Investing in high-yield growth stocks

|

Description

Book Introduction

Mark's book should be on every investor's bookshelf.

-David Ryan, three-time National Investment Competition winner

"High-Yield Growth Stock Investment" is the first Korean translation of Mark Minervini, known as the "God of Investment."

Introducing Mark Minervini, he turned a stock account of a few thousand dollars into millions of dollars, and in particular, in 1997, he entered the National Investment Competition with $250,000 (about 310 million won) and won with a whopping 155% return.

In addition, it is known to have recorded an average annual return of 220 percent (cumulative return of 33,500 percent) from 1994 to 2000, and only had one quarter of loss.

This book deals with growth stock investing, but it's far removed from the risky growth stocks we're familiar with, represented by thematic stocks.

Mark Minervini's growth stocks are those that are clearly growing on the balance sheet.

When to buy and sell these stocks is also important.

As history tells us, there is no stock that just keeps rising.

Accordingly, the author explains the stock cycle from stage 1 to stage 4 through his chart examples and tells you when to buy and sell.

In other words, if you want to make sure you get high profits, you need to learn when to enter and when to exit.

You need to select stocks that are likely to grow, buy and sell them at the right time, and if you make a mistake during this process, you need to set a clear stop-loss point and get out even if you suffer a loss, so that you can ultimately see profits.

High profits are not made by luck.

I hope everyone can find the next Apple, Google, or Starbucks through the investment method shared by Mark Minervini.

-David Ryan, three-time National Investment Competition winner

"High-Yield Growth Stock Investment" is the first Korean translation of Mark Minervini, known as the "God of Investment."

Introducing Mark Minervini, he turned a stock account of a few thousand dollars into millions of dollars, and in particular, in 1997, he entered the National Investment Competition with $250,000 (about 310 million won) and won with a whopping 155% return.

In addition, it is known to have recorded an average annual return of 220 percent (cumulative return of 33,500 percent) from 1994 to 2000, and only had one quarter of loss.

This book deals with growth stock investing, but it's far removed from the risky growth stocks we're familiar with, represented by thematic stocks.

Mark Minervini's growth stocks are those that are clearly growing on the balance sheet.

When to buy and sell these stocks is also important.

As history tells us, there is no stock that just keeps rising.

Accordingly, the author explains the stock cycle from stage 1 to stage 4 through his chart examples and tells you when to buy and sell.

In other words, if you want to make sure you get high profits, you need to learn when to enter and when to exit.

You need to select stocks that are likely to grow, buy and sell them at the right time, and if you make a mistake during this process, you need to set a clear stop-loss point and get out even if you suffer a loss, so that you can ultimately see profits.

High profits are not made by luck.

I hope everyone can find the next Apple, Google, or Starbucks through the investment method shared by Mark Minervini.

- You can preview some of the book's contents.

Preview

index

Recommendation

introduction

[Chapter 1] A Preface Worth Reading

Follow your dreams, believe in yourself / Trading will set you free / Achieve the best of both worlds / Invest in yourself first / When opportunity meets preparation / Acquire eternal knowledge / Be passionate / The best time to begin / Time to share

[Chapter 2] What You Need to Know First

No luck needed / You can start small / This time it won't be different / The biggest challenge isn't the market / No one will do it for you / Do you want to guess the answer or make money? / Practice doesn't make perfect / Why I don't like mock trading / Stock investing is a business / Don't invest like a fund manager / Conventional methods produce conventional results / The inevitable price of success / If you want to do even one thing well, focus / Trader or investor? / Expect tough times / Records are made to be broken

[Chapter 3] Sepa® Strategy

The Beginning of a Turning Point / The Furnace of Knowledge / The Technology That Finally Emerges / Leveraging Investment Studies / Leadership Profiles / Sepa: The Strategy of Precision / The Five Key Elements of Sepa / Converging Probabilities / Ultra-High-Yield Properties / Ultra-High-Yield Stocks Are Young / Size Matters / Stock Search / Commit to a Single Approach

[Chapter 4] Value Comes at a Price

PER, abuse and misunderstanding / The joy of buying low / The trap of low prices / Don't rule out a company just because it has a high PER / High growth confuses analysts / Where is it high? Where is it low? / There's a reason Ferrari is more expensive than Hyundai / It's people, not value, that move stock prices / Finding value / There is no magic number / Caution: Ultra-low PER / The deception of PER / The phenomenon of preferring outdated leading stocks / PER is a barometer of psychology / PEG (price-earnings growth ratio) / Judging a rising PER / What it all means

[Chapter 5] Investing according to trends

Becoming familiar with trends / Ultra-high returns and stage analysis / Stock price maturity: 4 stages / Stage 1 - Ignore phase: Consolidation / Stage 2 - Rising phase: Accumulation / Stage 3 - Peak phase: Diversification / Stage 4 - Bearish phase: Selling / Stock price maturity cycle / How to identify stage 2 / Timing of wave riding / How high have we climbed this mountain? / Trust, but verify / Beware of trend reversals / Financial stocks that warn of imminent danger / Trust your eyes, not your ears / Investment opinions of securities firms / Significant changes in stock price movements are major warnings / Ride the tailwind

[Chapter 6] Categories, Industries, and Materials

Leading Stocks / Top Competitors: Keep an eye on the competition / Institutional Favorites / Turnarounds / Cyclically Sensitive Companies / Stay Away from Underperforming Stocks / Specific Industries Lead New Bull Markets / Innovation Creates New Opportunities / Industry Cycle Dynamics / When Leading Stocks Sneeze, the Industry Catches a Cold / New Technologies Become Old

[Chapter 7] Fundamentals to Focus on

What drives super profits? / Why is operating profit important? / Expectations and surprises / Earnings surprises / Cockroach effect / Not all surprises are created equal / Analyst estimate revisions / Large profits attract large attention / Performance shown in financial statements / Rising operating profit growth rate / Find stocks whose sales support profits / Check trends / Annual performance / Find years that break out of the box / How to spot stocks with improving performance / Decreasing growth rate is a warning sign

[Chapter 8] Assessing the Quality of Benefits

Non-operating income or one-time revenue / Beware of adjusted figures / One-time expenses / Depreciation and sales transfers / Beware of profit realization through cost cutting / Measuring margins / Time for verification / Company guidance / Long-term outlook / Inventory analysis / Compare inventory to sales / Accounts receivable analysis / Differential disclosure / All cylinders firing: Code 33

[Chapter 9] Follow the Leader

Matching the Pace / The Neglected Market, the Waiting Correction Never Comes / The Best Stocks Hit Bottom First / Windows of Opportunity / The Underlying Growth Cycle / Typical Examples of Market Leaders / Spot the Technical Themes / Which Leading Stocks Should You Buy First? / A Double-Edged Sword / Leading Stocks Foreshadow Coming Trouble / Learn to Buy Leading Stocks and Avoid Laggards / Filter the Media

[Chapter 10] A Picture is Worth a Thousand Words

Can charts help you achieve super-high profits? / Use charts as a tool / Are charts the effect, not the cause? / Is the train on time? / What to do first / Look for consolidation zones / Volatility reduction patterns / Counting the number of reductions / Technical footprints / What does volatility reduction tell us? / Detecting selling zones / Why buy near the new highs? / Deep correction patterns are vulnerable to breakdowns / Time compression / Shaking / Check for evidence of demand / Surges before consolidation / Pivot points / Volume at pivot points / Estimation through intraday volume / Always wait until the pivot point is crossed / Squats and reversal recoveries / How to tell if a breakout has failed? / Responding to morning declines / Integration of all factors / Stock composition / Normal reactions and tennis ball action / Dishwasher with platform / 3C pattern / The trend reversal process / Why wait for a trend reversal? / The Livermore system / Failure resets / Failure pivot resets / Power play / Solid fundamentals vs. prepared prices

[Chapter 11] Don't Just Buy Stocks You Know

Basic Base / Give Your Basic Base Time to Form / Basic Base That No One Examines / Not All Frogs Become Princes / From Innovators to Bankrupt Companies

[Chapter 12] The Nature of Risk

What Champions Have in Common / It's My Money to Protect / Sound Principles Provide Clarity / Master Jack's Lessons / Losses Bring More Suffering / Up Twice, Down Once / Becoming Confident: Practice Loss-Cutting / Accepting the Market's Judgment / Knowing When You're Wrong / Avoid Big Errors / Don't Be an Involuntary Long-Term Investor / How Low Can It Go? / Visiting a Casino / One in a Million / What's the Difference? / Very Good Conditions / When Mistakes Matter / If You Don't Feel Stupid, You're Not Managing Risk / Why Do I Fail to Cut My Losses?

[Chapter 13] Risk Management and Control Methods

Develop lifestyle habits / Develop an emergency plan / Losses are a function of expected returns / When should you cut your losses? / Avoid the investor's deadly sins / Embrace failure / Determine your risk in advance / Adhere to the principles of cut-loss rules / Responding to stop-loss slippage / How to deal with consecutive failed purchases / Practices that guarantee disaster / Learn to pace yourself / Increase the size when you succeed / Buying in installments vs. riding the wave / When to raise your stop-loss line to break even / Not all ratios are created equal / Diversification does not guarantee protection / The story of walking barefoot in the snow

Acknowledgements

introduction

[Chapter 1] A Preface Worth Reading

Follow your dreams, believe in yourself / Trading will set you free / Achieve the best of both worlds / Invest in yourself first / When opportunity meets preparation / Acquire eternal knowledge / Be passionate / The best time to begin / Time to share

[Chapter 2] What You Need to Know First

No luck needed / You can start small / This time it won't be different / The biggest challenge isn't the market / No one will do it for you / Do you want to guess the answer or make money? / Practice doesn't make perfect / Why I don't like mock trading / Stock investing is a business / Don't invest like a fund manager / Conventional methods produce conventional results / The inevitable price of success / If you want to do even one thing well, focus / Trader or investor? / Expect tough times / Records are made to be broken

[Chapter 3] Sepa® Strategy

The Beginning of a Turning Point / The Furnace of Knowledge / The Technology That Finally Emerges / Leveraging Investment Studies / Leadership Profiles / Sepa: The Strategy of Precision / The Five Key Elements of Sepa / Converging Probabilities / Ultra-High-Yield Properties / Ultra-High-Yield Stocks Are Young / Size Matters / Stock Search / Commit to a Single Approach

[Chapter 4] Value Comes at a Price

PER, abuse and misunderstanding / The joy of buying low / The trap of low prices / Don't rule out a company just because it has a high PER / High growth confuses analysts / Where is it high? Where is it low? / There's a reason Ferrari is more expensive than Hyundai / It's people, not value, that move stock prices / Finding value / There is no magic number / Caution: Ultra-low PER / The deception of PER / The phenomenon of preferring outdated leading stocks / PER is a barometer of psychology / PEG (price-earnings growth ratio) / Judging a rising PER / What it all means

[Chapter 5] Investing according to trends

Becoming familiar with trends / Ultra-high returns and stage analysis / Stock price maturity: 4 stages / Stage 1 - Ignore phase: Consolidation / Stage 2 - Rising phase: Accumulation / Stage 3 - Peak phase: Diversification / Stage 4 - Bearish phase: Selling / Stock price maturity cycle / How to identify stage 2 / Timing of wave riding / How high have we climbed this mountain? / Trust, but verify / Beware of trend reversals / Financial stocks that warn of imminent danger / Trust your eyes, not your ears / Investment opinions of securities firms / Significant changes in stock price movements are major warnings / Ride the tailwind

[Chapter 6] Categories, Industries, and Materials

Leading Stocks / Top Competitors: Keep an eye on the competition / Institutional Favorites / Turnarounds / Cyclically Sensitive Companies / Stay Away from Underperforming Stocks / Specific Industries Lead New Bull Markets / Innovation Creates New Opportunities / Industry Cycle Dynamics / When Leading Stocks Sneeze, the Industry Catches a Cold / New Technologies Become Old

[Chapter 7] Fundamentals to Focus on

What drives super profits? / Why is operating profit important? / Expectations and surprises / Earnings surprises / Cockroach effect / Not all surprises are created equal / Analyst estimate revisions / Large profits attract large attention / Performance shown in financial statements / Rising operating profit growth rate / Find stocks whose sales support profits / Check trends / Annual performance / Find years that break out of the box / How to spot stocks with improving performance / Decreasing growth rate is a warning sign

[Chapter 8] Assessing the Quality of Benefits

Non-operating income or one-time revenue / Beware of adjusted figures / One-time expenses / Depreciation and sales transfers / Beware of profit realization through cost cutting / Measuring margins / Time for verification / Company guidance / Long-term outlook / Inventory analysis / Compare inventory to sales / Accounts receivable analysis / Differential disclosure / All cylinders firing: Code 33

[Chapter 9] Follow the Leader

Matching the Pace / The Neglected Market, the Waiting Correction Never Comes / The Best Stocks Hit Bottom First / Windows of Opportunity / The Underlying Growth Cycle / Typical Examples of Market Leaders / Spot the Technical Themes / Which Leading Stocks Should You Buy First? / A Double-Edged Sword / Leading Stocks Foreshadow Coming Trouble / Learn to Buy Leading Stocks and Avoid Laggards / Filter the Media

[Chapter 10] A Picture is Worth a Thousand Words

Can charts help you achieve super-high profits? / Use charts as a tool / Are charts the effect, not the cause? / Is the train on time? / What to do first / Look for consolidation zones / Volatility reduction patterns / Counting the number of reductions / Technical footprints / What does volatility reduction tell us? / Detecting selling zones / Why buy near the new highs? / Deep correction patterns are vulnerable to breakdowns / Time compression / Shaking / Check for evidence of demand / Surges before consolidation / Pivot points / Volume at pivot points / Estimation through intraday volume / Always wait until the pivot point is crossed / Squats and reversal recoveries / How to tell if a breakout has failed? / Responding to morning declines / Integration of all factors / Stock composition / Normal reactions and tennis ball action / Dishwasher with platform / 3C pattern / The trend reversal process / Why wait for a trend reversal? / The Livermore system / Failure resets / Failure pivot resets / Power play / Solid fundamentals vs. prepared prices

[Chapter 11] Don't Just Buy Stocks You Know

Basic Base / Give Your Basic Base Time to Form / Basic Base That No One Examines / Not All Frogs Become Princes / From Innovators to Bankrupt Companies

[Chapter 12] The Nature of Risk

What Champions Have in Common / It's My Money to Protect / Sound Principles Provide Clarity / Master Jack's Lessons / Losses Bring More Suffering / Up Twice, Down Once / Becoming Confident: Practice Loss-Cutting / Accepting the Market's Judgment / Knowing When You're Wrong / Avoid Big Errors / Don't Be an Involuntary Long-Term Investor / How Low Can It Go? / Visiting a Casino / One in a Million / What's the Difference? / Very Good Conditions / When Mistakes Matter / If You Don't Feel Stupid, You're Not Managing Risk / Why Do I Fail to Cut My Losses?

[Chapter 13] Risk Management and Control Methods

Develop lifestyle habits / Develop an emergency plan / Losses are a function of expected returns / When should you cut your losses? / Avoid the investor's deadly sins / Embrace failure / Determine your risk in advance / Adhere to the principles of cut-loss rules / Responding to stop-loss slippage / How to deal with consecutive failed purchases / Practices that guarantee disaster / Learn to pace yourself / Increase the size when you succeed / Buying in installments vs. riding the wave / When to raise your stop-loss line to break even / Not all ratios are created equal / Diversification does not guarantee protection / The story of walking barefoot in the snow

Acknowledgements

Detailed image

Into the book

You may be wondering why I decided to write this book now.

About ten years ago, several major publishers approached me about publishing a book.

But I decided not to do that.

right.

Publishing a book builds credibility and status.

Even self-esteem increases.

The publishing offer was tempting, but I hesitated.

"Why should I share my hard-earned knowledge just to make a small fortune? Most people won't be able to put it to good use anyway."

To be honest, I was a bit cynical.

Then it occurred to me that maybe even just one person could achieve their dream through my book and the efforts I made in the beginning.

Maybe that person is you.

--- p.33~34

All innovations eventually cease to be innovations.

In the process, it follows the path of market penetration and eventual saturation.

This is a timeless truth.

Initially, all new innovations (railways, automobiles, radio, television, computers, the Internet, etc.) start at a relatively high price point, accessible only to a select few.

Then, with the advancement of technology and manufacturing techniques, the price of new products gradually decreases.

This leads to market penetration, where more and more potential users can acquire new products or services.

As time goes by, the market becomes saturated.

That means every business or household that buys and uses a new product already has it.

Cars and televisions are good examples.

This market becomes a substitute purchasing market as overall unit growth is limited by slow economic growth.

--- p.164

One of the most common sayings heard in the stock market is “buy low, sell high.”

This phrase has become synonymous with how most people think about making money in stocks.

Of course, to make a profit, you have to buy at a lower price than the sell price.

That doesn't mean you have to buy at or near historic lows.

The market is more accurate than personal opinions or expert predictions.

Stocks that hit 52-week highs early in a new bull market could be budding winners.

On the other hand, stocks near their 52-week lows should be sold at best and lack upside momentum.

These stocks can make lower lows in succession.

A stock that has hit a new high has no counter-offering.

These stocks say, “I’m working on something, and people are noticing it.”

On the other hand, stocks that hit new lows are clearly underperforming.

These stocks either fail to attract investor interest or are sold off in large quantities by institutions.

--- p.270

Does this sound familiar? You bought a stock at $35 and are hesitant to sell it at $32.

The stock price then falls to $26.

Now, if I could sell it at the buy price of $35, I would be happy.

However, the stock price falls to $16.

Only then do you think, 'I had a chance to get out at a small loss, so why didn't I sell at $26 or even $32?'

The reason investors find themselves in this situation is because they allow their ego to get in the way without a proper plan to deal with the risk.

Proper planning requires action, and that requires discipline.

I can't help you with that part.

But I can teach you how to do it.

--- p.371

Don't tell me the stock market is against you, that retail investors can't win, or that only professionals make money in the market! Those are just excuses.

I dropped out of school at 15, so I had no money and no education.

But now, even I am making a lot of money in the stock market.

Consider how much better you could do based on my example! There's no reason why you can't outperform me.

They say that wise people learn from their mistakes.

I would go a step further and say that truly wise people learn from the mistakes of others.

I've been studying the great investors and innovative thinkers of our time closely, trying to follow their philosophies.

I've made many mistakes, but I've learned some hard lessons from them.

About ten years ago, several major publishers approached me about publishing a book.

But I decided not to do that.

right.

Publishing a book builds credibility and status.

Even self-esteem increases.

The publishing offer was tempting, but I hesitated.

"Why should I share my hard-earned knowledge just to make a small fortune? Most people won't be able to put it to good use anyway."

To be honest, I was a bit cynical.

Then it occurred to me that maybe even just one person could achieve their dream through my book and the efforts I made in the beginning.

Maybe that person is you.

--- p.33~34

All innovations eventually cease to be innovations.

In the process, it follows the path of market penetration and eventual saturation.

This is a timeless truth.

Initially, all new innovations (railways, automobiles, radio, television, computers, the Internet, etc.) start at a relatively high price point, accessible only to a select few.

Then, with the advancement of technology and manufacturing techniques, the price of new products gradually decreases.

This leads to market penetration, where more and more potential users can acquire new products or services.

As time goes by, the market becomes saturated.

That means every business or household that buys and uses a new product already has it.

Cars and televisions are good examples.

This market becomes a substitute purchasing market as overall unit growth is limited by slow economic growth.

--- p.164

One of the most common sayings heard in the stock market is “buy low, sell high.”

This phrase has become synonymous with how most people think about making money in stocks.

Of course, to make a profit, you have to buy at a lower price than the sell price.

That doesn't mean you have to buy at or near historic lows.

The market is more accurate than personal opinions or expert predictions.

Stocks that hit 52-week highs early in a new bull market could be budding winners.

On the other hand, stocks near their 52-week lows should be sold at best and lack upside momentum.

These stocks can make lower lows in succession.

A stock that has hit a new high has no counter-offering.

These stocks say, “I’m working on something, and people are noticing it.”

On the other hand, stocks that hit new lows are clearly underperforming.

These stocks either fail to attract investor interest or are sold off in large quantities by institutions.

--- p.270

Does this sound familiar? You bought a stock at $35 and are hesitant to sell it at $32.

The stock price then falls to $26.

Now, if I could sell it at the buy price of $35, I would be happy.

However, the stock price falls to $16.

Only then do you think, 'I had a chance to get out at a small loss, so why didn't I sell at $26 or even $32?'

The reason investors find themselves in this situation is because they allow their ego to get in the way without a proper plan to deal with the risk.

Proper planning requires action, and that requires discipline.

I can't help you with that part.

But I can teach you how to do it.

--- p.371

Don't tell me the stock market is against you, that retail investors can't win, or that only professionals make money in the market! Those are just excuses.

I dropped out of school at 15, so I had no money and no education.

But now, even I am making a lot of money in the stock market.

Consider how much better you could do based on my example! There's no reason why you can't outperform me.

They say that wise people learn from their mistakes.

I would go a step further and say that truly wise people learn from the mistakes of others.

I've been studying the great investors and innovative thinkers of our time closely, trying to follow their philosophies.

I've made many mistakes, but I've learned some hard lessons from them.

--- p.397~398

Publisher's Review

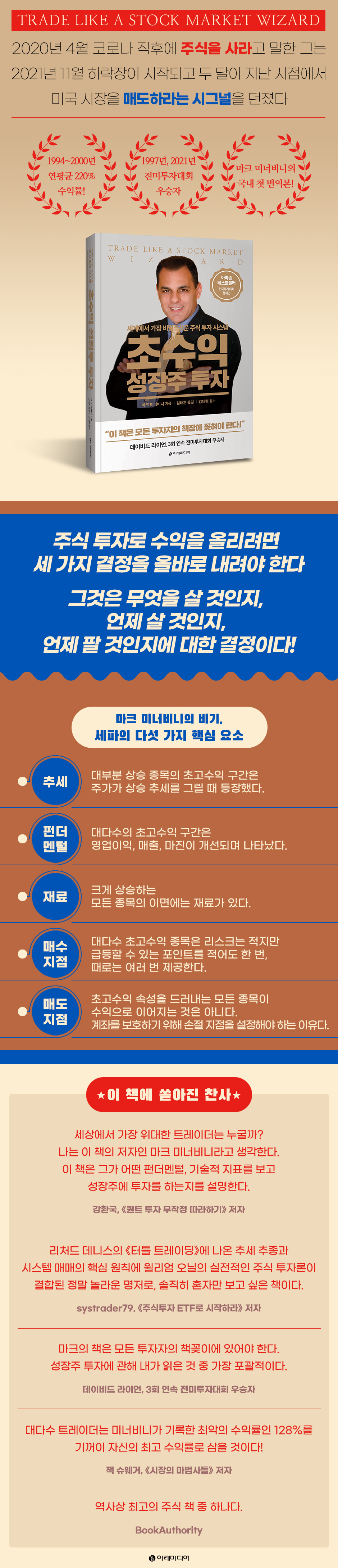

He told me to buy stocks in April 2020.

A sell signal was issued in November 2021.

Since this is the first time I've read Mark Minervini's book, I'd like to introduce him first.

He is already well known for winning the US Investment Championship in 1997 and 2021 and for achieving a legendary 220% (!) annual compound return over five years in the 1990s.

Another little-known fact is that 24 of the top 20 winners of the US Investment Championship (11 in 2021 and 13 in 2020) were students of his seminars, and that he, who said “buy stocks” right after the coronavirus outbreak in April 2020, signaled to sell the US market in November 2021, two months after the bear market began.

You might think it's a coincidence.

But after you finish reading this book, you won't think about that anymore.

『Trade Like a Stock Market Wizard』 is one of his representative works, and of course, this is the first time it has been introduced in Korea.

Why you can make big profits with a 50% chance!

The secret stock investment system he created,

Five Key Elements of SEPA

An interesting fact about Mark Minervini's background is that he dropped out of high school.

Like many stock market gurus, he has been through many ups and downs, learned lessons along the way, and reached his current position.

In this book he explains his own strategy called SEPA, but he doesn't say that it is 100% correct either.

The probability he's talking about is 50%.

That is, he put a lot of effort into creating a 50% probability.

Some of his SEPA strategies include:

1.

Trend: Most of the high-yield periods for large-cap stocks have occurred when the stock price is in an upward trend.

2.

Fundamentals: Most high-yield periods were marked by improvements in operating profit, sales, and margins.

This requirement is usually realized before the ultra-high yield period begins.

3.

Ingredients: Behind every stock that rises significantly, there is an ingredient.

Materials are not always readily apparent.

But a little research into the company's story can reveal tips on stocks with ultra-high return potential.

4.

Buy Points: Most high-yield stocks offer at least one, and sometimes multiple, point of potential upside with little risk.

Timing your purchases is extremely important.

If you get the timing wrong when you buy, you may have to cut your losses unnecessarily, or you may suffer a large loss because you cannot sell quickly when the price falls below the buy point after breaking through.

On the other hand, if you time your purchases well in a bull market, it can lead to a large-scale rise.

5.

Sell Point: Not all stocks that exhibit ultra-high yield properties will lead to profits.

Even if the majority buy at the exact point, the stock price will not rise.

This is why you need to set a stop loss point to force yourself out of a losing position to protect your account.

Conversely, at a certain point in time, you must sell your stocks to realize your profits.

This book develops the story based on this SEPA.

The trend can be represented by a four-stage cycle.

We need to buy in stage 2 and sell in stage 3.

Fundamentals are operating profit and sales growth rate.

In other words, you should include companies with steadily increasing operating profits and sales in your stocks of interest.

Even if it appears to be in a 2-stage position, you should not buy it unless the fundamentals support it.

Materials and buy points are linked to the trends and fundamentals mentioned above.

The selling point is represented by the stop loss point.

In other words, it can be said to be a point of departure.

This method is intended to minimize risk.

David Ryan, three-time National Investment Competition winner, asks if we can believe that even great investors like Minervini are only right in their predictions 50 percent of the time.

The secret to the legendary 220%(!) compound annual return over five years in the 1990s lies right here.

He was able to achieve great returns by not becoming an involuntary long-term investor.

The reason he is called the 'God of Stocks' is because he made incredible decisions about what to buy, when to buy, and when to sell.

And the secret is revealed in this book! The author states in the final chapter: "Don't tell me the stock market is against you, that retail investors can't win, or that only experts make money in the market! Those are just excuses.

I dropped out of school at 15, so I had no money and no education.

But now, even I am making a lot of money in the stock market.

Consider how much better you could do based on my example! There's no reason you can't outperform me.'

After reading this book, you will realize that you can do it too.

A sell signal was issued in November 2021.

Since this is the first time I've read Mark Minervini's book, I'd like to introduce him first.

He is already well known for winning the US Investment Championship in 1997 and 2021 and for achieving a legendary 220% (!) annual compound return over five years in the 1990s.

Another little-known fact is that 24 of the top 20 winners of the US Investment Championship (11 in 2021 and 13 in 2020) were students of his seminars, and that he, who said “buy stocks” right after the coronavirus outbreak in April 2020, signaled to sell the US market in November 2021, two months after the bear market began.

You might think it's a coincidence.

But after you finish reading this book, you won't think about that anymore.

『Trade Like a Stock Market Wizard』 is one of his representative works, and of course, this is the first time it has been introduced in Korea.

Why you can make big profits with a 50% chance!

The secret stock investment system he created,

Five Key Elements of SEPA

An interesting fact about Mark Minervini's background is that he dropped out of high school.

Like many stock market gurus, he has been through many ups and downs, learned lessons along the way, and reached his current position.

In this book he explains his own strategy called SEPA, but he doesn't say that it is 100% correct either.

The probability he's talking about is 50%.

That is, he put a lot of effort into creating a 50% probability.

Some of his SEPA strategies include:

1.

Trend: Most of the high-yield periods for large-cap stocks have occurred when the stock price is in an upward trend.

2.

Fundamentals: Most high-yield periods were marked by improvements in operating profit, sales, and margins.

This requirement is usually realized before the ultra-high yield period begins.

3.

Ingredients: Behind every stock that rises significantly, there is an ingredient.

Materials are not always readily apparent.

But a little research into the company's story can reveal tips on stocks with ultra-high return potential.

4.

Buy Points: Most high-yield stocks offer at least one, and sometimes multiple, point of potential upside with little risk.

Timing your purchases is extremely important.

If you get the timing wrong when you buy, you may have to cut your losses unnecessarily, or you may suffer a large loss because you cannot sell quickly when the price falls below the buy point after breaking through.

On the other hand, if you time your purchases well in a bull market, it can lead to a large-scale rise.

5.

Sell Point: Not all stocks that exhibit ultra-high yield properties will lead to profits.

Even if the majority buy at the exact point, the stock price will not rise.

This is why you need to set a stop loss point to force yourself out of a losing position to protect your account.

Conversely, at a certain point in time, you must sell your stocks to realize your profits.

This book develops the story based on this SEPA.

The trend can be represented by a four-stage cycle.

We need to buy in stage 2 and sell in stage 3.

Fundamentals are operating profit and sales growth rate.

In other words, you should include companies with steadily increasing operating profits and sales in your stocks of interest.

Even if it appears to be in a 2-stage position, you should not buy it unless the fundamentals support it.

Materials and buy points are linked to the trends and fundamentals mentioned above.

The selling point is represented by the stop loss point.

In other words, it can be said to be a point of departure.

This method is intended to minimize risk.

David Ryan, three-time National Investment Competition winner, asks if we can believe that even great investors like Minervini are only right in their predictions 50 percent of the time.

The secret to the legendary 220%(!) compound annual return over five years in the 1990s lies right here.

He was able to achieve great returns by not becoming an involuntary long-term investor.

The reason he is called the 'God of Stocks' is because he made incredible decisions about what to buy, when to buy, and when to sell.

And the secret is revealed in this book! The author states in the final chapter: "Don't tell me the stock market is against you, that retail investors can't win, or that only experts make money in the market! Those are just excuses.

I dropped out of school at 15, so I had no money and no education.

But now, even I am making a lot of money in the stock market.

Consider how much better you could do based on my example! There's no reason you can't outperform me.'

After reading this book, you will realize that you can do it too.

GOODS SPECIFICS

- Date of issue: March 17, 2023

- Page count, weight, size: 400 pages | 700g | 152*225*24mm

- ISBN13: 9791191328790

- ISBN10: 1191328791

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)