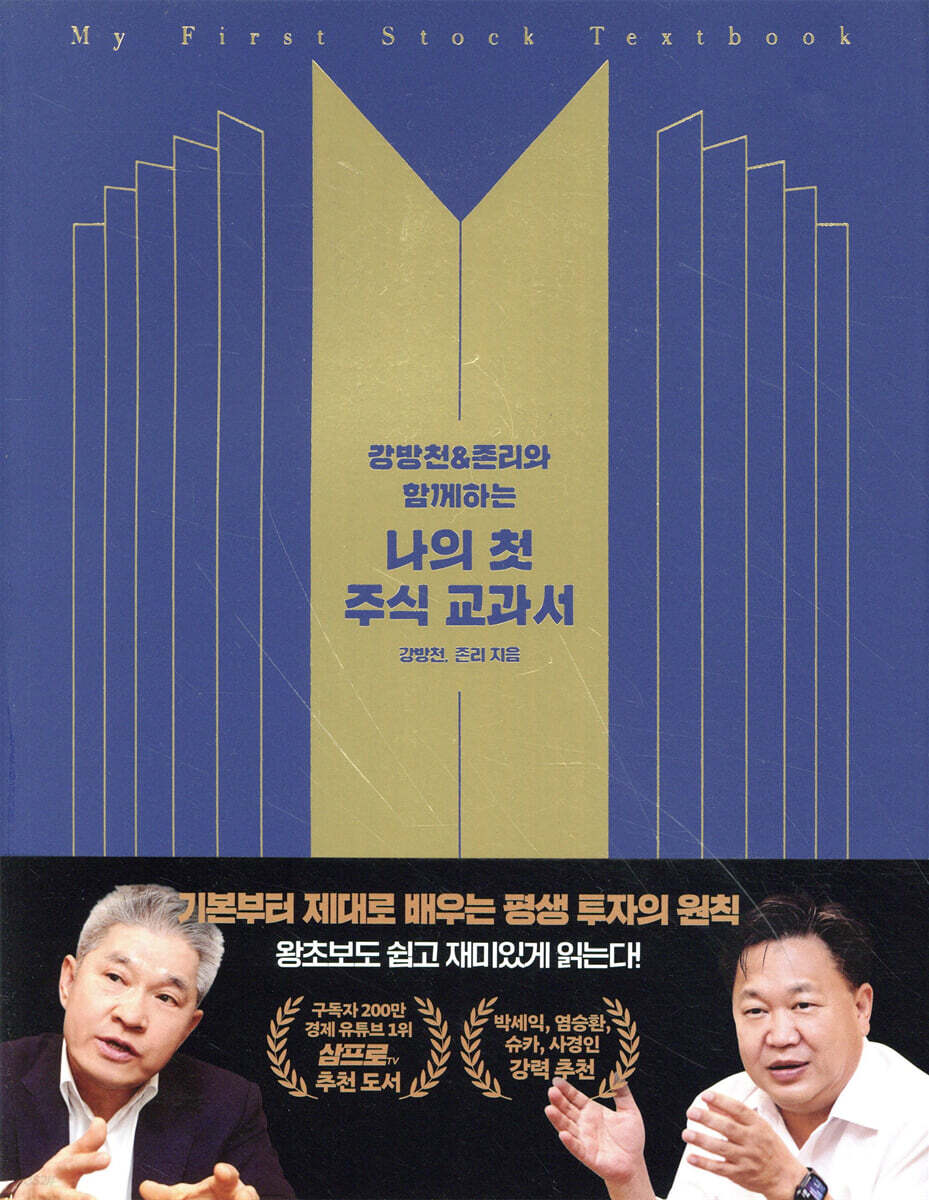

[YesRecover] My First Stock Textbook with Kang Bang-cheon and John Lee

|

Description

Book Introduction

The first joint project between Kang Bang-cheon and John Lee, living legends of Korean stock investment.

The Age of Investment: Investment Principles to Carry With You for Life “Let’s start learning about money and investing right now!” Investing in stocks has now become a necessity, not an option, for people. Reflecting the intense public interest, investment techniques from experts are published daily through books and media. But why do people still suffer losses and regret their investments? Without a sound investment philosophy, techniques only serve to confuse people and never deliver the sweet fruit of absolute returns. This book is a 'first stock investment textbook' for those who are just starting out in investing or individual investors who are investing but are unsure. Living legends of Korean stock investment, first-generation value investors, and top mentors who need no further explanation, Chairman Kang Bang-cheon of Asset Plus Asset Management and CEO John Lee of Meritz Asset Management have condensed into a single book the lifelong investment principles that have shaped their current status. This book contains the investment principles that Kang Bang-cheon and John Lee personally experienced and practiced to achieve their current success, including how to find the true value hidden in the stock price, how to develop investment habits that start with common sense and then interpret it further, and how to think and invest like a value investor. Many times, everyone is so focused on immediate profits that they neglect the principles of investment. Everyone knows it but doesn't practice it, and the easiest but most difficult thing is the basics and principles of investing. Just by following the principles in this book, you will be one step closer to successful investing. If you are an investor, this is a book you should keep on your bookshelf and read over and over again whenever you have free time. |

- You can preview some of the book's contents.

Preview

index

Recommendation

Kang Bang-cheon's words

John Lee's words

Part 1: Kang Bang-cheon's Stock Class

: There are investment ideas for life and consumption.

1st period.

Become a partner of great companies

There are three ways to make money.

Investment is our natural right.

The "Partner Ticket" to become the owner of a great company

Three great partners who made my dream come true

The power to face the changes of the world as an opportunity rather than a fear.

2nd period.

Invest in the value of the company

Don't invest in companies you don't understand.

Value determines price, and price is dependent on value.

There are many ways to find value; the essence lies in establishing your own principles.

A Prepared Opportunity for Me: Capital Market Liberalization

I am a perpetual value investor.

Raise your children with a values-oriented perspective.

3rd period.

Start with 'common sense' and develop into 'interpretation'.

Find value based on facts and add your own thoughts to determine value.

A Gangbangcheon-style way of thinking born from radio and maps

Same information, different interpretations! Fall in love with accounting.

'Associative Investment': Seeing One, Thinking of Two

Don't be tamed by rumors, be tamed by thoughts.

Where there is demand, there is competition.

4th period.

In the end, all investments are based on perspective.

Differences in perspective determine the success or failure of an investment.

Judge by market capitalization, not stock price.

Don't be fooled by the stock price that is lowered by illusions.

Be skeptical and interpret differently

Why Preferred Stock Over Common Stock

Perspective is important when investing in funds.

5th period.

Dig into life and consumption

Where will my wallet open?

Value lies where consumers' wallets open.

Consumers who buy good products can choose good stocks.

What consumers want is constantly changing.

Let's pay attention to the new emergence that will change our lives.

6th period.

The value of a company is in motion.

Add dynamic value to static value

Dynamic analysis to find future corporate value

The Successful Case of Korea Mobile Telecommunications Through Dynamic Analysis

A Different Interpretation of PER, the Investment Compass

Two things investors need: a microscope and a telescope.

Boom and bust cycles are constantly repeated.

Find top-tier companies that are unaffected by booms and busts.

Unless you're an investment guru, diversify your investments.

Look at the size of the industry and the competitive landscape.

Some companies enjoy competition.

A new world requires new measurement tools.

MDN, the fourth factor of production that can judge the new world

7th period.

Focus on the quality of your profits, not the quantity.

The "Quality of Profit" I Learned While Running a Resort

Four Criteria for Judging the Quality of Profits

Rediscovering the value of business models

Kang Bang-cheon's PER, 'K-PER'

Considering the potential for profit expansion: Expanding products and regions

Five Perspectives on Premium Offering

Two variables of future profits: future demand and future competition.

Analyzing future profits through financial statements

Step 5: Picking Good Stocks

8th period.

Invest in this business model

Lifelong perspectives that have shaped my investing

First keyword, customer

Second keyword: life

Third keyword: competitiveness

The fourth keyword is experience

Fifth keyword: leader

Part 2: John Lee's Stock Lessons

: Until the day when everyone becomes independent from the economy

1st period.

Think like a capitalist

Embarking on a new path that changed my life

Understanding the nature of capitalism

Wear two 'hats'

How Ordinary People Achieve Wealth

Let go of your obsession with real estate

It's more dangerous not to invest in stocks than to invest in them.

If you don't know money, you become a slave to money.

2nd period.

Look at value, not absolute price

Absolute stock price doesn't reflect a company's value; market capitalization is key.

What I Only Realized After Becoming Scudder's Fund Manager

Don't look at the stock price, look for value.

We buy company, not paper

To those who ask, 'Should I sell now?'

3rd period.

Investing is a matter of time and confidence.

Forgetting is a relatively effective investment strategy.

Look not at now, but at 10 years from now

Why You Can Never Make Money with Short-Term Trading

What if the company I invested in goes bankrupt in 10 or 20 years?

If you ask where 'value' will come from in the future,

The techniques may be different, but the philosophy is the same.

4th period.

The destruction of thought is still necessary

People who handle money but don't know anything about money

Until all of Korea is free from financial illiteracy

Korea will become the world's best investment market.

Watching Tesla's Battery Day

We need to get our kids out of the 'box'

How to prepare for your children's future and your own retirement at the same time

5th period.

Turn consumption into investment

A person who spends his whole life cannot beat a person who collects.

Pay yourself first!

Let's turn your daily spending of ten thousand won into an investment.

Never invest with debt

Make sure you understand and utilize your pension.

6th period.

Follow the steps and diversify your investments.

If you're afraid of failure, start step by step.

How Beginner Investors Can Choose the Right Fund

Misconceptions about funds and investments

If you're a beginner, diversify your investments like this.

Start now, even if it's just one year younger.

7th period.

Buy the company you want

A company that is good for me is good for others too.

The focus is on "companies you want to own."

Things to consider when looking for a company you want to own

How to determine the true value of a company

Can foreign capital be used as a basis for investment?

Investment strategies based on case studies: Invest in these companies!

8th period.

The art of stock trading is not to sell.

All you need to know about stocks is the skill of buying them.

Never try to 'time the market' (No timing the market time in the market)

Don't cut your losses

Don't sell unconditionally just because the target price has been reached.

Stocks are only sold in times like these.

Appendix: The Future of the Stock Market as Discussed by Kang Bang-cheon and John Lee

: What needs to change in the Korean capital market, and how?

Kang Bang-cheon's words

John Lee's words

Part 1: Kang Bang-cheon's Stock Class

: There are investment ideas for life and consumption.

1st period.

Become a partner of great companies

There are three ways to make money.

Investment is our natural right.

The "Partner Ticket" to become the owner of a great company

Three great partners who made my dream come true

The power to face the changes of the world as an opportunity rather than a fear.

2nd period.

Invest in the value of the company

Don't invest in companies you don't understand.

Value determines price, and price is dependent on value.

There are many ways to find value; the essence lies in establishing your own principles.

A Prepared Opportunity for Me: Capital Market Liberalization

I am a perpetual value investor.

Raise your children with a values-oriented perspective.

3rd period.

Start with 'common sense' and develop into 'interpretation'.

Find value based on facts and add your own thoughts to determine value.

A Gangbangcheon-style way of thinking born from radio and maps

Same information, different interpretations! Fall in love with accounting.

'Associative Investment': Seeing One, Thinking of Two

Don't be tamed by rumors, be tamed by thoughts.

Where there is demand, there is competition.

4th period.

In the end, all investments are based on perspective.

Differences in perspective determine the success or failure of an investment.

Judge by market capitalization, not stock price.

Don't be fooled by the stock price that is lowered by illusions.

Be skeptical and interpret differently

Why Preferred Stock Over Common Stock

Perspective is important when investing in funds.

5th period.

Dig into life and consumption

Where will my wallet open?

Value lies where consumers' wallets open.

Consumers who buy good products can choose good stocks.

What consumers want is constantly changing.

Let's pay attention to the new emergence that will change our lives.

6th period.

The value of a company is in motion.

Add dynamic value to static value

Dynamic analysis to find future corporate value

The Successful Case of Korea Mobile Telecommunications Through Dynamic Analysis

A Different Interpretation of PER, the Investment Compass

Two things investors need: a microscope and a telescope.

Boom and bust cycles are constantly repeated.

Find top-tier companies that are unaffected by booms and busts.

Unless you're an investment guru, diversify your investments.

Look at the size of the industry and the competitive landscape.

Some companies enjoy competition.

A new world requires new measurement tools.

MDN, the fourth factor of production that can judge the new world

7th period.

Focus on the quality of your profits, not the quantity.

The "Quality of Profit" I Learned While Running a Resort

Four Criteria for Judging the Quality of Profits

Rediscovering the value of business models

Kang Bang-cheon's PER, 'K-PER'

Considering the potential for profit expansion: Expanding products and regions

Five Perspectives on Premium Offering

Two variables of future profits: future demand and future competition.

Analyzing future profits through financial statements

Step 5: Picking Good Stocks

8th period.

Invest in this business model

Lifelong perspectives that have shaped my investing

First keyword, customer

Second keyword: life

Third keyword: competitiveness

The fourth keyword is experience

Fifth keyword: leader

Part 2: John Lee's Stock Lessons

: Until the day when everyone becomes independent from the economy

1st period.

Think like a capitalist

Embarking on a new path that changed my life

Understanding the nature of capitalism

Wear two 'hats'

How Ordinary People Achieve Wealth

Let go of your obsession with real estate

It's more dangerous not to invest in stocks than to invest in them.

If you don't know money, you become a slave to money.

2nd period.

Look at value, not absolute price

Absolute stock price doesn't reflect a company's value; market capitalization is key.

What I Only Realized After Becoming Scudder's Fund Manager

Don't look at the stock price, look for value.

We buy company, not paper

To those who ask, 'Should I sell now?'

3rd period.

Investing is a matter of time and confidence.

Forgetting is a relatively effective investment strategy.

Look not at now, but at 10 years from now

Why You Can Never Make Money with Short-Term Trading

What if the company I invested in goes bankrupt in 10 or 20 years?

If you ask where 'value' will come from in the future,

The techniques may be different, but the philosophy is the same.

4th period.

The destruction of thought is still necessary

People who handle money but don't know anything about money

Until all of Korea is free from financial illiteracy

Korea will become the world's best investment market.

Watching Tesla's Battery Day

We need to get our kids out of the 'box'

How to prepare for your children's future and your own retirement at the same time

5th period.

Turn consumption into investment

A person who spends his whole life cannot beat a person who collects.

Pay yourself first!

Let's turn your daily spending of ten thousand won into an investment.

Never invest with debt

Make sure you understand and utilize your pension.

6th period.

Follow the steps and diversify your investments.

If you're afraid of failure, start step by step.

How Beginner Investors Can Choose the Right Fund

Misconceptions about funds and investments

If you're a beginner, diversify your investments like this.

Start now, even if it's just one year younger.

7th period.

Buy the company you want

A company that is good for me is good for others too.

The focus is on "companies you want to own."

Things to consider when looking for a company you want to own

How to determine the true value of a company

Can foreign capital be used as a basis for investment?

Investment strategies based on case studies: Invest in these companies!

8th period.

The art of stock trading is not to sell.

All you need to know about stocks is the skill of buying them.

Never try to 'time the market' (No timing the market time in the market)

Don't cut your losses

Don't sell unconditionally just because the target price has been reached.

Stocks are only sold in times like these.

Appendix: The Future of the Stock Market as Discussed by Kang Bang-cheon and John Lee

: What needs to change in the Korean capital market, and how?

Detailed image

.jpg)

Publisher's Review

The World's Easiest Introduction to Stock Investment

A master's investment principles, easy to read with stories and illustrations

The era of investment has finally begun.

Many people open stock accounts and follow the investment techniques of experts, but not all of them make profits.

What should come before stock returns are the investment philosophy and principles.

Chairman Kang Bang-cheon and CEO John Lee have compiled their lifelong investment principles, which they have preached through lectures and the media, into eight lessons to convey a true investment philosophy and principles to those who currently speculate rather than invest.

This book contains the hope that everyone in Korea, from youth to seniors, will understand and learn the essentials of investment.

Part 1 is about Kang Bang-cheon's stock class, and it is divided into 8 lessons that explain his lifelong investment principles and investment success stories.

Likewise, in Part 2, CEO John Lee condenses his investment philosophy and advice into eight lessons to help all Koreans overcome financial illiteracy.

It is an easy-to-read book on investing with illustrations and stories, without any difficult numbers, making it suitable as an introduction to investing for parents and children to read together.

What's more important than charts and financial statements is your perspective on the world!

The expert's way of thinking: connecting even the smallest details of daily life to investments.

Investing is still difficult and burdensome for individual investors.

You're confused about which investment to choose and how long to hold onto it. You envy those around you who have made big profits, but you're also afraid when you see those who have suffered big losses.

Chairman Kang Bang-cheon and CEO John Lee, the first generation of value investors in Korea and top stock mentors, provide clear answers to the concerns individual investors have about the stock market.

When considering which investment options to choose, the book offers advice such as "Go with good things, not popular ones," and "Find a good business model that adds value," along with success stories. When considering how to get investment ideas like experts, the book offers principles such as "Don't be tamed by rumors, be tamed by thoughts," "Stock investment is a matter of time and confidence," and "Start with common sense and develop it into interpretation."

Experts get ideas from the small things in everyday life and connect them to investments.

And if it's a stock you're confident in, invest for the long term.

And the process returns with the sweet fruit of profit.

If individual investors want to make profits like institutions and foreign investors, they must find good stocks and invest for the long term.

This is the slowest but surest way to make money, as Kang Bang-cheon and John Lee demonstrate through the 16 principles of this book.

If you learn the fundamentals and solid investment principles through this book, you will be able to survive the harsh investment market and become a value investor capable of making wise investments.

A master's investment principles, easy to read with stories and illustrations

The era of investment has finally begun.

Many people open stock accounts and follow the investment techniques of experts, but not all of them make profits.

What should come before stock returns are the investment philosophy and principles.

Chairman Kang Bang-cheon and CEO John Lee have compiled their lifelong investment principles, which they have preached through lectures and the media, into eight lessons to convey a true investment philosophy and principles to those who currently speculate rather than invest.

This book contains the hope that everyone in Korea, from youth to seniors, will understand and learn the essentials of investment.

Part 1 is about Kang Bang-cheon's stock class, and it is divided into 8 lessons that explain his lifelong investment principles and investment success stories.

Likewise, in Part 2, CEO John Lee condenses his investment philosophy and advice into eight lessons to help all Koreans overcome financial illiteracy.

It is an easy-to-read book on investing with illustrations and stories, without any difficult numbers, making it suitable as an introduction to investing for parents and children to read together.

What's more important than charts and financial statements is your perspective on the world!

The expert's way of thinking: connecting even the smallest details of daily life to investments.

Investing is still difficult and burdensome for individual investors.

You're confused about which investment to choose and how long to hold onto it. You envy those around you who have made big profits, but you're also afraid when you see those who have suffered big losses.

Chairman Kang Bang-cheon and CEO John Lee, the first generation of value investors in Korea and top stock mentors, provide clear answers to the concerns individual investors have about the stock market.

When considering which investment options to choose, the book offers advice such as "Go with good things, not popular ones," and "Find a good business model that adds value," along with success stories. When considering how to get investment ideas like experts, the book offers principles such as "Don't be tamed by rumors, be tamed by thoughts," "Stock investment is a matter of time and confidence," and "Start with common sense and develop it into interpretation."

Experts get ideas from the small things in everyday life and connect them to investments.

And if it's a stock you're confident in, invest for the long term.

And the process returns with the sweet fruit of profit.

If individual investors want to make profits like institutions and foreign investors, they must find good stocks and invest for the long term.

This is the slowest but surest way to make money, as Kang Bang-cheon and John Lee demonstrate through the 16 principles of this book.

If you learn the fundamentals and solid investment principles through this book, you will be able to survive the harsh investment market and become a value investor capable of making wise investments.

GOODS SPECIFICS

- Date of issue: July 21, 2021

- Page count, weight, size: 288 pages | 598g | 185*240*18mm

- ISBN13: 9791190977326

- ISBN10: 119097732X

You may also like

카테고리

korean

korean

![[YesRecover] My First Stock Textbook with Kang Bang-cheon and John Lee](http://librairie.coreenne.fr/cdn/shop/files/812f7ff2f3a12a80a31eeabb9318a569.jpg?v=1765356355&width=3840)

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)