [Bloomberg] recently predicted that housing prices would fall sharply due to interest rate hikes in each country under the headline, “Global real estate bubble begins to burst… Young people will suffer greatly.”

In addition, along with the analysis that the younger generation will suffer greatly as wages decrease and the burden of interest rates increases due to inflation, he added a warning that the middle-aged and older generation may have to worry about money until they die due to inflation, which is commonly called the "assassin of old age."

So, what's the first thing these individuals, from young adults to retirees, whose biggest worry is money, should do now? It's learning how to invest resiliently, even in the face of inflation and falling asset values.

Hong Chun-wook, author of "Economist Hong Chun-wook's Investment Order," has long served as a mentor to numerous individual investors, emphasizing the importance of investment strategies tailored to each age group, as returns can vary significantly depending on the order of investment.

In this book, he shares all the investment guidelines and know-how that investors of all ages, from their 20s to their 50s, would be curious about, such as how to start investing, how to predict the ceiling and floor of Korean and American stocks, how to determine the timing of buying and selling apartments, and what assets are stable even in inflation.

He also leverages his experience as an economist at banks and securities firms and as an investment management manager at the National Pension Service to help ordinary investors develop the ability to read the investment market and make investments on their own, based on diverse financial data and decades of statistics.

This book, the author's first investment book, is packed with the investment principles he personally experienced and practiced to achieve his current success. It will become an investment bible to keep on your bookshelf and read over and over again whenever you have free time.

From seed money in your 20s to retirement funds in your 50s,

A comprehensive collection of effective investment strategies!

"If I could go back to being 30, I wouldn't buy a house."

Among the author's numerous interviews, there is one that is still talked about to this day.

On a YouTube channel, when asked, “If you could go back to being 30, how would you invest?” he replied, “If I could go back to being 30, I wouldn’t buy a house first.”

The author's subsequent answer is as follows:

It's not like real estate is the only asset class, but it seems like many people ignore the fact that commodities like stocks, bonds, and gold have performed very well over the long term.

In this book, the author details strategies for 'accumulating' investments based on various assets, including the dollar, stocks, auctions, REITs, and real estate.

In particular, based on the past 29 years of studying money, he has painfully experienced that 'the rate of return is determined by the order of investment', and thus he emphasizes that each generation, from those in their 20s who are concerned about seed money before investing, to those in their 30s and 40s who are most economically active, to those in their 50s whose expenses are clearly increasing more than their income, and the elderly, should create an asset portfolio that can maximize the rate of return through active investment activities.

This book, consisting of four parts, introduces 'half-and-half savings investment' as an investment method for people in their 20s in Part 1.

He emphasizes that one should become a contrarian investor by using rebalancing investments as a stepping stone, as well as managing assets with Korean stocks and U.S. Treasury bonds.

In Part 2, we discuss the 'Investment Trilogy' as an investment method for those in their 30s.

I advise people in their 20s to manage their assets by adding U.S. stocks to Korean stocks and U.S. Treasury bonds, following the investment strategy suggested to them.

We also share various tips, from reading the stock market to establishing conditions for long-term investment, to help you develop the ability to read investment trends.

In Part 3, we propose the 'Talmudic Investment Method' as an investment method for those in their 40s.

This investment strategy, based on stocks, bonds, and REITs, offers a realistic alternative to homeownership.

In the final part 4, we recommend the 'Investment Four-Part Method' as an investment method for people in their 50s.

In addition to the previously introduced Talmud investment method, we introduce a new investment strategy called the Four-Pronged Investment Method, which allows for diversified investments according to individual circumstances. This investment method provides stable investment performance even when the risk of inflation increases.

It covers a variety of investment strategies, including retirement savings and even inheritance to children, and is expected to completely resolve the major investment concerns of middle-aged and older people.

Even though countless investment books are being released these days, one thing is clear: blindly focusing on specific stocks isn't the only way to get on the fast track to wealth.

Is it possible to invest all your money in one stock while struggling with work or studying all day? If you want to prepare for an uncertain retirement and achieve financial stability faster than others, read this book.

By learning Hong Chun-wook's 17 investment strategies and know-how, which embody his lifelong investment principles, you can survive the challenging investment market and become a wise investor.

As soon as you turn the first page, your investment is already on the road to success.

"The rate of return varies depending on the order of investment."

The global economic journal [Bloomberg] recently predicted that housing prices would fall sharply due to interest rate hikes in each country under the headline, “Global real estate bubble begins to burst… Young people will suffer greatly.”

In addition, along with the analysis that the younger generation will suffer greatly as wages decrease and the burden of interest rates increases due to inflation, he added a warning that the middle-aged and older generation may have to worry about money until they die due to inflation, which is commonly called the "assassin of old age."

So, what's the first thing these individuals, from young adults to retirees, whose biggest worry is money, should do now? It's learning how to invest resiliently, even in the face of inflation and falling asset values.

Hong Chun-wook, author of "Economist Hong Chun-wook's Investment Order," has long served as a mentor to numerous individual investors, emphasizing the importance of investment strategies tailored to each age group, as returns can vary significantly depending on the order of investment.

In this book, he shares all the investment guidelines and know-how that investors of all ages, from their 20s to their 50s, would be curious about, such as how to start investing, how to predict the ceiling and floor of Korean and American stocks, how to determine the timing of buying and selling apartments, and what assets are stable even in inflation.

He also leverages his experience as an economist at banks and securities firms and as an investment management manager at the National Pension Service to help ordinary investors develop the ability to read the investment market and make investments on their own, based on diverse financial data and decades of statistics.

This book, the author's first investment book, is packed with the investment principles he personally experienced and practiced to achieve his current success. It will become an investment bible to keep on your bookshelf and read over and over again whenever you have free time.

From seed money in your 20s to retirement funds in your 50s,

A comprehensive collection of effective investment strategies!

"If I could go back to being 30, I wouldn't buy a house."

Among the author's numerous interviews, there is one that is still talked about to this day.

On a YouTube channel, when asked, “If you could go back to being 30, how would you invest?” he replied, “If I could go back to being 30, I wouldn’t buy a house first.”

The author's subsequent answer is as follows:

It's not like real estate is the only asset class, but it seems like many people ignore the fact that commodities like stocks, bonds, and gold have performed very well over the long term.

In this book, the author details strategies for 'accumulating' investments based on various assets, including the dollar, stocks, auctions, REITs, and real estate.

In particular, based on the past 29 years of studying money, he has painfully experienced that 'the rate of return is determined by the order of investment', and thus he emphasizes that each generation, from those in their 20s who are concerned about seed money before investing, to those in their 30s and 40s who are most economically active, to those in their 50s whose expenses are clearly increasing more than their income, and the elderly, should create an asset portfolio that can maximize the rate of return through active investment activities.

This book, consisting of four parts, introduces 'half-and-half savings investment' as an investment method for people in their 20s in Part 1.

He emphasizes that one should become a contrarian investor by using rebalancing investments as a stepping stone, as well as managing assets with Korean stocks and U.S. Treasury bonds.

In Part 2, we discuss the 'Investment Trilogy' as an investment method for those in their 30s.

I advise people in their 20s to manage their assets by adding U.S. stocks to Korean stocks and U.S. Treasury bonds, following the investment strategy suggested to them.

We also share various tips, from reading the stock market to establishing conditions for long-term investment, to help you develop the ability to read investment trends.

In Part 3, we propose the 'Talmudic Investment Method' as an investment method for those in their 40s.

This investment strategy, based on stocks, bonds, and REITs, offers a realistic alternative to homeownership.

In the final part 4, we recommend the 'Investment Four-Part Method' as an investment method for people in their 50s.

In addition to the previously introduced Talmud investment method, we introduce a new investment strategy called the Four-Pronged Investment Method, which allows for diversified investments according to individual circumstances. This investment method provides stable investment performance even when the risk of inflation increases.

It covers a variety of investment strategies, including retirement savings and even inheritance to children, and is expected to completely resolve the major investment concerns of middle-aged and older people.

Even though countless investment books are being released these days, one thing is clear: blindly focusing on specific stocks isn't the only way to get on the fast track to wealth.

Is it possible to invest all your money in one stock while struggling with work or studying all day? If you want to prepare for an uncertain retirement and achieve financial stability faster than others, read this book.

By learning Hong Chun-wook's 17 investment strategies and know-how, which embody his lifelong investment principles, you can survive the challenging investment market and become a wise investor.

As soon as you turn the first page, your investment is already on the road to success.

GOODS SPECIFICS

- Publication date: September 24, 2022

- Page count, weight, size: 256 pages | 514g | 145*215*20mm

- ISBN13: 9788925577500

- ISBN10: 892557750X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)