The Instinct of Wealth Gold Edition

|

Description

Book Introduction

"A Practical Guide to Investing That Never Fails"

"The Humanities of Wealth": An inspiring financial bible that launched the Woo Seok myth.

A masterpiece that introduced the world to Woo-seok, the most viewed debater on Naver's representative cafe, "Real Estate Study."

For those who are not feeling up to investing, we offer root cause analysis and solutions.

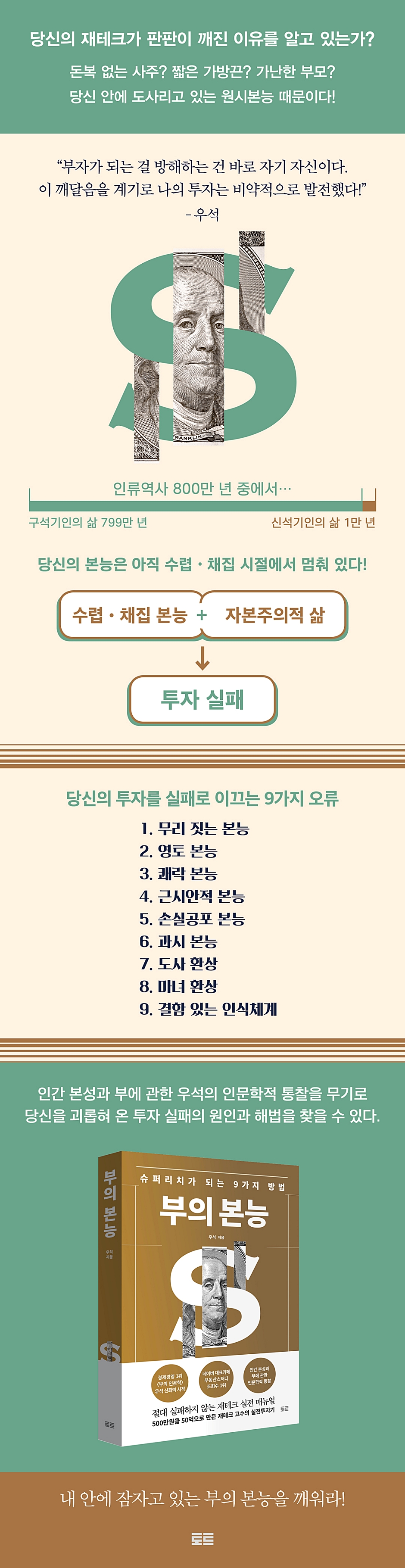

There are nine psychological obstacles within us that prevent us from becoming rich.

The culprits are instincts that have been ingrained in our genes since the primitive era, such as the herding instinct, territorial instinct, pleasure instinct, myopia instinct, loss fear instinct, showing off instinct, Taoist fantasy, witch fantasy, and errors in the cognitive system.

This book presents the properties of the nine internal obstacles and practical investment methods to overcome them.

Additionally, by presenting eight tools to awaken your wealth instinct and ten customized solutions for each type, it provides investment guides tailored to each individual's unique characteristics and money-making guidelines that can be implemented immediately in everyday life.

By analyzing how to overcome innate cognitive deficiencies and develop a balanced investment perspective, solutions for the unwavering investor mindset, and the impact of the Fourth Industrial Revolution and population decline on real estate and stock investments, this book offers a compelling perspective on investment direction.

The Practical Investment Story of a Financial Expert Who Turned 5 Million Won into 5 Billion Won

The author started with nothing, made billions, failed in his investments, became broke again, and then succeeded in his early 40s, retiring and living a life of financial freedom.

He honestly reveals the philosophy and practical investment methods he has acquired in the process, and imparts investment know-how that will not fail.

After reading this book, you will not only realize the real problem that has kept you from making money, but you will also learn how to overcome it.

If you learn and practice the methods presented in this book, you will no longer be driven by money; on the contrary, you will become masters of money.

You will gain more confidence in your finances and a blueprint for a future where you can achieve financial freedom.

"The Humanities of Wealth": An inspiring financial bible that launched the Woo Seok myth.

A masterpiece that introduced the world to Woo-seok, the most viewed debater on Naver's representative cafe, "Real Estate Study."

For those who are not feeling up to investing, we offer root cause analysis and solutions.

There are nine psychological obstacles within us that prevent us from becoming rich.

The culprits are instincts that have been ingrained in our genes since the primitive era, such as the herding instinct, territorial instinct, pleasure instinct, myopia instinct, loss fear instinct, showing off instinct, Taoist fantasy, witch fantasy, and errors in the cognitive system.

This book presents the properties of the nine internal obstacles and practical investment methods to overcome them.

Additionally, by presenting eight tools to awaken your wealth instinct and ten customized solutions for each type, it provides investment guides tailored to each individual's unique characteristics and money-making guidelines that can be implemented immediately in everyday life.

By analyzing how to overcome innate cognitive deficiencies and develop a balanced investment perspective, solutions for the unwavering investor mindset, and the impact of the Fourth Industrial Revolution and population decline on real estate and stock investments, this book offers a compelling perspective on investment direction.

The Practical Investment Story of a Financial Expert Who Turned 5 Million Won into 5 Billion Won

The author started with nothing, made billions, failed in his investments, became broke again, and then succeeded in his early 40s, retiring and living a life of financial freedom.

He honestly reveals the philosophy and practical investment methods he has acquired in the process, and imparts investment know-how that will not fail.

After reading this book, you will not only realize the real problem that has kept you from making money, but you will also learn how to overcome it.

If you learn and practice the methods presented in this book, you will no longer be driven by money; on the contrary, you will become masters of money.

You will gain more confidence in your finances and a blueprint for a future where you can achieve financial freedom.

- You can preview some of the book's contents.

Preview

index

preface

Are you going to live in poverty, obsessed with your primitive instincts?

Will you awaken your instinct for wealth and become super-rich?

PART 1: Woo-seok shares his real-life investment story.

If you want to live freely, 'invest'

The hard work of raising seed money becomes a memory.

If you're afraid of failure, you can't get rich.

The Difference Between Amateur and Expert Investment Methods

It's not the head, but the heart that ruins investing.

Invest in exclusive properties, whether land or stocks.

Know your enemy first, and only invest in what you can win.

To become rich, you must awaken the rich person within you.

PART 2: Is the Destiny of the Rich Innate?

People who became rich without any academic background or parental influence

Stop blaming your studies and focus on investing.

Is there a separate fortune for becoming rich?

The qualities and personality traits of the genetically wealthy

Your unconscious is more powerful than you think.

PART 3: Awaken Your Wealth Instinct to Become Rich

Intro

Why does money always avoid me?

Reasons for Investment Failure from an Evolutionary Psychology Perspective

Chapter 01 The Fallacy of the Herding Instinct

Why it's hard to buy from the knees and sell from the shoulders

The rich are lone wolves, the poor are flocks of sheep.

Speculative winds have a definite direction.

Stock market clichés, real estate market clichés

Even though the investment gods all say the same thing, why?

The pitfalls of relative evaluation

Chapter 02 The Fallacy of Territorial Instinct

The animalistic territorial instinct that humans possess

When you're young, roam like a wild dog.

Buying a house and living in a house are different things.

The more you move, the more wealth you accumulate.

Choosing a new home can affect your retirement wealth.

The global economy is the Korean economy.

Chapter 03 The Fallacy of the Pleasure Instinct

The signs of a rich person's future are visible from a young age.

The first step to becoming rich is paying off debt.

A painful reality promises a rosy future.

The first hobby of the rich is reading

High-short-term trading that feeds securities firms rather than investors

Chapter 04 The Fallacy of Myopic Instinct

The Death of a Clever Primitive Man

Why Did Kim Dan-ta Fail?

How Billionaires Use Credit Cards

Investing with debt is a surefire way to ruin.

If you keep saying 'YOLO YOLO', you'll end up in trouble.

The good news is still in redevelopment and reconstruction.

Saving 100 million won is something any dual-income couple can do.

How to Pick Stocks with Long-Term Potential for Big Wins

A good investment in the long run is also good in the short run.

All the myths of getting rich overnight are false.

Chapter 05 The Fallacy of the Loss Fear Instinct

The Mayfly Primitive Man's Terror

Those who evolve into investors become rich.

The biggest risk is not investing at all.

If you can't cut your losses well, just cut your hand off!

It's advantageous to buy a home even if it means taking out a loan.

If you insist on only safe bank deposits, you will inevitably fail.

Insurance companies make money because of the fear of loss.

To become rich, overcome fear and start your own business.

Chapter 06 The Fallacy of the Show-Off Instinct

Where does human desire to show off come from?

There is no such thing as a 'treat' for the rich.

Why You're Missing the Preparatory Period in Your 20s and the Decisive Period in Your 30s

The first goal, then and now, is to own a home.

Distinguish between what you 'want' and what you 'need'

A wife's frugality makes the family rich.

Empty carts flaunting money and cars

To become rich, you need to be aware of financial management while single.

Chapter 07 The Taoist Illusion's Error

Humans prefer to believe rather than know.

Why People Fall for Taoist Fantasies

The Rise and Fall of Joseph Granville, the Chartist Leader of the Stock Church

The Real Secret of Elliott Wave Theory

Robert Preacher, the legendary sham prophet

Can you trust the winner of the real-life stock investment competition?

Experts are actually salesmen.

Look how many real estate gurus fail.

5 Hidden Stock Market Enemies Targeting Your Money

Chapter 08 The Witch's Illusion Error

It is human nature to hate the rich.

The drive to become rich in exchange for witch fantasies

Instead of envying the rich, praise them.

Leave space between stimulus and response.

Instead of witch-hunting, learn the rules of the capitalist game.

As regulations on multiple homeowners are strengthened, housing prices rise.

If you want to be rich, join the rich line.

Real estate prices fluctuate with the economy, not speculators.

Invest only in leading companies with a dominant position.

Invest in a good business even if it means paying more.

Why the rich get richer and the poor get poorer

Chapter 09 Errors in the Cognitive System

Humans evolved to see only what they want to see.

3 Misconceptions That Prevent You From Getting Rich

Cast a spell to become rich

Learn the uncertainty principle

Positive beliefs about money make you rich.

PART 4 Tools and Solutions to Awaken Your Wealth Instinct

Intro

Half-baked financial management where the brain can do it but the body can't keep up

8 Useful Tools to Overcome Your Instincts

Chapter 01 8 Tools to Awaken Your Wealth Instinct

TOOL 1: Neural Conditioning

Follow the TOOL 2 model

TOOL 3: Avoiding Temptation

TOOL 4: Keeping a Household Account Book

TOOL 5: Experience Small Successes

TOOL 6 Writing a Pledge

TOOL 7: Understanding the Truth

TOOL 8 Praying to God

Chapter 02 Customized Solutions by Failure Type

TYPE 1: The type that consumes by borrowing

TYPE 2: The type that finds it difficult to buy a home

Type 3: The type that gives up because they don't have money

TYPE 4: The type that loses money without even realizing it

TYPE 5: The type that laments their low salary

TYPE 6: The type that blames others for poverty

TYPE 7: Those who have given up on investing altogether

TYPE 8: The type that is easy on the ears and listens well to others

TYPE 9: The type that is obsessed with getting rich quick

TYPE 10: The type that cannot invest due to fear

PART 5: A Mindful Solution to Boost Your Investment Power

How to Overcome Perception Deficiencies and Develop a Balanced Investment Perspective

How the Rich Brain Works

Five Psychological Traps Poor People Fall Into

5 Ways to Break Free from the Psychological Trap of Poverty

PART 6: How Does the Korean Wealth Instinct Varieties?

The current state of South Korea from an economic perspective

How will the Fourth Industrial Revolution impact the real estate market?

How Will the Decline in Self-Employment Affect Commercial Investment?

Early financial education to help your children become wealthy

How to overcome instinctual errors and create happiness

Are you going to live in poverty, obsessed with your primitive instincts?

Will you awaken your instinct for wealth and become super-rich?

PART 1: Woo-seok shares his real-life investment story.

If you want to live freely, 'invest'

The hard work of raising seed money becomes a memory.

If you're afraid of failure, you can't get rich.

The Difference Between Amateur and Expert Investment Methods

It's not the head, but the heart that ruins investing.

Invest in exclusive properties, whether land or stocks.

Know your enemy first, and only invest in what you can win.

To become rich, you must awaken the rich person within you.

PART 2: Is the Destiny of the Rich Innate?

People who became rich without any academic background or parental influence

Stop blaming your studies and focus on investing.

Is there a separate fortune for becoming rich?

The qualities and personality traits of the genetically wealthy

Your unconscious is more powerful than you think.

PART 3: Awaken Your Wealth Instinct to Become Rich

Intro

Why does money always avoid me?

Reasons for Investment Failure from an Evolutionary Psychology Perspective

Chapter 01 The Fallacy of the Herding Instinct

Why it's hard to buy from the knees and sell from the shoulders

The rich are lone wolves, the poor are flocks of sheep.

Speculative winds have a definite direction.

Stock market clichés, real estate market clichés

Even though the investment gods all say the same thing, why?

The pitfalls of relative evaluation

Chapter 02 The Fallacy of Territorial Instinct

The animalistic territorial instinct that humans possess

When you're young, roam like a wild dog.

Buying a house and living in a house are different things.

The more you move, the more wealth you accumulate.

Choosing a new home can affect your retirement wealth.

The global economy is the Korean economy.

Chapter 03 The Fallacy of the Pleasure Instinct

The signs of a rich person's future are visible from a young age.

The first step to becoming rich is paying off debt.

A painful reality promises a rosy future.

The first hobby of the rich is reading

High-short-term trading that feeds securities firms rather than investors

Chapter 04 The Fallacy of Myopic Instinct

The Death of a Clever Primitive Man

Why Did Kim Dan-ta Fail?

How Billionaires Use Credit Cards

Investing with debt is a surefire way to ruin.

If you keep saying 'YOLO YOLO', you'll end up in trouble.

The good news is still in redevelopment and reconstruction.

Saving 100 million won is something any dual-income couple can do.

How to Pick Stocks with Long-Term Potential for Big Wins

A good investment in the long run is also good in the short run.

All the myths of getting rich overnight are false.

Chapter 05 The Fallacy of the Loss Fear Instinct

The Mayfly Primitive Man's Terror

Those who evolve into investors become rich.

The biggest risk is not investing at all.

If you can't cut your losses well, just cut your hand off!

It's advantageous to buy a home even if it means taking out a loan.

If you insist on only safe bank deposits, you will inevitably fail.

Insurance companies make money because of the fear of loss.

To become rich, overcome fear and start your own business.

Chapter 06 The Fallacy of the Show-Off Instinct

Where does human desire to show off come from?

There is no such thing as a 'treat' for the rich.

Why You're Missing the Preparatory Period in Your 20s and the Decisive Period in Your 30s

The first goal, then and now, is to own a home.

Distinguish between what you 'want' and what you 'need'

A wife's frugality makes the family rich.

Empty carts flaunting money and cars

To become rich, you need to be aware of financial management while single.

Chapter 07 The Taoist Illusion's Error

Humans prefer to believe rather than know.

Why People Fall for Taoist Fantasies

The Rise and Fall of Joseph Granville, the Chartist Leader of the Stock Church

The Real Secret of Elliott Wave Theory

Robert Preacher, the legendary sham prophet

Can you trust the winner of the real-life stock investment competition?

Experts are actually salesmen.

Look how many real estate gurus fail.

5 Hidden Stock Market Enemies Targeting Your Money

Chapter 08 The Witch's Illusion Error

It is human nature to hate the rich.

The drive to become rich in exchange for witch fantasies

Instead of envying the rich, praise them.

Leave space between stimulus and response.

Instead of witch-hunting, learn the rules of the capitalist game.

As regulations on multiple homeowners are strengthened, housing prices rise.

If you want to be rich, join the rich line.

Real estate prices fluctuate with the economy, not speculators.

Invest only in leading companies with a dominant position.

Invest in a good business even if it means paying more.

Why the rich get richer and the poor get poorer

Chapter 09 Errors in the Cognitive System

Humans evolved to see only what they want to see.

3 Misconceptions That Prevent You From Getting Rich

Cast a spell to become rich

Learn the uncertainty principle

Positive beliefs about money make you rich.

PART 4 Tools and Solutions to Awaken Your Wealth Instinct

Intro

Half-baked financial management where the brain can do it but the body can't keep up

8 Useful Tools to Overcome Your Instincts

Chapter 01 8 Tools to Awaken Your Wealth Instinct

TOOL 1: Neural Conditioning

Follow the TOOL 2 model

TOOL 3: Avoiding Temptation

TOOL 4: Keeping a Household Account Book

TOOL 5: Experience Small Successes

TOOL 6 Writing a Pledge

TOOL 7: Understanding the Truth

TOOL 8 Praying to God

Chapter 02 Customized Solutions by Failure Type

TYPE 1: The type that consumes by borrowing

TYPE 2: The type that finds it difficult to buy a home

Type 3: The type that gives up because they don't have money

TYPE 4: The type that loses money without even realizing it

TYPE 5: The type that laments their low salary

TYPE 6: The type that blames others for poverty

TYPE 7: Those who have given up on investing altogether

TYPE 8: The type that is easy on the ears and listens well to others

TYPE 9: The type that is obsessed with getting rich quick

TYPE 10: The type that cannot invest due to fear

PART 5: A Mindful Solution to Boost Your Investment Power

How to Overcome Perception Deficiencies and Develop a Balanced Investment Perspective

How the Rich Brain Works

Five Psychological Traps Poor People Fall Into

5 Ways to Break Free from the Psychological Trap of Poverty

PART 6: How Does the Korean Wealth Instinct Varieties?

The current state of South Korea from an economic perspective

How will the Fourth Industrial Revolution impact the real estate market?

How Will the Decline in Self-Employment Affect Commercial Investment?

Early financial education to help your children become wealthy

How to overcome instinctual errors and create happiness

Detailed image

Into the book

“The greatest risk in life is not to take any risks, not to invest at all!”

Investing has always been risky, and I was scared.

But I thought not investing was the biggest risk.

If you don't invest, you won't have anything.

If I hadn't invested, I might have avoided the pain and sorrow of failure, but I wouldn't have been able to learn, feel, change, or grow.

And you will still be trapped in fear, living a slave-like life day after day.

I started investing and taking risks to live freely.

And finally, I achieved financial freedom.

“To love is to risk not being loved in return, and to live is to risk dying.

“To hope is to risk despair, and to try something new is always to risk failure.”

If you truly dream of living freely, you must not wish for a life without fear, but face your fears.

Because the most dangerous thing in life is not to take any risks.

The secret to becoming rich is not being afraid of losing money.

A person who can invest without being swayed by fear is truly free.

Investing has always been risky, and I was scared.

But I thought not investing was the biggest risk.

If you don't invest, you won't have anything.

If I hadn't invested, I might have avoided the pain and sorrow of failure, but I wouldn't have been able to learn, feel, change, or grow.

And you will still be trapped in fear, living a slave-like life day after day.

I started investing and taking risks to live freely.

And finally, I achieved financial freedom.

“To love is to risk not being loved in return, and to live is to risk dying.

“To hope is to risk despair, and to try something new is always to risk failure.”

If you truly dream of living freely, you must not wish for a life without fear, but face your fears.

Because the most dangerous thing in life is not to take any risks.

The secret to becoming rich is not being afraid of losing money.

A person who can invest without being swayed by fear is truly free.

--- From the text

Publisher's Review

Armed with Woo Seok's insight that penetrates the essence of humanity,

Awaken the instinct for wealth that lies dormant within you!

This book approaches human investment psychology and the laws of success from a perspective quite different from the numerous financial management books we've seen so far.

The author argues that humans are born with a natural tendency to fail at investing.

The reason is that since human evolution stopped after the Paleolithic Age, instincts that were only useful in primitive times have become engraved in our genes, hindering successful investment.

Humans have lived by hunting and gathering for most of the 8 million years since the emergence of Australopithecus.

It was only about 10,000 years ago that humans began farming.

After that, human life did not change much.

The author talks about instincts that were ingrained in human genes during the Paleolithic era, but these stories could be applied directly to pre-modern life without any awkwardness.

Human life underwent rapid changes after the first and second industrial revolutions.

However, the author argues that human genes have not evolved to adapt to modern life, which has lasted about 250 years, and remain in a primitive state.

The author draws on his own experiences, grounded in solid economics, evolutionary psychology, and philosophical background.

He tells the story of how he turned 5 million won in seed money made by emptying his deposit into 5 billion won, and how he lost all his money due to a misjudgment and started again with nothing to build up assets worth tens of billions of won. He also shares the secrets and principles he saw, heard, and realized along the way.

It doesn't matter if your financial management has been completely ruined.

It just proves that you are a very human person.

If you learn how to remove and overcome the obstacles within yourself through this book, you too can surely become rich.

If you are ready to overcome your primal instincts and awaken your instinct for wealth, then all you have to do is open the book.

You will agree with the author when he says that the most dangerous thing in life is not to take any risks.

Awaken the instinct for wealth that lies dormant within you!

This book approaches human investment psychology and the laws of success from a perspective quite different from the numerous financial management books we've seen so far.

The author argues that humans are born with a natural tendency to fail at investing.

The reason is that since human evolution stopped after the Paleolithic Age, instincts that were only useful in primitive times have become engraved in our genes, hindering successful investment.

Humans have lived by hunting and gathering for most of the 8 million years since the emergence of Australopithecus.

It was only about 10,000 years ago that humans began farming.

After that, human life did not change much.

The author talks about instincts that were ingrained in human genes during the Paleolithic era, but these stories could be applied directly to pre-modern life without any awkwardness.

Human life underwent rapid changes after the first and second industrial revolutions.

However, the author argues that human genes have not evolved to adapt to modern life, which has lasted about 250 years, and remain in a primitive state.

The author draws on his own experiences, grounded in solid economics, evolutionary psychology, and philosophical background.

He tells the story of how he turned 5 million won in seed money made by emptying his deposit into 5 billion won, and how he lost all his money due to a misjudgment and started again with nothing to build up assets worth tens of billions of won. He also shares the secrets and principles he saw, heard, and realized along the way.

It doesn't matter if your financial management has been completely ruined.

It just proves that you are a very human person.

If you learn how to remove and overcome the obstacles within yourself through this book, you too can surely become rich.

If you are ready to overcome your primal instincts and awaken your instinct for wealth, then all you have to do is open the book.

You will agree with the author when he says that the most dangerous thing in life is not to take any risks.

GOODS SPECIFICS

- Date of issue: May 31, 2022

- Page count, weight, size: 316 pages | 496g | 152*224*30mm

- ISBN13: 9791187444787

- ISBN10: 1187444782

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)