John Lee's Escape from Financial Illiteracy

|

Description

Book Introduction

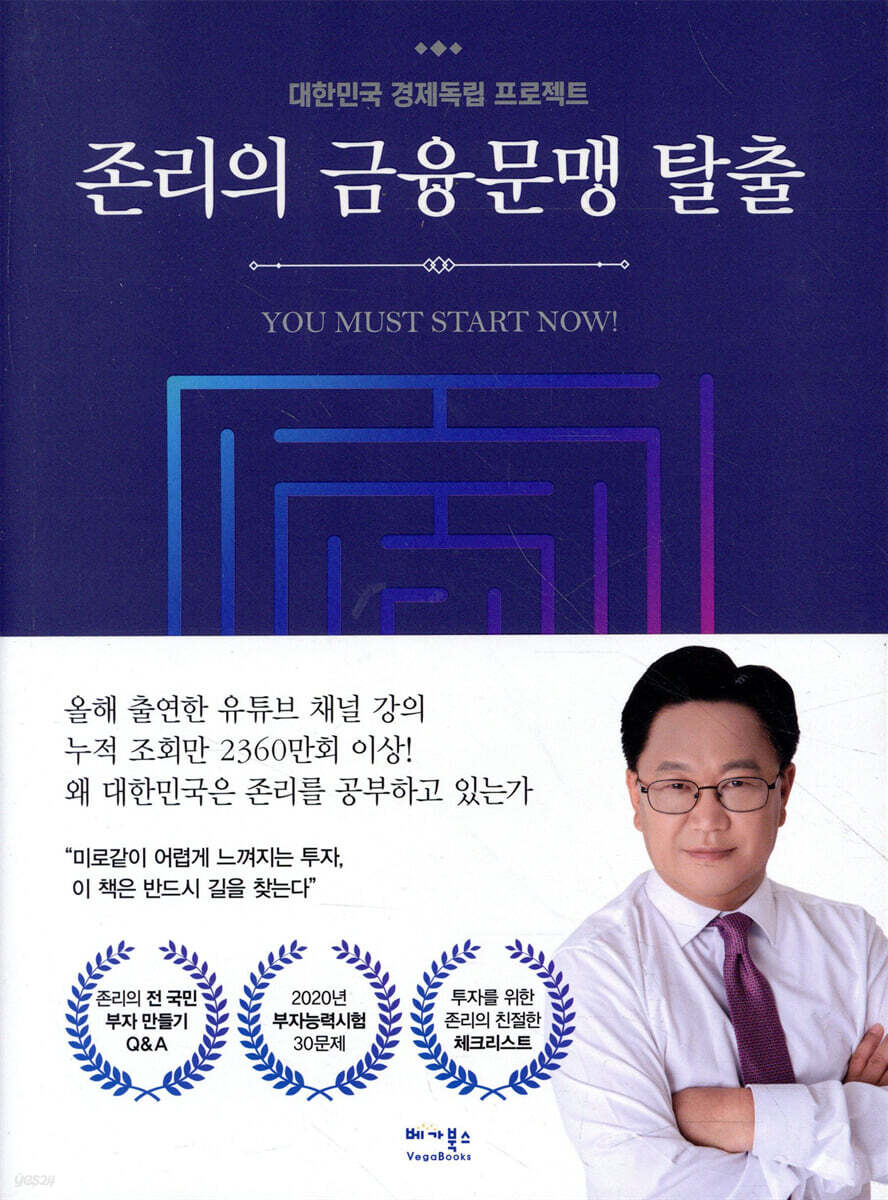

#1 in Economics and Management in the First Half of 2020 Financial illiteracy is a disease, and like an epidemic, it impoverishes everyone around it. John Lee's latest work, "Escape from Financial Illiteracy," has shaken up South Korea's financial philosophy. - A book containing messages for establishing a basic investment philosophy. - A must-read book to become rich - A book that helps you develop a mindset to overcome financial illiteracy. John Lee, the 'financial name,' is shaking up South Korea's financial philosophy. The combined number of views of videos on economics-related YouTube channels from January to September 2020 exceeds 23.6 million. South Korea is currently studying John Lee's financial philosophy, as his previous work ranked first in the economics and management bestseller list in the first half of this year. John Lee's latest work, "John Lee's Financial Literacy," has been published. John Lee, who believed his previous work "conveyed the philosophy of stock investment and the lifestyle of becoming wealthy," compiles the contents of various lectures he has given to date and answers questions from the audience in this book. And I wrote this book to make finance more accessible to those who still struggle with it, focusing on the concept of "financial illiteracy," which I haven't had the opportunity to properly and amply explain. So, I developed the content with the feeling of “explaining to the loved ones around me the many questions I have been asked,” and “I tried to reduce the stiffness of economic terms and concepts as much as possible.” In addition, by inserting cartoons that make learning about finance fun for everyone, we help anyone easily take the first step toward 'escaping financial illiteracy'. |

- You can preview some of the book's contents.

Preview

index

Hello, I'm John Lee, a financial evangelist.

Part 1: Overcoming Financial Illiteracy

1 What is financial illiteracy?

-John Lee's Q&A on Making the Nation Rich

2 401(k) Plans and America's Financial Competitiveness

3 Korea and Japan: The Worst Cases of Financial Illiteracy

-John Lee's Q&A on Making the Nation Rich

4 Follow the Jewish Way

5. This is what financial illiteracy looks like

-John Lee's Q&A on Making the Nation Rich

Test 6: How well do I know my finances?

7. How to overcome financial illiteracy?

-John Lee's Q&A on Making the Nation Rich

Part 2: Overcoming Financial Illiteracy and Stock Investment

1. Overcoming financial illiteracy is closely linked to stock investment.

-John Lee's Q&A on Making the Nation Rich

2 Are you still hesitating to invest in stocks?

3. Ignore short-term fluctuations: You're the expert.

-John Lee's Q&A on Making the Nation Rich

Selling 4 stocks is an 'exceptional' measure.

-John Lee's Q&A on Making the Nation Rich

5 The Advance of the 'Donghak Ants': Now It's Time for the Government to Step Up

-John Lee's Q&A on Making the Nation Rich

Chapter 3: Action Plan: The Best Time to Invest is Now

1. Start by investing in stocks and using the pension system.

2. It is better to raise a child who becomes truly rich than a child who only studies well.

-John Lee's Q&A on Making the Nation Rich

3 How long will you focus solely on finding a job?

-John Lee's Q&A on Making the Nation Rich

4 The obsession with owning a home

-John Lee's Q&A on Making the Nation Rich

Appendix 1: 2020 Ability Test for the Rich

Appendix 2: John Lee's Friendly Checklist for Stock/Fund Investing

Epilogue

Search

Part 1: Overcoming Financial Illiteracy

1 What is financial illiteracy?

-John Lee's Q&A on Making the Nation Rich

2 401(k) Plans and America's Financial Competitiveness

3 Korea and Japan: The Worst Cases of Financial Illiteracy

-John Lee's Q&A on Making the Nation Rich

4 Follow the Jewish Way

5. This is what financial illiteracy looks like

-John Lee's Q&A on Making the Nation Rich

Test 6: How well do I know my finances?

7. How to overcome financial illiteracy?

-John Lee's Q&A on Making the Nation Rich

Part 2: Overcoming Financial Illiteracy and Stock Investment

1. Overcoming financial illiteracy is closely linked to stock investment.

-John Lee's Q&A on Making the Nation Rich

2 Are you still hesitating to invest in stocks?

3. Ignore short-term fluctuations: You're the expert.

-John Lee's Q&A on Making the Nation Rich

Selling 4 stocks is an 'exceptional' measure.

-John Lee's Q&A on Making the Nation Rich

5 The Advance of the 'Donghak Ants': Now It's Time for the Government to Step Up

-John Lee's Q&A on Making the Nation Rich

Chapter 3: Action Plan: The Best Time to Invest is Now

1. Start by investing in stocks and using the pension system.

2. It is better to raise a child who becomes truly rich than a child who only studies well.

-John Lee's Q&A on Making the Nation Rich

3 How long will you focus solely on finding a job?

-John Lee's Q&A on Making the Nation Rich

4 The obsession with owning a home

-John Lee's Q&A on Making the Nation Rich

Appendix 1: 2020 Ability Test for the Rich

Appendix 2: John Lee's Friendly Checklist for Stock/Fund Investing

Epilogue

Search

Detailed image

.jpg)

Into the book

Anyone can become rich if they properly understand the fundamental principles of capitalism and the power of capital, that is, if they overcome 'financial illiteracy.'

I have no doubt about this.

Just as we need to know how to read and write to be able to function in society, those who do not understand money cannot function economically.

Let's take the United States as an example.

For example, if you look at the world of professional sports, there are quite a few players who earn tens of millions of dollars a year.

But 60% of them file for bankruptcy when they are older.

Because they have little interest in and no idea how to spend, save, and invest money.

They fall into the illusion that they will live a good life like they were in their 'prime days', and they face an unhappy future even though they earn an annual salary that others envy.

This is the disaster brought about by financial illiteracy.

--- p.16

Q: What is the standard for being rich?

A: Whether or not you are free from money, that is the standard.

There is no need to be mean because you don't have money, and you can readily provide financial support when your parents or family members are sick.

Ultimately, it comes down to being flexible with money.

We must prepare in advance to become free from money and realize that capital works for us.

Working for a company and owning its stock at the same time is what it means to be a capitalist and have the mindset of a rich person.

--- p.20

“What if I hold on to it for too long and the company goes wrong?” Of course, that could happen.

Some people argue that long-term investment is not right, citing examples such as investing for 10 years and seeing prices fall compared to 10 years ago.

However, we must not forget that there are many stocks that have increased 10-fold or 100-fold in 10 years of investment.

Investing in stocks means owning shares of the company, so if the company does well, you can share in the profits.

That's why we invest for the long term.

It's a very simple truth: if you wait a long time, the company's value will increase, and since I am an owner of the company, I can share in the profits.

--- p.127

What do you think capitalism is? In capitalism, there are two main types of people.

One is a capitalist, the other is a worker.

What capitalists do is provide capital and purchase labor to make goods or provide services to make money.

On the other hand, a worker is someone who provides his or her labor (time) and skills to capitalists and receives compensation for them.

In a capitalist system, wealth accumulation through capital is much faster than wealth accumulation through labor.

Therefore, it is only natural that everyone wants to become a capitalist in order to become rich.

When I returned to Korea, I was struck by how people felt they had to choose between capitalists and workers.

Why not consider a way to do both simultaneously? You can be a capitalist and a worker, or a worker and a capitalist.

I think the link is stocks.

I have no doubt about this.

Just as we need to know how to read and write to be able to function in society, those who do not understand money cannot function economically.

Let's take the United States as an example.

For example, if you look at the world of professional sports, there are quite a few players who earn tens of millions of dollars a year.

But 60% of them file for bankruptcy when they are older.

Because they have little interest in and no idea how to spend, save, and invest money.

They fall into the illusion that they will live a good life like they were in their 'prime days', and they face an unhappy future even though they earn an annual salary that others envy.

This is the disaster brought about by financial illiteracy.

--- p.16

Q: What is the standard for being rich?

A: Whether or not you are free from money, that is the standard.

There is no need to be mean because you don't have money, and you can readily provide financial support when your parents or family members are sick.

Ultimately, it comes down to being flexible with money.

We must prepare in advance to become free from money and realize that capital works for us.

Working for a company and owning its stock at the same time is what it means to be a capitalist and have the mindset of a rich person.

--- p.20

“What if I hold on to it for too long and the company goes wrong?” Of course, that could happen.

Some people argue that long-term investment is not right, citing examples such as investing for 10 years and seeing prices fall compared to 10 years ago.

However, we must not forget that there are many stocks that have increased 10-fold or 100-fold in 10 years of investment.

Investing in stocks means owning shares of the company, so if the company does well, you can share in the profits.

That's why we invest for the long term.

It's a very simple truth: if you wait a long time, the company's value will increase, and since I am an owner of the company, I can share in the profits.

--- p.127

What do you think capitalism is? In capitalism, there are two main types of people.

One is a capitalist, the other is a worker.

What capitalists do is provide capital and purchase labor to make goods or provide services to make money.

On the other hand, a worker is someone who provides his or her labor (time) and skills to capitalists and receives compensation for them.

In a capitalist system, wealth accumulation through capital is much faster than wealth accumulation through labor.

Therefore, it is only natural that everyone wants to become a capitalist in order to become rich.

When I returned to Korea, I was struck by how people felt they had to choose between capitalists and workers.

Why not consider a way to do both simultaneously? You can be a capitalist and a worker, or a worker and a capitalist.

I think the link is stocks.

--- p.192

Publisher's Review

Among Korean adults, only 33% have financial literacy.

You met me on your way to work today

Nine out of ten people are financially illiterate.

This happened when John Lee visited the studio for a profile photo shoot for 『John Lee's Escape from Financial Illiteracy』.

He brought three suits with him, and those were all the suits he had.

Besides, he came by bus carrying a suit.

Even now that he is rich, he still practices a frugal lifestyle.

He argues that to become rich, you must change your 'lifestyle of trying to look rich', a habit that is also reflected in his management philosophy.

When he recently appeared on SBS's [All the Butlers], he said, "I would rather raise my salary than spend money on company dinners," and revealed that he buys funds as a welfare benefit for employees of Meritz Asset Management, of which he is the CEO.

Unlike most companies that offer benefits like hotel stay discounts and airfare discounts, for CEO John Lee, “true benefits are investments in the future of employees.”

The best way is to live a lifestyle that maximizes the capital I have.

A lifestyle that eliminates capital is the worst path.

With this genuine attitude, CEO John Lee is working hard to lead many people to the path to wealth.

Every Saturday, I give free lectures to promote financial literacy and conduct bus tours to promote economic independence for all citizens.

From January to September 2020, the combined number of views of his appearances on economics-related YouTube channels exceeded a whopping 23.6 million.

He is appearing on shows such as [Butler in the House] and [You Quiz on the Block] and is working hard to help the public overcome financial illiteracy.

This is also the reason why I wrote “John Lee’s Escape from Financial Illiteracy.”

“Someone said they regained their composure after finding hope” and “Someone said they would now give their grandchildren funds as gifts” warm the author’s heart, but Korea’s financial illiteracy rate, as seen through various indicators, is still very high.

The reality that Korean society is facing is dire.

Perhaps one of the biggest reasons for the high suicide rate is financial hardship. Even after retirement, the reality in Korea is that many people are forced to scramble for work due to a lack of retirement funds.

This book helps you overcome financial illiteracy and take your first steps into investing.

The author's dream of everyone becoming rich is fully captured in this book, and it makes us realize why studying money is so necessary.

Who said money brings happiness?

Are you saying no?

If you don't have money, you're more likely to be unhappy.

Learn how to use money now and become rich with confidence.

A book that will help you take your first steps in investing, even if it's insufficient.

A book that will make you a capitalist even if your salary is low.

A book that gives you the courage to break free from anxiety and fear about money.

Financial illiteracy means a significant lack of financial knowledge.

It means having no idea how money is created, procured, circulated, used, how it relates to human life (or economic activity), how money increases or decreases, or why its value rises or falls.

The severity of financial illiteracy cannot be overemphasized, and all countries are making various efforts to reduce the financial illiteracy rate.

The lives of people with a high level of financial understanding and those without become increasingly different over time.

Understanding finance begins with understanding and handling money.

A person who has overcome financial illiteracy is one who has the knowledge to make effective and rational decisions about how to earn, spend, and invest money.

To be free from money, you must study 'money' in advance and learn how to make 'money' work for you.

“Understand the basic principles and power of capitalism

Anyone can become rich if they overcome ‘financial illiteracy.’

A book with a message for establishing a basic investment philosophy!

A must-read book to become rich!

If you are unable to overcome financial illiteracy, your knowledge and thoughts about money will be vague or vague, and you will handle money emotionally.

People who handle money emotionally will inevitably pay the price.

Financial illiteracy is like a disease: contagious and addictive.

"One person's faulty financial knowledge and habits not only hinder their own financial independence, but also impoverish their family, make financial life difficult for future generations, make society difficult, and ultimately weaken the nation's competitiveness."

So, what happens when you overcome financial illiteracy? It gives you hope for the first time in life.

You can become an independent person without having to rely blindly on other people's opinions when making important decisions every day.

Second, you feel like you're getting rich.

People who have overcome financial illiteracy feel that they are becoming richer every day.

This is because I chose a lifestyle that involved becoming rich rather than a lifestyle that involved struggling to look rich.

Third, the whole family is happy.

People who are free from money are free from anxiety or hostility toward money.

In other words, you can feel happiness through economic freedom.

·Answering 55 of the most frequently asked questions to CEO John Lee.

· Includes 30 questions from the 2020 Ability Test

· Includes John Lee's friendly checklist for investing.

·Studying finance is easy and fun while watching cartoons.

Even now, people are studying the author's sound financial philosophy.

This book will serve as a stepping stone to escaping financial illiteracy.

In fact, many readers have sent letters of thanks to the author, saying that they have regained hope in life by becoming financially independent.

It's not too late to become rich.

The moment you open this book, you can take the first step toward becoming rich.

- What is the lifestyle that only the rich know about?

- Can an ordinary salaried worker become rich?

- What stocks do the rich invest in?

- How can I make sure my child has 162 million won by the time he or she turns 25?

You met me on your way to work today

Nine out of ten people are financially illiterate.

This happened when John Lee visited the studio for a profile photo shoot for 『John Lee's Escape from Financial Illiteracy』.

He brought three suits with him, and those were all the suits he had.

Besides, he came by bus carrying a suit.

Even now that he is rich, he still practices a frugal lifestyle.

He argues that to become rich, you must change your 'lifestyle of trying to look rich', a habit that is also reflected in his management philosophy.

When he recently appeared on SBS's [All the Butlers], he said, "I would rather raise my salary than spend money on company dinners," and revealed that he buys funds as a welfare benefit for employees of Meritz Asset Management, of which he is the CEO.

Unlike most companies that offer benefits like hotel stay discounts and airfare discounts, for CEO John Lee, “true benefits are investments in the future of employees.”

The best way is to live a lifestyle that maximizes the capital I have.

A lifestyle that eliminates capital is the worst path.

With this genuine attitude, CEO John Lee is working hard to lead many people to the path to wealth.

Every Saturday, I give free lectures to promote financial literacy and conduct bus tours to promote economic independence for all citizens.

From January to September 2020, the combined number of views of his appearances on economics-related YouTube channels exceeded a whopping 23.6 million.

He is appearing on shows such as [Butler in the House] and [You Quiz on the Block] and is working hard to help the public overcome financial illiteracy.

This is also the reason why I wrote “John Lee’s Escape from Financial Illiteracy.”

“Someone said they regained their composure after finding hope” and “Someone said they would now give their grandchildren funds as gifts” warm the author’s heart, but Korea’s financial illiteracy rate, as seen through various indicators, is still very high.

The reality that Korean society is facing is dire.

Perhaps one of the biggest reasons for the high suicide rate is financial hardship. Even after retirement, the reality in Korea is that many people are forced to scramble for work due to a lack of retirement funds.

This book helps you overcome financial illiteracy and take your first steps into investing.

The author's dream of everyone becoming rich is fully captured in this book, and it makes us realize why studying money is so necessary.

Who said money brings happiness?

Are you saying no?

If you don't have money, you're more likely to be unhappy.

Learn how to use money now and become rich with confidence.

A book that will help you take your first steps in investing, even if it's insufficient.

A book that will make you a capitalist even if your salary is low.

A book that gives you the courage to break free from anxiety and fear about money.

Financial illiteracy means a significant lack of financial knowledge.

It means having no idea how money is created, procured, circulated, used, how it relates to human life (or economic activity), how money increases or decreases, or why its value rises or falls.

The severity of financial illiteracy cannot be overemphasized, and all countries are making various efforts to reduce the financial illiteracy rate.

The lives of people with a high level of financial understanding and those without become increasingly different over time.

Understanding finance begins with understanding and handling money.

A person who has overcome financial illiteracy is one who has the knowledge to make effective and rational decisions about how to earn, spend, and invest money.

To be free from money, you must study 'money' in advance and learn how to make 'money' work for you.

“Understand the basic principles and power of capitalism

Anyone can become rich if they overcome ‘financial illiteracy.’

A book with a message for establishing a basic investment philosophy!

A must-read book to become rich!

If you are unable to overcome financial illiteracy, your knowledge and thoughts about money will be vague or vague, and you will handle money emotionally.

People who handle money emotionally will inevitably pay the price.

Financial illiteracy is like a disease: contagious and addictive.

"One person's faulty financial knowledge and habits not only hinder their own financial independence, but also impoverish their family, make financial life difficult for future generations, make society difficult, and ultimately weaken the nation's competitiveness."

So, what happens when you overcome financial illiteracy? It gives you hope for the first time in life.

You can become an independent person without having to rely blindly on other people's opinions when making important decisions every day.

Second, you feel like you're getting rich.

People who have overcome financial illiteracy feel that they are becoming richer every day.

This is because I chose a lifestyle that involved becoming rich rather than a lifestyle that involved struggling to look rich.

Third, the whole family is happy.

People who are free from money are free from anxiety or hostility toward money.

In other words, you can feel happiness through economic freedom.

·Answering 55 of the most frequently asked questions to CEO John Lee.

· Includes 30 questions from the 2020 Ability Test

· Includes John Lee's friendly checklist for investing.

·Studying finance is easy and fun while watching cartoons.

Even now, people are studying the author's sound financial philosophy.

This book will serve as a stepping stone to escaping financial illiteracy.

In fact, many readers have sent letters of thanks to the author, saying that they have regained hope in life by becoming financially independent.

It's not too late to become rich.

The moment you open this book, you can take the first step toward becoming rich.

- What is the lifestyle that only the rich know about?

- Can an ordinary salaried worker become rich?

- What stocks do the rich invest in?

- How can I make sure my child has 162 million won by the time he or she turns 25?

GOODS SPECIFICS

- Publication date: October 12, 2020

- Page count, weight, size: 248 pages | 422g | 152*206*20mm

- ISBN13: 9791190242516

- ISBN10: 1190242516

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)