I made money through investments for 30 years.

|

Description

Book Introduction

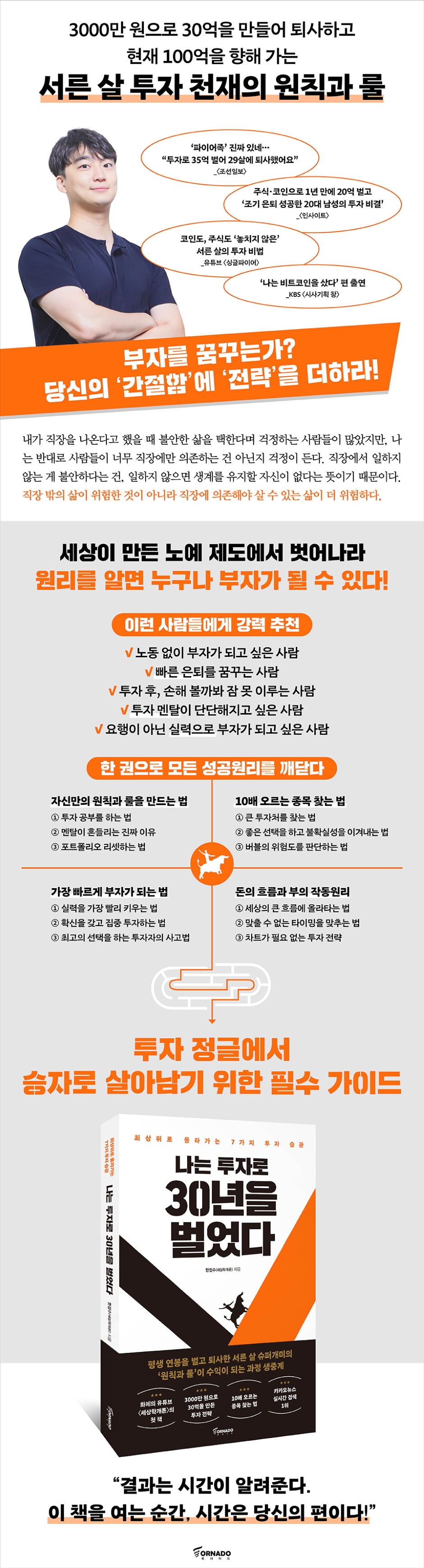

Kakao News ranks #1 in real-time searches The first book of the YouTube series "Introduction to World Studies," which heated up 2021. "Why should I invest? Because it can dramatically advance everything in life!" I resigned at the age of thirty and finally A dramatic investment story of a young man who became the envy of everyone. The story of an ordinary 30-year-old office worker achieving financial freedom through investment generated a lot of interest and a huge response. Since COVID-19, 'investment' has become a basic part of life. As the gap between investors and non-investors became more apparent, terms like "sudden rich" and "sudden poor" emerged, and job insecurity also accelerated. If you feel insecure about not working, it means you don't have the confidence to make a living without working. However, the author argues that it is not life outside of work that is dangerous, but rather a life that relies on work to survive that is more dangerous. "I Earned 30 Years Through Investment" is a book that explains the "principles and rules" that allowed you to make 3 billion won from 30 million won in the order of "Why you should live the life of an investor - How to invest - What to invest in." The results vividly demonstrate that you can become rich the fastest when you invest with confidence and focus on principles, not techniques. This book provides surprising insight into the real reasons why people become mentally unstable while investing, how to assess the risk of a bubble, and more. It also uses diagrams and illustrations to easily and powerfully convey the flow of money and the workings of wealth, how to make good choices and overcome uncertainty, and how to find stocks that will rise tenfold. Why do some people consistently achieve success while others don't? Why do crises become opportunities for some? What makes a difference in decision-making? If you're worried about losing money after investing, curious about how to navigate the world's major trends, or dreaming of an early retirement, this book is a must-read. Before you know it, you'll find yourself climbing the ladder of wealth with confidence instead of anxiety, and strategy instead of fear. |

- You can preview some of the book's contents.

Preview

index

Anyone can become rich if they know the prologue principle.

STAGE 1 Why live the life of an investor?

01 Investing is a way of life

What you can gain from the 'investor' lifestyle

Why I Feel Peaceful When Investing

How you invest your time and money determines the rest of your life.

02 How to Snowball Your Life Through Accumulation

Habit 1: Gather and manage your assets in one place.

Habit 2: Record Your Growth Consistently

Habit 3: Set Investment Goals

STAGE 2 How should I invest?

01 [Buy] Study, but don't fall in love.

When studying investments, take a top-down approach.

Books and resources that helped me study investment philosophy

I start my day by reading the newspaper.

How to Find Opportunities Around You

Obstacles to studying investment

Factors that create bias in investing

For anyone who just wants to know how to make money fast

02 [Buy] Kill your emotions rather than exploit them.

The real reason why your mental state is shaken

Investing is ultimately a zero-sum game.

Exploit people's greed and fear

Focus on a certain future, even if it's far away.

How to Make Good Choices and Overcome Uncertainty

03 [Buy] Investing is macro psychology.

Value is not directly reflected in price

How to find great investments

If news of a bubble comes out

How to assess the risk of a bubble

04 [Portfolio] Cash is also a stock

Maintain a consistent portion of your portfolio in cash.

When you need to match timing that can't be matched

05 [Portfolio] Focus to Make Money, Diversify to Protect It

Diversification is a strategy specifically designed to protect your money.

Misconceptions about concentrated investment

Ride the great current of the world

How I Focus My Investments

06 [Sell] The weather is unpredictable, but the seasons are.

The fatal flaw of short-term investing

Mindset for long-term investment

Why I Don't Obsess Over Charts

How to Invest Successfully Long-Term

How to reset your portfolio

07 [Sell] Luck is also a skill

Procrastinating out of fear is the biggest and dumbest mistake you can make.

The fastest way to improve your skills

STAGE 3 What should I invest in?

01 Stock Investment

Conditions for a company that cannot help but grow in the long term

Advantages of investing in domestic stocks

Advantages of Investing in US Stocks

How to get information about foreign stocks

Who is stock investing suitable for?

02 Real Estate Investment

Stocks and virtual assets are rising faster than real estate.

The buying mood can change in an instant.

Just because prices don't fall doesn't mean the investment isn't attractive.

The advantages of real estate investing can also be its disadvantages.

Don't give up other investments because of your home.

Who is real estate investing suitable for?

03 Virtual Asset Investment

Where does Bitcoin's value come from?

Classification of virtual asset markets

Technological advancements don't wait for the public to fully understand them.

How to Pick Undervalued Cryptocurrencies

How to get information about virtual assets

Who is investing in virtual assets suitable for?

STAGE 1 Why live the life of an investor?

01 Investing is a way of life

What you can gain from the 'investor' lifestyle

Why I Feel Peaceful When Investing

How you invest your time and money determines the rest of your life.

02 How to Snowball Your Life Through Accumulation

Habit 1: Gather and manage your assets in one place.

Habit 2: Record Your Growth Consistently

Habit 3: Set Investment Goals

STAGE 2 How should I invest?

01 [Buy] Study, but don't fall in love.

When studying investments, take a top-down approach.

Books and resources that helped me study investment philosophy

I start my day by reading the newspaper.

How to Find Opportunities Around You

Obstacles to studying investment

Factors that create bias in investing

For anyone who just wants to know how to make money fast

02 [Buy] Kill your emotions rather than exploit them.

The real reason why your mental state is shaken

Investing is ultimately a zero-sum game.

Exploit people's greed and fear

Focus on a certain future, even if it's far away.

How to Make Good Choices and Overcome Uncertainty

03 [Buy] Investing is macro psychology.

Value is not directly reflected in price

How to find great investments

If news of a bubble comes out

How to assess the risk of a bubble

04 [Portfolio] Cash is also a stock

Maintain a consistent portion of your portfolio in cash.

When you need to match timing that can't be matched

05 [Portfolio] Focus to Make Money, Diversify to Protect It

Diversification is a strategy specifically designed to protect your money.

Misconceptions about concentrated investment

Ride the great current of the world

How I Focus My Investments

06 [Sell] The weather is unpredictable, but the seasons are.

The fatal flaw of short-term investing

Mindset for long-term investment

Why I Don't Obsess Over Charts

How to Invest Successfully Long-Term

How to reset your portfolio

07 [Sell] Luck is also a skill

Procrastinating out of fear is the biggest and dumbest mistake you can make.

The fastest way to improve your skills

STAGE 3 What should I invest in?

01 Stock Investment

Conditions for a company that cannot help but grow in the long term

Advantages of investing in domestic stocks

Advantages of Investing in US Stocks

How to get information about foreign stocks

Who is stock investing suitable for?

02 Real Estate Investment

Stocks and virtual assets are rising faster than real estate.

The buying mood can change in an instant.

Just because prices don't fall doesn't mean the investment isn't attractive.

The advantages of real estate investing can also be its disadvantages.

Don't give up other investments because of your home.

Who is real estate investing suitable for?

03 Virtual Asset Investment

Where does Bitcoin's value come from?

Classification of virtual asset markets

Technological advancements don't wait for the public to fully understand them.

How to Pick Undervalued Cryptocurrencies

How to get information about virtual assets

Who is investing in virtual assets suitable for?

Detailed image

Into the book

It's not a problem to set your goals too high and fail, but it is a problem to set your goals too low and succeed.

If you want to constantly expand your horizons into new areas, there's no better motivation than a challenging goal.

It's not just a goal that's a little higher than you might think, but a goal that's high enough that when others hear it, they tilt their heads and ask, "Is this person serious?"

--- From "How to Snowball Your Life Through Accumulation"

When studying investment, you need to study from the top down, starting with the macro and working your way down, so you can get the big picture and have a clear direction.

Good investment decisions often stem from the simplest ideas anyone can understand.

--- From "Study, but don't fall in love"

The idea that you can make a living investing for the rest of your life by making just one good choice is a complete illusion.

If that were true, everyone who bought Samsung Electronics or Apple stocks in the past would have become incredibly rich.

Investing is a continuous series of choices.

Not changing yesterday's choice today is a choice, and every moment we hold on to past choices without changing them is a choice of many.

--- From "If you can't use your emotions, kill them"

Let's say there's news that a company has won a large contract.

While some may see this good news as a catalyst for buying, the contract is actually simply a consequence of existing market dominance.

If market dominance remains intact but people's interest suddenly increases, this kind of news could, on the contrary, become grounds for selling.

It is important to understand whether this large contract has the potential to significantly expand market dominance or whether it was simply a foregone conclusion.

--- From "Stock Investment"

As the sale price of a house goes up, the monthly rent for that house also goes up.

At first glance, it may seem like someone living in an apartment worth 3 billion won has no housing costs, but this calculation omits opportunity costs.

A person living in an apartment worth 3 billion won is actually paying in housing costs equal to the cash flow from the 3 billion won worth of assets.

--- From "Real Estate Investment"

No one knows how developed the virtual asset market will be in 5 or 10 years.

Just as Amazon's Jeff Bezos, Facebook's Mark Zuckerberg, and in Korea, Naver's Lee Hae-jin and Kakao's Kim Beom-su saw the potential of the internet and jumped into investment and business, amassing significant wealth, new wealthy individuals could emerge from investors and entrepreneurs who recognized the potential of virtual assets early on.

If you want to constantly expand your horizons into new areas, there's no better motivation than a challenging goal.

It's not just a goal that's a little higher than you might think, but a goal that's high enough that when others hear it, they tilt their heads and ask, "Is this person serious?"

--- From "How to Snowball Your Life Through Accumulation"

When studying investment, you need to study from the top down, starting with the macro and working your way down, so you can get the big picture and have a clear direction.

Good investment decisions often stem from the simplest ideas anyone can understand.

--- From "Study, but don't fall in love"

The idea that you can make a living investing for the rest of your life by making just one good choice is a complete illusion.

If that were true, everyone who bought Samsung Electronics or Apple stocks in the past would have become incredibly rich.

Investing is a continuous series of choices.

Not changing yesterday's choice today is a choice, and every moment we hold on to past choices without changing them is a choice of many.

--- From "If you can't use your emotions, kill them"

Let's say there's news that a company has won a large contract.

While some may see this good news as a catalyst for buying, the contract is actually simply a consequence of existing market dominance.

If market dominance remains intact but people's interest suddenly increases, this kind of news could, on the contrary, become grounds for selling.

It is important to understand whether this large contract has the potential to significantly expand market dominance or whether it was simply a foregone conclusion.

--- From "Stock Investment"

As the sale price of a house goes up, the monthly rent for that house also goes up.

At first glance, it may seem like someone living in an apartment worth 3 billion won has no housing costs, but this calculation omits opportunity costs.

A person living in an apartment worth 3 billion won is actually paying in housing costs equal to the cash flow from the 3 billion won worth of assets.

--- From "Real Estate Investment"

No one knows how developed the virtual asset market will be in 5 or 10 years.

Just as Amazon's Jeff Bezos, Facebook's Mark Zuckerberg, and in Korea, Naver's Lee Hae-jin and Kakao's Kim Beom-su saw the potential of the internet and jumped into investment and business, amassing significant wealth, new wealthy individuals could emerge from investors and entrepreneurs who recognized the potential of virtual assets early on.

--- From "Virtual Asset Investment"

Publisher's Review

"Start one year early and you'll retire ten years sooner!"

Earning a lifetime salary at the age of 30

7 Success Habits of Investment Geniuses

The rule of capitalism is not that good results are achieved by 'working hard' or 'putting in a lot of labor', but rather that profits are determined by how much risk you take and how much of your capital you invest.

Managing risk here isn't simply about minimizing risk, but finding a position that offers the best reward for the risk.

Investing is about examining various options for allocating your money and finding the position that feels most comfortable, so if you've invested correctly, it's normal to feel comfortable.

Even if you're lucky enough to get a glimpse into the portfolios of the world's greatest investors, blindly following them without understanding why and how they made those decisions can be detrimental.

Because investing is not a one-time choice, but a series of continuous choices.

If you don't know how to invest, you will be swayed by the uncertainty of the market and end up losing money.

Therefore, it is very important to accurately understand the investor's mindset, why such decisions are made, and what process was involved in making such decisions.

The highlight of this book is that it introduces the author's method of studying investment, books and materials that helped him study investment philosophy, and how to obtain information on stocks and other assets, and it is organized so that you can directly find great investment opportunities.

This allows investors to set their own standards for when, what, and how much to invest, and helps them overcome the numerous challenges they face when investing.

"If you know how wealth works, you will experience a frightening acceleration!"

Attention from the media and investors

From 100 million to 1 billion, from 1 billion to 4 billion

The roadmap for smart young rich people revealed!

It took the author 6 years to make 100 million won, but after he started studying investment in earnest and created his own 'principles and rules', it took him a year and a half to make 100 million won into 1 billion won, and less than 6 months to make 1 billion won into 4 billion won.

As principles and rules become more solid and know-how accumulates, the speed of development becomes frighteningly fast.

What are the principles and rules that transformed ordinary office workers into super ants? They include: "Price doesn't dictate asset value," "Predict the season, not the weather," "Exploit people's greed and fear," and "Focus on a certain future, even if it's far away."

In particular, the author emphasizes that when selecting stocks, 'invest based on attractiveness, not price.'

By applying his approach to finding attractive stocks to your own situation, you can discover valuable insights and practical alternatives on how to approach and study stocks, as well as when to buy and sell.

The top-tier investment habits presented in "I Made 30 Years of Investing" are powerful strategies and weapons that, once learned, can be used for a lifetime.

So, even if there are ups and downs in the investment process, you won't be overly excited or depressed by small profits or losses.

This book contains the fastest way to become rich by creating your own solid investment philosophy, and all the principles of wealth operation.

Earning a lifetime salary at the age of 30

7 Success Habits of Investment Geniuses

The rule of capitalism is not that good results are achieved by 'working hard' or 'putting in a lot of labor', but rather that profits are determined by how much risk you take and how much of your capital you invest.

Managing risk here isn't simply about minimizing risk, but finding a position that offers the best reward for the risk.

Investing is about examining various options for allocating your money and finding the position that feels most comfortable, so if you've invested correctly, it's normal to feel comfortable.

Even if you're lucky enough to get a glimpse into the portfolios of the world's greatest investors, blindly following them without understanding why and how they made those decisions can be detrimental.

Because investing is not a one-time choice, but a series of continuous choices.

If you don't know how to invest, you will be swayed by the uncertainty of the market and end up losing money.

Therefore, it is very important to accurately understand the investor's mindset, why such decisions are made, and what process was involved in making such decisions.

The highlight of this book is that it introduces the author's method of studying investment, books and materials that helped him study investment philosophy, and how to obtain information on stocks and other assets, and it is organized so that you can directly find great investment opportunities.

This allows investors to set their own standards for when, what, and how much to invest, and helps them overcome the numerous challenges they face when investing.

"If you know how wealth works, you will experience a frightening acceleration!"

Attention from the media and investors

From 100 million to 1 billion, from 1 billion to 4 billion

The roadmap for smart young rich people revealed!

It took the author 6 years to make 100 million won, but after he started studying investment in earnest and created his own 'principles and rules', it took him a year and a half to make 100 million won into 1 billion won, and less than 6 months to make 1 billion won into 4 billion won.

As principles and rules become more solid and know-how accumulates, the speed of development becomes frighteningly fast.

What are the principles and rules that transformed ordinary office workers into super ants? They include: "Price doesn't dictate asset value," "Predict the season, not the weather," "Exploit people's greed and fear," and "Focus on a certain future, even if it's far away."

In particular, the author emphasizes that when selecting stocks, 'invest based on attractiveness, not price.'

By applying his approach to finding attractive stocks to your own situation, you can discover valuable insights and practical alternatives on how to approach and study stocks, as well as when to buy and sell.

The top-tier investment habits presented in "I Made 30 Years of Investing" are powerful strategies and weapons that, once learned, can be used for a lifetime.

So, even if there are ups and downs in the investment process, you won't be overly excited or depressed by small profits or losses.

This book contains the fastest way to become rich by creating your own solid investment philosophy, and all the principles of wealth operation.

GOODS SPECIFICS

- Publication date: September 21, 2021

- Page count, weight, size: 264 pages | 432g | 145*215*20mm

- ISBN13: 9791158512248

- ISBN10: 1158512244

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)