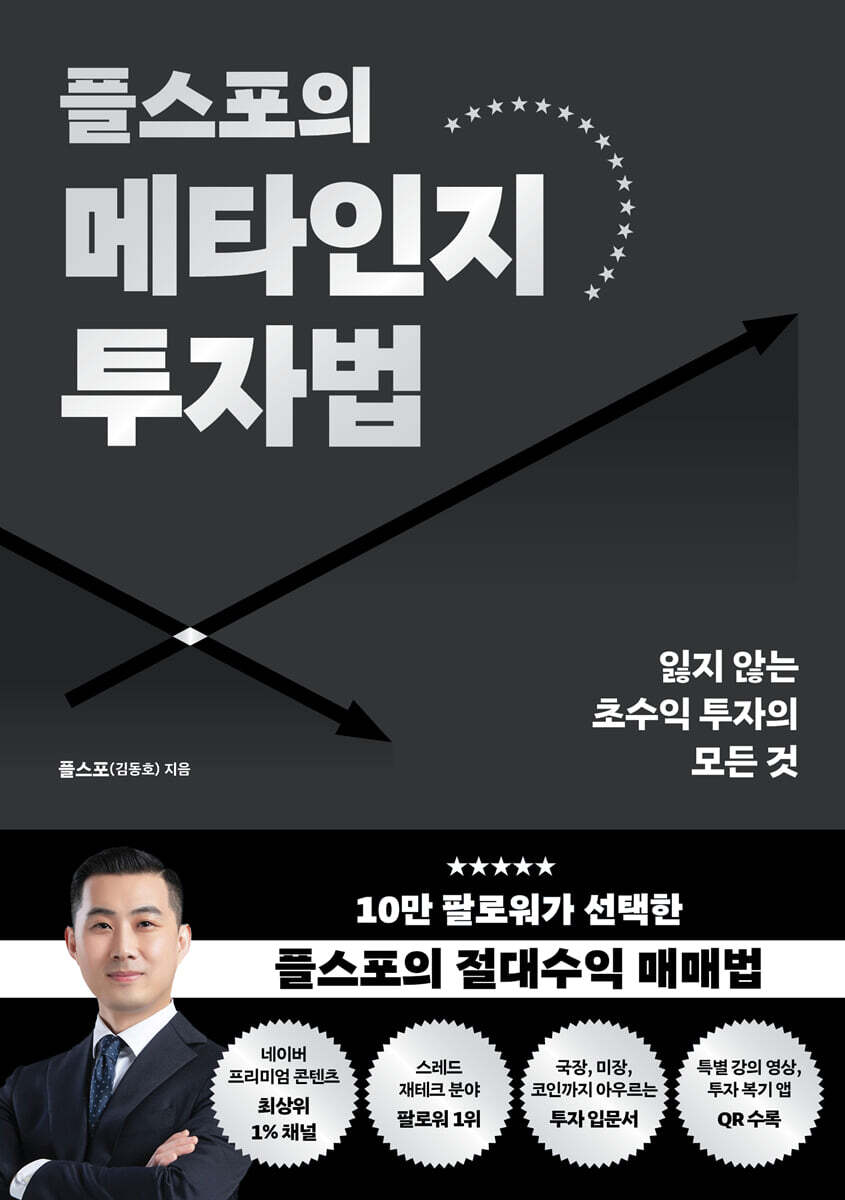

Pluspo's metacognitive investment method

|

Description

Book Introduction

- A word from MD

-

Successful investors have high metacognition.The first book by Pluspo, a financial technology expert chosen by 100,000 followers.

Through extensive practical experience, he has perfected his "Metacognitive Investment Method," which helps beginner investors overcome their wavering psychology and provides principles for generating consistent profits.

A practical investment book covering everything from chart analysis to thematic stock discovery.

November 7, 2025. Economics and Management PD Oh Da-eun

#1 overall bestseller on Yes24 immediately after publication!

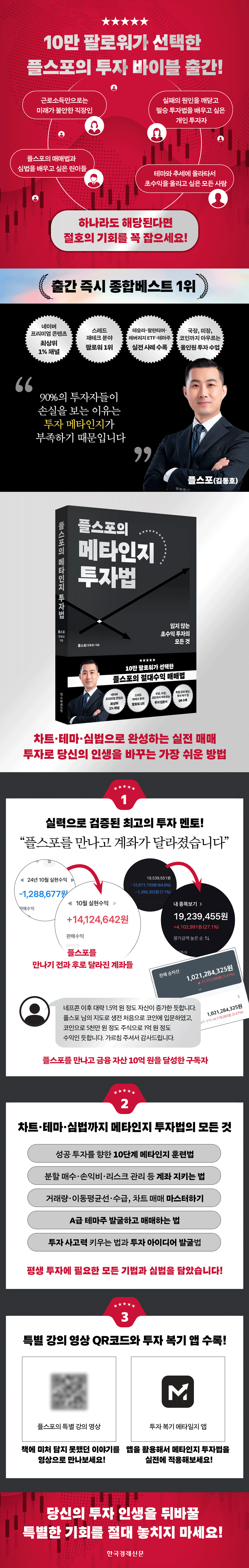

The investment bible chosen by 100,000 followers has been published!

- Naver Premium Content Top 1% Channel

- #1 in followers in the thread investment category

- Includes examples of trading Tesla, Palantir, leveraged ETFs, and thematic stocks.

All-in-one investment course covering directors, stocks, and coins

There are many and diverse investment strategies on the market.

However, no matter how much novice investors study, they continue to fail at investing.

This book deeply analyzes the fundamental causes of investment failure and teaches you how to consistently generate profits.

The author experienced countless failures over the past seven years investing in stocks and coins, and has generously shared the investment principles and attitudes he learned along the way on various social media platforms.

His investment perspective, which includes outstanding insights and identifying promising stocks, quickly spread by word of mouth, drawing an explosive response from his 100,000+ followers.

This book is a practical introduction to investing, condensing all of Pluspo's know-how and trading techniques, including chart reading, theme stock discovery, and corporate analysis, into a single volume. It's your go-to investment bible whenever you feel lost in the vast world of investing.

Why do 90% of investors lose money?

If you don't develop investment metacognition, failure will repeat itself!

With stock markets around the world hitting record highs every day, this book is essential for seizing the opportunities ahead and preparing for impending crises.

Metacognitive investing is an innovative investment method that prevents rapidly changing market conditions or investor volatility from affecting your account.

Take this all-in-one investment course that teaches you how to analyze charts, thematic stocks, and investment indicators, along with a 10-step metacognitive training method.

The investment bible chosen by 100,000 followers has been published!

- Naver Premium Content Top 1% Channel

- #1 in followers in the thread investment category

- Includes examples of trading Tesla, Palantir, leveraged ETFs, and thematic stocks.

All-in-one investment course covering directors, stocks, and coins

There are many and diverse investment strategies on the market.

However, no matter how much novice investors study, they continue to fail at investing.

This book deeply analyzes the fundamental causes of investment failure and teaches you how to consistently generate profits.

The author experienced countless failures over the past seven years investing in stocks and coins, and has generously shared the investment principles and attitudes he learned along the way on various social media platforms.

His investment perspective, which includes outstanding insights and identifying promising stocks, quickly spread by word of mouth, drawing an explosive response from his 100,000+ followers.

This book is a practical introduction to investing, condensing all of Pluspo's know-how and trading techniques, including chart reading, theme stock discovery, and corporate analysis, into a single volume. It's your go-to investment bible whenever you feel lost in the vast world of investing.

Why do 90% of investors lose money?

If you don't develop investment metacognition, failure will repeat itself!

With stock markets around the world hitting record highs every day, this book is essential for seizing the opportunities ahead and preparing for impending crises.

Metacognitive investing is an innovative investment method that prevents rapidly changing market conditions or investor volatility from affecting your account.

Take this all-in-one investment course that teaches you how to analyze charts, thematic stocks, and investment indicators, along with a 10-step metacognitive training method.

- You can preview some of the book's contents.

Preview

index

Prologue: Metacognitive Investment for Successful Investment

PART 1.

Successful investors have high metacognition.

The first step to investing begins with recognizing and filling a deficiency.

1.

Why do I lose money when I invest in stocks?

2.

What is metacognition?

3.

Metacognition in Stock Investing

4.

10-Step Metacognitive Training for Successful Investing

PART 2.

7 Weapons to Protect Your Account

Trading according to clear principles brings profits.

1.

Establish your own trading philosophy

2.

Support and resistance are the fundamentals of charts.

3.

Split purchase and split sale

4.

It is important to compromise with greed and cut losses.

5.

Profit/loss ratio for betting with a 51% probability

6.

Weight management is key to risk management.

7.

If you don't manage your account properly, you lose everything.

8.

Holding cash is not an option, it's a necessity.

Pluspo's Practical Investment Lesson ①

How to Buy in Fear When the Index Plummets

PART 3.

A chart that captures all investor sentiment

Not knowing how to read a chart is like going into battle without a gun.

1.

The First Step to Reading Charts

2.

The smallest psychological candle

3.

Trading volume that even power cannot hide

4.

The transaction amount is an honest signal

5.

A moving average line that intuitively shows the stock price trend

6.

A trend that can be used to read the direction of a stock

7.

A leader who rides a running horse

8.

Support and resistance are powerful balance points of force.

Pluspo's Practical Investment Lesson ②

_Every chart has one lifeline

PART 4.

Corporate Analysis: Let's Ask a Question

Sales and operating profit don't lie.

1.

The surest way to find good stocks

2.

What kind of company are you looking to acquire?

3.

Is your business making good money?

4.

Is the company's financial health sound?

5.

Is there potential for future growth?

6.

Are they a trustworthy management team?

7.

3 Must-Know Metrics for Corporate Analysis

Pluspo's Practical Investment Lesson ③

_Is it worth investing in Tesla and Palantir?

PART 5.

The director said that if it's not a performance stock, the theme stock is the answer.

There is no sector as safe and low-risk as thematic stocks.

1.

Understanding thematics

2.

3 Absolute Criteria for Finding a Grade A Theme

3.

How to find the leader of a theme

4.

Theme's main flow

5.

Things to keep in mind when trading theme stocks

6.

Analysis of real-world cases of theme stocks

Pluspo's Practical Investment Lesson ④

If you love the negative candlestick and buy in installments, you will be rewarded with a positive candlestick.

PART 6.

Perspective over technique

To invest well, you must understand how to read the market.

1.

Techniques have meaning only when there is a perspective.

2.

Why Money Flow Matters

3.

An economic newspaper that develops investment thinking skills

4.

Investment ideas found in everyday life

5.

Investment perspectives on reading themes

Pluspo's Practical Investment Lesson ⑤

SK traded on expectations of SK Biopharm listing

PART 7.

The final gateway to Gosu

Your mindset and attitude toward investing are important.

1.

Be proactive in stock selection and trading.

2.

The only way to succeed in investing is to just do it.

3.

In life, investing is like a dot on a long line.

4.

You must trade against your nature.

5.

How to train your mind in investing

6.

The 12 Commandments of Investing

7.

What we must do after reading a book

PART 1.

Successful investors have high metacognition.

The first step to investing begins with recognizing and filling a deficiency.

1.

Why do I lose money when I invest in stocks?

2.

What is metacognition?

3.

Metacognition in Stock Investing

4.

10-Step Metacognitive Training for Successful Investing

PART 2.

7 Weapons to Protect Your Account

Trading according to clear principles brings profits.

1.

Establish your own trading philosophy

2.

Support and resistance are the fundamentals of charts.

3.

Split purchase and split sale

4.

It is important to compromise with greed and cut losses.

5.

Profit/loss ratio for betting with a 51% probability

6.

Weight management is key to risk management.

7.

If you don't manage your account properly, you lose everything.

8.

Holding cash is not an option, it's a necessity.

Pluspo's Practical Investment Lesson ①

How to Buy in Fear When the Index Plummets

PART 3.

A chart that captures all investor sentiment

Not knowing how to read a chart is like going into battle without a gun.

1.

The First Step to Reading Charts

2.

The smallest psychological candle

3.

Trading volume that even power cannot hide

4.

The transaction amount is an honest signal

5.

A moving average line that intuitively shows the stock price trend

6.

A trend that can be used to read the direction of a stock

7.

A leader who rides a running horse

8.

Support and resistance are powerful balance points of force.

Pluspo's Practical Investment Lesson ②

_Every chart has one lifeline

PART 4.

Corporate Analysis: Let's Ask a Question

Sales and operating profit don't lie.

1.

The surest way to find good stocks

2.

What kind of company are you looking to acquire?

3.

Is your business making good money?

4.

Is the company's financial health sound?

5.

Is there potential for future growth?

6.

Are they a trustworthy management team?

7.

3 Must-Know Metrics for Corporate Analysis

Pluspo's Practical Investment Lesson ③

_Is it worth investing in Tesla and Palantir?

PART 5.

The director said that if it's not a performance stock, the theme stock is the answer.

There is no sector as safe and low-risk as thematic stocks.

1.

Understanding thematics

2.

3 Absolute Criteria for Finding a Grade A Theme

3.

How to find the leader of a theme

4.

Theme's main flow

5.

Things to keep in mind when trading theme stocks

6.

Analysis of real-world cases of theme stocks

Pluspo's Practical Investment Lesson ④

If you love the negative candlestick and buy in installments, you will be rewarded with a positive candlestick.

PART 6.

Perspective over technique

To invest well, you must understand how to read the market.

1.

Techniques have meaning only when there is a perspective.

2.

Why Money Flow Matters

3.

An economic newspaper that develops investment thinking skills

4.

Investment ideas found in everyday life

5.

Investment perspectives on reading themes

Pluspo's Practical Investment Lesson ⑤

SK traded on expectations of SK Biopharm listing

PART 7.

The final gateway to Gosu

Your mindset and attitude toward investing are important.

1.

Be proactive in stock selection and trading.

2.

The only way to succeed in investing is to just do it.

3.

In life, investing is like a dot on a long line.

4.

You must trade against your nature.

5.

How to train your mind in investing

6.

The 12 Commandments of Investing

7.

What we must do after reading a book

Detailed image

Into the book

The stock market was not an easy place.

Far from experiencing the financial freedom I desired, I experienced trials and frustrations in the investment process.

Starting stock investment in 2011, I wasted 7 years of my life, wasting money and time due to the wrong direction and study method.

I lost all 20 million won that I borrowed to invest in stocks in 2017, and I felt resentful and aggrieved about losing the money, so I started studying again.

I started to fill in the metacognition I was lacking one by one and as I eliminated my weaknesses one by one, I gradually started to see steady profits.

--- From "Prologue: Metacognitive Investment Methods for Successful Investment"

It is essential to have the skills to reduce losses and consistently generate profits in investing.

It's metacognition.

Many investors don't look back at themselves before jumping into the stock market.

Investing without knowing your current situation is like a firefighter jumping into a fire without any equipment.

This is especially true for beginner investors.

You start putting money into your account and choosing stocks without even knowing 'what you don't know'.

But this approach ultimately only increases the chances of losing money in the market.

--- From "Metacognition in Stock Investment"

When a bear market comes, fear grows, and when a sharp rise comes, excitement and impatience grow.

In this way, you should develop the habit of recording and observing how your emotions react to market changes.

If your trading criteria waver every time your emotions change, it's not investing; it's just a reflexive reaction.

Once standards and principles are properly established, you can trade according to plan without being greatly swayed by any issues or information.

--- From "10 Metacognitive Training Methods for Successful Investment"

If you draw a horizontal line at the point where multiple support and resistance levels overlap and look at the chart, you will get a sense of the balance of power.

Beginners usually only see the ups and downs of stock prices when looking at charts.

This is not a proper way to look at the chart.

It is important to find the psychological trends of institutions, foreigners, and individuals buying and selling within the chart.

That is the balance of power.

--- From "Support and Resistance: The Basics of Charts"

It is difficult to determine the true flow of the market by just looking at the rise or fall of stock prices, and the strength and reliability of the trend can only be determined by looking at the trading volume.

No matter how high the stock price goes, if there is no trading volume, I don't trust the trend.

On the other hand, a surge in trading volume could be a genuine trend that shows strong buying power and psychology within it.

--- From "Trading Volume That Even Power Can't Hide"

Moving averages have also begun to be utilized.

If the stock price moves above the 5-day, 20-day, or 60-day moving average, it is interpreted as an upward trend, and conversely, if it stays below, it is judged as a downward trend.

In particular, I tried to capture the turning points of the trend by referring to the golden cross and the dead cross.

The movement of moving averages is important because it's not just a simple line; it reflects the average sentiment and direction of many investors. Auxiliary indicators like the MACD and RSI were initially confusing, but once familiarized, they were incredibly helpful in determining the strength and speed of trends.

--- From "Trends that can read the direction of stocks"

Electric vehicles are the core of Tesla's business, but autonomous driving software is driving innovation in its revenue structure, energy storage solutions are enabling new future businesses, and AI supercomputers and robotics are strengthening its technological leadership.

Tesla is building an integrated hardware, software, energy, and AI ecosystem by connecting key sectors of future industries one by one.

Therefore, it is important for investors to understand Tesla's essence not simply as an automobile company, but as an energy-based technology company or future infrastructure company.

A deep understanding of a company's business structure and expansion strategy is what true corporate analysis is all about.

--- From "What kind of company are you buying?"

In the stock market, thematic stocks are considered a strong opportunity to generate high returns in a short period of time.

However, among numerous themes, it is by no means easy to select so-called A-grade thematic stocks that are truly worth investing in.

Themes are emotional and can dominate the market in an instant, sometimes paralyzing rational judgment.

Therefore, when approaching a theme stock, it is necessary to establish clear criteria and approach it systematically rather than relying on simple feelings or rumors.

The criteria are continuity, anticipation, and freshness.

--- From "3 Absolute Criteria for Finding an A-Class Theme"

Theme stocks flow like trends.

There are times when a topic that the whole world was paying attention to until yesterday is pushed out of the spotlight overnight.

Therefore, thematic stocks are suitable for short-term trading rather than long-term holding.

Timing is everything, and if you enter late, there is a high chance that the rise will already be over.

The best strategy is to enter quickly in the early stages, make a certain profit, and then sell.

It's stable.

Especially when the market atmosphere changes rapidly, you need to be decisive and get out quickly without hesitation.

Because while profit is important, avoiding losses is more important.

--- From "Things to keep in mind when trading theme stocks"

Economic newspapers don't just cover stock market news.

It covers a wide range of topics, including interest rate policies in major countries, exchange rate fluctuations, raw material price trends, trends across various industries, the growth of the venture ecosystem, the strategies of technology companies, and even the impact of political decisions on the economy.

Through economic newspapers that cover a wide range of topics, we can gauge the current market position and develop the ability to predict future trends.

That's investment insight.

--- From "Economic Newspaper that Develops Investment Thinking Skills"

The process of mastering the mind is deeply related to self-control.

The most damaging emotions for investors are impatience, fear, and overconfidence.

These emotions paralyze reason and cause us to make mistakes we normally wouldn't make.

The market exploits this emotional vulnerability precisely.

So investors must have a strong mind.

This strength does not come from outside, but is built from within through repeated failure, reflection, and perseverance.

The strong mind is not about controlling the market, but about controlling myself.

Far from experiencing the financial freedom I desired, I experienced trials and frustrations in the investment process.

Starting stock investment in 2011, I wasted 7 years of my life, wasting money and time due to the wrong direction and study method.

I lost all 20 million won that I borrowed to invest in stocks in 2017, and I felt resentful and aggrieved about losing the money, so I started studying again.

I started to fill in the metacognition I was lacking one by one and as I eliminated my weaknesses one by one, I gradually started to see steady profits.

--- From "Prologue: Metacognitive Investment Methods for Successful Investment"

It is essential to have the skills to reduce losses and consistently generate profits in investing.

It's metacognition.

Many investors don't look back at themselves before jumping into the stock market.

Investing without knowing your current situation is like a firefighter jumping into a fire without any equipment.

This is especially true for beginner investors.

You start putting money into your account and choosing stocks without even knowing 'what you don't know'.

But this approach ultimately only increases the chances of losing money in the market.

--- From "Metacognition in Stock Investment"

When a bear market comes, fear grows, and when a sharp rise comes, excitement and impatience grow.

In this way, you should develop the habit of recording and observing how your emotions react to market changes.

If your trading criteria waver every time your emotions change, it's not investing; it's just a reflexive reaction.

Once standards and principles are properly established, you can trade according to plan without being greatly swayed by any issues or information.

--- From "10 Metacognitive Training Methods for Successful Investment"

If you draw a horizontal line at the point where multiple support and resistance levels overlap and look at the chart, you will get a sense of the balance of power.

Beginners usually only see the ups and downs of stock prices when looking at charts.

This is not a proper way to look at the chart.

It is important to find the psychological trends of institutions, foreigners, and individuals buying and selling within the chart.

That is the balance of power.

--- From "Support and Resistance: The Basics of Charts"

It is difficult to determine the true flow of the market by just looking at the rise or fall of stock prices, and the strength and reliability of the trend can only be determined by looking at the trading volume.

No matter how high the stock price goes, if there is no trading volume, I don't trust the trend.

On the other hand, a surge in trading volume could be a genuine trend that shows strong buying power and psychology within it.

--- From "Trading Volume That Even Power Can't Hide"

Moving averages have also begun to be utilized.

If the stock price moves above the 5-day, 20-day, or 60-day moving average, it is interpreted as an upward trend, and conversely, if it stays below, it is judged as a downward trend.

In particular, I tried to capture the turning points of the trend by referring to the golden cross and the dead cross.

The movement of moving averages is important because it's not just a simple line; it reflects the average sentiment and direction of many investors. Auxiliary indicators like the MACD and RSI were initially confusing, but once familiarized, they were incredibly helpful in determining the strength and speed of trends.

--- From "Trends that can read the direction of stocks"

Electric vehicles are the core of Tesla's business, but autonomous driving software is driving innovation in its revenue structure, energy storage solutions are enabling new future businesses, and AI supercomputers and robotics are strengthening its technological leadership.

Tesla is building an integrated hardware, software, energy, and AI ecosystem by connecting key sectors of future industries one by one.

Therefore, it is important for investors to understand Tesla's essence not simply as an automobile company, but as an energy-based technology company or future infrastructure company.

A deep understanding of a company's business structure and expansion strategy is what true corporate analysis is all about.

--- From "What kind of company are you buying?"

In the stock market, thematic stocks are considered a strong opportunity to generate high returns in a short period of time.

However, among numerous themes, it is by no means easy to select so-called A-grade thematic stocks that are truly worth investing in.

Themes are emotional and can dominate the market in an instant, sometimes paralyzing rational judgment.

Therefore, when approaching a theme stock, it is necessary to establish clear criteria and approach it systematically rather than relying on simple feelings or rumors.

The criteria are continuity, anticipation, and freshness.

--- From "3 Absolute Criteria for Finding an A-Class Theme"

Theme stocks flow like trends.

There are times when a topic that the whole world was paying attention to until yesterday is pushed out of the spotlight overnight.

Therefore, thematic stocks are suitable for short-term trading rather than long-term holding.

Timing is everything, and if you enter late, there is a high chance that the rise will already be over.

The best strategy is to enter quickly in the early stages, make a certain profit, and then sell.

It's stable.

Especially when the market atmosphere changes rapidly, you need to be decisive and get out quickly without hesitation.

Because while profit is important, avoiding losses is more important.

--- From "Things to keep in mind when trading theme stocks"

Economic newspapers don't just cover stock market news.

It covers a wide range of topics, including interest rate policies in major countries, exchange rate fluctuations, raw material price trends, trends across various industries, the growth of the venture ecosystem, the strategies of technology companies, and even the impact of political decisions on the economy.

Through economic newspapers that cover a wide range of topics, we can gauge the current market position and develop the ability to predict future trends.

That's investment insight.

--- From "Economic Newspaper that Develops Investment Thinking Skills"

The process of mastering the mind is deeply related to self-control.

The most damaging emotions for investors are impatience, fear, and overconfidence.

These emotions paralyze reason and cause us to make mistakes we normally wouldn't make.

The market exploits this emotional vulnerability precisely.

So investors must have a strong mind.

This strength does not come from outside, but is built from within through repeated failure, reflection, and perseverance.

The strong mind is not about controlling the market, but about controlling myself.

--- From "How to Govern the Mind in Investment"

Publisher's Review

A winning investment strategy discovered after 7 years of failure!

Achieve Super Profits with Metacognitive Investing

The author has achieved the highest number of followers in the thread investment category and is in the top 1% of Naver Premium Content subscribers. He has also received continuous love and support from over 100,000 subscribers on his blog and YouTube.

It contains 100% of the experience of leading countless subscribers' accounts to the profit zone and the secrets of surviving for 15 years in the cold world of investment.

Many people jump into the stock market, but 9 out of 10 lose money.

The reason is simple.

Because you invest without knowing your own weaknesses.

This book uses the concept of "metacognition" to guide you through specific investment methods, allowing you to understand the causes of investment failure and develop investment habits that consistently generate profits.

The author unpacks his unique trading methods and insights across all areas of investment, from charts and thematic stocks to corporate analysis and even his own investment philosophy. He also presents investment metacognitive training methods for the most effective application of these methods.

Practical trading completed with charts, themes, and strategies

The easiest way to change your life through investing

It contains detailed investment methods, from theory to practical trading techniques, such as how to read charts and find thematic stocks that lead the market.

Each chapter features a "Practical Investment Lessons from Pluspo" section, which provides detailed guidance on how to identify stocks and find trading opportunities.

The author's account capture photos and actual company charts from various stocks, including Tesla, Palantir, Orient Watch, and SK, were used to increase the reliability of the content.

The biggest advantage is that it eliminates all elements that increase the barrier to entry, such as difficult technical terms and tricky economic theories, and provides practical content that can be put into practice immediately.

It's a book that's easy to read, yet packed with content. Whenever you're having trouble investing, you can pick it up and read it, and it'll be a long-term help.

Special lecture QR codes and investment review app included

An all-in-one investment book filled with all of Pluspo's investment know-how!

Chapter 1 (Successful Investors Have High Metacognition) and Chapter 2 (7 Weapons to Protect Your Account) are chapters where I objectively understand myself.

The first thing to do in investing is to know what you don't know.

It covers basic account defense principles such as loss cutting, profit cutting, split trading, and weight adjustment.

I've also prepared a dedicated app with a QR code that allows you to review your investments, so I hope you'll apply what you've learned in this book to real-world situations.

Chapters 3 (Charts Containing All Investor Psychology) through 5 (Director: If It's Not Performance Stocks, Theme Stocks Are the Answer) analyze the stock market by dividing it into chart trading, company analysis, and theme stock trading.

Chapters 6 (Perspective on Technique) and 7 (The Final Gateway to Mastery) emphasize the 'perspective' of reading the flow of money.

Perspective is the power to interpret the market on your own through economic newspapers, everyday ideas, and theme analysis.

The last chapter includes a QR code for a special lecture video where you can hear stories not included in the book.

It goes beyond simply acquiring knowledge through reading the book; it is structured to ensure that all readers can consistently generate profits through real-world trading.

Achieve Super Profits with Metacognitive Investing

The author has achieved the highest number of followers in the thread investment category and is in the top 1% of Naver Premium Content subscribers. He has also received continuous love and support from over 100,000 subscribers on his blog and YouTube.

It contains 100% of the experience of leading countless subscribers' accounts to the profit zone and the secrets of surviving for 15 years in the cold world of investment.

Many people jump into the stock market, but 9 out of 10 lose money.

The reason is simple.

Because you invest without knowing your own weaknesses.

This book uses the concept of "metacognition" to guide you through specific investment methods, allowing you to understand the causes of investment failure and develop investment habits that consistently generate profits.

The author unpacks his unique trading methods and insights across all areas of investment, from charts and thematic stocks to corporate analysis and even his own investment philosophy. He also presents investment metacognitive training methods for the most effective application of these methods.

Practical trading completed with charts, themes, and strategies

The easiest way to change your life through investing

It contains detailed investment methods, from theory to practical trading techniques, such as how to read charts and find thematic stocks that lead the market.

Each chapter features a "Practical Investment Lessons from Pluspo" section, which provides detailed guidance on how to identify stocks and find trading opportunities.

The author's account capture photos and actual company charts from various stocks, including Tesla, Palantir, Orient Watch, and SK, were used to increase the reliability of the content.

The biggest advantage is that it eliminates all elements that increase the barrier to entry, such as difficult technical terms and tricky economic theories, and provides practical content that can be put into practice immediately.

It's a book that's easy to read, yet packed with content. Whenever you're having trouble investing, you can pick it up and read it, and it'll be a long-term help.

Special lecture QR codes and investment review app included

An all-in-one investment book filled with all of Pluspo's investment know-how!

Chapter 1 (Successful Investors Have High Metacognition) and Chapter 2 (7 Weapons to Protect Your Account) are chapters where I objectively understand myself.

The first thing to do in investing is to know what you don't know.

It covers basic account defense principles such as loss cutting, profit cutting, split trading, and weight adjustment.

I've also prepared a dedicated app with a QR code that allows you to review your investments, so I hope you'll apply what you've learned in this book to real-world situations.

Chapters 3 (Charts Containing All Investor Psychology) through 5 (Director: If It's Not Performance Stocks, Theme Stocks Are the Answer) analyze the stock market by dividing it into chart trading, company analysis, and theme stock trading.

Chapters 6 (Perspective on Technique) and 7 (The Final Gateway to Mastery) emphasize the 'perspective' of reading the flow of money.

Perspective is the power to interpret the market on your own through economic newspapers, everyday ideas, and theme analysis.

The last chapter includes a QR code for a special lecture video where you can hear stories not included in the book.

It goes beyond simply acquiring knowledge through reading the book; it is structured to ensure that all readers can consistently generate profits through real-world trading.

GOODS SPECIFICS

- Date of issue: November 10, 2025

- Page count, weight, size: 296 pages | 478g | 148*210*20mm

- ISBN13: 9788947502047

- ISBN10: 8947502049

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)