Never invest in stocks if you don't know financial statements.

|

Description

Book Introduction

Can financial statements really help you invest in stocks? From the very beginning, a personalized financial statement reading method tailored to each investor! Since its first publication in 2016, "Never Invest in Stocks Without Understanding Financial Statements," which has been greatly loved by readers and has been reprinted ten times, has returned with a "latest revised edition." The revised edition includes updated case studies with the latest data for current market analysis and reflects changes in laws, regulations, and systems. It includes a "Checkpoint" section that contains essential financial statement knowledge for stock investors, and a "Case Study" section where you can practice using real-life examples. I've also added an 'Author's Note' with some meaningful case studies of what actually happened to the companies mentioned in the first edition. In the ever-changing stock market, which fluctuates depending on various circumstances, this book explains why financial statements are so helpful in determining returns, how to minimize losses, and how to generate profits. It also provides investors with the secrets of reading financial statements. While avoiding complex analysis and difficult terminology, it maintains the central focus of "financial statements for investment" from beginning to end. Now, your financial statements will become your safety belt that protects your money. |

- You can preview some of the book's contents.

Preview

index

Entering

The starting point of investment is financial statements.

Part 1: Financial Statements and Stock Investment

Do financial statements really help with profitability?

Why do accountants say the returns are like that?

Please stop this 'blind investment'!

The junior's wedding funds protected by financial statements

Why did the company fail when sales tripled?

[Check Point] Structure of the Financial Statement

How does a company make money?

[Check Point] How to View Electronic Disclosures

[Check Point] Structure of the Income Statement

Part 2 How to Reduce Losses

1.

How to Survive in the Market: The Strongest Are the Survivors!

The reason you can't make money is not because your profits are low, but because your losses are large.

[Check Point] Arithmetic Mean and Geometric Mean

Why do investors lose money when the stock index rises?

Financial statements are a fallacy, if you don't know the fallacy, you'll die!

2.

How to Read a Company's Hidden Intentions: The Truth Behind the Numbers!

Why did the stock price halve in two weeks?

How many years of deficit will it take for a company to be delisted?

[Case Study] Korea Resources Investment Development

Items to avoid unless you're an expert

[Author's Note] The Real Results of Companies We Warned About in the First Edition

The Secret of Stocks That Trade Despite 10 Consecutive Years of Losses

[Check Point] Consolidated Financial Statements and Separate/Individual Financial Statements

When you know the company's intentions, the numbers show up.

[Case Study] AminoLogics

Olympic sports that make a profit every four years

[Author's Note] What happened to 'Bota Bio' after that?

[Case Study] Jenax

Companies with a lot of fraudulent intentions

[Check Point] Discontinued Business Division

[Check Point] Bad Debt Provision

[Case Study] Softmax

3.

How to avoid bad news: Avoid the rain and let's see!

Investors who suddenly increase capital

[Check Point] Capital Erosion and Potatoes

The secret to predicting growth

Can you see it now?

You see as much as you know, and you earn as much as you see.

Protect your wealth by reading just one line of the thank you note!

[Check Point] Composition of Audit Opinion

Misleading articles and misconceptions about audit opinions

Never lose money!

Part 3: How to Make Money

Don't invest in good companies!

There is only one principle in investing!

Methods of Measuring Stock Value

The law of relative value is problematic

[Check Point] The Meaning and Use of PER

The principle of the law of absolute value is not difficult.

[Check Point] Present Value of Perpetual Cash Flows

Why I Don't Prefer DCF

Are analysts' target prices truly the result of their analysis?

2 trillion or 200 billion? Expert opinions differ by a factor of 10.

The point we arrived at after 10 years of thinking

[Case Study] Calculating Equity and ROE in HTS

The best way to calculate fair value

[Check Point] Depreciation

How to predict ROE?

How to Determine the Discount Rate: Theoretical Methods

[Check Point] CAPM

A realistic alternative for stock investing

How long will the company's excess profits last?

How much should I buy it for to get it cheap?

[Case Study] Calculating Target Stock Prices Using S-RIM

In conclusion

This is where it all begins!

The starting point of investment is financial statements.

Part 1: Financial Statements and Stock Investment

Do financial statements really help with profitability?

Why do accountants say the returns are like that?

Please stop this 'blind investment'!

The junior's wedding funds protected by financial statements

Why did the company fail when sales tripled?

[Check Point] Structure of the Financial Statement

How does a company make money?

[Check Point] How to View Electronic Disclosures

[Check Point] Structure of the Income Statement

Part 2 How to Reduce Losses

1.

How to Survive in the Market: The Strongest Are the Survivors!

The reason you can't make money is not because your profits are low, but because your losses are large.

[Check Point] Arithmetic Mean and Geometric Mean

Why do investors lose money when the stock index rises?

Financial statements are a fallacy, if you don't know the fallacy, you'll die!

2.

How to Read a Company's Hidden Intentions: The Truth Behind the Numbers!

Why did the stock price halve in two weeks?

How many years of deficit will it take for a company to be delisted?

[Case Study] Korea Resources Investment Development

Items to avoid unless you're an expert

[Author's Note] The Real Results of Companies We Warned About in the First Edition

The Secret of Stocks That Trade Despite 10 Consecutive Years of Losses

[Check Point] Consolidated Financial Statements and Separate/Individual Financial Statements

When you know the company's intentions, the numbers show up.

[Case Study] AminoLogics

Olympic sports that make a profit every four years

[Author's Note] What happened to 'Bota Bio' after that?

[Case Study] Jenax

Companies with a lot of fraudulent intentions

[Check Point] Discontinued Business Division

[Check Point] Bad Debt Provision

[Case Study] Softmax

3.

How to avoid bad news: Avoid the rain and let's see!

Investors who suddenly increase capital

[Check Point] Capital Erosion and Potatoes

The secret to predicting growth

Can you see it now?

You see as much as you know, and you earn as much as you see.

Protect your wealth by reading just one line of the thank you note!

[Check Point] Composition of Audit Opinion

Misleading articles and misconceptions about audit opinions

Never lose money!

Part 3: How to Make Money

Don't invest in good companies!

There is only one principle in investing!

Methods of Measuring Stock Value

The law of relative value is problematic

[Check Point] The Meaning and Use of PER

The principle of the law of absolute value is not difficult.

[Check Point] Present Value of Perpetual Cash Flows

Why I Don't Prefer DCF

Are analysts' target prices truly the result of their analysis?

2 trillion or 200 billion? Expert opinions differ by a factor of 10.

The point we arrived at after 10 years of thinking

[Case Study] Calculating Equity and ROE in HTS

The best way to calculate fair value

[Check Point] Depreciation

How to predict ROE?

How to Determine the Discount Rate: Theoretical Methods

[Check Point] CAPM

A realistic alternative for stock investing

How long will the company's excess profits last?

How much should I buy it for to get it cheap?

[Case Study] Calculating Target Stock Prices Using S-RIM

In conclusion

This is where it all begins!

Detailed image

Into the book

In 2010, when I was working at an accounting firm, a junior accountant recommended a stock to me.

The reason was simple.

“The company discovered a diamond.

“It will go up tenfold.”

This company was later delisted after its CEO was arrested on charges of stock manipulation.

The reason I didn't buy it despite my junior's enthusiastic recommendation was because of what I saw in the financial statements and business report.

Although it has been delisted, it is still a business, so it is difficult to mention it.

I'll leave out the analysis and just show you some facts.

First is the company's performance.

The graph shows the company's operating profit and net profit for the 10 years prior to 2010.

After posting a profit of millions of won in 2000 and 2001, the company has been in the red for eight consecutive years.

This is the status of capital increase over the past 10 years.

The deficit for the period was 31.3 billion won, and the amount of capital raised was 52.6 billion won.

It would be difficult to just procure it.

This is something the company adds to its business objectives every two years.

A company that continues to run a deficit says that things will change in the future because its business purpose and CEO have changed.

So, I ask you to trust me one more time and provide me with funds.

It's no different from asking for money for books and tutoring again, saying that things will be different now that your son, who is at the bottom of his class, has changed his reference books and tutor.

I've seen a lot of friends drinking with the money they earned like that.

Since I was recommended to the company by my junior accountant, the company's stock price has nearly doubled.

But I don't regret it.

The junior who made a big profit bought alcohol and asked, “Then why didn’t you buy it?”

“They say they found a diamond, but what kind of financial statement is that?” he said.

Afterwards, the junior calculated the reserves announced by the company and bought more stocks, saying that the stock price would rise fivefold in the future.

When the stock price went down, he took advantage of the opportunity by taking out loans and riding the wave.

And what happened? We drank together, but the junior ended up paying off the loan alone for several years.

As I said before, my junior is also an accountant.

In the introduction, the reason accountants are not making profits is because they 'do not know how to read financial statements well.'

And there is one more reason.

Even accountants don't look at financial statements when investing.

The reason was simple.

“The company discovered a diamond.

“It will go up tenfold.”

This company was later delisted after its CEO was arrested on charges of stock manipulation.

The reason I didn't buy it despite my junior's enthusiastic recommendation was because of what I saw in the financial statements and business report.

Although it has been delisted, it is still a business, so it is difficult to mention it.

I'll leave out the analysis and just show you some facts.

First is the company's performance.

The graph shows the company's operating profit and net profit for the 10 years prior to 2010.

After posting a profit of millions of won in 2000 and 2001, the company has been in the red for eight consecutive years.

This is the status of capital increase over the past 10 years.

The deficit for the period was 31.3 billion won, and the amount of capital raised was 52.6 billion won.

It would be difficult to just procure it.

This is something the company adds to its business objectives every two years.

A company that continues to run a deficit says that things will change in the future because its business purpose and CEO have changed.

So, I ask you to trust me one more time and provide me with funds.

It's no different from asking for money for books and tutoring again, saying that things will be different now that your son, who is at the bottom of his class, has changed his reference books and tutor.

I've seen a lot of friends drinking with the money they earned like that.

Since I was recommended to the company by my junior accountant, the company's stock price has nearly doubled.

But I don't regret it.

The junior who made a big profit bought alcohol and asked, “Then why didn’t you buy it?”

“They say they found a diamond, but what kind of financial statement is that?” he said.

Afterwards, the junior calculated the reserves announced by the company and bought more stocks, saying that the stock price would rise fivefold in the future.

When the stock price went down, he took advantage of the opportunity by taking out loans and riding the wave.

And what happened? We drank together, but the junior ended up paying off the loan alone for several years.

As I said before, my junior is also an accountant.

In the introduction, the reason accountants are not making profits is because they 'do not know how to read financial statements well.'

And there is one more reason.

Even accountants don't look at financial statements when investing.

--- From "Part 1 Financial Statements and Stock Investment"

Publisher's Review

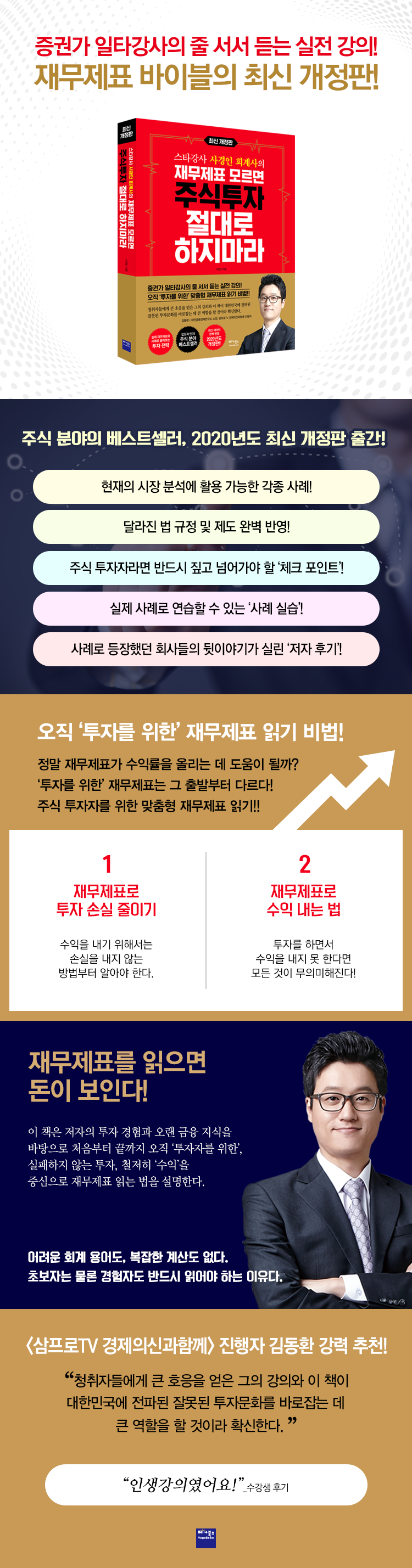

Can financial statements really help you invest in stocks?

From the very beginning, a personalized financial statement reading method tailored to each investor!

The practical lectures of the securities industry's daily instructors, which people have to wait in line to hear, are now available as a book!

The overwhelmingly popular financial statement bible is back with a new, revised edition!

Since its first publication in 2016, "Never Invest in Stocks Without Understanding Financial Statements," which has been greatly loved by readers and has been reprinted ten times, has returned with a "latest revised edition."

The revised edition includes updated case studies with the latest data for current market analysis and reflects changes in laws, regulations, and systems.

It includes a "Checkpoint" section that contains essential financial statement knowledge for stock investors, and a "Case Study" section where you can practice using real-life examples.

I've also added an 'Author's Note' with some meaningful case studies of what actually happened to the companies mentioned in the first edition.

This is a must-read for anyone investing in stocks, from beginner investors just starting out, to veteran investors who have tasted both sweet and bitter experiences, to even securities analysts who want to read secretly.

I understand the importance of financial statements, but how can I understand their complexities without any accounting knowledge? You can now put those worries aside.

You don't have to look like an accountant.

Financial statements for investment are different from the start.

In the ever-changing stock market, which fluctuates depending on various circumstances, this book explains why financial statements are so helpful in determining returns, how to minimize losses, and how to generate profits. It also provides investors with the secrets of reading financial statements.

While avoiding complex analysis and difficult terminology, it maintains the central focus of "financial statements for investment" from beginning to end.

Now, your financial statements will become your safety belt that protects your money.

No more 'blind investment'!

The author, who broke the so-called 'financial statement uselessness theory' that financial statements do not help in profitability, has been consistently generating returns in the 10% range annually using financial statements, and has been consistently popular for his financial statement lectures for over 10 years, earning him the title of 'one of the top 3 lecturers in the securities industry.'

Most investors continue to invest in stocks through "technical analysis," which involves reading economic articles and analyzing complex charts.

But we don't look at the financial statements, which are actually called 'fundamental analysis'.

Even when buying a single piece of clothing, it is common to check the price first, but I don't even check whether the stock I am buying is at a reasonable price.

The author points out that this is like 'buying stocks without looking at the price, like buying expensive luxury goods.'

In the hope that ordinary investors who invest based on 'charts' or 'feelings' will not shed tears, he decided to publish his secret strategy as a book despite the dissuasion of those around him.

This is the most reliable 'Financial Statement Bible for Investment' from 'The Man Who Reads Financial Statements, Accountant Sa-gyeong-in'!

Fight on!

Over 200 securities firms are flooding in with requests for lectures!

There's a reason for everything!

In the securities industry, where tens or hundreds of billions of won are traded every day, time is of the essence.

'Stockmen' take time out of their precious time to listen to the author's lectures.

Even then, the order of classes is so long that you can't attend unless you request the lecture a year in advance.

In fact, lectures on financial statements were not welcomed by both stock market investors and general investors due to the misconception that they were not helpful for profitability.

However, the author is now called one of the 'Top 3 Lecturers in the Securities Industry' and is receiving steady love as he lectures at dozens of securities firms.

The author's lecture on financial statements had a huge impact on the stock market, and it is said that there were only two reactions.

Whether to publish a book or not.

Those who wanted to publish the book wanted to make such important content widely known, while those who wanted to avoid publishing it were the securities company employees' wishful thinking that the 'secret' of stock investment would not be known to many people.

This is also proof that investing with knowledge of financial statements is much more beneficial for profitability than investing without knowledge.

What investors want is to know how to read financial statements.

It's not 'how to make'.

So why do accountants, who are financial experts, have such a pattern of earnings? The author, a fellow accountant, summarizes accountants' investments as follows:

First, analyze financial statements to find a good company.

Second, buy.

Third, it fails.

If financial statements are the secret sauce of investment, why do accountants, the true experts, fail? "Even accountants don't look at financial statements," the author says.

This means that creating financial statements and viewing them are very different things.

In other words, accountants know how to create and analyze financial statements, but they don't know how to "read" them for investment purposes.

It's like a chauffeur driving better than the person who built the car.

Let's set a new milestone in stock investment!

There are many books on financial statements published on the market so far.

But double-entry bookkeeping, resentment… even the difficult terms give me a headache and I can’t even think about looking at them.

I know it's important, but I'm just not sure how to connect it to investing.

There is no point in adding one more volume to it.

Based on the author's investment experience and extensive financial knowledge, this book explains from beginning to end, exclusively for investors, how to read financial statements with a focus on profit, and how to ensure foolproof investment.

No difficult accounting terms or complex calculations.

This is why it is a must-read for both beginners and experienced users.

Moreover, rather than simply imparting knowledge, we do not spare advice to help readers put it into practice and achieve success.

A book that conveys good content is a 'good book'.

However, a book that makes good content its own is a 'living book'.

This book will become a living book that will change the reader's investment method.

Finally, the author's writing, so captivating that it's impossible to look away, is another virtue of this book.

※ Warning!!: This is a fun book that you will read in one sitting from the moment you open it to the last page, but it has the side effect of making all other books boring.

From the very beginning, a personalized financial statement reading method tailored to each investor!

The practical lectures of the securities industry's daily instructors, which people have to wait in line to hear, are now available as a book!

The overwhelmingly popular financial statement bible is back with a new, revised edition!

Since its first publication in 2016, "Never Invest in Stocks Without Understanding Financial Statements," which has been greatly loved by readers and has been reprinted ten times, has returned with a "latest revised edition."

The revised edition includes updated case studies with the latest data for current market analysis and reflects changes in laws, regulations, and systems.

It includes a "Checkpoint" section that contains essential financial statement knowledge for stock investors, and a "Case Study" section where you can practice using real-life examples.

I've also added an 'Author's Note' with some meaningful case studies of what actually happened to the companies mentioned in the first edition.

This is a must-read for anyone investing in stocks, from beginner investors just starting out, to veteran investors who have tasted both sweet and bitter experiences, to even securities analysts who want to read secretly.

I understand the importance of financial statements, but how can I understand their complexities without any accounting knowledge? You can now put those worries aside.

You don't have to look like an accountant.

Financial statements for investment are different from the start.

In the ever-changing stock market, which fluctuates depending on various circumstances, this book explains why financial statements are so helpful in determining returns, how to minimize losses, and how to generate profits. It also provides investors with the secrets of reading financial statements.

While avoiding complex analysis and difficult terminology, it maintains the central focus of "financial statements for investment" from beginning to end.

Now, your financial statements will become your safety belt that protects your money.

No more 'blind investment'!

The author, who broke the so-called 'financial statement uselessness theory' that financial statements do not help in profitability, has been consistently generating returns in the 10% range annually using financial statements, and has been consistently popular for his financial statement lectures for over 10 years, earning him the title of 'one of the top 3 lecturers in the securities industry.'

Most investors continue to invest in stocks through "technical analysis," which involves reading economic articles and analyzing complex charts.

But we don't look at the financial statements, which are actually called 'fundamental analysis'.

Even when buying a single piece of clothing, it is common to check the price first, but I don't even check whether the stock I am buying is at a reasonable price.

The author points out that this is like 'buying stocks without looking at the price, like buying expensive luxury goods.'

In the hope that ordinary investors who invest based on 'charts' or 'feelings' will not shed tears, he decided to publish his secret strategy as a book despite the dissuasion of those around him.

This is the most reliable 'Financial Statement Bible for Investment' from 'The Man Who Reads Financial Statements, Accountant Sa-gyeong-in'!

Fight on!

Over 200 securities firms are flooding in with requests for lectures!

There's a reason for everything!

In the securities industry, where tens or hundreds of billions of won are traded every day, time is of the essence.

'Stockmen' take time out of their precious time to listen to the author's lectures.

Even then, the order of classes is so long that you can't attend unless you request the lecture a year in advance.

In fact, lectures on financial statements were not welcomed by both stock market investors and general investors due to the misconception that they were not helpful for profitability.

However, the author is now called one of the 'Top 3 Lecturers in the Securities Industry' and is receiving steady love as he lectures at dozens of securities firms.

The author's lecture on financial statements had a huge impact on the stock market, and it is said that there were only two reactions.

Whether to publish a book or not.

Those who wanted to publish the book wanted to make such important content widely known, while those who wanted to avoid publishing it were the securities company employees' wishful thinking that the 'secret' of stock investment would not be known to many people.

This is also proof that investing with knowledge of financial statements is much more beneficial for profitability than investing without knowledge.

What investors want is to know how to read financial statements.

It's not 'how to make'.

So why do accountants, who are financial experts, have such a pattern of earnings? The author, a fellow accountant, summarizes accountants' investments as follows:

First, analyze financial statements to find a good company.

Second, buy.

Third, it fails.

If financial statements are the secret sauce of investment, why do accountants, the true experts, fail? "Even accountants don't look at financial statements," the author says.

This means that creating financial statements and viewing them are very different things.

In other words, accountants know how to create and analyze financial statements, but they don't know how to "read" them for investment purposes.

It's like a chauffeur driving better than the person who built the car.

Let's set a new milestone in stock investment!

There are many books on financial statements published on the market so far.

But double-entry bookkeeping, resentment… even the difficult terms give me a headache and I can’t even think about looking at them.

I know it's important, but I'm just not sure how to connect it to investing.

There is no point in adding one more volume to it.

Based on the author's investment experience and extensive financial knowledge, this book explains from beginning to end, exclusively for investors, how to read financial statements with a focus on profit, and how to ensure foolproof investment.

No difficult accounting terms or complex calculations.

This is why it is a must-read for both beginners and experienced users.

Moreover, rather than simply imparting knowledge, we do not spare advice to help readers put it into practice and achieve success.

A book that conveys good content is a 'good book'.

However, a book that makes good content its own is a 'living book'.

This book will become a living book that will change the reader's investment method.

Finally, the author's writing, so captivating that it's impossible to look away, is another virtue of this book.

※ Warning!!: This is a fun book that you will read in one sitting from the moment you open it to the last page, but it has the side effect of making all other books boring.

GOODS SPECIFICS

- Date of issue: January 10, 2020

- Page count, weight, size: 360 pages | 880g | 188*242*22mm

- ISBN13: 9791190242271

- ISBN10: 1190242273

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)