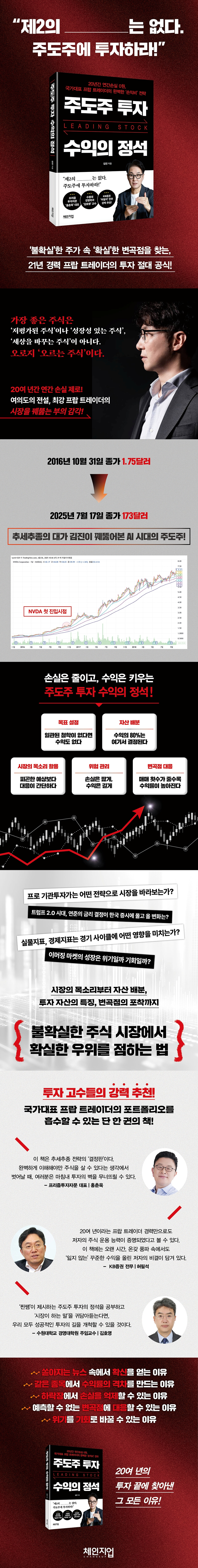

The basics of leading stock investment returns

|

Description

Book Introduction

Spring has finally arrived for KOSPI.

Instead of weak rising stocks, ride the wave of solid 'leading stocks'!

Zero investment losses over 20 years, with a maximum annual profit of 25 billion won.

The legend of Yeouido, Jin Kim, presents an overwhelming 'profit/loss ratio' strategy!

One of the most famous sayings in the stock market is Warren Buffett's "Rule 1: Never lose money."

Rule 2: Never forget rule 1.”

If there's a prop trader who's been beating the market for 20 years by adhering to these principles, and if he were to explain his entire portfolio, would we be able to achieve the same results? Surprisingly, author Jin Kim, author of "The Essentials of Leading Stock Investment Profits," says the answer is yes.

This is a book that all investors should read, but it's especially worth reading for those interested in trends and leading stocks.

The biggest concern for stock investors is that the market is difficult to predict.

Variables such as the 'Russo-Ukrainian War', the 'China-US hegemony struggle', and especially the 'global tariff war' that erupted with the start of Trump's second term, shook the market no matter how well prepared they were.

Some say that such bad news cannot be overcome.

However, by preemptively selecting stocks that will lead the future market through response rather than prediction, you can reduce losses and increase profits.

After all, stocks are a game of profit and loss, not of winning percentage.

To generate healthy returns, you need to be consistent with your perspective on the market, your investment objectives, and your investment principles.

If you neglect even one of these, it will end up being a one-time investment left to chance.

Anyone who follows the author's leadership concepts, asset allocation and risk management methods, how to listen to the market through various indicators, and the author's unique portfolio principles and logic, which have proven themselves loss-free for over 20 years, will magically be able to seize what the world desires.

Instead of weak rising stocks, ride the wave of solid 'leading stocks'!

Zero investment losses over 20 years, with a maximum annual profit of 25 billion won.

The legend of Yeouido, Jin Kim, presents an overwhelming 'profit/loss ratio' strategy!

One of the most famous sayings in the stock market is Warren Buffett's "Rule 1: Never lose money."

Rule 2: Never forget rule 1.”

If there's a prop trader who's been beating the market for 20 years by adhering to these principles, and if he were to explain his entire portfolio, would we be able to achieve the same results? Surprisingly, author Jin Kim, author of "The Essentials of Leading Stock Investment Profits," says the answer is yes.

This is a book that all investors should read, but it's especially worth reading for those interested in trends and leading stocks.

The biggest concern for stock investors is that the market is difficult to predict.

Variables such as the 'Russo-Ukrainian War', the 'China-US hegemony struggle', and especially the 'global tariff war' that erupted with the start of Trump's second term, shook the market no matter how well prepared they were.

Some say that such bad news cannot be overcome.

However, by preemptively selecting stocks that will lead the future market through response rather than prediction, you can reduce losses and increase profits.

After all, stocks are a game of profit and loss, not of winning percentage.

To generate healthy returns, you need to be consistent with your perspective on the market, your investment objectives, and your investment principles.

If you neglect even one of these, it will end up being a one-time investment left to chance.

Anyone who follows the author's leadership concepts, asset allocation and risk management methods, how to listen to the market through various indicators, and the author's unique portfolio principles and logic, which have proven themselves loss-free for over 20 years, will magically be able to seize what the world desires.

- You can preview some of the book's contents.

Preview

index

Prologue_22 Years as a Prop Trader

Chapter 1.

Get on the hottest stocks

- The only way to win an unfair fight

The most certain voice and trend shown by the market

Investment Philosophy of Trend Following Strategy

Understanding Investment Assets for Trend-Following Strategies

The only way to win an unfair fight

Chapter 2.

The Beginning of a Trend-Following Investment Strategy

- A top investor who grows assets thickly and safely

Asset allocation becomes easier

· Adjust stock weight

It is beneficial for risk management

· Utilizing volatility indices

Chapter 3.

The Art of Trend-Following Investing: Understanding Leading Stocks

- An all-rounder in stock investing, with a thorough understanding of leading stocks.

A friend of the leader, understanding the game

A 'firm lead' rather than a 'weak surge'

A look at the leading stocks in real-life cases

Chapter 4.

Trend-Following: The Ultimate Strategy for Practical Investment in Leading Stocks

- Navigate the all-rounder of stock investing with leading stocks.

Characteristics of leading stock prices

Leading Investment Rules

Global Investment Strategy (feat.

Trend-following investment)

Chapter 5.

"Indicator Class": Learn Today and Complete a Day That Will Last You a Lifetime

- A treasure map reading method that anyone can use

The Big Picture Drawn with Bonds

Understanding exchange rates allows you to hear the market's voice.

A Different Window on the Stock Market: Raw Materials

Stock Investment and Key Economic Indicators

Chapter 6.

Practical investment study with stock king Jinsam

- Small know-how makes a big difference

Successful Investment Routine to Minimize Losses

See the 'real trend' in the market

Understanding Inflection Points: When Trends Change

Teacher Jin's Complete Portfolio Construction Strategy

Teacher Jin's favorite lead portfolio

Epilogue: What I finally saw after 20 years of investing

Chapter 1.

Get on the hottest stocks

- The only way to win an unfair fight

The most certain voice and trend shown by the market

Investment Philosophy of Trend Following Strategy

Understanding Investment Assets for Trend-Following Strategies

The only way to win an unfair fight

Chapter 2.

The Beginning of a Trend-Following Investment Strategy

- A top investor who grows assets thickly and safely

Asset allocation becomes easier

· Adjust stock weight

It is beneficial for risk management

· Utilizing volatility indices

Chapter 3.

The Art of Trend-Following Investing: Understanding Leading Stocks

- An all-rounder in stock investing, with a thorough understanding of leading stocks.

A friend of the leader, understanding the game

A 'firm lead' rather than a 'weak surge'

A look at the leading stocks in real-life cases

Chapter 4.

Trend-Following: The Ultimate Strategy for Practical Investment in Leading Stocks

- Navigate the all-rounder of stock investing with leading stocks.

Characteristics of leading stock prices

Leading Investment Rules

Global Investment Strategy (feat.

Trend-following investment)

Chapter 5.

"Indicator Class": Learn Today and Complete a Day That Will Last You a Lifetime

- A treasure map reading method that anyone can use

The Big Picture Drawn with Bonds

Understanding exchange rates allows you to hear the market's voice.

A Different Window on the Stock Market: Raw Materials

Stock Investment and Key Economic Indicators

Chapter 6.

Practical investment study with stock king Jinsam

- Small know-how makes a big difference

Successful Investment Routine to Minimize Losses

See the 'real trend' in the market

Understanding Inflection Points: When Trends Change

Teacher Jin's Complete Portfolio Construction Strategy

Teacher Jin's favorite lead portfolio

Epilogue: What I finally saw after 20 years of investing

Detailed image

Into the book

The moment I look at all assets from a trend perspective, the market gives me countless investment hints.

It also tells you what the situation is like and who the key players are.

So, investment decisions are literally just a matter of doing 'whatever the market tells you to do'.

Success will follow naturally.

--- p.28

Even if it is a small investment, you must have a perspective on the market.

The difference in performance depending on whether there is a point of view or consistency is truly enormous.

I don't know how to put it, but if someone who doesn't have a market perspective and a consistent investment method makes money through stock investment, they're really incredibly lucky.

--- p.35

So my favorite, most highly valued stocks aren't "undervalued stocks," or "growth stocks," or "world-changing stocks."

It's just a 'rising stock'.

After all, stocks only provide value when their price rises.

The reason I talk about the utility of stocks is because if you make stock investment decisions based on this utility, you can naturally determine effective asset allocation.

--- p.53

In stock investing, it is necessary to treat the risk of loss and the risk of opportunity cost at the same level.

This does not mean that you should blindly chase rising stocks.

To do that, you need to have exceptional 'foresight' to pick out really good stocks.

This means that you should not sell a stock that is trending upwards recklessly just because you made some profits in the short term.

It means not to blow opportunity costs.

I think the best way to do this is to follow the trend.

--- p.69

In this way, the scope of your concerns is determined based on your investment goals.

By setting investment goals, we become more specific about what we need to do, and we only need to think about things that are in line with our investment goals.

You don't have to worry about unnecessary worries that arise when you invest in stocks that don't meet your goals.

This is also why setting investment goals and being specific about them are important.

--- p.229

The best way is to get into the habit of taking notes of small things as you see them.

With a consistent perspective on trends.

The term "small" here refers to looking at the movements of individual stocks representing the market and an industry.

So, just by looking at it, I take notes with a consistent standard called trend.

It also tells you what the situation is like and who the key players are.

So, investment decisions are literally just a matter of doing 'whatever the market tells you to do'.

Success will follow naturally.

--- p.28

Even if it is a small investment, you must have a perspective on the market.

The difference in performance depending on whether there is a point of view or consistency is truly enormous.

I don't know how to put it, but if someone who doesn't have a market perspective and a consistent investment method makes money through stock investment, they're really incredibly lucky.

--- p.35

So my favorite, most highly valued stocks aren't "undervalued stocks," or "growth stocks," or "world-changing stocks."

It's just a 'rising stock'.

After all, stocks only provide value when their price rises.

The reason I talk about the utility of stocks is because if you make stock investment decisions based on this utility, you can naturally determine effective asset allocation.

--- p.53

In stock investing, it is necessary to treat the risk of loss and the risk of opportunity cost at the same level.

This does not mean that you should blindly chase rising stocks.

To do that, you need to have exceptional 'foresight' to pick out really good stocks.

This means that you should not sell a stock that is trending upwards recklessly just because you made some profits in the short term.

It means not to blow opportunity costs.

I think the best way to do this is to follow the trend.

--- p.69

In this way, the scope of your concerns is determined based on your investment goals.

By setting investment goals, we become more specific about what we need to do, and we only need to think about things that are in line with our investment goals.

You don't have to worry about unnecessary worries that arise when you invest in stocks that don't meet your goals.

This is also why setting investment goals and being specific about them are important.

--- p.229

The best way is to get into the habit of taking notes of small things as you see them.

With a consistent perspective on trends.

The term "small" here refers to looking at the movements of individual stocks representing the market and an industry.

So, just by looking at it, I take notes with a consistent standard called trend.

--- p.236

Publisher's Review

Seize what the world wants!

If you have a leading stock

You can even see the flow of money when buying and selling!

The Korean stock market was stuck in a long box and was even mocked as a "box market."

But this atmosphere is changing little by little.

Just as Goldman Sachs, a major American investment bank, released a report predicting a rise in the Korean stock market right after the presidential election.

This is supported by a multifaceted set of positive factors, including the resolution of political uncertainty, large-scale fiscal policy based on quantitative easing, revitalization of the stock market through financial market reform, large-scale investment in strategic industries, and a strengthening won.

It's not just institutions that have noticed this change.

Parents planning to invest and gift money to their minor children's accounts are also returning to the Korean stock market. NH Investment & Securities analyzed 270,000 minor accounts and found that Samsung Electronics reclaimed the top spot in net buying since April of this year.

In a long-term trading environment, the PBR of certain sector leaders, such as Samsung Electronics and Hyundai Motors, fell below 1, giving the impression that they were 'sufficiently cheap.'

Investment trends in minors' accounts reflect parents' careful selection of stocks for long-term investment purposes, and when such changes occur, it signals a major shift in the landscape.

It can also be seen as a signal that increases when expectations of a bottom are higher than when the stock price is soaring.

Now we are at a point where we need to invest.

Should you choose a volatile and fragile stock that will rise and fall for a short time, or a stock that will lead the market for a long time?

"The Core Absolute Principles of Yeouido's Strongest Practical Investors"

The only way to win an unfair fight,

Get on the hottest stocks!

Can retail investors really beat the market? Some say tracking the index and waiting is enough, while others say buying undervalued or overlooked stocks.

But index tracking requires a lot of time and patience.

You must be able to invest mechanically even if something unexpected happens or the stock market fluctuates during the investment period.

Undervalued stocks are even more difficult.

Even if you find a truly promising stock, you still have to withstand the shock of institutions and foreign investors with much more information and funds.

So what's the answer? The author argues that for individual investors, the answer lies in large, market-leading stocks.

This is because only large-cap stocks with a lot of publicly available information and that everyone knows about are the ones that allow us to compete fairly with institutions and foreign investors.

You don't need any specialized knowledge or information to buy.

It is enough to listen to what the market tells you through 'trends' and respond accordingly.

We don't need 'undervalued' stocks, 'growth' stocks, or 'world-changing' stocks.

We only need 'rising' stocks.

If you have a leading stock

You can even see the flow of money when buying and selling!

The Korean stock market was stuck in a long box and was even mocked as a "box market."

But this atmosphere is changing little by little.

Just as Goldman Sachs, a major American investment bank, released a report predicting a rise in the Korean stock market right after the presidential election.

This is supported by a multifaceted set of positive factors, including the resolution of political uncertainty, large-scale fiscal policy based on quantitative easing, revitalization of the stock market through financial market reform, large-scale investment in strategic industries, and a strengthening won.

It's not just institutions that have noticed this change.

Parents planning to invest and gift money to their minor children's accounts are also returning to the Korean stock market. NH Investment & Securities analyzed 270,000 minor accounts and found that Samsung Electronics reclaimed the top spot in net buying since April of this year.

In a long-term trading environment, the PBR of certain sector leaders, such as Samsung Electronics and Hyundai Motors, fell below 1, giving the impression that they were 'sufficiently cheap.'

Investment trends in minors' accounts reflect parents' careful selection of stocks for long-term investment purposes, and when such changes occur, it signals a major shift in the landscape.

It can also be seen as a signal that increases when expectations of a bottom are higher than when the stock price is soaring.

Now we are at a point where we need to invest.

Should you choose a volatile and fragile stock that will rise and fall for a short time, or a stock that will lead the market for a long time?

"The Core Absolute Principles of Yeouido's Strongest Practical Investors"

The only way to win an unfair fight,

Get on the hottest stocks!

Can retail investors really beat the market? Some say tracking the index and waiting is enough, while others say buying undervalued or overlooked stocks.

But index tracking requires a lot of time and patience.

You must be able to invest mechanically even if something unexpected happens or the stock market fluctuates during the investment period.

Undervalued stocks are even more difficult.

Even if you find a truly promising stock, you still have to withstand the shock of institutions and foreign investors with much more information and funds.

So what's the answer? The author argues that for individual investors, the answer lies in large, market-leading stocks.

This is because only large-cap stocks with a lot of publicly available information and that everyone knows about are the ones that allow us to compete fairly with institutions and foreign investors.

You don't need any specialized knowledge or information to buy.

It is enough to listen to what the market tells you through 'trends' and respond accordingly.

We don't need 'undervalued' stocks, 'growth' stocks, or 'world-changing' stocks.

We only need 'rising' stocks.

GOODS SPECIFICS

- Date of issue: July 29, 2025

- Page count, weight, size: 292 pages | 520g | 152*225*18mm

- ISBN13: 9791191378771

- ISBN10: 1191378772

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)