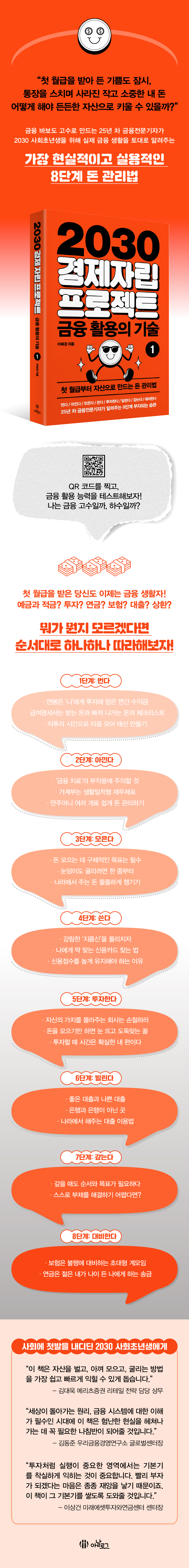

2030 Economic Self-Reliance Project 1: Financial Utilization Technology

|

Description

Book Introduction

“This book will help you learn the easiest and fastest way to earn, save, and manage your wealth.”

Kim Dae-wook, Managing Director of Retail Strategy at Meritz Securities

“This book is a compass you need to navigate these times, where understanding the financial system is essential!”

Kim Dong-jun, Director of the Global Center at Woori Financial Management Research Institute

“In a field like investing where execution is crucial, you must master the fundamentals.

The desire to get rich quickly often leads to disaster.

Anyone who learns the basics in this book will be able to do intermediate or higher.”

Lee Sang-geon, Director of Mirae Asset Investment & Pension Center

If you've received your first paycheck, you're now a financially savvy person!

Deposits, investments, pensions, loans, taxes… why is there so much to know and so complicated?

A practical financial guide for those just entering society in their 20s and 30s.

“You can somehow survive without financial knowledge.

But if you think of finance as a game of transferring money from the account of someone who doesn't know much about money to the account of someone who does, it really comes to mind. Once you start using even a little financial knowledge, you'll quickly realize there's no better tool." This is why a financial journalist with 25 years of experience wrote this book for the young adults in their 20s and 30s who are just starting out in society.

Unless you've received systematic financial education at home and school since childhood, or are born a financial genius, most people begin their careers in a state of financial illiteracy.

In fact, according to an OECD survey, approximately 67% of Koreans do not even understand basic financial concepts.

This means that not many people can properly answer questions about the difference between simple and compound interest, the impact of inflation on life, why credit management is important, and how interest rates are calculated.

This book is the first in the 2030 Economic Self-Reliance Project series, and covers the most fundamental skills for achieving economic independence: 'financial utilization skills.'

By reading this systematic eight-step money management method based on real-life financial life, you can naturally build a financial foundation.

You can't become a financial expert on your first try! This book is packed with essential information for every moment of earning, saving, accumulating, spending, investing, borrowing, repaying, and preparing for money, from how to read your payslip to how to manage your retirement pension.

If you want to start learning about money but don't know where to start or how to start, start with this book right now.

Kim Dae-wook, Managing Director of Retail Strategy at Meritz Securities

“This book is a compass you need to navigate these times, where understanding the financial system is essential!”

Kim Dong-jun, Director of the Global Center at Woori Financial Management Research Institute

“In a field like investing where execution is crucial, you must master the fundamentals.

The desire to get rich quickly often leads to disaster.

Anyone who learns the basics in this book will be able to do intermediate or higher.”

Lee Sang-geon, Director of Mirae Asset Investment & Pension Center

If you've received your first paycheck, you're now a financially savvy person!

Deposits, investments, pensions, loans, taxes… why is there so much to know and so complicated?

A practical financial guide for those just entering society in their 20s and 30s.

“You can somehow survive without financial knowledge.

But if you think of finance as a game of transferring money from the account of someone who doesn't know much about money to the account of someone who does, it really comes to mind. Once you start using even a little financial knowledge, you'll quickly realize there's no better tool." This is why a financial journalist with 25 years of experience wrote this book for the young adults in their 20s and 30s who are just starting out in society.

Unless you've received systematic financial education at home and school since childhood, or are born a financial genius, most people begin their careers in a state of financial illiteracy.

In fact, according to an OECD survey, approximately 67% of Koreans do not even understand basic financial concepts.

This means that not many people can properly answer questions about the difference between simple and compound interest, the impact of inflation on life, why credit management is important, and how interest rates are calculated.

This book is the first in the 2030 Economic Self-Reliance Project series, and covers the most fundamental skills for achieving economic independence: 'financial utilization skills.'

By reading this systematic eight-step money management method based on real-life financial life, you can naturally build a financial foundation.

You can't become a financial expert on your first try! This book is packed with essential information for every moment of earning, saving, accumulating, spending, investing, borrowing, repaying, and preparing for money, from how to read your payslip to how to manage your retirement pension.

If you want to start learning about money but don't know where to start or how to start, start with this book right now.

- You can preview some of the book's contents.

Preview

index

preface

Step 1: Burn

01.

Salary: Don't underestimate it just because it's so small.

02.

Payslip: A Checklist of Money In and Out

03.

Side Income: Another source of income from your side chars

[Tip 1] Learn the Basics of Taxes

[Tip 2] How to Get More from Your Year-End Tax Settlement

Step 2: Save

01.

Saving: The goal of saving isn't to accumulate money.

02.

Savings Basics: 3 Steps to Stop Money from Leaking Out

03.

Household Account Book: A Financial Statement that Shows Your Cash Flow at a Glance

04.

How to Manage a Household Ledger: Using a household ledger well is as important as using it.

05.

Splitting Your Account: How to Easily Manage Your Money with Multiple Separate Accounts

06.

Emergency Fund Account: How to Make Money with an Emergency Fund

Step 3: Collect

01.

Savings: The Easiest and Hardest Way to Save Money

02.

Deposits: To roll a snowball, start with a handful.

[Tip 1] Become more familiar with compound interest than simple interest.

[Tip 2] How to Take Advantage of Tax Benefits and Tax Exemptions

[Tip 3] How to Save More Money with Government and Public Support Policies

Step 4: Write

01.

Investment, Consumption, and Waste: Even if you spend the same amount of money, the value is different.

02.

Credit Cards: Use them wisely, even if only once.

03.

Credit Score: Proof that you are a trustworthy person

[Tip 1] How to Find the Right Credit Card for You

[Tip 2] Local currency with a 5-10 percent discount

Step 5: Invest

01.

Career Management: Investing in Yourself is Fundamental

02.

Investing Resolution: What if you don't want to wake up and have your assets stolen?

03.

Investing: 5 Key Points to Remember When Investing

04.

Asset Allocation: Minimize Principal Loss, Maximize Returns!

05.

Investment Types: Choosing Investments That Fit Your Inclination and Situation

[Tip 1] How to Turn Your Change into Assets by Making It Work

[Tip 2] How to Find Investment Targets Through News

Step 6: Borrow

01.

Loan: borrowing money from a financial institution

02.

A word of caution when borrowing: If you can't help it, use it wisely.

03.

Banks and Non-Banks: Understanding and Using Financial Institutions

[Tip 1] How to Use Loan Comparison Sites Effectively

[Tip 2] How to Request a Lower Interest Rate from Your Bank

[Tip 3] How to Use Government-Supported Loans

[Tip 4] How to Prevent Rental Fraud

[Tip 5] Things to watch out for when lending money to others

Step 7: Pay it off

01.

Loan Repayment: The Order and Strategies You Need to Pay Off Debt

02.

Debt Settlement: What if you can't handle your debt on your own?

Step 8: Prepare

01.

Insurance: A large-scale gathering of people to prepare for misfortune.

02.

Insurance: Insurance is not an investment.

03.

Pensions: Sending Money to Your Future Self

04.

How to Use Your Pension: The Amount You Receive Will Vary Depending on How It's Managed

[Tip 1] How to Use Mini Insurance

[Tip 2] Using Citizen Safety Insurance

Step 1: Burn

01.

Salary: Don't underestimate it just because it's so small.

02.

Payslip: A Checklist of Money In and Out

03.

Side Income: Another source of income from your side chars

[Tip 1] Learn the Basics of Taxes

[Tip 2] How to Get More from Your Year-End Tax Settlement

Step 2: Save

01.

Saving: The goal of saving isn't to accumulate money.

02.

Savings Basics: 3 Steps to Stop Money from Leaking Out

03.

Household Account Book: A Financial Statement that Shows Your Cash Flow at a Glance

04.

How to Manage a Household Ledger: Using a household ledger well is as important as using it.

05.

Splitting Your Account: How to Easily Manage Your Money with Multiple Separate Accounts

06.

Emergency Fund Account: How to Make Money with an Emergency Fund

Step 3: Collect

01.

Savings: The Easiest and Hardest Way to Save Money

02.

Deposits: To roll a snowball, start with a handful.

[Tip 1] Become more familiar with compound interest than simple interest.

[Tip 2] How to Take Advantage of Tax Benefits and Tax Exemptions

[Tip 3] How to Save More Money with Government and Public Support Policies

Step 4: Write

01.

Investment, Consumption, and Waste: Even if you spend the same amount of money, the value is different.

02.

Credit Cards: Use them wisely, even if only once.

03.

Credit Score: Proof that you are a trustworthy person

[Tip 1] How to Find the Right Credit Card for You

[Tip 2] Local currency with a 5-10 percent discount

Step 5: Invest

01.

Career Management: Investing in Yourself is Fundamental

02.

Investing Resolution: What if you don't want to wake up and have your assets stolen?

03.

Investing: 5 Key Points to Remember When Investing

04.

Asset Allocation: Minimize Principal Loss, Maximize Returns!

05.

Investment Types: Choosing Investments That Fit Your Inclination and Situation

[Tip 1] How to Turn Your Change into Assets by Making It Work

[Tip 2] How to Find Investment Targets Through News

Step 6: Borrow

01.

Loan: borrowing money from a financial institution

02.

A word of caution when borrowing: If you can't help it, use it wisely.

03.

Banks and Non-Banks: Understanding and Using Financial Institutions

[Tip 1] How to Use Loan Comparison Sites Effectively

[Tip 2] How to Request a Lower Interest Rate from Your Bank

[Tip 3] How to Use Government-Supported Loans

[Tip 4] How to Prevent Rental Fraud

[Tip 5] Things to watch out for when lending money to others

Step 7: Pay it off

01.

Loan Repayment: The Order and Strategies You Need to Pay Off Debt

02.

Debt Settlement: What if you can't handle your debt on your own?

Step 8: Prepare

01.

Insurance: A large-scale gathering of people to prepare for misfortune.

02.

Insurance: Insurance is not an investment.

03.

Pensions: Sending Money to Your Future Self

04.

How to Use Your Pension: The Amount You Receive Will Vary Depending on How It's Managed

[Tip 1] How to Use Mini Insurance

[Tip 2] Using Citizen Safety Insurance

Detailed image

Publisher's Review

In an era where financial knowledge creates a huge gap,

8-Step Practical Money Management Guide from a Financial Journalist with 25 Years of Experience

The new term 'financial illiteracy' has been heard a lot in the past few years.

This refers to people who have no financial knowledge to the point where they don't even know the difference between deposits and savings.

They desperately want to have a lot of money, but they have no real idea about how to earn, save, invest, spend, or manage it.

Of course, this kind of financial illiteracy did not suddenly appear in this day and age.

Even among the older generation, there are quite a few who don't know any other way to save money besides at the bank.

But now it's different from then.

The way we manage our assets has changed so much that there are even claims that saving money in a bank is actually a loss.

Even if we start from the same starting line, the gap is bound to widen depending on our level of understanding of finance.

However, even when you actually try to study money, there are many cases where you don't know where to start.

The overflowing YouTube content only makes us feel anxious.

Even if you ask ChatGPT, it will only give you short and obvious answers like a loophole.

This book was written by Hye-kyung Lee, a financial journalist with 25 years of experience, for those just starting out in society and earning money with their own hands.

Based on real-life financial life, it is divided into 8 steps: 'Earn/Save/Save/Spend/Invest/Borrow/Pay/Prepare', and contains only the essentials so that you can learn how to manage money systematically and practically.

It provides the foundation for forming lifelong consumption, saving, and investment habits.

A financial guide to living a life where you can take full responsibility for your finances.

If you are a freshman who has just stepped into society, you will be faced with the reality of having to take charge of your own life without even having time to enjoy the joy of gaining freedom.

You will feel that money is slipping away every moment you breathe.

The moment has come when you realize how scary money is.

However, I have never learned specifically how to take full responsibility for and manage my own finances, either at school or at home.

In times like these, 『2030 Economic Self-Reliance Project ①: Financial Utilization Technology』 can provide essential advice.

This book systematically covers the knowledge you might have at any given moment in life, including how to read your payslip, manage your household budget, split your bank account, manage your credit score, get a large year-end tax settlement, manage your money, find government and public support policies, and safely obtain loans from financial institutions.

Of course, if you search a little, you can find more detailed and more information anywhere.

But the problem with fresh graduates is that they don't even know 'what to be curious about.'

This book provides the foundation for forming lifelong spending, saving, and investment habits, starting from the moment your first paycheck is deposited into your bank account.

Keep it with you at all times and be the first to open it as you move through the stages of your financial life, as it will be of great help.

Financial literacy has gone beyond economic security to become a tool for survival.

Finance is a kind of game where you move money from the account of someone you don't know much about to the account of someone you know well.

This book is the perfect tutorial for the game.

If you follow along step by step, build your foundation, and improve your skills, you too will soon become a master of the financial game.

8-Step Practical Money Management Guide from a Financial Journalist with 25 Years of Experience

The new term 'financial illiteracy' has been heard a lot in the past few years.

This refers to people who have no financial knowledge to the point where they don't even know the difference between deposits and savings.

They desperately want to have a lot of money, but they have no real idea about how to earn, save, invest, spend, or manage it.

Of course, this kind of financial illiteracy did not suddenly appear in this day and age.

Even among the older generation, there are quite a few who don't know any other way to save money besides at the bank.

But now it's different from then.

The way we manage our assets has changed so much that there are even claims that saving money in a bank is actually a loss.

Even if we start from the same starting line, the gap is bound to widen depending on our level of understanding of finance.

However, even when you actually try to study money, there are many cases where you don't know where to start.

The overflowing YouTube content only makes us feel anxious.

Even if you ask ChatGPT, it will only give you short and obvious answers like a loophole.

This book was written by Hye-kyung Lee, a financial journalist with 25 years of experience, for those just starting out in society and earning money with their own hands.

Based on real-life financial life, it is divided into 8 steps: 'Earn/Save/Save/Spend/Invest/Borrow/Pay/Prepare', and contains only the essentials so that you can learn how to manage money systematically and practically.

It provides the foundation for forming lifelong consumption, saving, and investment habits.

A financial guide to living a life where you can take full responsibility for your finances.

If you are a freshman who has just stepped into society, you will be faced with the reality of having to take charge of your own life without even having time to enjoy the joy of gaining freedom.

You will feel that money is slipping away every moment you breathe.

The moment has come when you realize how scary money is.

However, I have never learned specifically how to take full responsibility for and manage my own finances, either at school or at home.

In times like these, 『2030 Economic Self-Reliance Project ①: Financial Utilization Technology』 can provide essential advice.

This book systematically covers the knowledge you might have at any given moment in life, including how to read your payslip, manage your household budget, split your bank account, manage your credit score, get a large year-end tax settlement, manage your money, find government and public support policies, and safely obtain loans from financial institutions.

Of course, if you search a little, you can find more detailed and more information anywhere.

But the problem with fresh graduates is that they don't even know 'what to be curious about.'

This book provides the foundation for forming lifelong spending, saving, and investment habits, starting from the moment your first paycheck is deposited into your bank account.

Keep it with you at all times and be the first to open it as you move through the stages of your financial life, as it will be of great help.

Financial literacy has gone beyond economic security to become a tool for survival.

Finance is a kind of game where you move money from the account of someone you don't know much about to the account of someone you know well.

This book is the perfect tutorial for the game.

If you follow along step by step, build your foundation, and improve your skills, you too will soon become a master of the financial game.

GOODS SPECIFICS

- Date of issue: November 6, 2025

- Page count, weight, size: 224 pages | 140*210*20mm

- ISBN13: 9791192706412

- ISBN10: 1192706412

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)