Machine Learning and Economic and Financial Time Series Forecasting

|

Description

Book Introduction

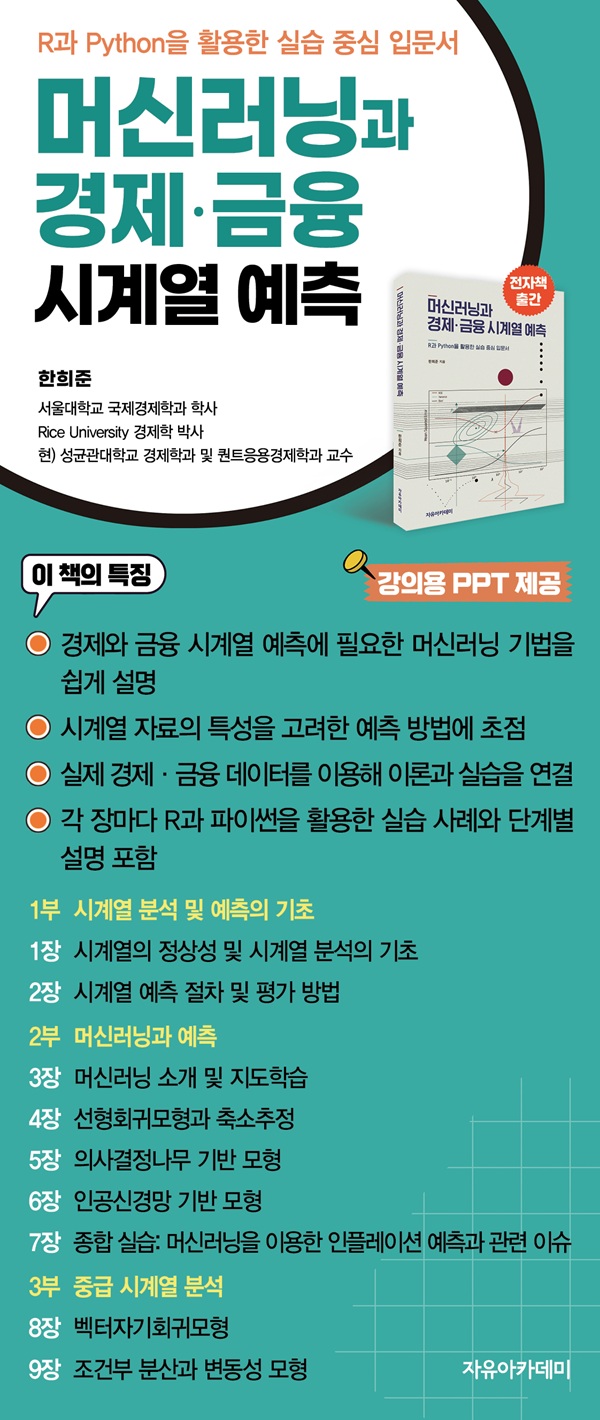

"Machine Learning and Economic and Financial Time Series Forecasting" is designed to help readers easily and systematically learn the machine learning techniques necessary for predicting time series data in economics and finance.

It focuses on forecasting methods that take into account the characteristics of time series data, and helps readers develop the ability to apply theoretical understanding to actual analysis through practical exercises using actual data.

It focuses on forecasting methods that take into account the characteristics of time series data, and helps readers develop the ability to apply theoretical understanding to actual analysis through practical exercises using actual data.

- You can preview some of the book's contents.

Preview

index

●Part 1: Fundamentals of Time Series Analysis and Forecasting

Chapter 1: Stationarity of Time Series and the Basics of Time Series Analysis

1.1 Stationarity of time series

1.2 Basic time series model

1.3 Unit root test

1.4 Conversion to stationary time series

1.5 Practice

Chapter 2 Time Series Forecasting Procedures and Evaluation Methods

2.1 Prediction Procedure

2.2 Multi-stage forward prediction

2.3 Prediction error function

2.4 Predictive power test method

2.5 Practice

Part 2: Machine Learning and Prediction

Chapter 3: Introduction to Machine Learning and Supervised Learning

3.1 What is machine learning?

3.2 Supervised learning

Chapter 4: Linear Regression Models and Downscaling

4.1 Linear regression model and least squares estimator

4.2 Reduced estimation method

4.3 Practice using time series data

4.4 Practice using cross-sectional data

Chapter 5 Decision Tree-Based Model

5.1 Decision tree model

5.2 Bagging

5.3 Random Forest

5.4 Boosting

5.5 Estimation Practice of Decision Tree-Based Models

Chapter 6: Artificial Neural Network-Based Models

6.1 Artificial Neural Networks

6.2 Artificial Neural Network Learning

6.3 Recurrent Neural Networks

6.4 LSTM

6.5 Estimation Practice of Artificial Neural Network Models

Chapter 7: Comprehensive Practice: Inflation Forecasting Using Machine Learning and Related Issues

7.1 US Inflation Forecasting Exercise

7.2 Practice data related to building a data set

7.3 The Relationship Between Time Series Persistence and Machine Learning Prediction

Part 3 Intermediate Time Series Analysis

Chapter 8 Vector Autoregression Model

8.1 Reduced vector autoregressive model

8.2 Structural vector autoregressive model

8.3 Practice

Chapter 9 Conditional Variance and Volatility Models

9.1 Conditional Variance Model

9.2 Development of ARCH/GARCH type models

9.3 Stochastic Volatility Model

9.4 Realized and Implied Volatility

9.5 Practice

supplement

Appendix AR and RStudio Installation and Basic Usage

Appendix B: Python and VS Code Installation and Basic Usage

Find references

Chapter 1: Stationarity of Time Series and the Basics of Time Series Analysis

1.1 Stationarity of time series

1.2 Basic time series model

1.3 Unit root test

1.4 Conversion to stationary time series

1.5 Practice

Chapter 2 Time Series Forecasting Procedures and Evaluation Methods

2.1 Prediction Procedure

2.2 Multi-stage forward prediction

2.3 Prediction error function

2.4 Predictive power test method

2.5 Practice

Part 2: Machine Learning and Prediction

Chapter 3: Introduction to Machine Learning and Supervised Learning

3.1 What is machine learning?

3.2 Supervised learning

Chapter 4: Linear Regression Models and Downscaling

4.1 Linear regression model and least squares estimator

4.2 Reduced estimation method

4.3 Practice using time series data

4.4 Practice using cross-sectional data

Chapter 5 Decision Tree-Based Model

5.1 Decision tree model

5.2 Bagging

5.3 Random Forest

5.4 Boosting

5.5 Estimation Practice of Decision Tree-Based Models

Chapter 6: Artificial Neural Network-Based Models

6.1 Artificial Neural Networks

6.2 Artificial Neural Network Learning

6.3 Recurrent Neural Networks

6.4 LSTM

6.5 Estimation Practice of Artificial Neural Network Models

Chapter 7: Comprehensive Practice: Inflation Forecasting Using Machine Learning and Related Issues

7.1 US Inflation Forecasting Exercise

7.2 Practice data related to building a data set

7.3 The Relationship Between Time Series Persistence and Machine Learning Prediction

Part 3 Intermediate Time Series Analysis

Chapter 8 Vector Autoregression Model

8.1 Reduced vector autoregressive model

8.2 Structural vector autoregressive model

8.3 Practice

Chapter 9 Conditional Variance and Volatility Models

9.1 Conditional Variance Model

9.2 Development of ARCH/GARCH type models

9.3 Stochastic Volatility Model

9.4 Realized and Implied Volatility

9.5 Practice

supplement

Appendix AR and RStudio Installation and Basic Usage

Appendix B: Python and VS Code Installation and Basic Usage

Find references

Detailed image

Publisher's Review

This book is designed to help readers easily and systematically learn the machine learning techniques necessary for predicting time series data in the fields of economics and finance.

It focuses on forecasting methods that take into account the characteristics of time series data, and helps readers develop the ability to apply theoretical understanding to actual analysis through practical exercises using actual data.

Parts 1 and 2 are based on lectures from the undergraduate course "Machine Learning and Economic and Financial Time Series Forecasting" and the graduate course "Machine Learning and Economic Forecasting" from the Department of Quantitative Applied Economics at Sungkyunkwan University.

We focused on selecting only the concepts and methods essential for predicting economic and financial time series data using machine learning techniques and explaining them as simply and clearly as possible.

We hope this book will serve as a useful guide for students, researchers, and instructors interested in economic and financial time series forecasting using machine learning.

The most notable feature of this book is that each chapter includes practical examples using R and Python.

The training is structured to allow you to learn by following the prediction process using real economic and financial data.

All practice code and data can be downloaded from the website below.

https://github.com/heejoonhan/Machine-Learning-and-Forecasting-Textbook

Each chapter includes a separate hands-on section, providing step-by-step instructions for running the code to produce prediction results.

Readers can download the practice code from the website above and run it themselves, while naturally learning the practice content by referring to the explanations in the textbook.

For a more detailed explanation of the program and code, please refer to the 'Program and Practice Code' section later.

Part 1 of this book covers the fundamentals of time series analysis and forecasting and consists of two chapters.

Chapter 1 explains essential concepts for time series analysis, such as stationarity and unit root, as well as basic time series models, such as autoregression and moving average.

Chapter 2 introduces forecasting procedures and methods for evaluating predictive power using time series data.

Most general machine learning textbooks assume cross-sectional data and often do not adequately reflect the characteristics of time-series data.

However, since time series data has unique characteristics that are different from cross-sectional data, it is not advisable to apply machine learning techniques as is while ignoring these characteristics.

In particular, economic and financial data often contain unit roots, so special care must be taken when using them for forecasting without properly converting them to stationary time series.

Therefore, in economic and financial time series forecasting, the process of judging and processing the stationarity of the time series is very important, and this background knowledge must be understood and passed over through the contents covered in Part 1.

Part 2 is the core part that deals with machine learning and prediction, and consists of five chapters, from Chapters 3 to 7.

Starting with the basic concepts of machine learning, we introduce key techniques widely used in both practical and academic fields.

In machine learning, classification, which predicts categorical variables, is also important, but since this book focuses on economic and financial time series prediction, it only covers regression, which predicts continuous variables.

Chapter 3 introduces the basic concepts of machine learning and supervised learning, helping you understand how machine learning works and how it learns.

Chapter 4 explains linear regression models and downscaling estimation techniques.

We focus on Lasso regression, which is particularly strong in variable selection and interpretation and is widely used in the field of economics.

Chapter 5 describes models based on decision trees, focusing in particular on random forests and boosting, which are frequently used in practice.

Chapter 6 covers artificial neural network-based prediction methods, focusing on recurrent neural networks and LSTM models, which are widely used for time series prediction.

For decision tree-based models and artificial neural network-based models, we attempted to minimize complex algorithmic explanations and explain only core concepts that aid intuitive understanding.

Chapter 7 is a practical chapter that summarizes and practices what was learned in Chapters 1 through 6.

We will actually build a data set, set up a forecasting procedure, make forecasts using various time series and machine learning models, and evaluate and test the predictive power, all with the theme of inflation forecasting.

Part 3 covers intermediate time series analysis and consists of two chapters.

Chapter 8 covers the vector autoregressive model, which analyzes the interactions between multiple time series variables, and Chapter 9 explains the conditional variance and volatility of time series, focusing on the ARCH and GARCH models.

The topics covered in these chapters are not only theoretically important in time series analysis, but are also very useful in practical economics and finance.

Vector autoregressive models are often used for time series forecasting, and forecasting financial market volatility provides important information for financial market participants' risk management and portfolio adjustments.

In classes such as 'Time Series Analysis and Forecasting' or 'Financial Econometrics', it would be advisable to study Parts 1 and 3 together, and Chapter 4 of Part 2 (Shortening Estimation).

The contents of this book are a compilation of the author's research and teaching over the past 20 years at the National University of Singapore, Kyung Hee University, and Sungkyunkwan University.

Although I did my best to write this book, there may be some shortcomings.

We ask for your understanding on this matter, and any revisions that may occur after publication will be provided in the data room of the Free Academy website (www.freeaca.com), so please refer to it.

It focuses on forecasting methods that take into account the characteristics of time series data, and helps readers develop the ability to apply theoretical understanding to actual analysis through practical exercises using actual data.

Parts 1 and 2 are based on lectures from the undergraduate course "Machine Learning and Economic and Financial Time Series Forecasting" and the graduate course "Machine Learning and Economic Forecasting" from the Department of Quantitative Applied Economics at Sungkyunkwan University.

We focused on selecting only the concepts and methods essential for predicting economic and financial time series data using machine learning techniques and explaining them as simply and clearly as possible.

We hope this book will serve as a useful guide for students, researchers, and instructors interested in economic and financial time series forecasting using machine learning.

The most notable feature of this book is that each chapter includes practical examples using R and Python.

The training is structured to allow you to learn by following the prediction process using real economic and financial data.

All practice code and data can be downloaded from the website below.

https://github.com/heejoonhan/Machine-Learning-and-Forecasting-Textbook

Each chapter includes a separate hands-on section, providing step-by-step instructions for running the code to produce prediction results.

Readers can download the practice code from the website above and run it themselves, while naturally learning the practice content by referring to the explanations in the textbook.

For a more detailed explanation of the program and code, please refer to the 'Program and Practice Code' section later.

Part 1 of this book covers the fundamentals of time series analysis and forecasting and consists of two chapters.

Chapter 1 explains essential concepts for time series analysis, such as stationarity and unit root, as well as basic time series models, such as autoregression and moving average.

Chapter 2 introduces forecasting procedures and methods for evaluating predictive power using time series data.

Most general machine learning textbooks assume cross-sectional data and often do not adequately reflect the characteristics of time-series data.

However, since time series data has unique characteristics that are different from cross-sectional data, it is not advisable to apply machine learning techniques as is while ignoring these characteristics.

In particular, economic and financial data often contain unit roots, so special care must be taken when using them for forecasting without properly converting them to stationary time series.

Therefore, in economic and financial time series forecasting, the process of judging and processing the stationarity of the time series is very important, and this background knowledge must be understood and passed over through the contents covered in Part 1.

Part 2 is the core part that deals with machine learning and prediction, and consists of five chapters, from Chapters 3 to 7.

Starting with the basic concepts of machine learning, we introduce key techniques widely used in both practical and academic fields.

In machine learning, classification, which predicts categorical variables, is also important, but since this book focuses on economic and financial time series prediction, it only covers regression, which predicts continuous variables.

Chapter 3 introduces the basic concepts of machine learning and supervised learning, helping you understand how machine learning works and how it learns.

Chapter 4 explains linear regression models and downscaling estimation techniques.

We focus on Lasso regression, which is particularly strong in variable selection and interpretation and is widely used in the field of economics.

Chapter 5 describes models based on decision trees, focusing in particular on random forests and boosting, which are frequently used in practice.

Chapter 6 covers artificial neural network-based prediction methods, focusing on recurrent neural networks and LSTM models, which are widely used for time series prediction.

For decision tree-based models and artificial neural network-based models, we attempted to minimize complex algorithmic explanations and explain only core concepts that aid intuitive understanding.

Chapter 7 is a practical chapter that summarizes and practices what was learned in Chapters 1 through 6.

We will actually build a data set, set up a forecasting procedure, make forecasts using various time series and machine learning models, and evaluate and test the predictive power, all with the theme of inflation forecasting.

Part 3 covers intermediate time series analysis and consists of two chapters.

Chapter 8 covers the vector autoregressive model, which analyzes the interactions between multiple time series variables, and Chapter 9 explains the conditional variance and volatility of time series, focusing on the ARCH and GARCH models.

The topics covered in these chapters are not only theoretically important in time series analysis, but are also very useful in practical economics and finance.

Vector autoregressive models are often used for time series forecasting, and forecasting financial market volatility provides important information for financial market participants' risk management and portfolio adjustments.

In classes such as 'Time Series Analysis and Forecasting' or 'Financial Econometrics', it would be advisable to study Parts 1 and 3 together, and Chapter 4 of Part 2 (Shortening Estimation).

The contents of this book are a compilation of the author's research and teaching over the past 20 years at the National University of Singapore, Kyung Hee University, and Sungkyunkwan University.

Although I did my best to write this book, there may be some shortcomings.

We ask for your understanding on this matter, and any revisions that may occur after publication will be provided in the data room of the Free Academy website (www.freeaca.com), so please refer to it.

GOODS SPECIFICS

- Date of issue: August 29, 2025

- Page count, weight, size: 324 pages | 188*257*15mm

- ISBN13: 9791158087494

- ISBN10: 1158087497

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)