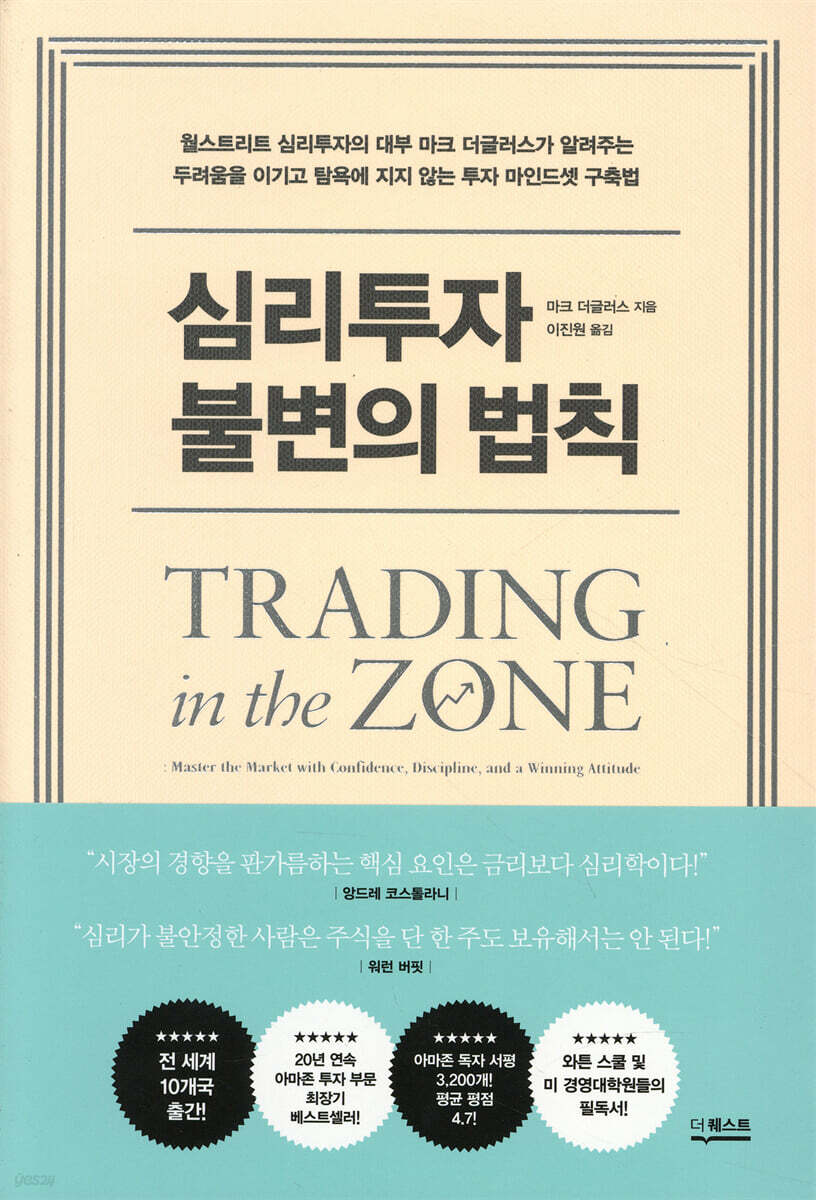

The immutable laws of psychological investment

|

Description

Book Introduction

The best book on psychological investing, recommended by investment experts with over 20 years of experience! Investors who are not swayed by emotions will not lose their way even in a bear market! How to survive in the stock market, where 90 percent of the battle is psychological, by sticking to your own principles! It is no exaggeration to say that the past two years have been a year of global liquidity explosion. As an unusually large amount of money was released, the stock market also experienced repeated crashes and surges, and the market chaos continues to this day. Who makes money in such turbulent markets? In a bull market, even novice investors can easily make money. However, the real success of an investment depends on how well you can maintain those profits when the market turns bearish. The best investors are those who maintain steady profits without suffering major losses even in a bear market. So how do they manage to consistently make profits when everyone else is panicking and selling? Mark Douglas, who has been known as the "godfather of psychological investing" and has served as an investment coach on Wall Street for the past 30 years, argues that the most fundamental factor that determines the success or failure of investment is "psychology." There is probably no one who has ever invested who has not heard the saying, “Stick to your principles.” Everyone knows the importance of establishing and sticking to your own investment principles, but why is it so difficult? It's because of a psychological issue within us. "The Unchangeable Laws of Psychological Investment" is a book that deals with the "psychological issues" in investing, which are as important as the principles of investing. That is, it talks about how to control the instinctive fear and terror of possibly losing, the regret and frustration of being wrong, and the excessive greed that breaks down principles. No matter how skilled an investor is at market analysis and armed with expert knowledge, if he or she cannot control these emotional aspects, his or her investments will ultimately end in failure. The author highlights that the greatest enemy of investment success is not a lack of knowledge or misinformation, but rather our own emotions. He explains how to maintain a stable mindset in the market. |

- You can preview some of the book's contents.

Preview

index

Recommendation: Learn to think like an investor.

Getting Started_ How to Not Fear Mr. Market's Whims

Attitude Checklist_How I View Investments

Chapter 1.

Fundamental analysis, technical analysis, and psychological analysis

Limitations of Fundamental Analysis

Technical analysis has become the new mainstream

How Psychoanalysis Leads to Transformation

The best investors are not afraid.

Chapter 2.

Embrace the temptations and risks of investing.

The stock market, a place of unlimited freedom

Humans reject all control and oppression.

Protect yourself from investment temptations

Chapter 3.

Take responsibility for your investments

It's all a matter of attitude.

Pain avoidance mechanisms and investing

Winners and losers, those who prosper and those who perish

Chapter 4.

Learn the winner's mindset

What exactly is investing?

The true meaning of taking risks

Don't think of the market as a threat

Chapter 5.

Recognize opportunities and threats

How to eliminate bugs in mental software

Something that exists but is not visible

Why do we fear danger?

Break free from the 'failures and pains of the past'

Chapter 6.

Look at it from the market's perspective

The principle of 'uncertainty'

The inherent fickleness of the market

Chapter 7.

Think probabilistically

Do random outcomes lead to consistent results?

Investing in the present moment

Don't have any expectations about the market.

Eliminate emotional risks

Chapter 8.

Invest with confidence

The illusion of predicting market direction

Precise definitions of terms

Five Fundamental Truths About Markets

Invest in the flow of opportunity

Chapter 9.

What is the essence of faith?

The Origin of Faith

How does faith affect our lives?

The relationship between faith and truth

Chapter 10.

Understand the relationship between faith and investment.

How Fear Comes and How It Is Overcome

How to Break Free from Self-Defeating Beliefs

Chapter 11.

Think like a top investor

Investing mechanically

The role of self-principle

7 Principles for Maintaining Consistency

How to Invest with a Casino-like Odds Edge

In conclusion: Investing with confidence and patience

Attitude Checklist_How I View Investments

Getting Started_ How to Not Fear Mr. Market's Whims

Attitude Checklist_How I View Investments

Chapter 1.

Fundamental analysis, technical analysis, and psychological analysis

Limitations of Fundamental Analysis

Technical analysis has become the new mainstream

How Psychoanalysis Leads to Transformation

The best investors are not afraid.

Chapter 2.

Embrace the temptations and risks of investing.

The stock market, a place of unlimited freedom

Humans reject all control and oppression.

Protect yourself from investment temptations

Chapter 3.

Take responsibility for your investments

It's all a matter of attitude.

Pain avoidance mechanisms and investing

Winners and losers, those who prosper and those who perish

Chapter 4.

Learn the winner's mindset

What exactly is investing?

The true meaning of taking risks

Don't think of the market as a threat

Chapter 5.

Recognize opportunities and threats

How to eliminate bugs in mental software

Something that exists but is not visible

Why do we fear danger?

Break free from the 'failures and pains of the past'

Chapter 6.

Look at it from the market's perspective

The principle of 'uncertainty'

The inherent fickleness of the market

Chapter 7.

Think probabilistically

Do random outcomes lead to consistent results?

Investing in the present moment

Don't have any expectations about the market.

Eliminate emotional risks

Chapter 8.

Invest with confidence

The illusion of predicting market direction

Precise definitions of terms

Five Fundamental Truths About Markets

Invest in the flow of opportunity

Chapter 9.

What is the essence of faith?

The Origin of Faith

How does faith affect our lives?

The relationship between faith and truth

Chapter 10.

Understand the relationship between faith and investment.

How Fear Comes and How It Is Overcome

How to Break Free from Self-Defeating Beliefs

Chapter 11.

Think like a top investor

Investing mechanically

The role of self-principle

7 Principles for Maintaining Consistency

How to Invest with a Casino-like Odds Edge

In conclusion: Investing with confidence and patience

Attitude Checklist_How I View Investments

Into the book

In other words, no matter how much you learn about market behavior or how smart an analyst you become, it is impossible to perfectly predict the market.

If you are afraid of making a mistake or suffering a loss, you cannot escape the negative effects that this fear has on your ability to act objectively and without hesitation.

That is, you become uncertain in the face of continued uncertainty.

In the world of investing, uncertainty of outcomes is a harsh reality.

Unless we learn to fully embrace uncertainty, we will consciously or unconsciously try to avoid many possibilities that we find painful.

And along the way, you'll make countless costly mistakes.

---From "Chapter 1_ Fundamental Analysis, Technical Analysis, and Mental Analysis"

The market is like a 'flow' that is constantly moving.

The market never stops or waits.

Even when the market is closed, prices move.

There is no rule that says the opening price of a day must be the same as the closing price of the previous day.

Yet, we haven't prepared ourselves to operate effectively in this "boundary-less" environment.

Even gambling has a 'built-in structure'.

So in some ways, gambling is much less risky than investing.

For example, if you play blackjack, the first thing you have to do is decide how much money you want to risk.

Because you can't start the game without making this decision.

However, in investing, there is no device that allows you to estimate the level of risk in advance.

You are standing in an environment where virtually anything can happen.

Only investors who consistently achieve success determine the risks involved in investing.

People who fail at investing fail to accept the reality that even if they seem to be doing well at the moment, they may actually be losing money.

So they fall into a distorted logic that makes them believe, through countless justifications and rationalizations, that they can never fail.

As a result, they do not even try to know in advance about the risks of the investment.

---From "Chapter 2_ Accept the Temptations and Risks of Investment"

By investing without self-criticism or regret and embracing the endless flow of opportunities the market offers, you're in the best "frame of mind" to act for maximum profit and learn from past experiences.

Conversely, if we perceive market information as painful in any way, we will likely try to avoid the pain by consciously or unconsciously blocking ourselves from recognizing such information.

In the process of blocking out such information, you are further and further distancing yourself from the opportunity to become rich.

Moreover, if you expect the market to do something for you or believe that the market owes you something, you will view the market hostilely.

You might feel the urge to fight at this point, but what exactly are you fighting against, and who are you fighting against? The market is clearly not fighting you.

Yes, that's right.

The market wants your money, but it also wants to give you as many opportunities as possible.

When you fight the market with hostility, you're really just fighting the negative consequences of not fully accepting that you need to take full advantage of the opportunities the market presents.

---From “Chapter 3_ Take Responsibility for Your Investments”

Yet, most investors fail to adhere to this basic principle.

Why can't they act in an absolutely and perfectly rational manner? Ordinary investors fail to define risk in advance, cut losses, or systematically realize profits.

He 'does not believe' that such things are necessary.

Why is this? Because we mistakenly believe we already know what will happen next based on what's happening "right now."

If he thinks he already knows what's going to happen, there's virtually no reason to stick to these three principles.

By assuming that 'I know', he will make every investment mistake he can make.

---From “Chapter 6_ Look at it from the market’s perspective”

I always ask my workshop participants a difficult question about the paradox of investing: "How can investors learn to be both rigorous and flexible?"

The answer to this question is this.

“We must be strict with ‘rules’ but flexible with ‘expectations.’”

We must strictly adhere to the rules we have set to gain confidence that they will protect us now and in the future from the environment that has boundaries.

On the other hand, in order to perceive the information the market conveys with clarity and objectivity, we must be able to flexibly change our expectations.

But when it comes to this issue, typical investors behave quite the opposite.

In short, be flexible with rules and strict with expectations.

Interestingly, the more stringent expectations become, the more the rules are bent, broken, or disregarded to get what the market offers.

---From "Chapter 7_ Think Probabilistically"

Remember that every thought, word, and action serves to strengthen the belief you have in yourself.

If we repeatedly hold negative self-criticism and develop the belief that we are a "mess," that belief may find a way to manifest itself in our thoughts, truly making us a mess.

In other words, even if we say what we believe about ourselves or others, our actions may be excessively self-defeating.

If you want to be a consistent winner, you must not accept mistakes and errors in a negative context, as most people do.

You need to be able to observe yourself to some degree, but if you are likely to feel emotional distress when you catch yourself doing something wrong, objective observation becomes difficult.

If you find yourself in that situation, you have two choices:

If you are afraid of making a mistake or suffering a loss, you cannot escape the negative effects that this fear has on your ability to act objectively and without hesitation.

That is, you become uncertain in the face of continued uncertainty.

In the world of investing, uncertainty of outcomes is a harsh reality.

Unless we learn to fully embrace uncertainty, we will consciously or unconsciously try to avoid many possibilities that we find painful.

And along the way, you'll make countless costly mistakes.

---From "Chapter 1_ Fundamental Analysis, Technical Analysis, and Mental Analysis"

The market is like a 'flow' that is constantly moving.

The market never stops or waits.

Even when the market is closed, prices move.

There is no rule that says the opening price of a day must be the same as the closing price of the previous day.

Yet, we haven't prepared ourselves to operate effectively in this "boundary-less" environment.

Even gambling has a 'built-in structure'.

So in some ways, gambling is much less risky than investing.

For example, if you play blackjack, the first thing you have to do is decide how much money you want to risk.

Because you can't start the game without making this decision.

However, in investing, there is no device that allows you to estimate the level of risk in advance.

You are standing in an environment where virtually anything can happen.

Only investors who consistently achieve success determine the risks involved in investing.

People who fail at investing fail to accept the reality that even if they seem to be doing well at the moment, they may actually be losing money.

So they fall into a distorted logic that makes them believe, through countless justifications and rationalizations, that they can never fail.

As a result, they do not even try to know in advance about the risks of the investment.

---From "Chapter 2_ Accept the Temptations and Risks of Investment"

By investing without self-criticism or regret and embracing the endless flow of opportunities the market offers, you're in the best "frame of mind" to act for maximum profit and learn from past experiences.

Conversely, if we perceive market information as painful in any way, we will likely try to avoid the pain by consciously or unconsciously blocking ourselves from recognizing such information.

In the process of blocking out such information, you are further and further distancing yourself from the opportunity to become rich.

Moreover, if you expect the market to do something for you or believe that the market owes you something, you will view the market hostilely.

You might feel the urge to fight at this point, but what exactly are you fighting against, and who are you fighting against? The market is clearly not fighting you.

Yes, that's right.

The market wants your money, but it also wants to give you as many opportunities as possible.

When you fight the market with hostility, you're really just fighting the negative consequences of not fully accepting that you need to take full advantage of the opportunities the market presents.

---From “Chapter 3_ Take Responsibility for Your Investments”

Yet, most investors fail to adhere to this basic principle.

Why can't they act in an absolutely and perfectly rational manner? Ordinary investors fail to define risk in advance, cut losses, or systematically realize profits.

He 'does not believe' that such things are necessary.

Why is this? Because we mistakenly believe we already know what will happen next based on what's happening "right now."

If he thinks he already knows what's going to happen, there's virtually no reason to stick to these three principles.

By assuming that 'I know', he will make every investment mistake he can make.

---From “Chapter 6_ Look at it from the market’s perspective”

I always ask my workshop participants a difficult question about the paradox of investing: "How can investors learn to be both rigorous and flexible?"

The answer to this question is this.

“We must be strict with ‘rules’ but flexible with ‘expectations.’”

We must strictly adhere to the rules we have set to gain confidence that they will protect us now and in the future from the environment that has boundaries.

On the other hand, in order to perceive the information the market conveys with clarity and objectivity, we must be able to flexibly change our expectations.

But when it comes to this issue, typical investors behave quite the opposite.

In short, be flexible with rules and strict with expectations.

Interestingly, the more stringent expectations become, the more the rules are bent, broken, or disregarded to get what the market offers.

---From "Chapter 7_ Think Probabilistically"

Remember that every thought, word, and action serves to strengthen the belief you have in yourself.

If we repeatedly hold negative self-criticism and develop the belief that we are a "mess," that belief may find a way to manifest itself in our thoughts, truly making us a mess.

In other words, even if we say what we believe about ourselves or others, our actions may be excessively self-defeating.

If you want to be a consistent winner, you must not accept mistakes and errors in a negative context, as most people do.

You need to be able to observe yourself to some degree, but if you are likely to feel emotional distress when you catch yourself doing something wrong, objective observation becomes difficult.

If you find yourself in that situation, you have two choices:

---From Chapter 11: Think Like a Top Investor

Publisher's Review

The best investors are not afraid!

The psychological rules of winning investment that remain unshaken even in market crises

Many investors, believing they need to understand the market to conquer it, become obsessed with various technical analysis methods. Despite the proliferation of cutting-edge AI-powered systems and various analytical tools, why do so many investors still lose money? The reason is that psychological dynamics operate within our minds, preventing us from properly interpreting the vast amount of information and market signals, thus preventing us from adhering to our established principles.

Even if you establish solid investment principles outside the market, the moment you jump into the market, those principles often crumble as they undergo transformation and distortion in the midst of self-rationalization.

They get caught up in the excitement and fail to objectively see the market signals, either entering positions when they should be liquidating and suffering losses, or, conversely, being gripped by fear and withdrawing when they should be investing more, thereby missing out on opportunities for greater profits.

If you want to become an investor who consistently generates profits in the market, you must accept market signals as they are, without rationalization or distortion, and invest while maintaining your own principles and advantages.

And those who can do that can become the 'best investors'.

The author emphasizes that this “winner’s mindset” can be learned through training.

Instead of following market analysis or the latest system, I advise you to develop your own probabilistic thinking and principles—your own edge—that will help you conquer the market.

It also helps us overcome the ingrained mental habits that hinder us from achieving consistent investment performance.

Specifically, it teaches you how to accept investment risks, what it truly means to take full responsibility for your investments, how to objectively perceive opportunities and threats, and how to move beyond negatively interpreting information based on past failures and pain to view information from a market perspective.

It also explains how to develop and train "probabilistic thinking," which allows you to deal with the uncertainty that governs all stock investments with a comfortable and flexible mind.

Learn the mindset of the best investors!

The art of self-control to achieve consistent profits in the game of probability called investment.

Legendary investor Andre Kostolany once said, “Psychology, rather than interest rates, is the key factor in determining market trends!” and investment guru Warren Buffett also emphasized the importance of psychology in investing, saying, “A person with an unstable mind should not own a single stock!”

In this way, in the world of investment, a 'stable mind' is more important than good analysis or technique to achieve good results.

The fact that this book has remained a top Amazon bestseller and is considered a bible since its first publication in the United States in 2001 clearly demonstrates the importance of psychology in investing.

This book will teach you how to overcome anxiety and fear and resist greed, and will help you discover how to become a top investor who generates consistent profits.

The psychological rules of winning investment that remain unshaken even in market crises

Many investors, believing they need to understand the market to conquer it, become obsessed with various technical analysis methods. Despite the proliferation of cutting-edge AI-powered systems and various analytical tools, why do so many investors still lose money? The reason is that psychological dynamics operate within our minds, preventing us from properly interpreting the vast amount of information and market signals, thus preventing us from adhering to our established principles.

Even if you establish solid investment principles outside the market, the moment you jump into the market, those principles often crumble as they undergo transformation and distortion in the midst of self-rationalization.

They get caught up in the excitement and fail to objectively see the market signals, either entering positions when they should be liquidating and suffering losses, or, conversely, being gripped by fear and withdrawing when they should be investing more, thereby missing out on opportunities for greater profits.

If you want to become an investor who consistently generates profits in the market, you must accept market signals as they are, without rationalization or distortion, and invest while maintaining your own principles and advantages.

And those who can do that can become the 'best investors'.

The author emphasizes that this “winner’s mindset” can be learned through training.

Instead of following market analysis or the latest system, I advise you to develop your own probabilistic thinking and principles—your own edge—that will help you conquer the market.

It also helps us overcome the ingrained mental habits that hinder us from achieving consistent investment performance.

Specifically, it teaches you how to accept investment risks, what it truly means to take full responsibility for your investments, how to objectively perceive opportunities and threats, and how to move beyond negatively interpreting information based on past failures and pain to view information from a market perspective.

It also explains how to develop and train "probabilistic thinking," which allows you to deal with the uncertainty that governs all stock investments with a comfortable and flexible mind.

Learn the mindset of the best investors!

The art of self-control to achieve consistent profits in the game of probability called investment.

Legendary investor Andre Kostolany once said, “Psychology, rather than interest rates, is the key factor in determining market trends!” and investment guru Warren Buffett also emphasized the importance of psychology in investing, saying, “A person with an unstable mind should not own a single stock!”

In this way, in the world of investment, a 'stable mind' is more important than good analysis or technique to achieve good results.

The fact that this book has remained a top Amazon bestseller and is considered a bible since its first publication in the United States in 2001 clearly demonstrates the importance of psychology in investing.

This book will teach you how to overcome anxiety and fear and resist greed, and will help you discover how to become a top investor who generates consistent profits.

GOODS SPECIFICS

- Publication date: December 6, 2021

- Page count, weight, size: 320 pages | 578g | 152*225*30mm

- ISBN13: 9791165217761

- ISBN10: 1165217767

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)