Next

|

Description

Book Introduction

- A word from MD

-

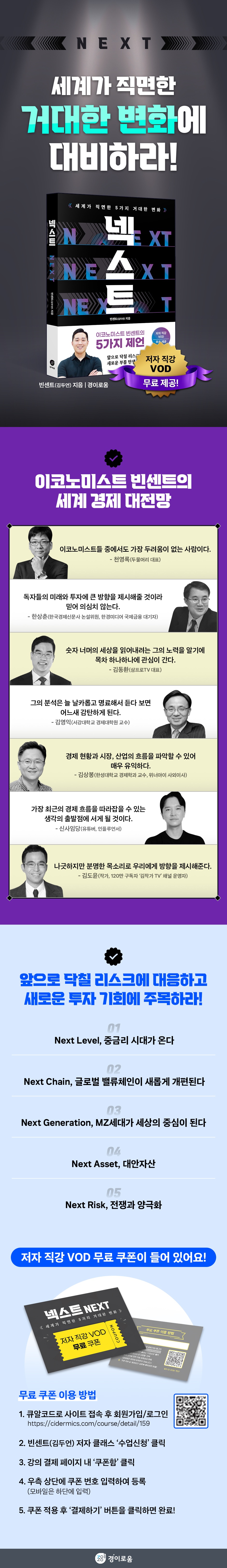

The change has begunThe first book by Vincent, a big data economist with a two-year career.

In this turbulent era of diverse risks, what changes must we face and how should we respond? The author examines five shifts in the financial market and offers a sobering analysis and countermeasures.

This one book is enough to understand the flow of the rapidly changing world.

March 22, 2022. Economics and Management PD Kim Sang-geun

Big Data Economist Vincent's

World Economic Outlook

Economist Vincent Kim Du-eon's first book! He compiles his global outlook and the countermeasures we must prepare for the future into a book.

This book examines five changes, or "next stages," under the grand proposition that a new paradigm shift has already begun in the financial market, and also presents response strategies.

The five changes are 'next level', 'next chain', 'next generation', 'next asset', and 'next risk'.

I hope you will pay close attention to the five waves of change introduced in this book and develop your own alternatives.

World Economic Outlook

Economist Vincent Kim Du-eon's first book! He compiles his global outlook and the countermeasures we must prepare for the future into a book.

This book examines five changes, or "next stages," under the grand proposition that a new paradigm shift has already begun in the financial market, and also presents response strategies.

The five changes are 'next level', 'next chain', 'next generation', 'next asset', and 'next risk'.

I hope you will pay close attention to the five waves of change introduced in this book and develop your own alternatives.

- You can preview some of the book's contents.

Preview

index

Prologue _ Prepare for a new paradigm!

Preview.

Next Stage: 7 Tangled Issues

01 Will the coronavirus ever end? Pandemic vs.

Endemic

02 The dawn of the era of austerity and inflation

03 G2 clashes on every issue, US-China conflict intensifies

04 Green Energy and the Emergence of Green-Related Policies

05 The MZ generation is the center of the world

06 Where are the new investment opportunities? Alternative assets.

07 The US's New Security Asset of Choice: Semiconductors

Chapter 1.

Next Level: The End of the Low-Interest Rate Era, the Beginning of a High-Interest Rate Era

Economic Outlook by Major Country

Back to normal, back to normal

Tapering, interest rate hikes, and quantitative tightening (QT)

Where are interest rates headed?

Increasing inflationary pressures

From a low interest rate era to a mid-interest rate era

Greenflation raises prices?

Stagflation or Reflation? Slowflation!

The Fed's policy shift: from IS to IF

Chapter 2.

Next Chain, a newly reorganized global value chain

The Chimerica value chain that reigned for 10 years

The Cracks of Chimerica

The coronavirus has brought the US-China conflict into sharp focus.

A new Cold War era has begun.

The ominous atmosphere of war between Russia and Ukraine

One China? Two? The conflict between China and Taiwan

The United States is expanding investment instead of consumption.

Again! The Made in USA Era

China to boost domestic demand and expand consumption

China's "Dual Circulation Strategy" and "Shared Wealth Theory"

The impact of the Chinese yuan's strength

The impact of the dissolution of Chimerica

Post-China: What Country Will Replace China?

Chapter 3.

The Next Generation, the MZ Generation, is the center of the world.

Now is the era of the MZ generation

A reality where dreams have disappeared, falling into idealism

The second characteristic of the MZ generation: altruism.

Customized services are the trend, hyper-personalization

Expansion of differentiated customized services

Pay attention to the big data industry

BONUS | The Economist's Predictions for Generation MZ in 2022

Chapter 4.

Next Asset: The Rise of Alternative Assets

Major assets that rose sharply even during the COVID-19 pandemic

Stocks, the synonym for traditional assets?

The bond-buying, no-questions-asked investment culture is over.

The real estate market is stabilizing downwards.

Next Asset, Alternative Asset

Chapter 5.

Next Risk, War, and Polarization

A few stories about oil

Semiconductors, America's New Strategic Asset

The expansion of the US-China conflict

War Risks: Russia-Ukraine

The emerging risk of polarization

Imitation is the mother of creation

Opportunities and crises: how to respond?

Epilogue _ Fill in your own next!

Appendix _ Key Quarterly Events in 2022

Preview.

Next Stage: 7 Tangled Issues

01 Will the coronavirus ever end? Pandemic vs.

Endemic

02 The dawn of the era of austerity and inflation

03 G2 clashes on every issue, US-China conflict intensifies

04 Green Energy and the Emergence of Green-Related Policies

05 The MZ generation is the center of the world

06 Where are the new investment opportunities? Alternative assets.

07 The US's New Security Asset of Choice: Semiconductors

Chapter 1.

Next Level: The End of the Low-Interest Rate Era, the Beginning of a High-Interest Rate Era

Economic Outlook by Major Country

Back to normal, back to normal

Tapering, interest rate hikes, and quantitative tightening (QT)

Where are interest rates headed?

Increasing inflationary pressures

From a low interest rate era to a mid-interest rate era

Greenflation raises prices?

Stagflation or Reflation? Slowflation!

The Fed's policy shift: from IS to IF

Chapter 2.

Next Chain, a newly reorganized global value chain

The Chimerica value chain that reigned for 10 years

The Cracks of Chimerica

The coronavirus has brought the US-China conflict into sharp focus.

A new Cold War era has begun.

The ominous atmosphere of war between Russia and Ukraine

One China? Two? The conflict between China and Taiwan

The United States is expanding investment instead of consumption.

Again! The Made in USA Era

China to boost domestic demand and expand consumption

China's "Dual Circulation Strategy" and "Shared Wealth Theory"

The impact of the Chinese yuan's strength

The impact of the dissolution of Chimerica

Post-China: What Country Will Replace China?

Chapter 3.

The Next Generation, the MZ Generation, is the center of the world.

Now is the era of the MZ generation

A reality where dreams have disappeared, falling into idealism

The second characteristic of the MZ generation: altruism.

Customized services are the trend, hyper-personalization

Expansion of differentiated customized services

Pay attention to the big data industry

BONUS | The Economist's Predictions for Generation MZ in 2022

Chapter 4.

Next Asset: The Rise of Alternative Assets

Major assets that rose sharply even during the COVID-19 pandemic

Stocks, the synonym for traditional assets?

The bond-buying, no-questions-asked investment culture is over.

The real estate market is stabilizing downwards.

Next Asset, Alternative Asset

Chapter 5.

Next Risk, War, and Polarization

A few stories about oil

Semiconductors, America's New Strategic Asset

The expansion of the US-China conflict

War Risks: Russia-Ukraine

The emerging risk of polarization

Imitation is the mother of creation

Opportunities and crises: how to respond?

Epilogue _ Fill in your own next!

Appendix _ Key Quarterly Events in 2022

Detailed image

Into the book

In Korea, interest rate hikes will be a major issue.

How much will interest rates rise in 2022? The Bank of Korea raised the base rate to 1.25% on January 14, 2022, following its previous hike on November 25, 2021.

In other words, interest rates that were in the 0% range during the COVID-19 era are returning to pre-COVID levels.

Even a newly inaugurated government will not be able to arbitrarily change the existing monetary policy.

This is because, although domestic household debt has exceeded GDP, we must prepare for the possibility of capital outflow through the foreign exchange market and keep pace with the global monetary policy normalization trend.

It may be helpful to remember the common opinion among experts that interest rates are likely to be raised at least once or twice more within the year.

--- p.61~62

From the perspective of a large exporter, a fall in the value of the yuan may be good in the short term as it will make product prices cheaper, but it is by no means a good thing for China's processing and assembly trade structure, which requires importing raw materials and intermediate goods to export goods.

So, as soon as China earned dollars, it started buying US Treasuries.

There are two main reasons to buy US Treasury bonds.

One is that money must flow to the United States so that the United States can buy Chinese products again.

Another thing is that when a country accumulates a lot of dollars, the exchange rate is bound to fluctuate, but especially from the perspective of exporters, a fixed exchange rate is more advantageous than a fluctuating exchange rate.

Naturally, China would have wanted to keep the exchange rate stable.

It is for this very reason that China has been constantly sending back the dollars it earns to the United States.

That's how the exchange rate was defended.

--- p.114~115

Evidence that the MZ generation, with its large population and high purchasing power, is very interested in the environment is appearing everywhere.

In fact, they open their wallets to buy eco-friendly products even if they are a little more expensive, rather than buying products that harm the environment and create waste and pollution.

This kind of behavior is possible because the MZ generation recognizes that it is a choice not only for themselves but also for their future descendants.

A generation that refuses to invest in companies that don't take the environment into account has emerged as the center of the world.

--- p.189

Semiconductors have been a hot topic in the stock market for a while, along with the Internet of Things and 5G.

Among these, semiconductors will continue to be at the center of trends.

Whether in industry or daily life, the demand for semiconductors is likely to increase rather than decrease.

That's why it's nicknamed the rice of the 21st century.

Samsung Electronics has the largest market capitalization and is bound to become a national stock.

Semiconductors are a difficult stock to invest in by looking at data.

Like other stocks, semiconductors can be invested in based on rumors and sold on news. However, I propose a counter-intuitive approach: consider risk rather than performance, as in the past.

This means that even if the profit is less, let's go in after looking at the confirmed data.

--- p.228

The recent war of words between the US and China over Taiwan is closely related to semiconductors.

Although the two countries claim that their goal is 'alliance' and 'national unification,' the reality is that 'semiconductors' are located in places that are not visible to the eye.

The G2's fight to obtain semiconductors, known as the rice of the 21st century, can be seen as inevitable.

From the U.S. perspective, it will make every effort to secure semiconductors from South Korea and Taiwan, asserting its security in East Asia.

China, which is well aware of America's intentions, will also try to counter this with force.

Therefore, the East Asian region, including Korea, Japan, and Taiwan, is exposed to enormous military and economic risks.

How much will interest rates rise in 2022? The Bank of Korea raised the base rate to 1.25% on January 14, 2022, following its previous hike on November 25, 2021.

In other words, interest rates that were in the 0% range during the COVID-19 era are returning to pre-COVID levels.

Even a newly inaugurated government will not be able to arbitrarily change the existing monetary policy.

This is because, although domestic household debt has exceeded GDP, we must prepare for the possibility of capital outflow through the foreign exchange market and keep pace with the global monetary policy normalization trend.

It may be helpful to remember the common opinion among experts that interest rates are likely to be raised at least once or twice more within the year.

--- p.61~62

From the perspective of a large exporter, a fall in the value of the yuan may be good in the short term as it will make product prices cheaper, but it is by no means a good thing for China's processing and assembly trade structure, which requires importing raw materials and intermediate goods to export goods.

So, as soon as China earned dollars, it started buying US Treasuries.

There are two main reasons to buy US Treasury bonds.

One is that money must flow to the United States so that the United States can buy Chinese products again.

Another thing is that when a country accumulates a lot of dollars, the exchange rate is bound to fluctuate, but especially from the perspective of exporters, a fixed exchange rate is more advantageous than a fluctuating exchange rate.

Naturally, China would have wanted to keep the exchange rate stable.

It is for this very reason that China has been constantly sending back the dollars it earns to the United States.

That's how the exchange rate was defended.

--- p.114~115

Evidence that the MZ generation, with its large population and high purchasing power, is very interested in the environment is appearing everywhere.

In fact, they open their wallets to buy eco-friendly products even if they are a little more expensive, rather than buying products that harm the environment and create waste and pollution.

This kind of behavior is possible because the MZ generation recognizes that it is a choice not only for themselves but also for their future descendants.

A generation that refuses to invest in companies that don't take the environment into account has emerged as the center of the world.

--- p.189

Semiconductors have been a hot topic in the stock market for a while, along with the Internet of Things and 5G.

Among these, semiconductors will continue to be at the center of trends.

Whether in industry or daily life, the demand for semiconductors is likely to increase rather than decrease.

That's why it's nicknamed the rice of the 21st century.

Samsung Electronics has the largest market capitalization and is bound to become a national stock.

Semiconductors are a difficult stock to invest in by looking at data.

Like other stocks, semiconductors can be invested in based on rumors and sold on news. However, I propose a counter-intuitive approach: consider risk rather than performance, as in the past.

This means that even if the profit is less, let's go in after looking at the confirmed data.

--- p.228

The recent war of words between the US and China over Taiwan is closely related to semiconductors.

Although the two countries claim that their goal is 'alliance' and 'national unification,' the reality is that 'semiconductors' are located in places that are not visible to the eye.

The G2's fight to obtain semiconductors, known as the rice of the 21st century, can be seen as inevitable.

From the U.S. perspective, it will make every effort to secure semiconductors from South Korea and Taiwan, asserting its security in East Asia.

China, which is well aware of America's intentions, will also try to counter this with force.

Therefore, the East Asian region, including Korea, Japan, and Taiwan, is exposed to enormous military and economic risks.

--- p.266

Publisher's Review

Big Data Economist Vincent's Global Economic Outlook

Economist Vincent Kim Du-eon's first book! He compiles his global outlook and the countermeasures we must prepare for the future into a book.

This book examines five changes, or "next stages," under the grand proposition that a new paradigm shift has already begun in the financial market, and also presents response strategies.

The five changes are 'next level', 'next chain', 'next generation', 'next asset', and 'next risk'.

I hope you will pay close attention to the five waves of change introduced in this book and develop your own alternatives.

In this era of upheaval, if you don't want to fall behind, prepare for a new paradigm that will change the future!

The impact of the coronavirus pandemic has led to a surge in liquidity, raising concerns about inflation and looming interest rate hikes.

Meanwhile, the US and China are clashing over every issue, significantly changing the existing value chain where China produces and the US consumes.

Moreover, with Russia invading Ukraine, the risk of war has increased worldwide.

In an era of complex risks, what strategy should Korea adopt? And what assets should individuals invest in? Economist Vincent, who has forecasted the future of the economy through numerous media outlets, presents a global economic scenario.

Of course, predictions can be wrong.

However, to prepare for future crises and seize new opportunities, we must look to the future and maintain a constant interest in it.

This is why we should listen to the author, who has repeatedly pondered trends and investments, not only in finance and economics, but also in the MZ generation, polarization, and alternative assets.

Vincent's Five Global Economic Changes

Next Level: The Era of High Interest Rates Has Arrived

The era of low prices and low interest rates is over.

Instead, we will enter an era of high inflation and high interest rates.

So, will this trend of rising interest rates continue? The author predicts that the pace of interest rate hikes will peak in the first half of 2022 and then stabilize thereafter.

Rather, the U.S. is likely to hesitate to raise interest rates in the second half of 2022 due to concerns about a slowdown in the economy.

The era of 'slowflation' is approaching, with prices and interest rates one level higher than in the past and a gradual, sideways growth trend continuing.

Next Chain, a newly reorganized global value chain

In 2022, Chimerica will be dismantled and the global value chain will be reorganized.

China, previously a producer, will likely focus more on growing its domestic market, while the United States, previously a consumer, will likely focus more on environmentally friendly investments.

As the US-China trade conflict deepens, Chimerica is broken.

The United States, which is turning its back on China, needs other sources of income.

As the G2 confrontation intensifies, Korea is faced with the time to choose one side or the other.

Next Generation, MZ Generation is the center of the world

The MZ generation has emerged as the center of the world and is leading numerous trends.

With their large global population and high purchasing power, they will become a key generation that will lead the future market. Three characteristics of Generation MZ are idealism, altruism, and hyper-personalization. Considering future investment directions based on this generation's characteristics, new business opportunities can be found in the metaverse, NFTs, ESG and eco-friendliness, and big data.

Next Asset, Alternative Asset

While the prices of traditional assets such as stocks, bonds, and real estate have risen significantly during the COVID-19 pandemic, they are showing signs of gradual adjustment.

Inflation concerns could lead to asset values that have risen over the past few years remaining flat or declining in 2022.

Of course, even if it rises, it is difficult to expect a large increase like in the past.

The author focuses on virtual currency as an alternative asset to traditional assets.

Although still volatile and not yet fully established as a fully realized asset class, cryptocurrencies are an important alternative asset class.

Next Risk: War and Polarization

If the past was an era of wars fought to secure oil, now is an era in which the world's major powers are willing to wage war to secure semiconductors.

The United States will pursue a two-track strategy to secure semiconductors.

First, we will expand our influence in Korea and Taiwan, which are forming the semiconductor belt, and then we will invest heavily in building semiconductor foundry infrastructure within the United States.

The problem of polarization has been a conflict that cannot be easily resolved even before the coronavirus outbreak.

But as the coronavirus swept the world, polarization became more evident.

We are heading towards a situation where it is difficult to bridge the gaps between countries, classes, and generations, centered on economic power.

Economist Vincent Kim Du-eon's first book! He compiles his global outlook and the countermeasures we must prepare for the future into a book.

This book examines five changes, or "next stages," under the grand proposition that a new paradigm shift has already begun in the financial market, and also presents response strategies.

The five changes are 'next level', 'next chain', 'next generation', 'next asset', and 'next risk'.

I hope you will pay close attention to the five waves of change introduced in this book and develop your own alternatives.

In this era of upheaval, if you don't want to fall behind, prepare for a new paradigm that will change the future!

The impact of the coronavirus pandemic has led to a surge in liquidity, raising concerns about inflation and looming interest rate hikes.

Meanwhile, the US and China are clashing over every issue, significantly changing the existing value chain where China produces and the US consumes.

Moreover, with Russia invading Ukraine, the risk of war has increased worldwide.

In an era of complex risks, what strategy should Korea adopt? And what assets should individuals invest in? Economist Vincent, who has forecasted the future of the economy through numerous media outlets, presents a global economic scenario.

Of course, predictions can be wrong.

However, to prepare for future crises and seize new opportunities, we must look to the future and maintain a constant interest in it.

This is why we should listen to the author, who has repeatedly pondered trends and investments, not only in finance and economics, but also in the MZ generation, polarization, and alternative assets.

Vincent's Five Global Economic Changes

Next Level: The Era of High Interest Rates Has Arrived

The era of low prices and low interest rates is over.

Instead, we will enter an era of high inflation and high interest rates.

So, will this trend of rising interest rates continue? The author predicts that the pace of interest rate hikes will peak in the first half of 2022 and then stabilize thereafter.

Rather, the U.S. is likely to hesitate to raise interest rates in the second half of 2022 due to concerns about a slowdown in the economy.

The era of 'slowflation' is approaching, with prices and interest rates one level higher than in the past and a gradual, sideways growth trend continuing.

Next Chain, a newly reorganized global value chain

In 2022, Chimerica will be dismantled and the global value chain will be reorganized.

China, previously a producer, will likely focus more on growing its domestic market, while the United States, previously a consumer, will likely focus more on environmentally friendly investments.

As the US-China trade conflict deepens, Chimerica is broken.

The United States, which is turning its back on China, needs other sources of income.

As the G2 confrontation intensifies, Korea is faced with the time to choose one side or the other.

Next Generation, MZ Generation is the center of the world

The MZ generation has emerged as the center of the world and is leading numerous trends.

With their large global population and high purchasing power, they will become a key generation that will lead the future market. Three characteristics of Generation MZ are idealism, altruism, and hyper-personalization. Considering future investment directions based on this generation's characteristics, new business opportunities can be found in the metaverse, NFTs, ESG and eco-friendliness, and big data.

Next Asset, Alternative Asset

While the prices of traditional assets such as stocks, bonds, and real estate have risen significantly during the COVID-19 pandemic, they are showing signs of gradual adjustment.

Inflation concerns could lead to asset values that have risen over the past few years remaining flat or declining in 2022.

Of course, even if it rises, it is difficult to expect a large increase like in the past.

The author focuses on virtual currency as an alternative asset to traditional assets.

Although still volatile and not yet fully established as a fully realized asset class, cryptocurrencies are an important alternative asset class.

Next Risk: War and Polarization

If the past was an era of wars fought to secure oil, now is an era in which the world's major powers are willing to wage war to secure semiconductors.

The United States will pursue a two-track strategy to secure semiconductors.

First, we will expand our influence in Korea and Taiwan, which are forming the semiconductor belt, and then we will invest heavily in building semiconductor foundry infrastructure within the United States.

The problem of polarization has been a conflict that cannot be easily resolved even before the coronavirus outbreak.

But as the coronavirus swept the world, polarization became more evident.

We are heading towards a situation where it is difficult to bridge the gaps between countries, classes, and generations, centered on economic power.

GOODS SPECIFICS

- Publication date: March 24, 2022

- Page count, weight, size: 292 pages | 530g | 152*225*20mm

- ISBN13: 9791197772801

- ISBN10: 1197772804

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)