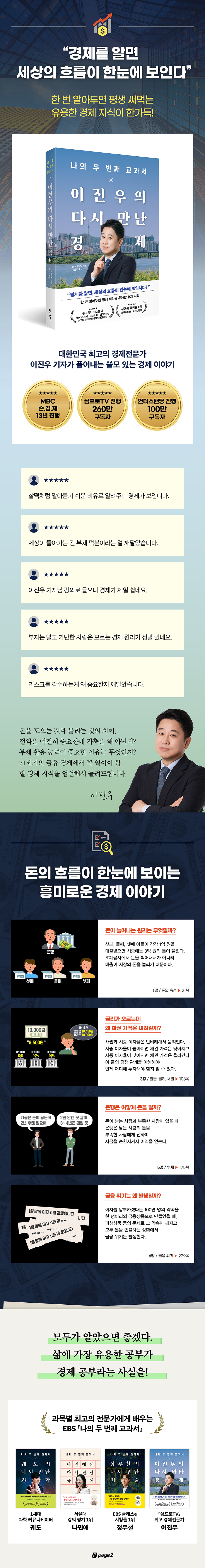

My Second Textbook X Lee Jin-woo's Reunited Economy

|

Description

Book Introduction

*** Host of MBC Radio's "Economy in Your Hands" for 13 years ***

*** 2.6 million subscribers 〈Sampro TV〉 famous host 'Lee Pro' ***

*** 1 million subscribers 〈Understanding〉's top economic expert ***

Korea's top economic expert

Easy-to-understand economic stories from reporter Lee Jin-woo

“If you know the economy, you can see what you didn’t see before.

“You can see the flow of the world at a glance!”

It's full of useful economic knowledge that you can use for the rest of your life once you learn it!

What's the economic knowledge that separates the rich from the poor? The methods of accumulating money and the methods of growing it are completely different.

We need to understand why the world has become more about being called than saving, and understand the contradictory meaning of the statement that while saving is essential for becoming rich, saving alone cannot make you rich.

To do so, we need to understand the 21st century's finance-centric economy, which is completely different from the 19th century economy and therefore cannot be learned from high school economics textbooks that are written based on past theories.

The rich know quite a bit, but the poor may not know until they die.

This book took a long time to select the topics that best fit that question.

Let's take a look at an economic story that may be awkward and a bit unfamiliar, but is closer to the truth.

*** 2.6 million subscribers 〈Sampro TV〉 famous host 'Lee Pro' ***

*** 1 million subscribers 〈Understanding〉's top economic expert ***

Korea's top economic expert

Easy-to-understand economic stories from reporter Lee Jin-woo

“If you know the economy, you can see what you didn’t see before.

“You can see the flow of the world at a glance!”

It's full of useful economic knowledge that you can use for the rest of your life once you learn it!

What's the economic knowledge that separates the rich from the poor? The methods of accumulating money and the methods of growing it are completely different.

We need to understand why the world has become more about being called than saving, and understand the contradictory meaning of the statement that while saving is essential for becoming rich, saving alone cannot make you rich.

To do so, we need to understand the 21st century's finance-centric economy, which is completely different from the 19th century economy and therefore cannot be learned from high school economics textbooks that are written based on past theories.

The rich know quite a bit, but the poor may not know until they die.

This book took a long time to select the topics that best fit that question.

Let's take a look at an economic story that may be awkward and a bit unfamiliar, but is closer to the truth.

- You can preview some of the book's contents.

Preview

index

prolog

PART 1 The Nature of Money: It Keeps Growing, and Must Keep Growing

The Secret to Growing Money: Three Faucets

- First faucet: private banks

- Second faucet: the government and the Bank of Korea

- Third faucet: Foreigner

(Surprise Investment Tip: Does the value of money always decrease when the amount of money increases?)

If money doesn't increase, the biggest victims are the people.

- Can you tolerate the bad?

Why inflation isn't a major problem in the US

(Surprise Investment Tip: Investing is all about riding the waves of money and riding on other people's shoulders.)

PART 2: RISK AND PORTFOLIO: CAPTURE VOLATILITY

'Meaningful' Questions About Stock and Real Estate Investments

- Differences related to volatility

- Important factors in pricing decisions

The cycle of hell that you get caught up in at some point

- The psychology of a person who always fails

- Highly volatile investments always lead to bad results.

- Investment returns come only from waiting.

- What does high risk, high return mean?

- The rules of the game that I win 100% of the time

- The only thing we can trust

(Surprise Investment Tip: Morgan Housel's Virtual Investment Game)

PART 3 Exchange Rates, Interest Rates, and Bonds: The Fluctuating World of Money

The world's easiest explanation of bonds and interest rates

- Current money and future money

- Relationship between bond prices and market interest rates

Judging the economy through the relationship between bonds and interest rates

- Why does a hungry Cheolsu want to do the dishes?

- Why we let the central bank set interest rates

A perspective that sees through the fluctuating exchange rate

- Major factors affecting exchange rate fluctuations

- What happens when the exchange rate doesn't change

- Why aren't interest rates the same in all countries around the world?

PART 4 REAL ESTATE: The Birth of the Apartment Myth

South Korea's apartment market is unprecedented worldwide.

- Government-led apartment supply

- The flag held by the weak operator

- Why do all apartments in our country look the same?

- Things to think about when listening to real estate news

Various factors driving the rise and fall of apartment prices

- Why are apartments that are just lumps of cement so expensive?

- When supply is high, prices fall.

The Secret of Interest Rates, Exports, and Housing Prices

Why Korea Can Maintain Low Interest Rates

- Then, will the housing prices in poor countries be cheap?

(Surprise Investment TIP: In fact, there is little correlation between money supply and real estate prices.)

PART 5 Debt: The Engine of the Modern Economic System

The Role of Debt in Solving Economic Problems

- What is the bank's core profit model?

- If you think about it, the world is 100% made up of debt.

- A dramatic solution to the problem

Good Debt That Can Change My Life

- Now or in 10 years?

- Buying future time with debt

- Risk of unbearable volatility

Is South Korea doomed by household debt?

- There's no need to be afraid.

- Why household debt is bound to be high

(Surprise Investment Tip: A Dilemma Without a Correct Answer: The Fate of Debt)

PART 6 The Financial Crisis: What is a Crisis and What to Watch for?

What defines a crisis in economics and finance?

- The moment the bank becomes suspicious

- The beginning of a crisis regardless of the size of the news

The questionable structure the bank is in

- The birth of a bank

- Reserve requirement ratio and capital adequacy ratio

(Surprise Investment Tip: Which is Worse: Banks or Loans?)

The development of the financial crisis as seen in the cases of the United States and Korea

- Good intentions at first

- IMF, foreign exchange crisis caused by exchange rate fluctuations

(Surprise Investment Tips: Signs of an Impending Financial Crisis)

PART 7 The Secret of a Prosperous Country: What Will I Do?

Why on earth do rich countries become rich?

- How can we become a prosperous country?

- There is no single right answer.

- Could a second Republic of Korea emerge?

- It's just that China was late in reforming and opening up...

The Reasons Why Britain Is a Prosperous Country

- Britain had to risk its life for a tree

- The overwhelming efficiency of improved steam engines

- The secret of a prosperous country created by interest

Surprising Investment Tips: Achievements Made Through Overcoming Uncomfortable Environments

The Secret of the Rich Country: Finally, Back to Being Human…

- When development stops and growth is limited

- Willingness and incentive to do business

(Surprise Investment Tip: Can South Korea Sustain Economic Development?)

PART 8 The Nature of Games and the Paradox of Choice: For a Wiser Life

The Game of Trading: The Surprising Rules That Apply

- Disgust at the high prices of street vendors

- What should I eat at the buffet?

- Wouldn't it be okay to just convince the customer?

(The essence of the game applied to communication with the Surprise Investment TIP company)

The rules of the game inherent in financial investment

- An unexpected new law

- Benefits of not opening an account

Why flipping a coin is the smartest choice

- Do I have to find something I love to do in life?

- It must have a value of at least 49

- Why the bank asks me to choose

Why Risky Choices Aren't Risky

- Income of people who left the village

- Why do Pakistanis pretend to be Indians?

Epilogue

PART 1 The Nature of Money: It Keeps Growing, and Must Keep Growing

The Secret to Growing Money: Three Faucets

- First faucet: private banks

- Second faucet: the government and the Bank of Korea

- Third faucet: Foreigner

(Surprise Investment Tip: Does the value of money always decrease when the amount of money increases?)

If money doesn't increase, the biggest victims are the people.

- Can you tolerate the bad?

Why inflation isn't a major problem in the US

(Surprise Investment Tip: Investing is all about riding the waves of money and riding on other people's shoulders.)

PART 2: RISK AND PORTFOLIO: CAPTURE VOLATILITY

'Meaningful' Questions About Stock and Real Estate Investments

- Differences related to volatility

- Important factors in pricing decisions

The cycle of hell that you get caught up in at some point

- The psychology of a person who always fails

- Highly volatile investments always lead to bad results.

- Investment returns come only from waiting.

- What does high risk, high return mean?

- The rules of the game that I win 100% of the time

- The only thing we can trust

(Surprise Investment Tip: Morgan Housel's Virtual Investment Game)

PART 3 Exchange Rates, Interest Rates, and Bonds: The Fluctuating World of Money

The world's easiest explanation of bonds and interest rates

- Current money and future money

- Relationship between bond prices and market interest rates

Judging the economy through the relationship between bonds and interest rates

- Why does a hungry Cheolsu want to do the dishes?

- Why we let the central bank set interest rates

A perspective that sees through the fluctuating exchange rate

- Major factors affecting exchange rate fluctuations

- What happens when the exchange rate doesn't change

- Why aren't interest rates the same in all countries around the world?

PART 4 REAL ESTATE: The Birth of the Apartment Myth

South Korea's apartment market is unprecedented worldwide.

- Government-led apartment supply

- The flag held by the weak operator

- Why do all apartments in our country look the same?

- Things to think about when listening to real estate news

Various factors driving the rise and fall of apartment prices

- Why are apartments that are just lumps of cement so expensive?

- When supply is high, prices fall.

The Secret of Interest Rates, Exports, and Housing Prices

Why Korea Can Maintain Low Interest Rates

- Then, will the housing prices in poor countries be cheap?

(Surprise Investment TIP: In fact, there is little correlation between money supply and real estate prices.)

PART 5 Debt: The Engine of the Modern Economic System

The Role of Debt in Solving Economic Problems

- What is the bank's core profit model?

- If you think about it, the world is 100% made up of debt.

- A dramatic solution to the problem

Good Debt That Can Change My Life

- Now or in 10 years?

- Buying future time with debt

- Risk of unbearable volatility

Is South Korea doomed by household debt?

- There's no need to be afraid.

- Why household debt is bound to be high

(Surprise Investment Tip: A Dilemma Without a Correct Answer: The Fate of Debt)

PART 6 The Financial Crisis: What is a Crisis and What to Watch for?

What defines a crisis in economics and finance?

- The moment the bank becomes suspicious

- The beginning of a crisis regardless of the size of the news

The questionable structure the bank is in

- The birth of a bank

- Reserve requirement ratio and capital adequacy ratio

(Surprise Investment Tip: Which is Worse: Banks or Loans?)

The development of the financial crisis as seen in the cases of the United States and Korea

- Good intentions at first

- IMF, foreign exchange crisis caused by exchange rate fluctuations

(Surprise Investment Tips: Signs of an Impending Financial Crisis)

PART 7 The Secret of a Prosperous Country: What Will I Do?

Why on earth do rich countries become rich?

- How can we become a prosperous country?

- There is no single right answer.

- Could a second Republic of Korea emerge?

- It's just that China was late in reforming and opening up...

The Reasons Why Britain Is a Prosperous Country

- Britain had to risk its life for a tree

- The overwhelming efficiency of improved steam engines

- The secret of a prosperous country created by interest

Surprising Investment Tips: Achievements Made Through Overcoming Uncomfortable Environments

The Secret of the Rich Country: Finally, Back to Being Human…

- When development stops and growth is limited

- Willingness and incentive to do business

(Surprise Investment Tip: Can South Korea Sustain Economic Development?)

PART 8 The Nature of Games and the Paradox of Choice: For a Wiser Life

The Game of Trading: The Surprising Rules That Apply

- Disgust at the high prices of street vendors

- What should I eat at the buffet?

- Wouldn't it be okay to just convince the customer?

(The essence of the game applied to communication with the Surprise Investment TIP company)

The rules of the game inherent in financial investment

- An unexpected new law

- Benefits of not opening an account

Why flipping a coin is the smartest choice

- Do I have to find something I love to do in life?

- It must have a value of at least 49

- Why the bank asks me to choose

Why Risky Choices Aren't Risky

- Income of people who left the village

- Why do Pakistanis pretend to be Indians?

Epilogue

Detailed image

Into the book

If you open the table of contents of a high school economics textbook, you will find the following contents.

Production and consumption, characteristics of a market economy, supply and demand and prices, the three elements of the national economy, the necessity and principles of trade, and South Korea in the world.

Perhaps that could be the case, since the educational goal of high school economics textbooks is to foster ‘responsible democratic citizens.’

But I also wonder if the goal of our lives as adults isn't just to be responsible democratic citizens.

Let's face our desires more honestly.

We want to make money, have a nice house and a nice car.

I want to be successful in stock investing, but I don't want to live a poor and difficult life.

I want to earn more money than others by working less hours, and I also want to avoid suddenly losing a lot of money and becoming poor one day.

In fact, it seems that only after things have become like this will we be able to fulfill our responsibilities as democratic citizens.

So what can we learn to do this?

--- pp.10-11, from "Prologue"

This is why banks are the 'money faucets'.

This is because as customers use banks and take out loans, their money continues to grow.

Now, when we hear the news that household bank loans increased by 5 trillion won last month, instead of thinking, "Household debt is increasing, so this is a big problem," we should think, "Oh, that means 5 trillion won more money has been released into the market."

We need to change our thinking to avoid the common misconception that "household debt continues to increase, so something big will happen soon, and people will be unable to buy houses due to the burden of debt, so house prices will fall."

If household debt continues to increase, it may become a burden in the long term, but in the short term, the increased amount of money released into the market will actually have a positive effect on housing prices.

--- p.23, from “PART 1 The Nature of Money: It Continues to Increase, and Must Increase”

The example of bond prices rising as market interest rates fall, as explained above, can be summarized as the fact that market interest rates and bond prices are inversely proportional.

Hearing this, you might wonder, 'Why are interest rates rising but bond prices falling?'

"Bonds are interest-bearing financial instruments, so doesn't rising interest rates mean the bonds are paying more? But why are bond prices falling? They should be rising instead." Many people think this way.

However, what we must not forget during this process is that the interest rate of a bond is already set when it is born, so no matter how much the market interest rate changes in the meantime, the interest rate written on the bond does not change.

When interest rates rise, it simply means that market interest rates are rising, not that the interest rate written on the bond is rising or falling.

Bonds are already set in stone at birth and remain unchanged until death.

--- p.105, from “PART 3 Exchange Rates, Interest Rates, and Bonds: The Fluctuating World of Money”

We say we deposited money in a bank, but from the bank's perspective, it is money that must be returned later, so in reality, the entire deposit is a liability.

If banks don't take on debt, the banking system won't function.

When someone borrows money from a bank, that money becomes that person's debt.

But if there were no such debt, no one would have any reason to deposit money, and the amount of money in circulation would always remain constant.

Because when someone borrows money from a bank, that amount of money is added to the market.

If you think about it, all the money that exists on Earth today was created based on someone's debt.

Currency, also known as cash, is a debt owed to the people by the central bank that issued the currency.

It's not like that now, but in the past, if you went to the bank with cash and asked to exchange it for gold, they would give it to you.

The essence of the currency called 10,000 won is a certificate that promises, "If you bring this certificate to the central bank at any time, I will give you gold or something similar worth 10,000 won." From the central bank's perspective, it is a debt that can be demanded for repayment at any time.

After the gold standard ends, we guarantee that you will be able to pay your taxes with this certificate at any time.

The value of this instrument is eternal as long as the system of mandatory tax payment is maintained,' the collateral for the debt has only changed slightly.

--- p.177, from "PART 5 Debt: The Engine of the Modern Economic System"

But as we do this, we are now running out of money.

Living expenses are running low, but you can't afford to not buy gasoline or go grocery shopping, so you're in a situation where you can't pay off your loan interest.

And this wasn't just happening in small towns.

As gasoline prices rose across the United States, similar events occurred simultaneously across the country.

And finally, what I was afraid of happened.

Across the United States, millions of people simultaneously defaulted on their subprime mortgage loans.

With this massive delinquency situation unfolding, the emergency lights have been turned on.

Problems began to arise with the derivatives sold while thinking, "Surely millions of people wouldn't be able to pay their interest at the same time?"

Because no one knew who had invested in these derivatives, people began to suspect each other, and because they were suspicious of each other, no one lent money.

In an instant, credit was paralyzed, and with the realization that even the most robust companies could go bankrupt in this situation, people became suspicious of banks and rushed to withdraw their cash.

This is the '2008 subprime mortgage crisis', an event that caused chaos around the world.

--- p.233, from “PART 6 Financial Crisis: What is a Crisis and What Should We Watch for?”

The reason we struggle and struggle when faced with the act of choice is because we are compelled to choose the better of the two.

But the 'essence' of the game of choice is not about picking the better one.

In an environment full of uncertainty, how can we always pick out the good?

Even if a better one is chosen in the end, it is just a result of luck.

The 'essence' of the game of choice we play is not making the best choice, but working afterwards to make the outcome of that choice the best outcome for me.

So, when we make a choice, what we should do is not pray that this choice will be the right one, but rather check to see if there are any considerations we may have missed when making the choice.

If there is no such thing, the way to play the game of choice well is to choose calmly and accept the results calmly.

--- p.313, from “PART 8 The Essence of Games and the Paradox of Choice: For a Wiser Life”

Just as the Creator cried out “Let there be light” when creating the world, the economic system of modern society began one day with a sudden cry, “Let there be debt.”

The reason why the economic development that humanity has been unable to achieve for thousands of years has been so dazzling in the last few hundred years is because it has become possible to borrow money from the market, or even if there is no money in the market, to borrow money from a bank when I need it.

Just as coffee is neither a medicine nor a poison, neither is debt.

The difference is that the world would run just fine without coffee, but not without debt.

The moment the debt disappears, the world ends.

Production and consumption, characteristics of a market economy, supply and demand and prices, the three elements of the national economy, the necessity and principles of trade, and South Korea in the world.

Perhaps that could be the case, since the educational goal of high school economics textbooks is to foster ‘responsible democratic citizens.’

But I also wonder if the goal of our lives as adults isn't just to be responsible democratic citizens.

Let's face our desires more honestly.

We want to make money, have a nice house and a nice car.

I want to be successful in stock investing, but I don't want to live a poor and difficult life.

I want to earn more money than others by working less hours, and I also want to avoid suddenly losing a lot of money and becoming poor one day.

In fact, it seems that only after things have become like this will we be able to fulfill our responsibilities as democratic citizens.

So what can we learn to do this?

--- pp.10-11, from "Prologue"

This is why banks are the 'money faucets'.

This is because as customers use banks and take out loans, their money continues to grow.

Now, when we hear the news that household bank loans increased by 5 trillion won last month, instead of thinking, "Household debt is increasing, so this is a big problem," we should think, "Oh, that means 5 trillion won more money has been released into the market."

We need to change our thinking to avoid the common misconception that "household debt continues to increase, so something big will happen soon, and people will be unable to buy houses due to the burden of debt, so house prices will fall."

If household debt continues to increase, it may become a burden in the long term, but in the short term, the increased amount of money released into the market will actually have a positive effect on housing prices.

--- p.23, from “PART 1 The Nature of Money: It Continues to Increase, and Must Increase”

The example of bond prices rising as market interest rates fall, as explained above, can be summarized as the fact that market interest rates and bond prices are inversely proportional.

Hearing this, you might wonder, 'Why are interest rates rising but bond prices falling?'

"Bonds are interest-bearing financial instruments, so doesn't rising interest rates mean the bonds are paying more? But why are bond prices falling? They should be rising instead." Many people think this way.

However, what we must not forget during this process is that the interest rate of a bond is already set when it is born, so no matter how much the market interest rate changes in the meantime, the interest rate written on the bond does not change.

When interest rates rise, it simply means that market interest rates are rising, not that the interest rate written on the bond is rising or falling.

Bonds are already set in stone at birth and remain unchanged until death.

--- p.105, from “PART 3 Exchange Rates, Interest Rates, and Bonds: The Fluctuating World of Money”

We say we deposited money in a bank, but from the bank's perspective, it is money that must be returned later, so in reality, the entire deposit is a liability.

If banks don't take on debt, the banking system won't function.

When someone borrows money from a bank, that money becomes that person's debt.

But if there were no such debt, no one would have any reason to deposit money, and the amount of money in circulation would always remain constant.

Because when someone borrows money from a bank, that amount of money is added to the market.

If you think about it, all the money that exists on Earth today was created based on someone's debt.

Currency, also known as cash, is a debt owed to the people by the central bank that issued the currency.

It's not like that now, but in the past, if you went to the bank with cash and asked to exchange it for gold, they would give it to you.

The essence of the currency called 10,000 won is a certificate that promises, "If you bring this certificate to the central bank at any time, I will give you gold or something similar worth 10,000 won." From the central bank's perspective, it is a debt that can be demanded for repayment at any time.

After the gold standard ends, we guarantee that you will be able to pay your taxes with this certificate at any time.

The value of this instrument is eternal as long as the system of mandatory tax payment is maintained,' the collateral for the debt has only changed slightly.

--- p.177, from "PART 5 Debt: The Engine of the Modern Economic System"

But as we do this, we are now running out of money.

Living expenses are running low, but you can't afford to not buy gasoline or go grocery shopping, so you're in a situation where you can't pay off your loan interest.

And this wasn't just happening in small towns.

As gasoline prices rose across the United States, similar events occurred simultaneously across the country.

And finally, what I was afraid of happened.

Across the United States, millions of people simultaneously defaulted on their subprime mortgage loans.

With this massive delinquency situation unfolding, the emergency lights have been turned on.

Problems began to arise with the derivatives sold while thinking, "Surely millions of people wouldn't be able to pay their interest at the same time?"

Because no one knew who had invested in these derivatives, people began to suspect each other, and because they were suspicious of each other, no one lent money.

In an instant, credit was paralyzed, and with the realization that even the most robust companies could go bankrupt in this situation, people became suspicious of banks and rushed to withdraw their cash.

This is the '2008 subprime mortgage crisis', an event that caused chaos around the world.

--- p.233, from “PART 6 Financial Crisis: What is a Crisis and What Should We Watch for?”

The reason we struggle and struggle when faced with the act of choice is because we are compelled to choose the better of the two.

But the 'essence' of the game of choice is not about picking the better one.

In an environment full of uncertainty, how can we always pick out the good?

Even if a better one is chosen in the end, it is just a result of luck.

The 'essence' of the game of choice we play is not making the best choice, but working afterwards to make the outcome of that choice the best outcome for me.

So, when we make a choice, what we should do is not pray that this choice will be the right one, but rather check to see if there are any considerations we may have missed when making the choice.

If there is no such thing, the way to play the game of choice well is to choose calmly and accept the results calmly.

--- p.313, from “PART 8 The Essence of Games and the Paradox of Choice: For a Wiser Life”

Just as the Creator cried out “Let there be light” when creating the world, the economic system of modern society began one day with a sudden cry, “Let there be debt.”

The reason why the economic development that humanity has been unable to achieve for thousands of years has been so dazzling in the last few hundred years is because it has become possible to borrow money from the market, or even if there is no money in the market, to borrow money from a bank when I need it.

Just as coffee is neither a medicine nor a poison, neither is debt.

The difference is that the world would run just fine without coffee, but not without debt.

The moment the debt disappears, the world ends.

--- p.323, from "Epilogue"

Publisher's Review

“A glance at the properties and flow of money.”

If you watch the flow of money, you can see the flow of the world.

If you open the table of contents of a high school economics textbook, you will find the following contents.

Production and consumption, characteristics of a market economy, supply and demand and prices, the three elements of the national economy, the necessity and principles of trade, Korea in the world…

Let's face our desires more honestly.

We want to make money, have a nice house and a nice car.

I want to be successful in stock investing, but I don't want to live a poor and difficult life.

I want to earn more money than others by working less hours, and I also want to avoid suddenly losing a lot of money and becoming poor one day.

So, what can we learn to achieve this? This book began with a similar question.

Let's examine one by one what an economics textbook, aimed at fostering "affluent citizens with a good understanding of the economy," should contain.

[PART 1.

[The Nature of Money: It Continues to Increase, and Must Continue to Increase] is the first step in understanding the economy, explaining that for the economy to grow, money must continue to increase.

We look into the truth that the property of money is that it constantly increases, and that if it does not increase, the economy cannot be maintained.

[PART 2.

In [Risk and Portfolios: Capturing Volatility], we explore volatility, which can sometimes be a source of profit and sometimes a source of loss.

We explore how to control volatility and invest through stock and real estate investments.

[PART 3.

Exchange Rates, Interest Rates, Bonds: The Fluctuating World of Money] explores why money moves and in what direction.

We will learn about the standards and thoughts behind exchanging and trading money through bonds that exchange present money for future money, interest rates that are the exchange rates applied when exchanging present money for future money, and exchange rates that are the exchange rates between our country's currency and foreign currency.

[PART 4.

In [Real Estate: The Birth of the Apartment Myth of Invincibility], we consider why housing prices in our country continue to rise and whether there is any solution.

We will explore the characteristics of housing prices in Korea, how they differ from those in other countries, why they are inevitably expensive, and why housing prices are bound to rise.

[PART 5.

Debt: The Engine of the Modern Economic System takes a true look at the reality of debt.

For an economy to function effectively, someone must constantly borrow money to provide the liquidity society needs.

Let's look at how to use debt wisely.

[PART 6.

In [Financial Crisis: What is a Crisis and What to Watch for?], we will learn about what an economic crisis and a financial crisis are and how they occur.

Furthermore, to distinguish between real and fake crises, we examine the nature of financial crises and explore ways to quickly determine whether or not a similar situation is a viable option.

[PART 7.

In [Secrets of a Prosperous Nation: What Should I Do?], we examine the question, ‘How can we become a prosperous nation?’ through the example of the UK.

What kind of country will South Korea be in 50 or 100 years? Learn what it means for a nation to grow and develop.

[PART 8.

In [The Essence of the Game and the Paradox of Choice: For a Wiser Life], the question, "How can we avoid making wrong choices?" is asked, and the answer is sought, "If we avoid making wrong choices, wouldn't our lives and our investments also improve?"

We will infer that making choices that are in line with our essence makes our economic lives possible.

"Modern society's financial system shines with debt."

A person who understands the meaning of debt and can utilize it is a true economist.

Some people believe that debt is a very dangerous thing and should be eliminated as soon as possible.

But the richer they are, the more they enjoy debt and use it freely, just like drinking coffee.

What on earth is debt? To some it is poison, and to others it is medicine.

And why is it important to properly understand the meaning and value of light? For thousands of years, humanity achieved little economic development because borrowing money from the market was nearly impossible.

The invention that solved that inconvenience was the bank.

The bank says:

“If you have extra money, don’t lend it to others, lend it to our bank.

You can withdraw your money whenever you need it, while receiving the same interest rate.”

Just as the Creator cried out “Let there be light” when creating the world, the economic system of modern society began one day with a sudden cry, “Let there be debt.”

The reason why the economic development that humanity has barely been able to achieve for thousands of years has been so dazzling in the last few hundred years is because it has become possible to borrow money from the market, or even if there is no money in the market, to borrow money from a bank when I need it.

Just as coffee is neither a medicine nor a poison, neither is debt.

The difference is that the world would run just fine without coffee, but not without debt.

The moment the debt disappears, the world ends.

This book carefully explains the flow of money so that you can understand these economic principles and apply them to your daily life.

If you watch the flow of money, you can see the flow of the world.

If you open the table of contents of a high school economics textbook, you will find the following contents.

Production and consumption, characteristics of a market economy, supply and demand and prices, the three elements of the national economy, the necessity and principles of trade, Korea in the world…

Let's face our desires more honestly.

We want to make money, have a nice house and a nice car.

I want to be successful in stock investing, but I don't want to live a poor and difficult life.

I want to earn more money than others by working less hours, and I also want to avoid suddenly losing a lot of money and becoming poor one day.

So, what can we learn to achieve this? This book began with a similar question.

Let's examine one by one what an economics textbook, aimed at fostering "affluent citizens with a good understanding of the economy," should contain.

[PART 1.

[The Nature of Money: It Continues to Increase, and Must Continue to Increase] is the first step in understanding the economy, explaining that for the economy to grow, money must continue to increase.

We look into the truth that the property of money is that it constantly increases, and that if it does not increase, the economy cannot be maintained.

[PART 2.

In [Risk and Portfolios: Capturing Volatility], we explore volatility, which can sometimes be a source of profit and sometimes a source of loss.

We explore how to control volatility and invest through stock and real estate investments.

[PART 3.

Exchange Rates, Interest Rates, Bonds: The Fluctuating World of Money] explores why money moves and in what direction.

We will learn about the standards and thoughts behind exchanging and trading money through bonds that exchange present money for future money, interest rates that are the exchange rates applied when exchanging present money for future money, and exchange rates that are the exchange rates between our country's currency and foreign currency.

[PART 4.

In [Real Estate: The Birth of the Apartment Myth of Invincibility], we consider why housing prices in our country continue to rise and whether there is any solution.

We will explore the characteristics of housing prices in Korea, how they differ from those in other countries, why they are inevitably expensive, and why housing prices are bound to rise.

[PART 5.

Debt: The Engine of the Modern Economic System takes a true look at the reality of debt.

For an economy to function effectively, someone must constantly borrow money to provide the liquidity society needs.

Let's look at how to use debt wisely.

[PART 6.

In [Financial Crisis: What is a Crisis and What to Watch for?], we will learn about what an economic crisis and a financial crisis are and how they occur.

Furthermore, to distinguish between real and fake crises, we examine the nature of financial crises and explore ways to quickly determine whether or not a similar situation is a viable option.

[PART 7.

In [Secrets of a Prosperous Nation: What Should I Do?], we examine the question, ‘How can we become a prosperous nation?’ through the example of the UK.

What kind of country will South Korea be in 50 or 100 years? Learn what it means for a nation to grow and develop.

[PART 8.

In [The Essence of the Game and the Paradox of Choice: For a Wiser Life], the question, "How can we avoid making wrong choices?" is asked, and the answer is sought, "If we avoid making wrong choices, wouldn't our lives and our investments also improve?"

We will infer that making choices that are in line with our essence makes our economic lives possible.

"Modern society's financial system shines with debt."

A person who understands the meaning of debt and can utilize it is a true economist.

Some people believe that debt is a very dangerous thing and should be eliminated as soon as possible.

But the richer they are, the more they enjoy debt and use it freely, just like drinking coffee.

What on earth is debt? To some it is poison, and to others it is medicine.

And why is it important to properly understand the meaning and value of light? For thousands of years, humanity achieved little economic development because borrowing money from the market was nearly impossible.

The invention that solved that inconvenience was the bank.

The bank says:

“If you have extra money, don’t lend it to others, lend it to our bank.

You can withdraw your money whenever you need it, while receiving the same interest rate.”

Just as the Creator cried out “Let there be light” when creating the world, the economic system of modern society began one day with a sudden cry, “Let there be debt.”

The reason why the economic development that humanity has barely been able to achieve for thousands of years has been so dazzling in the last few hundred years is because it has become possible to borrow money from the market, or even if there is no money in the market, to borrow money from a bank when I need it.

Just as coffee is neither a medicine nor a poison, neither is debt.

The difference is that the world would run just fine without coffee, but not without debt.

The moment the debt disappears, the world ends.

This book carefully explains the flow of money so that you can understand these economic principles and apply them to your daily life.

GOODS SPECIFICS

- Date of issue: January 31, 2025

- Page count, weight, size: 328 pages | 576g | 152*225*20mm

- ISBN13: 9791169851213

- ISBN10: 1169851215

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)