Zero to One (10th Anniversary Edition)

|

Description

Book Introduction

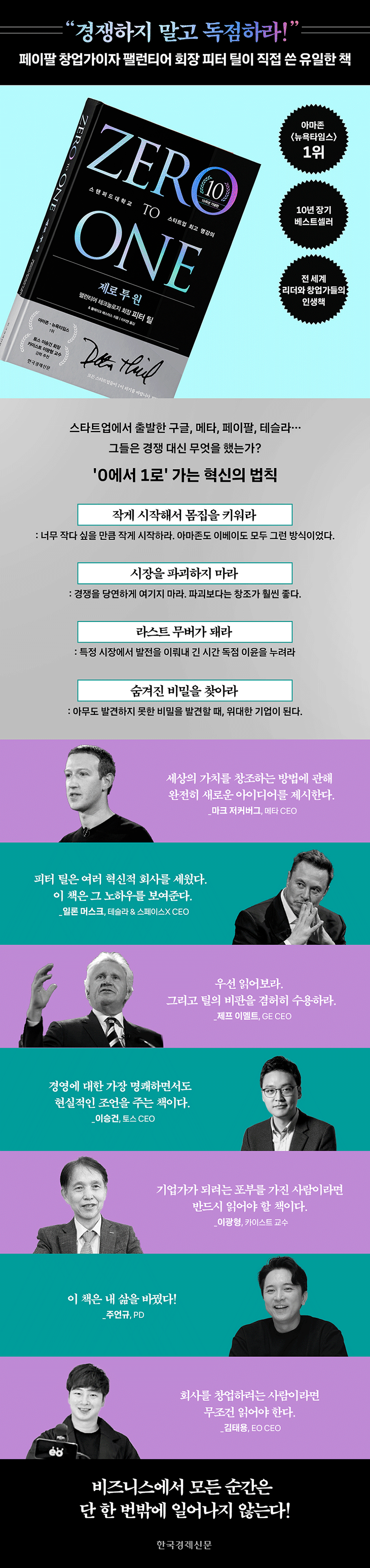

“Don’t compete, monopolize.”

The only book written by Peter Thiel, founder of PayPal and chairman of Palantir!

A must-read for business leaders and startup founders worldwide.

The 10th Anniversary Edition of "Zero to One" is out!

Mark Zuckerberg (CEO of Meta), Elon Musk (CEO of Tesla)

Lee Seung-geon (Toss CEO), Lee Kwang-hyung (KAIST professor), Joo Eon-gyu (PD), and Kim Tae-yong (EO CEO)

Highly recommended!

"Zero to One," considered a must-read by startup founders around the world, is being released with a re-covered cover to mark its 10th anniversary in Korea.

In this book, Peter Thiel, founder of PayPal and chairman of Palantir Technologies, preaches how to overcome competition with original ideas, clearly presenting the essence of entrepreneurship and innovation.

Since its first publication in 2014, Zero to One has sold over a million copies worldwide and remains one of the most influential books for startup founders and entrepreneurs.

This book is about successful entrepreneur Peter Thiel creating a company that creates something new and how to succeed by reading the flow of the future. Going from 0 to 1 means 'creating something new.'

When you create something new, the world goes from 0 to 1, and that means you can only be successful if you create a company that creates new things.

Successful companies and people find new value in places no one would think of.

Even if we follow existing best practices and make incremental progress, the world will only add one more thing to the familiar from 1 to n.

The author argues that companies should avoid the trap of competition and become monopolies.

And with clear logic and various examples, it directly refutes the claim that 'monopoly is harmful to the market economy', which has been taken for granted until now.

What we have always thought was that progress was driven by competition was merely an ideology instilled by economists and the education system.

He says that today, monopolies are no longer the exception, but rather a hallmark of successful businesses, because success is achieved only to the extent that a company can do something others cannot.

This book, "Zero to One," clearly reveals the nature of monopolies, which we have not been able to fully grasp until now, and provides methods for creating a monopoly and a company that creates something new "from 0 to 1."

And what Peter Thiel calls "creative monopolies" will fundamentally change the way we start and manage businesses.

The only book written by Peter Thiel, founder of PayPal and chairman of Palantir!

A must-read for business leaders and startup founders worldwide.

The 10th Anniversary Edition of "Zero to One" is out!

Mark Zuckerberg (CEO of Meta), Elon Musk (CEO of Tesla)

Lee Seung-geon (Toss CEO), Lee Kwang-hyung (KAIST professor), Joo Eon-gyu (PD), and Kim Tae-yong (EO CEO)

Highly recommended!

"Zero to One," considered a must-read by startup founders around the world, is being released with a re-covered cover to mark its 10th anniversary in Korea.

In this book, Peter Thiel, founder of PayPal and chairman of Palantir Technologies, preaches how to overcome competition with original ideas, clearly presenting the essence of entrepreneurship and innovation.

Since its first publication in 2014, Zero to One has sold over a million copies worldwide and remains one of the most influential books for startup founders and entrepreneurs.

This book is about successful entrepreneur Peter Thiel creating a company that creates something new and how to succeed by reading the flow of the future. Going from 0 to 1 means 'creating something new.'

When you create something new, the world goes from 0 to 1, and that means you can only be successful if you create a company that creates new things.

Successful companies and people find new value in places no one would think of.

Even if we follow existing best practices and make incremental progress, the world will only add one more thing to the familiar from 1 to n.

The author argues that companies should avoid the trap of competition and become monopolies.

And with clear logic and various examples, it directly refutes the claim that 'monopoly is harmful to the market economy', which has been taken for granted until now.

What we have always thought was that progress was driven by competition was merely an ideology instilled by economists and the education system.

He says that today, monopolies are no longer the exception, but rather a hallmark of successful businesses, because success is achieved only to the extent that a company can do something others cannot.

This book, "Zero to One," clearly reveals the nature of monopolies, which we have not been able to fully grasp until now, and provides methods for creating a monopoly and a company that creates something new "from 0 to 1."

And what Peter Thiel calls "creative monopolies" will fundamentally change the way we start and manage businesses.

- You can preview some of the book's contents.

Preview

index

Preface_ For 0 to become 1

1.

Challenge the future

2.

Learn from the past

3.

Every happy company is different.

4.

competing ideologies

5.

Last Mover Advantage

6.

Startups aren't a lottery.

7.

Follow the flow of money

8.

The secret not discovered

9.

Build a strong foundation

10.

Create a mafia

11.

Will customers come if I start a company?

12.

People and Machines: What Matters?

13.

Tesla's success

14.

The Founder's Paradox

Conclusion: The passage of time does not create the future.

1.

Challenge the future

2.

Learn from the past

3.

Every happy company is different.

4.

competing ideologies

5.

Last Mover Advantage

6.

Startups aren't a lottery.

7.

Follow the flow of money

8.

The secret not discovered

9.

Build a strong foundation

10.

Create a mafia

11.

Will customers come if I start a company?

12.

People and Machines: What Matters?

13.

Tesla's success

14.

The Founder's Paradox

Conclusion: The passage of time does not create the future.

Detailed image

Into the book

Of course, it is easier to imitate an existing model than to create something new.

But if we try to do something that people already know how to do, the world will only go from 1 to n.

It just means that one more thing is becoming familiar.

But when you create something new, the world goes from 0 to 1.

The act of creation is one and only one, and the moment of creation is one and only one.

With that one creation, something new and fresh comes into the world for the first time.

If American companies don't invest in the difficult task of "creating something new," they will go out of business, no matter how much profit they make now.

What will happen when we've squeezed every ounce out of the business we inherited, the business we've always done, by constantly improving and refining it? Believe it or not, a crisis of such magnitude will strike that it will make the 2008 crisis seem like a joke.

Today's 'best practices' only lead us down a dead end.

What leads us to success are the untrodden paths, the new paths.

In a world where massive administrative bureaucracy already reigns supreme, both in the public and private sectors, trying to find a new way forward might seem like hoping for a miracle.

It is also true that hundreds or thousands of miracles are needed for a single company to succeed in the United States.

But what sets humans apart from other species is our ability to perform miracles.

We call that miracle 'technology'.

Technology is a miracle because it allows us to do more with less.

Technology elevates our meager abilities to a higher level.

While other animals build dams and build hives simply by instinct, humans are unique in being able to invent new things and find ways to improve existing ones.

When deciding what to build, humans do not choose from a pre-existing set of options, but rather create new technologies and rewrite the plan for the world.

The reason we often forget this basic fact, which should have been learned in second grade, is because the world we live in is a world where most things are repeated.

This book is about how to build a company that creates something new.

This book contains everything I've learned as a co-founder of PayPal and Palantir, and as an investor in hundreds of startups, including Facebook and SpaceX.

Over the years, I've discovered countless patterns of success and failure, which I intend to share here, but this book doesn't offer an absolute formula for success.

The reason why I can't teach you the entrepreneurial spirit no matter how much I want to is because such a formula cannot necessarily exist.

--- pp.8-10

But the world we live in is much more dynamic than that.

It also means that it is possible to invent something new and better.

Creative monopolies offer customers 'more' choice by introducing a whole new kind of abundance to the world.

Creative monopolies are not just good for the rest of society; they are powerful forces that can create a better society.

The government is well aware of this, which is why, on one side, it tries to root out monopolies (by prosecuting antitrust violations), while on the other side, it tries to create monopolies (by granting patents to new inventions).

In fact, it is questionable whether someone being the first to come up with a design for a piece of mobile software actually grants them a legally binding monopoly.

But Apple's monopoly profits from designing, manufacturing, and marketing the iPhone aren't due to artificially reducing production, but rather to rewarding the world for making it a much richer place.

Finally, it's a reward for giving customers the choice to pay a premium and buy a smartphone that works.

The mere appearance of new monopolies clearly demonstrates that old monopolies do not hinder innovation.

With the rise of mobile computing, led by Apple's iOS, Microsoft's decades-long dominance in the OS market has waned dramatically.

Going back further, IBM, which dominated the hardware market in the 1960s and 1970s, ceded its throne to Microsoft's software monopoly. AT&T maintained a monopoly in telephone service throughout the 20th century, but now anyone can buy a cheap cell phone and use any service provider they choose.

If monopolies had a tendency to impede progress, they would have been dangerous, and we would have immediately rebelled against them.

But the history of progress is also a history of better monopolies taking the place of their predecessors.

Monopoly is the engine of progress.

The hope of enjoying monopoly profits for years or even decades is a powerful motivator for innovation.

This allows monopolies to continue to innovate because their monopoly profits allow them to plan long-term and fund ambitious research projects that their competitors would never dream of.

--- pp.47-48

Why is it that people working in professional venture capital, let alone others, don't see the power law? One reason is this.

The power law has a property that only becomes apparent after time has passed, yet we, even the experts who invest in technology companies, are too often living in the present.

Imagine a company investing in 10 companies with the potential to become monopolies (this is already a portfolio that deviates from standard principles).

These companies will likely look very similar in their early stages, before they begin their exponential growth.

After a few years, some of the ten will fail, and the rest will start to succeed.

Corporate value will vary, but it is not yet clear whether it will grow exponentially or linearly.

But after 10 years, the portfolio is no longer divided into successes and failures.

The portfolio is now divided into one dominant investment and everything else.

The problem, however, is that no matter how stark the final result of the power law may be, it does not reflect our day-to-day experience.

Because investors spend most of their time making new investments and looking after early-stage companies, most companies look like just regular companies.

What investors and entrepreneurs actually experience on a daily basis is not the stark contrast between overwhelming success and utter failure, but rather the relative difference between one company being slightly more successful and another slightly less successful.

And because no one wants to give up on an investment, venture capitalists often spend more time with the most troubled companies than with the most obviously successful ones.

But if we try to do something that people already know how to do, the world will only go from 1 to n.

It just means that one more thing is becoming familiar.

But when you create something new, the world goes from 0 to 1.

The act of creation is one and only one, and the moment of creation is one and only one.

With that one creation, something new and fresh comes into the world for the first time.

If American companies don't invest in the difficult task of "creating something new," they will go out of business, no matter how much profit they make now.

What will happen when we've squeezed every ounce out of the business we inherited, the business we've always done, by constantly improving and refining it? Believe it or not, a crisis of such magnitude will strike that it will make the 2008 crisis seem like a joke.

Today's 'best practices' only lead us down a dead end.

What leads us to success are the untrodden paths, the new paths.

In a world where massive administrative bureaucracy already reigns supreme, both in the public and private sectors, trying to find a new way forward might seem like hoping for a miracle.

It is also true that hundreds or thousands of miracles are needed for a single company to succeed in the United States.

But what sets humans apart from other species is our ability to perform miracles.

We call that miracle 'technology'.

Technology is a miracle because it allows us to do more with less.

Technology elevates our meager abilities to a higher level.

While other animals build dams and build hives simply by instinct, humans are unique in being able to invent new things and find ways to improve existing ones.

When deciding what to build, humans do not choose from a pre-existing set of options, but rather create new technologies and rewrite the plan for the world.

The reason we often forget this basic fact, which should have been learned in second grade, is because the world we live in is a world where most things are repeated.

This book is about how to build a company that creates something new.

This book contains everything I've learned as a co-founder of PayPal and Palantir, and as an investor in hundreds of startups, including Facebook and SpaceX.

Over the years, I've discovered countless patterns of success and failure, which I intend to share here, but this book doesn't offer an absolute formula for success.

The reason why I can't teach you the entrepreneurial spirit no matter how much I want to is because such a formula cannot necessarily exist.

--- pp.8-10

But the world we live in is much more dynamic than that.

It also means that it is possible to invent something new and better.

Creative monopolies offer customers 'more' choice by introducing a whole new kind of abundance to the world.

Creative monopolies are not just good for the rest of society; they are powerful forces that can create a better society.

The government is well aware of this, which is why, on one side, it tries to root out monopolies (by prosecuting antitrust violations), while on the other side, it tries to create monopolies (by granting patents to new inventions).

In fact, it is questionable whether someone being the first to come up with a design for a piece of mobile software actually grants them a legally binding monopoly.

But Apple's monopoly profits from designing, manufacturing, and marketing the iPhone aren't due to artificially reducing production, but rather to rewarding the world for making it a much richer place.

Finally, it's a reward for giving customers the choice to pay a premium and buy a smartphone that works.

The mere appearance of new monopolies clearly demonstrates that old monopolies do not hinder innovation.

With the rise of mobile computing, led by Apple's iOS, Microsoft's decades-long dominance in the OS market has waned dramatically.

Going back further, IBM, which dominated the hardware market in the 1960s and 1970s, ceded its throne to Microsoft's software monopoly. AT&T maintained a monopoly in telephone service throughout the 20th century, but now anyone can buy a cheap cell phone and use any service provider they choose.

If monopolies had a tendency to impede progress, they would have been dangerous, and we would have immediately rebelled against them.

But the history of progress is also a history of better monopolies taking the place of their predecessors.

Monopoly is the engine of progress.

The hope of enjoying monopoly profits for years or even decades is a powerful motivator for innovation.

This allows monopolies to continue to innovate because their monopoly profits allow them to plan long-term and fund ambitious research projects that their competitors would never dream of.

--- pp.47-48

Why is it that people working in professional venture capital, let alone others, don't see the power law? One reason is this.

The power law has a property that only becomes apparent after time has passed, yet we, even the experts who invest in technology companies, are too often living in the present.

Imagine a company investing in 10 companies with the potential to become monopolies (this is already a portfolio that deviates from standard principles).

These companies will likely look very similar in their early stages, before they begin their exponential growth.

After a few years, some of the ten will fail, and the rest will start to succeed.

Corporate value will vary, but it is not yet clear whether it will grow exponentially or linearly.

But after 10 years, the portfolio is no longer divided into successes and failures.

The portfolio is now divided into one dominant investment and everything else.

The problem, however, is that no matter how stark the final result of the power law may be, it does not reflect our day-to-day experience.

Because investors spend most of their time making new investments and looking after early-stage companies, most companies look like just regular companies.

What investors and entrepreneurs actually experience on a daily basis is not the stark contrast between overwhelming success and utter failure, but rather the relative difference between one company being slightly more successful and another slightly less successful.

And because no one wants to give up on an investment, venture capitalists often spend more time with the most troubled companies than with the most obviously successful ones.

--- pp.117-119

Publisher's Review

The law of innovation from '0 to 1'!

Google, Facebook, PayPal, Tesla… all started as startups.

What did they do instead of competing?

American airlines carry millions of passengers each year, generating hundreds of billions of dollars in value.

But in 2012, while the average one-way fare was $178, airlines earned just 37 cents per passenger.

Let's compare this to Google.

Google creates less value than airlines, but holds much more value.

Google earned $50 billion in 2012 (compared to airlines' $160 billion), but only 21 percent of its revenue was profit.

In terms of profit margin, it was 100 times more profitable than the airlines that year.

Because of its strong financial performance, Google's current value is three times greater than the combined value of all U.S. airlines.

Airlines compete with each other, but Google has no competitors.

Economists explain this difference with two simple models: perfect competition and monopoly.

When you first learn economics, 'perfect competition' is considered both an ideal and a basic state.

In a so-called perfectly competitive market, producer supply and consumer demand meet to achieve equilibrium.

In a competitive market, all companies sell the same undifferentiated products.

Since no one company has market dominance, everyone has no choice but to sell their goods at the price set by the market.

If there is still profitability, new firms will enter the market, increasing supply and driving down prices, thus eliminating the very profits that initially attracted them to the market.

In the long run, under perfect competition, 'no firm can make an economic profit.'

The opposite of perfect competition is monopoly.

Competing companies have no choice but to sell at the market price, but a monopolist controls the market and can therefore set its own prices.

A monopolist has no competitors, so it produces goods in quantities and at prices that maximize its profits.

In this book, Zero to One, the term "monopoly" refers to a company that is so outstanding in its field that other companies do not even dare to release a similar product.

Google has had no competition in search since the early 2000s, leaving Microsoft and Yahoo far behind.

Google is a representative company that went from 0 to 1.

We sanctify competition and say that it is what drives our progress, but in reality, capitalism and competition are incompatible.

Capitalism presupposes the accumulation of capital, but under perfect competition, all profits are lost through competition.

So, the point that entrepreneurs need to keep in mind is clear.

"If you want to create and retain lasting value, don't start a company with undifferentiated products."

Google didn't compete

The Hidden Truth About Monopoly Economics

There is a huge difference between perfect competition and monopoly.

Monopolies lie to protect themselves.

They know full well that if they boast about their huge monopolies, they will be audited, investigated, and attacked.

Monopolistic companies want to maintain their monopoly profits, so they will do anything to hide the fact that they are monopolists.

Consider how Google talks about its business.

Google doesn't 'claim' that they are a monopoly.

But is Google a monopoly? That depends on your perspective.

What field does this mean? First, let's assume Google is a search engine.

As of May 2014, Google had 68 percent of the search market (its closest competitors, Microsoft and Yahoo, had 19 percent and 10 percent, respectively).

But this time, let's think of Google primarily as an advertising company.

Then the story changes completely.

Even if Google completely monopolizes the U.S. search engine advertising market, it would only account for 3.4 percent of the global advertising market.

In this way, Google appears to be a very small player in a fiercely competitive environment.

This time, what if we viewed Google as a diversified technology company? It's a perfectly plausible assumption.

In addition to its search engine, Google makes dozens of software products.

Robot cars, Android phones, wearable computers, etc., you know that without me having to say anything.

But 95 percent of Google's revenue comes from its search engine.

The remaining products generated only $2.35 billion in sales in 2012.

The global consumer technology market is worth $964 billion, so Google has less than 0.24 percent of that, which makes it hardly a significant player, let alone a monopoly.

By defining itself as a technology company, Google can avoid all unwanted attention.

Because monopolies don't have to worry about competition, they can focus more on their employees and products.

On the other hand, companies in perfectly competitive markets are so focused on current profits that they have no time to plan for the long-term future.

When we step outside economic theory and into the real world, any business is only as successful as it can be at what others cannot.

Therefore, monopolies are not an exceptional phenomenon.

Monopoly is the status quo of all successful businesses.

From 0 to 1, create something new

In the business world, every moment happens only once.

No one will ever be able to create a computer operating system and become the next Bill Gates (founder of Microsoft).

You can't create a search engine and become the next Larry Page or Sergey Brin (Google founders), nor can you create a social network and become the next Mark Zuckerberg (Facebook founder).

If anyone tries to copy these as they are, they have not learned anything from them.

It is easier to copy an existing model than to create something new.

But if we try to do something that people already know how to do, the world will only go from 1 to n.

But when you create something new, the world goes from 0 to 1.

The act of creation is one and only one, and the moment of creation is one and only one.

With that one creation, something new and fresh comes into the world for the first time.

Successful companies are all different.

Because they each built a monopoly by solving their own unique problems.

On the other hand, failed companies are the same.

It is not possible to escape competition.

Creative monopoly is when a new product is created that benefits everyone while simultaneously generating sustainable monopoly profits for the creator.

The era of adapting to a changing environment by gradually improving the business you always did is over.

A monopoly may be possible if it escapes competition, but even a monopoly can only be great if it survives into the future.

Monopolies have four common characteristics:

1.

Reader technology

Have your own unique skills.

Independent technology is the most practical advantage a business can have.

Google is able to maintain a solid position no matter how many attacks other search engines make because its core product, search engine technology, is excellent.

At this point, a proprietary technology must be at least '10 times' better than the alternative technology to achieve a true monopoly advantage.

Bet on technology that enables innovation 10x or more.

2.

network effects

Network effects are powerful.

The more people who use a product, the more useful it becomes.

If you choose another social network while all your friends are using Facebook, you will be treated like a weirdo.

Any network is bound to be small at first.

Paradoxically, businesses that require network effects should start especially in smaller markets.

Facebook was initially designed solely for Harvard University students.

3.

economies of scale

The larger a monopoly grows, the more powerful it becomes.

Especially for software startups, the cost of producing an additional product is close to zero, so they can enjoy dramatic economies of scale.

A great startup should have the potential to grow at scale from the very beginning of its business design.

Like Twitter, which has 250 million users and has no need to add custom features or stop growing.

4.

Brand Strategy

Since any company has exclusive rights to its own brand, building a strong brand is a powerful means of becoming a monopoly.

The most powerful technology brand today is Apple.

A number of factors have combined to create the perception that Apple products are good enough to deserve a category of their own.

But no technology company can succeed with just a brand strategy.

Yahoo CEO Marissa Mayer has been trying to improve the Yahoo brand since taking office, but she hasn't been able to come up with an answer to the question of what products Yahoo will actually produce.

It should not be forgotten that Steve Jobs, upon his return to Apple, boldly cut back on product lines and focused on just a few products.

How can a startup become a monopoly?

So why do so many startups fail to become the best and disappear? Monopolies are created by a combination of the hallmarks of a monopoly: brand, scale, network effects, and proprietary technology.

But for these elements to work properly, some careful effort is required.

● Start small, monopolize, then grow.

Every startup has to start in a very small market.

Start small, so small that it seems too small.

Naturally, it is easier to dominate a small market than a large one.

Big markets are not a good choice.

Once you have created and dominated a niche market, you should gradually expand your business into a wider market.

Both Amazon and eBay built their success this way.

Successful companies plan from the start to dominate a specific niche and expand into adjacent markets.

● Don't destroy the market

Silicon Valley is obsessed with 'disruption'.

Disruptive innovation used to mean a market-grabbing strategy, but lately it has become a buzzword used to emphasize that one's product is the latest and greatest trend.

The reason this buzzword is important is because it makes entrepreneurs take competitive markets for granted.

Destruction means seeing yourself through the eyes of old-fashioned companies.

Rather, the activity of ‘creation’ is much more important to startups.

If you plan to expand your business into an adjacent market, don't destroy the market.

The less competition you avoid, the better.

● Be the last mover

A company that enters a market first can enjoy a first-mover advantage, securing market share while competitors scramble.

But moving first is a strategy, not a goal.

If a competitor comes along and takes away the top spot, it is better to be the last mover.

It is about making the last great strides in a particular market and enjoying monopoly profits for several years.

To be the last mover, you must be the first to capture the most important segment of the market, and every entrepreneur should plan to be the last mover in a particular market.

● Set out to find the hidden secret

You cannot be superior to others by following universal customs and common sense that everyone else knows.

"What truly valuable business is there that others aren't building?" We need to find the "hidden secret" that answers this question.

Great companies are created when people discover hidden secrets that no one has yet discovered, like Airbnb, Lyft, or Uber, which are all ideas about how the world works.

Just having the insight to rethink something that seems simple can build a valuable business.

Now we need entrepreneurs.

Beyond simple incremental progress, we need unique individuals who can build startups and lead companies.

It is more powerful to have one outstanding individual leading the company rather than a managerial team.

Of course, it is also dangerous.

Peter Thiel emphasizes that startup founders should never forget that personal fame and praise can at any time turn into infamy and ouster.

Above all, as an individual, you should not overestimate your own strength.

It's not because the founder is the only one, but because a great founder is someone who can bring out the best in everyone in their company.

7 Questions Every Entrepreneur Must Answer

Q1.

Technology: Can we create breakthrough technologies rather than incremental improvements?

Q2.

Timing: Is now the right time to start this business?

Q3.

Monopoly: Starting with a large share of a small market?

Q4.

People: Do you have a good team?

Q5.

Distribution: Do you have a way to get your product out there, not just make it?

Q6.

Sustainability: Can you defend your current market position for the next 10 or 20 years?

Q7.

Hidden Secret: Have you spotted a unique opportunity that others don't see?

Google, Facebook, PayPal, Tesla… all started as startups.

What did they do instead of competing?

American airlines carry millions of passengers each year, generating hundreds of billions of dollars in value.

But in 2012, while the average one-way fare was $178, airlines earned just 37 cents per passenger.

Let's compare this to Google.

Google creates less value than airlines, but holds much more value.

Google earned $50 billion in 2012 (compared to airlines' $160 billion), but only 21 percent of its revenue was profit.

In terms of profit margin, it was 100 times more profitable than the airlines that year.

Because of its strong financial performance, Google's current value is three times greater than the combined value of all U.S. airlines.

Airlines compete with each other, but Google has no competitors.

Economists explain this difference with two simple models: perfect competition and monopoly.

When you first learn economics, 'perfect competition' is considered both an ideal and a basic state.

In a so-called perfectly competitive market, producer supply and consumer demand meet to achieve equilibrium.

In a competitive market, all companies sell the same undifferentiated products.

Since no one company has market dominance, everyone has no choice but to sell their goods at the price set by the market.

If there is still profitability, new firms will enter the market, increasing supply and driving down prices, thus eliminating the very profits that initially attracted them to the market.

In the long run, under perfect competition, 'no firm can make an economic profit.'

The opposite of perfect competition is monopoly.

Competing companies have no choice but to sell at the market price, but a monopolist controls the market and can therefore set its own prices.

A monopolist has no competitors, so it produces goods in quantities and at prices that maximize its profits.

In this book, Zero to One, the term "monopoly" refers to a company that is so outstanding in its field that other companies do not even dare to release a similar product.

Google has had no competition in search since the early 2000s, leaving Microsoft and Yahoo far behind.

Google is a representative company that went from 0 to 1.

We sanctify competition and say that it is what drives our progress, but in reality, capitalism and competition are incompatible.

Capitalism presupposes the accumulation of capital, but under perfect competition, all profits are lost through competition.

So, the point that entrepreneurs need to keep in mind is clear.

"If you want to create and retain lasting value, don't start a company with undifferentiated products."

Google didn't compete

The Hidden Truth About Monopoly Economics

There is a huge difference between perfect competition and monopoly.

Monopolies lie to protect themselves.

They know full well that if they boast about their huge monopolies, they will be audited, investigated, and attacked.

Monopolistic companies want to maintain their monopoly profits, so they will do anything to hide the fact that they are monopolists.

Consider how Google talks about its business.

Google doesn't 'claim' that they are a monopoly.

But is Google a monopoly? That depends on your perspective.

What field does this mean? First, let's assume Google is a search engine.

As of May 2014, Google had 68 percent of the search market (its closest competitors, Microsoft and Yahoo, had 19 percent and 10 percent, respectively).

But this time, let's think of Google primarily as an advertising company.

Then the story changes completely.

Even if Google completely monopolizes the U.S. search engine advertising market, it would only account for 3.4 percent of the global advertising market.

In this way, Google appears to be a very small player in a fiercely competitive environment.

This time, what if we viewed Google as a diversified technology company? It's a perfectly plausible assumption.

In addition to its search engine, Google makes dozens of software products.

Robot cars, Android phones, wearable computers, etc., you know that without me having to say anything.

But 95 percent of Google's revenue comes from its search engine.

The remaining products generated only $2.35 billion in sales in 2012.

The global consumer technology market is worth $964 billion, so Google has less than 0.24 percent of that, which makes it hardly a significant player, let alone a monopoly.

By defining itself as a technology company, Google can avoid all unwanted attention.

Because monopolies don't have to worry about competition, they can focus more on their employees and products.

On the other hand, companies in perfectly competitive markets are so focused on current profits that they have no time to plan for the long-term future.

When we step outside economic theory and into the real world, any business is only as successful as it can be at what others cannot.

Therefore, monopolies are not an exceptional phenomenon.

Monopoly is the status quo of all successful businesses.

From 0 to 1, create something new

In the business world, every moment happens only once.

No one will ever be able to create a computer operating system and become the next Bill Gates (founder of Microsoft).

You can't create a search engine and become the next Larry Page or Sergey Brin (Google founders), nor can you create a social network and become the next Mark Zuckerberg (Facebook founder).

If anyone tries to copy these as they are, they have not learned anything from them.

It is easier to copy an existing model than to create something new.

But if we try to do something that people already know how to do, the world will only go from 1 to n.

But when you create something new, the world goes from 0 to 1.

The act of creation is one and only one, and the moment of creation is one and only one.

With that one creation, something new and fresh comes into the world for the first time.

Successful companies are all different.

Because they each built a monopoly by solving their own unique problems.

On the other hand, failed companies are the same.

It is not possible to escape competition.

Creative monopoly is when a new product is created that benefits everyone while simultaneously generating sustainable monopoly profits for the creator.

The era of adapting to a changing environment by gradually improving the business you always did is over.

A monopoly may be possible if it escapes competition, but even a monopoly can only be great if it survives into the future.

Monopolies have four common characteristics:

1.

Reader technology

Have your own unique skills.

Independent technology is the most practical advantage a business can have.

Google is able to maintain a solid position no matter how many attacks other search engines make because its core product, search engine technology, is excellent.

At this point, a proprietary technology must be at least '10 times' better than the alternative technology to achieve a true monopoly advantage.

Bet on technology that enables innovation 10x or more.

2.

network effects

Network effects are powerful.

The more people who use a product, the more useful it becomes.

If you choose another social network while all your friends are using Facebook, you will be treated like a weirdo.

Any network is bound to be small at first.

Paradoxically, businesses that require network effects should start especially in smaller markets.

Facebook was initially designed solely for Harvard University students.

3.

economies of scale

The larger a monopoly grows, the more powerful it becomes.

Especially for software startups, the cost of producing an additional product is close to zero, so they can enjoy dramatic economies of scale.

A great startup should have the potential to grow at scale from the very beginning of its business design.

Like Twitter, which has 250 million users and has no need to add custom features or stop growing.

4.

Brand Strategy

Since any company has exclusive rights to its own brand, building a strong brand is a powerful means of becoming a monopoly.

The most powerful technology brand today is Apple.

A number of factors have combined to create the perception that Apple products are good enough to deserve a category of their own.

But no technology company can succeed with just a brand strategy.

Yahoo CEO Marissa Mayer has been trying to improve the Yahoo brand since taking office, but she hasn't been able to come up with an answer to the question of what products Yahoo will actually produce.

It should not be forgotten that Steve Jobs, upon his return to Apple, boldly cut back on product lines and focused on just a few products.

How can a startup become a monopoly?

So why do so many startups fail to become the best and disappear? Monopolies are created by a combination of the hallmarks of a monopoly: brand, scale, network effects, and proprietary technology.

But for these elements to work properly, some careful effort is required.

● Start small, monopolize, then grow.

Every startup has to start in a very small market.

Start small, so small that it seems too small.

Naturally, it is easier to dominate a small market than a large one.

Big markets are not a good choice.

Once you have created and dominated a niche market, you should gradually expand your business into a wider market.

Both Amazon and eBay built their success this way.

Successful companies plan from the start to dominate a specific niche and expand into adjacent markets.

● Don't destroy the market

Silicon Valley is obsessed with 'disruption'.

Disruptive innovation used to mean a market-grabbing strategy, but lately it has become a buzzword used to emphasize that one's product is the latest and greatest trend.

The reason this buzzword is important is because it makes entrepreneurs take competitive markets for granted.

Destruction means seeing yourself through the eyes of old-fashioned companies.

Rather, the activity of ‘creation’ is much more important to startups.

If you plan to expand your business into an adjacent market, don't destroy the market.

The less competition you avoid, the better.

● Be the last mover

A company that enters a market first can enjoy a first-mover advantage, securing market share while competitors scramble.

But moving first is a strategy, not a goal.

If a competitor comes along and takes away the top spot, it is better to be the last mover.

It is about making the last great strides in a particular market and enjoying monopoly profits for several years.

To be the last mover, you must be the first to capture the most important segment of the market, and every entrepreneur should plan to be the last mover in a particular market.

● Set out to find the hidden secret

You cannot be superior to others by following universal customs and common sense that everyone else knows.

"What truly valuable business is there that others aren't building?" We need to find the "hidden secret" that answers this question.

Great companies are created when people discover hidden secrets that no one has yet discovered, like Airbnb, Lyft, or Uber, which are all ideas about how the world works.

Just having the insight to rethink something that seems simple can build a valuable business.

Now we need entrepreneurs.

Beyond simple incremental progress, we need unique individuals who can build startups and lead companies.

It is more powerful to have one outstanding individual leading the company rather than a managerial team.

Of course, it is also dangerous.

Peter Thiel emphasizes that startup founders should never forget that personal fame and praise can at any time turn into infamy and ouster.

Above all, as an individual, you should not overestimate your own strength.

It's not because the founder is the only one, but because a great founder is someone who can bring out the best in everyone in their company.

7 Questions Every Entrepreneur Must Answer

Q1.

Technology: Can we create breakthrough technologies rather than incremental improvements?

Q2.

Timing: Is now the right time to start this business?

Q3.

Monopoly: Starting with a large share of a small market?

Q4.

People: Do you have a good team?

Q5.

Distribution: Do you have a way to get your product out there, not just make it?

Q6.

Sustainability: Can you defend your current market position for the next 10 or 20 years?

Q7.

Hidden Secret: Have you spotted a unique opportunity that others don't see?

GOODS SPECIFICS

- Date of issue: April 18, 2025

- Format: Hardcover book binding method guide

- Page count, weight, size: 252 pages | 514g | 145*210*20mm

- ISBN13: 9788947547567

- ISBN10: 8947547565

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)