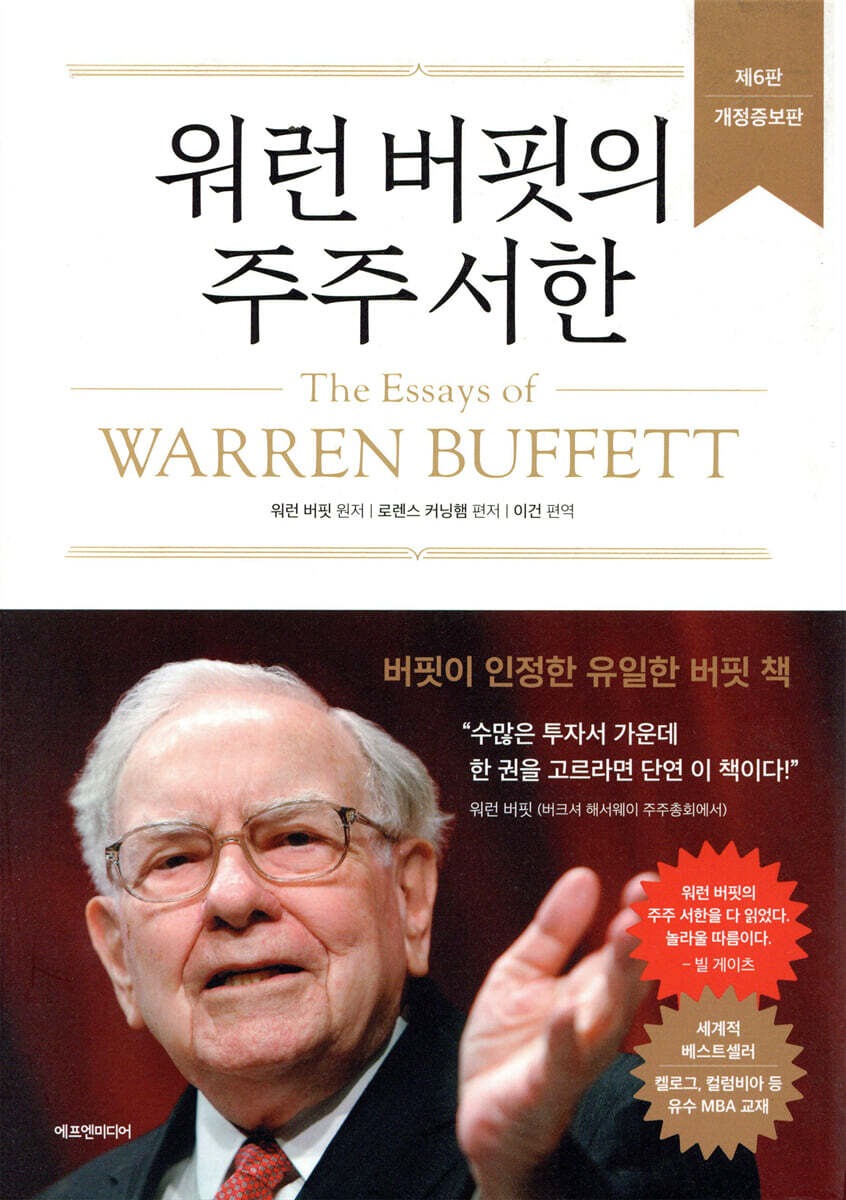

Warren Buffett's Shareholder Letter

|

Description

Book Introduction

A treasure trove of insights into 'knowledge' A timeless "masterclass" for investors, covering not only investment but also management and life wisdom. Warren Buffett's 43-year, painstakingly written shareholder letters from 1979 to 2021 (published in 2022) have been compiled into a single volume for easy understanding by ordinary investors. Lawrence Cunningham, a Buffett expert acknowledged by Warren Buffett, reorganized the voluminous shareholder letters into 10 themes, and investment book expert translator Lee Geon reorganized and translated them to suit the needs of Korean investors. It is evaluated as having 'organized Buffett's simple yet complex intellectual system and the 'grand Buffett universe' in an orderly and clear manner.' "The Essays of Warren Buffett" is also significant in that Buffett officially recommended it as the best book representing his philosophy at Berkshire Hathaway's annual shareholders' meetings (1998 and 2000). Since its first publication in 1997, it has been revised and expanded repeatedly, and has become a global bestseller, being used as a textbook at prestigious business schools such as Kellogg and Columbia. In this book, Warren Buffett generously shares his expertise on the fundamental principles of sound business management, manager selection and investment, corporate evaluation, and the use of financial information. There is no denying that this book is a timeless masterclass for investors seeking to learn the philosophy and investment methods of "the greatest investor in history," while also offering a wealth of wisdom and a broad perspective to both business executives and general readers. |

- You can preview some of the book's contents.

Preview

index

Recommendation | The Power of Originality _ Choi Jun-cheol

Recommendation | Why Buffett _ Hong Jin-chae

Editor's Preface

Preface.

Owner-Related Business Principles

Chapter 1.

Corporate Governance

A.

Full and fair disclosure

B.

Board of Directors and Management

C.

The agony of factory closures

D.

Public interest enterprises and social contracts

E.

Shareholder-centered corporate philanthropy

F.

Principles for Executive Compensation

G.

You may lose money, but you must not lose your reputation.

H.

A corporate culture with a strong sense of ownership

Chapter 2.

invest

A.

Real estate investment and stock investment

B.

Mr. Market

C.

Conditions for arbitrage

D.

Refutation of the efficient market theory

E.

'Value investing' is a redundant term

F.

Smart Investment

G.

Cigarette Butt Investment and Institutional Practices

H.

Debt is dangerous

Chapter 3.

Alternatives to stocks

A.

The most excellent type of investment

B.

The Parable of Junk Bonds and the Dagger

C.

A robber wearing a zero-coupon bond and a ski mask

D.

Preferred stock investment

E.

About derivatives

F.

The fiscal deficit is okay, but the current account deficit is a problem.

G.

A home is not something you buy, it's something you own.

H.

Great joint venture

Chapter 4.

stock

A.

Index funds win in the end.

B.

Suitable shareholders for the company

C.

Stock splits and the invisible foot

D.

Berkshire B share issuance

E.

Conditions for purchasing treasury stock

F.

Dividends and Capital Allocation

Chapter 5.

corporate acquisitions

A.

Bad incentives to pay high prices

B.

Reasonable treasury stock buybacks and green mail

C.

The truth and lies of leveraged buyouts

D.

sound acquisition policy

E.

Win-win corporate sale

F.

Berkshire's acquisition strengths

Chapter 6.

valuation

A.

Aesop and the Inefficient Forest Theory

B.

About intrinsic value, book value, and market price

C.

Reported income and comprehensive income

D.

Economic goodwill and accounting goodwill

E.

Shareholder Interest and Cash Flow Errors

F.

How to Evaluate Options

Chapter 7.

accounting

A. Satire about US Steel

B.

Difficulty in setting standards

C.

An audit committee that is not grateful

D.

The manager's numbers game

E.

Pension estimates and retiree benefits

F.

Net income is meaningless

G.

Blind spots in accounting

Chapter 8.

duty

A.

Who bears the corporate tax?

B.

The Impact of Taxes on Profits

Chapter 9.

history

A.

American Miracle

B.

Productivity Drives Prosperity

C.

Don't bet against America's downfall.

Chapter 10.

Conclusion

A.

Berkshire's corporate culture

B.

Charlie Munger's "Berkshire System"

C.

The Record of Methuselah

Chapter Summary (Lawrence Cunningham)

1.

Corporate Governance

2.

invest

3.

Alternatives to stocks

4.

stock

5.

corporate acquisitions

6.

valuation

7.

accounting

8.

duty

9.

history

10.

Conclusion

Data | Comparing Berkshire's and the S&P 500's Performance

Translator's Note

Search

Recommendation | Why Buffett _ Hong Jin-chae

Editor's Preface

Preface.

Owner-Related Business Principles

Chapter 1.

Corporate Governance

A.

Full and fair disclosure

B.

Board of Directors and Management

C.

The agony of factory closures

D.

Public interest enterprises and social contracts

E.

Shareholder-centered corporate philanthropy

F.

Principles for Executive Compensation

G.

You may lose money, but you must not lose your reputation.

H.

A corporate culture with a strong sense of ownership

Chapter 2.

invest

A.

Real estate investment and stock investment

B.

Mr. Market

C.

Conditions for arbitrage

D.

Refutation of the efficient market theory

E.

'Value investing' is a redundant term

F.

Smart Investment

G.

Cigarette Butt Investment and Institutional Practices

H.

Debt is dangerous

Chapter 3.

Alternatives to stocks

A.

The most excellent type of investment

B.

The Parable of Junk Bonds and the Dagger

C.

A robber wearing a zero-coupon bond and a ski mask

D.

Preferred stock investment

E.

About derivatives

F.

The fiscal deficit is okay, but the current account deficit is a problem.

G.

A home is not something you buy, it's something you own.

H.

Great joint venture

Chapter 4.

stock

A.

Index funds win in the end.

B.

Suitable shareholders for the company

C.

Stock splits and the invisible foot

D.

Berkshire B share issuance

E.

Conditions for purchasing treasury stock

F.

Dividends and Capital Allocation

Chapter 5.

corporate acquisitions

A.

Bad incentives to pay high prices

B.

Reasonable treasury stock buybacks and green mail

C.

The truth and lies of leveraged buyouts

D.

sound acquisition policy

E.

Win-win corporate sale

F.

Berkshire's acquisition strengths

Chapter 6.

valuation

A.

Aesop and the Inefficient Forest Theory

B.

About intrinsic value, book value, and market price

C.

Reported income and comprehensive income

D.

Economic goodwill and accounting goodwill

E.

Shareholder Interest and Cash Flow Errors

F.

How to Evaluate Options

Chapter 7.

accounting

A. Satire about US Steel

B.

Difficulty in setting standards

C.

An audit committee that is not grateful

D.

The manager's numbers game

E.

Pension estimates and retiree benefits

F.

Net income is meaningless

G.

Blind spots in accounting

Chapter 8.

duty

A.

Who bears the corporate tax?

B.

The Impact of Taxes on Profits

Chapter 9.

history

A.

American Miracle

B.

Productivity Drives Prosperity

C.

Don't bet against America's downfall.

Chapter 10.

Conclusion

A.

Berkshire's corporate culture

B.

Charlie Munger's "Berkshire System"

C.

The Record of Methuselah

Chapter Summary (Lawrence Cunningham)

1.

Corporate Governance

2.

invest

3.

Alternatives to stocks

4.

stock

5.

corporate acquisitions

6.

valuation

7.

accounting

8.

duty

9.

history

10.

Conclusion

Data | Comparing Berkshire's and the S&P 500's Performance

Translator's Note

Search

Detailed image

.jpg)

Into the book

1.

Although Berkshire's form is that of a corporation, our mindset is that of a partnership.

Charlie and I think of the shareholders as owner-partners and we are managing-partners (we own so much stock that, for better or worse, we are also controlling-partners).

We do not view the company as the ultimate owner of business assets.

A company is merely a vehicle for shareholders to hold assets.

Charlie and I want our shareholders to stop looking at stocks as pieces of paper.

A piece of paper that you can throw away when prices fluctuate daily and political and economic events worry you.

Instead, think of it as owning a piece of a company that will be with you forever.

Like owning a farm or an apartment with your family.

We believe that Berkshire shareholders are not a faceless, constantly changing crowd, but rather partners who have trusted us with their money for life.

---From "Preface: Owner-Related Business Principles"

Your company is 100% prepared for our demise.

We have five reasons for our optimism.

First, Berkshire's diverse portfolio of controlled companies generates attractive returns on capital overall.

Second, Berkshire continues to enjoy significant economic benefits by holding its controlled companies within a single (conglomerate) enterprise.

Third, Berkshire's exceptionally sound financial structure allows it to withstand even extreme external shocks.

Fourth, Berkshire has talented and dedicated managers who enjoy running the company far more than high salaries or fame.

Fifth, Berkshire's directors (who protect shareholders) are always focused on the interests of shareholders and the development of the corporate culture.

---「Chapter 1.

From “Corporate Governance”

We believe there is no fundamental difference between acquiring a company outright or buying a stake in the market.

Whichever method we choose, we want to buy companies with good long-term economic performance.

Our goal is to buy excellent companies at reasonable prices, not just average companies at cheap prices.

---「Chapter 2.

Among the "Investments"

Your investment objective should be to buy shares in easily understandable companies at a reasonable price that are certain to generate significantly higher profits 10 or 20 years from now.

As time goes by, you'll only find a few companies that fit these criteria.

So, when you find such a company, you should buy a lot of its stock.

We must also resist the temptation to deviate from the guidelines.

If you don't intend to hold it for 10 years, you shouldn't hold it for even 10 minutes.

Build your portfolio around companies that have consistently grown their profits over the long term.

Then, the valuation of the portfolio will also increase steadily over a long period of time.

---「Chapter 2.

Among the "Investments"

All we know is that the super-powerful epidemics of fear and greed that have plagued the investment world from time to time will continue to plague the world.

There is no way to predict when this pandemic will occur.

And it's equally unpredictable how long and how severely the market will be derailed by this pandemic.

So we have no intention of predicting when fear or greed will come and when it will go.

Our goal is more modest.

We want to be fearful when others are greedy, and greedy only when others are fearful.

---「Chapter 4.

Among the "stocks"

Excluding taxes, the formula we use to value stocks and companies is the same.

In fact, the formula for valuing any asset bought for profit has remained unchanged since it was first proposed by a very wise man around 600 BC (who probably didn't realize it was 600 BC).

The man who said that was Aesop, and his investment insight, which has survived to this day, though somewhat imperfectly, is, “A bird in the hand is worth two in the bush.”

To follow this principle, you must answer three questions:

(1) How can we be sure there are actually birds in the forest? (2) How many birds will appear and when? (3) What is the risk-free interest rate (the yield on long-term U.S. Treasury bonds)? Answering these three questions will reveal the forest's maximum value.

You can also find out how many birds you currently have in your hand to trade for.

Of course, don't think of it literally as new.

Think of it in terms of money.

---「Chapter 6.

From “Value Assessment”

Whether based on GAAP or not, reporting materials should answer three key questions for those who understand the financial statements:

(1) Approximately how much is this company worth? (2) How capable is it of repaying its debt in the future? (3) Based on past performance, how well has the management performed?

Reporting that adheres only to the minimum standards of GAAP often makes it difficult or impossible to answer these questions.

The world of business is so complex that no single set of principles can effectively capture the economic realities of all businesses.

This is especially true for companies like Berkshire, which operates in such diverse businesses.

Although Berkshire's form is that of a corporation, our mindset is that of a partnership.

Charlie and I think of the shareholders as owner-partners and we are managing-partners (we own so much stock that, for better or worse, we are also controlling-partners).

We do not view the company as the ultimate owner of business assets.

A company is merely a vehicle for shareholders to hold assets.

Charlie and I want our shareholders to stop looking at stocks as pieces of paper.

A piece of paper that you can throw away when prices fluctuate daily and political and economic events worry you.

Instead, think of it as owning a piece of a company that will be with you forever.

Like owning a farm or an apartment with your family.

We believe that Berkshire shareholders are not a faceless, constantly changing crowd, but rather partners who have trusted us with their money for life.

---From "Preface: Owner-Related Business Principles"

Your company is 100% prepared for our demise.

We have five reasons for our optimism.

First, Berkshire's diverse portfolio of controlled companies generates attractive returns on capital overall.

Second, Berkshire continues to enjoy significant economic benefits by holding its controlled companies within a single (conglomerate) enterprise.

Third, Berkshire's exceptionally sound financial structure allows it to withstand even extreme external shocks.

Fourth, Berkshire has talented and dedicated managers who enjoy running the company far more than high salaries or fame.

Fifth, Berkshire's directors (who protect shareholders) are always focused on the interests of shareholders and the development of the corporate culture.

---「Chapter 1.

From “Corporate Governance”

We believe there is no fundamental difference between acquiring a company outright or buying a stake in the market.

Whichever method we choose, we want to buy companies with good long-term economic performance.

Our goal is to buy excellent companies at reasonable prices, not just average companies at cheap prices.

---「Chapter 2.

Among the "Investments"

Your investment objective should be to buy shares in easily understandable companies at a reasonable price that are certain to generate significantly higher profits 10 or 20 years from now.

As time goes by, you'll only find a few companies that fit these criteria.

So, when you find such a company, you should buy a lot of its stock.

We must also resist the temptation to deviate from the guidelines.

If you don't intend to hold it for 10 years, you shouldn't hold it for even 10 minutes.

Build your portfolio around companies that have consistently grown their profits over the long term.

Then, the valuation of the portfolio will also increase steadily over a long period of time.

---「Chapter 2.

Among the "Investments"

All we know is that the super-powerful epidemics of fear and greed that have plagued the investment world from time to time will continue to plague the world.

There is no way to predict when this pandemic will occur.

And it's equally unpredictable how long and how severely the market will be derailed by this pandemic.

So we have no intention of predicting when fear or greed will come and when it will go.

Our goal is more modest.

We want to be fearful when others are greedy, and greedy only when others are fearful.

---「Chapter 4.

Among the "stocks"

Excluding taxes, the formula we use to value stocks and companies is the same.

In fact, the formula for valuing any asset bought for profit has remained unchanged since it was first proposed by a very wise man around 600 BC (who probably didn't realize it was 600 BC).

The man who said that was Aesop, and his investment insight, which has survived to this day, though somewhat imperfectly, is, “A bird in the hand is worth two in the bush.”

To follow this principle, you must answer three questions:

(1) How can we be sure there are actually birds in the forest? (2) How many birds will appear and when? (3) What is the risk-free interest rate (the yield on long-term U.S. Treasury bonds)? Answering these three questions will reveal the forest's maximum value.

You can also find out how many birds you currently have in your hand to trade for.

Of course, don't think of it literally as new.

Think of it in terms of money.

---「Chapter 6.

From “Value Assessment”

Whether based on GAAP or not, reporting materials should answer three key questions for those who understand the financial statements:

(1) Approximately how much is this company worth? (2) How capable is it of repaying its debt in the future? (3) Based on past performance, how well has the management performed?

Reporting that adheres only to the minimum standards of GAAP often makes it difficult or impossible to answer these questions.

The world of business is so complex that no single set of principles can effectively capture the economic realities of all businesses.

This is especially true for companies like Berkshire, which operates in such diverse businesses.

---「Chapter 7.

From "Accounting"

From "Accounting"

Publisher's Review

“What books should I read to become as good at investing as you?”

“If I had to pick one investment book out of the countless books out there, it would definitely be this one!”

Warren Buffett was asked at the 1998 Berkshire Hathaway annual meeting, “What books should I read to become as good an investor as you are?” and he answered:

“First of all, I recommend reading the shareholder letter.

It will help you understand my philosophy better than any other writing.

As it happens, Lawrence Cunningham has compiled decades of accumulated shareholder letters in a very well-organized manner.

“There is no better book than this.”

When the same question was asked in 2000, he once again officially acknowledged, “If I had to pick just one book that represents my investment philosophy, it would be Lawrence Cunningham’s book, which is a clear and concise summary of my writings without any editing.” He added, “The decades of shareholder letters included in this book are the essence of my investment philosophy.”

'Buffett expert' Lawrence Cunningham and 'Buffett fanatic' Lee Geon are translators.

Unraveling the Grand Buffett Universe in an Orderly and Clear Way

Is there a book Warren Buffett wrote for investors (○) or not (×)? To cut to the chase, the correct answer is a triangle (△).

The only writing Buffett writes directly to the public is the shareholder letter that appears in Berkshire Hathaway's annual report.

Shareholder letters are essential reading and awaited by investors worldwide, embodying the fundamental principles of sound corporate governance and offering a wealth of wisdom from a broad perspective on management selection, investment, corporate valuation, and the use of financial information.

Buffett's shareholder letters go beyond abstract, platitudes to elaborate on concrete principles that he has actually followed and achieved results.

Therefore, Warren Buffett's Shareholder Letters, which is a compilation of shareholder letters organized by topic and officially recommended by Buffett, is 'virtually the only book written by Buffett himself.'

Lawrence Cunningham, the editor of this book, is a professor at the Tucker Research Center at George Washington University and an authority on corporate culture and investment.

He is a 'Buffett expert' acknowledged by Buffett himself, and he successfully completed the enormous task of classifying and rearranging the contents of 40 years of shareholder letters from 1979 to 2018 into 10 topics.

The original book (The Essays of Warren Buffett) has been revised and expanded since its first publication in 1997, and is recognized as the best investment book and the definitive edition of Buffett's investment philosophy.

It has been adopted as a textbook for investment, finance, and accounting classes at leading U.S. business schools and universities, including Kellogg (Northwestern University), Columbia, Sloan (MIT), and Haas (UC Berkeley), and some investment firms have distributed it as training material to their employees and clients.

The recently published domestic version of Warren Buffett's Shareholder Letters is the 6th revised edition. While the original book includes shareholder letters up to 2018, the Korean edition includes letters from 2019 to 2021 translated by the editor for readers who are curious about the latest content, making it a total of 43 years worth of content.

Translator Lee Geon-eun, a professional translator of investment books and a Buffett fanatic, is praised for his work with Lawrence Cunningham to unravel the "grand Buffett universe" and Buffett's simple yet complex intellectual system in an orderly and clear manner.

A treasure trove of insights into 'knowledge'

A timeless 'masterclass' for investors

The book begins with "Ownership Business Principles," a document Buffett wrote to inform Berkshire Hathaway shareholders about the company's business, goals, and philosophy.

The famous "Berkshire's form is a corporation, but our heart is a partnership" is Principle No. 1.

The following shareholder letters are organized into ten topics: corporate governance, investing, alternatives to stocks, stocks, acquisitions, valuation, accounting, taxes, history, and concluding remarks, effectively conveying Buffett's sound management and investment philosophy in an easy-to-understand manner.

Finally, the editor briefly summarized each chapter.

Reading Buffett's characteristically honest and straightforward writing style, with humor and proverbs, will help you understand even difficult content with ease.

His sound common sense, strong sense of ethics, and keen insight into identifying talented individuals are also impressive.

Bill Gates said, “I’ve read all of Warren Buffett’s shareholder letters,” and “You can enjoy Buffett’s wisdom just by reading his shareholder letters.”

Howard Marks also frequently quotes Buffett's words and writings in his famous 'Memo'.

Choi Jun-cheol, CEO of VIP Asset Management, who is called the “Little Buffett of Korea,” said, “Buffett has praised this book as his one-pick among books on his investment methods.

“Having read almost every book on Buffett, I agree,” he said in his recommendation.

Hong Jin-chae, CEO of Raccoon Asset Management, said, “Anyone who wants to study Buffett’s investment method must start with this book.

I also started with this book.

“It was the greatest luck of my life as an investor,” he emphasized.

In addition, many domestic investment authorities, including Kim Hak-gyun, head of the Shinyoung Securities Research Center, and Lee Chae-won, chairman of the board of directors of Life Asset Management, strongly recommended the company.

Warren Buffett is respected worldwide as one of the most successful investment gurus in history.

The stock price of Berkshire Hathaway, managed by Buffett, rose 20.1% annually over 57 years from early 1965, when he acquired the company, to the end of 2021, recording a cumulative return of 3,641,613%.

If you invested $100 in the S&P 500 in early 1965, it would have grown to $32,009 by the end of 2021, while if you invested it in Berkshire, it would have grown to a whopping $3,641,613.

Buffett is the only investor who has achieved such 'long-term proven' high returns.

“If I had to pick one investment book out of the countless books out there, it would definitely be this one!”

Warren Buffett was asked at the 1998 Berkshire Hathaway annual meeting, “What books should I read to become as good an investor as you are?” and he answered:

“First of all, I recommend reading the shareholder letter.

It will help you understand my philosophy better than any other writing.

As it happens, Lawrence Cunningham has compiled decades of accumulated shareholder letters in a very well-organized manner.

“There is no better book than this.”

When the same question was asked in 2000, he once again officially acknowledged, “If I had to pick just one book that represents my investment philosophy, it would be Lawrence Cunningham’s book, which is a clear and concise summary of my writings without any editing.” He added, “The decades of shareholder letters included in this book are the essence of my investment philosophy.”

'Buffett expert' Lawrence Cunningham and 'Buffett fanatic' Lee Geon are translators.

Unraveling the Grand Buffett Universe in an Orderly and Clear Way

Is there a book Warren Buffett wrote for investors (○) or not (×)? To cut to the chase, the correct answer is a triangle (△).

The only writing Buffett writes directly to the public is the shareholder letter that appears in Berkshire Hathaway's annual report.

Shareholder letters are essential reading and awaited by investors worldwide, embodying the fundamental principles of sound corporate governance and offering a wealth of wisdom from a broad perspective on management selection, investment, corporate valuation, and the use of financial information.

Buffett's shareholder letters go beyond abstract, platitudes to elaborate on concrete principles that he has actually followed and achieved results.

Therefore, Warren Buffett's Shareholder Letters, which is a compilation of shareholder letters organized by topic and officially recommended by Buffett, is 'virtually the only book written by Buffett himself.'

Lawrence Cunningham, the editor of this book, is a professor at the Tucker Research Center at George Washington University and an authority on corporate culture and investment.

He is a 'Buffett expert' acknowledged by Buffett himself, and he successfully completed the enormous task of classifying and rearranging the contents of 40 years of shareholder letters from 1979 to 2018 into 10 topics.

The original book (The Essays of Warren Buffett) has been revised and expanded since its first publication in 1997, and is recognized as the best investment book and the definitive edition of Buffett's investment philosophy.

It has been adopted as a textbook for investment, finance, and accounting classes at leading U.S. business schools and universities, including Kellogg (Northwestern University), Columbia, Sloan (MIT), and Haas (UC Berkeley), and some investment firms have distributed it as training material to their employees and clients.

The recently published domestic version of Warren Buffett's Shareholder Letters is the 6th revised edition. While the original book includes shareholder letters up to 2018, the Korean edition includes letters from 2019 to 2021 translated by the editor for readers who are curious about the latest content, making it a total of 43 years worth of content.

Translator Lee Geon-eun, a professional translator of investment books and a Buffett fanatic, is praised for his work with Lawrence Cunningham to unravel the "grand Buffett universe" and Buffett's simple yet complex intellectual system in an orderly and clear manner.

A treasure trove of insights into 'knowledge'

A timeless 'masterclass' for investors

The book begins with "Ownership Business Principles," a document Buffett wrote to inform Berkshire Hathaway shareholders about the company's business, goals, and philosophy.

The famous "Berkshire's form is a corporation, but our heart is a partnership" is Principle No. 1.

The following shareholder letters are organized into ten topics: corporate governance, investing, alternatives to stocks, stocks, acquisitions, valuation, accounting, taxes, history, and concluding remarks, effectively conveying Buffett's sound management and investment philosophy in an easy-to-understand manner.

Finally, the editor briefly summarized each chapter.

Reading Buffett's characteristically honest and straightforward writing style, with humor and proverbs, will help you understand even difficult content with ease.

His sound common sense, strong sense of ethics, and keen insight into identifying talented individuals are also impressive.

Bill Gates said, “I’ve read all of Warren Buffett’s shareholder letters,” and “You can enjoy Buffett’s wisdom just by reading his shareholder letters.”

Howard Marks also frequently quotes Buffett's words and writings in his famous 'Memo'.

Choi Jun-cheol, CEO of VIP Asset Management, who is called the “Little Buffett of Korea,” said, “Buffett has praised this book as his one-pick among books on his investment methods.

“Having read almost every book on Buffett, I agree,” he said in his recommendation.

Hong Jin-chae, CEO of Raccoon Asset Management, said, “Anyone who wants to study Buffett’s investment method must start with this book.

I also started with this book.

“It was the greatest luck of my life as an investor,” he emphasized.

In addition, many domestic investment authorities, including Kim Hak-gyun, head of the Shinyoung Securities Research Center, and Lee Chae-won, chairman of the board of directors of Life Asset Management, strongly recommended the company.

Warren Buffett is respected worldwide as one of the most successful investment gurus in history.

The stock price of Berkshire Hathaway, managed by Buffett, rose 20.1% annually over 57 years from early 1965, when he acquired the company, to the end of 2021, recording a cumulative return of 3,641,613%.

If you invested $100 in the S&P 500 in early 1965, it would have grown to $32,009 by the end of 2021, while if you invested it in Berkshire, it would have grown to a whopping $3,641,613.

Buffett is the only investor who has achieved such 'long-term proven' high returns.

GOODS SPECIFICS

- Date of issue: August 1, 2022

- Format: Hardcover book binding method guide

- Page count, weight, size: 640 pages | 998g | 152*215*35mm

- ISBN13: 9791188754649

- ISBN10: 1188754645

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)