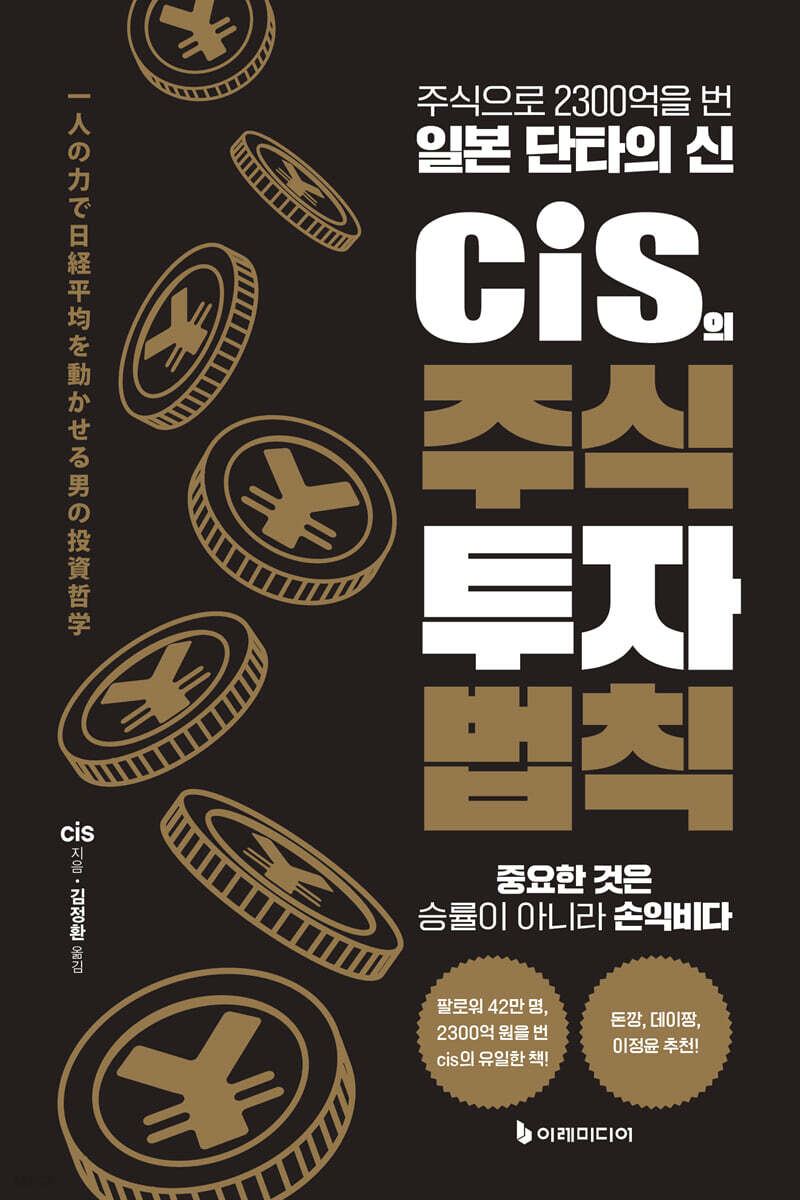

Cis's Stock Investment Rules

|

Description

Book Introduction

The Japanese short-term trader who made 230 billion won in stocks

The only book on cis!

Super Ants of Korea: Recommended by Donkang, Dayjjang, and Lee Jeong-yoon!

The author of this book, cis, is one of the most famous investors in Japan, along with BNF. He started with a capital of 30 million won at the age of 21 and has amassed 230 billion won as of 2018.

In other words, since this book was written five years ago, the amount is likely to have increased by now.

Cis is the only one of the two to have published a book, and even then, it is only this one.

In other words, it can be said that this is the first time a book by a famous Japanese trader has been introduced in Korea.

The book is packed with countless tips from the author, along with his investment stories.

By reading this book, which chronicles his journey to becoming a legendary trader, you will learn his practical know-how in stock trading and the wisdom to distinguish between what to focus on and what not to focus on.

The only book on cis!

Super Ants of Korea: Recommended by Donkang, Dayjjang, and Lee Jeong-yoon!

The author of this book, cis, is one of the most famous investors in Japan, along with BNF. He started with a capital of 30 million won at the age of 21 and has amassed 230 billion won as of 2018.

In other words, since this book was written five years ago, the amount is likely to have increased by now.

Cis is the only one of the two to have published a book, and even then, it is only this one.

In other words, it can be said that this is the first time a book by a famous Japanese trader has been introduced in Korea.

The book is packed with countless tips from the author, along with his investment stories.

By reading this book, which chronicles his journey to becoming a legendary trader, you will learn his practical know-how in stock trading and the wisdom to distinguish between what to focus on and what not to focus on.

- You can preview some of the book's contents.

Preview

index

The secret to winning at investing is simple.

[Chapter 1] You Can't Invest Successfully Without Overcoming Your Instincts

01.

Stocks that are rising will continue to rise, and stocks that are falling will continue to fall.

02.

'True randomness' is more brutal than the image.

03.

Don't buy under pressure

04.

If you rush to 'confirm profits', you won't be able to make a large profit.

05.

Water riding is the worst technique

06.

Can I buy a stock I sold off when it starts to rise again?

07.

In the trading world, there's no rule that says "8 wins, 7 losses"

08.

The inability to acknowledge loss leads to defeat.

09.

When people feel fear, that's when they have an opportunity.

10.

Risk hedging is a waste

[Chapter 2] In the world of investing, those who create hypotheses win.

01.

Are these stocks people are buying or selling now?

02.

The Jaycom stock mis-issuance scandal that created a multi-millionaire from the unemployed.

03.

Earning 600 million yen with a split-second decision

04.

Constantly thinking of hypotheses

05.

There's a hidden strategy lurking in the world of investing.

06.

There's a second loach in the stock market.

07.

Reading books alone won't lead to successful investing.

08.

The media is irresponsible

[Chapter 3] The first step to making money is to take a cool-headed look at yourself and the place.

01.

There is no such thing as a fair price.

02.

When I started investing in stocks

03.

The reason I kept losing

04.

You can only learn about the market from the market.

05.

News is faster on Twitter than on NHK.

06.

Spotting insider trading

07.

If there is a stock price movement that is suspected to be an operation stock, it is an opportunity!

08.

When blind money moves, it's a money-making opportunity.

09.

Retire before you lose your cool

[Chapter 4] Occupation: Trading Technician

01.

A Trading Technician's Morning

02.

Exceptional cases of stock purchase

03.

Why I Became an All-Rounder

04.

Real estate investing is a game of penalties.

05.

The most important thing in investing is efficiency.

06.

Being a good person can easily lead to bankruptcy.

07.

I don't want to manage other people's money.

08.

Crowds flocking to the National Pension Service's funds

09.

If I manage the national pension

10.

I have absolutely no talent for being a CEO.

[Chapter 5] The skills needed for investing were honed through games.

01.

If my parents hated games and gambling, I wouldn't have been an investor.

02.

It all started in a hole-in-the-wall shop

03.

Why I Earned 20 Million Yen at Age 20

04.

“Don’t get caught.”

05.

Online Mahjong Experience Leads to Investment Style

06.

20 million yen won't change your life.

[Chapter 6] The Secret to Becoming a Billionaire

01.

At first, I just lost

02.

Learn how to make money from offline gatherings on 2channel.

03.

Part-time work is difficult

04.

I quit the company when my total assets reached 60 million yen.

05.

Wealth and health flow in reverse.

06.

"I have 120 million, looking for a girlfriend."

[Chapter 7] For those who want to start investing in stocks

01.

Is the economy a zero-sum game?

02.

This is modern society

03.

A crisis like the China Shock is an opportunity.

04.

A huge failure that I still can't forget

05.

Hello, I'm Son Oh-eok.

06.

Fast people are always fast, slow people are always slow

07.

There's a dream to buying a fallen company.

08.

There are plenty of bugs like this in the world.

09.

Can investors beat AI?

10.

With infinite effort, most people can beat it.

11.

Every time you decide whether to push or back down

12.

Mahjong is also an extension of stocks.

13.

Why I Spend 100 Million Yen a Year on Mahjong

14.

The successful cis-style counting in blackjack

15.

The most attractive gambling venue is the Tokyo Stock Exchange.

[Chapter 1] You Can't Invest Successfully Without Overcoming Your Instincts

01.

Stocks that are rising will continue to rise, and stocks that are falling will continue to fall.

02.

'True randomness' is more brutal than the image.

03.

Don't buy under pressure

04.

If you rush to 'confirm profits', you won't be able to make a large profit.

05.

Water riding is the worst technique

06.

Can I buy a stock I sold off when it starts to rise again?

07.

In the trading world, there's no rule that says "8 wins, 7 losses"

08.

The inability to acknowledge loss leads to defeat.

09.

When people feel fear, that's when they have an opportunity.

10.

Risk hedging is a waste

[Chapter 2] In the world of investing, those who create hypotheses win.

01.

Are these stocks people are buying or selling now?

02.

The Jaycom stock mis-issuance scandal that created a multi-millionaire from the unemployed.

03.

Earning 600 million yen with a split-second decision

04.

Constantly thinking of hypotheses

05.

There's a hidden strategy lurking in the world of investing.

06.

There's a second loach in the stock market.

07.

Reading books alone won't lead to successful investing.

08.

The media is irresponsible

[Chapter 3] The first step to making money is to take a cool-headed look at yourself and the place.

01.

There is no such thing as a fair price.

02.

When I started investing in stocks

03.

The reason I kept losing

04.

You can only learn about the market from the market.

05.

News is faster on Twitter than on NHK.

06.

Spotting insider trading

07.

If there is a stock price movement that is suspected to be an operation stock, it is an opportunity!

08.

When blind money moves, it's a money-making opportunity.

09.

Retire before you lose your cool

[Chapter 4] Occupation: Trading Technician

01.

A Trading Technician's Morning

02.

Exceptional cases of stock purchase

03.

Why I Became an All-Rounder

04.

Real estate investing is a game of penalties.

05.

The most important thing in investing is efficiency.

06.

Being a good person can easily lead to bankruptcy.

07.

I don't want to manage other people's money.

08.

Crowds flocking to the National Pension Service's funds

09.

If I manage the national pension

10.

I have absolutely no talent for being a CEO.

[Chapter 5] The skills needed for investing were honed through games.

01.

If my parents hated games and gambling, I wouldn't have been an investor.

02.

It all started in a hole-in-the-wall shop

03.

Why I Earned 20 Million Yen at Age 20

04.

“Don’t get caught.”

05.

Online Mahjong Experience Leads to Investment Style

06.

20 million yen won't change your life.

[Chapter 6] The Secret to Becoming a Billionaire

01.

At first, I just lost

02.

Learn how to make money from offline gatherings on 2channel.

03.

Part-time work is difficult

04.

I quit the company when my total assets reached 60 million yen.

05.

Wealth and health flow in reverse.

06.

"I have 120 million, looking for a girlfriend."

[Chapter 7] For those who want to start investing in stocks

01.

Is the economy a zero-sum game?

02.

This is modern society

03.

A crisis like the China Shock is an opportunity.

04.

A huge failure that I still can't forget

05.

Hello, I'm Son Oh-eok.

06.

Fast people are always fast, slow people are always slow

07.

There's a dream to buying a fallen company.

08.

There are plenty of bugs like this in the world.

09.

Can investors beat AI?

10.

With infinite effort, most people can beat it.

11.

Every time you decide whether to push or back down

12.

Mahjong is also an extension of stocks.

13.

Why I Spend 100 Million Yen a Year on Mahjong

14.

The successful cis-style counting in blackjack

15.

The most attractive gambling venue is the Tokyo Stock Exchange.

Detailed image

.jpg)

Into the book

The reason stock prices rise is because there are many people who want to buy the stock.

On the other hand, the reason why the stock price falls is because there are many people who want to sell the stock.

I can't say with 100% certainty that this is the reason.

Some people may have bought it for a clear reason, while others may have bought it because others were buying it.

Although we may be able to guess the reason later, it cannot be a complete explanation.

However, it is a clear fact that prices are rising because there are many people buying, and falling because there are many people selling.

So, the most likely way to succeed is to go with the flow of the market.

--- p.21

When a stock price rises and hits a new high, I am willing to buy it.

But ordinary people are not willing to buy it.

Since the report was made, I think it will soon fall.

Of course, if the price of apples continues to rise and reaches 400 yen per apple, you would normally not feel like buying them.

But stocks are different.

Many people invest in stocks with the idea of 'buying low and selling high', and when doing so, they judge whether the stock is cheap or expensive by comparing it to the past.

If the stock price is rising, I think it is expensive compared to the past, so I don't buy it. If the stock price is falling, I think it is cheap compared to the past, so I think it is profitable to buy it.

Clearly, bubbles exist.

But there is no such thing as a fair price.

You make a profit by simply selling it for more than the purchase price.

It's better not to compare it to the past.

--- p.91

Basically, except for the most skilled traders, the difference between making and losing money in the world of investing is a thin line and a product of chance.

The only investment that can generate returns greater than those that automatically rise in response to economic indicators such as market interest rates, economic growth rates, government bond yields, and inflation rates is by chance.

Even if it looks like things are going well, I think it's either because you don't see the risk or you've fallen for a scam.

--- p.188

A person's play style does not change easily.

The fast ones are always fast, and the slow ones are always slow.

And the faster the person, the better suited he or she is as an investor.

Being fast here doesn't mean being smart.

It means acting faster than others.

Someone who bought Jaycom stocks before me and started Bitcoin much earlier than me was using various surveillance tools.

Since he himself doesn't know how to program, he hired a programmer to create such a tool.

In addition, he opened overseas accounts in the United States and Hong Kong and even visited the country to establish a corporation.

The corporation itself didn't seem to generate much profit, but I couldn't help but exclaim, 'How motivated is this guy?'

He was always more motivated and took action before others.

--- p.230~231

Stock investing is a cutting-edge, cutting-edge discipline and an economic activity.

Because it is cutting edge, the future cannot be predicted.

It is an 'incomplete information game' that is close to the extreme.

Doing something every day is a way to study, improve your skills, and even make money.

The fact that you don't know whether studying will make you profitable is both an advantage and a disadvantage.

Another interesting aspect of the game is that the overall power determines the outcome.

You can participate with just 100,000 yen.

Just because you're incredibly smart doesn't guarantee you'll be profitable.

It is also important to be quick in judgment and action.

There are also strategies that utilize various aspects, such as connections, information, and funding capabilities.

It is a grand game because it is a showdown of such comprehensive power.

There is no game on this scale.

On the other hand, the reason why the stock price falls is because there are many people who want to sell the stock.

I can't say with 100% certainty that this is the reason.

Some people may have bought it for a clear reason, while others may have bought it because others were buying it.

Although we may be able to guess the reason later, it cannot be a complete explanation.

However, it is a clear fact that prices are rising because there are many people buying, and falling because there are many people selling.

So, the most likely way to succeed is to go with the flow of the market.

--- p.21

When a stock price rises and hits a new high, I am willing to buy it.

But ordinary people are not willing to buy it.

Since the report was made, I think it will soon fall.

Of course, if the price of apples continues to rise and reaches 400 yen per apple, you would normally not feel like buying them.

But stocks are different.

Many people invest in stocks with the idea of 'buying low and selling high', and when doing so, they judge whether the stock is cheap or expensive by comparing it to the past.

If the stock price is rising, I think it is expensive compared to the past, so I don't buy it. If the stock price is falling, I think it is cheap compared to the past, so I think it is profitable to buy it.

Clearly, bubbles exist.

But there is no such thing as a fair price.

You make a profit by simply selling it for more than the purchase price.

It's better not to compare it to the past.

--- p.91

Basically, except for the most skilled traders, the difference between making and losing money in the world of investing is a thin line and a product of chance.

The only investment that can generate returns greater than those that automatically rise in response to economic indicators such as market interest rates, economic growth rates, government bond yields, and inflation rates is by chance.

Even if it looks like things are going well, I think it's either because you don't see the risk or you've fallen for a scam.

--- p.188

A person's play style does not change easily.

The fast ones are always fast, and the slow ones are always slow.

And the faster the person, the better suited he or she is as an investor.

Being fast here doesn't mean being smart.

It means acting faster than others.

Someone who bought Jaycom stocks before me and started Bitcoin much earlier than me was using various surveillance tools.

Since he himself doesn't know how to program, he hired a programmer to create such a tool.

In addition, he opened overseas accounts in the United States and Hong Kong and even visited the country to establish a corporation.

The corporation itself didn't seem to generate much profit, but I couldn't help but exclaim, 'How motivated is this guy?'

He was always more motivated and took action before others.

--- p.230~231

Stock investing is a cutting-edge, cutting-edge discipline and an economic activity.

Because it is cutting edge, the future cannot be predicted.

It is an 'incomplete information game' that is close to the extreme.

Doing something every day is a way to study, improve your skills, and even make money.

The fact that you don't know whether studying will make you profitable is both an advantage and a disadvantage.

Another interesting aspect of the game is that the overall power determines the outcome.

You can participate with just 100,000 yen.

Just because you're incredibly smart doesn't guarantee you'll be profitable.

It is also important to be quick in judgment and action.

There are also strategies that utilize various aspects, such as connections, information, and funding capabilities.

It is a grand game because it is a showdown of such comprehensive power.

There is no game on this scale.

--- p.269

Publisher's Review

The man who moves the Nikkei index of the Japanese stock market!

The only book written by the Japanese short-term trading god who made 230 billion won in stocks!

First of all, you might be wondering who cis is.

Cis is one of the most famous investors in Japan, along with BNF. He started with 30 million won in capital at the age of 21 and has amassed 230 billion won as of 2018.

In other words, since this book was written five years ago, the amount is likely to have increased by now.

The reason why BNF, let alone cis, is not well known is probably because only cis has written a book among them, and even that has not been introduced in Korea.

In that respect, 『CIS's Stock Investment Laws』 has merit not only in that it is the first book by a famous Japanese trader to be introduced in Korea, but also in that it is the only book by CIS.

cis has a somewhat different aspect from the investors we are familiar with.

While both fundamental and technical investors often draw a clear distinction between stocks and gambling, cis lumps the two activities together.

He introduces himself as follows:

When you think of an investor, you might think of someone who supports a company by buying stocks, but I'm not an investor in that sense.

I consider myself a gamer and gambler at heart.

I have also enjoyed other games and gambling, and have considered investing, including stocks, as a form of game (gambling).

For him, stocks are a fun game with a proper mix of skill, chance, risk, and return.

How can someone like him make money in stocks? As with many games, there are rules to the world.

His gaming instinct, which started from a claw machine in front of a hole-in-the-wall shop, expanded beyond pachinko to stocks and mahjong.

His ability to quickly grasp the rules of all these games was the secret to his success.

There is no such thing as maximizing efficiency on a stable path.

So what is the law of the stock market he speaks of? It's sticking to the fundamentals.

The idea is to buy stocks that are rising, because stocks that are rising will continue to rise, and stocks that are falling will continue to fall.

If the price of a stock you own falls, sell it rather than riding the wave. On the other hand, if the price of a stock is rising, hold it rather than hastily taking profits.

Since no one knows how high it will go, you should not make any arbitrary predictions on your own and should continue to hold on to it.

In addition, the book contains countless tips unique to cis, along with his story.

He calls himself defensive, but as you read the book, you'll find that he makes a lot of attempts that others would call dangerous.

For example, if a stock reaches its upper limit, you would usually choose to sell some to lock in profits and take some more, but cis doesn't do that.

One of his main theories is that 'there is no such thing as maximizing efficiency on a stable path', so he chooses to take everything rather than sell some.

The truth of the world is simple and universal, and the stock market is no different.

Simply reading stories filled with the experiences of successful traders can redefine the key to trading success, including mind control.

By reading this book, which chronicles his journey to becoming a legendary trader, I hope readers will learn his practical know-how in stock trading, as well as the wisdom to distinguish between what to focus on and what not to focus on.

The only book written by the Japanese short-term trading god who made 230 billion won in stocks!

First of all, you might be wondering who cis is.

Cis is one of the most famous investors in Japan, along with BNF. He started with 30 million won in capital at the age of 21 and has amassed 230 billion won as of 2018.

In other words, since this book was written five years ago, the amount is likely to have increased by now.

The reason why BNF, let alone cis, is not well known is probably because only cis has written a book among them, and even that has not been introduced in Korea.

In that respect, 『CIS's Stock Investment Laws』 has merit not only in that it is the first book by a famous Japanese trader to be introduced in Korea, but also in that it is the only book by CIS.

cis has a somewhat different aspect from the investors we are familiar with.

While both fundamental and technical investors often draw a clear distinction between stocks and gambling, cis lumps the two activities together.

He introduces himself as follows:

When you think of an investor, you might think of someone who supports a company by buying stocks, but I'm not an investor in that sense.

I consider myself a gamer and gambler at heart.

I have also enjoyed other games and gambling, and have considered investing, including stocks, as a form of game (gambling).

For him, stocks are a fun game with a proper mix of skill, chance, risk, and return.

How can someone like him make money in stocks? As with many games, there are rules to the world.

His gaming instinct, which started from a claw machine in front of a hole-in-the-wall shop, expanded beyond pachinko to stocks and mahjong.

His ability to quickly grasp the rules of all these games was the secret to his success.

There is no such thing as maximizing efficiency on a stable path.

So what is the law of the stock market he speaks of? It's sticking to the fundamentals.

The idea is to buy stocks that are rising, because stocks that are rising will continue to rise, and stocks that are falling will continue to fall.

If the price of a stock you own falls, sell it rather than riding the wave. On the other hand, if the price of a stock is rising, hold it rather than hastily taking profits.

Since no one knows how high it will go, you should not make any arbitrary predictions on your own and should continue to hold on to it.

In addition, the book contains countless tips unique to cis, along with his story.

He calls himself defensive, but as you read the book, you'll find that he makes a lot of attempts that others would call dangerous.

For example, if a stock reaches its upper limit, you would usually choose to sell some to lock in profits and take some more, but cis doesn't do that.

One of his main theories is that 'there is no such thing as maximizing efficiency on a stable path', so he chooses to take everything rather than sell some.

The truth of the world is simple and universal, and the stock market is no different.

Simply reading stories filled with the experiences of successful traders can redefine the key to trading success, including mind control.

By reading this book, which chronicles his journey to becoming a legendary trader, I hope readers will learn his practical know-how in stock trading, as well as the wisdom to distinguish between what to focus on and what not to focus on.

GOODS SPECIFICS

- Date of issue: May 31, 2024

- Page count, weight, size: 272 pages | 450g | 140*210*18mm

- ISBN13: 9791193394410

- ISBN10: 1193394414

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)