fake

|

Description

Book Introduction

A global financial crisis worth $1,200 trillion (141 trillion won), Only those who can distinguish between the real and the fake will survive. "Fake," which teaches you how to protect your real money and assets without being fooled by fake news and information, has been published by Minumsa. This is the latest installment in the million-selling financial technology series "Rich Dad Poor Dad" (published in the US in April 2019), which has sold over 40 million copies worldwide, and it exposes the reality of "fake money," "fake teachers," and "fake assets" that are rampant in the current market. Along with behind-the-scenes stories not revealed in the previous Rich Dad series, he shares the secrets of money and investment that are relevant to today's times in a simple and straightforward manner. Today, determining what is real and what is fake is a crucial task that can determine wealth and poverty, war and peace, and even life and death. The common wisdom that says, "Go to a good school, get a job, work hard to save money, pay off debt, and invest in the stock market for the long term" is also a product of fake financial education. As awareness of the global financial crisis grows, this book will help you accurately understand the current economic situation and prepare for the impending crisis. |

- You can preview some of the book's contents.

Preview

index

Acknowledgements

Introduction | The Future is Fake

Part 1: Fake Money

1.

Fake Money | The world will change soon.

2.

We Trust in God | Who Do You Trust?

3.

Practical Reasons for Holding Physical Gold and Silver | On God's Money

4.

Printing Fake Money | History Repeats Itself

5.

How Much Money Is Being Printed | How to Take Control

6.

The Philosophical Reasons for Holding Physical Gold and Silver | What Do You Have?

Part 2: Fake Teacher

7.

How the Magi Became Wise Men | The Value of Lifelong Learning

8.

Back to School | Fighting the Fakes

9.

How to Catch a Lot of Fish | How to See the Invisible

10.

Mistakes are the best teachers | Use your mistakes to become smarter

11.

Schools Make People Poor | Resisting an Outdated System

12.

Entrepreneurs in Education | Can You See the Future?

13.

Students of God | Choose Your Teachers Carefully

Part 3 Fake Assets

14.

How to Retire Young | The Crisis Is Coming

15.

Who Took My Money? | How Retirement, Pensions, and Fake Assets Are Making the Middle Class and Poor Poorer

16.

Fishing in Clear Water | Fake News and Transparency

17.

Is the End of the US Dollar Near? Boom, Bust, Crash, and Then Collapse?

18.

For a Bright Future | Finding Spiritual Health, Wealth, and Happiness

19.

Flying like an eagle in a world ruled by chickens | My life is my own

In conclusion

Introduction | The Future is Fake

Part 1: Fake Money

1.

Fake Money | The world will change soon.

2.

We Trust in God | Who Do You Trust?

3.

Practical Reasons for Holding Physical Gold and Silver | On God's Money

4.

Printing Fake Money | History Repeats Itself

5.

How Much Money Is Being Printed | How to Take Control

6.

The Philosophical Reasons for Holding Physical Gold and Silver | What Do You Have?

Part 2: Fake Teacher

7.

How the Magi Became Wise Men | The Value of Lifelong Learning

8.

Back to School | Fighting the Fakes

9.

How to Catch a Lot of Fish | How to See the Invisible

10.

Mistakes are the best teachers | Use your mistakes to become smarter

11.

Schools Make People Poor | Resisting an Outdated System

12.

Entrepreneurs in Education | Can You See the Future?

13.

Students of God | Choose Your Teachers Carefully

Part 3 Fake Assets

14.

How to Retire Young | The Crisis Is Coming

15.

Who Took My Money? | How Retirement, Pensions, and Fake Assets Are Making the Middle Class and Poor Poorer

16.

Fishing in Clear Water | Fake News and Transparency

17.

Is the End of the US Dollar Near? Boom, Bust, Crash, and Then Collapse?

18.

For a Bright Future | Finding Spiritual Health, Wealth, and Happiness

19.

Flying like an eagle in a world ruled by chickens | My life is my own

In conclusion

Detailed image

Into the book

"On Facebook, information and misinformation look the same.

The only difference is that misinformation generates more revenue and therefore receives better treatment."

This type of misinformation continues to inflame and excite people… … provoke, excite, and explode the public.

(…) In today’s world, determining what is real and what is fake is a crucial task that can determine wealth and poverty, war and peace, and even life and death.

--- p.20~21

In 2008, the derivatives market was worth nearly $700 trillion.

As of 2018, the upper limit estimate for the derivatives market is $1,200 trillion.

I didn't mishear.

The elites have blown the problem out of proportion, making it almost twice as big and serious.

As I write this, we are on the brink of a catastrophe worth over $1,000 trillion.

--- p.29

As I write this book, the prices of Bitcoin and other cryptocurrencies are soaring and then falling at an incredible rate.

Few people truly understand how Bitcoin and other currencies using blockchain technology will impact people's lives, futures, and financial security.

The rise in gold prices in 1971 and the rise in Bitcoin prices in 2018 are harbingers of massive global change.

The world's financial tectonic plates will be shaken, and a financial earthquake and financial tsunami will soon follow.

--- p.37

I said earlier that the world of money has become almost invisible today.

Because modern money is no longer printed on paper, but exists in cyberspace.

Even paper assets are the same.

A 'dark pool' is a space where institutional investors such as banks and hedge funds and big-time professional investors like Warren Buffett trade stocks secretly. Today, approximately 40 percent of all paper asset transactions occur in dark pools.

Ordinary investors are completely unaware of what is happening.

--- p.399~400

The real problem with government money is trust.

As long as people trust and rely on governments and central banks, government-backed fiat currencies like dollars, yen, yuan, pesos, and euros can be said to be safe.

Credit is the last snowflake.

The moment credit disappears, government money becomes nothing more than scraps of paper.

The dollar will collapse, and an avalanche will start from the top of the mountain, sweeping away everything below. --- p.494

Dark money is money that the Federal Reserve and other central banks issue, or "create," electronically and then funnel into large private banks and financial markets.

It is virtually impossible to trace the destination of this money.

The Federal Reserve, the European Central Bank (ECB), and the Bank of Japan (BOJ) have created approximately $15 trillion in dark money to date.

If you include the money created by the People's Bank of China (PBOC), it amounts to a whopping $23 trillion.

This dark money first flows into large private banks and financial institutions, and from there it disperses in almost infinite directions, affecting different financial assets in various ways.

The only difference is that misinformation generates more revenue and therefore receives better treatment."

This type of misinformation continues to inflame and excite people… … provoke, excite, and explode the public.

(…) In today’s world, determining what is real and what is fake is a crucial task that can determine wealth and poverty, war and peace, and even life and death.

--- p.20~21

In 2008, the derivatives market was worth nearly $700 trillion.

As of 2018, the upper limit estimate for the derivatives market is $1,200 trillion.

I didn't mishear.

The elites have blown the problem out of proportion, making it almost twice as big and serious.

As I write this, we are on the brink of a catastrophe worth over $1,000 trillion.

--- p.29

As I write this book, the prices of Bitcoin and other cryptocurrencies are soaring and then falling at an incredible rate.

Few people truly understand how Bitcoin and other currencies using blockchain technology will impact people's lives, futures, and financial security.

The rise in gold prices in 1971 and the rise in Bitcoin prices in 2018 are harbingers of massive global change.

The world's financial tectonic plates will be shaken, and a financial earthquake and financial tsunami will soon follow.

--- p.37

I said earlier that the world of money has become almost invisible today.

Because modern money is no longer printed on paper, but exists in cyberspace.

Even paper assets are the same.

A 'dark pool' is a space where institutional investors such as banks and hedge funds and big-time professional investors like Warren Buffett trade stocks secretly. Today, approximately 40 percent of all paper asset transactions occur in dark pools.

Ordinary investors are completely unaware of what is happening.

--- p.399~400

The real problem with government money is trust.

As long as people trust and rely on governments and central banks, government-backed fiat currencies like dollars, yen, yuan, pesos, and euros can be said to be safe.

Credit is the last snowflake.

The moment credit disappears, government money becomes nothing more than scraps of paper.

The dollar will collapse, and an avalanche will start from the top of the mountain, sweeping away everything below. --- p.494

Dark money is money that the Federal Reserve and other central banks issue, or "create," electronically and then funnel into large private banks and financial markets.

It is virtually impossible to trace the destination of this money.

The Federal Reserve, the European Central Bank (ECB), and the Bank of Japan (BOJ) have created approximately $15 trillion in dark money to date.

If you include the money created by the People's Bank of China (PBOC), it amounts to a whopping $23 trillion.

This dark money first flows into large private banks and financial institutions, and from there it disperses in almost infinite directions, affecting different financial assets in various ways.

--- p.508

Publisher's Review

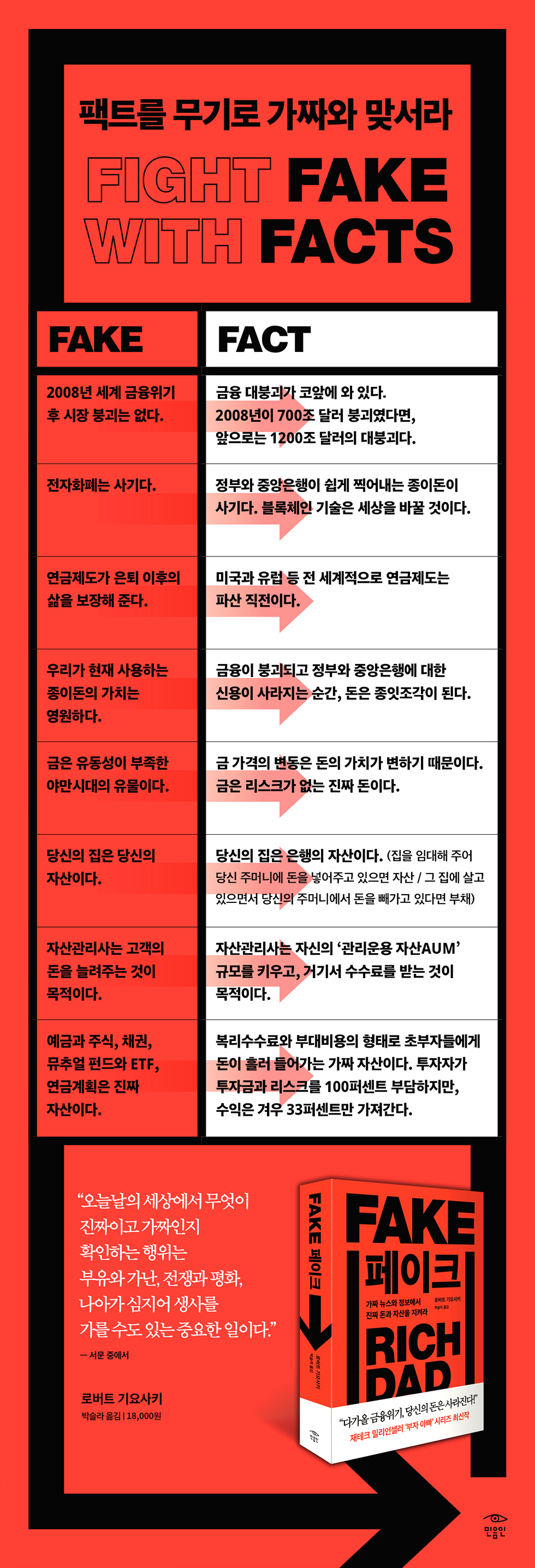

Fake assets are causing a financial meltdown.

The book warns that an unprecedented crisis is imminent as the fake money and assets currently supporting the global economy collapse.

The author explains complex concepts related to finance and economics as simply as possible and points out their problems.

In 2008, the $700 trillion derivatives market collapsed, nearly bringing the global economy to its knees.

The cause was derivatives such as collateralized debt obligations (CDOs), mortgage-backed securities (MBS), and credit default swaps (CDS), i.e. fake assets.

The bigger problem is that the financial elite are still creating more fake assets through 'financial engineering'.

It now stands at $1,200 trillion (KRW 1.41 trillion), nearly double the size of 2008.

The author says that to survive this crisis, we must clearly distinguish between fake and real assets.

Fake assets are structured to make the rich richer, while the costs of failure are borne by ordinary people.

The simplest and most practical way to distinguish them is that “assets are things that put money in my pocket,” and “liabilities are things that take money out of my pocket.”

Savings accounts, stocks, bonds, mutual funds, ETFs, pension plans, etc. are fake assets.

This is because the structure is such that investors bear all of the investment capital and risks but only receive a portion of the profits, meaning they are “taking money out of my pocket.”

Additionally, this book explains the principles and methods of building real assets such as gold, real estate, and businesses that generate infinite profits by “putting money in my pocket.”

Government money is fake money, and those who save it are losers.

The reason why savers become losers is because the paper money we use loses value the longer we keep it.

In 1971, when President Richard Nixon abolished the gold standard, the U.S. dollar became fiat money, or fake money, with no real value.

These easily printed paper moneys are losing their purchasing power and become worthless overnight as soon as trust in governments and central banks disappears.

This book divides the money we use today into three categories and explains them.

1.

God's money: gold and silver.

It is real money that cannot be printed by the government or central bank.

There is no risk in physical gold and silver, and their prices fluctuate because the value of government money (fake money) changes.

2.

Government's money: Fiat currency printed by governments and central banks, such as dollars, euros, and yuan.

It is fake money printed on paper based on the fractional reserve banking system of banks and the Mandrake Mechanism.

Since the abolition of the gold standard in 1971, the US dollar has become unreliable as a store of value and has been losing its value due to inflation.

3.

People's money: Cryptocurrencies such as Bitcoin, Ethereum, and Zipcoin.

The author argues that digital currency, the "people's money" based on blockchain technology, is more trustworthy than "government money," which easily depreciates and steals wealth.

I am also confident that blockchain technology will change the future.

Don't be fooled by fake teachers; learn real financial education.

The reason why people are becoming poorer and poorer by investing in these fakes and real things is because our education system is flawed.

While academic and vocational education are still provided in schools in many countries around the world, including the United States, financial education, which is essential for economic stability in an aging society, is rarely implemented.

The common economic wisdom that says, "Go to a good school, get a job, work hard to save money, pay off debt, and invest in the stock market for the long term" is also a product of false financial education.

This book provides a real financial education that has never been heard before through vivid testimonies from insiders such as David Stockman, former director of the Office of Management and Budget, James Rickards, an advisor to LTCM and the U.S. Department of Defense, and Nomi Prince, a former executive at Lehman Brothers and Goldman Sachs.

This is to ensure that ordinary people can see with their own eyes the real world dominated by 'invisible money' and avoid becoming victims of the rich.

"Fake," which reinterprets the principles of "Rich Dad," proven over the past 20 years, for today's times, will help you survive the coming financial crisis by changing your preconceived notions about money and investing.

The book warns that an unprecedented crisis is imminent as the fake money and assets currently supporting the global economy collapse.

The author explains complex concepts related to finance and economics as simply as possible and points out their problems.

In 2008, the $700 trillion derivatives market collapsed, nearly bringing the global economy to its knees.

The cause was derivatives such as collateralized debt obligations (CDOs), mortgage-backed securities (MBS), and credit default swaps (CDS), i.e. fake assets.

The bigger problem is that the financial elite are still creating more fake assets through 'financial engineering'.

It now stands at $1,200 trillion (KRW 1.41 trillion), nearly double the size of 2008.

The author says that to survive this crisis, we must clearly distinguish between fake and real assets.

Fake assets are structured to make the rich richer, while the costs of failure are borne by ordinary people.

The simplest and most practical way to distinguish them is that “assets are things that put money in my pocket,” and “liabilities are things that take money out of my pocket.”

Savings accounts, stocks, bonds, mutual funds, ETFs, pension plans, etc. are fake assets.

This is because the structure is such that investors bear all of the investment capital and risks but only receive a portion of the profits, meaning they are “taking money out of my pocket.”

Additionally, this book explains the principles and methods of building real assets such as gold, real estate, and businesses that generate infinite profits by “putting money in my pocket.”

Government money is fake money, and those who save it are losers.

The reason why savers become losers is because the paper money we use loses value the longer we keep it.

In 1971, when President Richard Nixon abolished the gold standard, the U.S. dollar became fiat money, or fake money, with no real value.

These easily printed paper moneys are losing their purchasing power and become worthless overnight as soon as trust in governments and central banks disappears.

This book divides the money we use today into three categories and explains them.

1.

God's money: gold and silver.

It is real money that cannot be printed by the government or central bank.

There is no risk in physical gold and silver, and their prices fluctuate because the value of government money (fake money) changes.

2.

Government's money: Fiat currency printed by governments and central banks, such as dollars, euros, and yuan.

It is fake money printed on paper based on the fractional reserve banking system of banks and the Mandrake Mechanism.

Since the abolition of the gold standard in 1971, the US dollar has become unreliable as a store of value and has been losing its value due to inflation.

3.

People's money: Cryptocurrencies such as Bitcoin, Ethereum, and Zipcoin.

The author argues that digital currency, the "people's money" based on blockchain technology, is more trustworthy than "government money," which easily depreciates and steals wealth.

I am also confident that blockchain technology will change the future.

Don't be fooled by fake teachers; learn real financial education.

The reason why people are becoming poorer and poorer by investing in these fakes and real things is because our education system is flawed.

While academic and vocational education are still provided in schools in many countries around the world, including the United States, financial education, which is essential for economic stability in an aging society, is rarely implemented.

The common economic wisdom that says, "Go to a good school, get a job, work hard to save money, pay off debt, and invest in the stock market for the long term" is also a product of false financial education.

This book provides a real financial education that has never been heard before through vivid testimonies from insiders such as David Stockman, former director of the Office of Management and Budget, James Rickards, an advisor to LTCM and the U.S. Department of Defense, and Nomi Prince, a former executive at Lehman Brothers and Goldman Sachs.

This is to ensure that ordinary people can see with their own eyes the real world dominated by 'invisible money' and avoid becoming victims of the rich.

"Fake," which reinterprets the principles of "Rich Dad," proven over the past 20 years, for today's times, will help you survive the coming financial crisis by changing your preconceived notions about money and investing.

GOODS SPECIFICS

- Date of issue: July 17, 2019

- Page count, weight, size: 584 pages | 702g | 148*210*35mm

- ISBN13: 9791158885342

- ISBN10: 1158885342

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)