Rich Dad Poor Dad 20th Anniversary Special Edition

|

Description

Book Introduction

- A word from MD

- The world's best-selling business book! The author compares the mindsets of the rich and the poor through the experiences of two fathers during his childhood.

Through straightforward language and immersive storytelling, he conveys basic economic knowledge, the concepts of assets and liabilities, and the secrets to successful investing in a way that is easy and clear for anyone to understand.

- Economic Management MD Kang Hyeon-jeong

The world's best-selling business book

Celebrating the 20th Anniversary of Rich Dad Poor Dad

Upgraded edition released!

- 41 new comments tailored to global financial changes

- 500 pages of additional content, including 10 study sessions for discussion and practice.

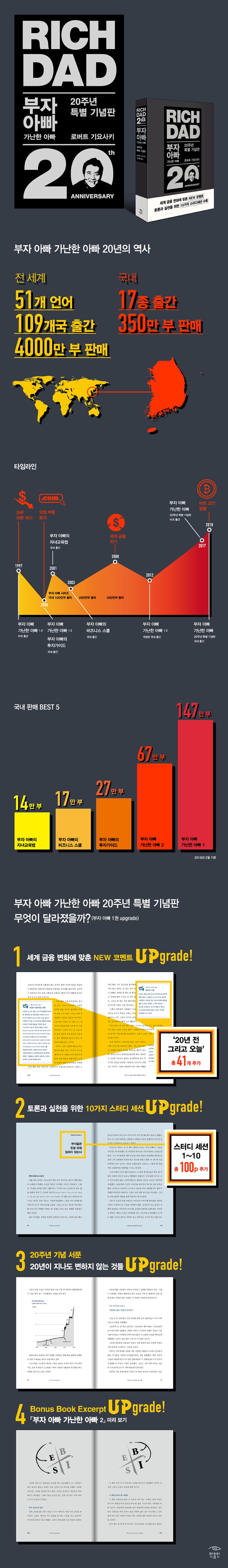

The "Rich Dad Poor Dad" series, a best-selling book in the fields of economics, management, and finance, has been published in 51 languages and 109 countries worldwide since its first publication in the United States in 1997, selling 40 million copies (3.5 million copies in Korea).

The special 20th anniversary edition of "Rich Dad Poor Dad," which includes the wealthy's proven guidance on money and investment over 20 years and new information tailored to today's times, has been published by Minumsa.

This is an upgraded edition with 500 pages of manuscript paper, including 41 '20 Years Ago and Today' chapters in line with global financial changes and 10 'Study Sessions' for discussion and practice, in addition to the content of 'Rich Dad Poor Dad 1', which has been most loved by readers for the past 20 years.

The groundbreaking content that shatters preconceived notions about money and the timeless principles of investment will continue to serve as an unwavering standard for "money" and "investment," even today, amidst growing interest in diverse investment trends, such as the Bitcoin craze and the revitalized real estate auction market.

Above all, the reason this book resonated with readers was because it overturned common sense about money.

The author argues that the reason people are poor is not because they lack money, but because of a mindset and culture that views money as taboo and distances them from financial knowledge.

The author's poor father, although well-educated, was always burdened by credit card bills and mortgage payments. (“The love of money is the root of all evil.

I need to study hard and get a good job.

“Avoid risks and live a stable life.”) On the other hand, my friend’s rich father, despite not having received a proper formal education, acquired financial IQ and amassed enormous wealth. (“Lack of money is the root of all evil.

Study hard and start a good company.

You need to hire smart people.

“Above all, you must learn how to manage risk.”) In this book, the author compares the mindsets of the poor and the rich through the two fathers he encountered during his childhood.

Through straightforward language and immersive storytelling, he conveys basic economic knowledge, the concepts of assets and liabilities, and the secrets to developing financial IQ for successful investment in a way that is easy and clear for anyone to understand.

Celebrating the 20th Anniversary of Rich Dad Poor Dad

Upgraded edition released!

- 41 new comments tailored to global financial changes

- 500 pages of additional content, including 10 study sessions for discussion and practice.

The "Rich Dad Poor Dad" series, a best-selling book in the fields of economics, management, and finance, has been published in 51 languages and 109 countries worldwide since its first publication in the United States in 1997, selling 40 million copies (3.5 million copies in Korea).

The special 20th anniversary edition of "Rich Dad Poor Dad," which includes the wealthy's proven guidance on money and investment over 20 years and new information tailored to today's times, has been published by Minumsa.

This is an upgraded edition with 500 pages of manuscript paper, including 41 '20 Years Ago and Today' chapters in line with global financial changes and 10 'Study Sessions' for discussion and practice, in addition to the content of 'Rich Dad Poor Dad 1', which has been most loved by readers for the past 20 years.

The groundbreaking content that shatters preconceived notions about money and the timeless principles of investment will continue to serve as an unwavering standard for "money" and "investment," even today, amidst growing interest in diverse investment trends, such as the Bitcoin craze and the revitalized real estate auction market.

Above all, the reason this book resonated with readers was because it overturned common sense about money.

The author argues that the reason people are poor is not because they lack money, but because of a mindset and culture that views money as taboo and distances them from financial knowledge.

The author's poor father, although well-educated, was always burdened by credit card bills and mortgage payments. (“The love of money is the root of all evil.

I need to study hard and get a good job.

“Avoid risks and live a stable life.”) On the other hand, my friend’s rich father, despite not having received a proper formal education, acquired financial IQ and amassed enormous wealth. (“Lack of money is the root of all evil.

Study hard and start a good company.

You need to hire smart people.

“Above all, you must learn how to manage risk.”) In this book, the author compares the mindsets of the poor and the rich through the two fathers he encountered during his childhood.

Through straightforward language and immersive storytelling, he conveys basic economic knowledge, the concepts of assets and liabilities, and the secrets to developing financial IQ for successful investment in a way that is easy and clear for anyone to understand.

- You can preview some of the book's contents.

Preview

index

20th Anniversary Preface | Things That Don't Change After 20 Years

Introduction | Rich Dad vs.

poor father

Chapter 1

Lesson 1: Rich people don't work for money.

Study Session 1

Chapter 2

Lesson 2: Why Learn Financial Literacy

Study Session 2

Chapter 3

Lesson 3: Rich people do business for themselves.

Study Session 3

Chapter 4

Lesson 4: The Rich's Biggest Secret: Taxes and Business

Study Session 4

Chapter 5

Lesson 5: Rich people make money.

Study Session 5

Chapter 6

Lesson 6: Don't work for money, work for lessons.

Study Session 6

Chapter 7

What are the obstacles that block the path to wealth?

Study Session 7

Chapter 8

10 Steps to Getting Rich

Study Session 8

Chapter 9

If you still want to know more, here's what you need to do

Study Session 9

In conclusion

Study Session 10

Bonus Book Excerpt

Preview of "Rich Dad Poor Dad 2"

Introduction | Rich Dad vs.

poor father

Chapter 1

Lesson 1: Rich people don't work for money.

Study Session 1

Chapter 2

Lesson 2: Why Learn Financial Literacy

Study Session 2

Chapter 3

Lesson 3: Rich people do business for themselves.

Study Session 3

Chapter 4

Lesson 4: The Rich's Biggest Secret: Taxes and Business

Study Session 4

Chapter 5

Lesson 5: Rich people make money.

Study Session 5

Chapter 6

Lesson 6: Don't work for money, work for lessons.

Study Session 6

Chapter 7

What are the obstacles that block the path to wealth?

Study Session 7

Chapter 8

10 Steps to Getting Rich

Study Session 8

Chapter 9

If you still want to know more, here's what you need to do

Study Session 9

In conclusion

Study Session 10

Bonus Book Excerpt

Preview of "Rich Dad Poor Dad 2"

Detailed image

Publisher's Review

The world's best-selling business book

Celebrating the 20th Anniversary of Rich Dad Poor Dad

Upgraded edition released!

- 41 new comments tailored to global financial changes

- 500 pages of additional content, including 10 study sessions for discussion and practice.

The "Rich Dad Poor Dad" series, a best-selling book in the fields of economics, management, and finance, has been published in 51 languages and 109 countries worldwide since its first publication in the United States in 1997, selling 40 million copies (3.5 million copies in Korea).

The special 20th anniversary edition of "Rich Dad Poor Dad," which includes the wealthy's proven guidance on money and investment over 20 years and new information tailored to today's times, has been published by Minumsa.

This is an upgraded edition with 500 pages of manuscript paper, including 41 '20 Years Ago and Today' chapters in line with global financial changes and 10 'Study Sessions' for discussion and practice, in addition to the content of 'Rich Dad Poor Dad 1', which has been most loved by readers for the past 20 years.

The groundbreaking content that shatters preconceived notions about money and the timeless principles of investment will continue to serve as an unwavering standard for "money" and "investment," even today, amidst growing interest in diverse investment trends, such as the Bitcoin craze and the revitalized real estate auction market.

“For those who want to take control of their financial future,

I recommend using “Rich Dad Poor Dad” as a starting point.”

― USA Today

Rich Dad's Lessons, Tested Over 20 Years

Rich Dad Poor Dad, first published in the United States in 1997, was first introduced in Korea in February 2000, during the long tunnel of the IMF foreign exchange crisis.

The 'Rich Dad Poor Dad' series, published following the success of the first volume, pioneered the field of 'economics, management, and financial technology', which was unfamiliar in the domestic publishing market at the time. To date, a total of 17 volumes have been published, selling 3.5 million copies, establishing themselves as million-sellers.

Above all, the reason this book resonated with readers was because it overturned common sense about money.

The author argues that the reason people are poor is not because they lack money, but because of a mindset and culture that views money as taboo and distances them from financial knowledge.

The author's poor father, although well-educated, was always burdened by credit card bills and mortgage payments. (“The love of money is the root of all evil.

I need to study hard and get a good job.

“Avoid risks and live a stable life.”) On the other hand, my friend’s rich father, despite not having received a proper formal education, acquired financial IQ and amassed enormous wealth. (“Lack of money is the root of all evil.

Study hard and start a good company.

You need to hire smart people.

“Above all, you must learn how to manage risk.”) In this book, the author compares the mindsets of the poor and the rich through the two fathers he encountered during his childhood.

Through straightforward language and immersive storytelling, he conveys basic economic knowledge, the concepts of assets and liabilities, and the secrets to developing financial IQ for successful investment in a way that is easy and clear for anyone to understand.

* Lessons from Rich Dad

“The poor and the middle class work for money.

“The rich make money work for them.”

“It doesn’t matter how much you earn.

“It’s all about how much you can collect.”

“Schools only teach you how to work for money, not how to manage it.”

“The reason people struggle financially is because they have spent their entire lives working for other people.”

“The reason the middle class is at risk today is because they lack proper financial education.”

“Once you get caught up in a life of paying bills, you become a hamster constantly running on a wheel.”

“Start your own business.

“Buy real assets, not liabilities, while keeping your job.”

“The rich focus on assets.

“Those who are not rich focus on income.”

“Your home is not an asset, and you are in trouble, especially if it is your biggest liability.”

“If you know what you’re doing, it’s investing. If you just pour money and pray, it’s gambling.”

“The fundamental difference between rich and poor is how they deal with fear.”

New information and practices discovered through 20 years of change

The 『Rich Dad Poor Dad 20th Anniversary Special Edition』 includes 41 new chapters of '20 Years Ago and Today' and 10 'Study Sessions' that were not included in the original 『Rich Dad Poor Dad 1』, totaling 500 pages.

The section "20 Years Ago and Today," inserted in the middle of the text, contains new information the author discovered in the midst of global financial changes over the past 20 years, including the advancement of IT technology and the formation of new markets, the development of robotics and the reduction of jobs, loopholes in the tax system, and the risks of welfare policies.

It also reveals how rich dad's teachings, which were both praised and criticized at the time of their publication—such as "Rich people don't work for money," "Savers are losers," "Your home is not an asset," and "Rich people pay less taxes"—have survived and exerted their influence 20 years later.

Additionally, the "Study Session" added at the end of each chapter will help readers reorganize the book's content, grasp the key points, ask their own questions, engage in discussions, and put Rich Dad's principles into practice in their lives.

* 20 years ago and today

- A home is not an asset: The 2008 US housing market crash clearly demonstrated that owning a home is not an asset.

A home won't put money in your pocket, nor is it guaranteed to appreciate in value.

In the United States today, many homes are worth less than they were twenty years ago. (p.26)

- Learn, unlearn, and relearn: This maxim, emphasized by futurist Alvin Toffler, reflects something my rich dad told me twenty years ago.

“Illiteracy in the 21st century will not be the inability to read and write, but the inability to learn, unlearn, and relearn.” (p. 110)

- Tax and welfare plans: As social demands expand the demand for taxes, property taxes, income taxes, and value-added taxes are rising worldwide.

In addition, the government has been steadily raising tax rates to finance social welfare programs, namely welfare and welfare plans, so high-income earners are facing even greater bracket creep (bracket creep, an unintended increase in tax due to an increase in nominal income caused by inflation, i.e. a tax increase caused by rising prices regardless of the increase in real income of the taxpayer).

It creates a 'hidden tax hike' because the government does not intend to increase taxes and taxpayers are not aware of it.

Today, governments around the world face serious challenges that could lead to the insolvency of welfare programs like social security and health insurance. (p.122)

- Mistakes are learning opportunities: Schools teach us to avoid mistakes and punish students who make them.

However, I've learned that in the real world, recognizing and evaluating your mistakes and using them as a means to make better decisions is an invaluable asset.

A little fear can be healthy, but you shouldn't live in fear of making mistakes.

Mistakes are good if you can learn from them. (p.298)

Celebrating the 20th Anniversary of Rich Dad Poor Dad

Upgraded edition released!

- 41 new comments tailored to global financial changes

- 500 pages of additional content, including 10 study sessions for discussion and practice.

The "Rich Dad Poor Dad" series, a best-selling book in the fields of economics, management, and finance, has been published in 51 languages and 109 countries worldwide since its first publication in the United States in 1997, selling 40 million copies (3.5 million copies in Korea).

The special 20th anniversary edition of "Rich Dad Poor Dad," which includes the wealthy's proven guidance on money and investment over 20 years and new information tailored to today's times, has been published by Minumsa.

This is an upgraded edition with 500 pages of manuscript paper, including 41 '20 Years Ago and Today' chapters in line with global financial changes and 10 'Study Sessions' for discussion and practice, in addition to the content of 'Rich Dad Poor Dad 1', which has been most loved by readers for the past 20 years.

The groundbreaking content that shatters preconceived notions about money and the timeless principles of investment will continue to serve as an unwavering standard for "money" and "investment," even today, amidst growing interest in diverse investment trends, such as the Bitcoin craze and the revitalized real estate auction market.

“For those who want to take control of their financial future,

I recommend using “Rich Dad Poor Dad” as a starting point.”

― USA Today

Rich Dad's Lessons, Tested Over 20 Years

Rich Dad Poor Dad, first published in the United States in 1997, was first introduced in Korea in February 2000, during the long tunnel of the IMF foreign exchange crisis.

The 'Rich Dad Poor Dad' series, published following the success of the first volume, pioneered the field of 'economics, management, and financial technology', which was unfamiliar in the domestic publishing market at the time. To date, a total of 17 volumes have been published, selling 3.5 million copies, establishing themselves as million-sellers.

Above all, the reason this book resonated with readers was because it overturned common sense about money.

The author argues that the reason people are poor is not because they lack money, but because of a mindset and culture that views money as taboo and distances them from financial knowledge.

The author's poor father, although well-educated, was always burdened by credit card bills and mortgage payments. (“The love of money is the root of all evil.

I need to study hard and get a good job.

“Avoid risks and live a stable life.”) On the other hand, my friend’s rich father, despite not having received a proper formal education, acquired financial IQ and amassed enormous wealth. (“Lack of money is the root of all evil.

Study hard and start a good company.

You need to hire smart people.

“Above all, you must learn how to manage risk.”) In this book, the author compares the mindsets of the poor and the rich through the two fathers he encountered during his childhood.

Through straightforward language and immersive storytelling, he conveys basic economic knowledge, the concepts of assets and liabilities, and the secrets to developing financial IQ for successful investment in a way that is easy and clear for anyone to understand.

* Lessons from Rich Dad

“The poor and the middle class work for money.

“The rich make money work for them.”

“It doesn’t matter how much you earn.

“It’s all about how much you can collect.”

“Schools only teach you how to work for money, not how to manage it.”

“The reason people struggle financially is because they have spent their entire lives working for other people.”

“The reason the middle class is at risk today is because they lack proper financial education.”

“Once you get caught up in a life of paying bills, you become a hamster constantly running on a wheel.”

“Start your own business.

“Buy real assets, not liabilities, while keeping your job.”

“The rich focus on assets.

“Those who are not rich focus on income.”

“Your home is not an asset, and you are in trouble, especially if it is your biggest liability.”

“If you know what you’re doing, it’s investing. If you just pour money and pray, it’s gambling.”

“The fundamental difference between rich and poor is how they deal with fear.”

New information and practices discovered through 20 years of change

The 『Rich Dad Poor Dad 20th Anniversary Special Edition』 includes 41 new chapters of '20 Years Ago and Today' and 10 'Study Sessions' that were not included in the original 『Rich Dad Poor Dad 1』, totaling 500 pages.

The section "20 Years Ago and Today," inserted in the middle of the text, contains new information the author discovered in the midst of global financial changes over the past 20 years, including the advancement of IT technology and the formation of new markets, the development of robotics and the reduction of jobs, loopholes in the tax system, and the risks of welfare policies.

It also reveals how rich dad's teachings, which were both praised and criticized at the time of their publication—such as "Rich people don't work for money," "Savers are losers," "Your home is not an asset," and "Rich people pay less taxes"—have survived and exerted their influence 20 years later.

Additionally, the "Study Session" added at the end of each chapter will help readers reorganize the book's content, grasp the key points, ask their own questions, engage in discussions, and put Rich Dad's principles into practice in their lives.

* 20 years ago and today

- A home is not an asset: The 2008 US housing market crash clearly demonstrated that owning a home is not an asset.

A home won't put money in your pocket, nor is it guaranteed to appreciate in value.

In the United States today, many homes are worth less than they were twenty years ago. (p.26)

- Learn, unlearn, and relearn: This maxim, emphasized by futurist Alvin Toffler, reflects something my rich dad told me twenty years ago.

“Illiteracy in the 21st century will not be the inability to read and write, but the inability to learn, unlearn, and relearn.” (p. 110)

- Tax and welfare plans: As social demands expand the demand for taxes, property taxes, income taxes, and value-added taxes are rising worldwide.

In addition, the government has been steadily raising tax rates to finance social welfare programs, namely welfare and welfare plans, so high-income earners are facing even greater bracket creep (bracket creep, an unintended increase in tax due to an increase in nominal income caused by inflation, i.e. a tax increase caused by rising prices regardless of the increase in real income of the taxpayer).

It creates a 'hidden tax hike' because the government does not intend to increase taxes and taxpayers are not aware of it.

Today, governments around the world face serious challenges that could lead to the insolvency of welfare programs like social security and health insurance. (p.122)

- Mistakes are learning opportunities: Schools teach us to avoid mistakes and punish students who make them.

However, I've learned that in the real world, recognizing and evaluating your mistakes and using them as a means to make better decisions is an invaluable asset.

A little fear can be healthy, but you shouldn't live in fear of making mistakes.

Mistakes are good if you can learn from them. (p.298)

GOODS SPECIFICS

- Date of issue: February 22, 2018

- Page count, weight, size: 446 pages | 631g | 148*210*30mm

- ISBN13: 9791158883591

- ISBN10: 1158883595

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)