I buy dollars instead of stocks

|

Description

Book Introduction

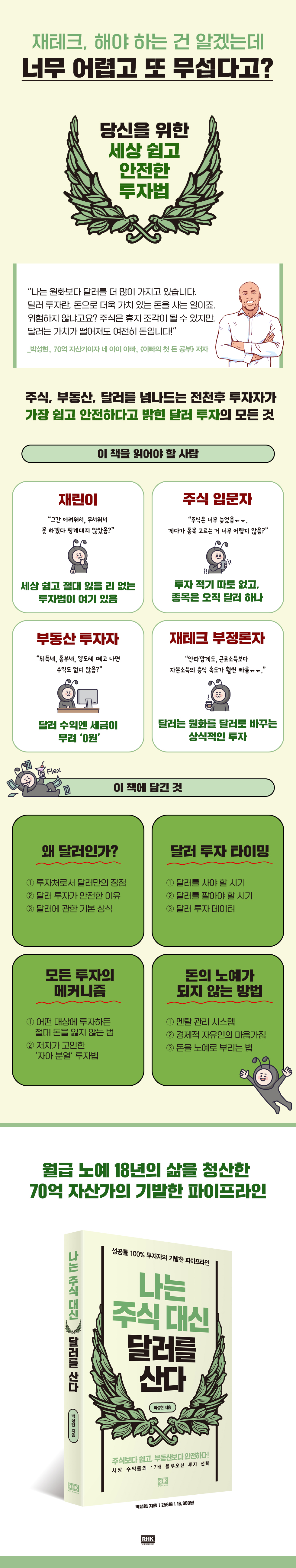

“Easier than stocks, safer than real estate!” Investment is fundamentally about valuable assets. This is because valuable assets increase in price over time due to inflation. Although S Electronics stocks and Gangnam apartments are currently trading at high prices, they cannot be said to have absolute value in themselves. What about the dollar? It possesses a unique, absolute, irreplaceable value. The dollar is the 'world's money' that is accepted anywhere in the world and cannot be issued by any country except the United States. This is why many people are recommending dollar investments at a time when many are excited about the real estate and stock markets. The success or failure of stock investment depends on stock selection. Before investing in real estate, there are so many things to consider, including location and rights analysis, as well as taxes. However, since dollar investments are denominated in dollars and are the currency of the United States, which holds the most power in the world, there is almost no risk of depreciation. In his previous work, "Dad's First Money Study," author Park Seong-hyeon revealed the secrets of escaping 18 years of wage slavery and becoming financially independent. In this book, he reveals one of his pipelines: dollar investment methods. In a market buzzing with stock and cryptocurrency investments, he achieved 17 times the market return in dollars! Looking for an investment method easier than stocks and safer than real estate? Here, we introduce the world's easiest and safest investment method. |

- You can preview some of the book's contents.

Preview

index

Introduction_The World's Easiest Investment

Chapter 1: Why Invest in Dollars?

01_Buy more valuable money with money

Fair value of 02 dollars

03_The value and price of the dollar

04_The most valuable money in the world

Chapter 2: How to Invest in Dollars?

01_When should I buy dollars?

02_What is the dollar gap ratio?

03_Data Reveals the Optimal Investment Times

04_Name tag of dollars, cash and wire transfer

05_Exchange rate spread and exchange fees

Chapter 3: What You Can Gain from Investing in Dollars

01_Direct dollar investment

02_Indirect dollar investment

03_Dollar Time Deposit

04_Investing in US monthly dividend ETFs

Chapter 4: Dollar Transactions by Platform

01_Investing with a currency exchange mobile app

02_Investing through Internet Banking

03_Investing with a securities firm's MTS

Chapter 5: The Mechanism of Dollar Investment

01_Gambling and Investment

02_The Magic of Compound Interest

03_Seven Split Investment

04_Dollar Investment and Financial Freedom

Chapter 6: Practical Dollar Investment

01_When to buy dollars

02_When you need to buy additional dollars

03_When to Withstand Dollar Investment

04_When to sell dollars

Chapter 7: Seven Split Dollar Investment System

01_Seven Split, Share and Get More

02_Respond to values, but do not predict them.

03_First purchase and additional purchase

04_Time to realize profits

05_7 Rules for Dollar Investment

06_Benefits of the Investment System

Concluding Thoughts: Let Your Money Work for You

supplement

1_US Monthly Dividend ETFs for Maximizing Profits

2_US Monthly Dividend REITs for Financial Freedom

Chapter 1: Why Invest in Dollars?

01_Buy more valuable money with money

Fair value of 02 dollars

03_The value and price of the dollar

04_The most valuable money in the world

Chapter 2: How to Invest in Dollars?

01_When should I buy dollars?

02_What is the dollar gap ratio?

03_Data Reveals the Optimal Investment Times

04_Name tag of dollars, cash and wire transfer

05_Exchange rate spread and exchange fees

Chapter 3: What You Can Gain from Investing in Dollars

01_Direct dollar investment

02_Indirect dollar investment

03_Dollar Time Deposit

04_Investing in US monthly dividend ETFs

Chapter 4: Dollar Transactions by Platform

01_Investing with a currency exchange mobile app

02_Investing through Internet Banking

03_Investing with a securities firm's MTS

Chapter 5: The Mechanism of Dollar Investment

01_Gambling and Investment

02_The Magic of Compound Interest

03_Seven Split Investment

04_Dollar Investment and Financial Freedom

Chapter 6: Practical Dollar Investment

01_When to buy dollars

02_When you need to buy additional dollars

03_When to Withstand Dollar Investment

04_When to sell dollars

Chapter 7: Seven Split Dollar Investment System

01_Seven Split, Share and Get More

02_Respond to values, but do not predict them.

03_First purchase and additional purchase

04_Time to realize profits

05_7 Rules for Dollar Investment

06_Benefits of the Investment System

Concluding Thoughts: Let Your Money Work for You

supplement

1_US Monthly Dividend ETFs for Maximizing Profits

2_US Monthly Dividend REITs for Financial Freedom

Detailed image

Into the book

I was very lucky.

Because through 'dollar investment', I was able to understand the investment mechanism more easily.

The reason I say we were lucky here is because the dollar has a relatively low investment difficulty compared to other instruments.

If I had started with other difficult and complex investments like stocks, it might have been impossible to understand the nature and mechanisms of investing, or it might have taken a very long time to do so.

--- p.6, from “Getting Started_The Easiest Investment in the World”

Buying world money with our country's money can be said to be buying money with high utility value with money with low utility value.

Of course, to trade something of low value for something of high value, you need more of the low value.

However, when it comes to money, that obvious principle is often not followed.

This is where the investment opportunity lies.

The dollar is clearly a valuable commodity.

However, no matter how valuable an item you have, if you cannot sell it for more than the price you initially paid for it, you will inevitably incur a loss.

--- p.26, from “Chapter 1_Why Invest in Dollars?”

The won/dollar exchange rate is the exchange rate between the dollar and the won.

Therefore, unless a country's economy is severely damaged or an extreme situation occurs that leads to national bankruptcy, the exchange rate will not rise or fall indefinitely.

In fact, considering the possibility alone, which country is more likely to collapse and its currency become worthless: the United States or South Korea? For this reason, I believe purchasing dollars with won—in other words, investing in dollars—is relatively safe.

However, it is important to maintain a certain level of dollar purchase price, as purchasing inflated assets at high prices can result in significant losses.

--- p.65~66, from “Chapter 2: How to Invest Dollars”

The reason I insist on investing in dollars 'only in cash' is because the biggest advantage of dollar investment is that it generates profits by purchasing safer 'money' rather than 'financial products' that come with risks.

The investment that is truly 'over the top' in terms of liquidity is dollar investment.

When the investment standby funds are in Korean Won, you can invest in Korean stocks, and when they are in US Dollars, you can invest in US stocks, so you can achieve the effect of an investment within an investment, or a kind of 'risk-free leverage' investment.

--- p.93, from “Chapter 3: What You Can Gain from Dollar Investment”

If you bought dollars on January 1, 2018, and sold them on December 31, 2018, you would have made a profit of 5.7%.

If you invested 100 million won, your profit would be about 5.7 million won.

However, I was able to achieve a return 17 times the market return through systematic system investment without confirming the valuation loss.

To this day, my investment system continues to operate without change, and my record of 100% investment success rate remains unbroken.

Of course, we also have dollars that are currently experiencing valuation losses.

But I have no intention of turning this dollar valuation loss into a confirmed loss.

For this to be possible, you only need to keep one thing in mind.

Not buying dollars at a higher price than they are worth.

--- p.129, from “Chapter 5_Mechanism of Dollar Investment”

The dollar has a disadvantage in that, because it has only one asset, if its price rises too much, it not only rapidly loses its merit as an investment target, but also becomes impossible to invest in.

However, there is no need to regret the missed opportunity, as the upward trend is closed and the price can fall at any time due to issues such as the rise in the value of the Korean Won or the fall in the value of the dollar.

Therefore, I did not invest unless the won/dollar exchange rate was at a good level for investment, believing that it was better to regret not buying than to buy and lose.

--- p.157, from “Chapter 6_Practical Dollar Investment”

In dollar investment, there is no such thing as a “dollar for long-term investment” because the upward price movement is obvious and long-term investment may not be of much help in profitability.

But if you think of dollar investments as a means of hedging risk, the story is a little different.

As evidenced by the 1997 IMF foreign exchange crisis, the 2008 global financial crisis, and the COVID-19 outbreak in 2020, the dollar is far more useful than the Korean won in times of domestic and international economic crisis.

In other words, it is a very wise idea to hold a certain amount of dollars to prepare for risk.

--- p.214~215, from “Chapter 7_Seven Split Dollar Investment System”

Investing in dollars in conjunction with stock investments can be used as a type of investment hedge.

Additionally, understanding of macroeconomic trends also increases, enabling smarter stock investing.

If you keep repeating the process of selling stocks and buying dollars when the stock price goes up, and selling dollars and buying stocks when the dollar goes up, you will be able to practice the saying, "Let your money work for you" better than anyone else.

When your cash is in dollars, you can invest in foreign stocks by investing in dollars and buying American stocks with those dollars at the same time. When your cash is in won, you can invest in domestic stocks by investing in won and buying Korean stocks with won at the same time.

This is the establishment of an investment system that gives money absolutely no rest.

Because through 'dollar investment', I was able to understand the investment mechanism more easily.

The reason I say we were lucky here is because the dollar has a relatively low investment difficulty compared to other instruments.

If I had started with other difficult and complex investments like stocks, it might have been impossible to understand the nature and mechanisms of investing, or it might have taken a very long time to do so.

--- p.6, from “Getting Started_The Easiest Investment in the World”

Buying world money with our country's money can be said to be buying money with high utility value with money with low utility value.

Of course, to trade something of low value for something of high value, you need more of the low value.

However, when it comes to money, that obvious principle is often not followed.

This is where the investment opportunity lies.

The dollar is clearly a valuable commodity.

However, no matter how valuable an item you have, if you cannot sell it for more than the price you initially paid for it, you will inevitably incur a loss.

--- p.26, from “Chapter 1_Why Invest in Dollars?”

The won/dollar exchange rate is the exchange rate between the dollar and the won.

Therefore, unless a country's economy is severely damaged or an extreme situation occurs that leads to national bankruptcy, the exchange rate will not rise or fall indefinitely.

In fact, considering the possibility alone, which country is more likely to collapse and its currency become worthless: the United States or South Korea? For this reason, I believe purchasing dollars with won—in other words, investing in dollars—is relatively safe.

However, it is important to maintain a certain level of dollar purchase price, as purchasing inflated assets at high prices can result in significant losses.

--- p.65~66, from “Chapter 2: How to Invest Dollars”

The reason I insist on investing in dollars 'only in cash' is because the biggest advantage of dollar investment is that it generates profits by purchasing safer 'money' rather than 'financial products' that come with risks.

The investment that is truly 'over the top' in terms of liquidity is dollar investment.

When the investment standby funds are in Korean Won, you can invest in Korean stocks, and when they are in US Dollars, you can invest in US stocks, so you can achieve the effect of an investment within an investment, or a kind of 'risk-free leverage' investment.

--- p.93, from “Chapter 3: What You Can Gain from Dollar Investment”

If you bought dollars on January 1, 2018, and sold them on December 31, 2018, you would have made a profit of 5.7%.

If you invested 100 million won, your profit would be about 5.7 million won.

However, I was able to achieve a return 17 times the market return through systematic system investment without confirming the valuation loss.

To this day, my investment system continues to operate without change, and my record of 100% investment success rate remains unbroken.

Of course, we also have dollars that are currently experiencing valuation losses.

But I have no intention of turning this dollar valuation loss into a confirmed loss.

For this to be possible, you only need to keep one thing in mind.

Not buying dollars at a higher price than they are worth.

--- p.129, from “Chapter 5_Mechanism of Dollar Investment”

The dollar has a disadvantage in that, because it has only one asset, if its price rises too much, it not only rapidly loses its merit as an investment target, but also becomes impossible to invest in.

However, there is no need to regret the missed opportunity, as the upward trend is closed and the price can fall at any time due to issues such as the rise in the value of the Korean Won or the fall in the value of the dollar.

Therefore, I did not invest unless the won/dollar exchange rate was at a good level for investment, believing that it was better to regret not buying than to buy and lose.

--- p.157, from “Chapter 6_Practical Dollar Investment”

In dollar investment, there is no such thing as a “dollar for long-term investment” because the upward price movement is obvious and long-term investment may not be of much help in profitability.

But if you think of dollar investments as a means of hedging risk, the story is a little different.

As evidenced by the 1997 IMF foreign exchange crisis, the 2008 global financial crisis, and the COVID-19 outbreak in 2020, the dollar is far more useful than the Korean won in times of domestic and international economic crisis.

In other words, it is a very wise idea to hold a certain amount of dollars to prepare for risk.

--- p.214~215, from “Chapter 7_Seven Split Dollar Investment System”

Investing in dollars in conjunction with stock investments can be used as a type of investment hedge.

Additionally, understanding of macroeconomic trends also increases, enabling smarter stock investing.

If you keep repeating the process of selling stocks and buying dollars when the stock price goes up, and selling dollars and buying stocks when the dollar goes up, you will be able to practice the saying, "Let your money work for you" better than anyone else.

When your cash is in dollars, you can invest in foreign stocks by investing in dollars and buying American stocks with those dollars at the same time. When your cash is in won, you can invest in domestic stocks by investing in won and buying Korean stocks with won at the same time.

This is the establishment of an investment system that gives money absolutely no rest.

--- p.223, from “Concluding Thoughts_Let Money Work for You”

Publisher's Review

To you who cannot start because it is difficult or scary

★ Blue Ocean Investment Strategy with 17x Market Returns ★

People who made their annual salary in a day through stocks, people who became billionaires through real estate, people who retired early with Bitcoin… Stories of people who achieved life-changing dramas through investment are pouring in every day.

In an era where inflation is soaring due to overflowing liquidity and capital income is growing faster than earned income, these nouveau riche are born.

The problem is that at the same time, 'sudden beggars' are also being created.

If you live in a capitalist society and neglect the study of money and are content with simply saving it, your paycheck will inevitably become a bottomless pit.

Books on stocks are now lining up on the bestseller lists in the book market, which was previously swept by real estate investment books.

Even Manager Lee and Manager Kim, who were close to financial illiteracy, talked about stocks whenever they opened their mouths.

Perhaps now, when it feels too late, is the earliest opportunity. I muster up the courage to open a stock book, but the terminology is difficult, and I'm afraid I might lose my money.

Is there an easy way to start investing without losing money?

It's right here in this book.

"I Buy Dollars Instead of Stocks" contains the unique investment method of author Park Sung-hyun, who ended up living as a wage slave for 18 years by investing in real estate, stocks, and dollars based on capitalist principles and knowledge of finance and investment technology.

In his previous work, "Dad's First Money Study," he introduced the secret to becoming a 7 billion won asset owner by investing solely with earned income. Among his various pipelines, the method of increasing assets with dollars, which was briefly mentioned, caught the attention of many readers.

In this book, written in response to requests from readers who wanted to know specifically how to make money with dollars, he kindly explains the world's easiest investment method: converting Korean Won into US Dollars to make profits, without the need for complex and specialized foreign exchange trading.

“There are no stocks to choose from, no taxes to pay!”

Easy, safe, and 'new' way to invest

When people talk about 'dollar investment', many confuse it with FX margin trading or dollar futures trading, which are forms of foreign exchange trading.

So I guess investing in dollars is a very complex and difficult thing.

Many people believe that the dollar is not a suitable investment because of its high transaction costs and limited price fluctuations.

However, the author, who has directly invested in various objects, says that the dollar is actually a very easy investment target compared to other instruments.

Another great advantage of dollar investing is that you don't have to worry about which stocks to buy, like stock investing, or which area to buy and how many square feet to buy, like real estate investing.

This means that there is no need to examine a company's complex financial statements or to obtain a real estate registration certificate and analyze its location to select a specific target that will determine the success or failure of an investment.

The method is simple.

Buying dollars cheap and selling them expensive.

What about investment safety? Stocks can become worthless if the company they're invested in goes bankrupt, but the dollar, even if its value declines, is still money.

Which is easier: a company's delisting or the US sovereign default? There's absolutely no risk involved, as it involves buying more valuable currency in the Korean won, a currency only accepted in Korea.

Above all, there are also advantages that real estate investors will welcome.

Compared to real estate, which is fraught with various taxes, including acquisition tax, property tax, and transfer tax, ultimately reducing profits, dollar investments incur zero tax! The only things to consider are exchange fees and the timing of buys and sells, which determine exchange rate gains.

In this book, the author details his own special formula for reducing transaction taxes and timing investments.

The book consists of a total of 7 chapters.

Chapter 1 introduces the basic concepts of dollar investment, exploring why the dollar is a good investment. Chapter 2 examines the scale for assessing the absolute value of the dollar, the transaction cost structure, and essential information to know before investing.

Chapter 3 covers various ways to make money through dollar investments, and Chapter 4 contains practical dollar investment methods beyond theory, filled with the author's know-how.

Chapter 5 reveals the investment mechanisms the author has learned while working across various investment fields. Chapters 6 and 7 then detail how the author actually invested and made profits using these mechanisms, as well as the "Seven Split Dollar Investment System," which he personally devised to cultivate an investment mindset.

In particular, the author discloses in the appendix all the monthly dividend ETFs and monthly dividend REITs he is currently investing in, which he is using as a strategy to maximize returns from dollar investments.

*

In this era of essential investment, there are various ways to increase your assets.

The rich of today have made their money through real estate.

And now, many office workers are studying stocks and jumping into the stock market.

There are also people who have made a lot of money by pouring all their assets into cryptocurrency.

But as Warren Buffett's lifelong partner Charles Munger says, "Following the crowd is like regressing to the average."

This book, which covers the Blue Ocean Strategy, a new dollar investment method that has never been introduced in a book before, and is the first of its kind in Korea and the world, is a compelling reason not to miss it.

★ Blue Ocean Investment Strategy with 17x Market Returns ★

People who made their annual salary in a day through stocks, people who became billionaires through real estate, people who retired early with Bitcoin… Stories of people who achieved life-changing dramas through investment are pouring in every day.

In an era where inflation is soaring due to overflowing liquidity and capital income is growing faster than earned income, these nouveau riche are born.

The problem is that at the same time, 'sudden beggars' are also being created.

If you live in a capitalist society and neglect the study of money and are content with simply saving it, your paycheck will inevitably become a bottomless pit.

Books on stocks are now lining up on the bestseller lists in the book market, which was previously swept by real estate investment books.

Even Manager Lee and Manager Kim, who were close to financial illiteracy, talked about stocks whenever they opened their mouths.

Perhaps now, when it feels too late, is the earliest opportunity. I muster up the courage to open a stock book, but the terminology is difficult, and I'm afraid I might lose my money.

Is there an easy way to start investing without losing money?

It's right here in this book.

"I Buy Dollars Instead of Stocks" contains the unique investment method of author Park Sung-hyun, who ended up living as a wage slave for 18 years by investing in real estate, stocks, and dollars based on capitalist principles and knowledge of finance and investment technology.

In his previous work, "Dad's First Money Study," he introduced the secret to becoming a 7 billion won asset owner by investing solely with earned income. Among his various pipelines, the method of increasing assets with dollars, which was briefly mentioned, caught the attention of many readers.

In this book, written in response to requests from readers who wanted to know specifically how to make money with dollars, he kindly explains the world's easiest investment method: converting Korean Won into US Dollars to make profits, without the need for complex and specialized foreign exchange trading.

“There are no stocks to choose from, no taxes to pay!”

Easy, safe, and 'new' way to invest

When people talk about 'dollar investment', many confuse it with FX margin trading or dollar futures trading, which are forms of foreign exchange trading.

So I guess investing in dollars is a very complex and difficult thing.

Many people believe that the dollar is not a suitable investment because of its high transaction costs and limited price fluctuations.

However, the author, who has directly invested in various objects, says that the dollar is actually a very easy investment target compared to other instruments.

Another great advantage of dollar investing is that you don't have to worry about which stocks to buy, like stock investing, or which area to buy and how many square feet to buy, like real estate investing.

This means that there is no need to examine a company's complex financial statements or to obtain a real estate registration certificate and analyze its location to select a specific target that will determine the success or failure of an investment.

The method is simple.

Buying dollars cheap and selling them expensive.

What about investment safety? Stocks can become worthless if the company they're invested in goes bankrupt, but the dollar, even if its value declines, is still money.

Which is easier: a company's delisting or the US sovereign default? There's absolutely no risk involved, as it involves buying more valuable currency in the Korean won, a currency only accepted in Korea.

Above all, there are also advantages that real estate investors will welcome.

Compared to real estate, which is fraught with various taxes, including acquisition tax, property tax, and transfer tax, ultimately reducing profits, dollar investments incur zero tax! The only things to consider are exchange fees and the timing of buys and sells, which determine exchange rate gains.

In this book, the author details his own special formula for reducing transaction taxes and timing investments.

The book consists of a total of 7 chapters.

Chapter 1 introduces the basic concepts of dollar investment, exploring why the dollar is a good investment. Chapter 2 examines the scale for assessing the absolute value of the dollar, the transaction cost structure, and essential information to know before investing.

Chapter 3 covers various ways to make money through dollar investments, and Chapter 4 contains practical dollar investment methods beyond theory, filled with the author's know-how.

Chapter 5 reveals the investment mechanisms the author has learned while working across various investment fields. Chapters 6 and 7 then detail how the author actually invested and made profits using these mechanisms, as well as the "Seven Split Dollar Investment System," which he personally devised to cultivate an investment mindset.

In particular, the author discloses in the appendix all the monthly dividend ETFs and monthly dividend REITs he is currently investing in, which he is using as a strategy to maximize returns from dollar investments.

*

In this era of essential investment, there are various ways to increase your assets.

The rich of today have made their money through real estate.

And now, many office workers are studying stocks and jumping into the stock market.

There are also people who have made a lot of money by pouring all their assets into cryptocurrency.

But as Warren Buffett's lifelong partner Charles Munger says, "Following the crowd is like regressing to the average."

This book, which covers the Blue Ocean Strategy, a new dollar investment method that has never been introduced in a book before, and is the first of its kind in Korea and the world, is a compelling reason not to miss it.

GOODS SPECIFICS

- Date of issue: May 30, 2021

- Page count, weight, size: 256 pages | 362g | 135*200*20mm

- ISBN13: 9788925588636

- ISBN10: 8925588633

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)