The Millionaire Next Door

|

Description

Book Introduction

How can ordinary people become rich? Since the beginning of the capitalist economy, people's greatest concern has been becoming rich. As class society collapsed and the sanctuary of wealth collapsed, ordinary people also dreamed of becoming rich, and they constantly looked into and observed the lives of the rich to learn something special from them. When he decided to study how to become rich, Thomas J. Stanley and William D. Danko began to investigate the people living in the so-called wealthy neighborhoods. Then I discovered the surprising fact that among people who live in expensive houses and drive luxury cars, there are more people who are not truly rich. In fact, the rich did not live in rich neighborhoods. A 20-year study of 12,000 wealthy people found that what they had in common wasn't luck, inheritance, or education, but spending habits. What's even more surprising is that this fact remains unchanged nearly 50 years after they began their investigation. Warren Buffett, the world's third-richest person and billionaire investment guru, has lived in the same house for 60 years and is famous for never spending more than $3.17 on breakfast. Facebook (Meta) CEO Mark Zuckerberg, who is ranked among the top 10 richest people in the world, wears a T-shirt and jeans and drives a compact car. He reportedly spends more time on his network than on deciding what to wear or what car to drive. Ingvar Kamprad, founder of the global furniture company IKEA, lives a frugal life, frequently flying economy class and using city buses. The Millionaire Next Door shows that the disciplined lifestyles of self-made people are not trivial episodes that accompany great achievements, but rather the core of the law of wealth. Even though the standards of the rich and the map of wealth have changed dozens of times in the history of capitalism that spans over 200 years, there are laws that only the rich have followed that remain unchanged. |

- You can preview some of the book's contents.

Preview

index

Preface to the Korean edition

Introduction

Chapter 1: What kind of person is the millionaire next door?

Chapter 2 Save, save, save again!

Chapter 3 Time, Energy, and Money

Chapter 4 You Can't Judge a Car by Its Owner

Chapter 5 Financial Aid for Adult Children

Chapter 6: Discrimination Allowance Policy, Family Style

Chapter 7: Find a profitable field

Chapter 8: Occupations: Millionaires and Heirs

Acknowledgements

Epilogue

Introduction

Chapter 1: What kind of person is the millionaire next door?

Chapter 2 Save, save, save again!

Chapter 3 Time, Energy, and Money

Chapter 4 You Can't Judge a Car by Its Owner

Chapter 5 Financial Aid for Adult Children

Chapter 6: Discrimination Allowance Policy, Family Style

Chapter 7: Find a profitable field

Chapter 8: Occupations: Millionaires and Heirs

Acknowledgements

Epilogue

Detailed image

Into the book

* How can I become rich? Most people have misconceptions about this too.

The ability to accumulate wealth has, in most cases, nothing to do with luck, inheritance, education, or even intelligence.

Wealth is usually acquired through hard work, patience, planning, and self-discipline.

The most important of these is self-control.

* These people can't be millionaires! They don't look like millionaires, they don't dress like millionaires, they don't eat like millionaires, and they don't act like millionaires! And they don't even have millionaire names.

Where the hell are the millionaires who look like millionaires?

Have you ever seen people who jog regularly every day? They're usually healthy and don't seem to need it.

But that is precisely why they are healthy.

Likewise, wealthy people strive to remain financially healthy.

But those who are economically unwell do little to change their circumstances.

* I have always been goal-oriented.

I have clearly defined daily, weekly, monthly, yearly and lifetime goals.

There is even a goal to go to the bathroom.

I always tell our company's young executives that they need to have goals.

* If you're not rich yet, but want to be someday, never buy a home that requires a mortgage loan that's more than twice your household's annual gross income.

* Rich people efficiently allocate their time, energy, and money to help them accumulate wealth.

* Why do so many adult children of UAW members earn high incomes but fail to accumulate significant wealth? A key reason is that they've been constantly told since childhood that their parents are wealthy.

* If I had just held onto the stocks, I would have been rich.

But I can't help but trade the stocks in my portfolio.

I watch the price fluctuations on the screen every day.

* If your goal is financial stability, you will achieve it.

But if your motivation is to make money to enjoy life… you will never succeed.

* Dr. and Mrs. North told us in detail how they raised their children.

Simply put, the Norths taught by example.

Frugal and moderate parents serve as good role models for their children.

* Never let your children know that their parents are rich until they are mature, disciplined, and have adult habits and careers.

* Adult children get angry when their parents interfere, so children should be left to live independently.

Even when giving advice, always get permission, and when giving expensive gifts to adult children, always ask their permission first.

* Among successful children from wealthy backgrounds with a strong desire for achievement, accumulating wealth is often not the ultimate goal.

Rather, they want to be educated, respected by their peers, and promoted to high positions.

Additionally, they do not place as much importance on income and wealth differences between occupations as their parents do.

The typical first-generation American millionaire is a businessman.

These people have a lot of wealth, but usually have little self-esteem.

* Why aren't you rich? Perhaps it's because you're not looking for money-making opportunities.

There are numerous business opportunities targeting wealthy people and their children, as well as wealthy widows and widowers.

People who work with the rich usually become rich themselves.

On the other hand, many people, including business owners, self-employed people, sales professionals, and some salarymen, never earn high incomes.

* The 'Million Dollar Investment Program' was passed by the U.S. Congress in 1990.

This program allows foreign citizens to obtain U.S. permanent residency by investing $1 million in a business within the United States and creating 10 jobs with that investment. (John R.

Emshler, 'US Visa Programs Based on Investment Are Rid of Fraud'

The ability to accumulate wealth has, in most cases, nothing to do with luck, inheritance, education, or even intelligence.

Wealth is usually acquired through hard work, patience, planning, and self-discipline.

The most important of these is self-control.

* These people can't be millionaires! They don't look like millionaires, they don't dress like millionaires, they don't eat like millionaires, and they don't act like millionaires! And they don't even have millionaire names.

Where the hell are the millionaires who look like millionaires?

Have you ever seen people who jog regularly every day? They're usually healthy and don't seem to need it.

But that is precisely why they are healthy.

Likewise, wealthy people strive to remain financially healthy.

But those who are economically unwell do little to change their circumstances.

* I have always been goal-oriented.

I have clearly defined daily, weekly, monthly, yearly and lifetime goals.

There is even a goal to go to the bathroom.

I always tell our company's young executives that they need to have goals.

* If you're not rich yet, but want to be someday, never buy a home that requires a mortgage loan that's more than twice your household's annual gross income.

* Rich people efficiently allocate their time, energy, and money to help them accumulate wealth.

* Why do so many adult children of UAW members earn high incomes but fail to accumulate significant wealth? A key reason is that they've been constantly told since childhood that their parents are wealthy.

* If I had just held onto the stocks, I would have been rich.

But I can't help but trade the stocks in my portfolio.

I watch the price fluctuations on the screen every day.

* If your goal is financial stability, you will achieve it.

But if your motivation is to make money to enjoy life… you will never succeed.

* Dr. and Mrs. North told us in detail how they raised their children.

Simply put, the Norths taught by example.

Frugal and moderate parents serve as good role models for their children.

* Never let your children know that their parents are rich until they are mature, disciplined, and have adult habits and careers.

* Adult children get angry when their parents interfere, so children should be left to live independently.

Even when giving advice, always get permission, and when giving expensive gifts to adult children, always ask their permission first.

* Among successful children from wealthy backgrounds with a strong desire for achievement, accumulating wealth is often not the ultimate goal.

Rather, they want to be educated, respected by their peers, and promoted to high positions.

Additionally, they do not place as much importance on income and wealth differences between occupations as their parents do.

The typical first-generation American millionaire is a businessman.

These people have a lot of wealth, but usually have little self-esteem.

* Why aren't you rich? Perhaps it's because you're not looking for money-making opportunities.

There are numerous business opportunities targeting wealthy people and their children, as well as wealthy widows and widowers.

People who work with the rich usually become rich themselves.

On the other hand, many people, including business owners, self-employed people, sales professionals, and some salarymen, never earn high incomes.

* The 'Million Dollar Investment Program' was passed by the U.S. Congress in 1990.

This program allows foreign citizens to obtain U.S. permanent residency by investing $1 million in a business within the United States and creating 10 jobs with that investment. (John R.

Emshler, 'US Visa Programs Based on Investment Are Rid of Fraud'

--- From the text

Publisher's Review

What to buy vs. how to collect?

We spend more than twice as much time thinking about how we spend our money.

Rich people invest in how they save money!

The millionaires featured in this book are people who can live without working for years.

However, they are not from the Rockefeller or Vanderbilt families, which are representative wealthy families in the United States, but rather people who accumulated their wealth on their own.

They have never won the lottery, they are not professional baseball players under contract with Major League Baseball, they are not pop singers or Hollywood actors.

Or, they are not people who suddenly became rich through stocks, stock options, or real estate investments.

The odds of getting rich that way are less than 0.025%.

These are our ordinary neighbors who have become rich by steadily earning money and accumulating wealth.

Their stories don't contain any special methods that are difficult for ordinary people to access, such as investing in stocks in promising businesses or buying real estate in prime locations.

The way they accumulated wealth is realistic and anyone can do it if they put their mind to it.

It presents seemingly trivial but proven rules such as, 'Never spend more than your income', 'Never buy a house that requires a loan of more than twice your income', 'The more wealthy you live in, the more your assets decrease', and 'How to become rich just by quitting smoking'.

What's the difference between those who feel insecure about their future while intoxicated by fine wine and those who prepare for a 100-year life while sipping cheap bottled beer? What's the secret behind the wealthy who don't even live in a wealthy neighborhood, share the same apartment as me, and drive a cheaper car, yet possess more than ten times my wealth?

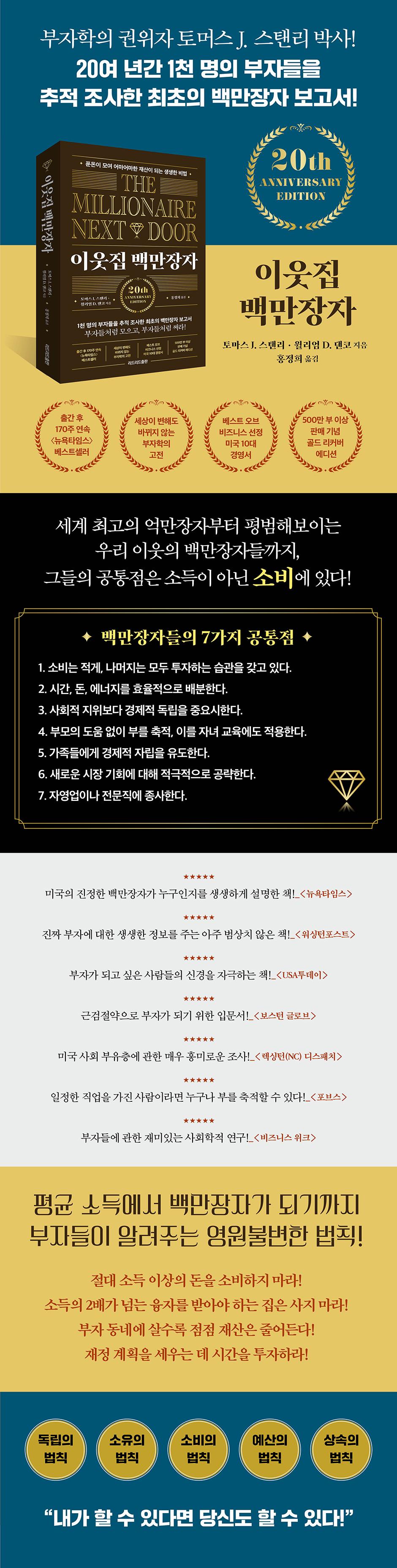

7 Things Millionaires Have in Common

1.

I have a habit of spending less and investing the rest.

2.

Allocate time, money, and energy efficiently.

3.

They value economic independence over social status.

4.

Accumulate wealth without parental help and apply this to your children's education.

5.

Encourage families to achieve economic independence.

6.

Actively pursue new market opportunities.

7.

Self-employed or professional.

Save like the rich, spend like the rich

“It’s easier to make money than to save money!”

· The Law of Independence They value financial independence more than showing off their upper-class social status.

Are you enjoying the same level of wealth as others but worried about your future? If so, it's time to reassess your financial situation.

· The Law of Ownership The rich don't live in wealthy neighborhoods or own expensive cars.

Possession only begets more possession, and possession and property are inversely proportional.

· The Law of Consumption They live a much more frugal life than their level of wealth suggests.

Are you wondering why you're not rich? Then take a look at your lifestyle.

The rich became rich by controlling their spending, and that's how they maintain their wealth.

· The Law of Budgeting They efficiently allocate their time, energy, and money to help them accumulate wealth.

Why do you always fail at the "wealth-building" game? Rich people spend more than twice as much time planning their finances as less-rich people.

How much time do you invest in financial planning?

· Law of Inheritance They accumulated wealth without the help of their parents and do not provide financial support to their adult children.

They don't pass on money, they pass on a lifestyle.

The basic principles of "The Millionaire Next Door" are more relevant today.

As we are more exposed to consumption now than in the past, we need to exercise self-restraint to reduce excessive consumption.

You can also witness your friends' excessive spending habits in real time through social media.

New cars, new homes, new gadgets, vacations, accessories, and luxury items are being shared and retweeted.

But paradoxically, we spend very little time managing our finances.

72% of Americans report being stressed about money, and more than a quarter of Americans report experiencing stress about money in their lifetime.

Americans spend only 0.5% of their time managing their household finances.

It is precisely this very behavior that speaks to the importance of The Millionaire Next Door.

_From the preface to the Korean edition

We spend more than twice as much time thinking about how we spend our money.

Rich people invest in how they save money!

The millionaires featured in this book are people who can live without working for years.

However, they are not from the Rockefeller or Vanderbilt families, which are representative wealthy families in the United States, but rather people who accumulated their wealth on their own.

They have never won the lottery, they are not professional baseball players under contract with Major League Baseball, they are not pop singers or Hollywood actors.

Or, they are not people who suddenly became rich through stocks, stock options, or real estate investments.

The odds of getting rich that way are less than 0.025%.

These are our ordinary neighbors who have become rich by steadily earning money and accumulating wealth.

Their stories don't contain any special methods that are difficult for ordinary people to access, such as investing in stocks in promising businesses or buying real estate in prime locations.

The way they accumulated wealth is realistic and anyone can do it if they put their mind to it.

It presents seemingly trivial but proven rules such as, 'Never spend more than your income', 'Never buy a house that requires a loan of more than twice your income', 'The more wealthy you live in, the more your assets decrease', and 'How to become rich just by quitting smoking'.

What's the difference between those who feel insecure about their future while intoxicated by fine wine and those who prepare for a 100-year life while sipping cheap bottled beer? What's the secret behind the wealthy who don't even live in a wealthy neighborhood, share the same apartment as me, and drive a cheaper car, yet possess more than ten times my wealth?

7 Things Millionaires Have in Common

1.

I have a habit of spending less and investing the rest.

2.

Allocate time, money, and energy efficiently.

3.

They value economic independence over social status.

4.

Accumulate wealth without parental help and apply this to your children's education.

5.

Encourage families to achieve economic independence.

6.

Actively pursue new market opportunities.

7.

Self-employed or professional.

Save like the rich, spend like the rich

“It’s easier to make money than to save money!”

· The Law of Independence They value financial independence more than showing off their upper-class social status.

Are you enjoying the same level of wealth as others but worried about your future? If so, it's time to reassess your financial situation.

· The Law of Ownership The rich don't live in wealthy neighborhoods or own expensive cars.

Possession only begets more possession, and possession and property are inversely proportional.

· The Law of Consumption They live a much more frugal life than their level of wealth suggests.

Are you wondering why you're not rich? Then take a look at your lifestyle.

The rich became rich by controlling their spending, and that's how they maintain their wealth.

· The Law of Budgeting They efficiently allocate their time, energy, and money to help them accumulate wealth.

Why do you always fail at the "wealth-building" game? Rich people spend more than twice as much time planning their finances as less-rich people.

How much time do you invest in financial planning?

· Law of Inheritance They accumulated wealth without the help of their parents and do not provide financial support to their adult children.

They don't pass on money, they pass on a lifestyle.

The basic principles of "The Millionaire Next Door" are more relevant today.

As we are more exposed to consumption now than in the past, we need to exercise self-restraint to reduce excessive consumption.

You can also witness your friends' excessive spending habits in real time through social media.

New cars, new homes, new gadgets, vacations, accessories, and luxury items are being shared and retweeted.

But paradoxically, we spend very little time managing our finances.

72% of Americans report being stressed about money, and more than a quarter of Americans report experiencing stress about money in their lifetime.

Americans spend only 0.5% of their time managing their household finances.

It is precisely this very behavior that speaks to the importance of The Millionaire Next Door.

_From the preface to the Korean edition

GOODS SPECIFICS

- Publication date: June 10, 2022

- Page count, weight, size: 376 pages | 526g | 153*224*30mm

- ISBN13: 9788972773627

- ISBN10: 897277362X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)