My investments start at 4 a.m.

|

Description

Book Introduction

- A word from MD

-

We're back with a level up in a different dimension!A new book by the nomadic author who gave hope to many individual investors through "My Salary Independence Project."

We have entered the next level through various investment methods, including short-term, swing, long-term, mezzanine, private equity, and unlisted stocks.

Discover the author's investment methodology and insights, which continue to grow through exceptional study.

April 19, 2022. Economics and Management PD Kim Sang-geun

New work by the author of "My Salary Independence Project," the No. 1 stock

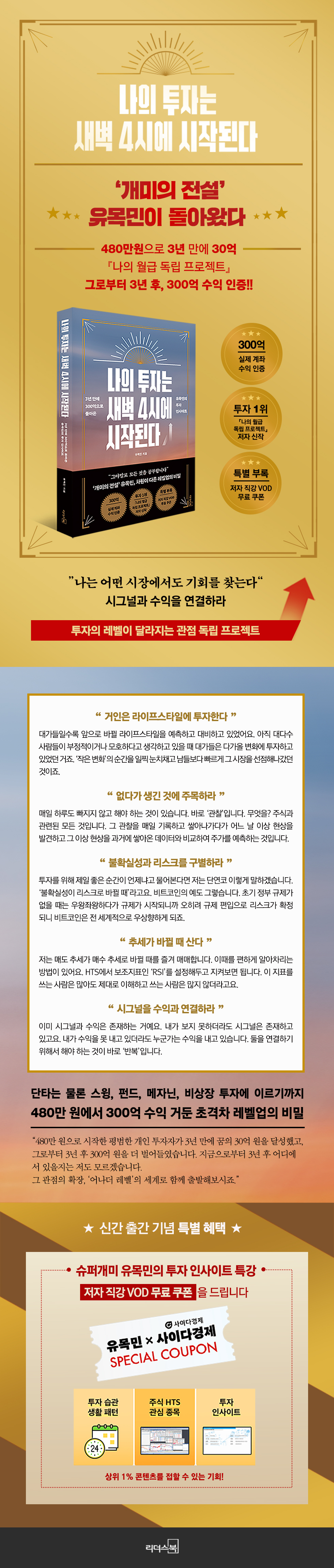

"The Legend of the Ants" Nomad offers a new level of investment insight.

Earn 3 billion won in 3 years with 4.8 million won and become independent in salary!

3 years later, back with 30 billion won in revenue!!

Nomad Yoo, the author of "My Salary Independence Project," which became an instant bestseller after revealing the vivid experiences of a short-term investor who earned 3 billion won in 3 years and quit his job, has returned with a new work after 3 years.

This book is evaluated as providing a new perspective on stocks and is consistently loved by many individual investors as the 'most realistic introductory book.'

Now, three years later, his assets have surpassed 30 billion won.

This is the result of entering the 'next level' as an investor by diversifying investment methods and portfolios.

How to do well in stocks? The Nomads say "unparalleled effort" is the number one requirement.

During my working days, I studied stocks every night until I fell asleep from exhaustion. Even now that I am independent from my salary, I wake up at 4 a.m. every day to observe the global economy and stock markets.

The author's second book, "My Investment Starts at 4 AM," shares his methodology and insights as an investor who has consistently studied and grown, from short-term trading up until 2017, when he achieved his dream of salary independence, to swing trading, long-term investing, mezzanine, private equity, and unlisted stocks, all with his characteristically lively and eloquent storytelling.

“An ordinary individual investor who started with 4.8 million won achieved his dream of 3 billion won in just three years, and earned another 30 billion won three years after that.

I don't know where I'll be three years from now.

Let's expand that perspective and embark together on a journey into the world of 'Another Level'.

I am confident that this book will connect you to the next world of investment.”

"The Legend of the Ants" Nomad offers a new level of investment insight.

Earn 3 billion won in 3 years with 4.8 million won and become independent in salary!

3 years later, back with 30 billion won in revenue!!

Nomad Yoo, the author of "My Salary Independence Project," which became an instant bestseller after revealing the vivid experiences of a short-term investor who earned 3 billion won in 3 years and quit his job, has returned with a new work after 3 years.

This book is evaluated as providing a new perspective on stocks and is consistently loved by many individual investors as the 'most realistic introductory book.'

Now, three years later, his assets have surpassed 30 billion won.

This is the result of entering the 'next level' as an investor by diversifying investment methods and portfolios.

How to do well in stocks? The Nomads say "unparalleled effort" is the number one requirement.

During my working days, I studied stocks every night until I fell asleep from exhaustion. Even now that I am independent from my salary, I wake up at 4 a.m. every day to observe the global economy and stock markets.

The author's second book, "My Investment Starts at 4 AM," shares his methodology and insights as an investor who has consistently studied and grown, from short-term trading up until 2017, when he achieved his dream of salary independence, to swing trading, long-term investing, mezzanine, private equity, and unlisted stocks, all with his characteristically lively and eloquent storytelling.

“An ordinary individual investor who started with 4.8 million won achieved his dream of 3 billion won in just three years, and earned another 30 billion won three years after that.

I don't know where I'll be three years from now.

Let's expand that perspective and embark together on a journey into the world of 'Another Level'.

I am confident that this book will connect you to the next world of investment.”

- You can preview some of the book's contents.

Preview

index

[Prologue] I'll show you the 'next step'

PART 1 How to Invest Well

Chapter 1: Expanding the Perspective

Chapter 2: My Own Investment Mechanism

Chapter 3: The Eyes That See Signals

Chapter 4: “Should I Invest Now?”

[Insight Plus] Nomad's Account Revealed

[Insight Plus] Introduction to Fund Investment Terminology

PART 2 UPGRADING YOUR PERSPECTIVE

Chapter 5: Note the appearance of something that was not there before.

Chapter 6: Opportunity Comes in Ambiguity

Chapter 7: Distinguishing Between Uncertainty and Risk

Chapter 8: Expectations are Multiplied

Chapter 9: Meet the Unicorn at the End of the Year

Chapter 10: Buy When the Trend Changes

Chapter 11: Mezzanine: A Profitable Investment Even in a Bear Market

[Insight Plus] This is what changes the future.

PART 3 Signals and Noise in Practice

Chapter 12 I Invested in This Signal

Chapter 13: Avoid these stocks at all costs

Chapter 14: We Fall into the Trap of Being Human

[Insight Plus] Nomad's Favorites

[Epilogue] It's better to have experts around than to become one.

[Appendix] 100-Day Stock Study Challenge

PART 1 How to Invest Well

Chapter 1: Expanding the Perspective

Chapter 2: My Own Investment Mechanism

Chapter 3: The Eyes That See Signals

Chapter 4: “Should I Invest Now?”

[Insight Plus] Nomad's Account Revealed

[Insight Plus] Introduction to Fund Investment Terminology

PART 2 UPGRADING YOUR PERSPECTIVE

Chapter 5: Note the appearance of something that was not there before.

Chapter 6: Opportunity Comes in Ambiguity

Chapter 7: Distinguishing Between Uncertainty and Risk

Chapter 8: Expectations are Multiplied

Chapter 9: Meet the Unicorn at the End of the Year

Chapter 10: Buy When the Trend Changes

Chapter 11: Mezzanine: A Profitable Investment Even in a Bear Market

[Insight Plus] This is what changes the future.

PART 3 Signals and Noise in Practice

Chapter 12 I Invested in This Signal

Chapter 13: Avoid these stocks at all costs

Chapter 14: We Fall into the Trap of Being Human

[Insight Plus] Nomad's Favorites

[Epilogue] It's better to have experts around than to become one.

[Appendix] 100-Day Stock Study Challenge

Detailed image

Into the book

I'll show you the prologue, 'The Next Step'

At that time, I was on the verge of losing my left eye.

I even remember the date.

April 30, 2018.

It was the moment when I hit 1 billion won per month.

I couldn't see the buy button.

The hospital said it was an inflammatory symptom caused by not sleeping.

Since I started trading stocks, the most I've slept that day was about 3 hours.

I am a natural 'short sleeper'

I thought so.

From that day on, I increased my sleeping time.

I went to bed at 8pm and woke up at 3am.

I studied stocks every night until I fell asleep, and that completely changed my life.

Since my eyesight was affected, my habits changed in an instant.

But the rate of burning seemed to have decreased significantly.

I started feeling anxious.

Although he had the ability to make money through stocks, he had no ability to manage stress.

Stocks are a source of unearned income? Investing in stocks is the ultimate in mental labor.

--- p.5-6

Chapter 2: My Own Investment Mechanism - Knowledge, the Core of Investing

What matters is not which keyword is important, but rather detecting whether something that caused a high price in the past has happened again today as a similar case.

That is, based on knowledge, we can distinguish between what came from nothing, what existed and then disappeared, and uncertainty and risk.

Also, if the 'knowledge' that you had before others becomes 'information' that others also know, then that is the moment to sell.

For example, when information becomes available without much effort, such as when knowledge I already knew becomes news, is publicly announced, or appears in an analyst's report, I should sell without hesitation.

It doesn't matter whether that moment is a profit or a loss.

Don't be greedy and try to sell at the high point in the first place.

You can't sell at the highest point of the gods.

--- p.50

Chapter 2: My Own Investment Mechanism - Sense, Keep an Open Mind

I think it's right to 'not mix emotions with changing opinions'.

If the market shows signs of going up, don't try to deny it.

The market is always right.

Ironically, that's why I have a principle of not being swayed by emotions, while also clearly incorporating my emotions into my trading.

When I'm trading a certain stock and I'm unconsciously being overly optimistic or dreaming of big profits, I judge it to be "overheated" and unconditionally reduce my exposure by 50%.

It's called 'taking advantage'.

On the other hand, I am interested in that subject

If you feel anxious or afraid about something, you may send a scout, even if it is only a small amount, thinking that it may be a blessing in disguise.

Even though I've been trading for a long time, I know that my sucker instinct still remains deep inside me, so I try to act in the opposite direction of my primal feelings.

I know very well that I often fall into psychological traps.

--- p.64

Chapter 3: Signal-Seeing Eyes - Mastering Stock History

To recap, you need to know everything about the stock's history.

You need to know everything about the company, including its website, business details, electronic disclosures, sales, operating profit, net income, and governance structure.

It's very basic.

However, in practice, the most important thing is to check the company's PR, that is, how it is packaged in the media, and whether the company's stock price moves due to that media news.

No matter how good a company is, if it is not known to the outside world, no one will know about it.

This becomes increasingly important in short-term trading.

When it comes to swing and long-term investing, as well as fund investing, you need to look beyond what's happening right now to what will become bigger in the future.

That means it's important to generate liquidity, improve performance, and have a big picture.

--- p.103-4

Chapter 4: "Is It Time to Invest Now?" - 2022 Market Outlook

Korea is said to be a bio powerhouse, a gaming powerhouse, and an IT powerhouse, but in reality, this is closer to self-consolation.

The Korean index is based solely on semiconductors, starting with Samsung Electronics and SK Hynix.

So, the Korean market in 2022 will ultimately depend on semiconductors.

(syncopation)

There are two hidden cards that I see.

First, Intel's 12th generation DDR5-supporting CPUs have begun to appear, and if they quickly dominate the market starting in 2022, demand for DDR5 is expected to increase around 2023.

In other words, it seems suitable as a material for ‘expectation’ of an exponential rise.

Second, the metaverse is not only the hottest topic of 2022, but also the next "big changer" after the internet revolution.

Building a metaverse requires several to several dozen times more cloud capacity than existing ones.

This is the moment when Samsung Electronics' DRAM is needed.

--- pp.129, 133

Chapter 10: Buy When the Trend Changes - RSI, an indicator that confirms trend reversals

I have a set of criteria that I always look at when entering or selling a stock.

It is the intensity of buying and selling.

When I look at a stock, if it is still in a selling trend, I tend not to buy it.

Also, do not buy when the buying trend is too excessive.

I like to trade when a selling trend turns into a buying trend.

There's an easy way to spot this moment. Just set up the auxiliary indicator "RSI" in HTS and monitor it.

Although many people use this indicator, not many people understand and use it properly.

I'm starting to buy at oversold levels.

The most enjoyable trade is when the market is oversold and it is difficult to sell any further.

Usually, I start buying in installments when the RSI breaks below 30.

In a way, you could say that it is 'when (selling) comes and goes', right?

At that time, I was on the verge of losing my left eye.

I even remember the date.

April 30, 2018.

It was the moment when I hit 1 billion won per month.

I couldn't see the buy button.

The hospital said it was an inflammatory symptom caused by not sleeping.

Since I started trading stocks, the most I've slept that day was about 3 hours.

I am a natural 'short sleeper'

I thought so.

From that day on, I increased my sleeping time.

I went to bed at 8pm and woke up at 3am.

I studied stocks every night until I fell asleep, and that completely changed my life.

Since my eyesight was affected, my habits changed in an instant.

But the rate of burning seemed to have decreased significantly.

I started feeling anxious.

Although he had the ability to make money through stocks, he had no ability to manage stress.

Stocks are a source of unearned income? Investing in stocks is the ultimate in mental labor.

--- p.5-6

Chapter 2: My Own Investment Mechanism - Knowledge, the Core of Investing

What matters is not which keyword is important, but rather detecting whether something that caused a high price in the past has happened again today as a similar case.

That is, based on knowledge, we can distinguish between what came from nothing, what existed and then disappeared, and uncertainty and risk.

Also, if the 'knowledge' that you had before others becomes 'information' that others also know, then that is the moment to sell.

For example, when information becomes available without much effort, such as when knowledge I already knew becomes news, is publicly announced, or appears in an analyst's report, I should sell without hesitation.

It doesn't matter whether that moment is a profit or a loss.

Don't be greedy and try to sell at the high point in the first place.

You can't sell at the highest point of the gods.

--- p.50

Chapter 2: My Own Investment Mechanism - Sense, Keep an Open Mind

I think it's right to 'not mix emotions with changing opinions'.

If the market shows signs of going up, don't try to deny it.

The market is always right.

Ironically, that's why I have a principle of not being swayed by emotions, while also clearly incorporating my emotions into my trading.

When I'm trading a certain stock and I'm unconsciously being overly optimistic or dreaming of big profits, I judge it to be "overheated" and unconditionally reduce my exposure by 50%.

It's called 'taking advantage'.

On the other hand, I am interested in that subject

If you feel anxious or afraid about something, you may send a scout, even if it is only a small amount, thinking that it may be a blessing in disguise.

Even though I've been trading for a long time, I know that my sucker instinct still remains deep inside me, so I try to act in the opposite direction of my primal feelings.

I know very well that I often fall into psychological traps.

--- p.64

Chapter 3: Signal-Seeing Eyes - Mastering Stock History

To recap, you need to know everything about the stock's history.

You need to know everything about the company, including its website, business details, electronic disclosures, sales, operating profit, net income, and governance structure.

It's very basic.

However, in practice, the most important thing is to check the company's PR, that is, how it is packaged in the media, and whether the company's stock price moves due to that media news.

No matter how good a company is, if it is not known to the outside world, no one will know about it.

This becomes increasingly important in short-term trading.

When it comes to swing and long-term investing, as well as fund investing, you need to look beyond what's happening right now to what will become bigger in the future.

That means it's important to generate liquidity, improve performance, and have a big picture.

--- p.103-4

Chapter 4: "Is It Time to Invest Now?" - 2022 Market Outlook

Korea is said to be a bio powerhouse, a gaming powerhouse, and an IT powerhouse, but in reality, this is closer to self-consolation.

The Korean index is based solely on semiconductors, starting with Samsung Electronics and SK Hynix.

So, the Korean market in 2022 will ultimately depend on semiconductors.

(syncopation)

There are two hidden cards that I see.

First, Intel's 12th generation DDR5-supporting CPUs have begun to appear, and if they quickly dominate the market starting in 2022, demand for DDR5 is expected to increase around 2023.

In other words, it seems suitable as a material for ‘expectation’ of an exponential rise.

Second, the metaverse is not only the hottest topic of 2022, but also the next "big changer" after the internet revolution.

Building a metaverse requires several to several dozen times more cloud capacity than existing ones.

This is the moment when Samsung Electronics' DRAM is needed.

--- pp.129, 133

Chapter 10: Buy When the Trend Changes - RSI, an indicator that confirms trend reversals

I have a set of criteria that I always look at when entering or selling a stock.

It is the intensity of buying and selling.

When I look at a stock, if it is still in a selling trend, I tend not to buy it.

Also, do not buy when the buying trend is too excessive.

I like to trade when a selling trend turns into a buying trend.

There's an easy way to spot this moment. Just set up the auxiliary indicator "RSI" in HTS and monitor it.

Although many people use this indicator, not many people understand and use it properly.

I'm starting to buy at oversold levels.

The most enjoyable trade is when the market is oversold and it is difficult to sell any further.

Usually, I start buying in installments when the RSI breaks below 30.

In a way, you could say that it is 'when (selling) comes and goes', right?

--- p.233

Publisher's Review

The story of 30 billion super ants' level-up to a whole new level.

Earn 3 billion won with 4.8 million won and quit your job to become independent from your salary!

3 years later, back with 30 billion won in revenue!!

Nomad Yoo, the author of "My Salary Independence Project," which became an instant bestseller with his vivid investment story of quitting his job, making 3 billion won in profit with a seed money of 4.8 million won, and becoming "salary independent" while working overtime as if it were nothing, has returned with a new work after 3 years.

The previous work was praised for breaking the stereotype of short-term trading and presenting a new perspective on stocks, and is consistently loved by many individual investors as the "most realistic introductory book."

However, the nomad refused to be famous, did not appear in any media, and did not hold any new lectures, leaving many readers curious about his whereabouts.

Now, three years later, the nomads' profits have exceeded 30 billion won.

This is the result of moving beyond short-term trading and diversifying your investment approach and portfolio to reach the 'next level' as an investor.

How to do well in stocks? The Nomads say "unparalleled effort" is the number one requirement.

During my working days, I studied stocks every night until I fell asleep from exhaustion. Even after becoming independent, I woke up at dawn every day to observe the global economy and stock markets.

So far, I have over 15,000 stock-related Evernote records that I have organized on my own.

Based on the big data accumulated in my head, I was able to expand my horizons to include funds and venture investments.

The author's second book, "My Investment Starts at 4 AM," shares his methodology and insights as a steadily growing investor, covering not only short-term trading up to 2017, when he achieved his dream of salary independence with 3 billion won, but also swing and long-term investments, mezzanine and private equity funds, and unlisted stocks.

“I wrote this book to teach you how to find investment signals and make profits.

Many people have asked how to do this.

So I wrote about my method.

The first thing to know is that it is more than you can imagine.

The path I have taken is, even in my opinion, an ignorant one.

But is there a royal road to learning? Don't expect superficial, one-point lessons on keywords or chart techniques.

“That’s literally how you study everything.”

“I look for opportunities in any market.”

Connect the signal to the profit, separate the signal from the noise.

Independent project with a different level of investment perspective

3 billion is impressive enough, but how did the jump to 30 billion come about? The author realized that, from the time he was making profits through short-term trading until now, he had been searching for "market signals" and connecting them to profits.

"Any change that alters the value of a stock or sector." Recognizing this signal faster than anyone else and connecting it to the future is the key to his ability to generate significant investment returns.

“Something that came out of nothing, something that existed and then disappeared” Here is the secret to making a lot of money with stocks.

If you can spot these two faster than anyone else, you can achieve overwhelming excess profits.

It's about capturing the very small 'signals' of the present, 'connecting' them with past cases, and 'imagining' the future.

The author wrote this book to teach you how to find investment signals and make profits.

As many people have asked, I also felt a sense of obligation to share how my perspective has changed from the past, when I was only focused on 'short-term trading'.

Eventually, while writing a revised edition of a previous work, I found myself writing a completely new book.

Because I wanted to show readers the 'next level' of investing through today's evolved perspective.

The book, with its signature lively narrative, explores various investment cases and explains how to find signals in the news you wake up to every morning and connect them to trades, how to distinguish meaningful signals from noise, and how to interpret and utilize market conditions and the macroeconomy.

The author's earnings certification, which was a hot topic in the stock gallery, was also not left out.

We also disclose our fund accounts, along with our general stock accounts, and our current major portfolios.

Revenue has already exceeded 30 billion won, and the company's early investments in unicorn-level startups, which are familiar to us, are also noteworthy.

Private equity funds, venture capital, and over-the-counter stock investments may seem like a distant dream for small business owners, but these areas have already expanded significantly and are showing remarkable growth.

“It might feel like investments from different worlds, but I wanted to tell you that they are all connected.

Ultimately, investing is strongly connected to life and lifestyle.

“I realized that the more advanced they are, the more they are predicting and investing in future lifestyle changes.”

No matter what area or method you're investing in, this book offers fresh insights and clear motivation for all readers.

Let's follow his time as he wakes up at 4 a.m. every day without fail on market days to prepare for 'battle'.

Earn 3 billion won with 4.8 million won and quit your job to become independent from your salary!

3 years later, back with 30 billion won in revenue!!

Nomad Yoo, the author of "My Salary Independence Project," which became an instant bestseller with his vivid investment story of quitting his job, making 3 billion won in profit with a seed money of 4.8 million won, and becoming "salary independent" while working overtime as if it were nothing, has returned with a new work after 3 years.

The previous work was praised for breaking the stereotype of short-term trading and presenting a new perspective on stocks, and is consistently loved by many individual investors as the "most realistic introductory book."

However, the nomad refused to be famous, did not appear in any media, and did not hold any new lectures, leaving many readers curious about his whereabouts.

Now, three years later, the nomads' profits have exceeded 30 billion won.

This is the result of moving beyond short-term trading and diversifying your investment approach and portfolio to reach the 'next level' as an investor.

How to do well in stocks? The Nomads say "unparalleled effort" is the number one requirement.

During my working days, I studied stocks every night until I fell asleep from exhaustion. Even after becoming independent, I woke up at dawn every day to observe the global economy and stock markets.

So far, I have over 15,000 stock-related Evernote records that I have organized on my own.

Based on the big data accumulated in my head, I was able to expand my horizons to include funds and venture investments.

The author's second book, "My Investment Starts at 4 AM," shares his methodology and insights as a steadily growing investor, covering not only short-term trading up to 2017, when he achieved his dream of salary independence with 3 billion won, but also swing and long-term investments, mezzanine and private equity funds, and unlisted stocks.

“I wrote this book to teach you how to find investment signals and make profits.

Many people have asked how to do this.

So I wrote about my method.

The first thing to know is that it is more than you can imagine.

The path I have taken is, even in my opinion, an ignorant one.

But is there a royal road to learning? Don't expect superficial, one-point lessons on keywords or chart techniques.

“That’s literally how you study everything.”

“I look for opportunities in any market.”

Connect the signal to the profit, separate the signal from the noise.

Independent project with a different level of investment perspective

3 billion is impressive enough, but how did the jump to 30 billion come about? The author realized that, from the time he was making profits through short-term trading until now, he had been searching for "market signals" and connecting them to profits.

"Any change that alters the value of a stock or sector." Recognizing this signal faster than anyone else and connecting it to the future is the key to his ability to generate significant investment returns.

“Something that came out of nothing, something that existed and then disappeared” Here is the secret to making a lot of money with stocks.

If you can spot these two faster than anyone else, you can achieve overwhelming excess profits.

It's about capturing the very small 'signals' of the present, 'connecting' them with past cases, and 'imagining' the future.

The author wrote this book to teach you how to find investment signals and make profits.

As many people have asked, I also felt a sense of obligation to share how my perspective has changed from the past, when I was only focused on 'short-term trading'.

Eventually, while writing a revised edition of a previous work, I found myself writing a completely new book.

Because I wanted to show readers the 'next level' of investing through today's evolved perspective.

The book, with its signature lively narrative, explores various investment cases and explains how to find signals in the news you wake up to every morning and connect them to trades, how to distinguish meaningful signals from noise, and how to interpret and utilize market conditions and the macroeconomy.

The author's earnings certification, which was a hot topic in the stock gallery, was also not left out.

We also disclose our fund accounts, along with our general stock accounts, and our current major portfolios.

Revenue has already exceeded 30 billion won, and the company's early investments in unicorn-level startups, which are familiar to us, are also noteworthy.

Private equity funds, venture capital, and over-the-counter stock investments may seem like a distant dream for small business owners, but these areas have already expanded significantly and are showing remarkable growth.

“It might feel like investments from different worlds, but I wanted to tell you that they are all connected.

Ultimately, investing is strongly connected to life and lifestyle.

“I realized that the more advanced they are, the more they are predicting and investing in future lifestyle changes.”

No matter what area or method you're investing in, this book offers fresh insights and clear motivation for all readers.

Let's follow his time as he wakes up at 4 a.m. every day without fail on market days to prepare for 'battle'.

GOODS SPECIFICS

- Publication date: April 15, 2022

- Page count, weight, size: 386 pages | 698g | 150*220*30mm

- ISBN13: 9788901259703

- ISBN10: 8901259702

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)