The Psychology of Money (Special Edition to Commemorate 300,000 Copies)

|

Description

Book Introduction

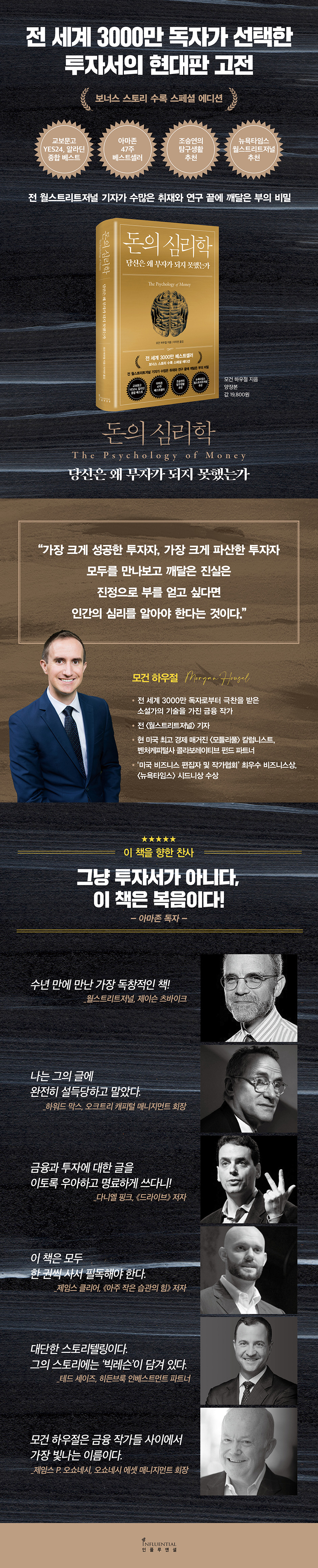

The most successful investors vs. The biggest bankrupt investor What separated the fates of these two? A financial writer with a novelist's skills, a storytelling genius. A masterpiece by Morgan Housel, winner of the Best Business Writer Award Why do some people become rich and others remain losers? The secret to wealth discovered by a former Wall Street Journal reporter after countless hours of reporting and research. This is the first book by Morgan Housel, a columnist who has written about finance and investing for the Wall Street Journal for over a decade and a partner at Collaborative Fund. Immediately after its publication, it ranked first in the Amazon investment category and received rave reviews from individual investors and professional consultants, earning it the distinction of being Amazon's "Best Financial Book of 2020." 《The Psychology of Money》 consists of a total of 20 stories. Living up to his nicknames of "storytelling genius" and "financial writer with a novelist's skills," Morgan Housel's 20 investment stories are incredibly compelling. Each story is based on true stories and evidence, yet it is packed with both the fun of the story and the lessons of investing. From stories about German tank units during World War II, Bill Gates' confession about founding Microsoft, an episode about a Ferrari from his time working as a valet in LA, to the secrets of Warren Buffett's incredible returns, the book captivates readers with its diverse and engaging narrative. And at the end, they all contain remarkable insights that elicit admiration. The question of wealth ultimately has nothing to do with education, intelligence, or effort, but rather has a close relationship with human biases and psychology regarding money, or in other words, the 'psychology of money.' |

- You can preview some of the book's contents.

Preview

index

Introduction _ How much do you know about money?

1.

No one is crazy

2.

Where does luck end and risk begin?

3.

something that can never be filled

4.

Time will make you rich

5.

Will you get rich or stay rich?

6.

The tail wags the body

7.

What it means to have money

8.

The paradox of Ferrari

9.

Definition of wealth

10.

What, you want me to save money?

11.

Is it better to be moderately reasonable or thoroughly rational?

12.

What has never happened before is bound to happen.

13.

safety margin

14.

Past Me vs.

Future me

15.

Invisible price tag

16.

You and I are playing different games

17.

The temptation of pessimism

18.

"If you desperately want something, you'll believe it."

19.

Some Universal Truths About Money

20.

My Investment Story

A story I want to know more about: How did these thoughts about money come about?

Special Appendix_ Financial Advice for My Children

References

1.

No one is crazy

2.

Where does luck end and risk begin?

3.

something that can never be filled

4.

Time will make you rich

5.

Will you get rich or stay rich?

6.

The tail wags the body

7.

What it means to have money

8.

The paradox of Ferrari

9.

Definition of wealth

10.

What, you want me to save money?

11.

Is it better to be moderately reasonable or thoroughly rational?

12.

What has never happened before is bound to happen.

13.

safety margin

14.

Past Me vs.

Future me

15.

Invisible price tag

16.

You and I are playing different games

17.

The temptation of pessimism

18.

"If you desperately want something, you'll believe it."

19.

Some Universal Truths About Money

20.

My Investment Story

A story I want to know more about: How did these thoughts about money come about?

Special Appendix_ Financial Advice for My Children

References

Detailed image

Into the book

The children of wealthy bankers cannot even begin to fathom the risk and return mindset of someone who grew up in poverty.

People who grow up in times of high inflation experience things that people who grow up in stable times don't have to.

Stockbrokers during the Great Depression suffered and lost everything that tech workers who enjoyed the glory days of the late 1990s could never have imagined.

…your experience with money is probably made up of 0.00000001 percent of what actually happens in the world and 80 percent of what you 'think' the world works.

--- pp.28-29 (story 1.

No one is crazy)

There was a hedge fund called Long-Term Capital Management.

These hedge fund employees invested most of their wealth in their own funds.

They took too many risks and ended up losing everything.

In 1998, the year of the strongest economy and the largest bull market in history.

Warren Buffett said about this:

They risked everything they had and needed to earn money they neither had nor needed.

This is stupid.

It's just pure stupidity.

It's just nonsense to risk something important to you for something that doesn't matter to you.

--- p.75 (story 3.

(which is never filled)

The only way I know how much food I can eat is to eat until I feel sick.

But few people try this.

Because the pain of vomiting is greater than any delicious meal.

But for some reason, people don't apply this same logic to business and investing.

So people only stop pursuing more when they are broke or in desperate situations.

--- p.79 (story 3.

(which is never filled)

There are over 2,000 books on how Warren Buffett built his wealth.

But no book has focused on the simplest fact.

The fact is that Buffett amassed such a large fortune not because he was simply a great investor, but because he was a great investor from a young age.

Buffett's net worth is $84.5 billion.

Of that, $84.2 billion was accumulated after his fifties.

The $81.5 billion was made after he was in his mid-60s.

Warren Buffett is a phenomenal investor.

But to attribute all his success solely to his investment acumen would be to miss the point.

The real key to his success is that he has been a phenomenal investor for a whopping 75 years.

--- p.89 (story 4.

Time will make you rich)

If you want safer, more predictable, and more stable returns, you should invest in large, publicly traded companies.

Or so you might think.

But remember.

The tail rules 'everything'.

As time goes by, the success distribution of large listed companies is not much different from that of venture capital.

A significant number of listed companies are failures, and only a handful are truly exceptional winners, responsible for most of the stock market's returns.

--- p.123 (story 6.

The tail wags the body)

Did they buy a Ferrari because they thought it would bring them respect? What about those who live in big houses? Is the same true? I'm not saying you shouldn't pursue wealth.

I'm not saying you shouldn't buy a nice car.

I like both too.

People generally want to be respected and praised, but buying something fancy with money might not bring as much respect or praise as you might think.

If respect and admiration are your goals, you must be careful how you pursue them.

Humility, kindness, and empathy will earn you more respect than a car with a large engine.

--- p.157 (story 8.

The paradox of Ferrari)

Cash in the bank gives us the freedom to make our own choices when we want to change careers, retire early, or be free from worries.

This is a great benefit in life.

Can this value be quantified? I don't think it can be calculated.

…if I can't use my time as I want, I have no choice but to accept whatever misfortune throws at me.

Maybe a 0% interest savings account at the bank could be a huge benefit.

If I have savings, I can choose a job that pays less but has a greater purpose for me.

If you have savings, you can seize golden investment opportunities that suddenly come along when you need them most.

--- pp.178-179 (story 10.

What, you want me to save money?)

The Intelligent Investor is one of the greatest investment books of all time.

However, I don't know if there is a single investor who has become wealthy by practicing the formulas Graham presented.

This book is full of wisdom.

It probably contains more wisdom than any other investment book ever published.

However, its value as a practical guide is questionable.

What happened? Graham was a highly successful investor himself.

Graham was a practical man.

He was not bound by an investment concept he had held onto until too many investors had adopted it, rendering it potentially useless.

--- p.214 (story 12.

What has never happened before is bound to happen)

The same goes for money matters.

Real estate prices rise almost every year, and you will receive a salary almost every year.

But if something has a 95 percent chance of being right and a 5 percent chance of being wrong, that means you're bound to experience some downside at some point in your life.

If the price of that downside is bankruptcy, then even if there is a 95 percent chance of a favorable outcome, the risk is not worth taking.

No matter how attractive the trade-off may be.

The devil here is leverage.

--- pp.230-231 (story 13.

safety margin)

Long-term financial planning is essential.

But things change.

The world around me changes, my goals change, and my desires change.

It's one thing to say, "I don't know what the future holds," but it's another thing to admit that I don't know what my future self will want.

In reality, few of us acknowledge this fact.

Making sustainable long-term decisions isn't easy, even though our thoughts about what we want in the future are likely to change.

--- p.244 (story 14.

Past Me vs.

Future Me)

Momentum is generating significant short-term returns, so what should we do? Should we just sit back and watch? Absolutely not.

The world doesn't work that way.

People always chase profit.

In areas where short-term traders operate, the rules that govern long-term investing (especially regarding valuation) are ignored.

Because it has nothing to do with the game you're playing right now.

So things get interesting and problems arise.

--- p.276 (story 16.

You and I are playing different games)

“Risk is what’s left when you think you’ve considered every possibility.” People know this.

None of the investors I've met truly believed that overall market forecasts were accurate or useful.

Despite this, there is still a huge demand for forecasts, both among the media and financial advisors.

Why? Psychologist Philip Tetlock once said:

“We need to believe that we live in a predictable and controllable world.

So we turn to authoritative-sounding people who promise to meet that need.”

People who grow up in times of high inflation experience things that people who grow up in stable times don't have to.

Stockbrokers during the Great Depression suffered and lost everything that tech workers who enjoyed the glory days of the late 1990s could never have imagined.

…your experience with money is probably made up of 0.00000001 percent of what actually happens in the world and 80 percent of what you 'think' the world works.

--- pp.28-29 (story 1.

No one is crazy)

There was a hedge fund called Long-Term Capital Management.

These hedge fund employees invested most of their wealth in their own funds.

They took too many risks and ended up losing everything.

In 1998, the year of the strongest economy and the largest bull market in history.

Warren Buffett said about this:

They risked everything they had and needed to earn money they neither had nor needed.

This is stupid.

It's just pure stupidity.

It's just nonsense to risk something important to you for something that doesn't matter to you.

--- p.75 (story 3.

(which is never filled)

The only way I know how much food I can eat is to eat until I feel sick.

But few people try this.

Because the pain of vomiting is greater than any delicious meal.

But for some reason, people don't apply this same logic to business and investing.

So people only stop pursuing more when they are broke or in desperate situations.

--- p.79 (story 3.

(which is never filled)

There are over 2,000 books on how Warren Buffett built his wealth.

But no book has focused on the simplest fact.

The fact is that Buffett amassed such a large fortune not because he was simply a great investor, but because he was a great investor from a young age.

Buffett's net worth is $84.5 billion.

Of that, $84.2 billion was accumulated after his fifties.

The $81.5 billion was made after he was in his mid-60s.

Warren Buffett is a phenomenal investor.

But to attribute all his success solely to his investment acumen would be to miss the point.

The real key to his success is that he has been a phenomenal investor for a whopping 75 years.

--- p.89 (story 4.

Time will make you rich)

If you want safer, more predictable, and more stable returns, you should invest in large, publicly traded companies.

Or so you might think.

But remember.

The tail rules 'everything'.

As time goes by, the success distribution of large listed companies is not much different from that of venture capital.

A significant number of listed companies are failures, and only a handful are truly exceptional winners, responsible for most of the stock market's returns.

--- p.123 (story 6.

The tail wags the body)

Did they buy a Ferrari because they thought it would bring them respect? What about those who live in big houses? Is the same true? I'm not saying you shouldn't pursue wealth.

I'm not saying you shouldn't buy a nice car.

I like both too.

People generally want to be respected and praised, but buying something fancy with money might not bring as much respect or praise as you might think.

If respect and admiration are your goals, you must be careful how you pursue them.

Humility, kindness, and empathy will earn you more respect than a car with a large engine.

--- p.157 (story 8.

The paradox of Ferrari)

Cash in the bank gives us the freedom to make our own choices when we want to change careers, retire early, or be free from worries.

This is a great benefit in life.

Can this value be quantified? I don't think it can be calculated.

…if I can't use my time as I want, I have no choice but to accept whatever misfortune throws at me.

Maybe a 0% interest savings account at the bank could be a huge benefit.

If I have savings, I can choose a job that pays less but has a greater purpose for me.

If you have savings, you can seize golden investment opportunities that suddenly come along when you need them most.

--- pp.178-179 (story 10.

What, you want me to save money?)

The Intelligent Investor is one of the greatest investment books of all time.

However, I don't know if there is a single investor who has become wealthy by practicing the formulas Graham presented.

This book is full of wisdom.

It probably contains more wisdom than any other investment book ever published.

However, its value as a practical guide is questionable.

What happened? Graham was a highly successful investor himself.

Graham was a practical man.

He was not bound by an investment concept he had held onto until too many investors had adopted it, rendering it potentially useless.

--- p.214 (story 12.

What has never happened before is bound to happen)

The same goes for money matters.

Real estate prices rise almost every year, and you will receive a salary almost every year.

But if something has a 95 percent chance of being right and a 5 percent chance of being wrong, that means you're bound to experience some downside at some point in your life.

If the price of that downside is bankruptcy, then even if there is a 95 percent chance of a favorable outcome, the risk is not worth taking.

No matter how attractive the trade-off may be.

The devil here is leverage.

--- pp.230-231 (story 13.

safety margin)

Long-term financial planning is essential.

But things change.

The world around me changes, my goals change, and my desires change.

It's one thing to say, "I don't know what the future holds," but it's another thing to admit that I don't know what my future self will want.

In reality, few of us acknowledge this fact.

Making sustainable long-term decisions isn't easy, even though our thoughts about what we want in the future are likely to change.

--- p.244 (story 14.

Past Me vs.

Future Me)

Momentum is generating significant short-term returns, so what should we do? Should we just sit back and watch? Absolutely not.

The world doesn't work that way.

People always chase profit.

In areas where short-term traders operate, the rules that govern long-term investing (especially regarding valuation) are ignored.

Because it has nothing to do with the game you're playing right now.

So things get interesting and problems arise.

--- p.276 (story 16.

You and I are playing different games)

“Risk is what’s left when you think you’ve considered every possibility.” People know this.

None of the investors I've met truly believed that overall market forecasts were accurate or useful.

Despite this, there is still a huge demand for forecasts, both among the media and financial advisors.

Why? Psychologist Philip Tetlock once said:

“We need to believe that we live in a predictable and controllable world.

So we turn to authoritative-sounding people who promise to meet that need.”

--- p.320 (story 18.

“If you desperately want something, you’ll end up believing it.”

“If you desperately want something, you’ll end up believing it.”

Publisher's Review

- #1 Amazon Bestseller in Investments

- Recommended by the New York Times and Wall Street Journal

- Praise from Howard Marks, Daniel Pink, and James Clear

- Five stars, rave reviews from Amazon readers

The cleaner who left 10 billion won vs.

A millionaire who went bankrupt overnight

What separated the fates of two people?

Here's an interesting story that made international news headlines.

Richard Fuscon graduated from Harvard University, earned an MBA, and then worked as an executive at Merrill Lynch.

He was named one of the '40 Under 40' successful businessmen and retired as a millionaire, enjoying a luxurious lifestyle.

He went into deep debt to build a mansion with 11 bathrooms, an elevator, and a swimming pool, and became a topic of conversation by throwing pool parties every day.

Then, when the financial crisis hit in 2008, Puscone went bankrupt overnight.

The mansion was foreclosed and he was left penniless.

A few months later, another news headline hits the headlines.

Ronald Reed.

With only a high school education, he repaired cars for 25 years, swept department store floors for 17 years, and at age 38 bought a two-bedroom house, where he lived until his death.

The fortune left behind by handyman Ronald Reed after his death was a whopping 10 billion won.

This amazing news is topping the news.

Investing isn't an IQ test.

The Secret to Wealth Revealed by a Wall Street Journal Reporter

Morgan Housel, a columnist for The Wall Street Journal who has written about finance and investing for over a decade, is deeply troubled by these two cases.

A janitor who left behind 10 billion won and a millionaire investor who went bankrupt overnight.

What decided the fate of these two people?

What is the difference?

Morgan Housel suggests that there are two possible explanations for the simultaneous existence of cases like Ronald Reed and Richard Fuscon in our time.

First, financial results are not directly related to talent, effort, or education.

Second, wealth accumulation is more psychological than scientific or numerical.

Morgan Housel paid particular attention to the second fact, and called soft skills such as the psychology and attitude toward money the "psychology of money."

“The more I studied and wrote about the financial crisis, the more I realized that it was better understood through the lenses of psychology and history, not just finance.

To understand why people are drowning in debt, we need to study not interest rates, but the history of greed, anxiety, and optimism.

To understand why investors sell off their assets at the bottom of a bear market, you need to look not at how to calculate future expected returns, but at their families.

“I have to think about the pain and wonder if my investments are putting our future at risk.” (p.20)

Getting rich vs.

Remaining rich

Warren Buffett remains rich, while his friend Rick Guerin disappears.

Morgan Housel tells 20 fascinating stories.

Among them, Rick Guerin's story is very impressive.

Rick Guerin was Warren Buffett and Charlie Munger's investment buddy 40 years ago.

Buffett, Munger, and Guerin jointly invested and interviewed managers to take charge of the business.

Then, Gerin disappeared.

Buffett said this:

“Charlie and I always knew we were going to be incredibly rich.

We weren't in a hurry to get rich.

Because I knew it would end up like that.

“Gerin was just as smart as we were, but he was in a hurry.” (p.107)

What differentiated Rick Guerin from Buffett and Munger? He used borrowed money to increase his investments during the economic downturn of 1973-1974.

During those two years, the stock market fell nearly 70 percent, and Guerin was required to post additional margin.

Guerin had to sell his Berkshire Hathaway stock to Buffett for less than $40 a share.

Rick Gaine became rich, but he didn't stay rich.

Munger, Buffett, and Guerin were equally talented at getting rich.

But Buffett and Munger also had a knack for staying rich.

As time goes by, the most important talent is this: remaining rich.

Nassim Taleb, the 'sage of Wall Street', said the following about this:

“Standing on high ground and surviving are two entirely different things.

The former requires the latter.

Catastrophe must be avoided.

“No matter what happens.”

In the blind investment frenzy, what no one is talking about

"The Real Reason We Need to Be Rich"

Why do you earn money? Why do you want to become rich? Why should we become rich? Morgan Housel emphasizes that these questions must be answered before jumping into investing.

Charlie Munger said this:

“I didn’t set out to become rich from the beginning.

“I just wanted to be independent.” This is the true meaning of wealth that this book talks about.

What I wanted through wealth was not a Ferrari.

It's not a big house.

Wealth, not in itself.

It is the power to live the way you want.

This is the true value of wealth.

But when people think of being rich, they imagine 'spending money'.

When people say they want to be a millionaire, they imagine spending a million dollars.

We find meaning in wealth in driving expensive cars, wearing expensive watches, and living in big houses.

But that satisfaction is temporary.

The lack comes back and repeats itself.

In The Psychology of Money, Morgan Housel offers a very thoughtful and thoughtful look at the "meaning of wealth."

"Wealth is the ability to do what you want, when you want, with whom you want, and as much as you want.

This is a priceless value, and it is the greatest dividend that money can bring." In other words, it is what Charlie Munger called "the power to live the way you want to live."

“Wealth is invisible to the eye.

Wealth is like a good car that you didn't buy.

It's like a diamond that you didn't buy.

It's a watch that hasn't been worn, clothes that have been given up, and a first-class upgrade that has been refused.

“Wealth is monetary assets that cannot be exchanged for tangible goods.” (p.163)

The value of wealth is not in consumption.

Wealth is about freedom and independence.

The freedom to spend your time as you wish.

The freedom to not have to do things you don't want to do when you don't want to.

It is the freedom not to have to associate with people you don't want to.

This is precisely why we need to earn money and become rich.

The Rich vs.

The Wealty,

What kind of rich person do you want to be?

《The Psychology of Money》 does not teach investment know-how or techniques.

Readers expecting such things will surely be disappointed.

This book makes you think about 'what money and wealth are for'.

Through 20 stories, it constantly asks the question, 'With what perspective and attitude should we pursue wealth?'

What kind of rich person do you want to be? Are you a spendthrift who drives a $100,000 car and lives faithfully in the present (The Rich), or are you a wealthy person who has secured assets for future freedom, even though they are invisible?

When asked what financial success is, Morgan Housel has a simple answer:

“It’s survival, survival, survival.” Investing, financial success, is all about survival.

No one is always successful in investing.

There is no natural law that says that just because something went well yesterday, it will go well today.

But people ignore or turn a blind eye to this fact.

Buffett's investment buddy Rick Guerin is gone.

Millionaire Richard Fuscone also went bankrupt overnight.

That's what capitalism is.

There is no such thing as eternal luck, and the world is not kind.

Therefore, whether it is investing, career, or business, survival must be the most fundamental of strategies.

Because no matter how great the profit, it is not worth risking total destruction.

Howser emphasizes the path to wealth that allows one to survive to the end without going bankrupt or being completely destroyed.

From World War II anecdotes to Bill Gates' confessions

20 Investment Stories You'll Fall in Love With in an Instant

Living up to his nicknames of "storytelling genius" and "financial writer with a novelist's skills," Morgan Housel's 20 investment stories are incredibly compelling.

Each story is based on true stories and evidence, yet it is packed with both the fun of the story and the lessons of investing.

From stories about German tank units during World War II, Bill Gates' confession about founding Microsoft, episodes from his days working as a valet in LA, to the secrets of Warren Buffett's incredible returns, the book captivates readers with its diverse and engaging narratives.

Moreover, at the end, they all contain insights that elicit both admiration and sighs.

After its publication, the world's response was enthusiastic.

The Wall Street Journal and the New York Times heaped praise on the book, and many professional investors took to social media to praise it, calling it “the best financial book of 2020” and “the most original book I’ve ever read.”

After reaching number one on Amazon's investment category, it remains in the top five of its category even months after its publication.

Amidst the controversy surrounding the 2020 bubble, which is being called the greatest liquidity crisis in history, a fierce investment frenzy continues.

In this context, the message of "The Psychology of Money" may be a bit harsh for some.

But if you want to go a little further and make investments with less regret, the message of this book is a track you must definitely go through at least once.

It doesn't matter whether you invest in stocks or real estate.

If you don't first define what you want to earn money for and what position you stand in now, you may end up in an extreme situation such as bankruptcy or ruin when a crisis comes.

Let me repeat what I said before.

Catastrophe must be avoided.

If you go bankrupt because of directionless investments, you will never have another chance.

Survive.

The first thing to do for survival is to know the ‘psychology of money.’

- Recommended by the New York Times and Wall Street Journal

- Praise from Howard Marks, Daniel Pink, and James Clear

- Five stars, rave reviews from Amazon readers

The cleaner who left 10 billion won vs.

A millionaire who went bankrupt overnight

What separated the fates of two people?

Here's an interesting story that made international news headlines.

Richard Fuscon graduated from Harvard University, earned an MBA, and then worked as an executive at Merrill Lynch.

He was named one of the '40 Under 40' successful businessmen and retired as a millionaire, enjoying a luxurious lifestyle.

He went into deep debt to build a mansion with 11 bathrooms, an elevator, and a swimming pool, and became a topic of conversation by throwing pool parties every day.

Then, when the financial crisis hit in 2008, Puscone went bankrupt overnight.

The mansion was foreclosed and he was left penniless.

A few months later, another news headline hits the headlines.

Ronald Reed.

With only a high school education, he repaired cars for 25 years, swept department store floors for 17 years, and at age 38 bought a two-bedroom house, where he lived until his death.

The fortune left behind by handyman Ronald Reed after his death was a whopping 10 billion won.

This amazing news is topping the news.

Investing isn't an IQ test.

The Secret to Wealth Revealed by a Wall Street Journal Reporter

Morgan Housel, a columnist for The Wall Street Journal who has written about finance and investing for over a decade, is deeply troubled by these two cases.

A janitor who left behind 10 billion won and a millionaire investor who went bankrupt overnight.

What decided the fate of these two people?

What is the difference?

Morgan Housel suggests that there are two possible explanations for the simultaneous existence of cases like Ronald Reed and Richard Fuscon in our time.

First, financial results are not directly related to talent, effort, or education.

Second, wealth accumulation is more psychological than scientific or numerical.

Morgan Housel paid particular attention to the second fact, and called soft skills such as the psychology and attitude toward money the "psychology of money."

“The more I studied and wrote about the financial crisis, the more I realized that it was better understood through the lenses of psychology and history, not just finance.

To understand why people are drowning in debt, we need to study not interest rates, but the history of greed, anxiety, and optimism.

To understand why investors sell off their assets at the bottom of a bear market, you need to look not at how to calculate future expected returns, but at their families.

“I have to think about the pain and wonder if my investments are putting our future at risk.” (p.20)

Getting rich vs.

Remaining rich

Warren Buffett remains rich, while his friend Rick Guerin disappears.

Morgan Housel tells 20 fascinating stories.

Among them, Rick Guerin's story is very impressive.

Rick Guerin was Warren Buffett and Charlie Munger's investment buddy 40 years ago.

Buffett, Munger, and Guerin jointly invested and interviewed managers to take charge of the business.

Then, Gerin disappeared.

Buffett said this:

“Charlie and I always knew we were going to be incredibly rich.

We weren't in a hurry to get rich.

Because I knew it would end up like that.

“Gerin was just as smart as we were, but he was in a hurry.” (p.107)

What differentiated Rick Guerin from Buffett and Munger? He used borrowed money to increase his investments during the economic downturn of 1973-1974.

During those two years, the stock market fell nearly 70 percent, and Guerin was required to post additional margin.

Guerin had to sell his Berkshire Hathaway stock to Buffett for less than $40 a share.

Rick Gaine became rich, but he didn't stay rich.

Munger, Buffett, and Guerin were equally talented at getting rich.

But Buffett and Munger also had a knack for staying rich.

As time goes by, the most important talent is this: remaining rich.

Nassim Taleb, the 'sage of Wall Street', said the following about this:

“Standing on high ground and surviving are two entirely different things.

The former requires the latter.

Catastrophe must be avoided.

“No matter what happens.”

In the blind investment frenzy, what no one is talking about

"The Real Reason We Need to Be Rich"

Why do you earn money? Why do you want to become rich? Why should we become rich? Morgan Housel emphasizes that these questions must be answered before jumping into investing.

Charlie Munger said this:

“I didn’t set out to become rich from the beginning.

“I just wanted to be independent.” This is the true meaning of wealth that this book talks about.

What I wanted through wealth was not a Ferrari.

It's not a big house.

Wealth, not in itself.

It is the power to live the way you want.

This is the true value of wealth.

But when people think of being rich, they imagine 'spending money'.

When people say they want to be a millionaire, they imagine spending a million dollars.

We find meaning in wealth in driving expensive cars, wearing expensive watches, and living in big houses.

But that satisfaction is temporary.

The lack comes back and repeats itself.

In The Psychology of Money, Morgan Housel offers a very thoughtful and thoughtful look at the "meaning of wealth."

"Wealth is the ability to do what you want, when you want, with whom you want, and as much as you want.

This is a priceless value, and it is the greatest dividend that money can bring." In other words, it is what Charlie Munger called "the power to live the way you want to live."

“Wealth is invisible to the eye.

Wealth is like a good car that you didn't buy.

It's like a diamond that you didn't buy.

It's a watch that hasn't been worn, clothes that have been given up, and a first-class upgrade that has been refused.

“Wealth is monetary assets that cannot be exchanged for tangible goods.” (p.163)

The value of wealth is not in consumption.

Wealth is about freedom and independence.

The freedom to spend your time as you wish.

The freedom to not have to do things you don't want to do when you don't want to.

It is the freedom not to have to associate with people you don't want to.

This is precisely why we need to earn money and become rich.

The Rich vs.

The Wealty,

What kind of rich person do you want to be?

《The Psychology of Money》 does not teach investment know-how or techniques.

Readers expecting such things will surely be disappointed.

This book makes you think about 'what money and wealth are for'.

Through 20 stories, it constantly asks the question, 'With what perspective and attitude should we pursue wealth?'

What kind of rich person do you want to be? Are you a spendthrift who drives a $100,000 car and lives faithfully in the present (The Rich), or are you a wealthy person who has secured assets for future freedom, even though they are invisible?

When asked what financial success is, Morgan Housel has a simple answer:

“It’s survival, survival, survival.” Investing, financial success, is all about survival.

No one is always successful in investing.

There is no natural law that says that just because something went well yesterday, it will go well today.

But people ignore or turn a blind eye to this fact.

Buffett's investment buddy Rick Guerin is gone.

Millionaire Richard Fuscone also went bankrupt overnight.

That's what capitalism is.

There is no such thing as eternal luck, and the world is not kind.

Therefore, whether it is investing, career, or business, survival must be the most fundamental of strategies.

Because no matter how great the profit, it is not worth risking total destruction.

Howser emphasizes the path to wealth that allows one to survive to the end without going bankrupt or being completely destroyed.

From World War II anecdotes to Bill Gates' confessions

20 Investment Stories You'll Fall in Love With in an Instant

Living up to his nicknames of "storytelling genius" and "financial writer with a novelist's skills," Morgan Housel's 20 investment stories are incredibly compelling.

Each story is based on true stories and evidence, yet it is packed with both the fun of the story and the lessons of investing.

From stories about German tank units during World War II, Bill Gates' confession about founding Microsoft, episodes from his days working as a valet in LA, to the secrets of Warren Buffett's incredible returns, the book captivates readers with its diverse and engaging narratives.

Moreover, at the end, they all contain insights that elicit both admiration and sighs.

After its publication, the world's response was enthusiastic.

The Wall Street Journal and the New York Times heaped praise on the book, and many professional investors took to social media to praise it, calling it “the best financial book of 2020” and “the most original book I’ve ever read.”

After reaching number one on Amazon's investment category, it remains in the top five of its category even months after its publication.

Amidst the controversy surrounding the 2020 bubble, which is being called the greatest liquidity crisis in history, a fierce investment frenzy continues.

In this context, the message of "The Psychology of Money" may be a bit harsh for some.

But if you want to go a little further and make investments with less regret, the message of this book is a track you must definitely go through at least once.

It doesn't matter whether you invest in stocks or real estate.

If you don't first define what you want to earn money for and what position you stand in now, you may end up in an extreme situation such as bankruptcy or ruin when a crisis comes.

Let me repeat what I said before.

Catastrophe must be avoided.

If you go bankrupt because of directionless investments, you will never have another chance.

Survive.

The first thing to do for survival is to know the ‘psychology of money.’

GOODS SPECIFICS

- Publication date: January 13, 2021

- Format: Hardcover book binding method guide

- Page count, weight, size: 396 pages | 690g | 140*210*30mm

- ISBN13: 9791191056372

- ISBN10: 1191056376

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)