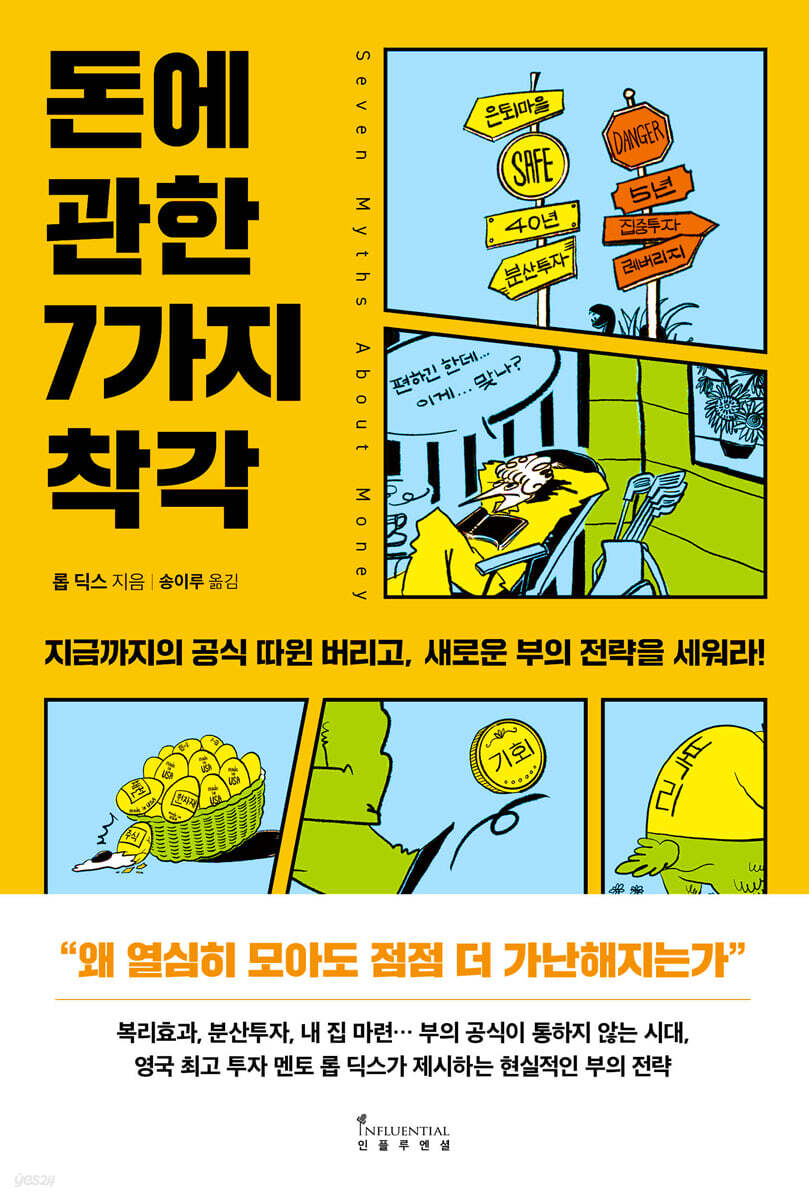

7 Myths About Money

|

Description

Book Introduction

“Why do I keep getting poorer no matter how hard I work to save?”

Compound interest, diversified investments, owning a home… In an era where the formula for wealth no longer applies,

Rob Dix, the UK's top investment mentor, offers a realistic wealth strategy.

The MZ generation is said to be “the first generation poorer than their parents.”

It is not a phenomenon unique to Korea that those born in an era of abundance but starting their social lives in an era of low growth are experiencing economic difficulties due to declining employment and rising asset prices.

“If you want to become rich, start by saving” “It is safe to invest for the long term with compound interest” “You have to buy your own house first to become rich”… .

Rob Dix, Britain's top investment mentor, says it's time to abandon the wealth formula that worked for our parents' generation and develop a new wealth strategy suited to the changing financial landscape.

Rob Dix, host of the UK's most popular economics podcast [Property Podcast] and bestselling author, dissects the false beliefs and illusions about money in his new book, Seven Myths About Money, based on 15 years of in-depth research into the economy and asset markets.

The book is not limited to mere criticism.

It overturns deeply ingrained misconceptions about "savings," "early retirement," "compound interest," "buying a home," and "diversified investment," and suggests ways to design your own investment strategy to overcome the low-growth era.

It also contains practical investment strategies that can be applied in real life, including how to assess your investment style from a three-step perspective of protection, maintenance, and improvement, strategies for protecting assets from inflation, how to use leverage to increase profits even with small amounts, and the principle of income growth that is more powerful than compound interest.

Above all, this book does not recommend extreme frugality or reckless investment.

Instead, it helps design a sustainable 'wealth system' that anyone can follow, from MZ generation workers to those nearing retirement.

As the author's philosophy goes, "Prepare for the future, but don't sacrifice the present."

If you cling to the laws of the past, you will be poorer in the future.

It's time to abandon the old ways, learn the new rules of the game, and develop a practical wealth strategy.

This book will be the most realistic and powerful guide to start with.

Compound interest, diversified investments, owning a home… In an era where the formula for wealth no longer applies,

Rob Dix, the UK's top investment mentor, offers a realistic wealth strategy.

The MZ generation is said to be “the first generation poorer than their parents.”

It is not a phenomenon unique to Korea that those born in an era of abundance but starting their social lives in an era of low growth are experiencing economic difficulties due to declining employment and rising asset prices.

“If you want to become rich, start by saving” “It is safe to invest for the long term with compound interest” “You have to buy your own house first to become rich”… .

Rob Dix, Britain's top investment mentor, says it's time to abandon the wealth formula that worked for our parents' generation and develop a new wealth strategy suited to the changing financial landscape.

Rob Dix, host of the UK's most popular economics podcast [Property Podcast] and bestselling author, dissects the false beliefs and illusions about money in his new book, Seven Myths About Money, based on 15 years of in-depth research into the economy and asset markets.

The book is not limited to mere criticism.

It overturns deeply ingrained misconceptions about "savings," "early retirement," "compound interest," "buying a home," and "diversified investment," and suggests ways to design your own investment strategy to overcome the low-growth era.

It also contains practical investment strategies that can be applied in real life, including how to assess your investment style from a three-step perspective of protection, maintenance, and improvement, strategies for protecting assets from inflation, how to use leverage to increase profits even with small amounts, and the principle of income growth that is more powerful than compound interest.

Above all, this book does not recommend extreme frugality or reckless investment.

Instead, it helps design a sustainable 'wealth system' that anyone can follow, from MZ generation workers to those nearing retirement.

As the author's philosophy goes, "Prepare for the future, but don't sacrifice the present."

If you cling to the laws of the past, you will be poorer in the future.

It's time to abandon the old ways, learn the new rules of the game, and develop a practical wealth strategy.

This book will be the most realistic and powerful guide to start with.

- You can preview some of the book's contents.

Preview

index

Prologue_New Game, New Rules

The decisive moment that changed the rules of money

Why did the old order collapse?

A new wealth formula in the era of low growth

Chapter 1 [Savings] Why Do We Get Poorer Even When We Save Hard?

The End of the 'Free Money' Era

How to Automate Your Savings

The Secret of the Three Financial Leverages

Chapter 2 [Early Retirement] The Dangerous Illusion of Retiring in Your 40s

Why Lottery Winners Are Going Back to Work

How to Break the Link Between Money and Time

A three-step process to achieve economic independence

Work less and earn more

Chapter 3 [Loss Minimization] Is 'principal guarantee' safe?

Why Billionaires Continue to Make Risky Investments

Understanding the Three Motivations for Money

How to Dramatically Simplify Investment Decisions

Find the right investment option for you

Keep your investments simple

Chapter 4: [Homeownership] Is Real Estate the Answer? The Illusion of Homeownership

Unique features of cash

Why a House Doesn't Make You Rich

Is renting just 'throwing away money'?

The End of the Era of Soaring Housing Prices

A realistic approach to avoiding the pressure of buying a home.

Chapter 5 [Welfare] Welfare is a game only for the rich.

Why Compensation Won't Save You

Miracles take time

Never be conscious of what welfare does.

How to Build a Welfare System in Your Life

Chapter 6 [Diversification] An Investment Strategy That Guarantees Only "Ordinaryness"

Why Index Funds Aren't Enough

The Hidden Charm of Bonds

A 'safe investment' that wasn't so safe

Is diversification really a realistic goal?

Pursue all-weather performance

How to Build a "Maintenance" Bucket to Prepare for the Future

Chapter 7 [Risky Investments] What's Not Risky Isn't Opportunity

How rich do you want to be?

If you want peace of mind, diversify your investments. If you want to get rich, concentrate your investments.

Leverage: How to Get Rich on Other People's Money

Focused Investment: Invest in Competitive Sectors

Human Capital: The Ultimate Wealth Creation Tool

If I can do it, anyone can do it.

Chapter 8 [Conclusion] How to Overturn Common Sense and Achieve True Wealth

An 8-Step Action Plan for a Better Financial Future

How to become the true master of your money

How to Deal with the Truth About Money

main

The decisive moment that changed the rules of money

Why did the old order collapse?

A new wealth formula in the era of low growth

Chapter 1 [Savings] Why Do We Get Poorer Even When We Save Hard?

The End of the 'Free Money' Era

How to Automate Your Savings

The Secret of the Three Financial Leverages

Chapter 2 [Early Retirement] The Dangerous Illusion of Retiring in Your 40s

Why Lottery Winners Are Going Back to Work

How to Break the Link Between Money and Time

A three-step process to achieve economic independence

Work less and earn more

Chapter 3 [Loss Minimization] Is 'principal guarantee' safe?

Why Billionaires Continue to Make Risky Investments

Understanding the Three Motivations for Money

How to Dramatically Simplify Investment Decisions

Find the right investment option for you

Keep your investments simple

Chapter 4: [Homeownership] Is Real Estate the Answer? The Illusion of Homeownership

Unique features of cash

Why a House Doesn't Make You Rich

Is renting just 'throwing away money'?

The End of the Era of Soaring Housing Prices

A realistic approach to avoiding the pressure of buying a home.

Chapter 5 [Welfare] Welfare is a game only for the rich.

Why Compensation Won't Save You

Miracles take time

Never be conscious of what welfare does.

How to Build a Welfare System in Your Life

Chapter 6 [Diversification] An Investment Strategy That Guarantees Only "Ordinaryness"

Why Index Funds Aren't Enough

The Hidden Charm of Bonds

A 'safe investment' that wasn't so safe

Is diversification really a realistic goal?

Pursue all-weather performance

How to Build a "Maintenance" Bucket to Prepare for the Future

Chapter 7 [Risky Investments] What's Not Risky Isn't Opportunity

How rich do you want to be?

If you want peace of mind, diversify your investments. If you want to get rich, concentrate your investments.

Leverage: How to Get Rich on Other People's Money

Focused Investment: Invest in Competitive Sectors

Human Capital: The Ultimate Wealth Creation Tool

If I can do it, anyone can do it.

Chapter 8 [Conclusion] How to Overturn Common Sense and Achieve True Wealth

An 8-Step Action Plan for a Better Financial Future

How to become the true master of your money

How to Deal with the Truth About Money

main

Detailed image

.jpg)

Into the book

There is one area in the life of an ordinary person that still has not improved.

It's money. In the 1960s, anyone who graduated from high school could get a job without a college degree.

Since I didn't need a degree, I didn't have to take out student loans.

I could run a normal household with just one income, and if I saved my salary well, I could even buy my own house.

During this period, the value of all assets, including homes, skyrocketed.

Moreover, many people lived on pensions linked to their final annual salary after retirement, regardless of the performance of the financial market.

I could live a financially comfortable life simply by following my colleagues at school and work and copying their financial habits.

But now things are different.

If you follow the set path, you will end up going to college even though you have no particular passion for academics.

This is because most workplaces require a college diploma as a condition of employment.

After graduation, you may spend most of your working life paying off your student loans.

Then, you realize that you have to work to support your family, and that you will have to be well into your 30s to be able to buy your own home.

If you want to enjoy a comfortable retirement, you need to save hard, buy an expensive house, and make investments.

We must pray that asset prices continue to rise.

Are you struggling to retire? You're not alone.

As of this writing, the UK's workforce aged 70 and over has increased by 61 per cent over the past decade.

The United States is also expected to see a 96 percent increase over the next five years.

Between 2004 and 2019, the proportion of the working-age population aged 55 and over increased from 12 percent to 20 percent across Europe.

---From "Prologue_New Game, New Rules"

Of course, we should continue to save, but we should not expect that it will dramatically change our lives or secure our future.

In other words, rather than giving too much attention to saving, it's better to focus on other ideas explored in this book.

The approach to saving presented in this book begins by exploring the fundamental reasons why we spend money in the first place.

We are implicitly expressing that we value the things we buy more than the money we pay for them.

You may not always feel that way (few people happily pay their electricity bills), but if you make a voluntary consumption decision, it's always true (it's better to spend money than live in the dark).

In theory, every time you spend money, your quality of life should improve.

Otherwise, you shouldn't have made that deal.

No one is forcing you to spend money, but you've probably realized that you often spend money in ways that don't improve your quality of life.

---From "Chapter 1 [Savings] Why Do I Get Poorer Even If I Work Hard to Save?"

Acknowledging and understanding these three conflicting motivations—protection from disaster, maintenance of current lifestyles, and improvement of financial status—holds the key to dramatically simplifying investment decisions.

Because any investment will satisfy only one of these three motivations.

For example, a cash emergency fund satisfies the motive of wanting to 'protect' from disaster.

Speculation about new cryptocurrencies fuels the desire to 'improve' one's financial situation.

Diversifying your investments in the stock market is motivated by a desire to "maintain" your current lifestyle, while owning stocks in a company is motivated by a desire to "improve" your financial health in the long term in the hope that the stock price will rise.

Once you view the world through these three motives, your investment life becomes incredibly simple.

No matter how complex the problem, it can be reduced to a decision about how to balance the three motivations.

Finding the right balance between the three types of 'buckets' is much more important than filling each bucket.

---From "Chapter 3 [Loss Minimization] Is Principal Guarantee Safe?"

No matter where you are in your investing journey, everyone faces psychological challenges.

A sharp decline in assets is not a pleasant experience, and not many people are able to weather such a crisis.

On the other hand, when the stock market crashed in 2020 and 2022, a small number of people saw the market as "undervalued" and behaved completely rationally, emptying their pockets and buying more stocks.

However, there were an overwhelming number of people who sold all their stocks and got out completely, rather than investors with such strong mentality.

This trend turned a potential disaster into an actual disaster.

The majority sold their stocks, locking in losses and giving up any chance of future profits.

Of course, if you have 20+ years left to live and have the steely mental fortitude and guts to endure whatever the market throws at you (perhaps you were one of the few brave souls who jumped into a burning building in 2020), then it might be okay to forgo diversification.

If you're investing with a very long-term perspective, a "maintenance" bucket comprised entirely of stocks might not seem crazy.

If you let history be your guide, you will likely be rewarded for your courage in the end.

But for most people, completely abandoning diversification isn't realistic.

In this situation of growing fundamental uncertainty, we are left with two choices.

One is a bad choice, the other is a good choice.

Unfortunately, today's investors are often plagued by a flawed investment strategy known as "false diversification."

They believe they have made a rational choice to lower returns instead of increasing their confidence, but if things go wrong, they risk being hit just as hard as aggressive investors.

This is a likely outcome for any investor who adopts the traditional approach of balancing their stock market investments with only bonds.

---From "Chapter 6 [Diversified Investment] Investment Strategies That Guarantee Only Mediocrity"

Nothing worthwhile comes easy.

Fortunately, you don't have to complete the process to enjoy the benefits.

In fact, you will feel better from the moment you take your first step.

The reason is simple.

Money is the result.

Money is the result of all the values you've added and the habits and decisions you've adopted.

This means that you cannot improve your financial situation without improving yourself overall.

The actions you take to increase your bank balance will have an impact on other areas of your life, improving your relationships, your mental state, and even your physical health.

This may sound like a grandiose claim, made by this book simply to clear up some misconceptions about money.

But I know this to be true because I have witnessed it happen to me and others.

Money is not something to be afraid of, anxious about, or feel guilty about.

Money is a tool that helps us live our best lives and helps the people we care about live theirs as well.

Because money impacts every aspect of our lives, making progress can enrich our lives far beyond our bank account balance.

And now that you've let go of your baseless beliefs and understood the reality before you, you can begin your journey right now.

It's money. In the 1960s, anyone who graduated from high school could get a job without a college degree.

Since I didn't need a degree, I didn't have to take out student loans.

I could run a normal household with just one income, and if I saved my salary well, I could even buy my own house.

During this period, the value of all assets, including homes, skyrocketed.

Moreover, many people lived on pensions linked to their final annual salary after retirement, regardless of the performance of the financial market.

I could live a financially comfortable life simply by following my colleagues at school and work and copying their financial habits.

But now things are different.

If you follow the set path, you will end up going to college even though you have no particular passion for academics.

This is because most workplaces require a college diploma as a condition of employment.

After graduation, you may spend most of your working life paying off your student loans.

Then, you realize that you have to work to support your family, and that you will have to be well into your 30s to be able to buy your own home.

If you want to enjoy a comfortable retirement, you need to save hard, buy an expensive house, and make investments.

We must pray that asset prices continue to rise.

Are you struggling to retire? You're not alone.

As of this writing, the UK's workforce aged 70 and over has increased by 61 per cent over the past decade.

The United States is also expected to see a 96 percent increase over the next five years.

Between 2004 and 2019, the proportion of the working-age population aged 55 and over increased from 12 percent to 20 percent across Europe.

---From "Prologue_New Game, New Rules"

Of course, we should continue to save, but we should not expect that it will dramatically change our lives or secure our future.

In other words, rather than giving too much attention to saving, it's better to focus on other ideas explored in this book.

The approach to saving presented in this book begins by exploring the fundamental reasons why we spend money in the first place.

We are implicitly expressing that we value the things we buy more than the money we pay for them.

You may not always feel that way (few people happily pay their electricity bills), but if you make a voluntary consumption decision, it's always true (it's better to spend money than live in the dark).

In theory, every time you spend money, your quality of life should improve.

Otherwise, you shouldn't have made that deal.

No one is forcing you to spend money, but you've probably realized that you often spend money in ways that don't improve your quality of life.

---From "Chapter 1 [Savings] Why Do I Get Poorer Even If I Work Hard to Save?"

Acknowledging and understanding these three conflicting motivations—protection from disaster, maintenance of current lifestyles, and improvement of financial status—holds the key to dramatically simplifying investment decisions.

Because any investment will satisfy only one of these three motivations.

For example, a cash emergency fund satisfies the motive of wanting to 'protect' from disaster.

Speculation about new cryptocurrencies fuels the desire to 'improve' one's financial situation.

Diversifying your investments in the stock market is motivated by a desire to "maintain" your current lifestyle, while owning stocks in a company is motivated by a desire to "improve" your financial health in the long term in the hope that the stock price will rise.

Once you view the world through these three motives, your investment life becomes incredibly simple.

No matter how complex the problem, it can be reduced to a decision about how to balance the three motivations.

Finding the right balance between the three types of 'buckets' is much more important than filling each bucket.

---From "Chapter 3 [Loss Minimization] Is Principal Guarantee Safe?"

No matter where you are in your investing journey, everyone faces psychological challenges.

A sharp decline in assets is not a pleasant experience, and not many people are able to weather such a crisis.

On the other hand, when the stock market crashed in 2020 and 2022, a small number of people saw the market as "undervalued" and behaved completely rationally, emptying their pockets and buying more stocks.

However, there were an overwhelming number of people who sold all their stocks and got out completely, rather than investors with such strong mentality.

This trend turned a potential disaster into an actual disaster.

The majority sold their stocks, locking in losses and giving up any chance of future profits.

Of course, if you have 20+ years left to live and have the steely mental fortitude and guts to endure whatever the market throws at you (perhaps you were one of the few brave souls who jumped into a burning building in 2020), then it might be okay to forgo diversification.

If you're investing with a very long-term perspective, a "maintenance" bucket comprised entirely of stocks might not seem crazy.

If you let history be your guide, you will likely be rewarded for your courage in the end.

But for most people, completely abandoning diversification isn't realistic.

In this situation of growing fundamental uncertainty, we are left with two choices.

One is a bad choice, the other is a good choice.

Unfortunately, today's investors are often plagued by a flawed investment strategy known as "false diversification."

They believe they have made a rational choice to lower returns instead of increasing their confidence, but if things go wrong, they risk being hit just as hard as aggressive investors.

This is a likely outcome for any investor who adopts the traditional approach of balancing their stock market investments with only bonds.

---From "Chapter 6 [Diversified Investment] Investment Strategies That Guarantee Only Mediocrity"

Nothing worthwhile comes easy.

Fortunately, you don't have to complete the process to enjoy the benefits.

In fact, you will feel better from the moment you take your first step.

The reason is simple.

Money is the result.

Money is the result of all the values you've added and the habits and decisions you've adopted.

This means that you cannot improve your financial situation without improving yourself overall.

The actions you take to increase your bank balance will have an impact on other areas of your life, improving your relationships, your mental state, and even your physical health.

This may sound like a grandiose claim, made by this book simply to clear up some misconceptions about money.

But I know this to be true because I have witnessed it happen to me and others.

Money is not something to be afraid of, anxious about, or feel guilty about.

Money is a tool that helps us live our best lives and helps the people we care about live theirs as well.

Because money impacts every aspect of our lives, making progress can enrich our lives far beyond our bank account balance.

And now that you've let go of your baseless beliefs and understood the reality before you, you can begin your journey right now.

---From "Chapter 8 [Conclusion] How to Overturn Common Sense and Achieve True Wealth"

Publisher's Review

“The formula for wealth you’ve believed in may have already collapsed.”

The UK's Top Real-World Investing Mentor Debunks 7 Common Misconceptions

The 21st century is the most prosperous era in human history.

Technology has advanced at a dazzling pace, and information and opportunities are now within reach.

But in the world of money, things are different.

The era of "free money" that lasted for decades after the abolition of the gold standard has ended, and inflation, high interest rates, and unstable asset markets have become the new reality.

Yet, many people still manage their finances blindly, believing in outdated advice like, “Save hard and you’ll get rich” and “Invest for the long term with compound interest and you’ll be safe.”

Rob Dix, Britain's most prominent real-world investing mentor, delves into this very illusion.

Through his podcasts and columns, which reach millions of readers, he dissects the recurring "myth of wealth" and proposes new strategies that work even in low-growth times.

His book, "The Seven Myths About Money," examines seven misconceptions one by one: "savings," "early retirement," "loss minimization," "buying a home," "compound interest," "diversification," and "risky investments," and argues that in order to achieve financial freedom, we must break free from these common beliefs.

He suggests changing spending habits through "conscious spending" instead of budgeting, securing cash flow instead of obsessing over home ownership, and growing opportunities through strategically focused investments rather than simply diversifying.

It also contains specific implementation methods to help reorganize the direction of investment and asset management with a long-term perspective.

All advice focuses on reality rather than ideals, and sustainability rather than short-term performance.

As a result, readers will be able to establish their own financial principles that will remain unshaken even in uncertain market environments.

“Common sense is the most ingenious trap!”

Saving, early retirement, owning a home… The money illusions that have been deceiving you.

"7 Misconceptions About Money" examines the common sense about money we've heard our entire lives.

“If you work hard and save, you will become rich.”

“Early retirement gives you true freedom.”

“The principal is guaranteed to be safe.”

“Having a home is success.”

“Welfare works miracles.”

“Diversification is the best strategy.”

“Risk must be avoided.”

How familiar and reassuring these words are.

However, the author warns that these very "reassuring words" are the most insidious traps that prevent us from achieving economic freedom.

Let's look at savings, for example.

For our parents' generation, saving was a "safety net for the future," but in today's era of inflation and negative real interest rates, simply saving money can actually mean losing money.

The same goes for early retirement.

While the idea of “retiring early and enjoying freedom” may sound tempting, it can actually reduce your life satisfaction.

The author emphasizes that, rather than focusing on retirement, breaking the link between money and time and achieving financial independence is a more realistic and sustainable path.

‘Principal guarantee’ is also a misconception.

The reason billionaires take risks is because risk is another name for opportunity.

The more obsessed I become about buying a home, the more I lose flexibility.

Having cash flow rather than owning a home can open up more opportunities.

Compound interest is often called the "miracle formula," but in reality, it's a game that only benefits the rich.

In reality, increasing income and expanding opportunities through concentrated investments is a more powerful strategy.

Moreover, unconditional diversification only guarantees mediocrity, and if you want true wealth, you must strategically focus on areas you know well.

Finally, risk is not something to be avoided, but an asset to be leveraged.

Only when we turn risk into opportunity through human capital, expertise, and experience can we truly reach the essence of wealth.

In this way, the book is divided into chapters 'Misunderstanding vs.

The structure of 'truth' shakes our way of thinking and makes readers ask questions of themselves.

"Am I still relying on outdated formulas? What principles should I establish in today's financial reality?" The answer is contained in the book's concrete examples and immediately actionable methods.

“Money is not something to be feared, but a tool to expand life!”

A shift in perspective and realistic implementation strategies for financial freedom.

The ultimate message of this book is simple.

Money is not something that causes anxiety and guilt, but rather a tool that allows us to expand the life we want.

Rob Dix tells readers to have a healthy relationship with money.

More important than the act of saving money itself is having a clear attitude about what you want to pursue with your money.

He doesn't tell any flashy success stories or secret formulas.

Instead, it offers an eight-step strategy anyone can implement right away, helping us fundamentally change the way we view money.

After reading this book, readers will let go of anxieties like, "Am I too late?" or "Do I have too little money?" and gain the confidence to establish their own principles.

What makes this book particularly stand out is that it goes beyond simply conveying a message to present realistic and concrete strategies.

· Investment Propensity Check: 3-Step Framework: Protect, Maintain, and Improve

· Inflation Defense Strategies: Practical Ways to Protect Your Assets

· Leverage: A technique for increasing profits with small amounts of money.

· The Principle of Income Growth: A Real Growth Engine More Powerful Than Compound Interest

"The 7 Money Illusions" is more than just an investment guide; it forces you to rethink how you relate to money in uncertain times.

And finally, he asks us:

“Will you still follow the old formula, or will you choose the new path to wealth?”

The UK's Top Real-World Investing Mentor Debunks 7 Common Misconceptions

The 21st century is the most prosperous era in human history.

Technology has advanced at a dazzling pace, and information and opportunities are now within reach.

But in the world of money, things are different.

The era of "free money" that lasted for decades after the abolition of the gold standard has ended, and inflation, high interest rates, and unstable asset markets have become the new reality.

Yet, many people still manage their finances blindly, believing in outdated advice like, “Save hard and you’ll get rich” and “Invest for the long term with compound interest and you’ll be safe.”

Rob Dix, Britain's most prominent real-world investing mentor, delves into this very illusion.

Through his podcasts and columns, which reach millions of readers, he dissects the recurring "myth of wealth" and proposes new strategies that work even in low-growth times.

His book, "The Seven Myths About Money," examines seven misconceptions one by one: "savings," "early retirement," "loss minimization," "buying a home," "compound interest," "diversification," and "risky investments," and argues that in order to achieve financial freedom, we must break free from these common beliefs.

He suggests changing spending habits through "conscious spending" instead of budgeting, securing cash flow instead of obsessing over home ownership, and growing opportunities through strategically focused investments rather than simply diversifying.

It also contains specific implementation methods to help reorganize the direction of investment and asset management with a long-term perspective.

All advice focuses on reality rather than ideals, and sustainability rather than short-term performance.

As a result, readers will be able to establish their own financial principles that will remain unshaken even in uncertain market environments.

“Common sense is the most ingenious trap!”

Saving, early retirement, owning a home… The money illusions that have been deceiving you.

"7 Misconceptions About Money" examines the common sense about money we've heard our entire lives.

“If you work hard and save, you will become rich.”

“Early retirement gives you true freedom.”

“The principal is guaranteed to be safe.”

“Having a home is success.”

“Welfare works miracles.”

“Diversification is the best strategy.”

“Risk must be avoided.”

How familiar and reassuring these words are.

However, the author warns that these very "reassuring words" are the most insidious traps that prevent us from achieving economic freedom.

Let's look at savings, for example.

For our parents' generation, saving was a "safety net for the future," but in today's era of inflation and negative real interest rates, simply saving money can actually mean losing money.

The same goes for early retirement.

While the idea of “retiring early and enjoying freedom” may sound tempting, it can actually reduce your life satisfaction.

The author emphasizes that, rather than focusing on retirement, breaking the link between money and time and achieving financial independence is a more realistic and sustainable path.

‘Principal guarantee’ is also a misconception.

The reason billionaires take risks is because risk is another name for opportunity.

The more obsessed I become about buying a home, the more I lose flexibility.

Having cash flow rather than owning a home can open up more opportunities.

Compound interest is often called the "miracle formula," but in reality, it's a game that only benefits the rich.

In reality, increasing income and expanding opportunities through concentrated investments is a more powerful strategy.

Moreover, unconditional diversification only guarantees mediocrity, and if you want true wealth, you must strategically focus on areas you know well.

Finally, risk is not something to be avoided, but an asset to be leveraged.

Only when we turn risk into opportunity through human capital, expertise, and experience can we truly reach the essence of wealth.

In this way, the book is divided into chapters 'Misunderstanding vs.

The structure of 'truth' shakes our way of thinking and makes readers ask questions of themselves.

"Am I still relying on outdated formulas? What principles should I establish in today's financial reality?" The answer is contained in the book's concrete examples and immediately actionable methods.

“Money is not something to be feared, but a tool to expand life!”

A shift in perspective and realistic implementation strategies for financial freedom.

The ultimate message of this book is simple.

Money is not something that causes anxiety and guilt, but rather a tool that allows us to expand the life we want.

Rob Dix tells readers to have a healthy relationship with money.

More important than the act of saving money itself is having a clear attitude about what you want to pursue with your money.

He doesn't tell any flashy success stories or secret formulas.

Instead, it offers an eight-step strategy anyone can implement right away, helping us fundamentally change the way we view money.

After reading this book, readers will let go of anxieties like, "Am I too late?" or "Do I have too little money?" and gain the confidence to establish their own principles.

What makes this book particularly stand out is that it goes beyond simply conveying a message to present realistic and concrete strategies.

· Investment Propensity Check: 3-Step Framework: Protect, Maintain, and Improve

· Inflation Defense Strategies: Practical Ways to Protect Your Assets

· Leverage: A technique for increasing profits with small amounts of money.

· The Principle of Income Growth: A Real Growth Engine More Powerful Than Compound Interest

"The 7 Money Illusions" is more than just an investment guide; it forces you to rethink how you relate to money in uncertain times.

And finally, he asks us:

“Will you still follow the old formula, or will you choose the new path to wealth?”

GOODS SPECIFICS

- Date of issue: August 27, 2025

- Page count, weight, size: 272 pages | 476g | 145*215*18mm

- ISBN13: 9791168343054

- ISBN10: 1168343054

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)