The myth of the dollar's end

|

Description

Book Introduction

Attempts at de-dollarization

Why is it destined to fail?

The dollar has reigned as the heart of the global economy and a symbol of hegemony for the past century.

But today, the stability of the dollar goes beyond mere financial considerations; it is directly linked to the fundamental value system that underpins democracy, market economies, and international security.

This book powerfully demonstrates that the cracks in the dollar's hegemony are not simply a currency swap, but a sign of a profound shift in the entire world order.

With the three driving forces of civilizational change—war, disease, and technological innovation—overlapping, the discussion of the dollar's demise is more timely than ever.

The 2008 global financial crisis, the US-China hegemony competition, and the rise of digital currencies are three shock waves shaking the dollar system.

Therefore, this book is not simply an economic analysis book, but a compass for reading fundamental changes in the world order.

The author compellingly argues that today's transition is happening much faster and on a much larger scale than in the past, emphasizing why now is the time to discuss the end of the dollar.

The greatest strength of this book is that it addresses the dollar issue from a civilizational perspective, rather than a narrow financial one.

The possibility of the collapse of American hegemony is interpreted as a simultaneous phenomenon of economic bubble and political rift, and is expanded to a problem directly related to the existence of the nation.

Readers will see the dollar's collapse scenario not simply as a crisis, but as the possibility of a new order and opportunity.

If the dollar crisis means a restructuring of the global economy, that process will have a direct impact on our lives.

This book provides the knowledge and insights to prepare for the future at that very point.

Insights into the rise and fall of the dollar can shed light on the survival requirements of a new era.

This is a must-read for everyone, not just financial professionals, but also policymakers, entrepreneurs, and the general reader.

Why is it destined to fail?

The dollar has reigned as the heart of the global economy and a symbol of hegemony for the past century.

But today, the stability of the dollar goes beyond mere financial considerations; it is directly linked to the fundamental value system that underpins democracy, market economies, and international security.

This book powerfully demonstrates that the cracks in the dollar's hegemony are not simply a currency swap, but a sign of a profound shift in the entire world order.

With the three driving forces of civilizational change—war, disease, and technological innovation—overlapping, the discussion of the dollar's demise is more timely than ever.

The 2008 global financial crisis, the US-China hegemony competition, and the rise of digital currencies are three shock waves shaking the dollar system.

Therefore, this book is not simply an economic analysis book, but a compass for reading fundamental changes in the world order.

The author compellingly argues that today's transition is happening much faster and on a much larger scale than in the past, emphasizing why now is the time to discuss the end of the dollar.

The greatest strength of this book is that it addresses the dollar issue from a civilizational perspective, rather than a narrow financial one.

The possibility of the collapse of American hegemony is interpreted as a simultaneous phenomenon of economic bubble and political rift, and is expanded to a problem directly related to the existence of the nation.

Readers will see the dollar's collapse scenario not simply as a crisis, but as the possibility of a new order and opportunity.

If the dollar crisis means a restructuring of the global economy, that process will have a direct impact on our lives.

This book provides the knowledge and insights to prepare for the future at that very point.

Insights into the rise and fall of the dollar can shed light on the survival requirements of a new era.

This is a must-read for everyone, not just financial professionals, but also policymakers, entrepreneurs, and the general reader.

- You can preview some of the book's contents.

Preview

index

| Introduction | When the dollar falters, civilization also stands at a turning point.

◆ CHAPTER 1 Trump's Misreading: The Dollar's Hegemony Is Unstable

A new era is changing, a new chapter is being created.

Who is Trump? A Variable in the American Order | Trump: A Misreading of the Changing Times | McKinley and Trump: Similar Yet Dissimilar | The Coexistence of Elected and Unelected Power | The Uneasy Start of Trump 2.0

Entering the 'Chinese Century' in earnest

The Prologue to the 'Chinese Century' | A Crossroads for the Future

Tariff Variables and Global Economic Growth Scenarios

An Age of Tariffs and Uncertainty | Economic Growth Scenarios Beyond 2025 | How Did the World Get Here?

The gap between diplomacy and national interests is widening.

Breaking with Idealism: National Interest-Centered Diplomacy | The Origins of Diplomacy: The Wisdom of Delaying War | America's Greatest Delusion: Can China Change? | China's Powerful Position and Challenges

◆ CHAPTER 2 The Allure and Cracks of the Dollar: The Power and Limits of a Reserve Currency

The invention of money, a revolution in exchange

'Money' is the only trust system created by humans | Money is a symbolic representation of 'value' | Surplus production and its entry into the institutional realm of 'capital' | Money has a unique scent.

The Beginning of the Dollar, the Beginning of America

The dollar system is finally established | The background of the Bretton Woods Agreement | The emergence of gold and the US dollar

The Dollar's Trials, a Test of Trust

De Gaulle's Challenge and the Collapse of the Bretton Woods System | 2003 US-China Exchange Rate Reform Pressure and Japan's Plan | The Second Ordeal: What if China Makes a Super Powerful Move? | The US Raised China on its Back | The "Chinese Century" Has Arrived | The US Dollar Is Like English, the International Language | Excessive Privilege: The History of the US Dollar's Dominance

America's Hidden Ambition: Pax Americana

The Benefits of Dollar Dominance | The US Dollar's Debt Addiction | China, Too, Is at the Center of Change | The Dollar's Financial Power: The "Unsetting Sun" | The Scent of the US Dollar | The Independence and Importance of the Federal Reserve | Steve Myron: America's Machiavelli? | The Dollar's Decline Is a Slow Flame

A weak dollar means a world of pain is imminent.

The economy is becoming entrenched in import-and-consumption | The possibility of a capital war following the trade war | The world of a weak dollar: the pros and cons of the US economy | The US credit rating downgrade is a symbolic event | Is the US Treasury warning signaling a weakening dollar? | Trump and the source of US power | The 'spectre of globalization' is resurrected.

◆ CHAPTER 3 The Shattering of the Dollar Hegemony: End or Transition?

New Imperialism and the World's Three Powers

Trump's Vision and the US-China-Russia Tripolar System | A Return to 19th-Century Imperialism | A Return to Neo-Imperialism?

Xi Jinping, Putin, and Trump: The Resurgence and Spread of Dictatorship

Dictatorship and the Destruction of Core American Values | All-Out Pressure from Law Firms, Media, and Universities | This Is Not the First Time That Government Critics Have Been Threatened and Retaliated Against

The volatility of Trump's policies and the collapse of trust

The Dictator's Claws Revealed | Price Increases and Shortages | Misguided Obsessions and Miscalculations

Distrust in US bonds and cracks in the financial order

Bonds, not the dollar: A tainted bond market | Factors shaking the US bond market | The US at risk of falling into the 'emerging market trap' | The allure of emerging market bonds | The real reason for the decline in US bond prices | The US dollar's reserve currency status 40 years from now

Why the US Dollar Is Still King

Why the Dollar Can't Be Dethroned | Factors Maintaining Dollar Hegemony and the Limits of Alternative Currencies | The Spread of the De-Dollarization Movement and the Challenges of the BRICS | The Future of the Dollar and the De-Dollarization Debate

◆ CHAPTER 4 Gold and Cryptocurrencies: Can They Replace the Dollar?

A crisis of confidence in the dollar shakes the financial order.

The Beginning of a Dollar-Based Transition | Is the US Dollar's Reserve Currency Status Under Threat? | Exchange Rate and Interest Rate Policy Risks in Emerging Markets

Economic pessimism and no signs of recovery

Dimon's pessimism, but his bank is doing better | 'Being too optimistic makes you look stupid' | The 'graveyard' of financial institutions and JPMorgan

The asset market is changing, and the flow of money is shifting.

The Unstable and Unpredictable US Economy and Markets | Uneasy Times Begin | 'The Three Idiots' or 'The Three Musketeers'

Investment return projections are becoming meaningless.

What strategy should investors adopt?

It's too early to challenge China's hegemony.

With great power comes great responsibility | Barriers to entry for superpower status | The US dwarfs China in comprehensive national wealth | The challenge facing the US

Rising gold prices highlight dollar anxiety

A Warning Sign About the Power of the US Dollar | Five Assets That Could Replace the US Dollar | Rediscovering the Value of Gold | The Potential Resurgence of Gold as a Reserve Asset | Can Gold Replace the US Dollar? | Where Are Gold Prices Headed?

Bitcoin: A Revolution That Will Shake the Dollar?

Complementing, Not Replacing, the Dollar: The Role of Cryptocurrencies | The Launch of Bitcoin and Its Implications | Bitcoin as a Modern Store of Value | Potential Pros and Cons of a Strategic Bitcoin Reserve | Trump and Cryptocurrencies | Trump's Threat to Make the US a Bitcoin Superpower | The US Government's Plans to Utilize Its Bitcoin Holdings | Can Bitcoin Replace the Dollar? | Stablecoins: A Bulwark for Maintaining the US Dollar's Reserve Currency Status?

| References |

| Americas |

◆ CHAPTER 1 Trump's Misreading: The Dollar's Hegemony Is Unstable

A new era is changing, a new chapter is being created.

Who is Trump? A Variable in the American Order | Trump: A Misreading of the Changing Times | McKinley and Trump: Similar Yet Dissimilar | The Coexistence of Elected and Unelected Power | The Uneasy Start of Trump 2.0

Entering the 'Chinese Century' in earnest

The Prologue to the 'Chinese Century' | A Crossroads for the Future

Tariff Variables and Global Economic Growth Scenarios

An Age of Tariffs and Uncertainty | Economic Growth Scenarios Beyond 2025 | How Did the World Get Here?

The gap between diplomacy and national interests is widening.

Breaking with Idealism: National Interest-Centered Diplomacy | The Origins of Diplomacy: The Wisdom of Delaying War | America's Greatest Delusion: Can China Change? | China's Powerful Position and Challenges

◆ CHAPTER 2 The Allure and Cracks of the Dollar: The Power and Limits of a Reserve Currency

The invention of money, a revolution in exchange

'Money' is the only trust system created by humans | Money is a symbolic representation of 'value' | Surplus production and its entry into the institutional realm of 'capital' | Money has a unique scent.

The Beginning of the Dollar, the Beginning of America

The dollar system is finally established | The background of the Bretton Woods Agreement | The emergence of gold and the US dollar

The Dollar's Trials, a Test of Trust

De Gaulle's Challenge and the Collapse of the Bretton Woods System | 2003 US-China Exchange Rate Reform Pressure and Japan's Plan | The Second Ordeal: What if China Makes a Super Powerful Move? | The US Raised China on its Back | The "Chinese Century" Has Arrived | The US Dollar Is Like English, the International Language | Excessive Privilege: The History of the US Dollar's Dominance

America's Hidden Ambition: Pax Americana

The Benefits of Dollar Dominance | The US Dollar's Debt Addiction | China, Too, Is at the Center of Change | The Dollar's Financial Power: The "Unsetting Sun" | The Scent of the US Dollar | The Independence and Importance of the Federal Reserve | Steve Myron: America's Machiavelli? | The Dollar's Decline Is a Slow Flame

A weak dollar means a world of pain is imminent.

The economy is becoming entrenched in import-and-consumption | The possibility of a capital war following the trade war | The world of a weak dollar: the pros and cons of the US economy | The US credit rating downgrade is a symbolic event | Is the US Treasury warning signaling a weakening dollar? | Trump and the source of US power | The 'spectre of globalization' is resurrected.

◆ CHAPTER 3 The Shattering of the Dollar Hegemony: End or Transition?

New Imperialism and the World's Three Powers

Trump's Vision and the US-China-Russia Tripolar System | A Return to 19th-Century Imperialism | A Return to Neo-Imperialism?

Xi Jinping, Putin, and Trump: The Resurgence and Spread of Dictatorship

Dictatorship and the Destruction of Core American Values | All-Out Pressure from Law Firms, Media, and Universities | This Is Not the First Time That Government Critics Have Been Threatened and Retaliated Against

The volatility of Trump's policies and the collapse of trust

The Dictator's Claws Revealed | Price Increases and Shortages | Misguided Obsessions and Miscalculations

Distrust in US bonds and cracks in the financial order

Bonds, not the dollar: A tainted bond market | Factors shaking the US bond market | The US at risk of falling into the 'emerging market trap' | The allure of emerging market bonds | The real reason for the decline in US bond prices | The US dollar's reserve currency status 40 years from now

Why the US Dollar Is Still King

Why the Dollar Can't Be Dethroned | Factors Maintaining Dollar Hegemony and the Limits of Alternative Currencies | The Spread of the De-Dollarization Movement and the Challenges of the BRICS | The Future of the Dollar and the De-Dollarization Debate

◆ CHAPTER 4 Gold and Cryptocurrencies: Can They Replace the Dollar?

A crisis of confidence in the dollar shakes the financial order.

The Beginning of a Dollar-Based Transition | Is the US Dollar's Reserve Currency Status Under Threat? | Exchange Rate and Interest Rate Policy Risks in Emerging Markets

Economic pessimism and no signs of recovery

Dimon's pessimism, but his bank is doing better | 'Being too optimistic makes you look stupid' | The 'graveyard' of financial institutions and JPMorgan

The asset market is changing, and the flow of money is shifting.

The Unstable and Unpredictable US Economy and Markets | Uneasy Times Begin | 'The Three Idiots' or 'The Three Musketeers'

Investment return projections are becoming meaningless.

What strategy should investors adopt?

It's too early to challenge China's hegemony.

With great power comes great responsibility | Barriers to entry for superpower status | The US dwarfs China in comprehensive national wealth | The challenge facing the US

Rising gold prices highlight dollar anxiety

A Warning Sign About the Power of the US Dollar | Five Assets That Could Replace the US Dollar | Rediscovering the Value of Gold | The Potential Resurgence of Gold as a Reserve Asset | Can Gold Replace the US Dollar? | Where Are Gold Prices Headed?

Bitcoin: A Revolution That Will Shake the Dollar?

Complementing, Not Replacing, the Dollar: The Role of Cryptocurrencies | The Launch of Bitcoin and Its Implications | Bitcoin as a Modern Store of Value | Potential Pros and Cons of a Strategic Bitcoin Reserve | Trump and Cryptocurrencies | Trump's Threat to Make the US a Bitcoin Superpower | The US Government's Plans to Utilize Its Bitcoin Holdings | Can Bitcoin Replace the Dollar? | Stablecoins: A Bulwark for Maintaining the US Dollar's Reserve Currency Status?

| References |

| Americas |

Detailed image

Into the book

To find new growth engines, we must go beyond the simple debate over trade and fiscal deficits.

Leaders must develop concrete plans to steer the global economy on a resilient and sustainable path.

The key question here is: Are the US tariffs and trade tensions justified? And, more fundamentally, will we continue down a path that appears unsustainable, or will we find a balance between economic resilience and national security?

Economies need a stable investment environment and reliable partners to grow and prosper.

Therefore, national leaders must strengthen mutual trust and, based on this, rebuild a cooperative system for trade, security, and the environment.

Because an economy lacking balance and trust can never prosper.

Furthermore, we must not overlook the fact that the level of balance and trust is directly related to income distribution.

--- From "CHAPTER 1: Trump's Misreading: Dollar Hegemony is Unstable"

'Security' includes the ability to deter external threats and support allies.

It is divided into 'hard power' and 'soft power', with an example of the latter being the ability to procure and produce goods and services.

A lack of national balance will inevitably exacerbate financial instability and weaken the ability to invest in human and physical capital for innovation, productivity, and growth.

The most important sufficient condition for economic growth is ‘trust.’

In a high-trust environment, costs and risk premiums are reduced, information flow is smoother, and transparent enforcement of laws and regulations reduces transaction costs.

This leads to welfare and security systems, and serves as a catalyst for entrepreneurship, innovation, and increased productivity.

--- From "CHAPTER 1: Trump's Misreading: Dollar Hegemony is Unstable"

The core of American diplomacy is undoubtedly the China issue.

China poses a broader and deeper challenge to the United States than perhaps any competitor in its history.

The United States cannot contain China as it could the Soviet Union.

Because China is too big and too integrated into the global economy.

Therefore, the United States must use every means possible to block China's practical option of forming an anti-American coalition.

The goal of diplomacy is to build the largest anti-China coalition possible, strengthen domestic economic power, and, based on that foundation, find a way to coexist in a favorable manner.

--- From "CHAPTER 1: Trump's Misreading: Dollar Hegemony is Unstable"

Most of today's currency is electronic data.

According to Harari, of the total world currency balance of approximately $60 trillion, less than $6 trillion is in banknotes and coins.

More than 90% of the data is just data on the server.

Few people take cash with them when buying a home.

As long as people trust electronic data, it is lighter, smaller, and easier to track than coins or banknotes.

For thousands of years, philosophers, thinkers, and prophets have denounced money as the root of evil.

Yet, money can be said to be the pinnacle of human tolerance.

Money is more inclusive than language, law, norms, religion, or habits.

Because it is the only trust system that transcends cultural barriers, regardless of religion, gender, race, age, or sexual orientation.

Thanks to this, even people who do not know or trust each other can cooperate within the system of money.

--- From "CHAPTER 2: The Allure and Cracks of the Dollar: The Power and Limits of the Reserve Currency"

The US dollar's reserve currency status operates on the basis of 'economies of scale', 'economies of scope', and 'economies of density', which are economic size, institutions, and financial market trust.

It will take considerable time for China to acquire all of these elements.

Therefore, challenges to the dollar could strengthen its resilience in the short term and further solidify America's credibility and leadership.

However, if global trust collapses at some point and Europe and Asia agree to experimentally introduce a new reserve currency, the dollar's position could be weakened.

--- From "CHAPTER 2: The Allure and Cracks of the Dollar: The Power and Limits of the Reserve Currency"

We examine the threats to the US dollar's status as the world's reserve currency through the views of two prominent economists.

The question of the text is, if a threat exists, how closely does it relate to the rapid rise of the Chinese economy? If not, can unnecessary concerns be dispelled?

So, is President Trump's dollar view a personal belief or the brainchild of White House Economic Adviser Stephen Miran? Every time Trump discusses economic policy, questions arise about whether he has adequately considered global leadership and domestic issues.

This is because the entrepreneurial career of being a “genius of deals” does not guarantee theoretical and empirical consistency with macroeconomic principles.

--- From "CHAPTER 2: The Allure and Cracks of the Dollar: The Power and Limits of the Reserve Currency"

Globalization has both positive and negative impacts.

But President Trump is attacking what is beneficial to America and neglecting what is truly harmful.

Globalization has strengthened America's power for the past 80 years since World War II, but its attacks only weaken it.

--- From "CHAPTER 2: The Allure and Cracks of the Dollar: The Power and Limits of the Reserve Currency"

Competitive authoritarianism can arrive without warning.

Because the government uses nominally legal means (such as defamation suits, tax audits, and political investigations) to attack opponents, citizens do not recognize that they have fallen into an authoritarian regime.

Even after a decade of Chávez's rule, most Venezuelans still believed they lived in a democratic country.

So what about the United States? A simple criterion for judging whether it has strayed into authoritarianism is the "cost of opposing the government."

In a democracy, there is no punishment for criticizing the government, supporting opposition candidates, or protesting peacefully.

The existence of legitimate opposition is a core principle of democracy.

All citizens have the right to criticize the government, organize opposition parties, and change the government through elections.

--- From "CHAPTER 3: The Shakenness of the Dollar Hegemony: The End or the Transition"

The biggest reason investors are hesitant to buy long-term Treasury bonds is the U.S. federal government's fiscal deficit.

This reflects concerns that the increasing supply of bonds to cover the fiscal deficit could lead to a decline in prices.

Republicans have been pushing for months on a massive tax cut bill, and the Congressional Budget Office (CBO) estimates that the bill would add about $2.5 trillion to the deficit over the next decade.

The widening fiscal deficit will soon lead to a weakening of the US dollar.

Therefore, the question of the dollar's reserve currency status will depend on factors such as the future development of US-China tariff policies, the pace and scale of fiscal deficit accumulation, and the level of dollar weakness.

--- From "CHAPTER 3: The Shakenness of the Dollar Hegemony: The End or the Transition"

One of the major factors shaking the U.S. bond market is the tax cut bill currently under discussion in Congress.

It seeks to make permanent the tax cuts that were a key Trump achievement in 2017, raising concerns that it could increase the federal debt by $2.5 trillion over the next decade.

The bill passed the House committee by one vote on June 2, 2025 (local time), but a fierce debate is expected in the Senate.

Another factor is the downgrade of the U.S. credit rating on May 16, 2025 (local time).

The downgrade is due to massive fiscal deficits and rising interest costs, which are key factors contributing to growing distrust among bond investors.

--- From "CHAPTER 3: The Shakenness of the Dollar Hegemony: The End or the Transition"

Despite US debt and inflation, the dollar remains strong.

The dollar index has risen 0.29% over the past five years, but has fallen 11% since the first half of 2025.

This is the result of the Trump administration's unpredictable policies increasing market uncertainty.

Trump threatened 100% tariffs on countries trading in alternative currencies and claimed that the strong dollar was hurting American manufacturing.

However, such a hard-line policy could actually shake confidence in the dollar.

This is because a reserve currency must be supported not only by economic power but also by political stability.

However, it is difficult for gold, cryptocurrencies, and smaller currencies to currently be practical alternatives to the dollar.

Gold and silver suffer from liquidity and transportation issues, while cryptocurrencies suffer from volatility and lack of trust.

Central banks around the world are seeking to diversify their holdings by adding smaller stablecoins like the Australian and Canadian dollars and gold, but this is not fundamentally shaking the dollar's position.

--- From "CHAPTER 3: The Shakenness of the Dollar Hegemony: The End or the Transition"

A 'crisis of confidence in the dollar' is being raised.

Experts have recently warned that the US dollar is currently facing a "regime shift" and could be considered a "risky currency" in the future.

The dollar is weakening despite increased volatility in financial markets due to President Trump's frequent changes in tariff policy.

The DXY dollar index fell 4% since Liberation Day, hitting a three-year low. "This is highly unusual, given the dollar's traditional role as a safe-haven asset and its tendency to strengthen during periods of market volatility," said UBS strategist Shahab Jalinoos.

--- From "CHAPTER 4 Gold and Cryptocurrency: Can They Replace the Dollar?"

The dollar's decline is leading to discussions about 'de-dollarization'.

The dollar currently accounts for 58% of global foreign exchange reserves, down from more than 70% 20 years ago.

In particular, in 2022, active selling by central banks accounted for more than half of the decline in the dollar's weighting.

The key is not the existence of a single competitor, but rather the shaky trust in existing reserve currencies.

Reserve currency status is not an innate right, but rather something earned and maintained through stability, responsibility, and leadership.

--- From "CHAPTER 4 Gold and Cryptocurrency: Can They Replace the Dollar?"

The factors driving up gold prices can be summarized as follows:

First, the recent sell-off of the dollar and the growing discussion of de-dollarization have raised questions about the dollar's appeal as a reserve currency.

This is because the Trump administration's strengthening of tariffs and protectionism, concerns about a global growth slowdown, the deepening conflict between the U.S. and China, and the expansion of government bond supply and rising interest costs due to accumulating fiscal deficits could act as structural headwinds for the dollar.

Second, gold and silver have re-emerged as a 'substitute and complementary good' for reserve assets.

Some countries are expanding their foreign exchange reserves to hold gold to hedge against the risk of dollar asset freezes.

Third, the proliferation of digital assets such as stablecoins is increasing demand for collateral and reserve assets, stimulating demand for gold.

While the safe-haven status of U.S. Treasury bonds is being reassessed to some extent, it remains difficult to replace them in the short term due to their liquidity and market depth.

In short, the rise in gold prices is not a short-term refuge, but a structural phenomenon intertwined with diversification of reserve assets and policy uncertainty.

--- From "CHAPTER 4 Gold and Cryptocurrency: Can They Replace the Dollar?"

Bitcoin now seems like an irreversible trend, but resistance from the corporate world persists.

In late 2024, Microsoft shareholders rejected a proposal to invest the company's cash in Bitcoin.

Bitcoin may have value as a part of an asset portfolio, but it cannot replace the dollar as a currency.

It is not based on a physical asset like gold, and blockchain is merely a security technology and a record-keeping system.

It cannot be equated with money, which is a public good.

Leaders must develop concrete plans to steer the global economy on a resilient and sustainable path.

The key question here is: Are the US tariffs and trade tensions justified? And, more fundamentally, will we continue down a path that appears unsustainable, or will we find a balance between economic resilience and national security?

Economies need a stable investment environment and reliable partners to grow and prosper.

Therefore, national leaders must strengthen mutual trust and, based on this, rebuild a cooperative system for trade, security, and the environment.

Because an economy lacking balance and trust can never prosper.

Furthermore, we must not overlook the fact that the level of balance and trust is directly related to income distribution.

--- From "CHAPTER 1: Trump's Misreading: Dollar Hegemony is Unstable"

'Security' includes the ability to deter external threats and support allies.

It is divided into 'hard power' and 'soft power', with an example of the latter being the ability to procure and produce goods and services.

A lack of national balance will inevitably exacerbate financial instability and weaken the ability to invest in human and physical capital for innovation, productivity, and growth.

The most important sufficient condition for economic growth is ‘trust.’

In a high-trust environment, costs and risk premiums are reduced, information flow is smoother, and transparent enforcement of laws and regulations reduces transaction costs.

This leads to welfare and security systems, and serves as a catalyst for entrepreneurship, innovation, and increased productivity.

--- From "CHAPTER 1: Trump's Misreading: Dollar Hegemony is Unstable"

The core of American diplomacy is undoubtedly the China issue.

China poses a broader and deeper challenge to the United States than perhaps any competitor in its history.

The United States cannot contain China as it could the Soviet Union.

Because China is too big and too integrated into the global economy.

Therefore, the United States must use every means possible to block China's practical option of forming an anti-American coalition.

The goal of diplomacy is to build the largest anti-China coalition possible, strengthen domestic economic power, and, based on that foundation, find a way to coexist in a favorable manner.

--- From "CHAPTER 1: Trump's Misreading: Dollar Hegemony is Unstable"

Most of today's currency is electronic data.

According to Harari, of the total world currency balance of approximately $60 trillion, less than $6 trillion is in banknotes and coins.

More than 90% of the data is just data on the server.

Few people take cash with them when buying a home.

As long as people trust electronic data, it is lighter, smaller, and easier to track than coins or banknotes.

For thousands of years, philosophers, thinkers, and prophets have denounced money as the root of evil.

Yet, money can be said to be the pinnacle of human tolerance.

Money is more inclusive than language, law, norms, religion, or habits.

Because it is the only trust system that transcends cultural barriers, regardless of religion, gender, race, age, or sexual orientation.

Thanks to this, even people who do not know or trust each other can cooperate within the system of money.

--- From "CHAPTER 2: The Allure and Cracks of the Dollar: The Power and Limits of the Reserve Currency"

The US dollar's reserve currency status operates on the basis of 'economies of scale', 'economies of scope', and 'economies of density', which are economic size, institutions, and financial market trust.

It will take considerable time for China to acquire all of these elements.

Therefore, challenges to the dollar could strengthen its resilience in the short term and further solidify America's credibility and leadership.

However, if global trust collapses at some point and Europe and Asia agree to experimentally introduce a new reserve currency, the dollar's position could be weakened.

--- From "CHAPTER 2: The Allure and Cracks of the Dollar: The Power and Limits of the Reserve Currency"

We examine the threats to the US dollar's status as the world's reserve currency through the views of two prominent economists.

The question of the text is, if a threat exists, how closely does it relate to the rapid rise of the Chinese economy? If not, can unnecessary concerns be dispelled?

So, is President Trump's dollar view a personal belief or the brainchild of White House Economic Adviser Stephen Miran? Every time Trump discusses economic policy, questions arise about whether he has adequately considered global leadership and domestic issues.

This is because the entrepreneurial career of being a “genius of deals” does not guarantee theoretical and empirical consistency with macroeconomic principles.

--- From "CHAPTER 2: The Allure and Cracks of the Dollar: The Power and Limits of the Reserve Currency"

Globalization has both positive and negative impacts.

But President Trump is attacking what is beneficial to America and neglecting what is truly harmful.

Globalization has strengthened America's power for the past 80 years since World War II, but its attacks only weaken it.

--- From "CHAPTER 2: The Allure and Cracks of the Dollar: The Power and Limits of the Reserve Currency"

Competitive authoritarianism can arrive without warning.

Because the government uses nominally legal means (such as defamation suits, tax audits, and political investigations) to attack opponents, citizens do not recognize that they have fallen into an authoritarian regime.

Even after a decade of Chávez's rule, most Venezuelans still believed they lived in a democratic country.

So what about the United States? A simple criterion for judging whether it has strayed into authoritarianism is the "cost of opposing the government."

In a democracy, there is no punishment for criticizing the government, supporting opposition candidates, or protesting peacefully.

The existence of legitimate opposition is a core principle of democracy.

All citizens have the right to criticize the government, organize opposition parties, and change the government through elections.

--- From "CHAPTER 3: The Shakenness of the Dollar Hegemony: The End or the Transition"

The biggest reason investors are hesitant to buy long-term Treasury bonds is the U.S. federal government's fiscal deficit.

This reflects concerns that the increasing supply of bonds to cover the fiscal deficit could lead to a decline in prices.

Republicans have been pushing for months on a massive tax cut bill, and the Congressional Budget Office (CBO) estimates that the bill would add about $2.5 trillion to the deficit over the next decade.

The widening fiscal deficit will soon lead to a weakening of the US dollar.

Therefore, the question of the dollar's reserve currency status will depend on factors such as the future development of US-China tariff policies, the pace and scale of fiscal deficit accumulation, and the level of dollar weakness.

--- From "CHAPTER 3: The Shakenness of the Dollar Hegemony: The End or the Transition"

One of the major factors shaking the U.S. bond market is the tax cut bill currently under discussion in Congress.

It seeks to make permanent the tax cuts that were a key Trump achievement in 2017, raising concerns that it could increase the federal debt by $2.5 trillion over the next decade.

The bill passed the House committee by one vote on June 2, 2025 (local time), but a fierce debate is expected in the Senate.

Another factor is the downgrade of the U.S. credit rating on May 16, 2025 (local time).

The downgrade is due to massive fiscal deficits and rising interest costs, which are key factors contributing to growing distrust among bond investors.

--- From "CHAPTER 3: The Shakenness of the Dollar Hegemony: The End or the Transition"

Despite US debt and inflation, the dollar remains strong.

The dollar index has risen 0.29% over the past five years, but has fallen 11% since the first half of 2025.

This is the result of the Trump administration's unpredictable policies increasing market uncertainty.

Trump threatened 100% tariffs on countries trading in alternative currencies and claimed that the strong dollar was hurting American manufacturing.

However, such a hard-line policy could actually shake confidence in the dollar.

This is because a reserve currency must be supported not only by economic power but also by political stability.

However, it is difficult for gold, cryptocurrencies, and smaller currencies to currently be practical alternatives to the dollar.

Gold and silver suffer from liquidity and transportation issues, while cryptocurrencies suffer from volatility and lack of trust.

Central banks around the world are seeking to diversify their holdings by adding smaller stablecoins like the Australian and Canadian dollars and gold, but this is not fundamentally shaking the dollar's position.

--- From "CHAPTER 3: The Shakenness of the Dollar Hegemony: The End or the Transition"

A 'crisis of confidence in the dollar' is being raised.

Experts have recently warned that the US dollar is currently facing a "regime shift" and could be considered a "risky currency" in the future.

The dollar is weakening despite increased volatility in financial markets due to President Trump's frequent changes in tariff policy.

The DXY dollar index fell 4% since Liberation Day, hitting a three-year low. "This is highly unusual, given the dollar's traditional role as a safe-haven asset and its tendency to strengthen during periods of market volatility," said UBS strategist Shahab Jalinoos.

--- From "CHAPTER 4 Gold and Cryptocurrency: Can They Replace the Dollar?"

The dollar's decline is leading to discussions about 'de-dollarization'.

The dollar currently accounts for 58% of global foreign exchange reserves, down from more than 70% 20 years ago.

In particular, in 2022, active selling by central banks accounted for more than half of the decline in the dollar's weighting.

The key is not the existence of a single competitor, but rather the shaky trust in existing reserve currencies.

Reserve currency status is not an innate right, but rather something earned and maintained through stability, responsibility, and leadership.

--- From "CHAPTER 4 Gold and Cryptocurrency: Can They Replace the Dollar?"

The factors driving up gold prices can be summarized as follows:

First, the recent sell-off of the dollar and the growing discussion of de-dollarization have raised questions about the dollar's appeal as a reserve currency.

This is because the Trump administration's strengthening of tariffs and protectionism, concerns about a global growth slowdown, the deepening conflict between the U.S. and China, and the expansion of government bond supply and rising interest costs due to accumulating fiscal deficits could act as structural headwinds for the dollar.

Second, gold and silver have re-emerged as a 'substitute and complementary good' for reserve assets.

Some countries are expanding their foreign exchange reserves to hold gold to hedge against the risk of dollar asset freezes.

Third, the proliferation of digital assets such as stablecoins is increasing demand for collateral and reserve assets, stimulating demand for gold.

While the safe-haven status of U.S. Treasury bonds is being reassessed to some extent, it remains difficult to replace them in the short term due to their liquidity and market depth.

In short, the rise in gold prices is not a short-term refuge, but a structural phenomenon intertwined with diversification of reserve assets and policy uncertainty.

--- From "CHAPTER 4 Gold and Cryptocurrency: Can They Replace the Dollar?"

Bitcoin now seems like an irreversible trend, but resistance from the corporate world persists.

In late 2024, Microsoft shareholders rejected a proposal to invest the company's cash in Bitcoin.

Bitcoin may have value as a part of an asset portfolio, but it cannot replace the dollar as a currency.

It is not based on a physical asset like gold, and blockchain is merely a security technology and a record-keeping system.

It cannot be equated with money, which is a public good.

--- From "CHAPTER 4 Gold and Cryptocurrency: Can They Replace the Dollar?"

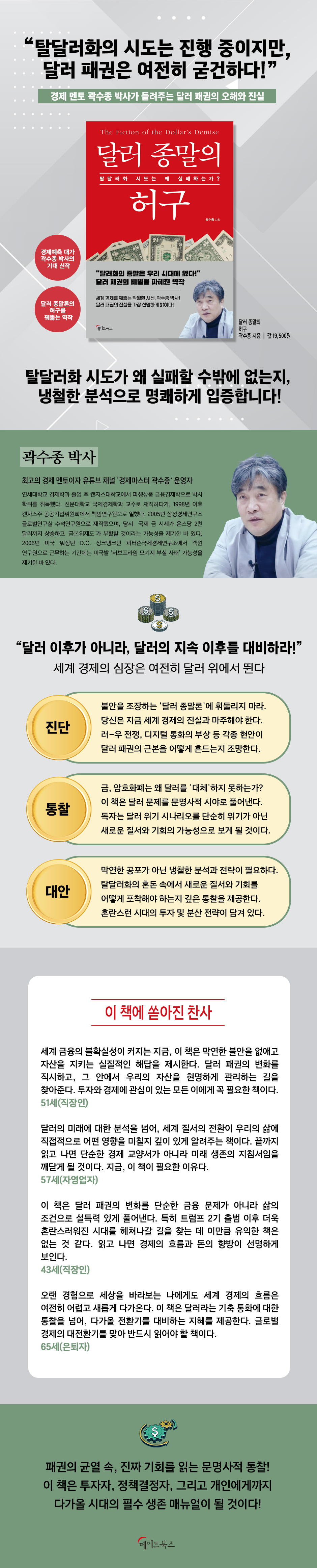

Publisher's Review

The secret of dollar hegemony

A masterpiece that delves into the future

This book consists of four chapters.

Chapter 1 begins by examining the fundamental shake-up of the dollar's hegemony through three driving forces: the war in Ukraine, the COVID-19 pandemic, and the rise of AI and digital currencies.

Next, Chapter 2 traces how the dollar became the foundation of the international order after the Bretton Woods system and analyzes the potential ramifications of the challenges posed by the yuan and digital currencies.

Chapter 3 then examines the invention and evolution of money within the context of politics, economics, and society, demonstrating that money is a symbol of power and order.

The final four chapters reexamine the dollar's position within the flow of various assets, including stocks, gold, bonds, and cryptocurrencies, and suggest investment and diversification strategies in an era of uncertainty.

In this way, each chapter presents the multilayered meaning of the dollar's demise by intersecting history and the present, finance and philosophy, crisis and alternatives.

In it, readers will be able to understand the reality of the shift in global hegemony and gain a starting point for a response strategy.

The message of this book is not just a simple warning.

The end of the dollar hegemony heralds an era of uncertainty, but it also presents a moment of opportunity to usher in a new order.

The author urges readers to have the courage to coolly analyze reality in the face of crisis and to actively plan for the future.

The chaos we face when the dollar fluctuates is inevitable, but there are certainly ways to survive it.

Therefore, this book is a proposal to turn the demise of the dollar into an opportunity for wisdom, not fear.

As we face a period of upheaval in the international order, this book becomes a must-read survival manual for individuals, societies, and nations.

By the time the final chapter is written, readers will have gained a new perspective on world order, one that goes beyond mere financial knowledge.

The end of the dollar is not the end, but the beginning, and for those preparing for that very beginning, this book is a decisive weapon.

Recommendation

As global financial uncertainty grows, this book offers practical solutions to dispel vague anxieties and protect your assets.

It helps us face the shift in dollar hegemony and find ways to wisely manage our assets within it.

This is a must-read for anyone interested in investing and economics.

51 years old (office worker)

Beyond analyzing the future of the dollar, this book delves deeply into how the shift in world order will directly impact our lives.

By the time you finish reading, you will realize that this is not just a simple economics textbook, but a guide to future survival.

This is why you need this book now.

57 years old (self-employed)

This book persuasively explains the shift in dollar hegemony not simply as a financial issue, but as a condition of life.

Especially since the inauguration of Trump's second term, there seems to be no book more helpful in navigating the increasingly chaotic times.

After reading it, you will see the flow of the economy and the direction of money clearly.

43 years old (office worker)

Even for me, who has a long history of looking at the world, the flow of the global economy still feels difficult and new.

Beyond providing insights into the dollar as a reserve currency, this book offers wisdom for preparing for the coming transition.

This is a must-read book as the global economy faces a major turning point.

65 years old (retired)

A masterpiece that delves into the future

This book consists of four chapters.

Chapter 1 begins by examining the fundamental shake-up of the dollar's hegemony through three driving forces: the war in Ukraine, the COVID-19 pandemic, and the rise of AI and digital currencies.

Next, Chapter 2 traces how the dollar became the foundation of the international order after the Bretton Woods system and analyzes the potential ramifications of the challenges posed by the yuan and digital currencies.

Chapter 3 then examines the invention and evolution of money within the context of politics, economics, and society, demonstrating that money is a symbol of power and order.

The final four chapters reexamine the dollar's position within the flow of various assets, including stocks, gold, bonds, and cryptocurrencies, and suggest investment and diversification strategies in an era of uncertainty.

In this way, each chapter presents the multilayered meaning of the dollar's demise by intersecting history and the present, finance and philosophy, crisis and alternatives.

In it, readers will be able to understand the reality of the shift in global hegemony and gain a starting point for a response strategy.

The message of this book is not just a simple warning.

The end of the dollar hegemony heralds an era of uncertainty, but it also presents a moment of opportunity to usher in a new order.

The author urges readers to have the courage to coolly analyze reality in the face of crisis and to actively plan for the future.

The chaos we face when the dollar fluctuates is inevitable, but there are certainly ways to survive it.

Therefore, this book is a proposal to turn the demise of the dollar into an opportunity for wisdom, not fear.

As we face a period of upheaval in the international order, this book becomes a must-read survival manual for individuals, societies, and nations.

By the time the final chapter is written, readers will have gained a new perspective on world order, one that goes beyond mere financial knowledge.

The end of the dollar is not the end, but the beginning, and for those preparing for that very beginning, this book is a decisive weapon.

Recommendation

As global financial uncertainty grows, this book offers practical solutions to dispel vague anxieties and protect your assets.

It helps us face the shift in dollar hegemony and find ways to wisely manage our assets within it.

This is a must-read for anyone interested in investing and economics.

51 years old (office worker)

Beyond analyzing the future of the dollar, this book delves deeply into how the shift in world order will directly impact our lives.

By the time you finish reading, you will realize that this is not just a simple economics textbook, but a guide to future survival.

This is why you need this book now.

57 years old (self-employed)

This book persuasively explains the shift in dollar hegemony not simply as a financial issue, but as a condition of life.

Especially since the inauguration of Trump's second term, there seems to be no book more helpful in navigating the increasingly chaotic times.

After reading it, you will see the flow of the economy and the direction of money clearly.

43 years old (office worker)

Even for me, who has a long history of looking at the world, the flow of the global economy still feels difficult and new.

Beyond providing insights into the dollar as a reserve currency, this book offers wisdom for preparing for the coming transition.

This is a must-read book as the global economy faces a major turning point.

65 years old (retired)

GOODS SPECIFICS

- Date of issue: October 20, 2025

- Page count, weight, size: 328 pages | 512g | 153*225*20mm

- ISBN13: 9791160029666

- ISBN10: 1160029660

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)