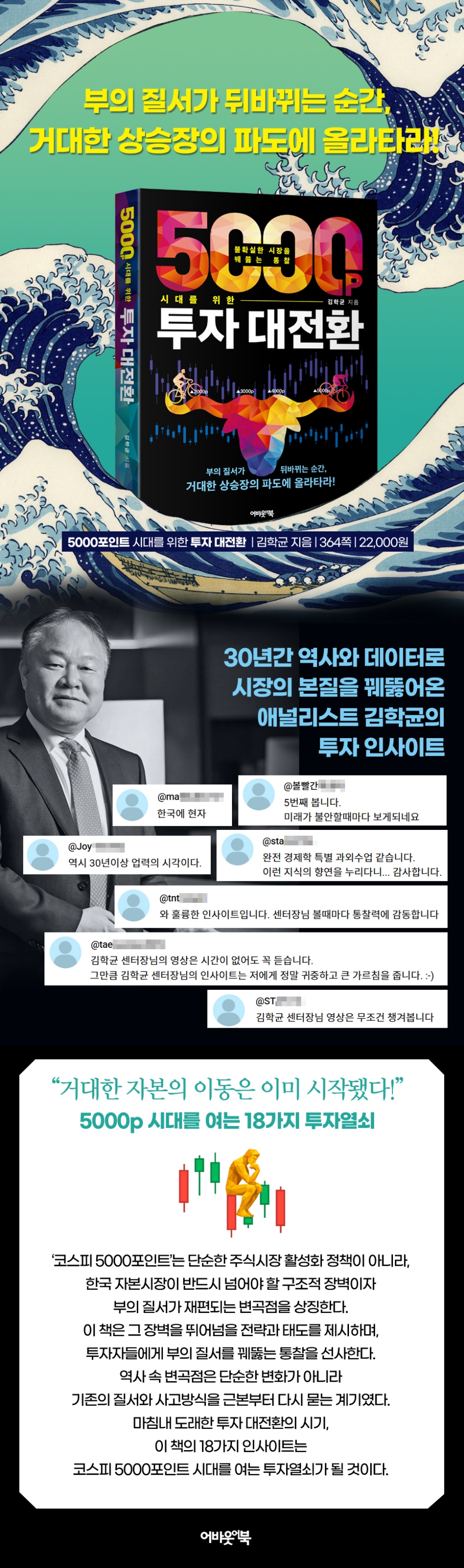

A Great Investment Transformation for the 5,000-Point Era

|

Description

Book Introduction

The moment the order of wealth changes,

Ride the massive bull market wave!

18 Investment Keys to Ushering in the 5000p Era

Analysts are the first to spot signs of a company's growth, sometimes sounding alarms in the market and serving as a compass for investors.

The author of this book, Kim Hak-gyun, has been an analyst for nearly 30 years, observing the market's joys and fears, and has built investor trust through in-depth analysis.

In a securities industry rife with short-term, fad-driven forecasts, he has focused on interpreting the fundamental trends of the market based on history and data.

In particular, the company has long pointed out the backward governance structure as the fundamental cause of the undervaluation of Korean stocks, and has consistently emphasized the need to improve the governance structure to increase capital efficiency and realize shareholder capitalism based on 'one share, one vote.'

The author comprehensively explores the problems facing global stock markets, including those in Korea and the United States.

Where does the imbalance come from where only the asset market is booming while the real economy is sluggish? Why do only a few people benefit from long-term investment even when the stock market is booming? Is the peak of a bubble predictable? How did ETFs, which were called the “saviors of the market,” fall? Is the “buy and hold” strategy still valid in the Korean stock market? How long does the “invincibility theory of the US stock market” last? Why did McDonald’s, which was in the black for 44 consecutive years, and Starbucks, which was in the black for 33 consecutive years, fall into capital erosion? Why does the Chinese stock market fail to reflect high economic growth? How does improving the governance structure become the key card to open the 5,000-point era? And how can KOSDAQ, which was called “a market built on the tears of investors,” shed its bad reputation?

The KOSPI 5,000 point mark is not simply a policy to stimulate the stock market. It is a structural barrier that the Korean capital market must overcome and a signal of an inflection point where the wealth order is being reorganized.

This book presents strategies and attitudes to overcome these barriers, offering investors insight into the order of wealth.

Turning points in history were not simple changes, but rather opportunities to fundamentally question the existing order and way of thinking.

With the arrival of a major investment revolution, the 18 insights in this book will be the key to unlocking the era of the KOSPI 5,000 point index.

Ride the massive bull market wave!

18 Investment Keys to Ushering in the 5000p Era

Analysts are the first to spot signs of a company's growth, sometimes sounding alarms in the market and serving as a compass for investors.

The author of this book, Kim Hak-gyun, has been an analyst for nearly 30 years, observing the market's joys and fears, and has built investor trust through in-depth analysis.

In a securities industry rife with short-term, fad-driven forecasts, he has focused on interpreting the fundamental trends of the market based on history and data.

In particular, the company has long pointed out the backward governance structure as the fundamental cause of the undervaluation of Korean stocks, and has consistently emphasized the need to improve the governance structure to increase capital efficiency and realize shareholder capitalism based on 'one share, one vote.'

The author comprehensively explores the problems facing global stock markets, including those in Korea and the United States.

Where does the imbalance come from where only the asset market is booming while the real economy is sluggish? Why do only a few people benefit from long-term investment even when the stock market is booming? Is the peak of a bubble predictable? How did ETFs, which were called the “saviors of the market,” fall? Is the “buy and hold” strategy still valid in the Korean stock market? How long does the “invincibility theory of the US stock market” last? Why did McDonald’s, which was in the black for 44 consecutive years, and Starbucks, which was in the black for 33 consecutive years, fall into capital erosion? Why does the Chinese stock market fail to reflect high economic growth? How does improving the governance structure become the key card to open the 5,000-point era? And how can KOSDAQ, which was called “a market built on the tears of investors,” shed its bad reputation?

The KOSPI 5,000 point mark is not simply a policy to stimulate the stock market. It is a structural barrier that the Korean capital market must overcome and a signal of an inflection point where the wealth order is being reorganized.

This book presents strategies and attitudes to overcome these barriers, offering investors insight into the order of wealth.

Turning points in history were not simple changes, but rather opportunities to fundamentally question the existing order and way of thinking.

With the arrival of a major investment revolution, the 18 insights in this book will be the key to unlocking the era of the KOSPI 5,000 point index.

- You can preview some of the book's contents.

Preview

index

Prologue | The Joys and Sorrows of Investing

INSIGHT 1.

The triumph of the optimist

- Memories held by the market: The probability of the Korean stock market rising since 1972

Time is on the investor's side: The hidden power of asymmetry in long-term investing.

INSIGHT 2.

The investor's enemy: the tempting allure of pessimism.

The illusion of greater uncertainty than ever before: the world is getting better in the long run and stock indices are rising.

- A blue spring from a distance: stock index converging to the trajectory of nominal GDP in the long term

INSIGHT 3.

Stock index, winner's record

- Top of the Top: The Dow Jones Industrial Average, the "blue chip among blue chip stocks."

Time to Give Up the Crown: What the Average Lifespan of Dow Jones Industrial Average Stocks Indicates

INSIGHT 4.

Central banks are powerful allies for investors.

- A cold economy and a hot stock market: Stock prices pushed up by liquidity from central banks.

The Central Bank's Unconventional Experiment: Liquidity's Backlash Shakes Asset Markets

INSIGHT 5.

The lure of buying high: Why are we attracted when prices are high?

- Do you believe what you see?: The future is 'nobody knows'

Money that always moves a step behind: The misfortune of investors who jump into a bull market late.

INSIGHT 6.

Investing in Individual Stocks: Not Everyone Gets a Good Results

- The Pareto Principle is no exception in the stock market: Stock indices raised by the efforts of a very small number of people

The Betrayal of Diversification: Don't Believe You've Reduced Risk

INSIGHT 7.

The Rules of the Game Inherent in Growth Stock Investing

- Shake it up, shake it up! : The high-flying market that shook the U.S. stock market in the 1960s

Shoot for Tomorrow!: From the blue chip stocks of the 1970s to the conceptual growth stocks of the late 1990s

The Paradox of the Bubble: Collective Enthusiasm as a Necessary Evil for Fostering Growth Industries

INSIGHT 8.

Can you measure bubbles?

Hot or Cold: Thermometers that Measure Market Heat, the Buffett Index and the Liquidity Index

- From an unverified future to a verified past: Robert J.

Schiller's CAPE

Stocks or Bonds: Which is More Attractive?: Yield Gap: Comparing PER and Interest Rates

- Indicators created to justify the bubble: PSR and PDR

INSIGHT 9.

Investing is not engineering.

The Future Surpasses Our Expectations: Black Monday 1987: A Causal Explanation

- A signal of upheaval: the public's tendency to shift just before major change.

INSIGHT 10.

Not investing is also investing: The Value Investor's Mindset

A philosophy of humility that acknowledges imperfection: A keyword that permeates value investing.

- The courage not to invest: Not investing is actually an active investment.

Extreme Patience and Extreme Execution: Qualities Required for Value Investors

INSIGHT 11.

Passive Investing: If You Can't Beat the Market, Join It

The Art of Idle Investing: The Great Triumph of Lazy Investing

- Regrets about active ETFs: Active investment disguised as passive.

INSIGHT 12.

Will long-term investing be effective in the Korean stock market?

KOSPI Stuck in a Box: Is 'Stock Immigration' the Right Choice?

The possibility of the Korean stock market becoming Japanized: Will it follow in the footsteps of the "Lost 20 Years"?

INSIGHT 13.

There is no such thing as an undefeated asset.

Beyond Asset Borders: Hedging Risk Through Global Diversification

Signs of an Empire's Decline: Stagnation Caused by Excessive Self-Consciousness

The most dangerous moment is when nothing seems to be worrying: How stock prices react to overoptimism.

INSIGHT 14.

Capitalism without capital

Capital Destruction at Blue Chip Companies in the U.S.: Aggressive Shareholder Return Policies

The Tragedy of Excessive Shareholder Returns: Efficiency Improvements for Whom?

INSIGHT 15.

Chinese Stock Market: Why Stock Prices Betray Growth

Supply is not a trade: Why China's stock market failed to live up to expectations.

A system that robs shareholders of the fruits of growth: governance risk

INSIGHT 16.

Governance: Between the Excess and Deficiency of Shareholder Capitalism

- The lie that the company's owners are shareholders: owners in name only

- The Equilibrium of Shareholder Capitalism: Excessive America vs.

Korea in need

Shareholders are the key to value-up: The key to resolving the Korea discount.

INSIGHT 17.

Why did the KOSDAQ market become a slump?

A Market Built on Investors' Tears: The KOSDAQ Market, the Minor League of the Korean Stock Market

- Too much is the problem: the result of chronic oversupply

INSIGHT 18.

Believe in the power of time

He who can wait patiently wins in the end: How to overcome Mr. Market's whims.

There are patterns, but no rules: the weapon of the long-term race called investment.

Investing is Buying Time: Advice for Young Investors

| Epilogue | Ten Tips for Investors

INSIGHT 1.

The triumph of the optimist

- Memories held by the market: The probability of the Korean stock market rising since 1972

Time is on the investor's side: The hidden power of asymmetry in long-term investing.

INSIGHT 2.

The investor's enemy: the tempting allure of pessimism.

The illusion of greater uncertainty than ever before: the world is getting better in the long run and stock indices are rising.

- A blue spring from a distance: stock index converging to the trajectory of nominal GDP in the long term

INSIGHT 3.

Stock index, winner's record

- Top of the Top: The Dow Jones Industrial Average, the "blue chip among blue chip stocks."

Time to Give Up the Crown: What the Average Lifespan of Dow Jones Industrial Average Stocks Indicates

INSIGHT 4.

Central banks are powerful allies for investors.

- A cold economy and a hot stock market: Stock prices pushed up by liquidity from central banks.

The Central Bank's Unconventional Experiment: Liquidity's Backlash Shakes Asset Markets

INSIGHT 5.

The lure of buying high: Why are we attracted when prices are high?

- Do you believe what you see?: The future is 'nobody knows'

Money that always moves a step behind: The misfortune of investors who jump into a bull market late.

INSIGHT 6.

Investing in Individual Stocks: Not Everyone Gets a Good Results

- The Pareto Principle is no exception in the stock market: Stock indices raised by the efforts of a very small number of people

The Betrayal of Diversification: Don't Believe You've Reduced Risk

INSIGHT 7.

The Rules of the Game Inherent in Growth Stock Investing

- Shake it up, shake it up! : The high-flying market that shook the U.S. stock market in the 1960s

Shoot for Tomorrow!: From the blue chip stocks of the 1970s to the conceptual growth stocks of the late 1990s

The Paradox of the Bubble: Collective Enthusiasm as a Necessary Evil for Fostering Growth Industries

INSIGHT 8.

Can you measure bubbles?

Hot or Cold: Thermometers that Measure Market Heat, the Buffett Index and the Liquidity Index

- From an unverified future to a verified past: Robert J.

Schiller's CAPE

Stocks or Bonds: Which is More Attractive?: Yield Gap: Comparing PER and Interest Rates

- Indicators created to justify the bubble: PSR and PDR

INSIGHT 9.

Investing is not engineering.

The Future Surpasses Our Expectations: Black Monday 1987: A Causal Explanation

- A signal of upheaval: the public's tendency to shift just before major change.

INSIGHT 10.

Not investing is also investing: The Value Investor's Mindset

A philosophy of humility that acknowledges imperfection: A keyword that permeates value investing.

- The courage not to invest: Not investing is actually an active investment.

Extreme Patience and Extreme Execution: Qualities Required for Value Investors

INSIGHT 11.

Passive Investing: If You Can't Beat the Market, Join It

The Art of Idle Investing: The Great Triumph of Lazy Investing

- Regrets about active ETFs: Active investment disguised as passive.

INSIGHT 12.

Will long-term investing be effective in the Korean stock market?

KOSPI Stuck in a Box: Is 'Stock Immigration' the Right Choice?

The possibility of the Korean stock market becoming Japanized: Will it follow in the footsteps of the "Lost 20 Years"?

INSIGHT 13.

There is no such thing as an undefeated asset.

Beyond Asset Borders: Hedging Risk Through Global Diversification

Signs of an Empire's Decline: Stagnation Caused by Excessive Self-Consciousness

The most dangerous moment is when nothing seems to be worrying: How stock prices react to overoptimism.

INSIGHT 14.

Capitalism without capital

Capital Destruction at Blue Chip Companies in the U.S.: Aggressive Shareholder Return Policies

The Tragedy of Excessive Shareholder Returns: Efficiency Improvements for Whom?

INSIGHT 15.

Chinese Stock Market: Why Stock Prices Betray Growth

Supply is not a trade: Why China's stock market failed to live up to expectations.

A system that robs shareholders of the fruits of growth: governance risk

INSIGHT 16.

Governance: Between the Excess and Deficiency of Shareholder Capitalism

- The lie that the company's owners are shareholders: owners in name only

- The Equilibrium of Shareholder Capitalism: Excessive America vs.

Korea in need

Shareholders are the key to value-up: The key to resolving the Korea discount.

INSIGHT 17.

Why did the KOSDAQ market become a slump?

A Market Built on Investors' Tears: The KOSDAQ Market, the Minor League of the Korean Stock Market

- Too much is the problem: the result of chronic oversupply

INSIGHT 18.

Believe in the power of time

He who can wait patiently wins in the end: How to overcome Mr. Market's whims.

There are patterns, but no rules: the weapon of the long-term race called investment.

Investing is Buying Time: Advice for Young Investors

| Epilogue | Ten Tips for Investors

Detailed image

Into the book

“When shopping, people make purchasing decisions when prices drop due to a sale, but in the stock market, money actually flows in only after stock prices rise.

(Omitted) The graph shows the pattern of fund inflows into the stock market that lag behind stock prices.

Fund inflows are concentrated when the stock price reaches its peak, not just when it is lagging behind.

It's always been like that."

---From "'Do You Only Believe What You See?: The Future Is 'Nobody Knows'"

“To create a new growth industry, massive amounts of capital must flow into the entire industry.

Attracting investors to an industry with significant uncertainty requires a collective enthusiasm fueled by extreme optimism.

This enthusiasm eventually manifests itself in the form of a bubble.

No matter how abnormally high the stock price rises, investors are lured by the optimism that "this time is different."

Only then can sufficient funds flow into growth industries.

During this process, a significant number of companies that raised funds from the capital market are largely eliminated, but the few that survive ultimately create a new ecosystem.

(Omitted) The view that ‘bubbles are a necessary evil’ is very important to investors.

“Your investment may fuel a new industry, but it could also burn your fortune in the process.”

---From "The Bubble Paradox: Collective Enthusiasm, a Necessary Evil for Fostering Growth Industries"

“Active ETFs can also encourage bubbles.

This is because they mechanically follow the order formed in the current market rather than actively analyzing future value.

Many active ETFs are structured to follow stock price movements, taking advantage of popular themes at a particular point in time.

“Ultimately, by passively endorsing the current order, the stock prices of existing popular stocks could rise to bubble levels.”

---From "Regretful of Active ETFs: Active Investment Disguised as Passive"

“Boeing returned all the money it earned to its shareholders.

The company continued to pay dividends and bought back and burned its own shares.

Not only did they use their profits to buy back their own stock, they also took out debt to buy back and burn their own stock.

Although it was a strategy to increase capital efficiency, the result was an excessive reduction in equity capital.

(Omitted) Equity capital is the last safety net that a company can rely on in a crisis situation.

However, with this safety net weakened, Boeing, which had been recording profits for 21 consecutive years, fell into the abyss with a single loss in 2019.

In 2018, a year before its collapse, Boeing's ROE was a whopping 985%.

ROE was abnormally inflated due to excessive reduction in equity capital.

If an ROE approaching 1000% was a farce, the fall of a company that had been profitable for 21 consecutive years to the brink of bankruptcy in a single year was a devastating tragedy.”

---From "The Tragedy of Excessive Shareholder Returns: For Whom Are Efficiency Improvements Being Made?"

“I also acknowledge the short-term bias inherent in shareholder capitalism.

However, in Korea, there's a prevailing opinion that the benefits of strengthening shareholder rights outweigh the benefits. It's undeniable that the growing influence of foreign investors in the wake of the IMF foreign exchange crisis led to an overall improvement in the governance structure of Korean listed companies.

There have been many cases where management rights were directly attacked, but these have ultimately led to positive changes.

In the early to mid-2000s, SK Group was under attack for management rights from a hedge fund called Sovereign.

However, the ones who benefited the most from this controversy were none other than the controlling shareholders of the SK Group.

“Because the management structure has become transparent and the stock price has risen significantly in the long term.”

---「The Equilibrium of Shareholder Capitalism: Excessive America vs.

From "Deficient Korea"

“Many Korean venture companies were listed on the KOSDAQ market.

Listing is the act of raising funds by selling stocks.

Korean individual investors were willing to provide funds to venture companies, but this activity was not rewarded with returns.

The initial public offering (IPO), a process by which startups enter the KOSDAQ market, was used as an opportunity for venture capitalists, who were early investors in these companies, to 'exit' their investment stakes.

It may be unfair to hold venture capitalists accountable for taking on so many risks.

However, it is undeniable that IPOs have become a channel for transferring wealth from individual investors, known as "ants," to professional investors.

(Omitted) The graph shows the pattern of fund inflows into the stock market that lag behind stock prices.

Fund inflows are concentrated when the stock price reaches its peak, not just when it is lagging behind.

It's always been like that."

---From "'Do You Only Believe What You See?: The Future Is 'Nobody Knows'"

“To create a new growth industry, massive amounts of capital must flow into the entire industry.

Attracting investors to an industry with significant uncertainty requires a collective enthusiasm fueled by extreme optimism.

This enthusiasm eventually manifests itself in the form of a bubble.

No matter how abnormally high the stock price rises, investors are lured by the optimism that "this time is different."

Only then can sufficient funds flow into growth industries.

During this process, a significant number of companies that raised funds from the capital market are largely eliminated, but the few that survive ultimately create a new ecosystem.

(Omitted) The view that ‘bubbles are a necessary evil’ is very important to investors.

“Your investment may fuel a new industry, but it could also burn your fortune in the process.”

---From "The Bubble Paradox: Collective Enthusiasm, a Necessary Evil for Fostering Growth Industries"

“Active ETFs can also encourage bubbles.

This is because they mechanically follow the order formed in the current market rather than actively analyzing future value.

Many active ETFs are structured to follow stock price movements, taking advantage of popular themes at a particular point in time.

“Ultimately, by passively endorsing the current order, the stock prices of existing popular stocks could rise to bubble levels.”

---From "Regretful of Active ETFs: Active Investment Disguised as Passive"

“Boeing returned all the money it earned to its shareholders.

The company continued to pay dividends and bought back and burned its own shares.

Not only did they use their profits to buy back their own stock, they also took out debt to buy back and burn their own stock.

Although it was a strategy to increase capital efficiency, the result was an excessive reduction in equity capital.

(Omitted) Equity capital is the last safety net that a company can rely on in a crisis situation.

However, with this safety net weakened, Boeing, which had been recording profits for 21 consecutive years, fell into the abyss with a single loss in 2019.

In 2018, a year before its collapse, Boeing's ROE was a whopping 985%.

ROE was abnormally inflated due to excessive reduction in equity capital.

If an ROE approaching 1000% was a farce, the fall of a company that had been profitable for 21 consecutive years to the brink of bankruptcy in a single year was a devastating tragedy.”

---From "The Tragedy of Excessive Shareholder Returns: For Whom Are Efficiency Improvements Being Made?"

“I also acknowledge the short-term bias inherent in shareholder capitalism.

However, in Korea, there's a prevailing opinion that the benefits of strengthening shareholder rights outweigh the benefits. It's undeniable that the growing influence of foreign investors in the wake of the IMF foreign exchange crisis led to an overall improvement in the governance structure of Korean listed companies.

There have been many cases where management rights were directly attacked, but these have ultimately led to positive changes.

In the early to mid-2000s, SK Group was under attack for management rights from a hedge fund called Sovereign.

However, the ones who benefited the most from this controversy were none other than the controlling shareholders of the SK Group.

“Because the management structure has become transparent and the stock price has risen significantly in the long term.”

---「The Equilibrium of Shareholder Capitalism: Excessive America vs.

From "Deficient Korea"

“Many Korean venture companies were listed on the KOSDAQ market.

Listing is the act of raising funds by selling stocks.

Korean individual investors were willing to provide funds to venture companies, but this activity was not rewarded with returns.

The initial public offering (IPO), a process by which startups enter the KOSDAQ market, was used as an opportunity for venture capitalists, who were early investors in these companies, to 'exit' their investment stakes.

It may be unfair to hold venture capitalists accountable for taking on so many risks.

However, it is undeniable that IPOs have become a channel for transferring wealth from individual investors, known as "ants," to professional investors.

---From "'Too Much is the Problem: The Chronic Burden of Oversupply'"

Publisher's Review

· Analyst Kim Hak-gyun, who has been analyzing the joys and fears of the market for 30 years

18 Investment Keys to Ushering in the 5000p Era

Analysts are the first to spot signs of a company's growth, sometimes sounding alarms in the market and serving as a compass for investors.

The author of this book, Kim Hak-gyun, has been an analyst for nearly 30 years, observing the market's joys and fears, and has built investor trust through in-depth analysis.

In a securities industry rife with short-term, fad-driven forecasts, he has focused on interpreting the fundamental trends of the market based on history and data.

This attitude has established him as a reliable guide for investors in uncertain markets.

He has long pointed out the backward governance structure as the fundamental cause of the undervaluation of Korean stocks, and has consistently emphasized the need to improve the governance structure to increase capital efficiency and realize shareholder capitalism of 'one share, one vote.'

He is also recognized as an expert with deep insight into value investing, having hosted a reading session of Warren Buffett's "Snowball" and conducted a commentary broadcast.

· The moment the order of wealth changes,

Ride the massive bull market wave!

In June 2025, the KOSPI index surpassed 3,000 points again for the first time in three years and five months.

The market atmosphere, once filled with cynicism that "the escape of the director is determined by intelligence," has shifted to anticipation for the "KOSPI 5000 era."

As the stock market enters a new phase, investors' attention is naturally focused on the possibility of reaching 5,000 points.

The author is optimistic about the arrival of the KOSPI 5000 era based on market history and data.

From 1972 to 2024, the KOSPI rose 36 times over the 53 years, with an annual probability of increase of 67.9% (page 17).

For the KOSPI, currently at 3,000 points, to reach 5,000 points in five years, it would need to rise by an average of 10.7% per year.

This level of upward movement is not at all uncommon historically.

In fact, the total net income of KOSPI-listed companies increased by an average of 8.8% per year from 2015 to 2024.

If government, corporate, and investor efforts to improve the capital market's structure are combined, 5,000 points is by no means an unrealistic goal. (Page 5)

Above all, the 'improvement of governance structure' that began in earnest with the revision of the Commercial Act will be a key driving force in ushering in the 5,000-point era.

The weak governance structure, in which the owner monopolized management rights with a low stake and neglected shareholder returns, was the root of the "Korea Discount" and the biggest obstacle that caused people to turn away from the Korean stock market.

On the other hand, Japan emerged from a long period of stagnation by improving capital efficiency and improving its governance structure ahead of us.

As a result, as of the end of July 2025, the Nikkei 225 index had risen 99% over the previous 10 years, significantly outperforming the KOSPI's 59% increase over the same period. (p. 301)

· A solid investment strategy that is unshakable by market fluctuations.

How can we capitalize on the upcoming massive bull market? The author points out that the biggest reason many investors fail in stock investing is because they enter at excessively high prices.

In fact, analyzing the patterns of capital inflows into the stock market reveals that capital inflows tend to be concentrated when the market reaches its peak (page 80). This is due to cognitive bias.

When prices rise, fear disappears, but when prices fall, even greater fear sets in.

Also, when predicting the future, most people rely too heavily on present experiences or memories of the recent past.

The author explores the thinking of value investors to overcome cognitive biases and develop sustainable investment strategies.

The key is 'skepticism'.

Skepticism is a strict attitude toward what we believe we know.

Distinguishing between what is known and what is not, critical reflection on majority opinion, and a certain amount of counter-intuitive thinking are the attitudes that skeptics maintain.

Investors should be cool-headed skeptics in a bull market when everyone is excited, and optimistic skeptics in a bear market when everyone is depressed. (p. 358)

Furthermore, from a value investor's perspective, in an environment that is not favorable to investors, 'doing nothing' is also an investment.

Buying an unknown stock is speculation, and buying a stock without a safety margin significantly reduces the investment's odds of success.

"The courage to not act" is also an important virtue for investors. (p. 184)

· Signals of long-term sideways trading hidden behind the "invincibility" theory of the US stock market.

The U.S. stock market is directly linked to the Korean capital market, as 94% of Koreans' net purchases of foreign stocks since 2000 have been U.S. stocks.

The author warns against the "invincibility of the US stock market," which has become a widespread belief among individual investors.

This is because signs predicting a long-term sideways trend are being detected everywhere.

Historically, five signs of economic decline in the United States have repeatedly appeared: inflation, fiscal deficits, war, erosion of soft power, and the rise of growth stocks.

Whenever the United States boasted of a prolonged boom and became confident, it was followed by fiscal and military overexpansion, which ultimately resulted in the loss of economic hegemony. (p. 234)

All five of these signs are currently present in the United States.

The Biden administration's excessive spending has led to a deficit of 7% of GDP, and the United States has indirectly intervened in two wars, one in Ukraine and one in Israel.

Here, President Trump has been wielding the sword of "protectionism" since the beginning of his term, structurally undermining America's soft power.

Also, the stock market is showing strength in growth stocks consisting of large technology stocks, known as the "Magnificent 7."

These seven stocks accounted for 78% of the Nasdaq index's gains in 2024. (p. 239)

As alarm bells sound across the U.S. economy, unusual phenomena are also emerging at the corporate level.

This is the ‘destruction of capital by excellent companies.’

Among the S&P 500 index stocks representing the United States, 31 companies have negative equity, or capital impairment.

Typically, capital erosion occurs in failing companies that have accumulated losses, but these companies are different.

These are companies that have been profitable for decades, such as McDonald's (44 consecutive years of profit), Starbucks (33 consecutive years of profit), and Philip Morris (18 consecutive years of profit). (p. 248)

The decline in equity capital of these companies is the result of aggressive shareholder return policies such as dividend increases and stock buybacks and cancellations.

McDonald's and Starbucks are even borrowing money to buy back their own stock.

Why are America's best companies destroying their own equity?

ROE (return on equity) is an indicator of capital efficiency, calculated by dividing net income by equity capital.

These companies are drastically increasing their capital efficiency by increasing their ROE by reducing their equity capital, which is the denominator.

However, this type of excessive shareholder return deepens the gap between the real economy and the stock market, further widening asset inequality.

Furthermore, it even weakens the company's ability to respond to crises.

In fact, Boeing, which had been profitable for 21 consecutive years, was immediately pushed to the brink of bankruptcy after just one year of poor performance.

· Exploring the essential questions of capital markets

The author comprehensively explores the problems facing global stock markets, including those in Korea and the United States.

Where does the imbalance come from where only the asset market is booming while the real economy is sluggish? Why do only a few people benefit from long-term investments even when the stock market is booming? Is the peak of a bubble predictable? How did ETFs, once called the “saviors of the market,” fall? Is the “buy and hold” strategy still valid in the Korean stock market? Why did the Chinese stock market fail to reflect high economic growth? How is improving governance a key card to open the 5,000-point era? How can KOSDAQ, which was called a “market built on the tears of investors,” shed its bad reputation? We delve into this extensively.

The KOSPI 5,000 point mark is not simply a policy to stimulate the stock market. It is a structural barrier that the Korean capital market must overcome and a signal of an inflection point where the wealth order is being reorganized.

This book presents strategies and attitudes to overcome these barriers, offering investors insight into the order of wealth.

Turning points in history were not simple changes, but rather opportunities to fundamentally question the existing order and way of thinking.

With the arrival of a major investment revolution, the 18 insights in this book will be the key to unlocking the era of the KOSPI 5,000 point index.

18 Investment Keys to Ushering in the 5000p Era

Analysts are the first to spot signs of a company's growth, sometimes sounding alarms in the market and serving as a compass for investors.

The author of this book, Kim Hak-gyun, has been an analyst for nearly 30 years, observing the market's joys and fears, and has built investor trust through in-depth analysis.

In a securities industry rife with short-term, fad-driven forecasts, he has focused on interpreting the fundamental trends of the market based on history and data.

This attitude has established him as a reliable guide for investors in uncertain markets.

He has long pointed out the backward governance structure as the fundamental cause of the undervaluation of Korean stocks, and has consistently emphasized the need to improve the governance structure to increase capital efficiency and realize shareholder capitalism of 'one share, one vote.'

He is also recognized as an expert with deep insight into value investing, having hosted a reading session of Warren Buffett's "Snowball" and conducted a commentary broadcast.

· The moment the order of wealth changes,

Ride the massive bull market wave!

In June 2025, the KOSPI index surpassed 3,000 points again for the first time in three years and five months.

The market atmosphere, once filled with cynicism that "the escape of the director is determined by intelligence," has shifted to anticipation for the "KOSPI 5000 era."

As the stock market enters a new phase, investors' attention is naturally focused on the possibility of reaching 5,000 points.

The author is optimistic about the arrival of the KOSPI 5000 era based on market history and data.

From 1972 to 2024, the KOSPI rose 36 times over the 53 years, with an annual probability of increase of 67.9% (page 17).

For the KOSPI, currently at 3,000 points, to reach 5,000 points in five years, it would need to rise by an average of 10.7% per year.

This level of upward movement is not at all uncommon historically.

In fact, the total net income of KOSPI-listed companies increased by an average of 8.8% per year from 2015 to 2024.

If government, corporate, and investor efforts to improve the capital market's structure are combined, 5,000 points is by no means an unrealistic goal. (Page 5)

Above all, the 'improvement of governance structure' that began in earnest with the revision of the Commercial Act will be a key driving force in ushering in the 5,000-point era.

The weak governance structure, in which the owner monopolized management rights with a low stake and neglected shareholder returns, was the root of the "Korea Discount" and the biggest obstacle that caused people to turn away from the Korean stock market.

On the other hand, Japan emerged from a long period of stagnation by improving capital efficiency and improving its governance structure ahead of us.

As a result, as of the end of July 2025, the Nikkei 225 index had risen 99% over the previous 10 years, significantly outperforming the KOSPI's 59% increase over the same period. (p. 301)

· A solid investment strategy that is unshakable by market fluctuations.

How can we capitalize on the upcoming massive bull market? The author points out that the biggest reason many investors fail in stock investing is because they enter at excessively high prices.

In fact, analyzing the patterns of capital inflows into the stock market reveals that capital inflows tend to be concentrated when the market reaches its peak (page 80). This is due to cognitive bias.

When prices rise, fear disappears, but when prices fall, even greater fear sets in.

Also, when predicting the future, most people rely too heavily on present experiences or memories of the recent past.

The author explores the thinking of value investors to overcome cognitive biases and develop sustainable investment strategies.

The key is 'skepticism'.

Skepticism is a strict attitude toward what we believe we know.

Distinguishing between what is known and what is not, critical reflection on majority opinion, and a certain amount of counter-intuitive thinking are the attitudes that skeptics maintain.

Investors should be cool-headed skeptics in a bull market when everyone is excited, and optimistic skeptics in a bear market when everyone is depressed. (p. 358)

Furthermore, from a value investor's perspective, in an environment that is not favorable to investors, 'doing nothing' is also an investment.

Buying an unknown stock is speculation, and buying a stock without a safety margin significantly reduces the investment's odds of success.

"The courage to not act" is also an important virtue for investors. (p. 184)

· Signals of long-term sideways trading hidden behind the "invincibility" theory of the US stock market.

The U.S. stock market is directly linked to the Korean capital market, as 94% of Koreans' net purchases of foreign stocks since 2000 have been U.S. stocks.

The author warns against the "invincibility of the US stock market," which has become a widespread belief among individual investors.

This is because signs predicting a long-term sideways trend are being detected everywhere.

Historically, five signs of economic decline in the United States have repeatedly appeared: inflation, fiscal deficits, war, erosion of soft power, and the rise of growth stocks.

Whenever the United States boasted of a prolonged boom and became confident, it was followed by fiscal and military overexpansion, which ultimately resulted in the loss of economic hegemony. (p. 234)

All five of these signs are currently present in the United States.

The Biden administration's excessive spending has led to a deficit of 7% of GDP, and the United States has indirectly intervened in two wars, one in Ukraine and one in Israel.

Here, President Trump has been wielding the sword of "protectionism" since the beginning of his term, structurally undermining America's soft power.

Also, the stock market is showing strength in growth stocks consisting of large technology stocks, known as the "Magnificent 7."

These seven stocks accounted for 78% of the Nasdaq index's gains in 2024. (p. 239)

As alarm bells sound across the U.S. economy, unusual phenomena are also emerging at the corporate level.

This is the ‘destruction of capital by excellent companies.’

Among the S&P 500 index stocks representing the United States, 31 companies have negative equity, or capital impairment.

Typically, capital erosion occurs in failing companies that have accumulated losses, but these companies are different.

These are companies that have been profitable for decades, such as McDonald's (44 consecutive years of profit), Starbucks (33 consecutive years of profit), and Philip Morris (18 consecutive years of profit). (p. 248)

The decline in equity capital of these companies is the result of aggressive shareholder return policies such as dividend increases and stock buybacks and cancellations.

McDonald's and Starbucks are even borrowing money to buy back their own stock.

Why are America's best companies destroying their own equity?

ROE (return on equity) is an indicator of capital efficiency, calculated by dividing net income by equity capital.

These companies are drastically increasing their capital efficiency by increasing their ROE by reducing their equity capital, which is the denominator.

However, this type of excessive shareholder return deepens the gap between the real economy and the stock market, further widening asset inequality.

Furthermore, it even weakens the company's ability to respond to crises.

In fact, Boeing, which had been profitable for 21 consecutive years, was immediately pushed to the brink of bankruptcy after just one year of poor performance.

· Exploring the essential questions of capital markets

The author comprehensively explores the problems facing global stock markets, including those in Korea and the United States.

Where does the imbalance come from where only the asset market is booming while the real economy is sluggish? Why do only a few people benefit from long-term investments even when the stock market is booming? Is the peak of a bubble predictable? How did ETFs, once called the “saviors of the market,” fall? Is the “buy and hold” strategy still valid in the Korean stock market? Why did the Chinese stock market fail to reflect high economic growth? How is improving governance a key card to open the 5,000-point era? How can KOSDAQ, which was called a “market built on the tears of investors,” shed its bad reputation? We delve into this extensively.

The KOSPI 5,000 point mark is not simply a policy to stimulate the stock market. It is a structural barrier that the Korean capital market must overcome and a signal of an inflection point where the wealth order is being reorganized.

This book presents strategies and attitudes to overcome these barriers, offering investors insight into the order of wealth.

Turning points in history were not simple changes, but rather opportunities to fundamentally question the existing order and way of thinking.

With the arrival of a major investment revolution, the 18 insights in this book will be the key to unlocking the era of the KOSPI 5,000 point index.

GOODS SPECIFICS

- Date of issue: September 1, 2025

- Page count, weight, size: 364 pages | 590g | 150*210*21mm

- ISBN13: 9791192229683

- ISBN10: 1192229681

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)