Being good at investing

|

Description

Book Introduction

The secret to turning 5 million won into billions of won in assets All successful investment strategies, including the proven Super Ant TenBagger, are revealed! The book "What It Means to Invest Well" written by Jinhan Bae, a super ant on Lessonmon TV with 240,000 subscribers, has been published. He is a super ant who has reported acquisition of more than 5% of shares in numerous companies, including Daeryuk Corporation and Kokusai Paper, and has made profits of more than 1,000% in several stocks. Achieved an average annual return of over 50% for over 20 years. Currently, he operates several companies, including the investment firm Noble Jane Invest, the education platform Decamon, and Banchan Heaven. Having experienced both market crashes and booms, including the IMF crisis, the dot-com bubble, the financial crisis, and the COVID-19 pandemic, the author, a successful investor, wrote this book to help those struggling with investing. This book contains all of the success tips of Super Ant Bae Jin-han, who created assets worth hundreds of billions of won with an investment of 5 million won. |

- You can preview some of the book's contents.

Preview

index

Recommendation_ Good investment

Prologue_ Finding a mentor who has succeeded in investing is the shortcut to beating the stock market!

Chapter 1: The Joy and Happiness of Economic Freedom

1.

Dirt spoon, dreaming of becoming a businessman

2.

Be a person who practices what you believe in.

3.

Will a high salary really make you happy?

4.

What Economic Freedom Guarantees

5.

Financial Freedom: Here's How to Achieve It!

● Super Ant Bae Jin-han's friendly investment mentoring

Chapter 2: Act 1 of Life as a Businessman

1.

A side dish shop will change the world.

2.

When the side dish paradise fell into hell

● Super Ant Bae Jin-han's friendly investment mentoring

Chapter 3: Characteristics of People Who Lose Money in Investments

1.

The Real Reason Individual Investors Lose Money in the Stock Market

2.

People who succeed in the short term are like professional gamers.

3.

There's a cliff at the end of excessive leverage.

4.

To survive till the end in the stock market

5.

Beware of the devil's whispers

6.

Establish your own investment principles

● Super Ant Bae Jin-han's friendly investment mentoring

Chapter 4: Becoming a True Investor

1.

Investment started with 5 million won

2.

How to raise seed money with little money

3.

A bargain hunter dreams of becoming Korea's Walter Schroth.

4.

My experience of failure as a trader

5.

Successful Transformation from Trader to Long-Term Investor

● Super Ant Bae Jin-han's friendly investment mentoring

Chapter 5: Super Ant Bae Jin-han's Stock Investment Strategy Part 1

1.

Super Ant Bae Jin-han's 5 Investment Principles

2.

How to Use Auxiliary Indicators Properly

3.

You can determine the timing of buys and sells using three indicators.

● Super Ant Bae Jin-han's friendly investment mentoring

Chapter 6: Super Ant Bae Jin-han's Stock Investment Strategy Part 2

1.

Find the Tenbagger, the Key to Wealth

2.

Use contrarian investment strategies

3.

Invest in leading stocks that are part of a megatrend.

4.

You need to read industry trends

5.

Find stocks with earnings turnarounds.

6.

Invest in undervalued assets

7.

Invest in companies run by top CEOs.

8.

The secret to enduring stock price fluctuations

9.

Hold on with patience

10.

6 things to consider when making a comprehensive judgment

11.

Let's learn the key secrets of reading candles.

12.

How to Read Moving Averages Correctly

13.

Let's also look at the secrets of investing by looking at trading volume.

14.

Use split buying and split selling

● Super Ant Bae Jin-han's friendly investment mentoring

Chapter 7: Investing is a psychological warfare. You must learn to control your mind to make money!

1.

The key to successful investing is mental management.

2.

Investors have different ways of managing their funds.

3.

You need to know the difference between top-down and bottom-up approaches.

4.

Understand the principles of stock price fluctuations

5.

Don't be a slave to money

6.

Think of it as your own company, invest in it, and manage it continuously.

● Super Ant Bae Jin-han's friendly investment mentoring

Chapter 8: Super Ant's New Rise: Becoming a Startup CEO

1.

From financial illiteracy to financial powerhouse

2.

The secret to conquering the world

3.

Why You Should Invest in Startups

4.

Become an enabler to help others succeed

● Super Ant Bae Jin-han's friendly investment mentoring

Epilogue_ Developing your own capabilities is a must!

Prologue_ Finding a mentor who has succeeded in investing is the shortcut to beating the stock market!

Chapter 1: The Joy and Happiness of Economic Freedom

1.

Dirt spoon, dreaming of becoming a businessman

2.

Be a person who practices what you believe in.

3.

Will a high salary really make you happy?

4.

What Economic Freedom Guarantees

5.

Financial Freedom: Here's How to Achieve It!

● Super Ant Bae Jin-han's friendly investment mentoring

Chapter 2: Act 1 of Life as a Businessman

1.

A side dish shop will change the world.

2.

When the side dish paradise fell into hell

● Super Ant Bae Jin-han's friendly investment mentoring

Chapter 3: Characteristics of People Who Lose Money in Investments

1.

The Real Reason Individual Investors Lose Money in the Stock Market

2.

People who succeed in the short term are like professional gamers.

3.

There's a cliff at the end of excessive leverage.

4.

To survive till the end in the stock market

5.

Beware of the devil's whispers

6.

Establish your own investment principles

● Super Ant Bae Jin-han's friendly investment mentoring

Chapter 4: Becoming a True Investor

1.

Investment started with 5 million won

2.

How to raise seed money with little money

3.

A bargain hunter dreams of becoming Korea's Walter Schroth.

4.

My experience of failure as a trader

5.

Successful Transformation from Trader to Long-Term Investor

● Super Ant Bae Jin-han's friendly investment mentoring

Chapter 5: Super Ant Bae Jin-han's Stock Investment Strategy Part 1

1.

Super Ant Bae Jin-han's 5 Investment Principles

2.

How to Use Auxiliary Indicators Properly

3.

You can determine the timing of buys and sells using three indicators.

● Super Ant Bae Jin-han's friendly investment mentoring

Chapter 6: Super Ant Bae Jin-han's Stock Investment Strategy Part 2

1.

Find the Tenbagger, the Key to Wealth

2.

Use contrarian investment strategies

3.

Invest in leading stocks that are part of a megatrend.

4.

You need to read industry trends

5.

Find stocks with earnings turnarounds.

6.

Invest in undervalued assets

7.

Invest in companies run by top CEOs.

8.

The secret to enduring stock price fluctuations

9.

Hold on with patience

10.

6 things to consider when making a comprehensive judgment

11.

Let's learn the key secrets of reading candles.

12.

How to Read Moving Averages Correctly

13.

Let's also look at the secrets of investing by looking at trading volume.

14.

Use split buying and split selling

● Super Ant Bae Jin-han's friendly investment mentoring

Chapter 7: Investing is a psychological warfare. You must learn to control your mind to make money!

1.

The key to successful investing is mental management.

2.

Investors have different ways of managing their funds.

3.

You need to know the difference between top-down and bottom-up approaches.

4.

Understand the principles of stock price fluctuations

5.

Don't be a slave to money

6.

Think of it as your own company, invest in it, and manage it continuously.

● Super Ant Bae Jin-han's friendly investment mentoring

Chapter 8: Super Ant's New Rise: Becoming a Startup CEO

1.

From financial illiteracy to financial powerhouse

2.

The secret to conquering the world

3.

Why You Should Invest in Startups

4.

Become an enabler to help others succeed

● Super Ant Bae Jin-han's friendly investment mentoring

Epilogue_ Developing your own capabilities is a must!

Detailed image

Into the book

The easiest way to earn money through capital is through investing.

If you don't know how to invest, it's difficult to become rich, to put it extremely simply.

There is a best way to do business, but only a few people succeed.

Moreover, the value of money continues to decline over time.

As a result, the gap between rich and poor people is widening.

In times like these, this truth hits home even more deeply.

People who own houses or buildings in good locations have become very wealthy in an instant, while homeless salaried workers and small business owners are living in even more difficult circumstances.

The difference in wealth can be so great that you can't save it all in a lifetime of working.

---From "Chapter 1: The Joy and Happiness of Economic Freedom"

Think of stocks as a business.

When you do business, you often see cases where things don't go the way you want them to.

Even if you pursue a business with a strong belief that it will definitely succeed, the result may be failure.

We must avoid the “all or nothing” investment approach at all times.

Even if some of your business fails, you should always have a plan to get back on track.

Otherwise, there is a high probability that you will experience a failure so great that you will not be able to recover.

You can succeed ten times in a row.

But with just one failure, you can lose everything.

Anyone who invests inevitably comes to a point where they fail.

Always considering the possibility of failure is one of the secrets to surviving in the stock market.

---From "Characteristics of People Who Lose Money in Chapter 3 Investments"

You might be wondering how many stocks actually reach the ten-bagger level in Korea.

I looked for domestic stocks that had a return of 1,000%.

There are 72 Tenbagger stocks based on the closing price from April 30, 2001 to April 30, 2011 (10 years).

There are 34 stocks with 10-base hits based on the closing price from April 30, 2011 to April 30, 2021 (10 years).

Over the past 20 years (evaluated every 10 years), approximately 100 ten-bagger stocks have been created.

If you consider the stocks that achieved the ten-bagger and fell, the number increases further.

If you include stocks that achieved returns close to 1000% (over 800%), but not quite 10-baggers, the number increases significantly.

---From "Chapter 6: Super Ant Bae Jin-han's Stock Investment Strategy Part 2"

The stock market takes money from those who are impatient and need to do something on their own, and rewards investors who admit their own helplessness and wait patiently.

To wait long enough for the stock market to move on its own, I must realize that I have no control over it and that it is out of my hands.

Only then can you let go of the hand you are clenching tightly.

If you don't know these facts, you will find yourself buying or selling without waiting, believing you have the upper hand.

The harder you invest, the more you lose, as long as you believe the initiative is in your hands.

We must remember the characteristics of the stock market.

If you don't know how to invest, it's difficult to become rich, to put it extremely simply.

There is a best way to do business, but only a few people succeed.

Moreover, the value of money continues to decline over time.

As a result, the gap between rich and poor people is widening.

In times like these, this truth hits home even more deeply.

People who own houses or buildings in good locations have become very wealthy in an instant, while homeless salaried workers and small business owners are living in even more difficult circumstances.

The difference in wealth can be so great that you can't save it all in a lifetime of working.

---From "Chapter 1: The Joy and Happiness of Economic Freedom"

Think of stocks as a business.

When you do business, you often see cases where things don't go the way you want them to.

Even if you pursue a business with a strong belief that it will definitely succeed, the result may be failure.

We must avoid the “all or nothing” investment approach at all times.

Even if some of your business fails, you should always have a plan to get back on track.

Otherwise, there is a high probability that you will experience a failure so great that you will not be able to recover.

You can succeed ten times in a row.

But with just one failure, you can lose everything.

Anyone who invests inevitably comes to a point where they fail.

Always considering the possibility of failure is one of the secrets to surviving in the stock market.

---From "Characteristics of People Who Lose Money in Chapter 3 Investments"

You might be wondering how many stocks actually reach the ten-bagger level in Korea.

I looked for domestic stocks that had a return of 1,000%.

There are 72 Tenbagger stocks based on the closing price from April 30, 2001 to April 30, 2011 (10 years).

There are 34 stocks with 10-base hits based on the closing price from April 30, 2011 to April 30, 2021 (10 years).

Over the past 20 years (evaluated every 10 years), approximately 100 ten-bagger stocks have been created.

If you consider the stocks that achieved the ten-bagger and fell, the number increases further.

If you include stocks that achieved returns close to 1000% (over 800%), but not quite 10-baggers, the number increases significantly.

---From "Chapter 6: Super Ant Bae Jin-han's Stock Investment Strategy Part 2"

The stock market takes money from those who are impatient and need to do something on their own, and rewards investors who admit their own helplessness and wait patiently.

To wait long enough for the stock market to move on its own, I must realize that I have no control over it and that it is out of my hands.

Only then can you let go of the hand you are clenching tightly.

If you don't know these facts, you will find yourself buying or selling without waiting, believing you have the upper hand.

The harder you invest, the more you lose, as long as you believe the initiative is in your hands.

We must remember the characteristics of the stock market.

.

---From "Chapter 7: Investing is a psychological warfare. You must learn to control your mind to make money!"

---From "Chapter 7: Investing is a psychological warfare. You must learn to control your mind to make money!"

Publisher's Review

Key know-how for turning a 5 million won seed capital into billions of won

Popular YouTuber with 240,000 subscribers

Super Ant Bae Jin-han's key investment secrets!

The book "Investing Well" by Jinhan Bae, author of Lessonmon TV with 240,000 subscribers, has been published.

He is a super ant who has reported acquisition of more than 5% of shares in numerous companies, including Daeryuk Corporation and Kokusai Paper, and has made profits of more than 1,000% in several stocks.

Achieved an average annual return of over 50% for over 20 years.

Currently, he operates several companies, including the investment firm Noble Jane Invest, the education platform Decamon, and Banchan Heaven.

The author dreamed of becoming a successful businessman since his youth, when he wanted to escape the shackles of extreme poverty.

I was determined to become rich, so I started investing as an adult.

1998, the year I first started investing, was a year of unprecedented market crash due to the IMF crisis.

I didn't study stocks properly, but I knew that I had to buy stocks with good future prospects.

The author looked at companies that manufacture mobile phones among various sectors and invested in LG Information and Communication (now LG Electronics).

Maybe because I was lucky, I invested 5 million won and made a profit of 50 million won, and with that money I started the electrical business I had dreamed of.

Because I started a business with only a dream and without properly understanding the market, I faced the harsh reality and eventually experienced the bitter experience of closing down the business.

The author, who needed to make money again, decided to invest again.

At that time, I saw a flyer advertising the sale of unlisted stocks called KTF as over-the-counter stocks at 7,000 won per share, and I thought that if KTF went public, the stock price would rise significantly.

I pooled all the money I had available and bought unlisted KTF stock in late 1999.

At that time, I purchased 500 shares of unlisted stock at 10,000 won per share and invested an additional 5 million won in a paid-in capital increase. When KTF went public, the price rose to 300,000 won per share. While I missed the peak, I sold the shares for around 100,000 won, earning a profit of approximately tenfold.

The author, Bae Jin-han, is a Tenbegger expert with extensive experience in Tenbegger profits.

How to Find Tenbeger, the Key to Wealth

If you want to be rich, follow the path of the rich.

A ten bagger is a stock that has achieved a tenfold return on investment.

Tenbagger is a term first used by legendary American investor Peter Lynch, who managed the Magellan Fund for 13 years and achieved a total return of 2,703%.

The author first started investing and experienced Tenbagger.

The reason I was able to do it even though I was a beginner was because I invested because I saw potential for future growth.

Among domestic stocks, there are about 100 stocks that have achieved returns of 1,000% over the past 20 years.

If you include stocks that achieved returns close to 1000% (over 800%), but not quite 10-baggers, the number increases significantly.

This book clearly organizes in a table the stocks that achieved ten-baggers over the past 20 years and their growth rates.

It is said that professional Baduk players review the game after it is over and improve on any shortcomings.

The same goes for investing.

The easiest and quickest way to discover a tenbagger is to review the best stocks that have achieved tenbaggers in the past.

As you continue to study and research the approximately 100 stocks introduced in this book, you will discover the unique characteristics of the Tenbagger stocks and be able to select related stocks.

The most complete way to beat the stock market

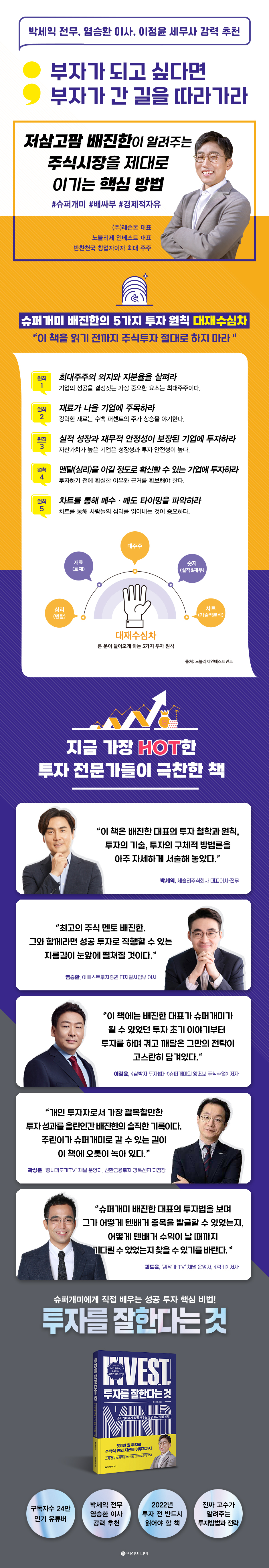

Super Ant Bae Jin-han's 5 Investment Principles

If I had to pick the most important thing in stock investing, it would be establishing principles.

Investment principles are your own investment method that outlines what you should and should not do while investing for a long period of time.

Investment principles should reflect the investor's philosophy.

However, it is very difficult for a novice investor to immediately establish his or her own investment philosophy.

Therefore, you should look into the investment principles of proven super ants and make an effort to make them your own.

The author claims that when he followed five principles while investing for over 20 years, he not only had a higher probability of success but also achieved high returns.

One of the five investment principles he mentioned is to look at the will and stake of the largest shareholder.

Because the largest shareholder is the most important factor in determining a company's success.

The second rule is to pay attention to the companies that will produce the materials.

The driving force behind stock price movements is materials.

Because powerful materials often cause stock prices to rise by hundreds of percent.

This book contains 19 positive materials and 17 negative materials.

The third principle is to invest in companies with guaranteed performance growth and financial stability.

Companies with high asset value relative to their market capitalization are undervalued in the market, which gives them the potential for their stock prices to rise. Furthermore, even in the worst-case scenario, most of the invested assets can be preserved through liquidation value (the value that can be received upon sale).

The fourth rule is to invest in companies that you can be confident enough to overcome your mentality.

The 5th principle is to determine the timing of buying and selling through the chart.

Additionally, the three key elements of the chart and three auxiliary indicators are organized together.

In particular, at the end of each chapter, you can see the questions investors are curious about along with detailed answers from author Jinhan Bae, titled 'Super Ant Jinhan Bae's Friendly Investment Mentoring.'

Investment mentoring that contains only the most useful information will be of great help to beginners who don't know how to invest.

Popular YouTuber with 240,000 subscribers

Super Ant Bae Jin-han's key investment secrets!

The book "Investing Well" by Jinhan Bae, author of Lessonmon TV with 240,000 subscribers, has been published.

He is a super ant who has reported acquisition of more than 5% of shares in numerous companies, including Daeryuk Corporation and Kokusai Paper, and has made profits of more than 1,000% in several stocks.

Achieved an average annual return of over 50% for over 20 years.

Currently, he operates several companies, including the investment firm Noble Jane Invest, the education platform Decamon, and Banchan Heaven.

The author dreamed of becoming a successful businessman since his youth, when he wanted to escape the shackles of extreme poverty.

I was determined to become rich, so I started investing as an adult.

1998, the year I first started investing, was a year of unprecedented market crash due to the IMF crisis.

I didn't study stocks properly, but I knew that I had to buy stocks with good future prospects.

The author looked at companies that manufacture mobile phones among various sectors and invested in LG Information and Communication (now LG Electronics).

Maybe because I was lucky, I invested 5 million won and made a profit of 50 million won, and with that money I started the electrical business I had dreamed of.

Because I started a business with only a dream and without properly understanding the market, I faced the harsh reality and eventually experienced the bitter experience of closing down the business.

The author, who needed to make money again, decided to invest again.

At that time, I saw a flyer advertising the sale of unlisted stocks called KTF as over-the-counter stocks at 7,000 won per share, and I thought that if KTF went public, the stock price would rise significantly.

I pooled all the money I had available and bought unlisted KTF stock in late 1999.

At that time, I purchased 500 shares of unlisted stock at 10,000 won per share and invested an additional 5 million won in a paid-in capital increase. When KTF went public, the price rose to 300,000 won per share. While I missed the peak, I sold the shares for around 100,000 won, earning a profit of approximately tenfold.

The author, Bae Jin-han, is a Tenbegger expert with extensive experience in Tenbegger profits.

How to Find Tenbeger, the Key to Wealth

If you want to be rich, follow the path of the rich.

A ten bagger is a stock that has achieved a tenfold return on investment.

Tenbagger is a term first used by legendary American investor Peter Lynch, who managed the Magellan Fund for 13 years and achieved a total return of 2,703%.

The author first started investing and experienced Tenbagger.

The reason I was able to do it even though I was a beginner was because I invested because I saw potential for future growth.

Among domestic stocks, there are about 100 stocks that have achieved returns of 1,000% over the past 20 years.

If you include stocks that achieved returns close to 1000% (over 800%), but not quite 10-baggers, the number increases significantly.

This book clearly organizes in a table the stocks that achieved ten-baggers over the past 20 years and their growth rates.

It is said that professional Baduk players review the game after it is over and improve on any shortcomings.

The same goes for investing.

The easiest and quickest way to discover a tenbagger is to review the best stocks that have achieved tenbaggers in the past.

As you continue to study and research the approximately 100 stocks introduced in this book, you will discover the unique characteristics of the Tenbagger stocks and be able to select related stocks.

The most complete way to beat the stock market

Super Ant Bae Jin-han's 5 Investment Principles

If I had to pick the most important thing in stock investing, it would be establishing principles.

Investment principles are your own investment method that outlines what you should and should not do while investing for a long period of time.

Investment principles should reflect the investor's philosophy.

However, it is very difficult for a novice investor to immediately establish his or her own investment philosophy.

Therefore, you should look into the investment principles of proven super ants and make an effort to make them your own.

The author claims that when he followed five principles while investing for over 20 years, he not only had a higher probability of success but also achieved high returns.

One of the five investment principles he mentioned is to look at the will and stake of the largest shareholder.

Because the largest shareholder is the most important factor in determining a company's success.

The second rule is to pay attention to the companies that will produce the materials.

The driving force behind stock price movements is materials.

Because powerful materials often cause stock prices to rise by hundreds of percent.

This book contains 19 positive materials and 17 negative materials.

The third principle is to invest in companies with guaranteed performance growth and financial stability.

Companies with high asset value relative to their market capitalization are undervalued in the market, which gives them the potential for their stock prices to rise. Furthermore, even in the worst-case scenario, most of the invested assets can be preserved through liquidation value (the value that can be received upon sale).

The fourth rule is to invest in companies that you can be confident enough to overcome your mentality.

The 5th principle is to determine the timing of buying and selling through the chart.

Additionally, the three key elements of the chart and three auxiliary indicators are organized together.

In particular, at the end of each chapter, you can see the questions investors are curious about along with detailed answers from author Jinhan Bae, titled 'Super Ant Jinhan Bae's Friendly Investment Mentoring.'

Investment mentoring that contains only the most useful information will be of great help to beginners who don't know how to invest.

GOODS SPECIFICS

- Publication date: January 30, 2022

- Page count, weight, size: 264 pages | 492g | 152*225*20mm

- ISBN13: 9791191328462

- ISBN10: 1191328465

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)