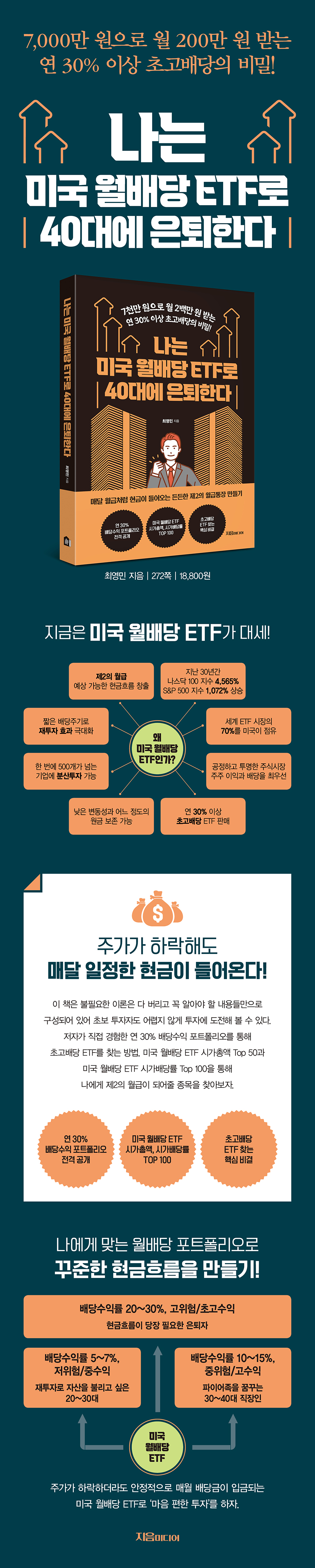

I'm retiring in my 40s with US monthly dividend ETFs.

|

Description

Book Introduction

A new trend emerging in the global financial market

Knowing just this much about US monthly dividend ETFs is all you need to invest!

This book dispenses with unnecessary theory and focuses solely on essential information, making it easy for even novice investors to begin investing. By understanding the basic concepts of ETFs and following the steps from account opening and currency exchange to buy orders and dividend confirmation, you can immediately begin investing.

By analyzing US monthly dividend ETFs, you can develop an insight into which products to invest in.

You can also create a customized investment portfolio for those who want to create a smooth cash flow by receiving monthly cash dividends or grow their assets through reinvestment.

In addition, you can find ultra-high dividend ETFs through the author's own 30% annual dividend yield portfolio, as well as various US monthly dividend ETF products through the Top 50 US monthly dividend ETFs by market capitalization and the Top 100 US monthly dividend ETFs by market dividend yield.

Knowing just this much about US monthly dividend ETFs is all you need to invest!

This book dispenses with unnecessary theory and focuses solely on essential information, making it easy for even novice investors to begin investing. By understanding the basic concepts of ETFs and following the steps from account opening and currency exchange to buy orders and dividend confirmation, you can immediately begin investing.

By analyzing US monthly dividend ETFs, you can develop an insight into which products to invest in.

You can also create a customized investment portfolio for those who want to create a smooth cash flow by receiving monthly cash dividends or grow their assets through reinvestment.

In addition, you can find ultra-high dividend ETFs through the author's own 30% annual dividend yield portfolio, as well as various US monthly dividend ETF products through the Top 50 US monthly dividend ETFs by market capitalization and the Top 100 US monthly dividend ETFs by market dividend yield.

- You can preview some of the book's contents.

Preview

index

Prologue: You Can Dream Now Too

Chapter 1: Why I Started the US Monthly Dividend ETF

01 I also wanted to become a member of the Fire Tribe

[Retirement Diary] My Father's Shabby Retirement After Going All-In on His Company

02 What can replace a salary?

[Investment Diary] A thought that occurred to me while studying commercial real estate: Wouldn't it be better to invest in dividend stocks, which offer peace of mind?

Chapter 2: A Closer Look at US Monthly Dividend ETFs

01 What is an ETF?

02 Why America?

03 Representative ETFs in the US, SPY and QQQ

04 So what is a monthly dividend ETF?

Chapter 3: Analysis of US Monthly Dividend ETFs

01 Dividend Stocks: Stock Dividends

· SCHD (Schwab US

Dividend Equity ETF), dividend yield 3.13%

02 Covered Call: Option Premium

JEPI (JPMorgan Equity Premium Income ETF), dividend yield 7.64%

JEPQ (JPMorgan Nasdaq Equity Premium Income ETF), dividend yield 9.9%

· QYLD (Global X Nasdaq 100 Covered Call ETF), dividend yield 11.05%

· NVDY (YieldMax NVDA Option Income Strategy ETF), market dividend rate 107.61%

· APLY (YieldMax APPL Option Income Strategy ETF), dividend yield 27.80%

[The Secret of High Dividends] What is a Covered Call?

[Investment Diary] NVDY's Ultra-High Dividend: Even if the Stock Price Halves in Two Years, You'll Still Profit

03 REITs: Rental income

· O (Realty Income Corporation), dividend yield 5.91%

· VNQ (Vanguard Real Estate Index Fund ETF Shares), dividend yield 3.50%

04 Bonds: Interest

· TLT (iShares 20+ Year Treasury Bond ETF), dividend yield 3.97%

· TLTW (iShares 20+ Year Treasury Bond Buywrite Strategy ETF), market dividend rate 11.51%

[US Dividend ETF Summary (12 Stocks)]

[Investment Diary] Investing in leveraged ETFs like TQQQ and SOXL requires caution.

Chapter 4: Creating an Investment Portfolio That's Right for You

Before Creating a Portfolio | Higher Dividends Mean Increased Risk

01 Fixed-term investment

Dividend yield of 20-30%, high risk/high return: "Retirees in immediate need of cash flow."

Dividend yield: 10-15%, medium risk/high return: "For office workers in their 30s and 40s who dream of becoming FIRE members."

Dividend yield: 5-7%, low risk/medium return: "For those in their 20s and 30s who want to reinvest dividends and grow their assets."

02 Accumulated investment

Investments for minor children

[Investor's Choice] Should I increase my investment amount or increase the dividend yield?

[Honest Disclosure] My Monthly Dividend ETF Investment Status

03 Useful Sites for Investing in US Monthly Dividend ETFs

Chapter 5 Successful Investment Strategies

01 The beginning is success

[Retirement Diary] I Will Become the First Penguin to Take on Challenges with Courage

02 Never be shaken

03 How should I study investment?

[Investment Diary] Books and lectures are more helpful than YouTube.

04 Successful Investment Methods

05 Portfolio Management

06 Tax/Tax Savings

Chapter 6: Follow the real-world investing

01 Open a stock account

02 Exchange money

03 Buy Order

[Investment Diary] Don't Stay Up All Night Trading US Stocks: Use the "LOC" Buy Feature

04 Check dividends

05 US Stock Trading Hours

Chapter 7: My Own Investment Secrets

01 You have to have time to think to become rich.

02 The easiest thing to solve is with money.

03 All investment results are my fault.

04 Don't put the book down for success

05 In investing, mentality is everything.

[The Final Step to Early Retirement] Ask Your Wife for Permission to Resign, Ask for Forgiveness Rather Than Permission!

Epilogue_ Finishing the Writing

Appendix 1.

Top 50 US Monthly Dividend ETFs by Market Capitalization (Base Date: August 21, 2024)

Appendix 2.

Top 100 US Monthly Dividend ETFs (Base Date: August 21, 2024)

Appendix 3.

How to Find Ultra-High Dividend (Monthly Dividend) ETFs

Chapter 1: Why I Started the US Monthly Dividend ETF

01 I also wanted to become a member of the Fire Tribe

[Retirement Diary] My Father's Shabby Retirement After Going All-In on His Company

02 What can replace a salary?

[Investment Diary] A thought that occurred to me while studying commercial real estate: Wouldn't it be better to invest in dividend stocks, which offer peace of mind?

Chapter 2: A Closer Look at US Monthly Dividend ETFs

01 What is an ETF?

02 Why America?

03 Representative ETFs in the US, SPY and QQQ

04 So what is a monthly dividend ETF?

Chapter 3: Analysis of US Monthly Dividend ETFs

01 Dividend Stocks: Stock Dividends

· SCHD (Schwab US

Dividend Equity ETF), dividend yield 3.13%

02 Covered Call: Option Premium

JEPI (JPMorgan Equity Premium Income ETF), dividend yield 7.64%

JEPQ (JPMorgan Nasdaq Equity Premium Income ETF), dividend yield 9.9%

· QYLD (Global X Nasdaq 100 Covered Call ETF), dividend yield 11.05%

· NVDY (YieldMax NVDA Option Income Strategy ETF), market dividend rate 107.61%

· APLY (YieldMax APPL Option Income Strategy ETF), dividend yield 27.80%

[The Secret of High Dividends] What is a Covered Call?

[Investment Diary] NVDY's Ultra-High Dividend: Even if the Stock Price Halves in Two Years, You'll Still Profit

03 REITs: Rental income

· O (Realty Income Corporation), dividend yield 5.91%

· VNQ (Vanguard Real Estate Index Fund ETF Shares), dividend yield 3.50%

04 Bonds: Interest

· TLT (iShares 20+ Year Treasury Bond ETF), dividend yield 3.97%

· TLTW (iShares 20+ Year Treasury Bond Buywrite Strategy ETF), market dividend rate 11.51%

[US Dividend ETF Summary (12 Stocks)]

[Investment Diary] Investing in leveraged ETFs like TQQQ and SOXL requires caution.

Chapter 4: Creating an Investment Portfolio That's Right for You

Before Creating a Portfolio | Higher Dividends Mean Increased Risk

01 Fixed-term investment

Dividend yield of 20-30%, high risk/high return: "Retirees in immediate need of cash flow."

Dividend yield: 10-15%, medium risk/high return: "For office workers in their 30s and 40s who dream of becoming FIRE members."

Dividend yield: 5-7%, low risk/medium return: "For those in their 20s and 30s who want to reinvest dividends and grow their assets."

02 Accumulated investment

Investments for minor children

[Investor's Choice] Should I increase my investment amount or increase the dividend yield?

[Honest Disclosure] My Monthly Dividend ETF Investment Status

03 Useful Sites for Investing in US Monthly Dividend ETFs

Chapter 5 Successful Investment Strategies

01 The beginning is success

[Retirement Diary] I Will Become the First Penguin to Take on Challenges with Courage

02 Never be shaken

03 How should I study investment?

[Investment Diary] Books and lectures are more helpful than YouTube.

04 Successful Investment Methods

05 Portfolio Management

06 Tax/Tax Savings

Chapter 6: Follow the real-world investing

01 Open a stock account

02 Exchange money

03 Buy Order

[Investment Diary] Don't Stay Up All Night Trading US Stocks: Use the "LOC" Buy Feature

04 Check dividends

05 US Stock Trading Hours

Chapter 7: My Own Investment Secrets

01 You have to have time to think to become rich.

02 The easiest thing to solve is with money.

03 All investment results are my fault.

04 Don't put the book down for success

05 In investing, mentality is everything.

[The Final Step to Early Retirement] Ask Your Wife for Permission to Resign, Ask for Forgiveness Rather Than Permission!

Epilogue_ Finishing the Writing

Appendix 1.

Top 50 US Monthly Dividend ETFs by Market Capitalization (Base Date: August 21, 2024)

Appendix 2.

Top 100 US Monthly Dividend ETFs (Base Date: August 21, 2024)

Appendix 3.

How to Find Ultra-High Dividend (Monthly Dividend) ETFs

Detailed image

Into the book

It seemed obvious that I would never become rich as a salaried worker and that I would only be able to barely maintain my current lifestyle.

So how can I escape the salaryman trap and dream of becoming rich? No matter how much I thought about it, there was no alternative.

An alternative to your salary after leaving your job….

It seemed like the outside of the company was full of invisible dangers.

What could replace the steady salary I'd been receiving? With no alternative, I just gave up and kept thinking, "I can't go on like this."

I started creating my own retirement scenario four years ago, thinking that I couldn't live like this and die.

I started watching successful people's YouTube videos and started writing on my own blog.

Then, the dim future began to appear little by little, and results began to appear.

--- p.25

Domestic companies are also very stingy with dividends.

When a company makes a profit, it often hoards it as cash instead of paying dividends to shareholders.

However, this does not mean that we actively invest in product development or research.

There are many companies that are more focused on real estate investment than on increasing corporate value, and I believe this is not an action that takes shareholder value into consideration.

On the other hand, American companies actively pay dividends to shareholders.

The owners of a company are not a small number of executives, but a large number of shareholders, and it is taken for granted that the company's performance is reported to shareholders without lies.

Dividends paid also increase every year, and in the United States, there are many companies that have continuously increased their dividends for more than 50 years, such as Coca-Cola and P&G.

--- p.47

“America has a short history, but there has never been an incubator like the United States anywhere in the world.

“America lets people reach their full potential,” said Warren Buffett.

The United States holds the lead in the global economy, and if the U.S. economy is not doing well, it can stimulate the economy by releasing dollars through interest rate cuts.

The United States has an economic system that can withstand constant dollar printing! Its power is expected to last for at least 50 years.

--- p.53

When it comes to US ETFs, the most well-known are SPY and QQQ, which are the most traded ETFs among Koreans.

Although the dividend yield is low at 0.5-1%, it is an excellent stock for long-term investment purposes of 10 years or more, as it tracks the U.S. S&P 500 and Nasdaq 100 indices, which have been trending upward over the long term.

--- p.63

SCHD is an ETF that many retail investors invest in, and they invest primarily based on dividend growth rather than dividend yield.

The dividend yield is below expectations at 3%, but the dividend growth rate is high at around 11%, meaning that the dividend increases by 11% every year.

This ETF aims to increase dividends by improving performance every year, and thus, it can capture both dividends and stock price gains.

--- p.86

APLY has a lower dividend yield than NVDY, TSLY, and CONY, but its stock price volatility is relatively low, making it more stable.

Still, the dividend yield exceeds 27% per year.

This ETF generates income (option premium) by selling call and put options, and also earns interest income by investing in government bonds.

Meanwhile, APLY also fell significantly due to the decline in Apple's stock price caused by the loss of business momentum due to the withdrawal of the Apple Car business and sluggish sales in China.

However, as Apple's stock price has significant room for growth in the future, including the recent announcement of an artificial intelligence (AI) project, APLY's outlook also appears bright.

--- p.102

No matter how strong your resolve, how strong your goals, and how strong your dreams are, they are all useless if you don't put them into action.

But putting it into practice is truly difficult.

People are forced to do things they normally wouldn't do, and when they accept change and put that change into action, they experience a lot of stress.

Because environments and behaviors change.

There are many people who miss opportunities by judging this and that before even starting, and end up giving up like that.

Instead of trying to do too many things right away, let's start with small and easy things and work our way up.

So how can I escape the salaryman trap and dream of becoming rich? No matter how much I thought about it, there was no alternative.

An alternative to your salary after leaving your job….

It seemed like the outside of the company was full of invisible dangers.

What could replace the steady salary I'd been receiving? With no alternative, I just gave up and kept thinking, "I can't go on like this."

I started creating my own retirement scenario four years ago, thinking that I couldn't live like this and die.

I started watching successful people's YouTube videos and started writing on my own blog.

Then, the dim future began to appear little by little, and results began to appear.

--- p.25

Domestic companies are also very stingy with dividends.

When a company makes a profit, it often hoards it as cash instead of paying dividends to shareholders.

However, this does not mean that we actively invest in product development or research.

There are many companies that are more focused on real estate investment than on increasing corporate value, and I believe this is not an action that takes shareholder value into consideration.

On the other hand, American companies actively pay dividends to shareholders.

The owners of a company are not a small number of executives, but a large number of shareholders, and it is taken for granted that the company's performance is reported to shareholders without lies.

Dividends paid also increase every year, and in the United States, there are many companies that have continuously increased their dividends for more than 50 years, such as Coca-Cola and P&G.

--- p.47

“America has a short history, but there has never been an incubator like the United States anywhere in the world.

“America lets people reach their full potential,” said Warren Buffett.

The United States holds the lead in the global economy, and if the U.S. economy is not doing well, it can stimulate the economy by releasing dollars through interest rate cuts.

The United States has an economic system that can withstand constant dollar printing! Its power is expected to last for at least 50 years.

--- p.53

When it comes to US ETFs, the most well-known are SPY and QQQ, which are the most traded ETFs among Koreans.

Although the dividend yield is low at 0.5-1%, it is an excellent stock for long-term investment purposes of 10 years or more, as it tracks the U.S. S&P 500 and Nasdaq 100 indices, which have been trending upward over the long term.

--- p.63

SCHD is an ETF that many retail investors invest in, and they invest primarily based on dividend growth rather than dividend yield.

The dividend yield is below expectations at 3%, but the dividend growth rate is high at around 11%, meaning that the dividend increases by 11% every year.

This ETF aims to increase dividends by improving performance every year, and thus, it can capture both dividends and stock price gains.

--- p.86

APLY has a lower dividend yield than NVDY, TSLY, and CONY, but its stock price volatility is relatively low, making it more stable.

Still, the dividend yield exceeds 27% per year.

This ETF generates income (option premium) by selling call and put options, and also earns interest income by investing in government bonds.

Meanwhile, APLY also fell significantly due to the decline in Apple's stock price caused by the loss of business momentum due to the withdrawal of the Apple Car business and sluggish sales in China.

However, as Apple's stock price has significant room for growth in the future, including the recent announcement of an artificial intelligence (AI) project, APLY's outlook also appears bright.

--- p.102

No matter how strong your resolve, how strong your goals, and how strong your dreams are, they are all useless if you don't put them into action.

But putting it into practice is truly difficult.

People are forced to do things they normally wouldn't do, and when they accept change and put that change into action, they experience a lot of stress.

Because environments and behaviors change.

There are many people who miss opportunities by judging this and that before even starting, and end up giving up like that.

Instead of trying to do too many things right away, let's start with small and easy things and work our way up.

--- p.169

Publisher's Review

US monthly dividend ETFs are all the rage these days!

The domestic ETF market is growing rapidly. The rapid growth of ETFs is evidence of their attractiveness.

Investors are now focusing on US monthly dividend ETFs and are buying a lot of them, such as JEPI and QYLD.

Domestic asset management companies are also competing to create dividend ETFs and list them on the domestic stock market. ETFs offer easy access even for novice investors due to their diversification and low volatility.

It is cheaper than funds and allows for real-time trading.

Also, you don't have to spend time analyzing companies like you do when investing in stocks.

And the biggest advantage is that you can earn dividend income.

Types of US monthly dividend ETFs

· ETFs that invest in dividend stocks: You can earn dividend income as well as capital gains from rising stock prices.

· ETFs that employ a covered call strategy: This strategy involves buying stocks and simultaneously selling call options, allowing for high call option premiums. Covered call ETFs for individual stocks, such as NVDY and TSLY, have recently seen dividend yields approaching 50%.

· ETFs that invest in REITs: These funds are raised from investors by issuing stocks or securities, and then invested in real estate, receiving dividends from the operating profits.

· ETFs that invest in bonds: These are relatively safe assets compared to stocks, providing stable interest income.

Why US Monthly Dividend ETFs?

Over the past 30 years, the Nasdaq 100 Index has risen 4,565%, and the S&P 500 Index has risen 1,072%.

In contrast, South Korea's KOSPI index rose 170%.

The U.S. accounts for 70% of the global ETF market, and the U.S. stock market operates fairly and transparently, prioritizing shareholder profits and dividends.

US monthly dividend ETFs, some of which pay ultra-high dividends of over 30% annually, are attracting significant interest from investors seeking monthly cash flow equivalent to their monthly salary. ETFs allow for diversified investments across over 500 companies at once, and their low volatility allows for a certain degree of principal preservation.

Unlike stock investing, there is no need to spend time analyzing companies.

Why US Dividend ETFs Are So Popular

· Predictable cash flow: Monthly dividend ETFs provide monthly cash dividends, making them ideal for retirement savings or as a hedge against rising living expenses.

· High reinvestment effect with short dividend cycle: Young investors in their 20s and 30s can enjoy long-term compound interest by reinvesting monthly dividends.

· Low volatility allows for a certain level of capital preservation: Compared to individual stocks, low volatility allows for a stable monthly cash flow.

· There are many monthly dividend ETFs that pay high dividends of 10% or more: Without considering taxes, a simple calculation shows that if you invest 100 million won, you will receive 830,000 won in dividends every month.

Even beginner investors can invest with ease

Create a second salary with US monthly dividend ETFs.

Create a steady cash flow with a monthly dividend portfolio that suits you.

In fact, it suggests a customized portfolio based on the stocks in which the author has invested.

Retirees in immediate cash flow need a high-risk/high-return portfolio with a dividend yield of 20-30%.

· Office workers in their 30s and 40s who dream of becoming FIRE members: Dividend yield of 10-15%, medium-risk/high-return portfolio

· Those in their 20s and 30s who want to increase their assets by reinvesting dividends: A low-risk/mid-return portfolio with a dividend yield of 5-7%.

Dividend is 'investment amount × dividend rate'.

To increase your monthly dividends, you can either increase the amount you invest or invest in stocks with high dividend yields.

But both of these have risks.

The important thing is to create an investment portfolio that suits your circumstances and then adjust it accordingly to increase your returns.

US monthly dividend ETFs offer a "peace of mind" investment method, with stable monthly dividend payments even when stock prices decline.

The key to investing is to act now.

Let's delve into the world of US monthly dividend ETFs through this book.

The domestic ETF market is growing rapidly. The rapid growth of ETFs is evidence of their attractiveness.

Investors are now focusing on US monthly dividend ETFs and are buying a lot of them, such as JEPI and QYLD.

Domestic asset management companies are also competing to create dividend ETFs and list them on the domestic stock market. ETFs offer easy access even for novice investors due to their diversification and low volatility.

It is cheaper than funds and allows for real-time trading.

Also, you don't have to spend time analyzing companies like you do when investing in stocks.

And the biggest advantage is that you can earn dividend income.

Types of US monthly dividend ETFs

· ETFs that invest in dividend stocks: You can earn dividend income as well as capital gains from rising stock prices.

· ETFs that employ a covered call strategy: This strategy involves buying stocks and simultaneously selling call options, allowing for high call option premiums. Covered call ETFs for individual stocks, such as NVDY and TSLY, have recently seen dividend yields approaching 50%.

· ETFs that invest in REITs: These funds are raised from investors by issuing stocks or securities, and then invested in real estate, receiving dividends from the operating profits.

· ETFs that invest in bonds: These are relatively safe assets compared to stocks, providing stable interest income.

Why US Monthly Dividend ETFs?

Over the past 30 years, the Nasdaq 100 Index has risen 4,565%, and the S&P 500 Index has risen 1,072%.

In contrast, South Korea's KOSPI index rose 170%.

The U.S. accounts for 70% of the global ETF market, and the U.S. stock market operates fairly and transparently, prioritizing shareholder profits and dividends.

US monthly dividend ETFs, some of which pay ultra-high dividends of over 30% annually, are attracting significant interest from investors seeking monthly cash flow equivalent to their monthly salary. ETFs allow for diversified investments across over 500 companies at once, and their low volatility allows for a certain degree of principal preservation.

Unlike stock investing, there is no need to spend time analyzing companies.

Why US Dividend ETFs Are So Popular

· Predictable cash flow: Monthly dividend ETFs provide monthly cash dividends, making them ideal for retirement savings or as a hedge against rising living expenses.

· High reinvestment effect with short dividend cycle: Young investors in their 20s and 30s can enjoy long-term compound interest by reinvesting monthly dividends.

· Low volatility allows for a certain level of capital preservation: Compared to individual stocks, low volatility allows for a stable monthly cash flow.

· There are many monthly dividend ETFs that pay high dividends of 10% or more: Without considering taxes, a simple calculation shows that if you invest 100 million won, you will receive 830,000 won in dividends every month.

Even beginner investors can invest with ease

Create a second salary with US monthly dividend ETFs.

Create a steady cash flow with a monthly dividend portfolio that suits you.

In fact, it suggests a customized portfolio based on the stocks in which the author has invested.

Retirees in immediate cash flow need a high-risk/high-return portfolio with a dividend yield of 20-30%.

· Office workers in their 30s and 40s who dream of becoming FIRE members: Dividend yield of 10-15%, medium-risk/high-return portfolio

· Those in their 20s and 30s who want to increase their assets by reinvesting dividends: A low-risk/mid-return portfolio with a dividend yield of 5-7%.

Dividend is 'investment amount × dividend rate'.

To increase your monthly dividends, you can either increase the amount you invest or invest in stocks with high dividend yields.

But both of these have risks.

The important thing is to create an investment portfolio that suits your circumstances and then adjust it accordingly to increase your returns.

US monthly dividend ETFs offer a "peace of mind" investment method, with stable monthly dividend payments even when stock prices decline.

The key to investing is to act now.

Let's delve into the world of US monthly dividend ETFs through this book.

GOODS SPECIFICS

- Date of issue: September 27, 2024

- Page count, weight, size: 272 pages | 370g | 152*225*18mm

- ISBN13: 9791193780084

- ISBN10: 119378008X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)