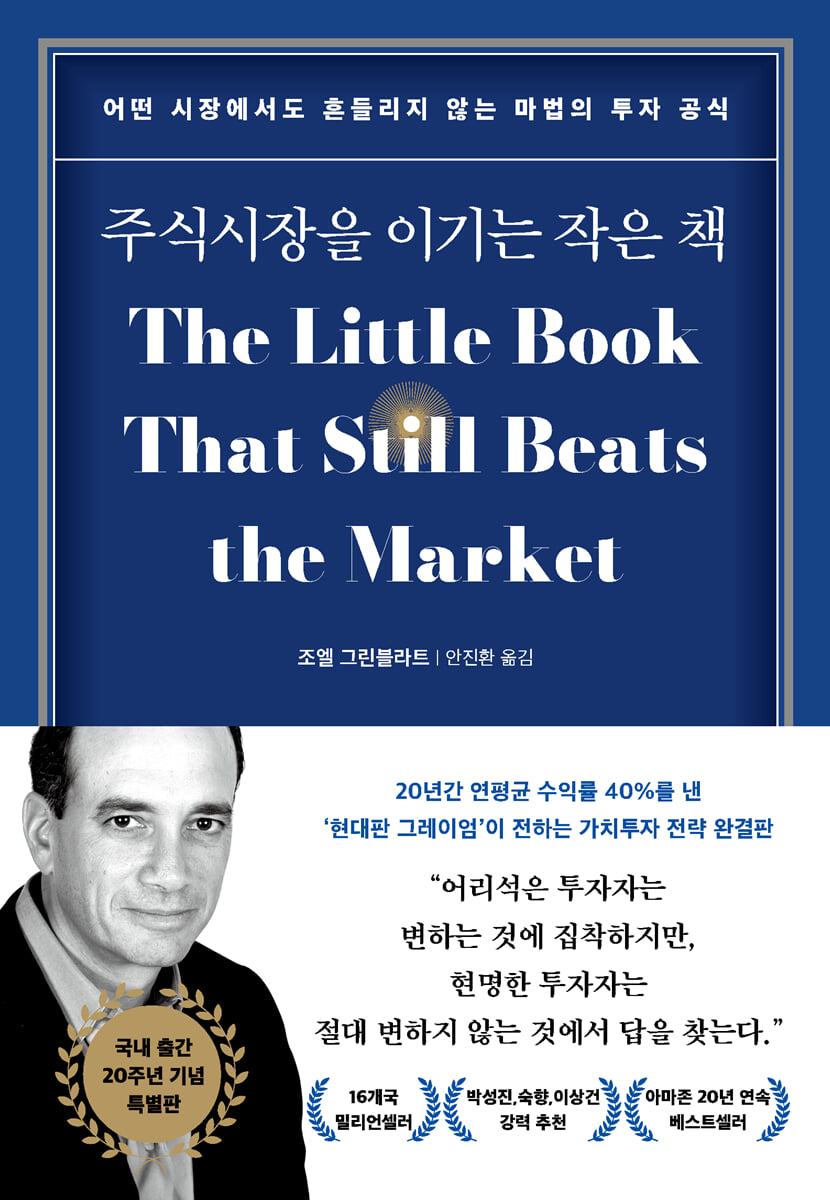

The Little Book That Beats the Stock Market

|

Description

Book Introduction

★★★ A million-selling bestseller with over 1 million copies sold worldwide ★★★

★★★ Recommendations: Park Sung-jin of Ian Investment Advisory, Sukhyang of "Warren Buffett Next Door," and Sang-geon Lee of Mirae Asset Investment & Pension. ★★★

★★★ Amazon Bestseller for 20 Consecutive Years ★★★

“Foolish investors are obsessed with change,

“A wise investor seeks answers in what never changes.”

It has achieved an average annual return of 40% over 20 years.

The Complete Guide to Value Investing from a Modern-Day Graham

As in any field, there are people in investing who are called 'masters' or 'gurus'.

Joel Greenblatt, founder of Gotham Capital and author of this book, is a guru in the investment world, following in the footsteps of Warren Buffett and John Templeton.

Also known as the 'Guru of Value Investing' and the 'Modern Benjamin Graham', he reveals in this book the 'magic formula' that can help even beginners who know nothing about investing earn an annual return of more than 6%.

Greenblatt's investment secret is simple.

"Buy good stocks at bargain prices!" He says that most people repeat investment failures simply because they don't know exactly what constitutes a "good stock" and what constitutes a "cheap price." He explains the "return on capital" and "earnings yield," which are the criteria for judging this.

Joel Greenblatt, in his "Little Book," which is about 300 pages long and can be read in an hour, explains how these two criteria enrich our stock investments. He also guides us through the "Magic Formula Site," which he created, on how to apply the Magic Formula to real-world investments.

Of course, it may be hard to believe that you can make a profit based on just two criteria: return on capital and profit yield.

In fact, if you use this magic formula, you will get stocks that are completely different from the stocks that are currently the most popular and are talked about among people.

Greenblatt dispels countless doubts about the magic formula, one by one, and explains in detail how it generates magical profits in such a simple way.

Even though it's been 20 years since its publication, "The Little Book That Beats the Stock Market" is still widely sold in 16 countries around the world, including the United States, France, the United Kingdom, and Japan.

This may be evidence that the 'magic formula' is still valid and not outdated.

Park Sung-jin, the CEO of Ian Investment Consulting, a renowned expert in value investing in Korea, and Sook Hyang, the "Warren Buffett next door neighbor," also praised this book.

In the chaotic stock market, where you go back and forth between red and blue lights hundreds of times, "The Little Book That Beats the Stock Market" will guide you on a comfortable yet sure path.

★★★ Recommendations: Park Sung-jin of Ian Investment Advisory, Sukhyang of "Warren Buffett Next Door," and Sang-geon Lee of Mirae Asset Investment & Pension. ★★★

★★★ Amazon Bestseller for 20 Consecutive Years ★★★

“Foolish investors are obsessed with change,

“A wise investor seeks answers in what never changes.”

It has achieved an average annual return of 40% over 20 years.

The Complete Guide to Value Investing from a Modern-Day Graham

As in any field, there are people in investing who are called 'masters' or 'gurus'.

Joel Greenblatt, founder of Gotham Capital and author of this book, is a guru in the investment world, following in the footsteps of Warren Buffett and John Templeton.

Also known as the 'Guru of Value Investing' and the 'Modern Benjamin Graham', he reveals in this book the 'magic formula' that can help even beginners who know nothing about investing earn an annual return of more than 6%.

Greenblatt's investment secret is simple.

"Buy good stocks at bargain prices!" He says that most people repeat investment failures simply because they don't know exactly what constitutes a "good stock" and what constitutes a "cheap price." He explains the "return on capital" and "earnings yield," which are the criteria for judging this.

Joel Greenblatt, in his "Little Book," which is about 300 pages long and can be read in an hour, explains how these two criteria enrich our stock investments. He also guides us through the "Magic Formula Site," which he created, on how to apply the Magic Formula to real-world investments.

Of course, it may be hard to believe that you can make a profit based on just two criteria: return on capital and profit yield.

In fact, if you use this magic formula, you will get stocks that are completely different from the stocks that are currently the most popular and are talked about among people.

Greenblatt dispels countless doubts about the magic formula, one by one, and explains in detail how it generates magical profits in such a simple way.

Even though it's been 20 years since its publication, "The Little Book That Beats the Stock Market" is still widely sold in 16 countries around the world, including the United States, France, the United Kingdom, and Japan.

This may be evidence that the 'magic formula' is still valid and not outdated.

Park Sung-jin, the CEO of Ian Investment Consulting, a renowned expert in value investing in Korea, and Sook Hyang, the "Warren Buffett next door neighbor," also praised this book.

In the chaotic stock market, where you go back and forth between red and blue lights hundreds of times, "The Little Book That Beats the Stock Market" will guide you on a comfortable yet sure path.

- You can preview some of the book's contents.

Preview

index

Praise poured in for this book

A Review | Investing Isn't Just a Head-On Thing

Korean Edition Preface | How to Buy Above-Average Companies at Below-Average Prices

Preface to the 2010 Edition | Five Years Later, the Magic Formula Still Remains the Same

Before entering

Chapter 1: Lessons from a 13-Year-Old Rich Man

Are you saying there are fools who would sell a $1,000 company for $500?

Chapter 2: How to Make Money Without Risk

Jason must guarantee a minimum return of 6%.

Chapter 3 If I Bet My Money on Jason's Gum Shop

What does it mean to own shares in a company?

Chapter 4: Mr. Market and the Margin of Safety

There is no need to know why stock prices rise and fall.

Chapter 5: Buying Good Companies at a Low Price

Just two skills are enough

Chapter 6: The Magic Formula

Oh my, the results are just too good!

Chapter 7: Can We Really Believe in the Magic Formula?

Are you saying that you were lucky or that you only bought the best companies?

Chapter 8: There is a reward for those who persevere

Magic formulas sometimes don't work.

Great!

Chapter 9: The Very Solid Reasons That Support the Magic Formula

What if you and I both started the same business?

Chapter 10: Mr. Market, who will definitely come to his senses

Close your eyes and endure for three years.

Chapter 11: How to Use the Minimum Magic Formula to Prevent an Explosion

If you insist on picking individual stocks, please compromise with the magic formula.

Chapter 12: Things You Must Do All Alone

There's no tooth fairy on Wall Street who'll give you free money.

Chapter 13 Advice to You

Save money, befriend the magic formula, and set meaningful goals.

Step-by-step instructions

2010 edition review

supplement

A random walk gone wrong

Translator's Note

A Review | Investing Isn't Just a Head-On Thing

Korean Edition Preface | How to Buy Above-Average Companies at Below-Average Prices

Preface to the 2010 Edition | Five Years Later, the Magic Formula Still Remains the Same

Before entering

Chapter 1: Lessons from a 13-Year-Old Rich Man

Are you saying there are fools who would sell a $1,000 company for $500?

Chapter 2: How to Make Money Without Risk

Jason must guarantee a minimum return of 6%.

Chapter 3 If I Bet My Money on Jason's Gum Shop

What does it mean to own shares in a company?

Chapter 4: Mr. Market and the Margin of Safety

There is no need to know why stock prices rise and fall.

Chapter 5: Buying Good Companies at a Low Price

Just two skills are enough

Chapter 6: The Magic Formula

Oh my, the results are just too good!

Chapter 7: Can We Really Believe in the Magic Formula?

Are you saying that you were lucky or that you only bought the best companies?

Chapter 8: There is a reward for those who persevere

Magic formulas sometimes don't work.

Great!

Chapter 9: The Very Solid Reasons That Support the Magic Formula

What if you and I both started the same business?

Chapter 10: Mr. Market, who will definitely come to his senses

Close your eyes and endure for three years.

Chapter 11: How to Use the Minimum Magic Formula to Prevent an Explosion

If you insist on picking individual stocks, please compromise with the magic formula.

Chapter 12: Things You Must Do All Alone

There's no tooth fairy on Wall Street who'll give you free money.

Chapter 13 Advice to You

Save money, befriend the magic formula, and set meaningful goals.

Step-by-step instructions

2010 edition review

supplement

A random walk gone wrong

Translator's Note

Detailed image

Into the book

Investing is, of course, difficult.

That's why a rational, disciplined, organized, and long-term investment strategy is essential for success.

In any market environment.

And that strategy must not stop at being rational.

That means it has to make sense to you.

Deep understanding and acceptance is the only way to stick to a long-term strategy that may not work in the short term.

---From the "2010 Edition Preface"

“No, Ben.

I don't mean to say I sell gum.

My dad works on figuring out how much companies are worth, like we just looked at with Jason's business.

So if I can buy the company for a lot less than I think it's worth, I'll buy it!" "Wait a minute," Ben blurted out.

“That’s ridiculous.

“If a company is worth $1,000, why would you sell it to your dad for $500?”

---From "Chapter 1, Lessons Taught by a 13-Year-Old Rich Boy"

What would happen if you bought stocks in companies that simultaneously yield high earnings and high returns on capital? In other words, what would happen if you only bought stocks in good companies when they were cheap? To put it another way, what if you only bought stocks in companies with high returns on capital when they yield high earnings? I'll tell you the answer.

'You'll make a lot of money!'

---From "Chapter 6, Magic Formula"

Unfortunately, in today's markets, few companies meet the criteria required by Graham's original formula: stocks trading below their net liquidation value.

If so, then Graham's formula is not as useful as it once was.

Fortunately, our magic formula doesn't seem to have that problem.

Because the magic formula is a formula for assigning ‘ranks’.

There are bound to be stocks that clearly rank highest at any given time.

Moreover, since the stocks perform well in the order of the official rankings, our investments are not limited to just the stocks of the top 30 companies.

Since all stocks in the group with high rankings perform well, there is a wide range of stock choices.

---From "Chapter 7, Can We Trust the Magic Formula?"

The point is, if the magic formula always worked, everyone would use it.

If everyone uses it, the formula will eventually cease to be successful.

If too many people buy the cheap stocks chosen by the magic formula, the price of these stocks will rise almost immediately.

In other words, if everyone uses the magic formula, the price will disappear, and the magic formula will eventually lose its effectiveness! This is why it's fortunate that the magic formula isn't all that great.

---From "Chapter 8, How Luck Comes to Those Who Persevere"

If you don't believe the magic formula will work for you, you're very likely to quit before it even has a chance to succeed! At least that's what statistics from the past 17 years suggest.

The magic formula works.

The magic formula delivers long-term annual returns that are twice, and sometimes three times, the market average.

The point is that such good performance is not always maintained.

In the short term, the magic formula may or may not work.

And when discussing magic formulas, 'short term' sometimes means 'years' rather than days or months.

It may sound strange, but logically speaking, this is good news.

If you believe in the magic formula enough to stick with it for the long term, then this is good news.

But to stick with a strategy that doesn't work year after year, you have to believe in it, deep down, and truly.

---From "Chapter 8, How Luck Comes to Those Who Persevere"

Mr. Market, who may seem crazy in the short term, is actually a very sensible person in the long term.

It may take weeks or months, or (not infrequently) years, but Mr. Market will eventually pay the "fair price" for our stock.

I actually make a promise to my business school students at the beginning of every semester.

If they do a good job of evaluating the value of a company, Mr. Market will eventually agree with them.

I would say that if their assessment is correct, Mr. Market will reward you for buying a stock at a bargain price within about two to three years, although it may take a little longer.

How can that be? Aren't Mr. Market's emotions incurable? Well, in the short term, it's true that Mr. Market is often swayed by emotions, but over time, these emotions are replaced by "facts and reality."

---From "Chapter 10, Mr. Market, Who Will Definitely Come to His Sane"

The magic formula picks stocks from multiple companies at once.

When you look at a portfolio of companies as a whole, last year's earnings are often a good indicator of future earnings.

On the other hand, this is not the case for individual companies.

However, when it comes to averages across multiple companies, last year's earnings often serve as a good baseline for estimating what a normal year's earnings might be like.

That's why, when you actually use the magic formula, you buy stocks of 20 or 30 companies at a time.

In the case of the magic formula, we seek the average (i.e., the average return that a portfolio of stocks selected by the magic formula would return).

Therefore, since the average return that the magic formula will produce will hopefully be excellent, owning stocks in many of the companies selected by the magic formula will allow us to get very close to the average we are seeking.

That's why a rational, disciplined, organized, and long-term investment strategy is essential for success.

In any market environment.

And that strategy must not stop at being rational.

That means it has to make sense to you.

Deep understanding and acceptance is the only way to stick to a long-term strategy that may not work in the short term.

---From the "2010 Edition Preface"

“No, Ben.

I don't mean to say I sell gum.

My dad works on figuring out how much companies are worth, like we just looked at with Jason's business.

So if I can buy the company for a lot less than I think it's worth, I'll buy it!" "Wait a minute," Ben blurted out.

“That’s ridiculous.

“If a company is worth $1,000, why would you sell it to your dad for $500?”

---From "Chapter 1, Lessons Taught by a 13-Year-Old Rich Boy"

What would happen if you bought stocks in companies that simultaneously yield high earnings and high returns on capital? In other words, what would happen if you only bought stocks in good companies when they were cheap? To put it another way, what if you only bought stocks in companies with high returns on capital when they yield high earnings? I'll tell you the answer.

'You'll make a lot of money!'

---From "Chapter 6, Magic Formula"

Unfortunately, in today's markets, few companies meet the criteria required by Graham's original formula: stocks trading below their net liquidation value.

If so, then Graham's formula is not as useful as it once was.

Fortunately, our magic formula doesn't seem to have that problem.

Because the magic formula is a formula for assigning ‘ranks’.

There are bound to be stocks that clearly rank highest at any given time.

Moreover, since the stocks perform well in the order of the official rankings, our investments are not limited to just the stocks of the top 30 companies.

Since all stocks in the group with high rankings perform well, there is a wide range of stock choices.

---From "Chapter 7, Can We Trust the Magic Formula?"

The point is, if the magic formula always worked, everyone would use it.

If everyone uses it, the formula will eventually cease to be successful.

If too many people buy the cheap stocks chosen by the magic formula, the price of these stocks will rise almost immediately.

In other words, if everyone uses the magic formula, the price will disappear, and the magic formula will eventually lose its effectiveness! This is why it's fortunate that the magic formula isn't all that great.

---From "Chapter 8, How Luck Comes to Those Who Persevere"

If you don't believe the magic formula will work for you, you're very likely to quit before it even has a chance to succeed! At least that's what statistics from the past 17 years suggest.

The magic formula works.

The magic formula delivers long-term annual returns that are twice, and sometimes three times, the market average.

The point is that such good performance is not always maintained.

In the short term, the magic formula may or may not work.

And when discussing magic formulas, 'short term' sometimes means 'years' rather than days or months.

It may sound strange, but logically speaking, this is good news.

If you believe in the magic formula enough to stick with it for the long term, then this is good news.

But to stick with a strategy that doesn't work year after year, you have to believe in it, deep down, and truly.

---From "Chapter 8, How Luck Comes to Those Who Persevere"

Mr. Market, who may seem crazy in the short term, is actually a very sensible person in the long term.

It may take weeks or months, or (not infrequently) years, but Mr. Market will eventually pay the "fair price" for our stock.

I actually make a promise to my business school students at the beginning of every semester.

If they do a good job of evaluating the value of a company, Mr. Market will eventually agree with them.

I would say that if their assessment is correct, Mr. Market will reward you for buying a stock at a bargain price within about two to three years, although it may take a little longer.

How can that be? Aren't Mr. Market's emotions incurable? Well, in the short term, it's true that Mr. Market is often swayed by emotions, but over time, these emotions are replaced by "facts and reality."

---From "Chapter 10, Mr. Market, Who Will Definitely Come to His Sane"

The magic formula picks stocks from multiple companies at once.

When you look at a portfolio of companies as a whole, last year's earnings are often a good indicator of future earnings.

On the other hand, this is not the case for individual companies.

However, when it comes to averages across multiple companies, last year's earnings often serve as a good baseline for estimating what a normal year's earnings might be like.

That's why, when you actually use the magic formula, you buy stocks of 20 or 30 companies at a time.

In the case of the magic formula, we seek the average (i.e., the average return that a portfolio of stocks selected by the magic formula would return).

Therefore, since the average return that the magic formula will produce will hopefully be excellent, owning stocks in many of the companies selected by the magic formula will allow us to get very close to the average we are seeking.

---From "Chapter 11, How to Use the Minimum Magic Formula to Prevent an Explosion"

Publisher's Review

“Just two questions are enough.

“Is it a good stock? And is it cheap?”

You can read it in an hour

A new classic in value investing that will shape 100 years of investment.

Looking at the stock market can be incredibly confusing.

In just a few days, the stock price of the same company can plummet by 30%, and the difference between the lowest and highest prices in a year can be more than double.

Does a company's intrinsic value fluctuate that frequently? Considering this is a common occurrence even among some established, well-established companies in their respective fields, it's probably not the case.

So what exactly causes these extreme fluctuations in stock prices? Do the masters of stock investing understand this? Joel Greenblatt, a practicing investor who has achieved an astonishing 40% annual return over 20 years and a longtime lecturer at Columbia University, known as the "cradle of value investing," offers a blunt answer to this question.

“Who knows, and what does it matter?”

Maybe it's because people are often not in their right minds, or maybe it's because it's difficult to predict future earnings.

But there is no need to know why stock prices rise and fall.

You just have to know that 'people do that'.

Greenblatt argues that it's enough to ask just two questions: "Is it a good stock?" and "Is it cheap?"

There is no problem as long as there are two criteria: 'return on capital', which determines how much profit is generated compared to the investment amount, and 'earnings yield', which determines how much profit is generated compared to the price paid for the stock.

The magic formula he presents is simple.

Companies are ranked in descending order of return on capital and earnings yield, respectively, and the two rankings are added together to give a score.

For example, if a company ranks 15th in return on capital and 250th in earnings yield, its score is 265. If a company ranks 1st in return on capital but 602nd in earnings yield, its score is 603.

You can sort them in order of high scores, buy stocks of the top 20-30 companies, and hold each for one year.

The magic formula is this simple!

The first edition of The Little Book That Beats the Market was published in 2005.

And by the time the revised edition came out in 2010, countless questions had been raised.

"What if I bought it thinking it was undervalued but it's just a cheap stock?", "Wasn't I just lucky?", "What if a more attractive competitor emerges and the return on capital becomes meaningless?" In his revised 2010 edition, Joel Greenblatt presented the results of backtests conducted over various time periods and stocks, once again proving the power of the magic formula.

“In a word, it’s perfect.

“This is the most important investment book of the last 50 years.”

Michael Price (founder of MFP Investors)

Of course, now that more than ten years have passed, these questions may arise.

"Isn't this just a formula that worked in the past?" The answer can be found in Berkshire Hathaway's 2024 performance, which surprised the investment world.

Berkshire Hathaway, led by Warren Buffett, generated annual profits of approximately 68 trillion won, even in the midst of macroeconomic uncertainty, achieving higher returns than the previous year.

Moreover, this achievement was achieved without any investment in big tech companies, such as secondary batteries and electric vehicles, which are popular with active stock investors, especially Korean stock investors.

Buffett's direct returns have resonated deeply with investors, demonstrating the continued strength of value investing.

In fact, many successful stock investors are still making money through the principles of value investing, 100 years after Graham's time.

Joel Greenblatt's magic formula is a modern take on Graham's formula for picking up bargain stocks during the Great Depression.

The book has received glowing reviews over the past 20 years, including “The most important investment book of the past 50 years” (Michael Price, founder of MFP Investors), “A monumental book” (Michael Steinhart, hedge fund pioneer), and “The best book that summarizes modern value investing principles in a concise and clear way” (Bruce Greenwald, professor at Columbia University), adding to its credibility.

The 2025 edition of "The Little Book That Beats the Stock Market" celebrates its 20th anniversary with enhanced translation accuracy and meticulous review by Mirae Asset Investment & Pension Center Director Lee Sang-geon, enhancing the book's quality.

Additionally, it is made with hardcover binding to add sturdiness and luxury so that it can be read like a 'Bible' for a long time.

This book, which is always at the top of the bookshelves of savvy stock market experts, will also provide domestic stock investors with the insight to navigate the uncertain market.

“Is it a good stock? And is it cheap?”

You can read it in an hour

A new classic in value investing that will shape 100 years of investment.

Looking at the stock market can be incredibly confusing.

In just a few days, the stock price of the same company can plummet by 30%, and the difference between the lowest and highest prices in a year can be more than double.

Does a company's intrinsic value fluctuate that frequently? Considering this is a common occurrence even among some established, well-established companies in their respective fields, it's probably not the case.

So what exactly causes these extreme fluctuations in stock prices? Do the masters of stock investing understand this? Joel Greenblatt, a practicing investor who has achieved an astonishing 40% annual return over 20 years and a longtime lecturer at Columbia University, known as the "cradle of value investing," offers a blunt answer to this question.

“Who knows, and what does it matter?”

Maybe it's because people are often not in their right minds, or maybe it's because it's difficult to predict future earnings.

But there is no need to know why stock prices rise and fall.

You just have to know that 'people do that'.

Greenblatt argues that it's enough to ask just two questions: "Is it a good stock?" and "Is it cheap?"

There is no problem as long as there are two criteria: 'return on capital', which determines how much profit is generated compared to the investment amount, and 'earnings yield', which determines how much profit is generated compared to the price paid for the stock.

The magic formula he presents is simple.

Companies are ranked in descending order of return on capital and earnings yield, respectively, and the two rankings are added together to give a score.

For example, if a company ranks 15th in return on capital and 250th in earnings yield, its score is 265. If a company ranks 1st in return on capital but 602nd in earnings yield, its score is 603.

You can sort them in order of high scores, buy stocks of the top 20-30 companies, and hold each for one year.

The magic formula is this simple!

The first edition of The Little Book That Beats the Market was published in 2005.

And by the time the revised edition came out in 2010, countless questions had been raised.

"What if I bought it thinking it was undervalued but it's just a cheap stock?", "Wasn't I just lucky?", "What if a more attractive competitor emerges and the return on capital becomes meaningless?" In his revised 2010 edition, Joel Greenblatt presented the results of backtests conducted over various time periods and stocks, once again proving the power of the magic formula.

“In a word, it’s perfect.

“This is the most important investment book of the last 50 years.”

Michael Price (founder of MFP Investors)

Of course, now that more than ten years have passed, these questions may arise.

"Isn't this just a formula that worked in the past?" The answer can be found in Berkshire Hathaway's 2024 performance, which surprised the investment world.

Berkshire Hathaway, led by Warren Buffett, generated annual profits of approximately 68 trillion won, even in the midst of macroeconomic uncertainty, achieving higher returns than the previous year.

Moreover, this achievement was achieved without any investment in big tech companies, such as secondary batteries and electric vehicles, which are popular with active stock investors, especially Korean stock investors.

Buffett's direct returns have resonated deeply with investors, demonstrating the continued strength of value investing.

In fact, many successful stock investors are still making money through the principles of value investing, 100 years after Graham's time.

Joel Greenblatt's magic formula is a modern take on Graham's formula for picking up bargain stocks during the Great Depression.

The book has received glowing reviews over the past 20 years, including “The most important investment book of the past 50 years” (Michael Price, founder of MFP Investors), “A monumental book” (Michael Steinhart, hedge fund pioneer), and “The best book that summarizes modern value investing principles in a concise and clear way” (Bruce Greenwald, professor at Columbia University), adding to its credibility.

The 2025 edition of "The Little Book That Beats the Stock Market" celebrates its 20th anniversary with enhanced translation accuracy and meticulous review by Mirae Asset Investment & Pension Center Director Lee Sang-geon, enhancing the book's quality.

Additionally, it is made with hardcover binding to add sturdiness and luxury so that it can be read like a 'Bible' for a long time.

This book, which is always at the top of the bookshelves of savvy stock market experts, will also provide domestic stock investors with the insight to navigate the uncertain market.

GOODS SPECIFICS

- Date of issue: August 1, 2025

- Page count, weight, size: 304 pages | 486g | 137*195*23mm

- ISBN13: 9791130669090

- ISBN10: 1130669092

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)