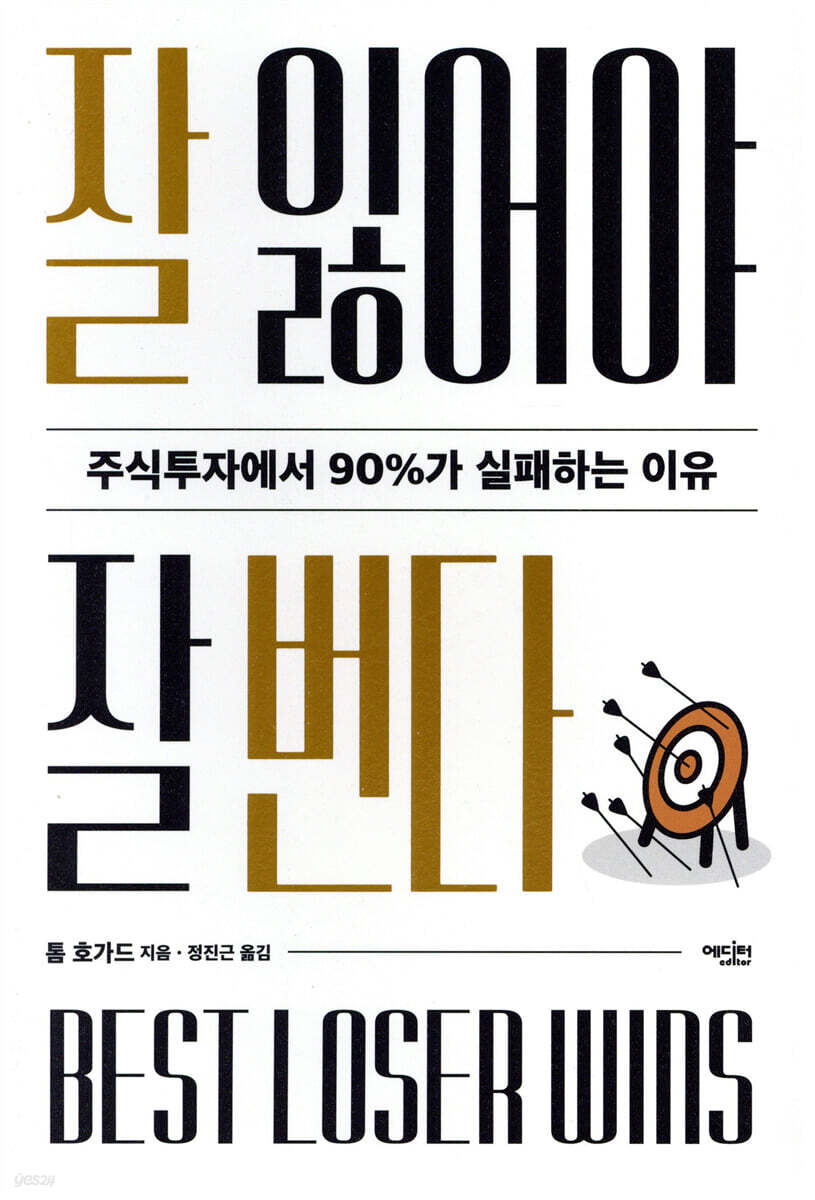

You have to lose well to earn well

|

Description

Book Introduction

He who loses the most wins!

A book that identifies the causes of investment failure through analysis of 43 million transactions!

A book by a former financial institution trader and now a seasoned investor, clearly explaining why 90% of stock investments fail and providing solutions through analysis of 43 million transactions.

In this book, titled "You Have to Lose Well to Earn Well," the author, a winner of several investment competitions, draws on his own trading experience and his observations and analysis of millions of trades made by individual investors while working in the financial markets to understand why most investors are destined to fail.

The secret the author discovered is that individual investors don't know how to lose properly.

“What 99% of investors don’t realize is that they’re looking in the wrong place for answers.

Everyone knows about technical analysis, fundamental analysis, indicators, ratios, patterns, or trend lines, but all but 1% lose money.”

A book that identifies the causes of investment failure through analysis of 43 million transactions!

A book by a former financial institution trader and now a seasoned investor, clearly explaining why 90% of stock investments fail and providing solutions through analysis of 43 million transactions.

In this book, titled "You Have to Lose Well to Earn Well," the author, a winner of several investment competitions, draws on his own trading experience and his observations and analysis of millions of trades made by individual investors while working in the financial markets to understand why most investors are destined to fail.

The secret the author discovered is that individual investors don't know how to lose properly.

“What 99% of investors don’t realize is that they’re looking in the wrong place for answers.

Everyone knows about technical analysis, fundamental analysis, indicators, ratios, patterns, or trend lines, but all but 1% lose money.”

- You can preview some of the book's contents.

Preview

index

Dear Market

Introduction / What 99% of Investors Don't Realize

ingress

Liar's Poker

Trading Headquarters

Everyone is a chart expert

The Curse of Patterns

The struggle with humanity

aversion

The Wanderer's Heart

Trading in a slump

Embrace failure

He who loses the most wins.

Ideal mindset

Conclusion / Understand Your Heart Better Than the Market

Translator's Note / Become the most losing investor and the ultimate winner.

Introduction / What 99% of Investors Don't Realize

ingress

Liar's Poker

Trading Headquarters

Everyone is a chart expert

The Curse of Patterns

The struggle with humanity

aversion

The Wanderer's Heart

Trading in a slump

Embrace failure

He who loses the most wins.

Ideal mindset

Conclusion / Understand Your Heart Better Than the Market

Translator's Note / Become the most losing investor and the ultimate winner.

Into the book

As investors, we tend to engage in endlessly predictable cycles.

Trading is going well for the time being.

We are happy.

Our discipline is weakened.

We lose money.

Then we strengthen our resolve and get more education.

And then again, it does well for a while.

But we lose money.

Sometimes trading is halted for a while, sometimes permanently.

Sound familiar? The sad part about this cycle is that everyone has their good days trading.

Everyone has a time when they make money.

Everyone has their own moment.

Maybe you did too.

So what happens? 99% of people don't know how to lose well.

The emotions they experience when they lose cause them to act in ways that are not in their best interest.

---From "Trading Headquarters"

Over time, losing investors will repeatedly lose faith in the prevailing trend and take counter-trend positions.

From an emotional standpoint, he will do so because it appears he is buying low or selling high.

While this may be emotionally satisfying, like buying toilet paper at a 50% discount at your local supermarket, the financial markets are not supermarkets.

There is nothing 'cheap' here.

There is nothing 'expensive'.

There is just a price that the trend creates.

---From "Trading Headquarters"

I believe that what separates the top 1% from the remaining 99% is how they think and how they handle their emotions when trading.

That doesn't mean there aren't benefits to learning chart reading skills.

I know from my own experience that chart reading is absolutely essential to my decision-making, but it is only a small part of the overall trading situation.

---From "Everyone is a Chart Expert"

During my time at City Index, I studied customer behavior and concluded that the majority had unhealthy mental thought patterns.

They feel fear when there is no reason to be afraid.

It appears when the positions they hold are profitable.

No matter how I phrase it differently, it's still the fear of failure.

In this case, it is the fear of losing unrealized valuation gains.

---From "Everyone is a Chart Expert"

The world of investing is the opposite of the world outside of investing.

The traits I display as a human being outside of the investing world are of little help in the investing world.

It's not just my story.

This is a story that applies to everyone in general.

---From "The Curse of Patterns"

What's the right thing to do? What about observing what others are doing and doing the opposite?

The basic premise is that the majority of traders end up losing money.

That's our starting point.

Now we will observe what those people do.

I've been doing it for 10 years.

Here's what I observed:

1.

Do not add to a position that is already making a profit.

2.

Do not use stop loss

3.

Add a position to a losing trade

4.

Take half the profits

---From "The Struggle with Humanity"

From the subconscious brain's perspective, there are two types of pain in trading.

One is the pain of seeing profit.

When you see a profit, you want to get rid of it so you don't have to endure the pain of seeing the profit disappear.

And the pain of seeing loss.

When your subconscious brain sees a loss, it wants you to hold that position a little longer, a little longer.

Otherwise, you will have to admit a loss.

As long as a losing position is maintained, there is always hope.

---From "The Struggle with Humanity"

This is the paradox of investing.

You can be successful by doing what 90% of people can't do.

In other words, I expect that I will be uncomfortable.

I expect my trading to make me anxious.

But I'm waiting for it.

To summarize in a few sentences:

1.

Until proven otherwise, assume I'm wrong.

2.

I expect it to be uncomfortable.

3.

I scale when I'm right.

4.

I never scale when I'm wrong.

---From "He who loses the most wins"

Emotions kill your trading account.

It is not lack of knowledge that blocks the path to great success.

It's how you handle yourself when trading.

I've been watching investors lose money for 10 years.

They were smart people with a high hit rate, but they didn't know how to lose well.

If you have read this book so far and you have to remember only one thing, remember this.

Unlike life, in trading, the one who loses the most wins.

---From "He who loses the most wins"

My training is to accept pain, and through habit and repetition, to expand the limits of my pain tolerance by making it a part of my being.

I also need to train my mind to deal with expectations and unrealized expectations.

This requires persistent effort through journaling, mental imagery, and asking for help.

You might ask, “Does that work?”

I think so.

It revolutionized my trading.

As of March 2022, when I write this, I haven't had a single daily loss since September 2021.

That's almost seven months without a single day of loss.

Trading is going well for the time being.

We are happy.

Our discipline is weakened.

We lose money.

Then we strengthen our resolve and get more education.

And then again, it does well for a while.

But we lose money.

Sometimes trading is halted for a while, sometimes permanently.

Sound familiar? The sad part about this cycle is that everyone has their good days trading.

Everyone has a time when they make money.

Everyone has their own moment.

Maybe you did too.

So what happens? 99% of people don't know how to lose well.

The emotions they experience when they lose cause them to act in ways that are not in their best interest.

---From "Trading Headquarters"

Over time, losing investors will repeatedly lose faith in the prevailing trend and take counter-trend positions.

From an emotional standpoint, he will do so because it appears he is buying low or selling high.

While this may be emotionally satisfying, like buying toilet paper at a 50% discount at your local supermarket, the financial markets are not supermarkets.

There is nothing 'cheap' here.

There is nothing 'expensive'.

There is just a price that the trend creates.

---From "Trading Headquarters"

I believe that what separates the top 1% from the remaining 99% is how they think and how they handle their emotions when trading.

That doesn't mean there aren't benefits to learning chart reading skills.

I know from my own experience that chart reading is absolutely essential to my decision-making, but it is only a small part of the overall trading situation.

---From "Everyone is a Chart Expert"

During my time at City Index, I studied customer behavior and concluded that the majority had unhealthy mental thought patterns.

They feel fear when there is no reason to be afraid.

It appears when the positions they hold are profitable.

No matter how I phrase it differently, it's still the fear of failure.

In this case, it is the fear of losing unrealized valuation gains.

---From "Everyone is a Chart Expert"

The world of investing is the opposite of the world outside of investing.

The traits I display as a human being outside of the investing world are of little help in the investing world.

It's not just my story.

This is a story that applies to everyone in general.

---From "The Curse of Patterns"

What's the right thing to do? What about observing what others are doing and doing the opposite?

The basic premise is that the majority of traders end up losing money.

That's our starting point.

Now we will observe what those people do.

I've been doing it for 10 years.

Here's what I observed:

1.

Do not add to a position that is already making a profit.

2.

Do not use stop loss

3.

Add a position to a losing trade

4.

Take half the profits

---From "The Struggle with Humanity"

From the subconscious brain's perspective, there are two types of pain in trading.

One is the pain of seeing profit.

When you see a profit, you want to get rid of it so you don't have to endure the pain of seeing the profit disappear.

And the pain of seeing loss.

When your subconscious brain sees a loss, it wants you to hold that position a little longer, a little longer.

Otherwise, you will have to admit a loss.

As long as a losing position is maintained, there is always hope.

---From "The Struggle with Humanity"

This is the paradox of investing.

You can be successful by doing what 90% of people can't do.

In other words, I expect that I will be uncomfortable.

I expect my trading to make me anxious.

But I'm waiting for it.

To summarize in a few sentences:

1.

Until proven otherwise, assume I'm wrong.

2.

I expect it to be uncomfortable.

3.

I scale when I'm right.

4.

I never scale when I'm wrong.

---From "He who loses the most wins"

Emotions kill your trading account.

It is not lack of knowledge that blocks the path to great success.

It's how you handle yourself when trading.

I've been watching investors lose money for 10 years.

They were smart people with a high hit rate, but they didn't know how to lose well.

If you have read this book so far and you have to remember only one thing, remember this.

Unlike life, in trading, the one who loses the most wins.

---From "He who loses the most wins"

My training is to accept pain, and through habit and repetition, to expand the limits of my pain tolerance by making it a part of my being.

I also need to train my mind to deal with expectations and unrealized expectations.

This requires persistent effort through journaling, mental imagery, and asking for help.

You might ask, “Does that work?”

I think so.

It revolutionized my trading.

As of March 2022, when I write this, I haven't had a single daily loss since September 2021.

That's almost seven months without a single day of loss.

---From "The Ideal Mindset"

Publisher's Review

Trading strategy: Managing your mind is more important than managing your money!

In this book, the author asserts that while trading may seem easy on the surface, it is actually much more difficult than people think, and the reason for this is that most people have unhealthy mental thought patterns.

“People have hope when they lose money.

And when it comes to making money, you feel fear.

I believe 90% of people think this way.

“This is why, in a study of 25,000 investors, they won more often than they lost, but their average loss was 66% greater than their average gain when they won.”

In this book, the author argues that ordinary thinking leads to ordinary results, and that investors must think differently to achieve extraordinary results.

This book will guide and inspire you in a way other investment guides cannot.

It's not about strategy or money management.

It's all about mind management.

“You need to teach your brain to be hopeful (about gains) when it feels the wrong fear (about loss).

“You need to teach your brain to feel fear (of loss) when it mistakenly hopes (for a positive change in position).”

An antidote to conventional and misconceptions about investing!

This book presents a way to move from mediocrity, with only occasional profits, to excellence and consistency in the trading game by thinking differently about trading.

No technical analysis can do that.

People don't fail because they don't know enough about technical analysis.

The author argues that they fail because they do not understand how the market affects their minds.

This book is an antidote to conventional and misguided thinking about investing, and a blueprint for a new belief system for investors who want to elevate their results to levels they never dreamed possible.

By embracing failure and following the author's ideal mindset, you will be able to achieve your ultimate goal of success as an investor, while gaining a better understanding of yourself and the market.

In this book, the author asserts that while trading may seem easy on the surface, it is actually much more difficult than people think, and the reason for this is that most people have unhealthy mental thought patterns.

“People have hope when they lose money.

And when it comes to making money, you feel fear.

I believe 90% of people think this way.

“This is why, in a study of 25,000 investors, they won more often than they lost, but their average loss was 66% greater than their average gain when they won.”

In this book, the author argues that ordinary thinking leads to ordinary results, and that investors must think differently to achieve extraordinary results.

This book will guide and inspire you in a way other investment guides cannot.

It's not about strategy or money management.

It's all about mind management.

“You need to teach your brain to be hopeful (about gains) when it feels the wrong fear (about loss).

“You need to teach your brain to feel fear (of loss) when it mistakenly hopes (for a positive change in position).”

An antidote to conventional and misconceptions about investing!

This book presents a way to move from mediocrity, with only occasional profits, to excellence and consistency in the trading game by thinking differently about trading.

No technical analysis can do that.

People don't fail because they don't know enough about technical analysis.

The author argues that they fail because they do not understand how the market affects their minds.

This book is an antidote to conventional and misguided thinking about investing, and a blueprint for a new belief system for investors who want to elevate their results to levels they never dreamed possible.

By embracing failure and following the author's ideal mindset, you will be able to achieve your ultimate goal of success as an investor, while gaining a better understanding of yourself and the market.

GOODS SPECIFICS

- Date of issue: November 11, 2023

- Page count, weight, size: 328 pages | 596g | 152*225*18mm

- ISBN13: 9788967442712

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)