Jesse Livermore's Stock Investment Bible

|

Description

Book Introduction

In the history of mankind, there has never been a better investor than Livermore. _Mark Minervini His methods are often imitated but never surpassed. _Alexander Elder *** Jesse Livermore's only book, 『How to Trade in Stocks』, officially translated and signed! *** Includes commentary by Richard Smeaton, the leading authority on Jesse Livermore! Jesse Livermore, an investment legend praised by William O'Neil, Mark Minervini, and Alexander Elder, and called the "Bear of Wall Street" and the "Father of Trend Trading," is the greatest individual investor in Wall Street history. His groundbreaking timing techniques, money management system, and advanced momentum approach, which are the real-life protagonists of "Memoirs of a Stock Investor," are still recognized for their value even after 80 years. This book is a reinterpretation of Jesse Livermore's investment philosophy and techniques for the modern era by Richard Smeaton, who is considered the foremost authority on Jesse Livermore. Richard Smeaton, drawing on personal documents and family sources, provides valuable information on Livermore's stock trading techniques, while also suggesting how this information can be applied to modern technical investment techniques. Also included is Livermore's Market Key, the first market pattern analysis method and still considered the most accurate method for tracking and recording market patterns. The investment techniques of the great investor Jesse Livermore are still recognized as some of the most useful today. Jesse Livermore's cool-headed investment acumen and Richard Smeaton's thorough analysis will provide a solid path for investors who are struggling to establish investment principles. |

- You can preview some of the book's contents.

Preview

index

Acknowledgements

Great investor Jesse Livermore

preface

Livermore's New Year's Ceremony

Part 1: How to Invest Like Jesse Livermore

CHAPTER 1: Speculation is a Business

CHAPTER 2 Capturing the Stock Market Flow

CHAPTER 3: Follow the Leader

CHAPTER 4 Money in My Hand

CHAPTER 5: Capturing the Turning Point

CHAPTER 6 The Million Dollar Mistake

CHAPTER 7 $3 Million Profit

Part 2: Jesse Livermore's Pyramiding Strategy Explained

CHAPTER 8 Jesse Livermore's Pyramiding Strategy 1.

timing

Timing is everything

Understand overall market trends. Understand the price movements of the relevant industry. Compare stocks of interest with their sister stocks. Conduct detailed research on individual stocks.

· Industry movements

· Why collective movements occur across industries

The principle of following the leader

· Predicting ceilings based on industry movements

Serial Trading Method│Reversal Turning Points│Continuous Turning Points│Price Surges and Intraday Reversals│Breaking Through New Highs│Breaking Through Fixed Lines

· Least resistance line

· Stocks also have personalities.

· Information and patience

CHAPTER 9 Jesse Livermore's Pyramiding Strategy 2.

Fund management techniques

· Never lose money

Livermore's Principle of Money Management 1.

Don't Lose Money│Livermore's Money Management Principle 2.

Set a buy ratio│Livermore's money management principle 3.

Save up a reserve fund│Livermore's money management principle 4.

Hold on to profitable stocks│Livermore's Money Management Principle 5.

Set aside a portion of your profits as a reserve fund.

· Avoid low-priced stocks

· Ignore insider actions

· Set a target profit - risk-reward ratio

· Set a stop-loss level before entering a trade.

· Time as a trading factor

The key to financial management is 'points'

· Livermore's pyramiding technique

· Profit is the basis of all stocks

CHAPTER 10 Jesse Livermore's Pyramiding Strategy 3.

emotional control

· How to control greed and fear, ignorance and hope

· Attitude toward preparing for trading

Efforts to Become the Best in Your Field│Develop Information Ability and Perseverance

· Special work environment

Composure, patience, and silence│Lone wolf investor who makes decisions alone│Office manager Harry Dach│Livermore's office and work atmosphere

· Sheet music for the symphony titled 'Money'

· Maintain patience and caution

· What matters is 'trading volume'

· Ability to find turning points

· Everything is the investor's responsibility

· Attitude toward media reports

· Loss cut

· The will to control emotions

· Be wary of confidential information.

· Work hard and consistently

CHAPTER 11 How to Trade Stocks Like Jesse Livermore in the 21st Century Market

· Computer Utilization - Preview the Trading System

TDT (Top Down Trading)│TM (The Market)│TIG (The Industry Group)│TT (Tandem Trading)

· Common chart confirming Livermore trading

RPP (reversal point) │ CPP (continuation point) │ S (price surge) │ ODR (intraday reversal)

· Key risk signals indicating a possible trend reversal

BOCB (Breakthrough of Fixed Line)│BONH (Breakthrough of New High)│BV (Bulk Trading)

CHAPTER 12: Jesse Livermore's Stock Trading Techniques

· Market-related rules

Timing rules

· Top-down trading - follow the trend and check major markets.

· Fund management rules

Five Key Principles of Money Management

· Emotion control rules

Appendix Jesse Livermore's Market Key (1940 edition)

Market Key in Livermore

Explanation of rules for preparing stock price records

Livermore Market Key Chart and Description

Great investor Jesse Livermore

preface

Livermore's New Year's Ceremony

Part 1: How to Invest Like Jesse Livermore

CHAPTER 1: Speculation is a Business

CHAPTER 2 Capturing the Stock Market Flow

CHAPTER 3: Follow the Leader

CHAPTER 4 Money in My Hand

CHAPTER 5: Capturing the Turning Point

CHAPTER 6 The Million Dollar Mistake

CHAPTER 7 $3 Million Profit

Part 2: Jesse Livermore's Pyramiding Strategy Explained

CHAPTER 8 Jesse Livermore's Pyramiding Strategy 1.

timing

Timing is everything

Understand overall market trends. Understand the price movements of the relevant industry. Compare stocks of interest with their sister stocks. Conduct detailed research on individual stocks.

· Industry movements

· Why collective movements occur across industries

The principle of following the leader

· Predicting ceilings based on industry movements

Serial Trading Method│Reversal Turning Points│Continuous Turning Points│Price Surges and Intraday Reversals│Breaking Through New Highs│Breaking Through Fixed Lines

· Least resistance line

· Stocks also have personalities.

· Information and patience

CHAPTER 9 Jesse Livermore's Pyramiding Strategy 2.

Fund management techniques

· Never lose money

Livermore's Principle of Money Management 1.

Don't Lose Money│Livermore's Money Management Principle 2.

Set a buy ratio│Livermore's money management principle 3.

Save up a reserve fund│Livermore's money management principle 4.

Hold on to profitable stocks│Livermore's Money Management Principle 5.

Set aside a portion of your profits as a reserve fund.

· Avoid low-priced stocks

· Ignore insider actions

· Set a target profit - risk-reward ratio

· Set a stop-loss level before entering a trade.

· Time as a trading factor

The key to financial management is 'points'

· Livermore's pyramiding technique

· Profit is the basis of all stocks

CHAPTER 10 Jesse Livermore's Pyramiding Strategy 3.

emotional control

· How to control greed and fear, ignorance and hope

· Attitude toward preparing for trading

Efforts to Become the Best in Your Field│Develop Information Ability and Perseverance

· Special work environment

Composure, patience, and silence│Lone wolf investor who makes decisions alone│Office manager Harry Dach│Livermore's office and work atmosphere

· Sheet music for the symphony titled 'Money'

· Maintain patience and caution

· What matters is 'trading volume'

· Ability to find turning points

· Everything is the investor's responsibility

· Attitude toward media reports

· Loss cut

· The will to control emotions

· Be wary of confidential information.

· Work hard and consistently

CHAPTER 11 How to Trade Stocks Like Jesse Livermore in the 21st Century Market

· Computer Utilization - Preview the Trading System

TDT (Top Down Trading)│TM (The Market)│TIG (The Industry Group)│TT (Tandem Trading)

· Common chart confirming Livermore trading

RPP (reversal point) │ CPP (continuation point) │ S (price surge) │ ODR (intraday reversal)

· Key risk signals indicating a possible trend reversal

BOCB (Breakthrough of Fixed Line)│BONH (Breakthrough of New High)│BV (Bulk Trading)

CHAPTER 12: Jesse Livermore's Stock Trading Techniques

· Market-related rules

Timing rules

· Top-down trading - follow the trend and check major markets.

· Fund management rules

Five Key Principles of Money Management

· Emotion control rules

Appendix Jesse Livermore's Market Key (1940 edition)

Market Key in Livermore

Explanation of rules for preparing stock price records

Livermore Market Key Chart and Description

Detailed image

Into the book

It is dangerous to be interested in too many stocks at once.

If you have your feet wet with a lot of stocks, you'll only get more confused and your work will get more complicated.

Therefore, try to focus on a small number of industries as much as possible.

Focusing on a small number of segments is much more helpful in understanding market trends than analyzing the entire market.

By analyzing the stock price movements of just two stocks in the four dominant industries, it will not be difficult to understand the movements of the remaining stocks.

There is no need to bring up the old saying, 'Follow the leader.'

Be flexible in your thinking.

Keep in mind that today's leading stock may not be the leading stock in two years.

---From "CHAPTER 3: Follow the Leader"

Money in a securities account or bank account feels different from money you can hold in your hands.

It is something that can be felt in the hand and has a sense of reality.

And because of the feeling of having touched the money with your own hands, the loss feels more real than when you lose money that only existed on the ledger.

Therefore, the tendency to act recklessly will decrease compared to before.

So, it is a good idea to convert the valuation profit that exists only on the ledger into actual money and check your trading performance with your own eyes.

This process is especially necessary before closing a trade and entering the next trade.

---From "CHAPTER 4 Money in My Hand"

Livermore's argument is that if you've been patient and waited throughout the period when stock prices were rising, now that the "intraday reversal" has occurred, you need to be courageous enough to recognize this danger signal and take appropriate action.

In short, it's time to consider short selling the stock.

In this way, Livermore was a believer in 'patience' and 'courage'.

---「CHAPTER 8 Jesse Livermore's Pyramiding Strategy 1.

From "Timing"

Pyramiding is not a simple task.

Because this can be a very risky technique, traders who wish to use it must be nimble and experienced.

Moreover, the situation becomes more dangerous as the stock price rises or falls further.

Livermore tried to limit the use of pyramiding strategies to the early stages of a trend formation.

We found that it is not advisable to use pyramiding techniques when the stock price has advanced too far from the baseline.

It is much better to wait for a consecutive turning point after breaking through the reporting point.

Always remember that there are no hard and fast rules in the stock market.

A stock investor's primary goal is to focus as many market factors in his favor as possible.

Even in such a favorable situation, there is still a possibility of making a wrong decision.

Therefore, in times like these, you must immediately use a tool called loss cutting.

---「CHAPTER 9 Jesse Livermore's Pyramiding Strategy 2.

Among the “Fund Management Techniques”

There's a reason I go to bed at 10 p.m. and wake up at 6 a.m.

They say that if you are careful and disciplined in everything you do, you will pay attention to everything.

In this world, there is nothing that can be ignored or overlooked.

Missing one thing, big or small, can ruin everything and ruin all your plans.

In wartime, the lives of subordinates depend on the general's ability to plan and execute operations.

There is no room for mistakes or carelessness in the stock market.

If you have your feet wet with a lot of stocks, you'll only get more confused and your work will get more complicated.

Therefore, try to focus on a small number of industries as much as possible.

Focusing on a small number of segments is much more helpful in understanding market trends than analyzing the entire market.

By analyzing the stock price movements of just two stocks in the four dominant industries, it will not be difficult to understand the movements of the remaining stocks.

There is no need to bring up the old saying, 'Follow the leader.'

Be flexible in your thinking.

Keep in mind that today's leading stock may not be the leading stock in two years.

---From "CHAPTER 3: Follow the Leader"

Money in a securities account or bank account feels different from money you can hold in your hands.

It is something that can be felt in the hand and has a sense of reality.

And because of the feeling of having touched the money with your own hands, the loss feels more real than when you lose money that only existed on the ledger.

Therefore, the tendency to act recklessly will decrease compared to before.

So, it is a good idea to convert the valuation profit that exists only on the ledger into actual money and check your trading performance with your own eyes.

This process is especially necessary before closing a trade and entering the next trade.

---From "CHAPTER 4 Money in My Hand"

Livermore's argument is that if you've been patient and waited throughout the period when stock prices were rising, now that the "intraday reversal" has occurred, you need to be courageous enough to recognize this danger signal and take appropriate action.

In short, it's time to consider short selling the stock.

In this way, Livermore was a believer in 'patience' and 'courage'.

---「CHAPTER 8 Jesse Livermore's Pyramiding Strategy 1.

From "Timing"

Pyramiding is not a simple task.

Because this can be a very risky technique, traders who wish to use it must be nimble and experienced.

Moreover, the situation becomes more dangerous as the stock price rises or falls further.

Livermore tried to limit the use of pyramiding strategies to the early stages of a trend formation.

We found that it is not advisable to use pyramiding techniques when the stock price has advanced too far from the baseline.

It is much better to wait for a consecutive turning point after breaking through the reporting point.

Always remember that there are no hard and fast rules in the stock market.

A stock investor's primary goal is to focus as many market factors in his favor as possible.

Even in such a favorable situation, there is still a possibility of making a wrong decision.

Therefore, in times like these, you must immediately use a tool called loss cutting.

---「CHAPTER 9 Jesse Livermore's Pyramiding Strategy 2.

Among the “Fund Management Techniques”

There's a reason I go to bed at 10 p.m. and wake up at 6 a.m.

They say that if you are careful and disciplined in everything you do, you will pay attention to everything.

In this world, there is nothing that can be ignored or overlooked.

Missing one thing, big or small, can ruin everything and ruin all your plans.

In wartime, the lives of subordinates depend on the general's ability to plan and execute operations.

There is no room for mistakes or carelessness in the stock market.

---「CHAPTER 10 Jesse Livermore's Pyramiding Strategy 3.

From “Emotional Control”

From “Emotional Control”

Publisher's Review

Jesse Livermore's "How to Trade in Stocks": The only official, complete translation!

"There's nothing in the stock market that can be ignored."

How to Trade Stocks with Jesse Livermore, the Legendary Wall Street Trader

Jesse Livermore, the real-life protagonist of "Reminiscences of a Stock Operator," a must-read for fund managers and traders around the world, is an investment legend praised by numerous Wall Street gurus such as William O'Neil, Mark Minervini, Ed Seykota, and Alexander Elder, and is called the "Bear of Wall Street" and the "Father of Trend Trading." He is the greatest individual investor in Wall Street history.

Along with value investing, he established trend trading, which forms an important axis in today's stock trading techniques.

He started investing in stocks at the age of 15 with just $5, and by the time of his death in 1940, he was a legend in the stock market, to the point that even the renowned banker JP Morgan asked him to change his position.

Livermore's timing techniques, money management system, and advanced momentum approach remain valuable even after 80 years.

In this book, Richard Smeaton provides valuable information on Jesse Livermore's stock trading techniques, drawing on his personal papers and family sources, while also showing how to apply this information to modern technical investment techniques.

Also included is Livermore's Market Key, the first market pattern analysis method and still considered the most accurate method for tracking and recording market patterns.

“I would like to once again express my gratitude to Livermore for his wisdom, hard work, and excellence.

And I am grateful for your constant research into stock market trends.”

Richard Smeaton

"When Jesse Livermore moves, the market moves."

Uncovering Jesse Livermore's Pyramiding Strategy!

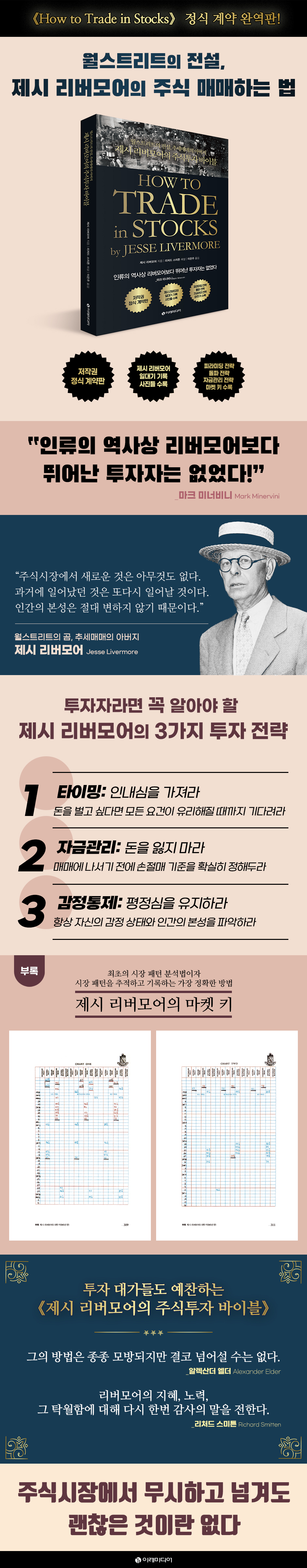

Jesse Livermore, the investment guru, always focused on the following three strategies.

■ Timing - Be patient

Jesse Livermore always emphasized the importance of emotional balance and emphasized that making big money in stock investment comes not from thinking with your head, but from 'patient waiting.'

The idea is to wait until all factors are favorable before entering into a trade.

Once you've established a position, you should be patient and wait patiently as long as the trend continues. You should have a clear reason for entering or exiting the market.

If you make a wrong judgment, you should immediately accept the loss and walk away.

■ Money Management Techniques - Don't Lose Money

This was the area that Jesse Livermore devoted the most effort to, and he continued to emphasize this even to his two sons.

Investors are advised to set a clear stop-loss standard before entering into a trade.

This means that you should set a standard for the level at which you will sell your stocks if the stock price moves in a direction that is unfavorable to you.

Livermore's stop-loss criterion is that the loss does not exceed 10% of the invested capital.

And at some point it says, 'realize your profits'.

It is advised to deposit a portion of the realized profits in a bank or put them in safe products such as bonds or pensions.

■ Emotional Control - Maintain composure, patience, and silence.

The most important, yet difficult, thing when trading stocks is ‘emotional control.’

You shouldn't make hasty predictions and you should wait for some signal or clue before the market moves.

Stocks are similar to human nature.

Aggressive, passive, nervous, and future-oriented.

When analyzing the stock market like this, we must understand human nature.

You should always be aware of your emotional state and maintain your composure so that you don't get swayed by the stock market situations that make people very excited.

A Reinterpretation by Richard Smeaton, Jesse Livermore's Leading Authority

Applying Jesse Livermore's Trading Techniques to the 21st Century Market

“For an investor, trading is like battle for a soldier.

“It’s a highly intellectual exercise that requires intuition, a game that engages all your senses and nerves, but the prizes are enormous.” Jesse Livermore’s investment techniques offer useful information even to modern investors.

Richard Smeaton categorizes Livermore's trading principles into TDT (Top-Down Trading), TM (Market), TIG (Industry), TT (Territory Trading), reversal turning points, continuation turning points, price spikes, and intraday reversals, and applies Livermore's techniques to modern charts.

The investment techniques of Wall Street legend Jesse Livermore remain relevant even in the 21st century.

Additionally, Richard Smithon's commentary will provide direction and guidance to investors who wish to begin investing.

"There's nothing in the stock market that can be ignored."

How to Trade Stocks with Jesse Livermore, the Legendary Wall Street Trader

Jesse Livermore, the real-life protagonist of "Reminiscences of a Stock Operator," a must-read for fund managers and traders around the world, is an investment legend praised by numerous Wall Street gurus such as William O'Neil, Mark Minervini, Ed Seykota, and Alexander Elder, and is called the "Bear of Wall Street" and the "Father of Trend Trading." He is the greatest individual investor in Wall Street history.

Along with value investing, he established trend trading, which forms an important axis in today's stock trading techniques.

He started investing in stocks at the age of 15 with just $5, and by the time of his death in 1940, he was a legend in the stock market, to the point that even the renowned banker JP Morgan asked him to change his position.

Livermore's timing techniques, money management system, and advanced momentum approach remain valuable even after 80 years.

In this book, Richard Smeaton provides valuable information on Jesse Livermore's stock trading techniques, drawing on his personal papers and family sources, while also showing how to apply this information to modern technical investment techniques.

Also included is Livermore's Market Key, the first market pattern analysis method and still considered the most accurate method for tracking and recording market patterns.

“I would like to once again express my gratitude to Livermore for his wisdom, hard work, and excellence.

And I am grateful for your constant research into stock market trends.”

Richard Smeaton

"When Jesse Livermore moves, the market moves."

Uncovering Jesse Livermore's Pyramiding Strategy!

Jesse Livermore, the investment guru, always focused on the following three strategies.

■ Timing - Be patient

Jesse Livermore always emphasized the importance of emotional balance and emphasized that making big money in stock investment comes not from thinking with your head, but from 'patient waiting.'

The idea is to wait until all factors are favorable before entering into a trade.

Once you've established a position, you should be patient and wait patiently as long as the trend continues. You should have a clear reason for entering or exiting the market.

If you make a wrong judgment, you should immediately accept the loss and walk away.

■ Money Management Techniques - Don't Lose Money

This was the area that Jesse Livermore devoted the most effort to, and he continued to emphasize this even to his two sons.

Investors are advised to set a clear stop-loss standard before entering into a trade.

This means that you should set a standard for the level at which you will sell your stocks if the stock price moves in a direction that is unfavorable to you.

Livermore's stop-loss criterion is that the loss does not exceed 10% of the invested capital.

And at some point it says, 'realize your profits'.

It is advised to deposit a portion of the realized profits in a bank or put them in safe products such as bonds or pensions.

■ Emotional Control - Maintain composure, patience, and silence.

The most important, yet difficult, thing when trading stocks is ‘emotional control.’

You shouldn't make hasty predictions and you should wait for some signal or clue before the market moves.

Stocks are similar to human nature.

Aggressive, passive, nervous, and future-oriented.

When analyzing the stock market like this, we must understand human nature.

You should always be aware of your emotional state and maintain your composure so that you don't get swayed by the stock market situations that make people very excited.

A Reinterpretation by Richard Smeaton, Jesse Livermore's Leading Authority

Applying Jesse Livermore's Trading Techniques to the 21st Century Market

“For an investor, trading is like battle for a soldier.

“It’s a highly intellectual exercise that requires intuition, a game that engages all your senses and nerves, but the prizes are enormous.” Jesse Livermore’s investment techniques offer useful information even to modern investors.

Richard Smeaton categorizes Livermore's trading principles into TDT (Top-Down Trading), TM (Market), TIG (Industry), TT (Territory Trading), reversal turning points, continuation turning points, price spikes, and intraday reversals, and applies Livermore's techniques to modern charts.

The investment techniques of Wall Street legend Jesse Livermore remain relevant even in the 21st century.

Additionally, Richard Smithon's commentary will provide direction and guidance to investors who wish to begin investing.

GOODS SPECIFICS

- Date of issue: March 10, 2023

- Page count, weight, size: 340 pages | 600g | 152*225*20mm

- ISBN13: 9791191328776

- ISBN10: 1191328775

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)