An era of great transformation

|

Description

Book Introduction

- A word from MD

-

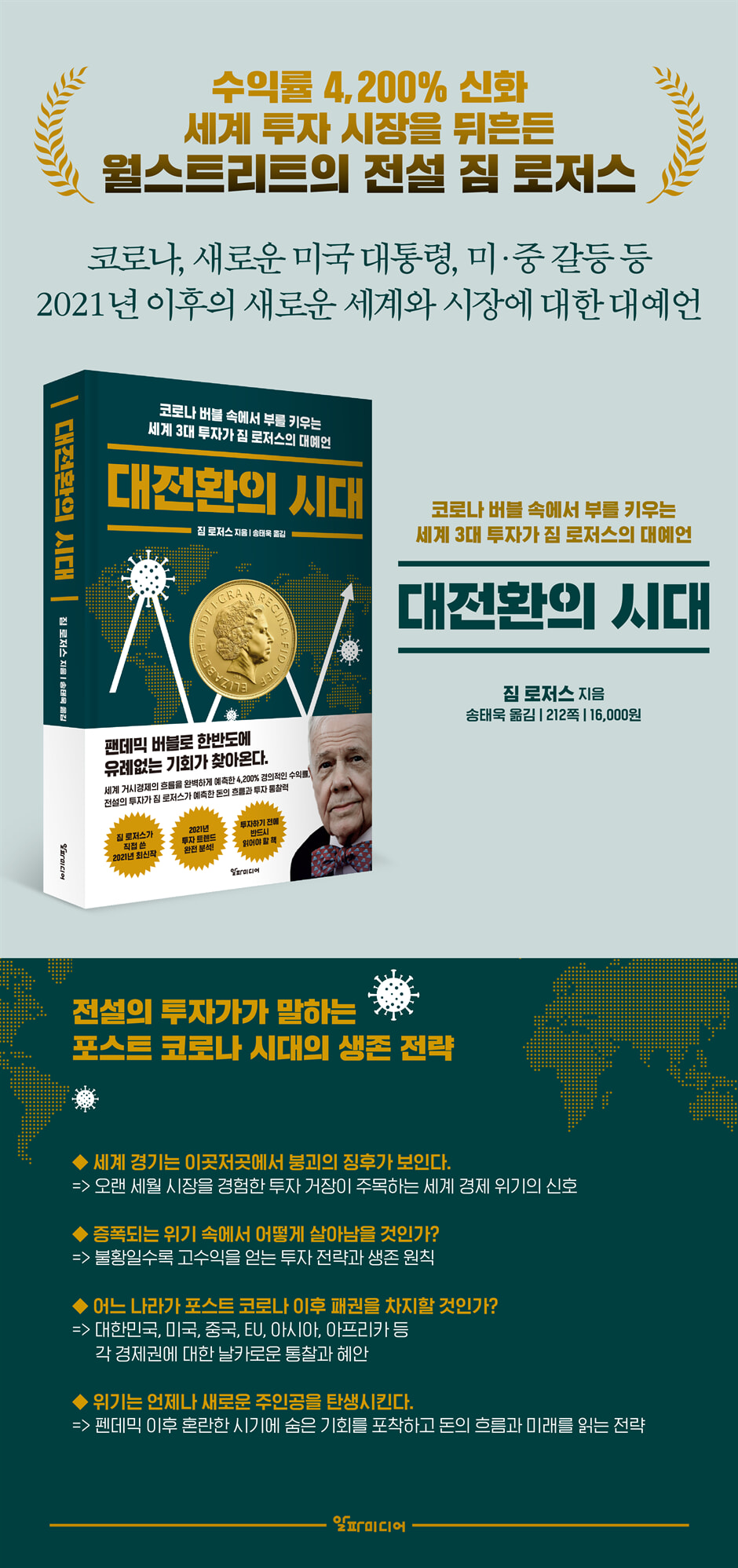

Jim Rogers' latest book for 2021! The Great Corona Bubble PredictionJim Rogers, a Wall Street legend with a 4,200% return and one of the world's top three investors, predicts the global market beyond 2021, influenced by factors such as vaccines, a new US president, and the US-China conflict.

A book that teaches you how to grow your wealth by seizing the flow of money and opportunities amid the coronavirus bubble crisis.March 23, 2021. Economics and Management PD Kang Hyeon-jeong

Jim Rogers, one of the world's top three investors, makes a grand prediction about growing wealth amid the pandemic bubble.

Jim Rogers, who has been called one of the world's top three investors, achieved an astonishing 4,200% return.

In "The Age of Great Transformation," he predicts the global market after 2021, influenced by factors such as the emergence of vaccines, the election of a new US president, and the US-China conflict.

The coronavirus shock of 2020 shut down global connections and disrupted many industries.

However, global stock markets, which had plummeted due to the emergence of vaccines, appear to have recovered significantly.

But legendary Wall Street investor Jim Rogers has a strong warning about the current market.

Countries around the world are implementing unprecedented levels of monetary easing, the United States and China are clashing for global hegemony, and a new president has been elected in the United States.

Due to the impact of COVID-19, movement is restricted, and remote work is becoming increasingly common.

The world has now entered a period of great transformation.

Jim Rogers predicts that the biggest crisis of his life will soon come.

At the same time, some say that this crisis is the best opportunity of one's life as an investor.

What did Jim Rogers buy and sell during these turbulent times? And what does he intend to invest in? In this book, legendary investor Jim Rogers examines past history and global politics, incorporating the latest global information following the US presidential election to predict the market outlook for 2021 and beyond.

In "The Age of Transformation," Jim Rogers draws on his extensive experience, extensive knowledge of history, and keen analysis of the macroeconomy to forecast the changes that will occur in each economic sector in the future.

This book provides insights, perspectives, and reflections that investors must understand, including the impact of the US presidential election, the US-China trade war, the changes in Europe brought about by Brexit, the resolution of inter-Korean issues, and the political and economic value of the Korean Peninsula.

Jim Rogers, who has been called one of the world's top three investors, achieved an astonishing 4,200% return.

In "The Age of Great Transformation," he predicts the global market after 2021, influenced by factors such as the emergence of vaccines, the election of a new US president, and the US-China conflict.

The coronavirus shock of 2020 shut down global connections and disrupted many industries.

However, global stock markets, which had plummeted due to the emergence of vaccines, appear to have recovered significantly.

But legendary Wall Street investor Jim Rogers has a strong warning about the current market.

Countries around the world are implementing unprecedented levels of monetary easing, the United States and China are clashing for global hegemony, and a new president has been elected in the United States.

Due to the impact of COVID-19, movement is restricted, and remote work is becoming increasingly common.

The world has now entered a period of great transformation.

Jim Rogers predicts that the biggest crisis of his life will soon come.

At the same time, some say that this crisis is the best opportunity of one's life as an investor.

What did Jim Rogers buy and sell during these turbulent times? And what does he intend to invest in? In this book, legendary investor Jim Rogers examines past history and global politics, incorporating the latest global information following the US presidential election to predict the market outlook for 2021 and beyond.

In "The Age of Transformation," Jim Rogers draws on his extensive experience, extensive knowledge of history, and keen analysis of the macroeconomy to forecast the changes that will occur in each economic sector in the future.

This book provides insights, perspectives, and reflections that investors must understand, including the impact of the US presidential election, the US-China trade war, the changes in Europe brought about by Brexit, the resolution of inter-Korean issues, and the political and economic value of the Korean Peninsula.

- You can preview some of the book's contents.

Preview

index

Chapter 1: The World Falls Into the Worst Recession of My Life Due to the Corona Shock

The worst crash of our lives has already begun.

Countries locked down due to coronavirus cannot return to normal.

Even if the market overheats due to the emergence of vaccines, it won't last long.

A double-dip market may be imminent.

Is the world now incapable of escaping inflation?

The "MMT Theory," as prevalent as the coronavirus, is leading the world to ruin.

Crises bring about rapid changes in the world.

Will big cities decline after the coronavirus pandemic?

My portfolio changed due to the coronavirus shock

Real estate in Asian countries, excluding Japan, is already in a bubble.

Debt investing vs. commodity investing: Which is actually more risky?

How to act in an overheated market

Chapter 2: Which country will seize post-COVID hegemony?

In the past, the only country that held hegemony multiple times was China.

Trade wars escalate in a closed world.

What will the Xi Jinping regime's isolationist policy lead to?

Is it better for Hong Kong to be part of China?

If I were to think 20 years from now, I would choose the yuan over the US dollar.

If the yuan becomes a free currency, it will temporarily weaken.

A US-China war is inevitable in 10 to 15 years.

Anger over anti-Black discrimination is also evidence of a recession.

The year following the US presidential election is one to watch.

Can the US dollar maintain its reserve currency status?

If war breaks out, deposits will be blocked.

Now is the time to diversify your assets overseas.

Should the Tokyo Olympics be held in 2021?

Why Warren Buffett Bought Japanese Trading Company Stock

Why I Loved Russia, Even Though It Was Hated

If I were to move in the future, where would be a promising place to live?

When the 38th parallel opens on the Korean Peninsula, opportunities also open.

The future of Britain and the EU is uncertain.

Which African country has the most promising future?

The most attractive country in the Middle East is Iran

Chapter 3: Weak Crude Oil, Water and Food Crises… What Happens to Commodities?

The era of commodities returns after COVID.

Are gold and silver in a bubble? Is it safe to buy them now?

Gold and silver will rise further in the long run.

Will crude oil prices ever go negative again?

Agriculture and fishing are changing due to climate change.

Will Mass Chinese Consumption Create Opportunities for Meat Substitutes?

Anyone can easily invest in listed index funds or listed index securities.

Chapter 4: New Markets Activated by COVID-19

Is GAFA a promising investment destination?

What Happens When a Unicorn Company Appears on the Market

Blockchain will make it so no one has to go to the bank.

Will those who rebel against the government with cryptocurrency win?

Government subsidies and basic income are in the red

No system better than capitalism has ever been discovered.

Japan's debt doesn't decrease even with tax increases.

Are there opportunities for the tourism industry, which has been devastated by the coronavirus?

Will Japan's tourism industry recover?

The future of agriculture is brighter

Marijuana holds a huge business opportunity.

SDGs and ESG investments can no longer be ignored.

Chapter 5: Surviving in a World of Great Transformation

History teaches us the future.

What's Changing and What's Not Changing in the World 15 Years From Now

Can the Japanese Dream Be Recreated?

Japan's immigration policy should be learned from Singapore.

If you don't go abroad, you don't know about your own country.

Studying philosophy reveals the essence of things.

Japanese people aren't the only ones with low financial literacy.

It's a time when you can't make money by investing in the S&P 500.

MBA is a waste of money

It is better for the child to go to a university far from the country where he or she lives.

I'm sending my cute high school daughter on a trip.

Freedom is an irreplaceable asset.

When a child turns 14, he or she is made to work.

The inheritance will not be passed on until the child turns 38.

Is education in Asia better than in Europe or the United States?

There's no need to give up on your dreams unless the world ends.

Going out

References

The worst crash of our lives has already begun.

Countries locked down due to coronavirus cannot return to normal.

Even if the market overheats due to the emergence of vaccines, it won't last long.

A double-dip market may be imminent.

Is the world now incapable of escaping inflation?

The "MMT Theory," as prevalent as the coronavirus, is leading the world to ruin.

Crises bring about rapid changes in the world.

Will big cities decline after the coronavirus pandemic?

My portfolio changed due to the coronavirus shock

Real estate in Asian countries, excluding Japan, is already in a bubble.

Debt investing vs. commodity investing: Which is actually more risky?

How to act in an overheated market

Chapter 2: Which country will seize post-COVID hegemony?

In the past, the only country that held hegemony multiple times was China.

Trade wars escalate in a closed world.

What will the Xi Jinping regime's isolationist policy lead to?

Is it better for Hong Kong to be part of China?

If I were to think 20 years from now, I would choose the yuan over the US dollar.

If the yuan becomes a free currency, it will temporarily weaken.

A US-China war is inevitable in 10 to 15 years.

Anger over anti-Black discrimination is also evidence of a recession.

The year following the US presidential election is one to watch.

Can the US dollar maintain its reserve currency status?

If war breaks out, deposits will be blocked.

Now is the time to diversify your assets overseas.

Should the Tokyo Olympics be held in 2021?

Why Warren Buffett Bought Japanese Trading Company Stock

Why I Loved Russia, Even Though It Was Hated

If I were to move in the future, where would be a promising place to live?

When the 38th parallel opens on the Korean Peninsula, opportunities also open.

The future of Britain and the EU is uncertain.

Which African country has the most promising future?

The most attractive country in the Middle East is Iran

Chapter 3: Weak Crude Oil, Water and Food Crises… What Happens to Commodities?

The era of commodities returns after COVID.

Are gold and silver in a bubble? Is it safe to buy them now?

Gold and silver will rise further in the long run.

Will crude oil prices ever go negative again?

Agriculture and fishing are changing due to climate change.

Will Mass Chinese Consumption Create Opportunities for Meat Substitutes?

Anyone can easily invest in listed index funds or listed index securities.

Chapter 4: New Markets Activated by COVID-19

Is GAFA a promising investment destination?

What Happens When a Unicorn Company Appears on the Market

Blockchain will make it so no one has to go to the bank.

Will those who rebel against the government with cryptocurrency win?

Government subsidies and basic income are in the red

No system better than capitalism has ever been discovered.

Japan's debt doesn't decrease even with tax increases.

Are there opportunities for the tourism industry, which has been devastated by the coronavirus?

Will Japan's tourism industry recover?

The future of agriculture is brighter

Marijuana holds a huge business opportunity.

SDGs and ESG investments can no longer be ignored.

Chapter 5: Surviving in a World of Great Transformation

History teaches us the future.

What's Changing and What's Not Changing in the World 15 Years From Now

Can the Japanese Dream Be Recreated?

Japan's immigration policy should be learned from Singapore.

If you don't go abroad, you don't know about your own country.

Studying philosophy reveals the essence of things.

Japanese people aren't the only ones with low financial literacy.

It's a time when you can't make money by investing in the S&P 500.

MBA is a waste of money

It is better for the child to go to a university far from the country where he or she lives.

I'm sending my cute high school daughter on a trip.

Freedom is an irreplaceable asset.

When a child turns 14, he or she is made to work.

The inheritance will not be passed on until the child turns 38.

Is education in Asia better than in Europe or the United States?

There's no need to give up on your dreams unless the world ends.

Going out

References

Detailed image

Into the book

The pre-COVID bubble may already have small holes, but it hasn't burst yet.

And I think the recent market is the so-called 'overheated market' that comes before the bubble bursts.

--- p.25

If I ruled the world, I would do exactly the same things I did in the past when there was an epidemic.

It is a 'do nothing' thing.

(Omitted) Looking at the situation in the United States, it is clear that the situation caused by the pandemic is serious.

But as I've said many times, shutting everything down will only lead to worse outcomes in the long run.

--- p.33

For Korea, the opening of the 38th parallel is an opportunity.

People, goods, and money will be able to move freely across the Korean Peninsula, and great opportunities will come to North Korea.

North Korea has a cheap, well-educated workforce, and with the support of South Korea's management capabilities and capital, its potential is very high.

--- p.86

To reduce debt, we must reduce spending and taxes.

If I were the head of state, I would increase the amount of money the people could spend and encourage them to spend actively.

But my thoughts will never be accepted.

--- p.140

These days, airlines are said to be transporting cargo rather than people.

But as passenger planes gradually return to the skies, and as treatments and vaccines for COVID-19 emerge and a sense of security spreads around the world, tourism will return to its long-term growth trend.

Global air passenger demand is projected to increase 2.3-fold between 2018 and 2038.

As the world's population grows, we are confident that the number of travelers will not decrease and that the tourism industry will continue to grow.

--- p.144

If you want to make a lot of money in agriculture, you must first become a farmer yourself.

The population is concentrated in one large city and land prices in rural areas are falling.

The number of people moving to rural areas may increase slightly due to the coronavirus, but in any case, people who can work the fields in the countryside are needed.

Just buy a farm boldly.

--- p.147

In 15 years, the Korean Peninsula will be the hottest place in the world in every sense of the word.

If things continue this way, Japan could unfortunately become exciting in a negative sense, as chaos such as demonstrations are predicted.

There may be a national strike in Japan in the future.

It will definitely happen when your child becomes an adult, even if it's 15 years.

--- p.162

When I was 30, I was on the verge of achieving great success as an investor without even realizing it.

But the mistake I made when I retired at 37 and then at 40 was that I woke up and witnessed the evolving giant dragon that is China, but I didn't stay there.

And I think the recent market is the so-called 'overheated market' that comes before the bubble bursts.

--- p.25

If I ruled the world, I would do exactly the same things I did in the past when there was an epidemic.

It is a 'do nothing' thing.

(Omitted) Looking at the situation in the United States, it is clear that the situation caused by the pandemic is serious.

But as I've said many times, shutting everything down will only lead to worse outcomes in the long run.

--- p.33

For Korea, the opening of the 38th parallel is an opportunity.

People, goods, and money will be able to move freely across the Korean Peninsula, and great opportunities will come to North Korea.

North Korea has a cheap, well-educated workforce, and with the support of South Korea's management capabilities and capital, its potential is very high.

--- p.86

To reduce debt, we must reduce spending and taxes.

If I were the head of state, I would increase the amount of money the people could spend and encourage them to spend actively.

But my thoughts will never be accepted.

--- p.140

These days, airlines are said to be transporting cargo rather than people.

But as passenger planes gradually return to the skies, and as treatments and vaccines for COVID-19 emerge and a sense of security spreads around the world, tourism will return to its long-term growth trend.

Global air passenger demand is projected to increase 2.3-fold between 2018 and 2038.

As the world's population grows, we are confident that the number of travelers will not decrease and that the tourism industry will continue to grow.

--- p.144

If you want to make a lot of money in agriculture, you must first become a farmer yourself.

The population is concentrated in one large city and land prices in rural areas are falling.

The number of people moving to rural areas may increase slightly due to the coronavirus, but in any case, people who can work the fields in the countryside are needed.

Just buy a farm boldly.

--- p.147

In 15 years, the Korean Peninsula will be the hottest place in the world in every sense of the word.

If things continue this way, Japan could unfortunately become exciting in a negative sense, as chaos such as demonstrations are predicted.

There may be a national strike in Japan in the future.

It will definitely happen when your child becomes an adult, even if it's 15 years.

--- p.162

When I was 30, I was on the verge of achieving great success as an investor without even realizing it.

But the mistake I made when I retired at 37 and then at 40 was that I woke up and witnessed the evolving giant dragon that is China, but I didn't stay there.

--- p.199

Publisher's Review

The worst crisis that will surpass the recession so far is coming.

What to focus on and how to survive?

There is an investor who has been appearing frequently in various media outlets recently.

The protagonist is none other than Jim Rogers, the Wall Street legend who has openly declared that he would invest his entire fortune in North Korea and has openly declared that the Korean Peninsula would become the most exciting country in the world.

In 2020, the global economy suddenly went into a tailspin after the coronavirus pandemic, and people were gripped by fear.

The spread of the coronavirus has halted international travel and trade, and the real economy has begun to freeze.

Governments around the world are attempting the largest stimulus packages in history, but the future of the global economy remains bleak.

Jim Rogers is adamant that this crisis is a once-in-a-lifetime opportunity for investors.

Jim Rogers' book, "The Age of Transformation," introduces promising investment opportunities in the coming era of low interest rates, how to wisely gather and judge information, and asset management strategies necessary in times of crisis.

It also contains the background, philosophy, principles and insights that created his investment view.

A new book from 2021 by Jim Rogers, known as one of the world's top three investors along with Warren Buffett and George Soros.

Focusing on Korea, Japan, and China, it predicts how the flow of 'money' will unfold and how the rise and fall of each country will change accordingly, and explains through real-life examples how reading the future based on the flow of history is important in foreseeing the 'flow of money.'

He explains which sectors are emerging and promising for investment in a rapidly changing economy, and details his investment principles and life wisdom, gleaned from nearly half a century of success and failure.

In particular, the part that contrasts the future of Korea and Japan is also interesting to us.

In "The Age of Transformation," Jim Rogers offers a remarkable analysis of global market trends and future prospects, drawing on his investment acumen gained through extensive experience.

It makes a sharp argument about how Asia will dominate the 21st century global economy and why the US and EU are bound to decline.

He also says that the future economy will be driven by agriculture, and that those who make food, energy, goods, and consumables will drive the economy.

Where does Jim Rogers' investment insight, which so clearly sees through the essence of global trends, come from?

Readers can find the answer in "The Age of Great Transformation," and gain clear guidance on "where, what, and how to invest" in the era of the COVID-19 pandemic.

What to focus on and how to survive?

There is an investor who has been appearing frequently in various media outlets recently.

The protagonist is none other than Jim Rogers, the Wall Street legend who has openly declared that he would invest his entire fortune in North Korea and has openly declared that the Korean Peninsula would become the most exciting country in the world.

In 2020, the global economy suddenly went into a tailspin after the coronavirus pandemic, and people were gripped by fear.

The spread of the coronavirus has halted international travel and trade, and the real economy has begun to freeze.

Governments around the world are attempting the largest stimulus packages in history, but the future of the global economy remains bleak.

Jim Rogers is adamant that this crisis is a once-in-a-lifetime opportunity for investors.

Jim Rogers' book, "The Age of Transformation," introduces promising investment opportunities in the coming era of low interest rates, how to wisely gather and judge information, and asset management strategies necessary in times of crisis.

It also contains the background, philosophy, principles and insights that created his investment view.

A new book from 2021 by Jim Rogers, known as one of the world's top three investors along with Warren Buffett and George Soros.

Focusing on Korea, Japan, and China, it predicts how the flow of 'money' will unfold and how the rise and fall of each country will change accordingly, and explains through real-life examples how reading the future based on the flow of history is important in foreseeing the 'flow of money.'

He explains which sectors are emerging and promising for investment in a rapidly changing economy, and details his investment principles and life wisdom, gleaned from nearly half a century of success and failure.

In particular, the part that contrasts the future of Korea and Japan is also interesting to us.

In "The Age of Transformation," Jim Rogers offers a remarkable analysis of global market trends and future prospects, drawing on his investment acumen gained through extensive experience.

It makes a sharp argument about how Asia will dominate the 21st century global economy and why the US and EU are bound to decline.

He also says that the future economy will be driven by agriculture, and that those who make food, energy, goods, and consumables will drive the economy.

Where does Jim Rogers' investment insight, which so clearly sees through the essence of global trends, come from?

Readers can find the answer in "The Age of Great Transformation," and gain clear guidance on "where, what, and how to invest" in the era of the COVID-19 pandemic.

GOODS SPECIFICS

- Publication date: March 31, 2021

- Format: Hardcover book binding method guide

- Page count, weight, size: 212 pages | 420g | 140*211*22mm

- ISBN13: 9791191122060

- ISBN10: 1191122069

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)