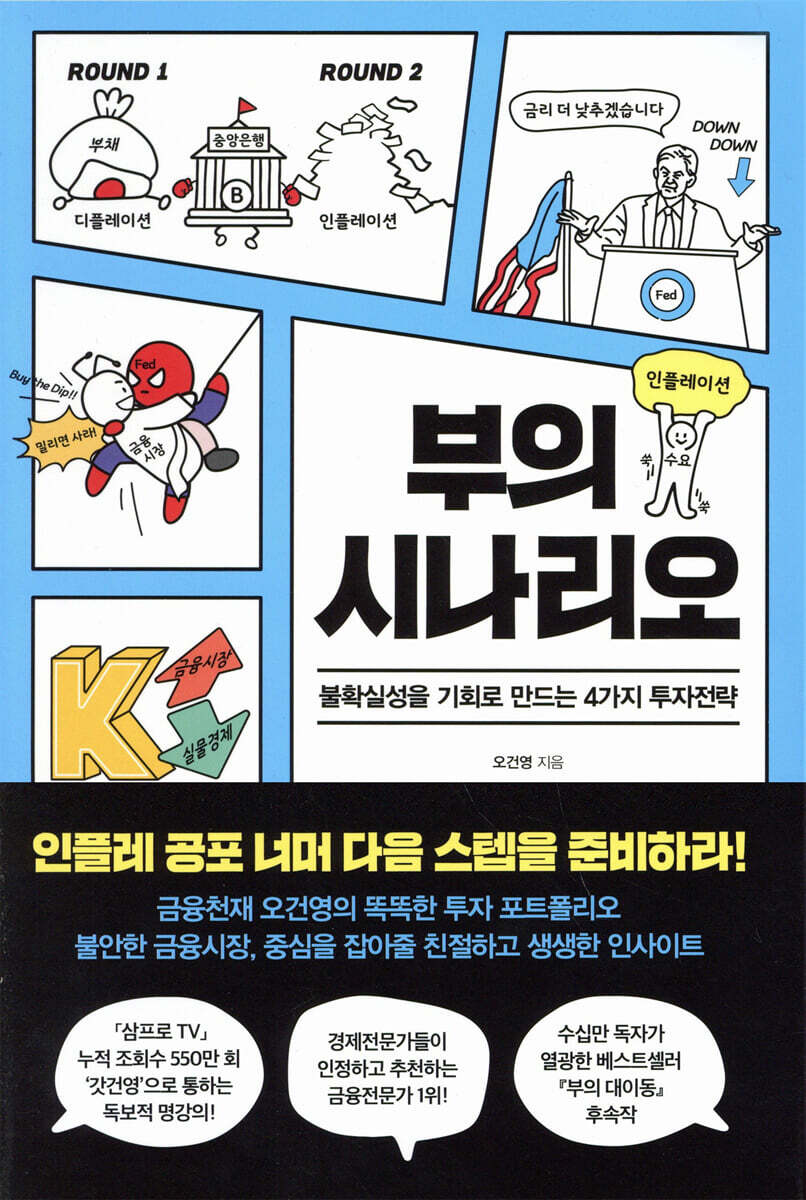

Wealth Scenario

|

Description

Book Introduction

"Beyond the fear of inflation, prepare for the next step!" Financial genius Oh Geon-young's smart investment portfolio In a volatile financial market, helpful and vivid insights will keep you grounded. Author Oh Geon-yeong returns to help investors navigate the uncertain financial markets and navigate their next steps. In addition to the unrivaled, friendly explanations by Oh Geon-yeong that allow you to grasp economic trends and knowledge just by reading them, we also prepared a "wealth scenario" to help you fight against the fear of inflation. Living up to the title of "Yeouido's #1 lecturer," we've placed graphs and articles in the right places to help economic concepts sink in, and added illustrations to make it even easier but more powerful. As you follow the author's explanations, from the central banks' efforts to stabilize interest rates in the wake of the COVID-19 crisis to the flood of stimulus measures and the resulting aftershocks, you'll gain a clearer perspective on the economy and a robust investment portfolio to combat the volatile financial markets. |

- You can preview some of the book's contents.

Preview

index

Recommended Article | It's Time to Break Free from the Indiscriminate Rising Inertia

Prologue | Let's move beyond inflation fears and prepare for the next step.

Laying the Groundwork | Understanding Interest Rates, Exchange Rates, and Bonds

01 Interest rates and exchange rates are determined by supply and demand.

ㆍ Interest rates - controlled by banks and companies

Exchange rates - Each country's banks, growth potential, and interest rates are important.

02 Bonds generate profits and losses depending on the interest rate and period.

Bonds - Non-cancellable, fixed-rate term deposits

Government bonds - the safest bonds

Corporate bonds - The higher the credit rating, the safer the bond.

Chapter 1 | The Post-COVID-19 Global Economic Environment

01 How did COVID-19 shake up financial markets?

A cold virus that no one could have predicted

Piles of debt piled up all over the world

ㆍ China's massive and powerful debt

ㆍ The meeting of the black swan and the gray rhinoceros

02 How the US Federal Reserve (Fed) Responds to Crisis

ㆍ The only source of money in a cash-strapped market

Quantitative easing - unlimited supply of dollars to banks

ㆍ Purchase of corporate bonds - Minimizing debt burden

Currency Swaps - Addressing Dollar Shortages in Emerging Countries

03 What is the Fed's new monetary policy, quantitative easing?

Market interest rates, which move according to market supply and demand

ㆍ The 'base interest rate' determined by the central bank

ㆍ Policy of lowering the base interest rate with a weaker base

Quantitative easing that lowers long-term interest rates

04 The US is on the brink of negative interest rates (difficulty level: high)

ㆍ Do interest rates and stock prices move together?

ㆍ As interest rates fall, stock prices also rise.

Negative interest rates chosen by Japan and Europe

ㆍ Side effects of negative interest rates

05 Individual investors whose investment patterns have changed significantly

ㆍ Buy the dip (BTD)

Don't be left out - Fear of missing out (FOMO)

Stocks are the answer - There is no alternative (TINA)

Stocks are overheated, the economy is in a slump - K-Recovery

06 Fiscal policy to revitalize the economy of ordinary people

ㆍ A 'bank' that lends money to the government

The 'government' that gives money to the common people

The end result of a wrong fiscal policy is a rise in market interest rates.

The solution is cooperation between banks and the government.

Chapter 2 | Interest Rate Situation in Korea

01 Is it better for Korea's base interest rate to be lower?

ㆍ Assets that cheer when interest rates fall 1 - Bonds

ㆍ Assets that cheer when interest rates fall 2 - Monthly rent

Side Effect of Interest Rate Cuts 1 - Rising Housing Costs

Side Effect of Interest Rate Cuts 2 - Damage to Healthy Companies

Side Effect of Interest Rate Cuts 3: Debt Surges Due to Continued Low Interest Rates

Side Effect of Interest Rate Cuts 4: Neglected Emerging Countries

ㆍ It is appropriate to lower the interest rate up to the effective lower limit.

02 Conditions for establishing quantitative easing

The start of economic recovery is a surprisingly 'powerful' stimulus package.

ㆍ The dollar is an international currency with strong demand.

ㆍ The Korean Won is a local currency used only in Korea.

Foreign investors who dislike foreign exchange losses

03 The Possibility of a Korean Quantitative Easing (Difficulty Level: High)

ㆍ Is the Bank of Korea's purchase of government bonds a quantitative easing policy?

Two ways to purchase government bonds

ㆍ The Korean standard is 'base rate', and the US standard is 'quantity'

Chapter 3 | Everyone's Goal: Escape Low Inflation

01 Inflation and Deflation: Which is Better?

ㆍ Good inflation vs.

bad inflation

Good deflation vs.

Bad deflation

ㆍ When debt is high, inflation vs.

deflation

02 Central Banks Become Deflation Fighters

ㆍ 1970, severe global inflation

ㆍ The swamp of economic recession from which one cannot escape

Deflation that swept Japan

Efforts to escape deflation 1 - Symmetric price target

Efforts to escape deflation 2 - Average price targeting system

03 Why Prices Don't Rise Even When Money Is Released

Amazon fuels competition for the lowest price

ㆍ Maintaining long-term low oil prices through smooth supply

ㆍDriving down the unit prices of zombie companies

ㆍ Shrinking consumer market

Currency wars that lower the value of a currency

ㆍ Excessive debt loaded

04 How Central Banks Overcome Deflation

A 'high-pressure economy' that increases corporate productivity

ㆍEven if the market overheats, job growth and price stability are top priorities.

ㆍThe end result of infinite supply is massive inflation?

ㆍ A swamp of massive deflation

Chapter 4 | Draw a Scenario and Take the Next Step

01 Four 'Wealth Scenarios' Distinguished by Growth and Inflation

Scenario 1: High Growth and High Prices

Scenario 2: Low Growth and High Prices

Scenario 3: High Growth, Low Inflation

Scenario 4 | Low Growth and Low Inflation

ㆍ We are now in an era of low growth and low prices. What is the next step?

02 Oh Geon-young's Post-COVID-19 Scenario

ㆍ Lack of demand is a global problem

ㆍ If the United States maintains its economic stimulus measures

It is important that China does not start a currency war.

A beautiful bull market blossoms through cooperation among nations.

ㆍ Complete your own portfolio by drawing future scenarios.

Epilogue | The Optimal Portfolio, Built with Economic Data

Appendix | How to Start Studying Finance

Prologue | Let's move beyond inflation fears and prepare for the next step.

Laying the Groundwork | Understanding Interest Rates, Exchange Rates, and Bonds

01 Interest rates and exchange rates are determined by supply and demand.

ㆍ Interest rates - controlled by banks and companies

Exchange rates - Each country's banks, growth potential, and interest rates are important.

02 Bonds generate profits and losses depending on the interest rate and period.

Bonds - Non-cancellable, fixed-rate term deposits

Government bonds - the safest bonds

Corporate bonds - The higher the credit rating, the safer the bond.

Chapter 1 | The Post-COVID-19 Global Economic Environment

01 How did COVID-19 shake up financial markets?

A cold virus that no one could have predicted

Piles of debt piled up all over the world

ㆍ China's massive and powerful debt

ㆍ The meeting of the black swan and the gray rhinoceros

02 How the US Federal Reserve (Fed) Responds to Crisis

ㆍ The only source of money in a cash-strapped market

Quantitative easing - unlimited supply of dollars to banks

ㆍ Purchase of corporate bonds - Minimizing debt burden

Currency Swaps - Addressing Dollar Shortages in Emerging Countries

03 What is the Fed's new monetary policy, quantitative easing?

Market interest rates, which move according to market supply and demand

ㆍ The 'base interest rate' determined by the central bank

ㆍ Policy of lowering the base interest rate with a weaker base

Quantitative easing that lowers long-term interest rates

04 The US is on the brink of negative interest rates (difficulty level: high)

ㆍ Do interest rates and stock prices move together?

ㆍ As interest rates fall, stock prices also rise.

Negative interest rates chosen by Japan and Europe

ㆍ Side effects of negative interest rates

05 Individual investors whose investment patterns have changed significantly

ㆍ Buy the dip (BTD)

Don't be left out - Fear of missing out (FOMO)

Stocks are the answer - There is no alternative (TINA)

Stocks are overheated, the economy is in a slump - K-Recovery

06 Fiscal policy to revitalize the economy of ordinary people

ㆍ A 'bank' that lends money to the government

The 'government' that gives money to the common people

The end result of a wrong fiscal policy is a rise in market interest rates.

The solution is cooperation between banks and the government.

Chapter 2 | Interest Rate Situation in Korea

01 Is it better for Korea's base interest rate to be lower?

ㆍ Assets that cheer when interest rates fall 1 - Bonds

ㆍ Assets that cheer when interest rates fall 2 - Monthly rent

Side Effect of Interest Rate Cuts 1 - Rising Housing Costs

Side Effect of Interest Rate Cuts 2 - Damage to Healthy Companies

Side Effect of Interest Rate Cuts 3: Debt Surges Due to Continued Low Interest Rates

Side Effect of Interest Rate Cuts 4: Neglected Emerging Countries

ㆍ It is appropriate to lower the interest rate up to the effective lower limit.

02 Conditions for establishing quantitative easing

The start of economic recovery is a surprisingly 'powerful' stimulus package.

ㆍ The dollar is an international currency with strong demand.

ㆍ The Korean Won is a local currency used only in Korea.

Foreign investors who dislike foreign exchange losses

03 The Possibility of a Korean Quantitative Easing (Difficulty Level: High)

ㆍ Is the Bank of Korea's purchase of government bonds a quantitative easing policy?

Two ways to purchase government bonds

ㆍ The Korean standard is 'base rate', and the US standard is 'quantity'

Chapter 3 | Everyone's Goal: Escape Low Inflation

01 Inflation and Deflation: Which is Better?

ㆍ Good inflation vs.

bad inflation

Good deflation vs.

Bad deflation

ㆍ When debt is high, inflation vs.

deflation

02 Central Banks Become Deflation Fighters

ㆍ 1970, severe global inflation

ㆍ The swamp of economic recession from which one cannot escape

Deflation that swept Japan

Efforts to escape deflation 1 - Symmetric price target

Efforts to escape deflation 2 - Average price targeting system

03 Why Prices Don't Rise Even When Money Is Released

Amazon fuels competition for the lowest price

ㆍ Maintaining long-term low oil prices through smooth supply

ㆍDriving down the unit prices of zombie companies

ㆍ Shrinking consumer market

Currency wars that lower the value of a currency

ㆍ Excessive debt loaded

04 How Central Banks Overcome Deflation

A 'high-pressure economy' that increases corporate productivity

ㆍEven if the market overheats, job growth and price stability are top priorities.

ㆍThe end result of infinite supply is massive inflation?

ㆍ A swamp of massive deflation

Chapter 4 | Draw a Scenario and Take the Next Step

01 Four 'Wealth Scenarios' Distinguished by Growth and Inflation

Scenario 1: High Growth and High Prices

Scenario 2: Low Growth and High Prices

Scenario 3: High Growth, Low Inflation

Scenario 4 | Low Growth and Low Inflation

ㆍ We are now in an era of low growth and low prices. What is the next step?

02 Oh Geon-young's Post-COVID-19 Scenario

ㆍ Lack of demand is a global problem

ㆍ If the United States maintains its economic stimulus measures

It is important that China does not start a currency war.

A beautiful bull market blossoms through cooperation among nations.

ㆍ Complete your own portfolio by drawing future scenarios.

Epilogue | The Optimal Portfolio, Built with Economic Data

Appendix | How to Start Studying Finance

Detailed image

Into the book

While the first book explained the potential for crisis, and the second explained what weapons could protect my portfolio from such a crisis, this book focuses on what kind of portfolio should be constructed going forward.

--- p.9

When it comes to portfolio diversification, many people think, "It's just a hodgepodge of investments," or "It's a very boring investment method."

But if investing is such a tedious endeavor, why do so many investment gurus emphasize the importance of diversification? Why do financial academia churn out countless methodologies for portfolio diversification? And why do major funds around the world adhere to strict diversification rules? The answer is simple.

Because we don't know what the future holds.

--- p.9

When financial markets are shaken more than when they are calm, unprecedented responses emerge, and in the process, more distinct correlations between finance and assets are discovered.

I, too, learned and experienced a great deal from the past financial crisis, and the COVID-19 crisis is also a significant turning point.

By conveying the current situation as vividly as possible, we aim to enhance your understanding of financial investment.

--- p.12

If we consider this a time of excessive debt, would deflation or inflation be more fatal? Rather than deflation, or even cost-push inflation, which can lead to a slowdown in consumption, healthy, moderate inflation would be more beneficial for expanding consumption and reducing the debt burden.

So, governments and central banks around the world want mild inflation and are working in that direction.

And they are repeatedly expressing their intention to take strong measures against any deflation that may come.

--- p.235~236

Going forward, we will need to keep an eye on this area.

The first question is whether the current effort to escape the swamp of deflation, which involves using the booster of a high-pressure economy and sacrificing the central bank's goal of financial stability, will succeed.

If successful, we will see a shift from deflation to inflation.

If we fail, we will once again be in the swamp of deflation, wondering about the next jump.

The second thing is to see if inflation, when it does appear, is it a controllable friend, inflation, that we haven't seen in a long time, or is it an uncontrollable bad inflation?

--- p.313

When looking at stocks, two very important factors are 'growth' and 'interest rates'.

Even if growth is strong, if interest rates are too high, people will try to open deposit accounts instead of investing in stocks.

If there's a really good stock that can go up 50 percent a year, but there's a time deposit that gives you 100 percent a year, you'd naturally want to put your money in the deposit rather than investing in stocks.

Because you can invest without any risk that may arise.

Yes, when looking at stocks, it's important to look at the company's performance, but it's also important to pay close attention to the various environments the company is in.

Among them, interest rates and exchange rates will be included.

--- p.318

Then, of course, this question will arise.

I understand what's needed, but the question is how we can integrate certain elements of the economy into investment.

In this chapter, we will examine two important factors—growth and inflation—and connect them to investment.

--- p.319

Looking at the chart, you can see which assets are performing well or poorly in each phase.

So, this question arises here.

"So, are you saying that since we're in a low-growth, low-inflation era, we should invest in growth stocks?" No, investing is about looking to the future.

When investing in real estate, even if there is no subway now, you hear that a subway will be built in two years, and you invest while drawing a picture of the future.

Let's look at the picture again with the perspective of investing with an eye on the future in mind.

We're currently in a low-growth, low-inflation phase, but will we remain in this phase in the future? If we were to move beyond this low-growth, low-inflation phase, which phase would we move into?

--- p.9

When it comes to portfolio diversification, many people think, "It's just a hodgepodge of investments," or "It's a very boring investment method."

But if investing is such a tedious endeavor, why do so many investment gurus emphasize the importance of diversification? Why do financial academia churn out countless methodologies for portfolio diversification? And why do major funds around the world adhere to strict diversification rules? The answer is simple.

Because we don't know what the future holds.

--- p.9

When financial markets are shaken more than when they are calm, unprecedented responses emerge, and in the process, more distinct correlations between finance and assets are discovered.

I, too, learned and experienced a great deal from the past financial crisis, and the COVID-19 crisis is also a significant turning point.

By conveying the current situation as vividly as possible, we aim to enhance your understanding of financial investment.

--- p.12

If we consider this a time of excessive debt, would deflation or inflation be more fatal? Rather than deflation, or even cost-push inflation, which can lead to a slowdown in consumption, healthy, moderate inflation would be more beneficial for expanding consumption and reducing the debt burden.

So, governments and central banks around the world want mild inflation and are working in that direction.

And they are repeatedly expressing their intention to take strong measures against any deflation that may come.

--- p.235~236

Going forward, we will need to keep an eye on this area.

The first question is whether the current effort to escape the swamp of deflation, which involves using the booster of a high-pressure economy and sacrificing the central bank's goal of financial stability, will succeed.

If successful, we will see a shift from deflation to inflation.

If we fail, we will once again be in the swamp of deflation, wondering about the next jump.

The second thing is to see if inflation, when it does appear, is it a controllable friend, inflation, that we haven't seen in a long time, or is it an uncontrollable bad inflation?

--- p.313

When looking at stocks, two very important factors are 'growth' and 'interest rates'.

Even if growth is strong, if interest rates are too high, people will try to open deposit accounts instead of investing in stocks.

If there's a really good stock that can go up 50 percent a year, but there's a time deposit that gives you 100 percent a year, you'd naturally want to put your money in the deposit rather than investing in stocks.

Because you can invest without any risk that may arise.

Yes, when looking at stocks, it's important to look at the company's performance, but it's also important to pay close attention to the various environments the company is in.

Among them, interest rates and exchange rates will be included.

--- p.318

Then, of course, this question will arise.

I understand what's needed, but the question is how we can integrate certain elements of the economy into investment.

In this chapter, we will examine two important factors—growth and inflation—and connect them to investment.

--- p.319

Looking at the chart, you can see which assets are performing well or poorly in each phase.

So, this question arises here.

"So, are you saying that since we're in a low-growth, low-inflation era, we should invest in growth stocks?" No, investing is about looking to the future.

When investing in real estate, even if there is no subway now, you hear that a subway will be built in two years, and you invest while drawing a picture of the future.

Let's look at the picture again with the perspective of investing with an eye on the future in mind.

We're currently in a low-growth, low-inflation phase, but will we remain in this phase in the future? If we were to move beyond this low-growth, low-inflation phase, which phase would we move into?

--- p.346

Publisher's Review

★★★★ "Sampro TV" has accumulated 5.5 million views and is known as "God Gun-young" for its unique and renowned lectures.

★★★★ The #1 financial expert recognized and recommended by economic experts!

★★★★ The sequel to the best-selling "The Great Wealth Transfer" that has captivated hundreds of thousands of readers.

“The rich don’t fight inflation!”

_ Four investment strategies that turn uncertainty into opportunity

The COVID-19 pandemic ushered in an era of universal stock ownership.

From teenagers saving their allowance and starting to invest in stocks to people in their 60s investing their retirement funds, everyone is jumping into the stock market.

Just a few months ago, it was easy to come across rumors like, “Manager Kim from the next team made a 200% profit,” or “He made 10 million won by investing heavily in Samsung Electronics.”

The stock market, which had been red-hot, entered a period of rapid wealth transformation immediately after encountering the issue of 'interest rate hikes' in the United States.

The Donghak Ant Corps, which started trading stocks for the first time since the coronavirus outbreak, has now reached its first turning point.

Fears that the bubble was about to burst began to spread in earnest immediately after U.S. Treasury Secretary Janet Yellen announced an interest rate hike.

This happened just one year after people started using overdraft accounts and debt-to-equity schemes, saying that in an era of ultra-low interest rates, you have to invest.

If you spent a year ago selecting stocks, looking for profitable companies that would boost your returns, now is the time to take the next step and prepare for the coming massive inflation.

The secret to author Oh Geon-young, known as a macroeconomics expert with 5.5 million cumulative views on "Sampyo TV," becoming a "financial genius" was, ironically, thanks to the 2008 financial crisis.

Every time the market fluctuated, new countermeasures were developed, and economic data was analyzed night after night.

As I interpreted economic articles and pondered policies, I began to see the government's hidden intentions and the overall economic system.

The COVID-19 pandemic has not only led to more economic stimulus measures being created than during the financial crisis, but they have also been implemented immediately.

What can we do in these turbulent times, when even experts can't predict the future? The author introduces "Four Investment Strategies," developed based on decades of practical experience and experience, having weathered various ups and downs.

Furthermore, by conveying firsthand experience in the field as simply and vividly as possible, he emphasizes that the financial market can fluctuate at any time, and therefore, the importance of consistently studying the financial market.

Oh Geon-young's financial class that will help you develop an eye for investment.

_ The sequel to the best-selling book, "The Great Migration of Wealth," chosen by hundreds of thousands of readers

“It guides readers to grow gradually.”

"Economics: A Must-Read Even for Those Who Don't Invest in Stocks"

The reason why 『The Great Migration of Wealth』 was chosen by hundreds of thousands of readers is because of its ‘easy and friendly explanation.’

The author has the ability to concisely convey only the essential information, to the point where he has earned the nickname of 'Yeouido's No. 1 Instructor.'

First, we've organized interest rates, exchange rates, bonds, and more in a clear and easy-to-understand manner so that even beginners can build a solid foundation.

We also added graphs to help readers see the major trends in the macroeconomy, and included related economic articles to help readers improve their economic literacy.

By inserting illustrations here, we have once again lowered the barrier to entry for 'economic studies'.

In particular, important content was illustrated to enhance understanding and ensure that the content was remembered.

Chapter 1 introduces new central bank policies introduced to stabilize the shaky stock market.

By analyzing the new crisis management manuals called "unlimited quantitative easing" and "qualitative easing," we examine the objectives of central banks, the main players in the economy, and the direction they take when problems arise.

Chapter 2 examines the potential fallout from lower interest rates brought about by massive stimulus measures.

We will also examine whether "unlimited quantitative easing" is possible in Korea, whether the "base interest rate" will continue to decline, and what actions the government can take.

Chapter 3 deals with 'inflation,' the biggest issue of the first half of 2021.

We examine how central banks view inflation and the likelihood of massive inflation occurring, based on the overall economic mechanism.

Chapter 4 is such an important chapter that it would not be an exaggeration to say that Chapters 1 through 3 were written for Chapter 4.

We present 'four scenarios' that can actively and flexibly respond to large and small changes in the stock market.

The future scenario presented in the previous work, “The Great Migration of Wealth,” has been further concretized and its elements have been subdivided.

As the scenario became more concrete, the solutions also became more diverse.

It tells you which assets are strong in which situation, including the dollar, gold, stocks, and bonds.

The scenario you prepare now will determine the 'size of your wealth' one year from now!

_ Future scenarios brought about by economic stimulus measures and inflation

The four newly proposed wealth scenarios are also simple in structure.

The economy was divided into two axes, 'growth' and 'price', to create four quadrants, which were then used as investment portfolios.

You just need to distinguish whether there is a possibility of 'growth' or not, and whether 'price' is high or low.

For example, if we are in an era of slow growth and low interest rates like we are now, we can view it as a 'low growth, low inflation scenario.'

If you anticipate interest rates rising, you should prepare for a "low growth, high inflation scenario."

Using the 'Four Wealth Scenarios', you can easily change your investment strategy even when the economic situation changes like this.

What we need to do is quickly change our portfolio before a new scenario unfolds.

Because the strengths and weaknesses of alternative assets such as stocks, bonds, raw materials, and gold are organized by scenario, they can be easily applied in practice.

By dividing your investments into smaller groups, such as stocks and bonds, you will be able to achieve better returns.

In a high-growth, high-inflation scenario, stocks are strong, but investing in Chinese stocks yields higher returns than investing in U.S. stocks, which is the same logic.

Bonds also come in a variety of types, including short-term bonds, medium-term bonds, long-term bonds, investment-grade corporate bonds, and emerging market government bonds, allowing for a more diversified portfolio.

The key here is to constantly ask the question, "What scenario will we move towards next?"

Rather than following a portfolio, it's important to get ideas on where and how to invest based on economic data.

Only then can we turn the next wave of COVID-19 into an opportunity to build wealth.

★★★★ The #1 financial expert recognized and recommended by economic experts!

★★★★ The sequel to the best-selling "The Great Wealth Transfer" that has captivated hundreds of thousands of readers.

“The rich don’t fight inflation!”

_ Four investment strategies that turn uncertainty into opportunity

The COVID-19 pandemic ushered in an era of universal stock ownership.

From teenagers saving their allowance and starting to invest in stocks to people in their 60s investing their retirement funds, everyone is jumping into the stock market.

Just a few months ago, it was easy to come across rumors like, “Manager Kim from the next team made a 200% profit,” or “He made 10 million won by investing heavily in Samsung Electronics.”

The stock market, which had been red-hot, entered a period of rapid wealth transformation immediately after encountering the issue of 'interest rate hikes' in the United States.

The Donghak Ant Corps, which started trading stocks for the first time since the coronavirus outbreak, has now reached its first turning point.

Fears that the bubble was about to burst began to spread in earnest immediately after U.S. Treasury Secretary Janet Yellen announced an interest rate hike.

This happened just one year after people started using overdraft accounts and debt-to-equity schemes, saying that in an era of ultra-low interest rates, you have to invest.

If you spent a year ago selecting stocks, looking for profitable companies that would boost your returns, now is the time to take the next step and prepare for the coming massive inflation.

The secret to author Oh Geon-young, known as a macroeconomics expert with 5.5 million cumulative views on "Sampyo TV," becoming a "financial genius" was, ironically, thanks to the 2008 financial crisis.

Every time the market fluctuated, new countermeasures were developed, and economic data was analyzed night after night.

As I interpreted economic articles and pondered policies, I began to see the government's hidden intentions and the overall economic system.

The COVID-19 pandemic has not only led to more economic stimulus measures being created than during the financial crisis, but they have also been implemented immediately.

What can we do in these turbulent times, when even experts can't predict the future? The author introduces "Four Investment Strategies," developed based on decades of practical experience and experience, having weathered various ups and downs.

Furthermore, by conveying firsthand experience in the field as simply and vividly as possible, he emphasizes that the financial market can fluctuate at any time, and therefore, the importance of consistently studying the financial market.

Oh Geon-young's financial class that will help you develop an eye for investment.

_ The sequel to the best-selling book, "The Great Migration of Wealth," chosen by hundreds of thousands of readers

“It guides readers to grow gradually.”

"Economics: A Must-Read Even for Those Who Don't Invest in Stocks"

The reason why 『The Great Migration of Wealth』 was chosen by hundreds of thousands of readers is because of its ‘easy and friendly explanation.’

The author has the ability to concisely convey only the essential information, to the point where he has earned the nickname of 'Yeouido's No. 1 Instructor.'

First, we've organized interest rates, exchange rates, bonds, and more in a clear and easy-to-understand manner so that even beginners can build a solid foundation.

We also added graphs to help readers see the major trends in the macroeconomy, and included related economic articles to help readers improve their economic literacy.

By inserting illustrations here, we have once again lowered the barrier to entry for 'economic studies'.

In particular, important content was illustrated to enhance understanding and ensure that the content was remembered.

Chapter 1 introduces new central bank policies introduced to stabilize the shaky stock market.

By analyzing the new crisis management manuals called "unlimited quantitative easing" and "qualitative easing," we examine the objectives of central banks, the main players in the economy, and the direction they take when problems arise.

Chapter 2 examines the potential fallout from lower interest rates brought about by massive stimulus measures.

We will also examine whether "unlimited quantitative easing" is possible in Korea, whether the "base interest rate" will continue to decline, and what actions the government can take.

Chapter 3 deals with 'inflation,' the biggest issue of the first half of 2021.

We examine how central banks view inflation and the likelihood of massive inflation occurring, based on the overall economic mechanism.

Chapter 4 is such an important chapter that it would not be an exaggeration to say that Chapters 1 through 3 were written for Chapter 4.

We present 'four scenarios' that can actively and flexibly respond to large and small changes in the stock market.

The future scenario presented in the previous work, “The Great Migration of Wealth,” has been further concretized and its elements have been subdivided.

As the scenario became more concrete, the solutions also became more diverse.

It tells you which assets are strong in which situation, including the dollar, gold, stocks, and bonds.

The scenario you prepare now will determine the 'size of your wealth' one year from now!

_ Future scenarios brought about by economic stimulus measures and inflation

The four newly proposed wealth scenarios are also simple in structure.

The economy was divided into two axes, 'growth' and 'price', to create four quadrants, which were then used as investment portfolios.

You just need to distinguish whether there is a possibility of 'growth' or not, and whether 'price' is high or low.

For example, if we are in an era of slow growth and low interest rates like we are now, we can view it as a 'low growth, low inflation scenario.'

If you anticipate interest rates rising, you should prepare for a "low growth, high inflation scenario."

Using the 'Four Wealth Scenarios', you can easily change your investment strategy even when the economic situation changes like this.

What we need to do is quickly change our portfolio before a new scenario unfolds.

Because the strengths and weaknesses of alternative assets such as stocks, bonds, raw materials, and gold are organized by scenario, they can be easily applied in practice.

By dividing your investments into smaller groups, such as stocks and bonds, you will be able to achieve better returns.

In a high-growth, high-inflation scenario, stocks are strong, but investing in Chinese stocks yields higher returns than investing in U.S. stocks, which is the same logic.

Bonds also come in a variety of types, including short-term bonds, medium-term bonds, long-term bonds, investment-grade corporate bonds, and emerging market government bonds, allowing for a more diversified portfolio.

The key here is to constantly ask the question, "What scenario will we move towards next?"

Rather than following a portfolio, it's important to get ideas on where and how to invest based on economic data.

Only then can we turn the next wave of COVID-19 into an opportunity to build wealth.

GOODS SPECIFICS

- Date of issue: June 7, 2021

- Page count, weight, size: 392 pages | 720g | 152*225*30mm

- ISBN13: 9791190977265

- ISBN10: 1190977265

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)